HI Market View Commentary 10-28-2019

| Market Recap |

| WEEK OF OCT. 21 THROUGH OCT. 25, 2019 |

| Equities ended higher Friday after the Office of US Trade Representative said the US and China are close to finalizing some parts of a phase one deal announced two weeks ago.

CNBC reported the USTR issued a statement on the status of the discussions after a conversation between Treasury Secretary Steven Mnuchin, US Trade Representative Robert Lighthizer and Chinese Vice Premier Liu He. “They made headway on specific issues and the two sides are close to finalizing some sections of the agreement,” the agency was quoted as saying in a statement, according to the report. “Discussions will go on continuously at the deputy level, and the principals will have another call in the near future.” Trade-sensitive materials and information tech shares surged, rising 1% and 1.2%, respectively. Intel (INTC) popped 8.1% after the chipmaker’s third-quarter results easily beat expectations while Apple (AAPL) firmed 1.2%. Dow (DOW) rose 2%, and Freeport-McMoRan (FCX) gained 5.7%. Communication services shares added 0.7%, led higher by Charter Communications’ (CHTR) 6.2% rise after its third-quarter results beat views. Netflix (NFLX) rose 2% while Comcast (CMCSA) added 1.8%. Coca-Cola (KO) slid 1.6% and Procter & Gamble (PG) fell 1.2% to pull consumer staples shares more than 0.5% lower. Campbell Soup (CPB) shed 1.3%. Consumer discretionary shares fell 0.2%, led lower by Amazon.com’s (AMZN) 1.1% retreat. VF Corp. (VFC) fell 7.3%. In corporate news, PG&E (PCG) sank nearly 31% after the California utility said its electrical equipment may have ignited a wildfire in the state’s wine-growing region. Goodyear Tire & Rubber (GT) shares popped 9.4% despite the company missing views with its third-quarter results. The Dow Jones Industrial Average rose nearly 0.6% to end the week 0.7% higher. The Standard & Poor’s 500 added 0.4% to finish the five-day period up 1.2%. The Nasdaq Composite gained 0.7%, closing out the week 1.9% higher. |

Patience and let the earnings season run its course.

Where will our markets end this week?

