HI Market View Commentary 09-18-2023

Today the NAHB housing market index came in at ???? 45 vs est 50

People aren’t selling! Why? Demand not being met for new homes because people don’t want to pay a 6%+ interest rate

There is still a shortage on homes and a 6.5 month selling cycle UNLESS the buyer is paying cash and that is currently at an all time high This means people are not willing to move to new jobs

Benefit – Lowes, Home Depot – Home repair, Vacations and Air B&B (rentals), Travel

Geez people are getting crazy and dumber all at the same time!!!!!!!

UAW Strike – 40% increase salary, 4 day workweeks, more benefits, strike fund payments

This is not capitalism at its best

CA passed the fast food act for all fast food workers to get a $20 per hour minimum wage

https://www.investopedia.com/trading/using-pivot-points-for-predictions/

Using Pivot Points for Predictions

Updated May 21, 2022

Reviewed by CHARLES POTTERS

Fact checked by JIWON MA

0 of 1 minute, 47 secondsVolume 0%

Pivot points are used by traders in equity and commodity exchanges. They’re calculated based on the high, low, and closing prices of previous trading sessions, and they’re used to predict support and resistance levels in the current or upcoming session. These support and resistance levels can be used by traders to determine entry and exit points, both for stop-losses and profit taking.

KEY TAKEAWAYS

- A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

- The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

- On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Arm climbs 25% in Nasdaq debut after pricing IPO at $51 a share

PUBLISHED THU, SEP 14 202312:11 PM EDTUPDATED THU, SEP 14 20234:02 PM EDT

Rohan Goswami@IN/ROHANGOSWAMICNBC/@ROGOSWAMI

KEY POINTS

- Arm Holdings has started trading on the Nasdaq under the ticker “ARM.”

- The chip design company is valued at a steep premium relative to the rest of the semiconductor market.

- SoftBank still holds about 90% of Arm’s stock.

Arm Holdings, the chip design company controlled by SoftBank, jumped nearly 25% during its first day of trading Thursday after selling shares at $51 a piece in its initial public offering.

At the open, Arm was valued at almost $60 billion. The company, trading under ticker symbol “ARM,” sold about 95.5 million shares. SoftBank, which took the company private in 2016, controls about 90% of shares outstanding.

On Wednesday, Arm priced shares at the upper end of its expected range. On Thursday, the stock first traded at $56.10 and ended the day at $63.59.

It’s a hefty premium for the British chip company. At a $60 billion valuation, Arm’s price-to-earnings multiple would be over 110 based on the most recent fiscal year profit. That’s comparable to Nvidia’s valuation, which trades at 108 times earnings, but without Nvidia’s 170% growth forecast for the current quarter.

Arm Chief Financial Officer Jason Child told CNBC in an interview that the company is focusing on royalty growth and providing products to its customers that cost and do more.Many of Arm’s royalties come from products released decades ago. About half the company’s royalty revenue, which totaled $1.68 billion in 2022, comes from products released between 1990 and 2012.

“As a CFO, it’s one of the better business models I’ve seen. I joke sometimes that those older products are like the Beatles catalog, they just keep delivering royalties. Some of those products are three decades old,” Child said.

In a presentation to investors, Arm said it expects the total market for its chip designs to be worth about $250 billion by 2025, including growth in chip designs for data centers and cars. Arm’s revenue in its fiscal year that ended in March slipped less than 1% from the prior year to $2.68 billion.

Arm’s architecture is used in nearly every smartphone chip and outlines how a central processor works at its most basic level, such as doing arithmetic or accessing computer memory.

Child said the company sold $735 million in shares to a group of strategic investors comprising Apple, Google, Nvidia, Samsung, AMD, Intel, Cadence, Synopsis, Samsung and Taiwan Semiconductor Manufacturing Company. It’s a testament to Arm’s influence among chip companies, which rely on Arm’s technology to design and build their own chips.

