HI Market View Commentary 05-24-2021

My Quote of the Day

Entrepreneurship IS living a few years of your life like most people won’t, so that you can spend the rest of your life like most people can’t

https://go.ycharts.com/weekly-pulse

| Market Recap |

| WEEK OF MAY. 17 THROUGH MAY. 21, 2021 |

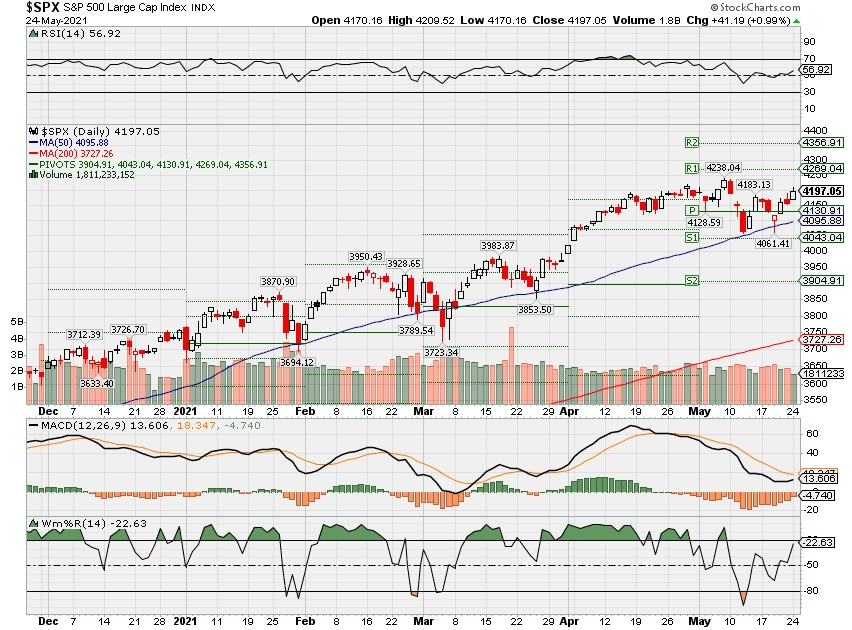

| The S&P 500 index fell 0.4% last week, the benchmark’s second consecutive week in the red, amid continued inflation worries. The S&P 500 ended the week at 4,155.86, down from last week’s closing level of 4,173.85. This is the first time since February that the index has had back-to-back weekly declines. With the S&P 500 having fallen in two of May’s three weeks so far, it is now in negative territory for the month, down 0.6% for the month to date. However, it is still up 11% for the year to date. Energy and industrials had the largest percentage drops last week, down 2.8% and 1.7%, respectively. Other sectors in the red included financials, consumer discretionary, materials and communication services. On the upside, real estate had the largest percentage increase of the week, up 0.9%, followed by a 0.7% rise in health care and a 0.3% increase in utilities. Technology and consumer staples eked out gains of about 0.1% each. The mixed activity came as investors continued to worry about larger-than-expected April inflation figures reported last week and fretted over how to view the latest weekly jobless claims, which hit their lowest level since the COVID-19 pandemic began. While the improving employment data show the US economy is recovering, investors worry the recovery could lead to the Federal Reserve ending its easy-money policies sooner. The drop in the energy sector came amid concerns about inflation and reports that Iran and the US were nearing a nuclear agreement that would call for sanctions on Iran’s oil production to be lifted. Among the decliners, shares of Chevron (CVX) shed 4.9% on the week. Decliners among industrials included shares of John Deere (DE), which posted a 6.3% weekly drop despite reporting higher fiscal Q2 earnings Friday and raising its fiscal 2021 income forecast above analysts’ estimates. While the agriculture and construction equipment maker’s shares rose 1.3% Friday after the Q2 report, the Friday gain failed to outweigh declines posted earlier in the week. In real estate, gainers included shares of Simon Property Group (SPG), which edged up 0.2% amid positive analyst actions from Piper Sandler and Morgan Stanley even as S&P downgraded its credit rating on the stock by one notch to A-. Piper Sandler raised its price target on SPG to $150 from $130 while maintaining its investment rating on the shares at overweight. Morgan Stanley, which also kept its investment rating on the stock at overweight, raised its price target on Simon Property Group to $140 from $135. Next week, April new home sales and the May consumer confidence index will be released Tuesday, followed by revised Q1 gross domestic product and April durable goods and pending home sales on Thursday. Friday’s economic reports will include April core inflation as well as May consumer sentiment. Provided by MT Newswires |

