HI Market View Commentary 04-08-2019

What I want to talk about today?

Right now I am in stock positions, Without protection, I don’t want a bearish position on a bullish moving stock.

DOWNGRADES – BA, GE

“I am willing to own BA when it is at $393 and you might buy in at 390”? ANSWER – HELL NO

A speculative trade is a trade that you should be willing to lose every penny.

LOOK to have a trigger or contingent order in play to protect myself to the downside.

Where will our markets end this week?

Higher

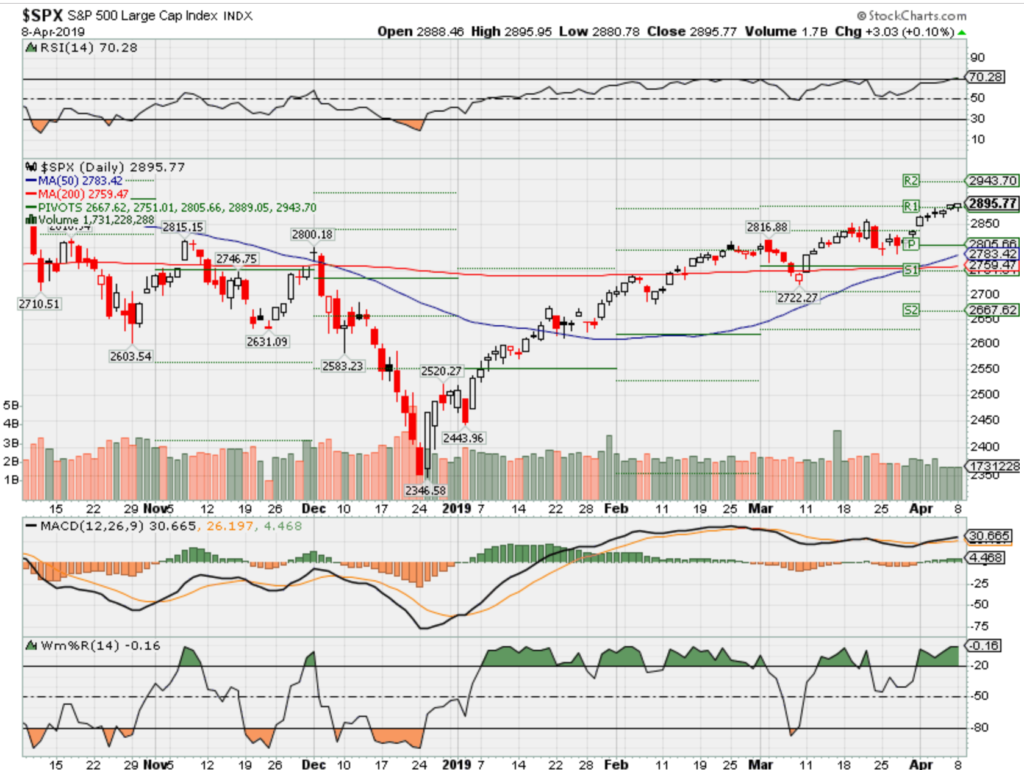

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end April 2019?

04-08-2019 2.5%

04-01-2019 2.5%

03-25-2019 0.0%

Earnings:

Mon:

Tues: WDFC

Wed: DAL, BBBY

Thur: FAST, RAD

Fri: JPM, WFC, PNC

Econ Reports:

Mon: Factory Order

Tues: NFIB Small Business, JOLTS

Wed: MBA, CPI, Core CPI, Treasury Budget, FOMC Minutes

Thur: Initial, Continuing, PPI, Core PPI,

Fri: Import, Export, Michigan Sentiment

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Going long for a China Deal and next Earnings which I expect to be better than expected

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://seekingalpha.com/news/3448415-ford-gains-detroit-peers-q1

Ford gains on Detroit peers in Q1

Apr. 4, 2019 9:33 AM ET|About: Ford Motor Company (F)|By: Clark Schultz, SA News Editor

Ford (NYSE:F) reports Q1 U.S. sales were down 1.6% to 590,429 units. The automaker saw a smaller drop for the quarter than either GM (-7%) or Fiat Chrysler (-3%).

Ford brand sales were down 2.1% during the quarter and Lincoln brand sales rose 11.2%.

Car sales -23.7% to 98,265 units. Fusion sales -3.5% to 41,683 units.