Up

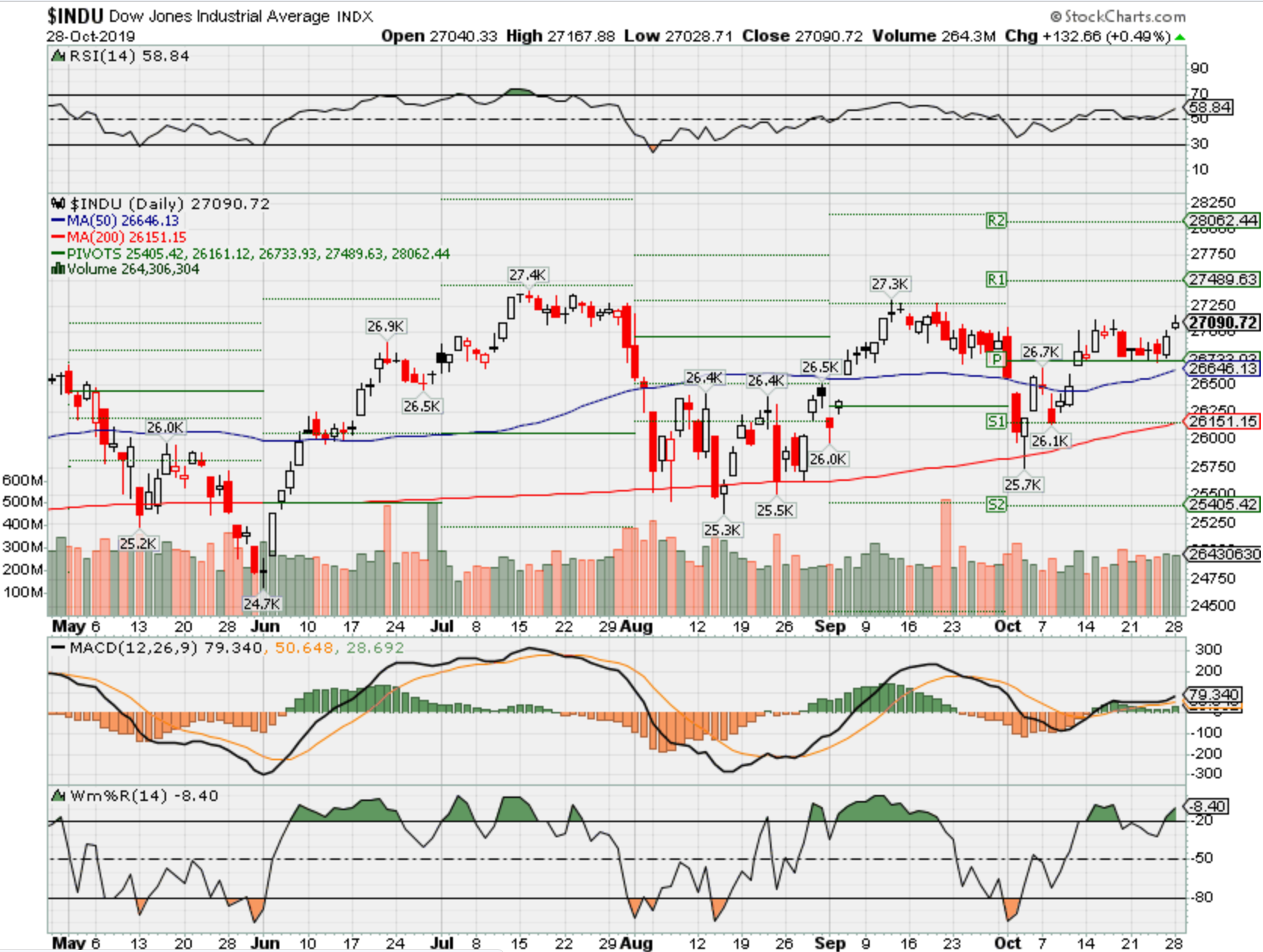

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end Oct 2019?

10-29-2019 +2.25%

10-21-2019 +1.25%

10-14-2019 +1.25%

10-07-2019 +1.25%

09-30-2019 +1.25%

Earnings:

Mon: AGN, GOOGL, T, DENN, KBR, L, RMBS, RIG

Tues: CHRW, CMI, EA, GM, K, MA, MRK, TPR, ZAGG

Wed: BRK, CF, CHK, D, FEYE, HLF, PFE, SQ, SBUX, TMUS, X, AAPL, FB

Thur: BHI, CBS, CLX, FLR, IP, SHAK, S, YUM

Fri: CVX, XOM, HNZ

Econ Reports:

Mon:

Tues: Case Shiller Home Price Index, Consumer Confidence, Pending Home Sales,

Wed: MBA, ADP Employment, GDP, GDP Deflator. FOMC Rate Decision

Thur: Initial, Continuing, Employment Cost Index, Personal Income, Personal Spending, PCE Price, Chicago PMI

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate, Construction Spending, ISM Index, Auto, Truck

Int’l:

Mon –

Tues –

Wed –

Thursday – EUR: GDP, CPI

Friday-

Saturday/Sunday –

How am I looking to trade?

I’m preparing for earnings = Adding long puts

AAPL – 10/30 AMC

AOBC – 12/05 est

BIDU – 11/06 AMC

CVS – 11/06 BMO

CVX – 11/01 BMO

DIS – 11/07 AMC

FB – 10/30 AMC

MRO – 11/06 AMC

MRVL 11/26 est

TGT – 11/20 BMO

XOM – 11/01 BMO

www.myhurleyinvestment.com = Blogsite

support@hurleyinvestments.com = Email

Questions???

Goldman Sachs predicts the Fed will make two big changes next week

PUBLISHED THU, OCT 24 201910:08 AM EDT UPDATED THU, OCT 24 20194:27 PM EDT

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- The Fed is expected to cut interest rates next week, but that would be the last such move for a while, according to Goldman Sachs.

- Fed officials are likely to say this is the end of the “midcycle” adjustment that Chairman Jerome Powell alluded to in July, the bank predicts.

- In addition, the central bank could remove the language stating it will “act as appropriate to sustain the expansion” that has been in play since June.

The Federal Reserve likely will cut interest rates next week, but in doing so will make a pair of adjustments aimed at signaling that the current easing cycle could be over, according to a Goldman Sachs forecast.