There are certain thing in life you just have to deal with

1st point to mention = right now the market isn’t making a whole lot of sense

AAPL – Best earnings ever and the lost $10

BA – Has a rebound to $405 IF they can solve the problems, ship out the planes and have the CEO shut his damn mouth

BAC – Up to $42.50 and has pre 2008 $60 price target

BIDU – Great earning, pushed around by hedge funds that lost almost everything

DIS – Do we get now with the re-opening occurring except in CA

FB – Volatile because the owner is a rich idiot

MU – A key chip maker, potential buy out opportunity so do we sell out now

UAA – $42 price target, good earnings

V – exit all the long calls because it fell from $235 to $220

The stock market doesn’t move in a straight and this year, SO FAR, we don’t look amazing

You have to do your research , Warren Buffet has it right, just minimize downward movement until the companies head higher

2nd Crypto Currency

Right now crypto currency is the biggest Ponsi Scheme out there

BECAUSE : because the is no product, service or tangible pricing involved with the currency, Not endorsed by any government, not a stable platform and the coins can be stolen and mined, it is right now 100% emotionally based traded, zero intrinsic value

Because unlike stocks, index, and ETF’s which has some intrinsic value, this is absolutely dependent on instant non transparent supply and demand cycles, which can be affected by anything, even unreal news

IF you feel like gambling

Bitcoin BTC, Ethereum ETH, Lite Coin LTC

Hurley Investments has chosen to NOT gamble with clients or our own money

3rd We make our decisions based on technical analysis, fundamental analysis, sentimental analysis and plain old common sense

Core Holdings:

COST – 5/27 AMC

Where will our markets end this week?

