Trade Findings and Adjustments 10-24-2019

Looking at the end of the day to place trades.

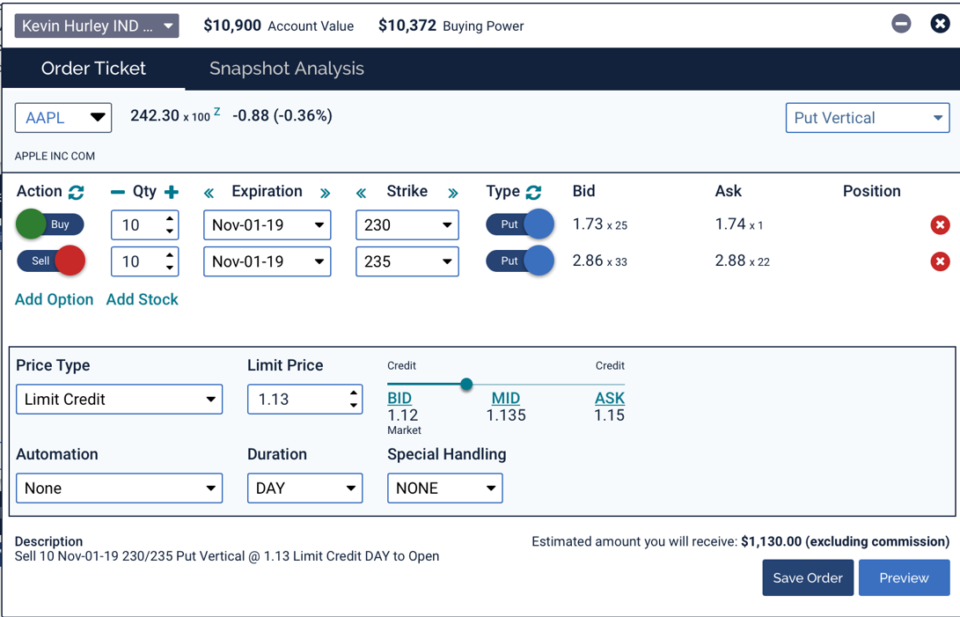

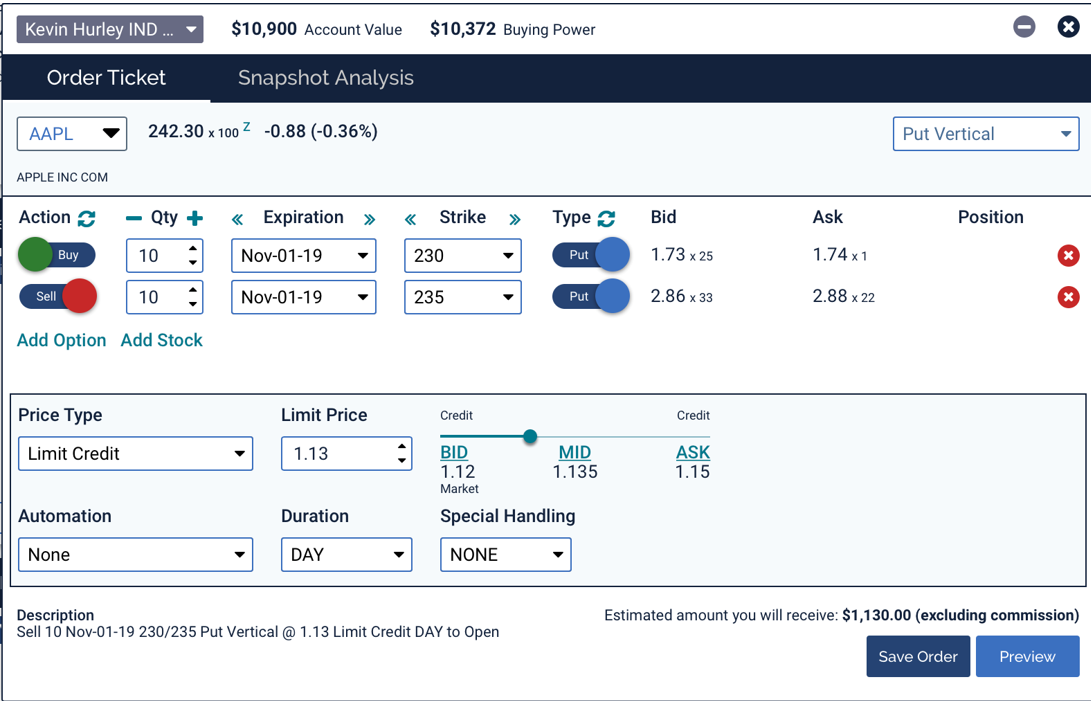

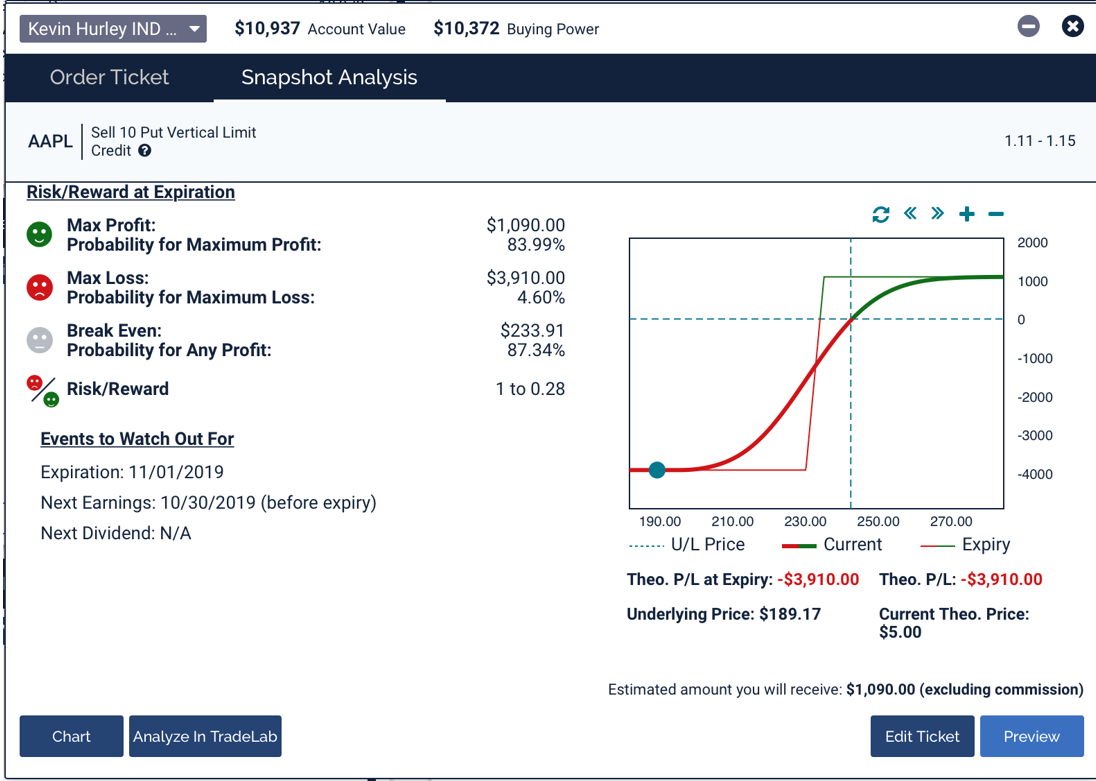

AAPL Nov. 1 Bull Put 230 Long Put/ 235 Short Put

Credit: about 1.10ish

– With earnings on the 30th, it would be best to be out with a profit before then if you don’t want to risk taking stock ownership.