Markets widely expect the policymaking Federal Open Market Committee to approve a quarter-point reduction at the Oct. 29-30 meeting that will take the target range for the funds rate down to 1.5% to 1.75%. Goldman concurs, assigning a 95% probability of a cut. The rate applies to what banks charge each other for overnight lending, but influences a broad swath of consumer debt as well.

However, that could be it for a while.

Goldman economists see the Fed tweaking some language in its statement to indicate that this move, the third policy easing of the year, will fulfill the central bank’s “midcycle adjustment” that Chairman Jerome Powell alluded to in July. The characterization rankled some on Wall Street, but Powell has largely stuck to the narrative that economic conditions are otherwise solid even as the Fed has moved to relax financial conditions.

In making the rate cuts, Fed officials have said that they are largely in response to fears of global slowing, U.S.-China tariffs and tame inflation rather than an indication that the U.S. economy is in trouble.

“Strong signaling from Fed leadership indicates that the modest trade war de-escalation since September has not deterred them from completing a 75bp, 1990s-style ‘mid-cycle adjustment,’” Goldman economist Spencer Hill said in a note to clients.

Tempering the language to a less acommodative tone would be in keeping with recent statements coming out of the central bank. Some fed officials at the September meeting expressed concern that the market was expecting more in terms of rate cuts than the Fed was likely to deliver, according to minutes from the two-day gathering.

Removing ‘act as appropriate’

Indications that the rate-cutting cycle has been completed likely would come from Powell at his news conference rather than the FOMC’s post-meeting statement.

But Goldman expects another key tweak that would be in the statement: Removal of the key language that the Fed “will act as appropriate to sustain the expansion.” The phrase made its first official appearance in the June statement, after Powell had used it earlier that month, as a way to tee up the July rate cut.

“We expect the ‘act as appropriate’ sentence to be replaced with a reference to the easing actions already delivered (mirroring the language in October 2007 and June 2008) coupled with the following less committal guidance: ‘will act as needed to promote its objectives,’” Hill wrote.

Finessing the language behind the two moves will be left to Powell at his news conference. The chairman has had mixed success in assuaging market concerns, with several slip-ups over the past year leading to periods of turbulence.

“Chair Powell will have a fine line to walk during the press conference if he hopes to satisfy market participants projecting additional easing as well as the critics of insurance cuts — both on and off the Committee,” Hill said “Reflecting this, we expect a slightly hawkish tone, with Powell alluding to a baseline of unchanged policy but emphasizing data-dependence and the ability to respond quickly if the outlook deteriorates.”

Other possible adjustments include a downgrade of consumption from “strong” to “solid” as retail spending cooled in September, and an acknowledgement of a further decline in the unemployment rate to 3.5% from 3.7%.

Fed Presidents Esther George of Kansas City and Eric Rosengren of Boston also are likely to dissent again, as both prefer that rates remain unchanged. St. Louis Fed President James Bullard also was a dissenter in September, though he was on the other side of the debate, preferring a more aggressive 50 basis point cut. He, therefore, would be unlikely to resist next week’s expected 25 basis point reduction.

Goldman also does not expect the committee to address the Fed’s recent action in the overnight repo markets as they are not technically related to monetary policy adjustments. However, Powell likely will be asked about them during his news conference.

Short sellers betting against Tesla lose more than $1 billion in single day as stock surges

PUBLISHED THU, OCT 24 201911:18 AM EDTUPDATED THU, OCT 24 20196:01 PM EDT

KEY POINTS

- Investors betting against Tesla collectively lose more than $1 billion on Thursday as the company’s stock headed for its best day since 2013.

- “Short sellers are, as Elon Musk stated earlier in the year, ‘feeling the burn,’” writes Ihor Dusaniwsky, managing director at S3.

- Some high-profile short sellers such as Greenlight founder David Einhorn and Jim Chanos have clashed with Tesla and CEO Musk in the last few years.

Investors betting against Elon Musk’s electric-auto maker Tesla collectively lost an estimated $1 billion-plus on Thursday as the company’s stock headed for its best day on Wall Street since 2013.

Tesla popped 16.5% Thursday to around $300 per share, meaning short sellers betting against the stock are on track for $1.4 billion in mark-to-market losses on the day — wiping out almost 70% of short sellers’ year-to-date profits, estimates S3 Analytics.

