Recorded 01-27-2016 Commentary

HI Financial Services Mid-Week Commentary 01-27-2016

Investors: Keep your itchy finger off the trigger

What followed the 2008 mass exodus from stock funds? A five-year, cumulative 8.6 percent return for the S&P 500.

Sunday, 24 Jan 2016 | 3:00 PM ETCNBC.com

How about that 550-point intraday dive last week in the Dow! Did that finally get you to sell?

Or was it one of the many headlines about the trillions of dollars that have been wiped out of the stock market in the worst start for the Dow in history — since 1897! And worst start for the S&P 500 since the Great Depression began in 1929.

Oh, c’mon, that was “so last Wednesday.”

Surely, when all the major indices ripped higher on Friday, and stocks registered their first positive week of the year, and that diving-Dow had two straight days with triple-digit gains, you had plowed right back into the stock market and banked all those big gains.

Right?

It seemed like the panic and the paranoia were over — until the Dow dropped by another 200 points on Monday.

Vanguard Group CEO Bill McNabb said on Monday that stocks are pretty highly valued and investors should expect the volatility to last longer — and expect less from stocks for up to a decade.

And so far in January, investors have yanked near-$7 billion from U.S. stock funds, according to Thomson Reuters Lipper data. Investors have also put more than $3 billion into money market funds — the market’s under-the-mattress cash equivalent. But the more alarming data comes from last month, when investors pulled $48 billion from stock funds. That is eerily similar to 2008, as the financial crash hardened: Investors took $49 billion out of stock funds in Sept. 2008 and $55 billion out of stock funds in October 2008.

Kudos to investors for the great timing. Except for the fact that from 2008 to 2012, the S&P 500 generated a cumulative return of 8.6 percent.

Here’s the problem: If an investor missed the 36 percent drop in the S&P 500 in 2008 — or even worse, bailed on the markets mid-carnage — they probably also missed the 26 percent gain in the S&P 500 in 2009, and the next three positive years for the index that followed.

In 2011, investors pulled another $94 billion from stock funds, and in 2012 another $129 billion, when the S&P 500 was up 16 percent. Hundreds of billions of dollars pulled out of stocks during a period of time when a stay-the-course strategy would have netted an 8.6 percent cumulative gain. Not a shoot-the-lights-out strategy, but nothing to sneeze at either in today’s low-return — not to mention nil savings rate — environment.

“The global financial crisis created such a high level of risk aversion that people didn’t just wait for the start of the rebound. In some cases, they waited for years,” said Kristina Hooper, U.S. investment strategist at Allianz Global Investors. “I can’t tell you how many investors I came across in 2011, 2012 and even 2013 who had missed out on a lot of the comeback in the stock market and were still sitting in cash.”

It’s what Lipper’s head of Americas Research, Jeff Tjornehoj, calls the dilemma of the do-nothing investor: More often than not, the do-nothing investor does better.

“It’s a rocky ride, but the do-nothing investor would have been fine and avoided headaches,” Tjornehoj said, referring to those who stayed invested through the crash. He added, “If you know precisely how to move between stocks and bonds and everything else, you would have done better, but how many investors know how to do that?”

“The big issue is that when you go to cash, you have to be right twice,” said Mitch Goldberg, financial advisor and president of Dix Hills, New York-based ClientFirst Strategy. “First, you have to be right about getting your timing correct when you sell. If you are selling because it is your panic reaction in a down market, I think it’s fair to say you probably got that part of the decision wrong. The second part you have to get right is the timing of your buy orders. And if you are waiting for the perfect time to buy, you’ll never pull the trigger.”

And here’s a key that many investors who plan to be smarter than the “herd” miss, especially in markets like the one investors faced last week, with huge swings in the norm day-to-day. A move to cash works against the investor to a greater degree when there is greater volatility.

“Friday’s rally in global equity markets is a case in point of how investors who just binged on cash are missing out on a big rebound,” Goldberg said. “It’s tough to time, and missing out on the best days of the year has a restraining effect on long-term performance,” Goldberg said.

Allianz Global Investors provided an example of just how much investors can lose out in just a few days. The Allianz economic research and strategy team looked at the period from 1973 to the end of 2014, comparing four different approaches to investing in the U.S. stock market. Investors who missed the three biggest days of each year see their gains go down dramatically.

In the first approach, $100 is invested on the first day of the year and another $100 dollars added at the start of each year thereafter. The total return over the four decades was $52,251.

In the market-timing approach, if an investor invests the same $100 at the start of each year but misses the top three days of the year, the total return was $2,953.