“There was interest to buy more than what was indicated, but we wanted to make sure we had a diverse set of shareholders,” Child said.

In an interview with CNBC on Thursday, SoftBank CEO Masayoshi Son emphasized how Arm’s technology is used in artificial intelligence chips, as he seeks to tie the firm to the recent boom in AI and machine learning. He also said he wanted to keep the company’s remaining Arm stake as long as possible.

The debut could kick open the market for technology IPOs, which have been paused for nearly two years. It’s the biggest technology offering of 2023.

Earnings dates:

MU – 9/27

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 15-Sep-23 15:08 ET | Archive

Stock market is dealing with a digestive process

Year-to-date the S&P 500 is up 15.9% and the Nasdaq Composite is up 30.8%. Those are huge moves, but they get even better when measured from the lows registered in October 2022. From there, the S&P 500 has surged 27.6% and the Nasdaq Composite has soared 35.9%.

Those aren’t bite-sized gains. They are a veritable feast of good fortune for many equity portfolios that went on a crash diet for most of 2022. Of course, when you eat too much or too fast — or eat too much, too fast — you are prone to suffer some indigestion.

The stock market is no different. When it moves too much, too fast, it will experience a period of indigestion otherwise referred to as a consolidation phase to work off some of the excess. Sometimes the process happens quickly and other times it takes a while.

This process is underway right now for the stock market, only we wouldn’t characterize it so much as an uncomfortable process of indigestion as we would a normal digestive process.

Where To?

The S&P 500 closed the month of July at 4,588.96. It hit a low of 4,335.31 on August 18, and today it is sitting at 4,450. Where it is today, though, isn’t as important as where it is going.

And where might that be? We don’t know for certain. Nobody does. We think, however, that it is unlikely to go much higher from here for a spell. For some context, it would take a move of approximately 8% to get back to its all-time high.

That won’t be an easy run given the headwinds posed by elevated interest rates, stretched valuations, China’s economic challenges, and the slow-moving storm that is the lag effect of prior rate hikes not only from the Fed, but also from the ECB, the Reserve Bank of Australia, and the Bank of Canada to name a few others.

To be fair, the stock market might not go much lower from here either, especially if earnings estimates hold up, the Fed is done raising rates, and incoming data continue to defy hard landing fears.

What we could be looking at, then, is a stock market that needs more time to digest its feast, which means a market that has more of a sideways disposition with some volatile moments in between.

Protection Mode

One issue hanging over the market is just how well it has done already this year. The average price return for the S&P 500 since 1930 is 7.45%, according to FactSet. This year the S&P 500 has far exceeded that average — in a rising interest rate environment no less.

We suspect plenty of investors are in a protection mode now, not wanting to surrender those gains and knowing they can still pad returns with risk-free and relatively risk-free alternatives with yields north of 5.00%.

That is an attractive option knowing that the S&P 500 is trading at 18.8x forward twelve-month earnings, which is a 7% premium to a 10-year average of 17.5x forged on the back of lower interest rates.

If there is going to be a more concerted move to boost equity allocations, it will likely be driven by multiple compression that stems either from falling prices or rising earnings estimates.

Earnings estimates have been going up, but what is important to the market’s prospects is that they keep going up. That is the antidote for a market that might encounter some weakness. Still, our contention has been — and remains — that there is value in the equal-weighted S&P 500. It trades at 14.9x forward twelve-month estimates, which is a 15% discount to its 10-year average of 17.6x.

Notwithstanding the discounted valuation of the equal-weighted S&P 500, the magnetic appeal of the mega-cap stocks, the allure of AI growth prospects, and worries the economy will disappoint in future quarters as the lag effect of prior rate hikes kick in, have kept many other stocks in a trailing position.

At the moment, the equal-weighted S&P 500, up 4.5% for the year, is trailing the market-cap weighted S&P 500 by 1140 basis points. What this tells us is that the investment community is still not convinced the economy is going to hit the sweet spot of a soft landing that features disinflation, falling interest rates, and a continued rise in earnings estimates. If it was, the performance gap between the market-cap weighted S&P 500 and equal-weighted S&P 500 would not be as wide as it is.