“Short sellers are, as Elon Musk stated earlier in the year, ‘feeling the burn,’” wrote Ihor Dusaniwsky, managing director at S3. “Prior to today’s price move TSLA short sellers were up +$2.00 billion in mark-to-market profits, this is down from its year-to-date P/L high of +$5.16 billion of mark-to-market profits before TSLA began its sustained rally in June.”

To be sure, those who bet against Tesla at the start of 2019 are still in the black to date with the equity down more than 11% this year after Thursday’s price moves. Tesla stock closed at $254.68 on Wednesday, which at the time represented a 23.4% slide for 2019.

Tesla is the most heavily shorted stock in the U.S., as well as the most heavily shorted automaker in the world. Short interest, or the number of shares borrowed in hopes of buying them back at a profit after the stock drops, totals $9.03 billion for Tesla, according to S3.

Some high-profile short sellers such as Greenlight founder David Einhorn and Jim Chanos have clashed with Tesla and Musk in the last few years.

Musk himself has over the years taken to Twitter to do battle against such doubters, fighting back against investors betting against his stock and other detractors, often with controversial comments.

In May 2018, Musk tweeted that shorts were about to feel the “burn of the century.” Over a year late, but maybe it’s just starting to play out for the Tesla chief.

After new record, these are the stocks Wall Street thinks will lead the next market leg higher

PUBLISHED MON, OCT 28 201910:02 AM EDTUPDATED 6 HOURS AGO

Maggie Fitzgerald@MKMFITZGERALD

KEY POINTS

- The S&P 500 hits an all-time record high on Monday, boosted by runups in companies such as Apple and J.P. Morgan.

- CNBC screens the largest 50 companies in the S&P 500 and finds the stocks that analysts predict will contribute the most to the next leg of the bull market.

- Despite the recent underperformance of growth stocks, Wall Street expects a recovery in the so-called FANG group.

The S&P 500 hit an all-time high on Monday, but investors are already wondering who’s going to lead the next leg of the bull market.

The index topped the 3,027.98 level, thanks to Apple, UnitedHealth and J.P. Morgan, the largest point contributors to the new record.

Now, analysts see social media giant Facebook, Disney and red-hot software company Salesforce taking over.

CNBC screened the largest 50 companies in the S&P 500 and found which stocks have the most upside to their consensus 12-month price target set by analysts on Wall Street. In other words, these are the big U.S. stocks analysts believe will be up the most in the next one year.

Despite the recent underperformance of growth stocks, specifically the so-called FANG (Facebook, Amazon, Netflix and Google) stocks, data shows Wall Street is bullish on a recovery in the group. Netflix, Facebook and Amazon are all expected to rally, and with such large market values, these stocks can certainly move the needle on the index.

Shares of Jeff Bezos-led Amazon tanked last week when it reported earnings that fell short of Wall Street’s expectations, as a return to a heavy investment cycle cut into the e-commerce giant’s profitability. However, the stock is only down 1% since the disappointing results. Facebook reports third-quarter earnings after the bell on Wednesday.

Salesforce has remained relatively insulated from the recent pullback in software stocks. Health-care company Merck reports earnings before the bell on Tuesday.

PayPal surged 8% last week after growth in its Venmo business led the company to the strongest earnings results in at least a year.

Billionaire investor Ron Baron sees Dow 650,000 in 50 years — about 25 times higher than today

PUBLISHED FRI, OCT 25 20196:24 AM EDTUPDATED FRI, OCT 25 201910:07 AM EDT

Matthew J. Belvedere@MATT_BELVEDERE

KEY POINTS

- Buy-and-hold billionaire Ron Baron says “fear is evident” in the stock market, but that should not deter people from investing in stocks.

- Baron says that for investors 50 years ago, “all you had to do was believe that this country was going to survive and invest then and you would have made 25 times your money.”

- “I’m thinking the next 50 years is going to be similar to the last 50 years,” he says.

WATCH NOW

VIDEO

05:57

Ron Baron: Expect the Dow to reach 650,000 in 50 years

Buy-and-hold billionaire Ron Baron told CNBC on Friday “fear is evident” in the stock market, but that should not deter people from investing in stocks.

Speaking from his annual investment conference in New York, Baron predicted the Dow Jones Industrial Average, based on historical moves over decades, will reach 650,000 in 50 years, with an over $500 trillion U.S. economy.

The Dow closed at 26,805.53 on Thursday — about 2% away from all-time highs.

“Everybody is worried about something,” Baron said on “Squawk Box.” “If you invested in 1969, amidst turmoil in 1969, you would have make 25 times your money.”

