HI Financial Services Mid-Week Commentary 01-19-2016

I ask myself daily does all of this news about oil, China and Iran really mean anything to our stock market? Kevin Hurley

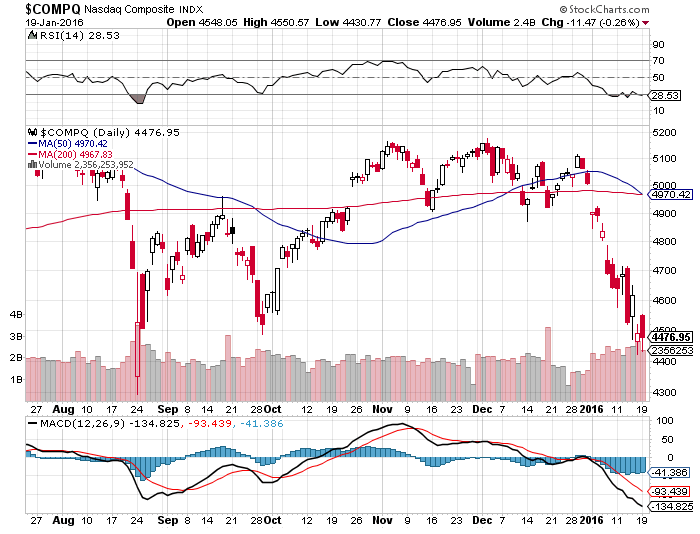

Year to Date : DJIA down 8.24%, S&P 500 down 8.1%, COMP down 10.46%

My three worries are China, oil and the Forgotten Europe fiasco. WHY?

Is there any reason I should be worried about these three – Only in perception

HOW?

China is exporter and we only sell 120 Billion or 0.7 % of GDP output is linked to China

BUT, they’ve bought up so many commodities – Oil, Copper, Gold, etc….

They were on the wrong side of the trade and probably punished for manipulating their currency

OIL – WHY does market worry about oil?

Tons of supply for a slowly growing demand – US, Mexico, Venezuela, Russia, Iran, Iraq, all coming online or producing more oil

Low price = low to slow growth NOT TRUE Lower demand = low to slower growth which in turn means a lower price

I see low oil helping every industry except the energy industry because lower cost to produce, ship and run businesses & acts like a tax break to the consumers

Europe = Has payments coming due this year on QE but they have a central bank, more QE to go and the need to improve the economy

I think consumers are weaker due to health care costs? Yes no maybe so ?

No they health care has gone up the doctors should be making more but they also are making less

THIS IS MY BELIEF – We haven’t recovered from 2008 we’ve only placed a 5.5 Trillion dollar band aid over the problems

I think this year all comes down to earnings and for three years they’ve been lower on a the S&P 500

Real wage growth has also come down in the last 6 years. = People working again but for less money

Remember the Quantitative Easing is nothing more than a Fed experiment.

An experience with Limit orders that I want to share with you this evening:

I had V 75 January 16 long puts ITM by over $3. I was trying to roll the long puts to a March $72.50 to protect thru earnings and here’s what happened

Spreads were $0.25 to $0.30 and now OptionsHouse says you can close a short options trade commission free if the position is $0.10 or less of value!

What’s happening this week and why?

Much more indecision and selling into the rally with key support levels being tested.

I wish we would just have the bottom fall out and let’s get a 20 to 30 to 40 % drop over with

BECAUSE as stock break key levels of support I just add more long put contracts

Where will our market end this week?

Down probably another 3% or 1% a day for today

DJIA – Still Technically bearish

SPX –

COMP –

Where Will the SPX end January 2016?

01-12-2016 Down 6%

01-12-2016 Down 5%

01-07-2016 Down 5%

What is on tap for the rest of the week?=

Earnings:

Tues: BAC, SCHW, EBAY, IBM, KMI, MS, NFLX

Wed: FFIV, GS, JCI, SWKS

Thur: ALK, HON, SLB, LUV, SBUX, UNP, VZ, ISRG

Fri: GE, STI

Econ Reports:

Tues: NAHB Housing Market Index, Net TIC Flows,

Wed: MBA, CPI, Core CPI, Housing Starts, Building Permits.

Thur: Initial, Continuing Claims, Phil Fed

Fri: Existing Home Sales, Leading Indicators

Int’l:

Tues –

Wed – JP: ALL Industry Index, GB: Labour Market Report

Thursday – EMU: ECB Announcement, JP: PMI Manufacturing Index Flash

Friday – FR:DE:EMU: PMI Composite Flash

Sunday – JP: Merchandise Trade

How I am looking to trade?

Protective puts and collars to get me through an earnings season

Will leave in place if market goes down.

Will roll long puts to at the money (ATM) for the earnings

Questions???

Long Puts are out to Feb and March

Short calls on March and April

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Apple: TSMC Partnership A Path To Even Greater Smartphone Dominance

What Should Your Expectations Be If You’re Looking To Invest In Ford?

http://www.seekingalpha.com/article/3815156

How US oil shipped abroad will be felt at home

http://www.cnbc.com/id/103306529

Ford: A Very Special Dividend

Ford Motor: OK, This Is Just Stupid

Why Ford Is A Buy: 7% Dividend In 2016, 10 P/E, Plus International Growth

Why a China slowdown will not hurt that much

http://www.cnbc.com/id/103307134

Apple’s Tough Compare May Not Be So Tough After All

HI Financial Services Mid-Week 06-24-2014