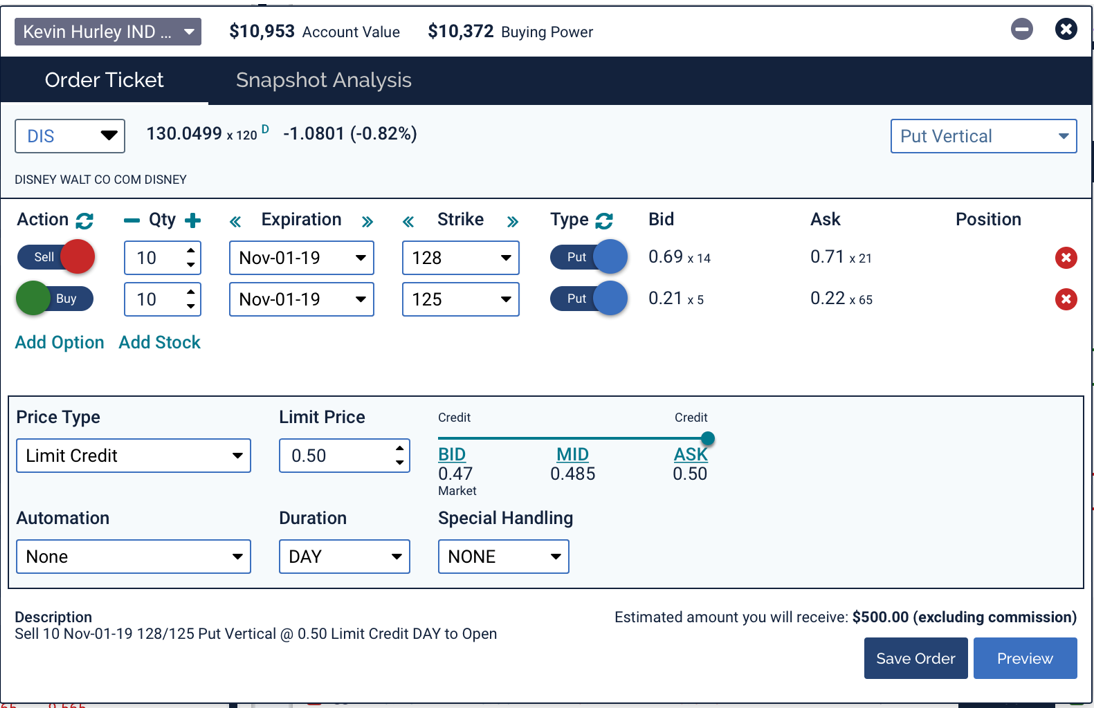

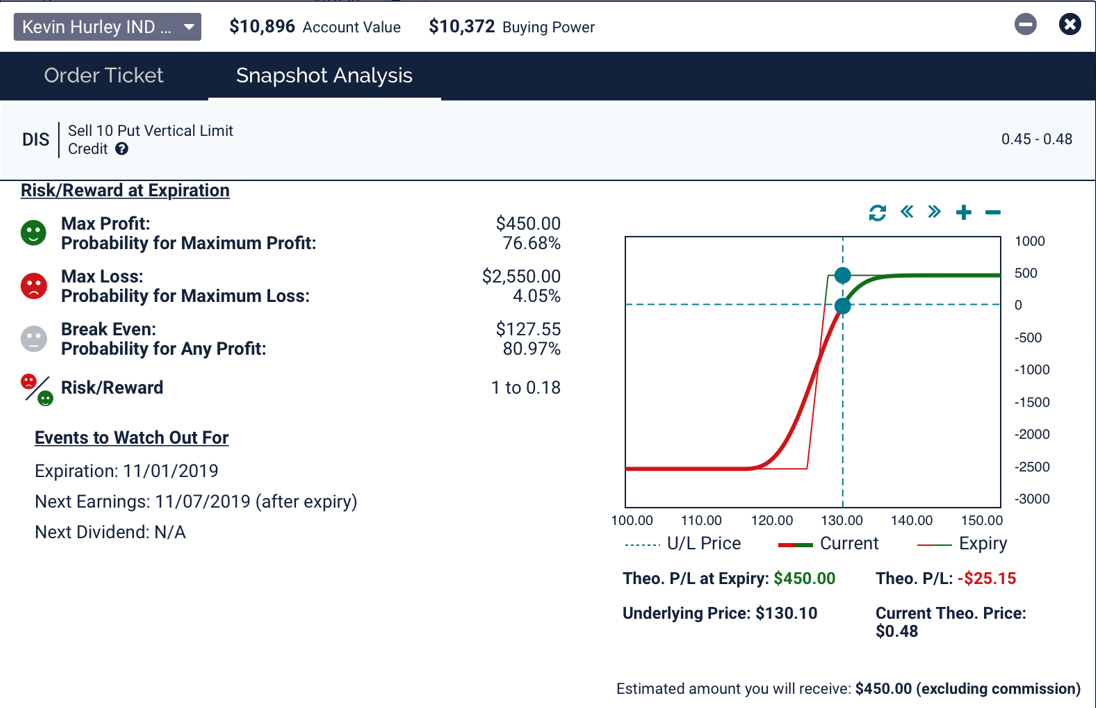

DIS Nov. 1 Bull Put 125 Long Put / 128 Short Put

Credit: .45 – .50 cents

– a little less risky than the AAPL trade and you can let it expire for full profit with less risk.