The best return of all came from investing $100 on the day of the lowest index level of the year — the best day of the year to invest — and adding $100 on the lowest-index-level days of subsequent years. That approach netted a total return of $54,355.

“The problem is that we can never predict when the best days will occur, so we have to stay fully invested all the time to experience them,” Hooper said, adding that most days in any given year (both positive and negative) will typically produce a net flat performance.

Those “big day” misses, or gains, compound over the years.

The pleasure and pain of investing

The key problem I see when investors go to cash has a lot to do with procrastination,” Goldberg said. “They think about getting back into the market in a conceptual way, but when it comes right down to it, they often don’t because they didn’t implement a disciplined strategy to get back in. If the stock market bounces and rips higher, they say to themselves, ‘I could’ve gotten in lower, so now I’ll wait for another pullback.’ Then the market pulls back and they say to themselves, ‘I’ll wait to see if it goes lower.’ And so on.”

Tim Maurer, director of personal finance for The BAM Alliance of financial advisory companies, said that the field of behavioral finance has demonstrated how our brains often think (wrongly) when it comes to evaluating the pain of losses versus the pleasure of gains.

Maurer said to consider the decision between staying invested after a market decline or moving to cash as a four-step process:

- The pain of staying invested is that I could lose even more.

- The pleasure of moving to cash is that my worry is eliminated and I’m guaranteed not to lose any more.

- The pain involved in moving to cash is that I’ll miss the upside, thereby eliminating my opportunity to recoup recent losses in the next market up move.

- The pleasure in staying invested is that I’m giving myself a better chance to achieve my financial goals in the long term — the reason I invested in the market in the first place.

He said the four-step process has one purpose: to bring the vast majority of investors back to the conclusion that they shouldn’t get out of the market.

“The market has historically paid investors a premium over cash and bonds precisely because it requires investors to endure times of volatility,” Maurer said. “Without volatility, we’d have no reason to expect higher long-term gains.”

A few weeks ago — amid one of the many recent bouts of extreme daily selling — a friend asked me whether they should sell their Facebook shares. I asked, “And replace them with what?” She didn’t have an answer.

Another friend, in his 40s, texted in a panic to ask if it was the time to get out of stocks. I asked him what stocks, in particular, he meant to sell. He said no stocks, just moving his retirement portfolio as a whole out of equities. I replied with several exclamation points — you can imagine the words that preceded the punctuation yourself.

“At the start of December, I addressed a roomful of high-net-worth financial advisors and asked them, ‘How many of you expect the market to fall more than 10 percent in 2016?'” said Allianz’ Hooper. “Nearly every hand in the room went up. And yet now that the market has experienced the sell-off, many are not viewing it as a healthy correction but are panicking and fearing the worst.”

“The big issue is that when you go to cash, you have to be right twice.”-Mitch Goldberg, president of ClientFirst Strategy

Hooper said the psychology is easy to understand. Sell-offs are by nature disorderly and create a contagion of fear, and investors believe that when stocks go down 10 percent in value, there’s something “the market knows” but a Main Street investor doesn’t.

“In reality it is just a herd, and herding is a dangerous activity for investors,” Hooper said.

There is always a good case to be made for rebalancing from stocks that have run up a lot into stocks that seem undervalued. Maurer said it’s good to be “greedy” like Berkshire Hathaway chairman and CEO Warren Buffett through stock rebalancing. But when Lipper fund-flows data shows net negative flows in equity funds, that’s not what’s going on with the mass of retail investors.

Goldberg is a “big proponent” of raising cash at times, but said the time to do it is when stocks are rising and then wait patiently for new opportunities. “I never feel pressure to be fully invested at all times. But I do not believe in going to cash as an ‘all or nothing’ trade,” he said.

Cash proponents will argue that staying invested is a disaster-in-the-making for retirees. Goldberg said retirees are naturally the most fearful, but it’s the cash mentality rather than staying in equities that is the “never-ending wealth destroyer pattern.”

“You’re now giving up on an asset class that historically has been a hedge against inflation,” Goldberg said. “Sure, inflation is nonexistent according to headline statistics. But if you pay for health insurance, which as a senior could easily be sending a big proportion of your income on health care, you know you are ground zero for inflation pain.”

In fact, if any retiree has a portfolio constructed with investments that would collectively go to zero in a stock market correction, the only question worth asking is, Who designed your portfolio, and how quickly can you fire them?

There’s a reason that famed investors like Vanguard Group’s Jack Bogle and Buffett sound like a broken record with the “stay the course” mantra.