“I think the 6.5% annual growth [in the market] is going to continue, on average, for the next 50 years, at least,” he added, making the point that investors should forget the day-to-day market gyrations and stay focused on the long term.

“People forget about compounding” money over time, he said.

The current stock market is the same valuation as it was in 1969, during turbulent times with “cities on fire” and Vietnam War protests and the Dow trading around 1,000, Baron said.

“The economy then was $850 billion. It’s now $21.3 trillion. That’s up 25 times,” he said. “All you had to do was believe that this country was going to survive and invest then and you would have made 25 times your money.”

“I’m thinking the next 50 years is going to be similar to the last 50 years. That would be 25 times your money if you invest now,” he said, adding that currently “extraordinarily” low interest rates provide even more incentive to invest.

“Technology is making businesses grow faster,” compared with the traditional, capital intensive ways of building physical structures in hopes they will pay off over time, Baron said. “It’s making the costs be lower.”

The founder of Baron Capital, with $29.6 billion in assets under management, also said, “Knowledge is growing at the fastest pace it’s ever grown.”

Nearly a year ago, Baron had predicted the Dow would reach 500,000 in a half-century.

Goldman Sachs is latest firm to pull money from Fisher Investments, total is now $2.7 billion

PUBLISHED THU, OCT 24 20199:15 PM EDTUPDATED FRI, OCT 25 201911:06 AM EDT

KEY POINTS

