HI Financial Services Mid-Week Commentary 01-12-2016

Life can only be understood backwards; but it must be lived forwards. Soren Kierkegaard

Let’s talk about the start of the year – today the stock market is down about 5% and it was down last Friday 6%

Worst start in History or worst first week in the history of the stock market

WHY? China, Tax selling for the year 2016, Oil, Better Job news which can lead to more interest rate hikes.

Asset allocations models, Harry Markowitz models, traditional mutual funds ALL Offer no protection,

AND You shouldn’t have any money with these type of investments.

I cashed in BIDU, AAPL, DIS, V long puts over the last 3 trading days and I’m ready for earnings

Collar Trade allows for mistakes, protection and the ability to dollar cost average without having to find more money.

What’s happening this week and why?

Two up days and better than expected Jolts numbers but nothing matters until the end of the week.

Where will our market end this week?

3% higher for the week

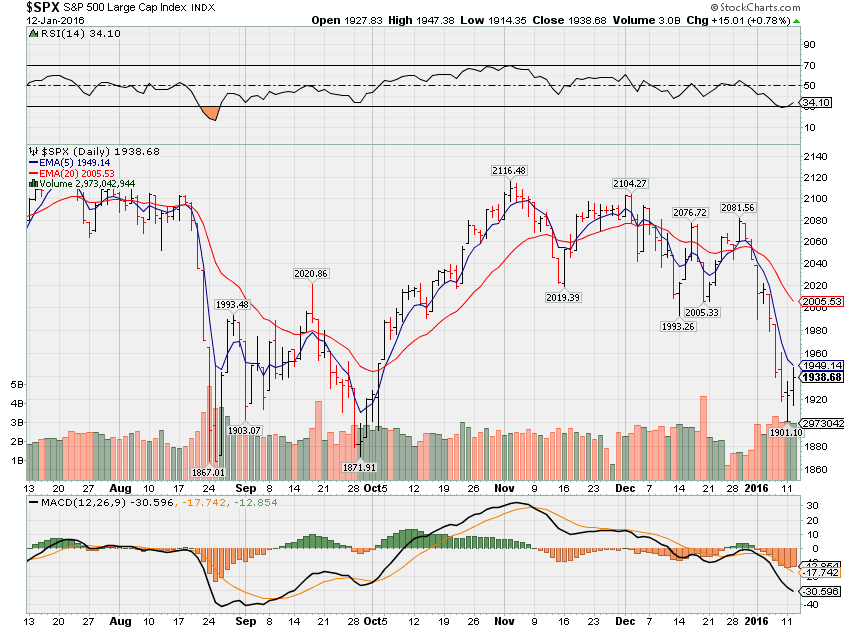

DJIA – three technical crossovers to the bearish side but we are OVER-sold

SPX – three technical crossovers to the bearish side but we are OVER-sold

COMP – three technical crossovers to the bearish side but we are OVER-sold

Where Will the SPX end January 2016?

01-12-2016 Down 5%

01-07-2016 Down 5%

What is on tap for the rest of the week?=

Earnings:

Tues: CSX, FUL

Wed: SVU

Thur: JPM, INTC

Fri: BLK, C, USB, WFC, RNC

Econ Reports:

Tues: Jolts Job Openings,

Wed: MBA, Fed Beige Book, Treasury Budget

Thur: Initial, Continuing Claims, Import, Export

Fri: Retail Sales, Retail ex-auto, Empire Manufacturing, PPI, Core PPI, Michigan Sentiment, Industrial Production, Capacity Utilization, Business Inventories, OPTIONS EXPIRATION

Int’l:

Tues – GB: Industrial Production, CN: Merchandise Trade Balance

Wed –

Thursday –

Friday –

Sunday –

How I am looking to trade?

Protective puts and collars to get me through an earnings season

Will leave in place if market goes down.

Will roll long puts to at the money for the earnings

Questions???

Long Puts are out to Feb and March

Short calls on March and April

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Cramer: Worst mistake you can make in a sell-off

http://www.cnbc.com/id/102812366

This is when you should panic about market

http://www.cnbc.com/id/103281134

The Risk Of Ford At $13 – The Fed, China And The Upcoming Recession

http://www.seekingalpha.com/article/3795436

Buying Visa Could Be Your Most Sensible Investment Of 2016

http://www.seekingalpha.com/article/3794836

2016 Ten Predictions from Bob Doll: Investors See Glimmers of Hope Along a Rocky Path

Returns on this investment could hit 65-year low

http://www.cnbc.com/id/103295322

What’s the tax bill on a $1.4B Powerball win?

http://www.cnbc.com/id/103295702

Grow Old And Become Wealthy With Disney

Disney’s Studio Success Will Drive The Stock Higher, Not Lower

http://www.seekingalpha.com/article/3801736

HI Financial Services Mid-Week 06-24-2014