SUV sales +5.0% to 213,086 units. Explorer sale -1.5% to 53,306 units.

Truck sales +4.1% to 278,898 units. F-Series sales +0.2 to 214,611 units.

Sales update from Ford management: “First quarter 2019 sales were solid for Ford. Our winning portfolio continues to deliver. F-Series expanded our leadership position while others slugged it out for second place. We have a close connection with our customers, allowing us to deliver what they need in their trucks. It can also be seen in our record sales of Ford SUVs as well as Lincoln’s significant growth.”

The respectable quarter by Ford is another indication of the “piecemeal progress” described by Morgan Stanley’s Adam Jonas earlier this week that is ever-so-slowly drawing the attention of investors.

Previously: Investors kick the tires on Ford (April 1)

Shares of Ford are up 0.33% to $9.16.

https://seekingalpha.com/news/3448405-goldman-gets-back-disneys-corner-fox-deal-done

Goldman gets back in Disney’s corner with Fox deal done

Apr. 4, 2019 9:23 AM ET|About: The Walt Disney Company (DIS)|By: Jason Aycock, SA News Editor

Walt Disney (NYSE:DIS) is up 0.6% premarket after Goldman Sachs reinstated the company at Buy: It’s “the dawn of a new era” after the company bought the media assets of Twenty-First Century Fox.

Goldman advised on that deal, and had suspended its previous Buy rating in December 2017.

Now the impending launch of Disney Plus marks a “momentous” shift in content monetization, though investors will need to be patient with some heavy lifting around the launch, suggests Drew Borst. Meanwhile the market may be so focused on Fox and the streaming launch that it’s overlooking the benefit of growth in the Parks, film and consumer products businesses, he writes. (h/t Bloomberg)

Borst has a price target of $142, implying 26.2% upside from a current $112.52.

There is a savings crisis and many Americans don’t know how to fix it. Here’s how

PUBLISHED MON, APR 1 2019 • 6:00 AM EDT UPDATED MON, APR 1 2019 • 11:35 AM EDT

- Policy experts, economists, business people and teachers are debating the extent to which personal finance education can turn around the fact that so many Americans are one emergency away from financial disaster.

- At the same time, the ways in which people think about how we can become financially better off are increasing and evolving.

WHEN PARTS OF THE FEDERAL GOVERNMENT SHUT DOWN toward the end of last year, many Americans went without a paycheck or two. Crisis followed.

A tax examiner for the IRS couldn’t afford to pick up his insulinprescription. A geologist for the Department of Interior was left with just $33. Some workers had to take on temporary jobs.

For a large swath of America, it was probably not a surprise that so many people became so vulnerable, so quickly. If their income was put on pause, or an unforeseen expense dropped into their lives, they’d be in a similar bind. Forty percent of people in the U.S. don’t have $400 set aside for an emergency, according to the Federal Reserve. Additionally, 25 percent of Americans have nothing saved for retirement.

APRIL IS FINANCIAL LITERACY MONTH, and policy experts, economists, business people and teachers are debating the extent to which personal finance education can reverse these grim statistics. Meanwhile, the ways in which people think about how we can become financially well are increasing and evolving.

In 2015, a study published in the Journal of Human Resources found little evidence that education intended to improve people’s financial decision-making is successful. “Policies to expand high school financial literacy education … may be misguided,” the researchers concluded.

Yet other experts argue that lessons on lending and credit are just as important as English or science classes — and the only chance to reach every child before he or she goes on to make life-defining financial decisions.

“The finding is not that we shouldn’t spend on financial education — we should actually try to make it better,” said Annamaria Lusardi, the director of the Global Financial Literacy Excellence Center at George Washington University.

Financial educators are also confronting their limitations in a society where wealth and income are so unevenly divided, said Billy J. Hensley, the president and chief executive officer of the National Endowment for Financial Education.

The three richest people in the U.S. — Bill Gates, Jeff Bezos and Warren Buffett — now own more wealth than the bottom half of the American population. As medical, childcare and college costs take off, wages have sputtered. The median family income, after accounting for inflation, was $59,039 in 2016, little different than in it was in 2000 ($58,544).

In a new CNBC Invest In You and Acorns Savings Survey, more than a third of respondents said they don’t make enough money to meet their needs and save.