Stock Market Is Not Alone

The digestive process is not exclusive to the stock market. The Treasury market is in a delicate digestive mode, contemplating where the economy and inflation might be headed, and what that means for the Fed’s next move.

Ironically, the Fed itself is in a digestive mode, resolved it seems to watch incoming data to determine if it is showing the effects of its prior rate hikes, which have been aimed at slowing the economy to get inflation back down to the Fed’s 2.0% target.

The labor market has been a focal point, and while it has started to show some softening, it seems only to have gone from very tight to tight. The unemployment rate sits at 3.8%, not far from a 50-year low, and there are still 1.4 job openings for every unemployed worker.

How the Fed processes the data meals it is served will be key to the stock market’s performance since the market has been convincing itself that the Fed will be cutting rates in the first half of 2024. If that expectation gets pushed out, stock prices are apt to come in.

The bigger risk, though, is if the Fed has to keep raising rates. That would not only push out the timing of the first rate cut, but it would also rekindle fears about a hard landing that likely wouldn’t bode well for earnings estimates.

What It All Means

The easy money so to speak looks to have been made on the move in the first half of the year that few people thought would be so “easy.”

With the market running like it did in the first half of the year thanks to the vast outperformance of the mega-cap stocks, the pull higher from here won’t be easy. That’s because expectations are higher now, earnings multiples for the leadership stocks are more stretched, interest rates are higher, and there is some concern that the economy will be weakening because of the prior rate hikes, which raises the level of uncertainty about earnings prospects.

This is why the stock market’s digestive process could have a sense of agitation about it that creates a choppy trading environment.

The future is inherently uncertain, but there is an elevated sense of uncertainty today about all things that matter for the stock market — interest rates, monetary and fiscal policy, earnings, inflation, the economy, and the performance of the mega-cap stocks — and that it is apt to get in the way of conviction on the part of buyers and sellers for the time being.

That is simply part of the digestive process for a market that has feasted on big returns this year and knows it can find some comfort food in alternative investments that pose less risk of a stomach upset as the digestive process continues.

—Patrick J. O’Hare, Briefing.com

Where will our markets end this week?

Lower

DJIA – Bearish

SPX –Bearish

COMP – Bearish

Where Will the SPX end September 2023?

09-18-2023 -1.5%

09-11-2023 -1.5%

09-05-2023 -1.5%

08-28-2023 -1.5%

Earnings:

Mon:

Tues: AZO

Wed: GIS, FDX, KBH

Thur: DRI

Fri:

Econ Reports:

Mon: NAHB Housing Market Index

Tue: Building Permits, Housing Starts

Wed: MBA, FOMC Rate Decision

Thur: Initial Claims, Continuing Claims, Phil Fed, Existing Home Sales, Leading Indicators,

Fri:

How am I looking to trade?

Added Puts Thursday and Friday of last week for Rate Hike Decision and falling market

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Everything you need to know about UAW’s targeted strike plans — and possible lockouts

PUBLISHED THU, SEP 14 20233:08 PM EDTUPDATED FRI, SEP 15 20237:44 AM EDT

KEY POINTS

- The United Auto Workers union said it was prepared to conduct targeted strikes against the Detroit automakers if the sides failed to reach new deals by 11:59 p.m. ET.

- UAW President Shawn Fain called the plans “historic,” but there are potential risks regarding what the union is calling “stand-up” strikes.

- The targeted strikes could have unintended ripple effects for members and open the door for the companies to hire permanent replacement workers and even conduct plant lockouts.

DETROIT – The United Auto Workers union said it was prepared to conduct unprecedented, targeted strikes against Ford Motor, General Motors and Stellantis if the sides failed to reach new deals by 11:59 p.m. ET Thursday.

