Trade Findings and Adjustments 04-9-2019

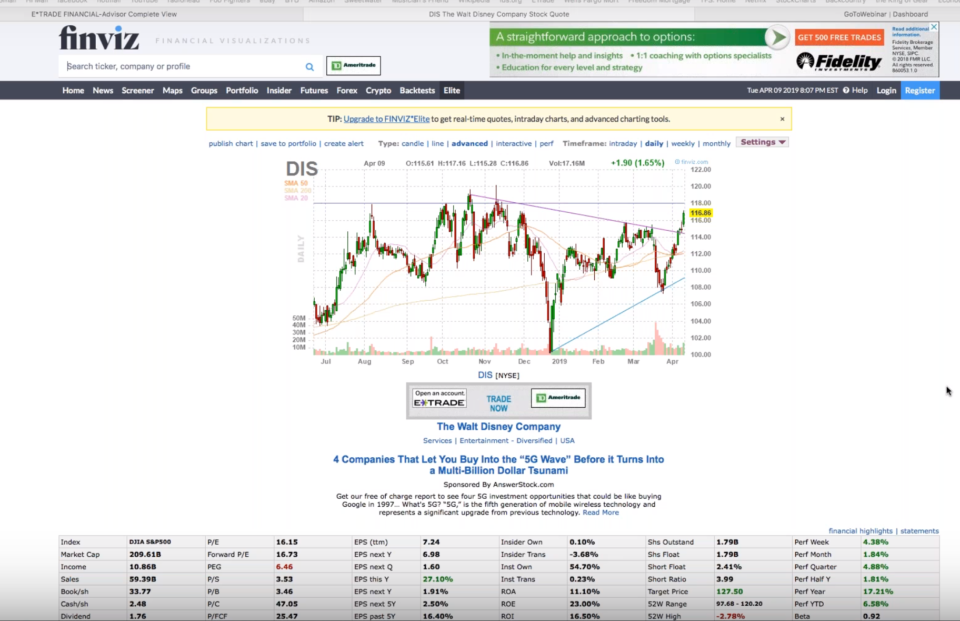

DIS – What could be a good chance for Disney stock to keep moving up?

– Technically due for a break out as it has broken the $115 resistance and wedge pattern chart

– Movies this summer… Most importantly Avengers Endgame in May.

– Streaming content with Disney +

– Pre-earnings run for May 8th report.

Option A:

May 24th $116 – 120 strike Bull Call

116 Long Call at 4.45

120 Short Call at 2.45

Cost: $2.00

Reward: $2.00

117.92 breakeven.

Easy to adjust if it goes the wrong way

An alternative:

Option B:

Jan 2020

$120 Strike Leap Long Call for $7

Lots of time for potential profit

Another alternative:

Option C:

May monthly 110 – 105 Bull Put

110 Short Put

105 Long Put

for .66 credit with a BIG buffer below current price of $116.60ish

You are risking more money for a smaller return, but has a high probability of profit.

Hard to adjust if it goes the wrong way.

I prefer options A and B because I like knowing that I can take it off if it goes the right way very quickly. Option C as a credit spread,

requires time decay over the next month in order to make money, and puts you at risk of a news event ruining the trade during that time.

www.hurleyinvestments.com www.myhurleyinvestment.com www.KevinMhurley.com