“People may be blocked out of financial institutions, or their income is too low, and it’s hard to get that extra 2 percent into a retirement account,” Hensley said. “You have to be able to apply what you’re learning.”

STILL, BETWEEN THE RAPID RISE in borrowing among college students and the fact that workers are increasingly tasked with saving for their retirement, financial education is more essential now than ever, Lusardi said.

“There are these huge challenges in front of us,” Lusardi said. “We need to be better equipped.”

Efforts to improve the curriculum in schools are underway.

The George Washington University School of Business recently launched an online resource, Fast Lane, which provides certain people, including students and policy makers, specific directions for implementing high-quality financial literacy in their schools. Checkyourschool.org is another new project, by the non-profit Jump$tart Coalition, which invites parents and students to report how their school is faring when it comes to personal finance education.

“A lot of parents are very engaged and they’re natural activists,” said Laura Levine, president and CEO of the Jump$tart Coalition. “We want them to start the conversations at their school about introducing or augmenting financial education.”

Recently, more states are leading the effort to bring lessons on taxes and debt into their schools.

Alex Todd has taught a personal finance class at Elizabethtown High School in Kentucky for more than two decades. After the 2008 financial crisis, he began to hold more of the courses. “Parents said they wished they’d had this class in high school,” Todd said.

Last year, Todd worked with state representatives to pass legislation that will require every student in Kentucky who enters high school in 2020 to enroll in a course like his, which teaches students how to be skeptical consumers and smart savers.

A recent study found that in states where personal finance education is mandated, students go on to make better decisions about how to pay for college. For example, they don’t take on as much private debt.

“If every state in America would spend a little bit of time teaching financial literacy to high school students, we can begin to win a battle we’ve been losing for the last 40 to 50 years,” Todd said.

IMPROVING TECHNOLOGY HAS ALSO made its way into the financial literacy field.

Practical Money Skills, a financial literacy platform created by Visa, includes interactive tools such as Financial Football, a 3D game in which players learn personal finance lessons as they try to score touchdowns.

Financial literacy start-up Money Experience has created a simulator in which players need to make all of the various choices that crop up throughout life. Whom will they date? What college will they attend? When will they start saving for retirement?

“We’re trying to express to students that every decision you make has a financial component,” said Jeet Singh, founder and CEO of Money Experience. ’We don’t hide the consequences.”

The innovation is not just for kids. Researchers at Stanford University are leveraging virtual reality to show people their aging avatars, in the hopes that they develop empathy for their 70- or 80-year-old self.

“People view their future selves like a stranger,” said Sarah Raposo, a researcher at the Stanford University’s Life-span Development Laboratory. “If we could help people understand they’re preparing for themselves and caring for themselves, they might be more motivated to learn about financial planning.”

IT’S NEVER BEEN SO EASY TO FIND INFORMATIONabout paying off debt or investing. There are personal finance books, podcasts, television shows, YouTube series, blogs, news sites and Meetup events. The Reddit personal finance channel, in which people detail their financial circumstances and ask for advice, has more than 13.5 million subscribers.

“The personal finance education space is getting a lot more inclusive and friendly,” said Chris Browning, who hosts the podcast Popcorn Finance.

Browning created the series on tax tips and side hustles back in June of 2017 and releases an episode a week. Around 1,500 people currently listen in, he said, often while they’re driving to work or cleaning up the house.

“Talking about money gets kind of intimidating and pushes people away,” Browning said. “I try not to use a lot of jargon.

“People tell me they appreciate that it’s easy to understand.”

As personal finance advice proliferates, it also grows harder for people to pick out what’s actually good for them, said Hensley, the president of the National Endowment for Financial Education.

“There’s a lot of money to be made off of someone’s decision,” Hensley said. “Getting high-quality, vetted information is a challenge.”

TO THAT POINT, companies are moving beyond education, and streamlining the financial decision making process for their employees.

Nearly 75 percent of businesses today that offer a 401(k) plan already automatically enroll their workers. Research shows that few people opt out.

Up until recently, if an employee did drop out, that would be the end of their workplace retirement savings unless they signed up again. But now, some companies are auto-enrolling their workers more than once a year. (Nearly 10 percent of Prudential’s retirement clients do so today).

Prudential also now offers a way for workers to build up an emergency savings account at their jobs. The savings is an after-tax contribution that allows employees to automatically put money away in low-cost investments such as money market or so-called stable value funds.