Targeted, or bottleneck, strikes are an alternative to national actions in which the union only strikes select plants. They’re different from when members walk out of all factories and onto picket lines, like what occurred four years ago during the last round of UAW negotiations with General Motors.

Targeted strikes typically focus on key plants that can then cause other plants to cease production due to a lack of parts. They are not unprecedented, but the way UAW President Shawn Fain plans to conduct the work stoppages is not typical. They include initiating targeted strikes at select plants and then potentially increasing the number of strikes based on the status of the negotiations.

“We will strike all three companies, a historic first, initially at a limited number of targeted locations that we will be announcing. Then, based on what’s happening in bargaining, we’re going to announce more locals that are going to be called to stand up and strike,” Fain said Wednesday during a Facebook Live.

Fain referred to the union’s plans as a “stand-up strike,” a nod to historic “sit-down” strikes by the UAW in the 1930s.

While “historic,” the targeted strikes could have unintended ripple effects. It’s not clear how one plant will impact on others. The actions could also potentially send non-striking union members to unemployment lines, if their state allows them to collect any benefits due to being out of work as a result of a strike.

What about lockouts?

The stoppages also more easily open the door for the companies to hire permanent replacement workers and even conduct plant lockouts, according to labor experts.

The UAW’s strategy puts “some heat on the companies,” but it also gives the companies “much more ability” to use such tactics, said Dennis Devaney, senior counsel at Clark Hill who formerly served as a board member of the National Labor Relations Board.

“I think that obviously is not a good thing from the UAW’s perspective,” said Devaney, who also formerly served as an attorney for GM and Ford.

Plant lockouts, in which companies don’t allow workers into a facility, are more common overseas than in the U.S., but they have occurred.

For example, there was roughly a 10-month lockout of workers at an Exxon Mobil refinery in Texas that ended last year upon union ratification of a new agreement. The company said it was done in response to a strike notice issued by the union during negotiations in January 2021 for a new contract.

Automakers, however, may want to continue producing parts and vehicles at plants for as long as they can in the event of the strikes intensifying, especially following years of supply chain disruptions due to parts shortages and the coronavirus pandemic.

There are “significant, important factors” that companies need to take into account to determine if such “actions might be legal and appropriate,” said Jeffrey S. Kopp, a corporate labor attorney with 26 years of experience and a partner at Foley & Lardner.

The UAW knows lockouts are an option, citing “everything’s on the table” for both sides if it comes to striking under the expired deals, said a person familiar with the union’s plans.

Expired deals

The UAW hasn’t conducted a strike like this before because under terms of the union’s national contracts with the Detroit automakers, strikes at individual plants must be over local contracts, not national issues. But Fain said the UAW will strike at local plants over national issues.

(For context, the UAW as an organization has an “international” unit that operates a leader, or umbrella, for local UAW units that all have their own contracts in addition to a national agreement.)

Typically, such actions would be breach of the contracts and could lead to litigation or a complaint with the NLRB. In 1998, for example, GM filed a lawsuit against the UAW claiming a bottleneck strike at two Michigan plants that affected dozens of other company facilities was illegal.

However, according to the union, this rule no longer matters because members are working under expired contracts that nullify those terms.

Ben Dictor, who serves as legal counsel for the UAW, said most of contracts such as wages and working conditions are still in effect but the “no strike, no lockout clause” expires. That means the union can strike, but it also opens the door for the companies to potentially lock out workers.

“As part of the stand-up strike, some of us will be working without a contract. This is an essential part of our strategy to keep the companies off balance by calling locals out on strike based on what is happening in negotiations,” Dictor said in a video posted online Thursday by the union. “That will keep them guessing and turbocharge your national negotiators in bargaining with the big three.”

Strike fund

Conducting targeted strikes can be complex, as it’s not clear how one plant will impact on others. The actions could potentially send non-striking union members to unemployment lines, if their state allows them to collect any benefits due to being out of work as a result of a strike.