Lower

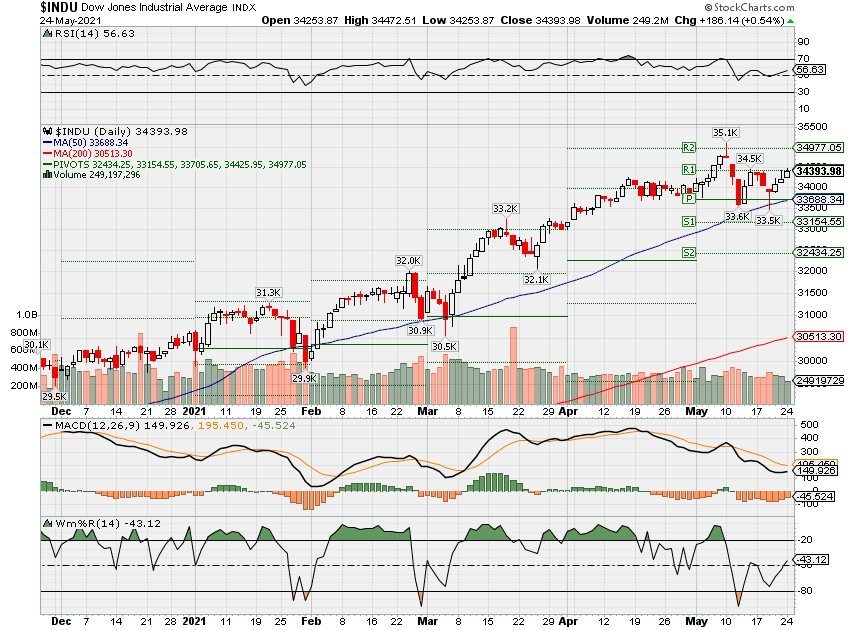

DJIA – Bullish

SPX – Bullish

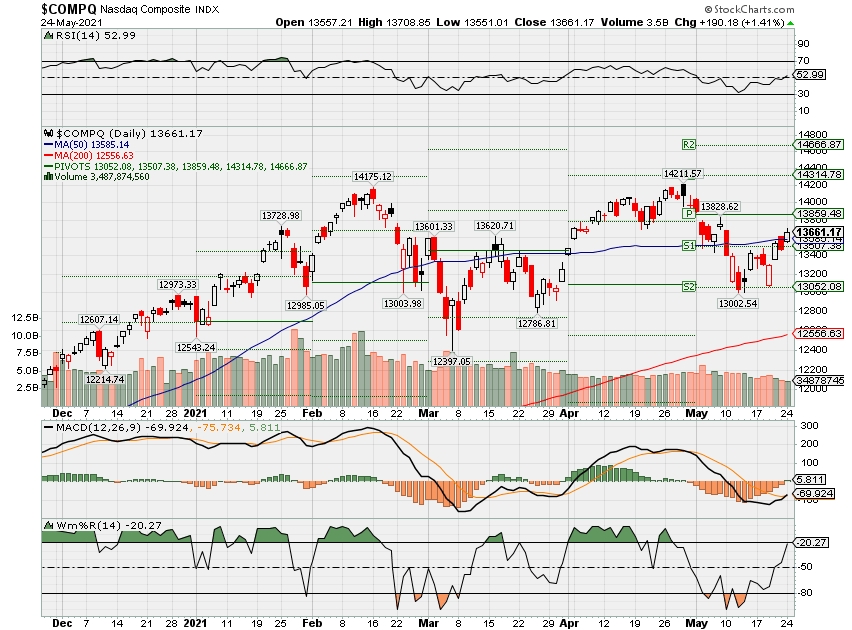

COMP – Bullish

Where Will the SPX end June 2021?

05-24-2021 4.0%

Earnings:

Mon:

Tues: AZO, INTU, JWN, TOL, URBN

Wed: ANF, DKS, AEO, NVDA

Thur: DLTR, MDT, DELL, DG, COST

Fri: BIG

Econ Reports:

Mon:

Tues: FHFA Housing Price Index, Case-Shiller, New Home Sales, Consumer Confidence

Wed: MBA,

Thur: Initial Claims, Continuing Claims, Durable Goods, Durable es-trans, GDP, GDP Deflator, Pending Home Sales,

Fri: Personal Income, Personal Spending, PCE Prices, Chicago PMI, Michigan Sentiment, END OF MONTH

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Earnings and adding protection where needed

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Industry Must Rethink the Future of the Workplace: Finra Chair

By Ian Thomas

May 21, 2021

The debate around the future of the workplace post-pandemic has only grown as firms are bringing back to offices their employees, many of whom want flexible arrangements moving forward, according to a discussion raised yesterday at the 2021 Finra Annual Conference.

The future of theworkplace needs to be rethought, Eileen Murray, chair of the Financial Industry Regulatory Authority and former co-CEO of investment management firm Bridgewater Associates, said at the conference.

“Just two years ago, people were looking at offices as a strategic attraction for talent, particularly young people in terms of game rooms and so on and so forth,” she said. “And then we had the pandemic, and I think that thinking has to be rethought and work has to be reimagined.”

Murray said the solution is a hybrid system where workers are provided flexibility to be located elsewhere two or three days a week and then be required to come to the office on the other days.

“I think that hybrid approach is necessary to ensure that you retain your culture, your community, your collaboration, and ways of learning that are beyond a particular job function,” Murray said.

Seventy percent of top executives in the financial services industry believe that employees should come to the office at least three days a week — once Covid-19 isn’t a major threat, according to a survey conducted by PwC in November and December.

Employees, however, think otherwise. Only 20% of those who responded to the PwC survey believe they should come in at least three times a week, and 30% would work remotely every day if they were allowed.