“Education is important because people need to understand the context of their financial decisions,” said Vishal Jain, the head of financial wellness strategy and development for Prudential. “At the same time, its important to guide people to action.”

Steve Vernon, a retirement savings expert, also believes that information sessions on saving and spending can only go so far.

He is pushing for companies to offer a retirement income menu, in which workers could decide between a number of ways to receive their savings on a regular basis, say monthly or quarterly, as opposed to in one lump sum when they exit the workforce.

Vernon believes it’s unreasonable for companies to expect their employees to turn into an investment manager in their retirement. “That’s a complex task that most ordinary workers are not equipped to do on their own,” he said.

“You can educate people until you’re blue in the face,” Vernon added. “We need more.”

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.

https://seekingalpha.com/article/4253291-disneys-investor-day-catalyst-stock

Disney’s Investor Day: A Catalyst For The Stock?

Apr. 8, 2019 10:56 AM ET

Summary

Disney has an investor day scheduled for April 11.

Bullish options bets suggest shares rally over the next month.

The technical chart suggest shares rise too.

This idea was discussed in more depth with members of my private investing community, Reading The Markets. Get started today »

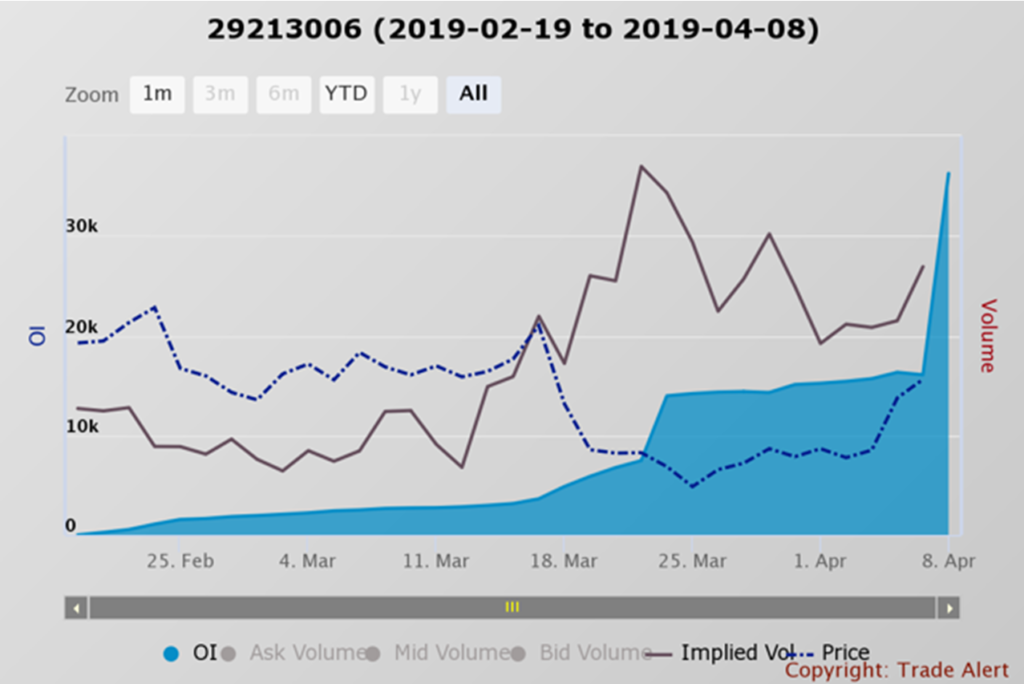

Disney (DIS) will have its highly anticipated investor day on April 11. It’s widely expected that the company will give investors their first look at the Disney+ streaming service. There have been some big options bets placed ahead of this event which would indicate that some are looking for the stock to rise sharply over the next month.

A Breakout Nears

The stock has essentially gone nowhere since late 2015, after peaking at roughly $122. But now the stock appears to be breaking out rising above a multi-year downtrend. Additionally, the stock is nearing a level of resistance around $116.50. Should the stock rise above that resistance level the shares may push higher back to their all-time highs.

However, should the stock fail to break out at $116.50 it could result in the stock falling back to roughly $100, a drop of about 13% from the shares current price.