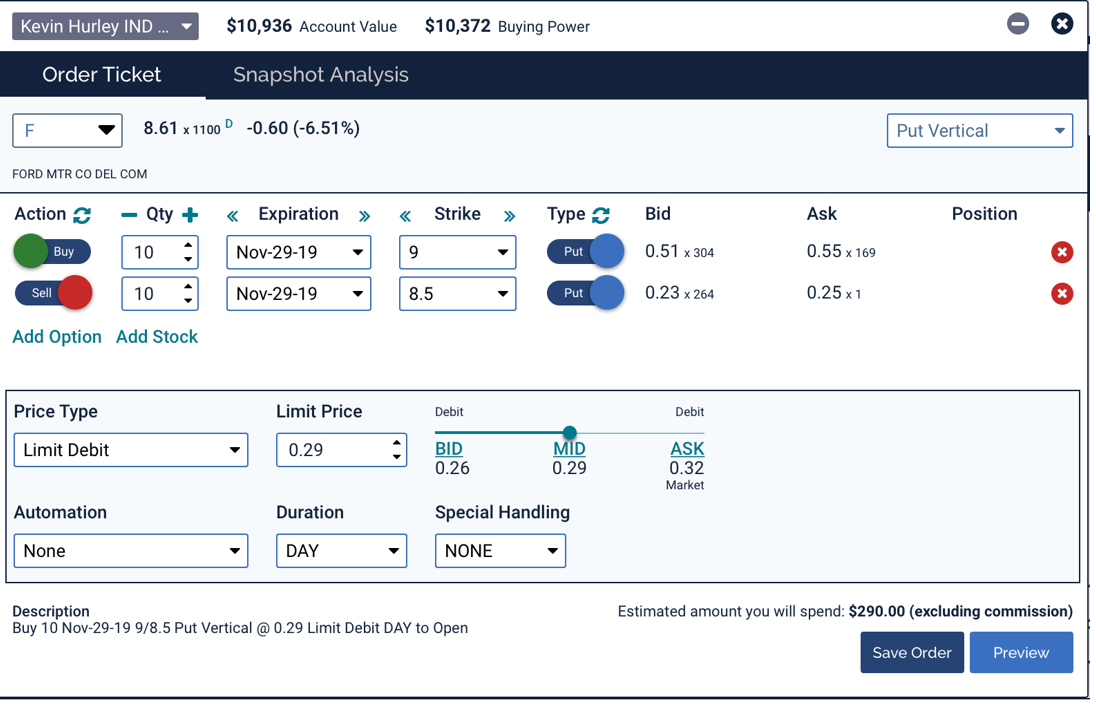

F Nov. 29 Bear Put or Long Put

$9 Strike Long Put / $8.50 Strike Short Put

Debit: .30

OR:

F Nov 29 $9 Strike Long Put

Debit: .55

www.hurleyinvestments.com www.myhurleyinvestment.com www.KevinMhurley.com