Trade Findings and Adjustments 12-14-2023

Keve Bybee – keve@hurleyinvestments.com

What’s been going on?

– FED announced no rate hike and looking possibly 3 rate cuts in

2024

– Stocks rallied nicely

– Only negative is if we run into a recession next year as rates remain

high.

– This means we focus on following trends and watching economic

numbers and earnings numbers.

– Most of the market return this year has come because of our 7 big

stocks

– Should be time we see some of our other stocks run that haven’t.

BAC, BA, DIS, F, JPM, UAA

BAC – Market sees less risk in bank stocks with the FED rate pause and

upcoming cuts. My pick for a bullish trade into the end of the year.

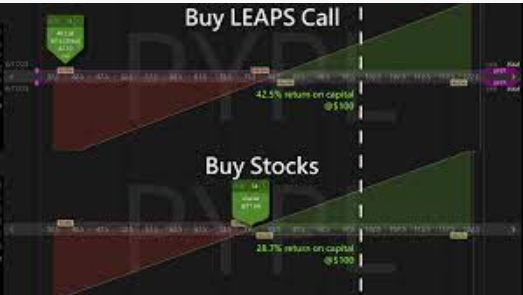

Watch over the next few days to buy some LEAP Calls on BAC on a

short term pull back. You can also look at February monthly calls for

a shorter run.

BA – Fundamentally has room to run up to 280 over the next few

months. Definitely look longer term with some LEAP Calls as it might

cool off before it continues higher.

DIS – Better chance of a long term rally. Look at LEAP Calls as well.

JPM – Similar to BAC but BAC might give you more opportunity.

● Page 2 12/14/2023

UAA – Good Christmas rally stock for shorter term Calls out to

February. Longer term LEAP Calls are a good idea as well.