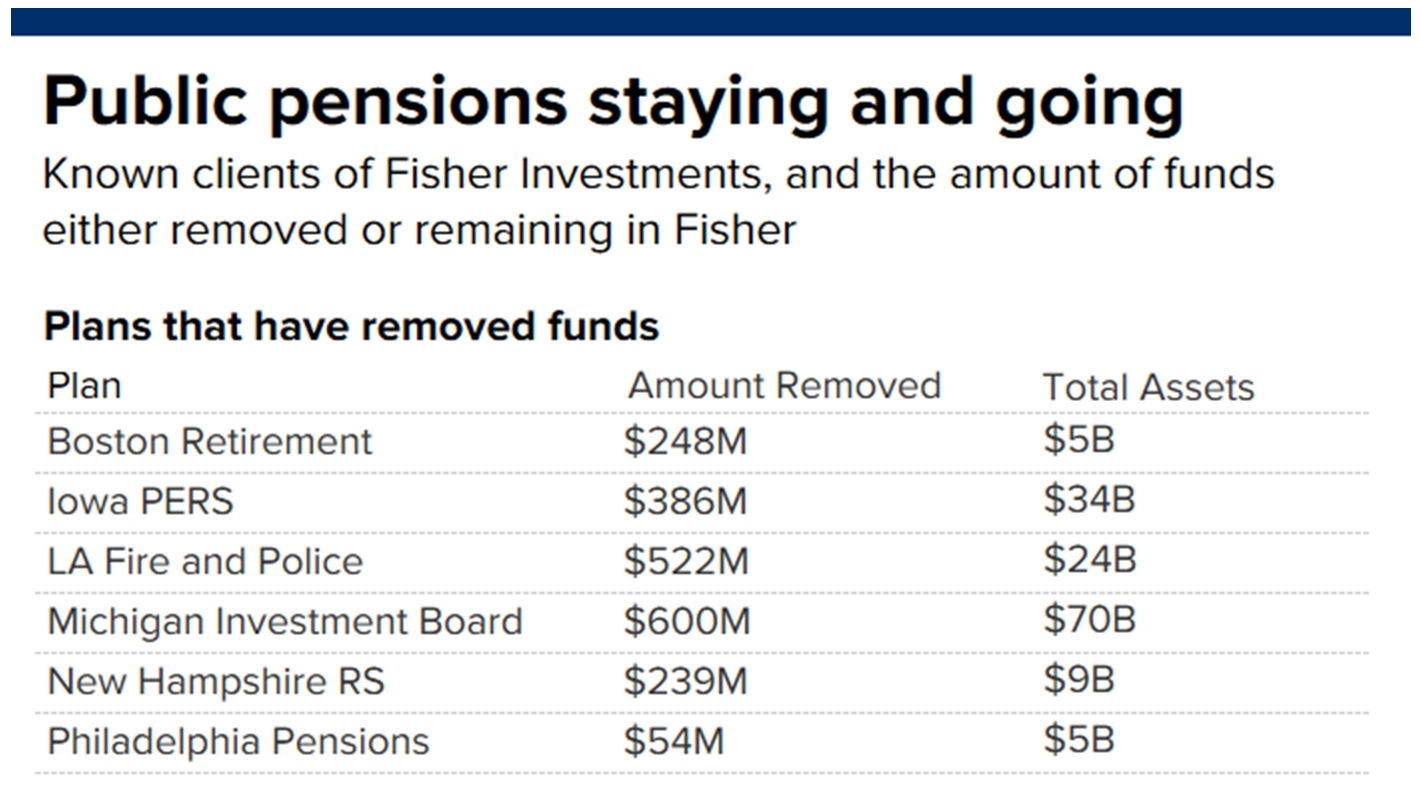

- Goldman’s departure would mark the eighth institutional investor to fire Fisher Investments since Ken Fisher made lewd comments at a conference on Oct. 8.

- The Los Angeles Fire and Police Pension System voted on Oct. 24 to terminate its relationship.

- In total, Fisher Investments has lost more than $2.7 billion in recent weeks.

Goldman Sachs has joined the flight of institutional investors from Fisher Investments.

The giant investment bank is pulling $234 million from Camas, Washington-based Fisher, according to a source close to the matter.

However, the end tally could be even greater, a source told CNBC.

Goldman confirmed Fisher would no longer be an underlying manager for the Goldman Sachs Multi-Manager Global Equity Fund in an Oct. 25 filing with the Securities and Exchange Commission.

Fisher Investments declined to comment.

In all, institutional investors, along with Goldman, are withdrawing more than $2.7 billion from Fisher Investments in light of Ken Fisher’s lewd comments made at a conference on Oct. 8.

Meanwhile on Thursday, the Los Angeles fire and police pension plan voted to fire Fisher, where it held $522 million.

The Los Angeles pension has $24 billion in total assets.

The board of commissioners said they had invited Fisher himself to speak at the meeting, which was webcast live, but he did not attend.

“The only explanation is that Mr. Fisher was unable to attend and had business in the office,” Ray Ciranna, general manager of the Los Angeles Fire and Police Pension System, wrote in an email to CNBC.