It’s not just because their millions and billions allow them to do so with comfort — though that helps.

Almost the End of January Hurley Investments Re-Cap

Hello Everyone,

I have a couple of phone calls to make with some of you tomorrow and a couple of questions occurred over the last month. Let me go over some market comments, ideas, and numbers. I want to start off with an experience I had that I will never do again. About four years ago or so I had a client or two talk me out of sticking with Boeing. They had been in it long enough, picked up tons of shares but the stock had been in a range for years “not making any money”. I lost an argument and decided that to not show any preferential treatment everyone would exit Boeing. So yes of course it popped from $75 to over $100 and now trades at $120. If I would’a, should’a, could’a had that one back I would trade it in no questions asked. We suffered through years of a sideways moving stock to give up the growth by getting out. I spend my whole Christmas vacation spending hours working fundamentals, valuations, and going over market growth predictions to make sure we, on paper, are in the best growth opportunities available for the money you have available to invest. I can’t predict when the stocks will move but by adding shares we get huge jumps on profits!

I’m telling this story because two of you came to me with a question about managed funds that charge less than I do. I am think skinned so no I didn’t take offense to you looking at your options. I asked what they were and one of my clients brought two to my attention. One charges 0.85% and the other charges 0.09%. Well the first one was from Fidelity and yes it was an actively managed fund. That means that they turnover 45% of the fund when positions don’t make an expected return and then put something else in it’s place that did make money over the previous quarter. The management fee, aka….what they pay someone like me, was 0.85% front loaded. The TRUE cost of the fund was 3.60% plus whatever the capital gains taxes end up on the gains for the year. Going on the previous years return’s it would have cost 4.6%. How is that possible? 12-01B fees for marketing, senior portfolio manager, jr portfolio manager, broker fees, restructuring, rebalance and turnover fees not to mention commissions at $25 per ticket. I was asked how is that possible and why is it so deceitful? My best answer was it is the way it has always been and the big brokerage houses are only in it to make themselves rich. The other 0.09 was an ETF with a whole other set of charges that were over 5%. What I am saying is when it sounds to good to be true it usually is.

I quite often when the markets are ridiculous will wake up at 1:30 Am to see what the Asian or Hong Kong Market is closing at. If I stay up and hour I can see what the European Markets are like after the first hour of trading overseas. Why? It usually dictates our futures for the morning before economic reports come out. So I get back to sleep when I can and I’m up two hours before the market opens which is 5:30 AM Mountain Standard Time. I usually spend two hours soaking up information. I read anything and everything I can and then validate the numbers in the article. I see if I can verify their numbers to agree or disagree with what they say. That is how I so often know about something you’ve read, seen or may have been talked about in the market. I worked these numbers on the close of Monday’s market:

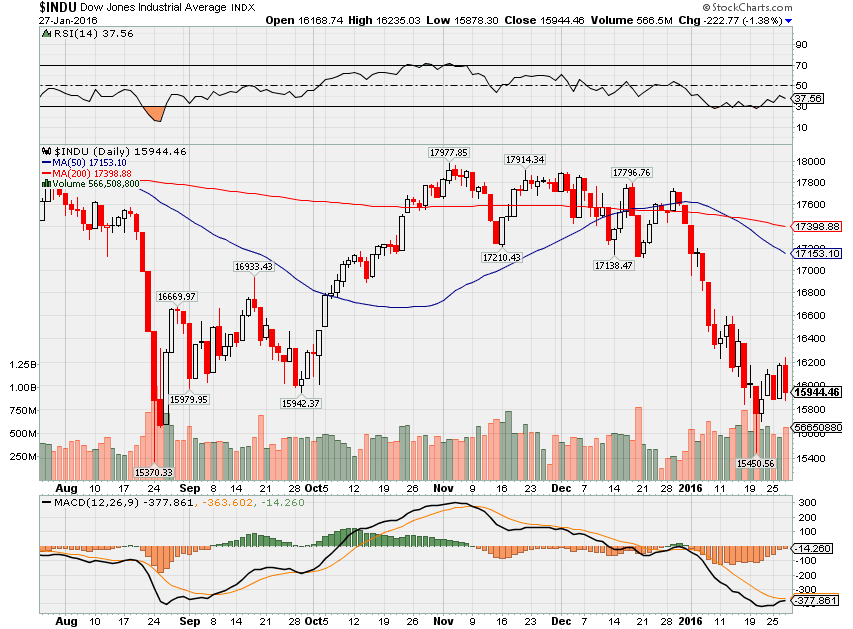

Dow down 8.93%

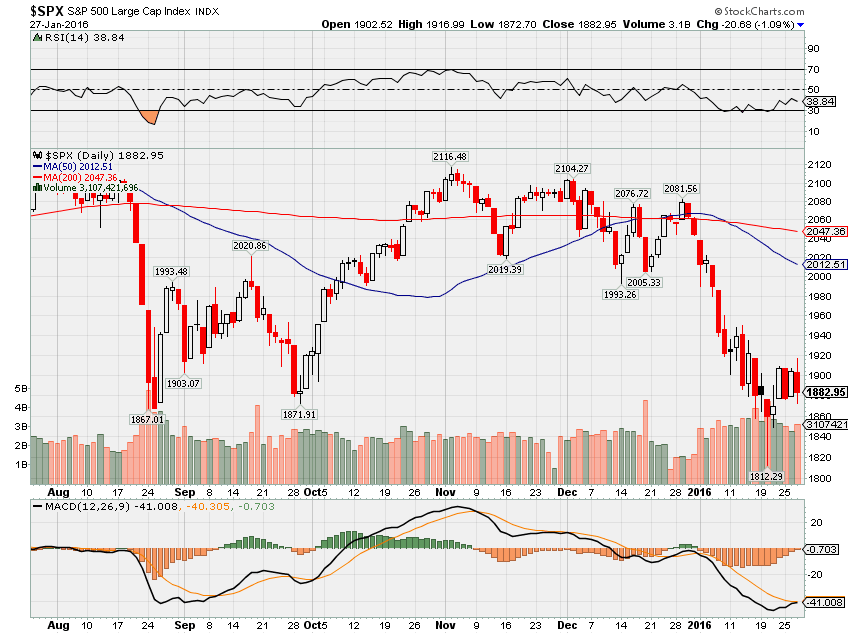

S&P 500 down 8.26%

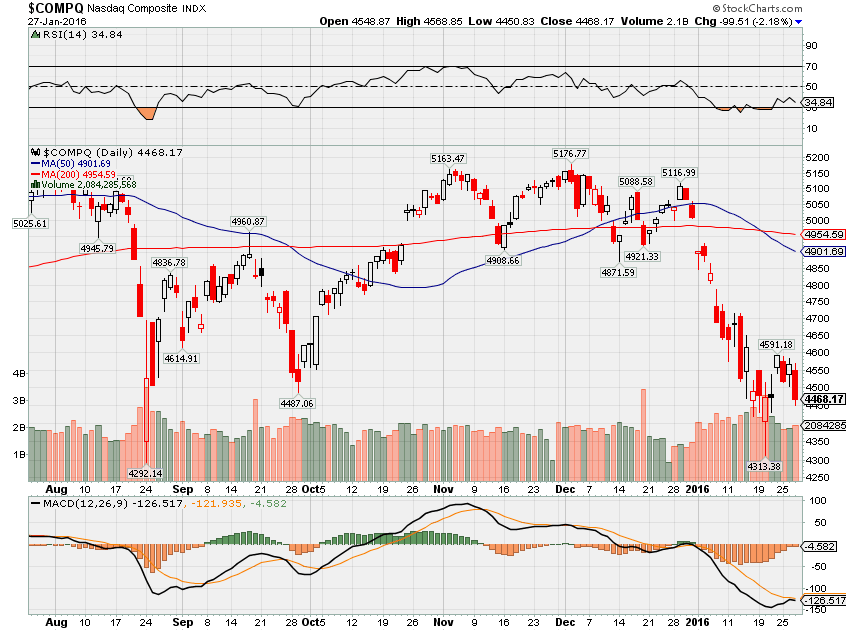

Nasdaq down 9.89%

Add another 4% for the down December and our market now has a correction of more than 10%. I hope as clients you have been able to appreciate the fact your accounts are not down 12% to 15% in the last 8 weeks. YES they are down and that fact is undisputable. BUT anything we make on the way down is profit as stocks come back. We are only in the first month of the worst start in market history. We have plenty of time for great stocks to come back. Our core stocks = AAPL, BIDU, DIS, V, F, and NVDA have all been down. AAPL down 25%, DIS down 25%, V down 14% and F has been the worst!!! Now could I have done a better job on DIS and possible gotten out of F at $17. Of course looking back I could have done those things but I look forward. I care more about the future than the past. Why is this important? It allows me to answer these questions as they come up.