JPMorgan reopened its U.S. offices on Monday to all employees, subject to an occupancy cap, in line with the firm’s plan to bring back most of its U.S. workforce to the office in July. Goldman Sachstold its bankers in the U.S. that they should return to the office in June. Bank of America and Wells Fargo plan to bring back some employees to their offices starting in September.

Bringing employees back to the office could be unpopular, Murray said. “I don’t envy CEOs that have to explain to employees why it’s not 100% [work from home], but I think most people will be reasonable.”

Murray believes the adaptability of employees to working remotely during the pandemic will usher in more flexible work arrangements moving forward.

“If there is one positive thing from Covid, [it] is that [for] people who didn’t think flexibility in the workforce made sense, this is something that has convinced them that this could work well,” she said.

Do you have a news tip you’d like to share with FA-IQ? Email us at editorial@financialadvisoriq.com.

Ford already has 20,000 reservations for new electric F-150 Lightning pickup

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- Ford has taken 20,000 reservations for its new electric F-150 Lightning pickup in less than 12 hours since the truck was officially unveiled.

- The reservations are being closely watched by the company as well as investors to gauge the interest of customers in EV pickups.

- CEO Jim Farley said the F-150 Lightning will be a test as to whether mainstream Americans truly want electric vehicles.

Ford Motor has taken 20,000 reservations for its new electric F-150 Lightning pickup in less than 12 hours since the truck was officially unveiled to the public, CEO Jim Farley told CNBC.

The automaker revealed the vehicle at 9:30 p.m. ET Wednesday night during an elaborate presentation at the company’s world headquarters in Dearborn, Michigan. The company’s shares jumped 3.3% in Thursday morning trading.

“The response has been great,” Farley said during an interview on “Squawk Box.” “With 20,000 orders already, we’re off to the races.”

The reservations are being closely watched by the company as well as investors to gauge the interest of customers in EV pickups, which is an unproven segment that automakers are rushing to enter. They include Tesla, General Motors and several start-ups such as Rivian, Lordstown Motors and Canoo.

Ford’s strong reservations for the F-150 Lightning are not unique. Two days after unveiling the Tesla Cybertruck in November 2019, CEO Elon Musk tweeted that the company had taken 146,000 reservations for the steel trapezoid-shaped pickup.

Farley said the F-150 Lightning will be a test as to whether mainstream Americans truly want electric vehicles.

“I am looking at this vehicle as a test for adoption for electric vehicles,” Farley told reporters at the vehicle’s unveiling. “We should all watch very carefully how this does in the market.”

The wildly popular truck series has reigned supreme for 44 years, including 39 as the best-selling vehicle overall in the U.S. The significance of the truck to Ford can’t be overstated. F-Series, which includes the F-150 and large truck siblings, is the automaker’s profit engine.

Ford is taking reservations for the vehicle on its website. A refundable $100 deposit is required.

Ford announces joint venture with SK Innovation to manufacture EV battery cells in U.S.

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- Ford plans to form a joint venture with South Korean battery maker SK Innovation that will eventually manufacture battery cells for electric vehicles in the U.S.

- The companies on Thursday announced they have signed a memorandum of understanding for a joint venture that will be called BlueOvalSK.

- Production of the battery cells as well as supporting modules is expected to start by mid-decade.

DETROIT – Ford Motor plans to form a joint venture with South Korean battery maker SK Innovation that will eventually manufacture battery cells for electric vehicles in the U.S.

The companies on Thursday announced they have signed a memorandum of understanding for a joint venture that will be called BlueOvalSK. Production of the battery cells as well as supporting modules is expected to start by mid-decade, they said.

The announcement comes amid an expected surge in electric vehicle sales as well as a push by the Biden administration to increase domestic production of critical technologies for EVs such as battery cells, which power the vehicles.

“As the industry changes, we have to insource now,” Ford CEO Jim Farley told reporters Wednesday night during the unveiling of the automaker’s new electric F-150 Lightning pickup.