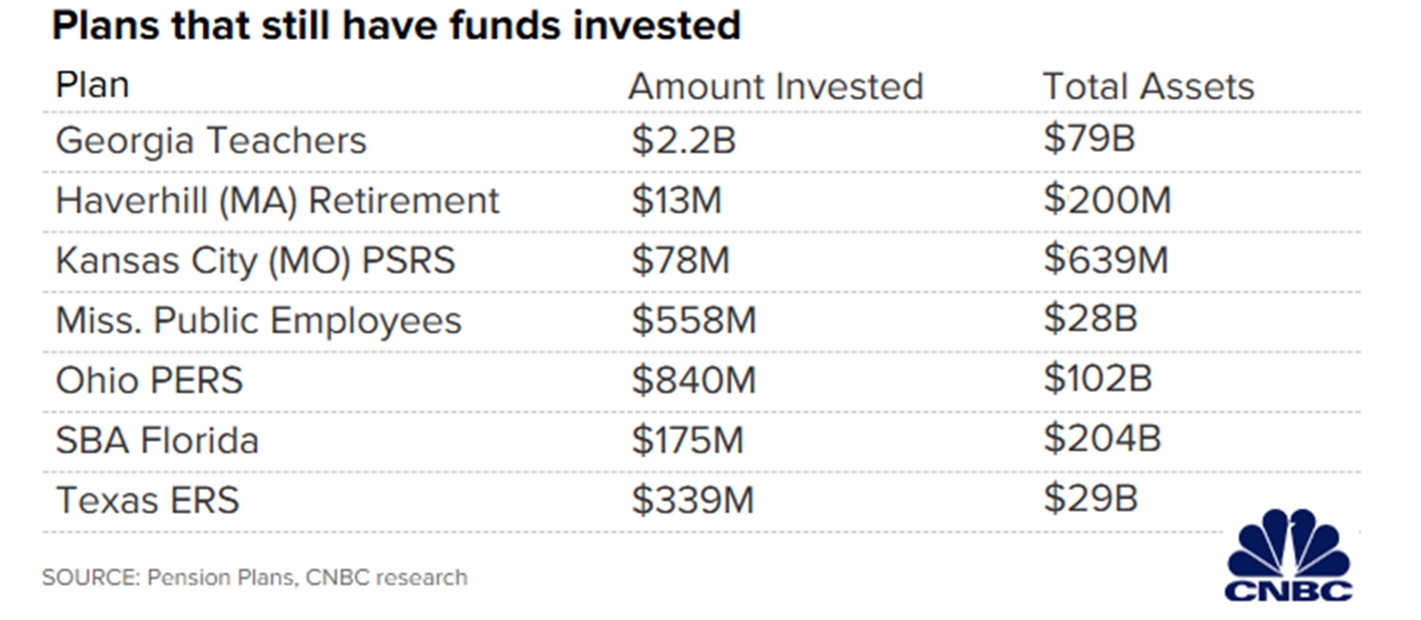

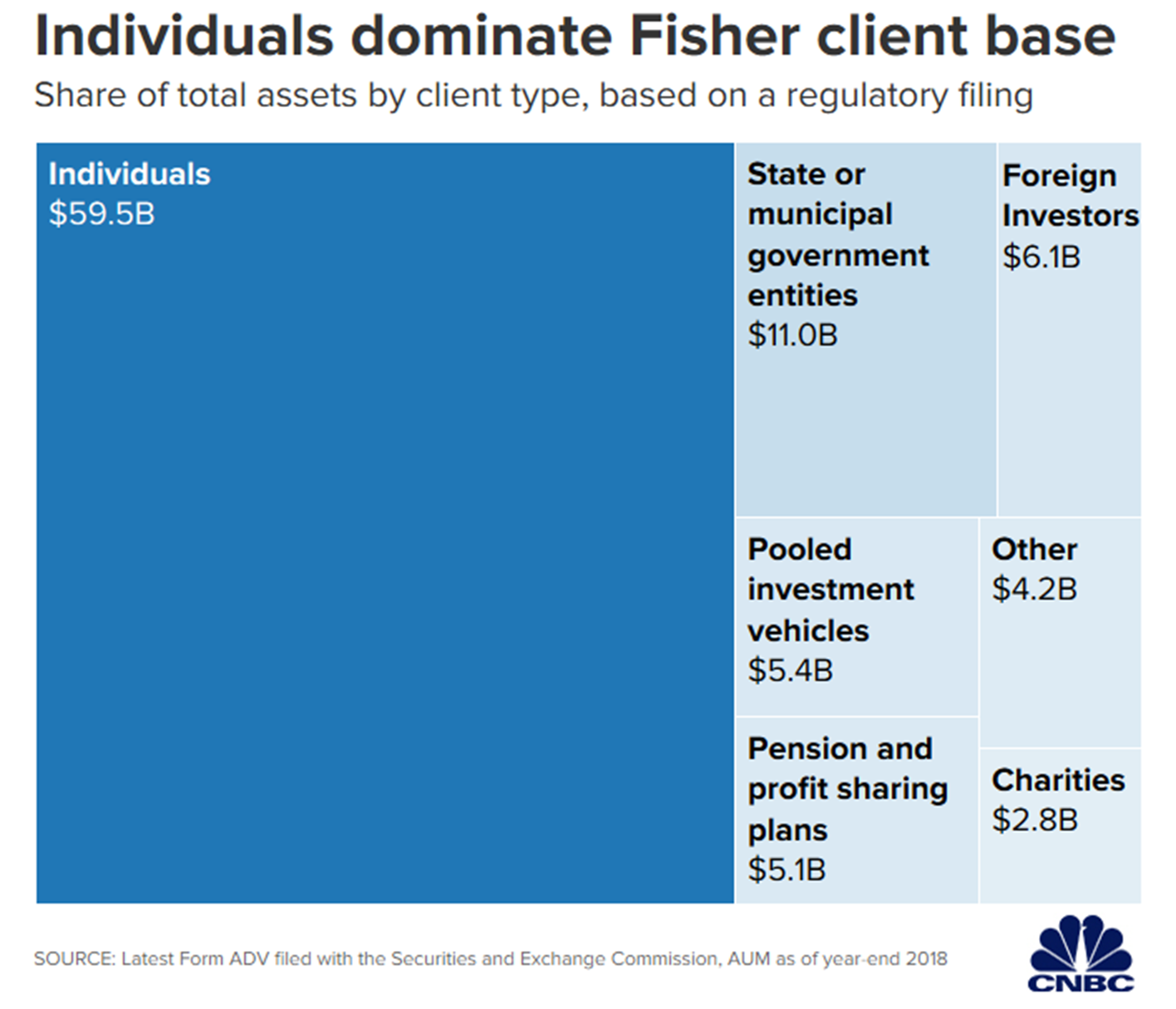

In total, Fisher Investments has lost more than $2.7 billion in recent weeks as eight institutional clients — six of which were government pensions — parted ways with the firm. Fisher had $94 billion in assets under management as of Dec. 31, 2018, according to their SEC filing.

That figure reached $112 billion as of Sept. 30, 2019, according to the firm.

On Monday, Fidelity said it would remove its money from Fisher. The firm managed $500 million for Fidelity’s Strategic Advisers Small-Mid Cap Fund.

Additionally, the New Hampshire Retirement System voted on Tuesday to terminate its $239 million relationship with the firm as well. That same day, the Public Employees Retirement System of Mississippi, which has $558 million invested with Fisher, said it would put the firm on a watch list due to “organizational concerns,” according to Ray Higgins, executive director of the plan.

Conference comments

CNBC obtained an audio recording of Fisher’s comments at the Tiburon CEO Summit, as well as audio of him speaking at a previous conference.

Clips from both were featured on CNBC’s “Power Lunch.” Combined, they show that the money manager made flippant remarks about sex.

In the audio obtained by CNBC, Fisher, 68, said at the Tiburon conference, “Money, sex, those are the two most private things for most people,” so when trying to win new clients you need to be careful.

He said, “It’s like going up to a girl in a bar … [inaudible] … going up to a woman in a bar and saying, hey, I want to talk about what’s in your pants.”

Further, when Fisher was a speaker at the Evidence-Based Investing conference in 2018 he compared marketing mutual funds to propositioning a woman for sex at a bar.

“I mean the, the most stupid thing you can do, which is what every mutual fund firm in the world always did, was to brag about performance, uh, in, in a direct mail piece, which is a little bit like walking into a bar if you’re a single guy and you want to get laid and walking up to some girl and saying, ‘Hey, you want to have sex?’” Fisher said, according to audio obtained by CNBC.

The billionaire has since apologized for his comments.