Targeted strikes also will save the union cash, as it won’t have to give “strike pay” to as many members from its $825 million strike fund.

The fund pays each eligible member $500 per week, which would mean it has enough cash for roughly 11 weeks if all members went on strike. However, that doesn’t include health-care costs that the union would cover, such as temporary COBRA plans, which would likely drain the fund far more quickly.

When asked about the ability for the strike fund to support the union, Fain has regularly referred to how past union leaders conducted work stoppages without pay and how UAW members need to stick together.

“Nobody’s coming to save us. Nobody can win this fight for us. Our greatest hope, and or only hope is with each other, standing together,” Fain said. “I’ll tell you this, I’m at peace with a decision to strike if we have to because I know that we’re on the right side of this battle.”

Emerging markets have a China problem.’ This strategist favors India, which just hit a record.

Last Updated: Sept. 14, 2023 at 8:36 a.m. ETFirst Published: Sept. 14, 2023 at 6:42 a.m. ET

By

Steve Goldstein

Bank of America’s global fund manager survey this week reported the biggest ever push into the U.S., and exit from emerging markets, on record. That result didn’t come as a big surprise to Matt Orton, chief market strategist at Raymond James Investment Management.

“Emerging markets have a China problem,” says Orton.

Speaking from the sidelines of a Jefferies venture-capital conference in Tel Aviv, Orton shares a negative outlook on China, citing the weakness in activity since the economy re-opened, the real estate debt issues, the regulatory environment as well as its market concentration issues.

The U.S., by contrast, has been one of the best-performing markets this year, and a soft landing now looks more likely than it did at the beginning of the year. “Because so many people were under-invested in the U.S., you can get that almost chasing as you go into the end of the year, because a lot of managers are underperforming.”

Orton however is enthusiastic about emerging markets outside of China, and in particular India. India’s Sensex IN:1 on Thursday closed at a record high, its first since July 20.

“India is a direct beneficiary of what China has lost during zero-COVID. As supply chains continue to diversify away from China, you’ve seen a lot of companies embrace India. You’ve got an economy that has held up well, you’ve got a massive opportunity for infrastructure investment, along with a prime minister and government that seems very pro-business, and willing to insure that a lot of the investments that are put into infrastructure don’t turn into the boondoggles the way they have been in the past.”

He says that’s reflected in earnings per share expansion as well as market breadth. “That’s a lot more exciting than worrying about the overhang risks that you have in a place like China,” says Orton. For India to be an alternative, it will need the same massive and effective infrastructure investment that took place in China 10 to 20 years ago. But separate from infrastructure, there’s a burgeoning consumer class as well, creating opportunities for example in automobile manufacturing.

Orton was asked about the situation at the Adani Group companies, where there have been allegations, denied by the company, that stock of different subsidiaries were manipulated against local market rules. “I think the market has almost forgotten about it,” said Orton. “Time will tell as we see more, but those who invested towards the bottom and said there’s a large opportunity, have been rewarded.”

Other emerging markets he likes include Taiwan and South Korea, and he sees big opportunities in countries like Vietnam, the Phillipines and Indonesia, as supply chain reshoring candidates outside of China. “Where investors are willing to do a little bit of homework, there’s definitely opportunities in Asia ex China.”

Orton returned to the U.S. market, and wonders about the lack of market breadth. “You have companies that continue to beat and raise estimates, but they can’t break out,” he said. “In August, when there was a risk-off environment, I would have thought that the higher-quality names would outperform.”

The clients he has spoken with are reluctant to put new money to work given they can get returns of over 5% in money-market funds. He says he tells them that rates are going to come down, as he likes growth-at-a-reasonable-price type companies.

The executives he spoke with at the conference in Israel, he added, were optimistic. “I think they all understand that 2021 was not a normal environment, and that right now, we’ve probably returned back to what normal should be, focused on profitability or a path to profitability. Everyone here is willing to put money to the work, but in the right opportunities, which I think gives me more confidence as well, that quality is going to matter more in the public markets as well going forward.”