Kevin why didn’t we sell? Answer: I don’t want to pay taxes until it is in our best interest. Long term capital gains are always best and I start sending out emails the beginning and throughout November to go over taxes with anyone who wish to, have a carryover or just want to talk about the year.

Kevin why didn’t you protect at the top and sell at the bottom? Answer: I can’t predict the future and never have been able too. If I could, we would mortgage the house and pick the Super Bowl winner to live the rest of our lives in financial bliss !

Kevin why are you trading this way? Answer: Because the new normal is a pain in the butt!!! I’ve worked too hard to live through a 50% loss and if we have another 2008 we will all be profitable while others lose half of the value of their portfolio. My money is in the same positions that you are in and it eats me alive to lose money.

EVERYONE except for maybe F and NFLX portfolios are beating the market and with a little move up will be profitable. YES, I know nobody cares about beating the market when it is down. We all want to be profitable. I can make it so your portfolio never losses but it is called an annuity. AAPL is going down farther after their earnings today but we have protection on the make up some of the downward losses. DIS, BIDU, FB, F, SNDK, NVDA, V are all coming this week or the second week of February. We are protected for earnings and maybe tomorrow the FED will give the market a reprieve with no more rate hikes for the next 6 months or make the rate hikes “data dependent”. If you have any questions or want to talk with me please give me a call and let’s spend some time going over portfolios. I’m not big enough that I don’t have time for my clients and I want to always make sure ya’ll are taken care of. I care and look forward to another wild year in the stock market.

DIS and Earnings on 2/9 AMC

$119.88 All-time high last year

What’s happening this week and why?

Fed kept rates the same – But not dovish enough

Possible global slowdown

AAPL, BA drug the market lower

Volatility picked up bigtime last week but only at 23 today (VIX)

Orderly shakeout ?!?!?!!!

Fewer people traveling – Zika Virus, terrorist activity, not enough money

Where will our market end this week?

Lower by 2 to 3%

DJIA – Technically bearish and in no man’s land

SPX – Technically bearish and in no man’s land

COMP – Technically bearish and in no man’s land

Where Will the SPX end January 2016?

01-27-2016 Down 8.5%

01-19-2016 Down 6%

01-12-2016 Down 5%

01-07-2016 Down 5%

What is on tap for the rest of the week?=

Earnings:

Tues: AKS, T, COH, GLW, FCX, JNJ, LMT, PG, X, VMW, GWW, AAPL

Wed: BA, CLF, CRUS, BRCM, DFS, EBAY, EMC, GD, HES, LVS, MUR, TXN, FB, SNDK,

Thur: ABT, AMZN, BLL, CAT, CELG, EA, LLY, JCI, LBLU, HOG, MSFT, NUE, RTN, VLO, HSY, BABA, F, V,

Fri: ALV, CVX, HON, CL, MA, PSX, WHR, XRX

Econ Reports:

Tues: Case Shiller, FHFA Housing Price Index, Consumer Confidence

Wed: MBA, New Home Sales, FOMC Rate

Thur: Initial, Continuing Claims, Durable Goods, Pending Home Sales

Fri: GDP, GDP Deflator, Michigan Sentiment, Chicago PMI, Employment Cost Index,

Int’l:

Tues –

Wed – JP: Retail Sales

Thursday – JP: CPI, Household Spending, Industrial Production, Unemployment rate, BOJ Announcement

Friday – FR: GDP Flash, DE: Retail Sales, EMU: HICP Flash

Sunday – JP: PMI Manufacturing Index, CN: CFLP Manufacturing PMI, PMI Manufacturing Index

How I am looking to trade?

Protective puts and collars to get me through an earnings season

Will leave in place if market goes down.

Will roll long puts to at the money (ATM) for the earnings

Closed at 93.42 and with 216 Billion in cash = $39 a share of intrinsic cash value on outstanding shares

93.42 – 39 = Stock value of $54.42

Questions???

AAPL – I was going to move half of the money from AAPL over to FB

AAPL Still a good buy? YES looking into the end of 2016, iPhone 7 and valuations are cheap

There is NOT a shrinking iPhone situation they just sold the most ever 74.6 Million

This is a great example of the law of large numbers

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

JPMorgan: Disney attractive, ESPN subscriber woes ‘exaggerated’

Falling ESPN Subscribers Don’t Mean The Sky Is Falling For Disney

Subject: AAPL: Apple: 3 Reasons To Stay Positive

| Disney: Tumbling ESPN Subscribers Not A Worry For Me |

http://seekingalpha.com/article/3838906-disney-tumbling-espn-subscribers-worry

HI Financial Services Mid-Week 06-24-2014