“Some of the words and phrases I used during a recent conference to make certain points were clearly wrong and I shouldn’t have made them,” Fisher said in a statement. “I realize this kind of language has no place in our company or industry. I sincerely apologize.”

Organizers of both conferences subsequently banned him from speaking again in the future.

Billionaire investor Jeffrey Vinik closes hedge fund less than a year after its relaunch

PUBLISHED WED, OCT 23 20192:11 PM EDTUPDATED WED, OCT 23 20192:55 PM EDT

KEY POINTS

- “It has been much harder to raise money over the last several months than I anticipated,” Vinik says in a letter dated Wednesday to investors.

- Vinik Asset Management funds will close by Nov. 15, the letter says.

- The “performance of the VAM funds, while good … has not provided the necessary momentum to bring in our desired level of investments.”

Jeffrey Vinik, the billionaire investor who relaunched his hedge fund earlier this year, is cutting his comeback tour short.

“It has been much harder to raise money over the last several months than I anticipated,” Vinik said in a letter dated Wednesday to investors. The Wall Street Journal first reported the news. CNBC later confirmed it.

“The climate for raising long-short equity hedge fund assets has been far more difficult than I expected, and performance of the VAM funds, while good … has not provided the necessary momentum to bring in our desired level of investments.”

Vinik Asset Management funds rose 4.8% on a net basis between March 1 and Sept. 30, the letter said. The funds will close by Nov. 15.

The fund manager, who made a name for himself running Fidelity’s Magellan fund before going out on his own, announced his comeback in mid-January. At the time, he told CNBC’s “Squawk Box” that “the fire in my belly still burns.”

But Vinik had a hard time raising money. Vinik Asset Management had more than $500 million in assets, according to the Journal, but Vinik hoped to raise between $2 billion and $3 billion. Vinik, who owns the Tampa Bay Lightning hockey team, told the Journal he needed to raise more money for the “economics” of the business to “make sense.”

The asset-management industry has been under pressure lately as the rise in passive investment vehicles such as exchanged-traded funds has pressured fees.