The supply and production of battery cells are crucial for automakers pivoting to electric vehicles. Farley compared it to automakers building their own engines and powertrain components in the early 1900s. He said it will help avoid any potential future shortages like the industry is currently experiencing with semiconductor chips.

By 2030, Ford expects to produce up to 140 gigawatt (GWh) hours of energy for battery cells annually in North America and up to 240 GWh globally.

In the U.S., the companies plan to initially produce up to 60 GWh a year. That would be enough power for about 600,000 of automaker’s electric Mustang Mach-E crossover, Hau Thai-Tang, Ford’s chief product platform and operations officer, told the media during a call Thursday.

The creation of the joint venture, which was first reported Wednesday by Reuters, is subject to definitive agreements, regulatory approvals and other conditions.

In May, CNBC first reported Ford expected to sell enough EVs to begin manufacturing its own battery cells by 2025.

Ford didn’t plan to make its own battery cells until Farley took the helm on Oct. 1. He changed the course set by his predecessor, Jim Hackett, who had said the automaker saw “no advantage” in producing battery cells.

Ford’s largest crosstown rival, General Motors, is years ahead on its EV battery plans, recently announcing its second $2.3 billion Ultium plant in the U.S. to produce battery cells through a joint venture with LG Chem. The two companies are already building an Ultium Cell plant in Lordstown, Ohio, that’s scheduled to be finished in 2022.

Both of GM’s plants in the U.S. are expected to come online ahead of Ford’s production.

Bitcoin resumes sell-off over weekend, dropping below $32,000

KEY POINTS

- The bitcoin sell-off continued Sunday following a roller-coaster week of trading.

- Bitcoin fell roughly 16% to $31,772.43 by 12:27 p.m. ET, according to Coin Metrics data.

- Bitcoin on Wednesday plunged more than 30% at one point to nearly $30,000, its lowest price since late January.

- Chinese authorities and the U.S. Treasury last week announced moves to tighten regulations and tax compliance on cryptocurrencies.

- · The bitcoin sell-off continued Sunday following a roller-coaster week of trading, as authorities in China and the U.S. move to tighten regulation and tax compliance on cryptocurrencies.

Bitcoin fell roughly 16% to $31,772.43 by 12:27 p.m. ET, according to Coin Metrics data.

The price of the world’s most popular cryptocurrency rose slightly on Monday to $36,315.52 by 3:09 a.m. ET.

Bitcoin’s recent sell-off is a major reversal for the cryptocurrency, which appeared to be gaining traction among major Wall Street banks and publicly traded companies. This month, however, bitcoin has been hit by a series of negative headlines from major influencers and regulators.

Tesla CEO Elon Musk, who helped fuel bullish sentiment when his company bought $1.5 billion of bitcoin, delivered a blow earlier this month when he announced that the automaker had suspended vehicle purchases using the cryptocurrency over environmental concerns.

Musk subsequently sent mixed messages about his position on bitcoin, implying in a tweet that Tesla may have sold its holdings, only to clarify later that it had not done so.

“The asset class continues to be highly volatile, with the potential of significant price movements resulting from a single tweet or public comment,” CIBC analyst Stephanie Price said in a note Thursday.

A JPMorgan report showed large institutional investors were dumping bitcoin in favor of gold. The news raised questions about institutional support for the cryptocurrency.

Cryptocurrencies continued to slide as Chinese authorities called for tighter regulation on crypto mining and trading, and the U.S. Treasury announced that it would require stricter crypto compliance with the IRS.

Bitcoin on Wednesday plunged more than 30% at one point to nearly $30,000, its lowest price since late January, according to Coin Metrics. The cryptocurrency peaked in April near $65,000.

“Even with this week’s selloff cryptocurrencies have had an incredible run over the last year,” Price said.

Bitcoin is up 268% in the past year, according to Coinbase. Ether, the second largest cryptocurrency, grew more than 840%.

HI Financial Services Mid-Week 06-24-2014