Bullish Betting

The options for expiration on May 17 saw their open interest levels rise by more than 20,000 contracts on April 8, to a total open interest of 36,200 contracts. According to data from Trade Alert, the options were traded on the offer, suggesting they were bought for roughly $1.60 per contract. Additionally, the data also shows they were part of a spread trade, with the trader selling the $105 June 21 puts, for roughly $1.00 per contract. By buying the calls and selling the puts, the trader is betting the shares rise above $120 by expiration. They sold the $105 put to collect a premium to offset the cost of the calls, from $1.60 to around $0.60. It means the stock needs to rise to around $120.60, or about 5% from the stock’s price of $115 on April 5, by the May expiration date.

The Big Event

Investors are looking forward to the Investor day on April 11, where they should get their first look at the new Disney+ streaming service. The company noted on its fiscal third quarter conference call in 2018 that because of the quality of content with productions from Pixar, Marvel, Lucasfilm and its other brands, the company doesn’t plan to have the same volume as Netflix (NASDAQ:NFLX), and the pricing will reflect the lower volume. Based on this language it’s likely that Disney’s pricing for its new streaming service will be at a lower price than Netflix. Additionally, investors will likely look for additional content that may be exclusive to the streaming platform. As well, as the highly anticipated launch date in 2019.

Risks

There are obviously some significant risks going into this event as well as we do not know if Disney will reveal any update to its earnings guidance, as it’s unclear how the streaming platforms expenses are evolving. The company noted on its fiscal first quarter call for 2019 that the development of ESPN+ and Disney+ services would have an adverse impact of about $200 million on operating income for the second quarter.

Also, the company had noted on its fiscal third quarter conference call in 2018 that it had planned to launch the Disney+ service in calendar 2019. However, during the first quarter call in February the company noted later this year as a time frame. It’s a subtle change in language but certainly could be viewed as less definitive. Any delay in the timing of this launch would be a big negative for the stock. Investors have been waiting for the launch of this service for a long time and it is a big piece of the bull narrative.

It would seem based on the charts and the options bets that investors are very bullish on Disney heading into this event. While Disney could announce many positive catalysts that could take the stock soaring to record highs, it is not to say it does not come without risks.

The focus of Reading the Markets is to find stocks that may rise or fall using fundamental, technical, and options market analysis. Additionally, we search for clues from the broader markets to discover trends and gauge direction.

Michael Kramer relies on his more than 20-year of experience working in the financial industry. 10-years of experience comes as an international and domestic buy-side equity trader at multi-billion long/short investment advisor.

I hope this gives a brief overview of how we are dissecting the markets daily. Sign up and get two-weeks for free!

-Mike

Disclosure: I am/we are long DIS,NFLX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.

Warren Buffett: Banks will be worth more money 10 years from now

Reporter

Yahoo FinanceApril 3, 2019

Warren Buffett’s Berkshire Hathaway (BRK-A, BRK-B) is bullish on the banks.

“They’re a business I understand, and I like the price at which they’re selling relative to their future prospects,” Buffett said in a wide-ranging interview with Yahoo Finance’s editor-in-chief Andy Serwer. “I think, ten years from now, that they’ll be worth more money. And I feel there’s a very high probability I’m right.”

During the third quarter of 2018, Berkshire Hathaway snapped up a new position in JPMorgan Chase (JPM) of 35.6 million shares. Buffett then added another 14.5 million shares during the fourth quarter, making it the 9th largest stock holding for him with more than 50.1 million shares.

“I don’t think that it will turn out to be the best investments at all, of the whole panoply of things you could do, but I’m pretty sure that they won’t disappoint me,” Buffett added.Buffett, 88, has publicly praised JPMorgan’s CEO Jamie Dimon for years but had not owned the stock until late last year. Last year, he told Yahoo Finance that he made a “mistake” by not buying JPMorgan earlier.

Lately, Buffett has been bullish on bank stocks. Berkshire Hathaway holds large positions in Bank of America (BAC), Goldman Sachs (GS), Bank of New York Mellon (BK), and PNC Financial (PNC).

Buffett has been a long-time holder of Wells Fargo’s stock (WFC) with the position dating back to 2001. He’s trimmed the position slightly in recent quarters, though it’s still a top three holding for Berkshire.

1 comment

You could definitely see your skills in the article you write.

The sector hopes for even more passionate writers like you

who are not afraid to say how they believe. Always go

after your heart.