The chart

Corporate governance in Japan is improving but has a long way to catch up to rivals in the U.S. and Europe, finds analysts at Morgan Stanley. They also find that while European companies have been rewarded with a multiple premium for better governance metrics, Japanese companies have not.

“There is a very large valuation gap between Japanese equities and counterparts in the U.S. and Europe, and we are bullish that this gap can be narrowed significantly as governance metrics in Japan improve,” they say.

Striking unions impacting the economy at a level not seen in decades

PUBLISHED MON, SEP 18 20231:44 PM EDTUPDATED AN HOUR AGO

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- So far, the United Auto Workers stoppage has impacted just a small portion of the workforce with limited implications for the broader economy.

- However, if things heat up and it turns into an all-out strike, bringing into play the 146,000 of those working at Ford, GM and Stellantis, that could change things.

- August alone saw some 4.1 million labor hours lost this year, the most for a single month since August 2000.

- Potential pay raises have raised the specter that inflation, which has abated recently from 40-year highs, could be stickier as unions fight for higher ground.

The auto workers’ strike is the latest in a series of labor-management conflicts that economists say could start having significant growth impacts if they persist.

So far, the United Auto Workers stoppage has impacted just a small portion of the workforce with limited implications for the broader economy.

But it is part of a pattern in labor-management conflicts that has resulted in the most missed hours of work in some 23 years, according to Labor Department statistics.

“The immediate impact of the auto workers strike will be limited, but that will change if the strike broadens and is prolonged,” Ian Shepherdson, chief economist at Pantheon Macroeconomics, said in a client note Monday.

The UAW has taken a somewhat novel approach to this walkout, targeting just three factories and involving less than one-tenth of the workers at the Big Three automakers’ membership. However, if things heat up and it turns into an all-out strike, bringing into play the 146,000 union members at Ford, GM and Stellantis, that could change things.

In that case, Shepherdson sees a potential 1.7 percentage point quarterly hit to GDP at a time when many economists still fear the U.S. could tip into recession in the coming months. Auto production amounts to 2.9% of GDP.

A broader strike also would complicate policymaking for the Federal Reserve, which is trying to bring down inflation without tipping the economy into contraction.

“The problem for the Fed is that it would be impossible to know in real time how much of any slowing in economic growth could confidently be pinned on the strike, and how much could be due to other factors, notably the hit to consumption from the restart of student loan payments,” Shepherdson said.

Labor hours lost

American workplaces have taken a substantial hit from strikes this year.

August alone saw some 4.1 million labor hours lost this year, the most for a single month since August 2000, according to the Labor Department. Combined with July, there were nearly 6.4 million hours lost from 20 stoppages. Year to date, there have been 7.4 million hours lost, compared to just 636 hours total for the same period in 2022.

Those big numbers have been the result of 20 large stoppages that have included the Writers Guild of America and Screen Actors Guild, state workers at the University of Michigan and hotel employees in Los Angeles. Some 60,000 health care workers in California, Oregon and Washington are threatening to walk out next.

After years of being relatively quiescent, unions have found a louder voice in the high-inflation era of the past several years.

“If you’re a corporate CEO and you’re not anticipating labor demands, you’re not tethered to reality,” Joseph Brusuelas, chief economist at RSM, said in an interview. “After the inflation shock we’ve gone through, workers are going to demand more money, given the … likelihood that they’ve lost ground during this period of inflation. They’re going to ask for more money, and they’re going to ask for workplace flexibility.”

Indeed, recent New York Fed data has shown that workers on average are asking for salaries close to $80,000 a year when switching jobs.

In the UAW’s case, the union has asked for demanded a 36% raise spread over four years, similar to the pay gains that automaker CEOs have seen.

Inflation impacts

Such potential pay increases have raised the specter that inflation, which has abated recently from 40-year highs, could be stickier as unions fight for higher ground.

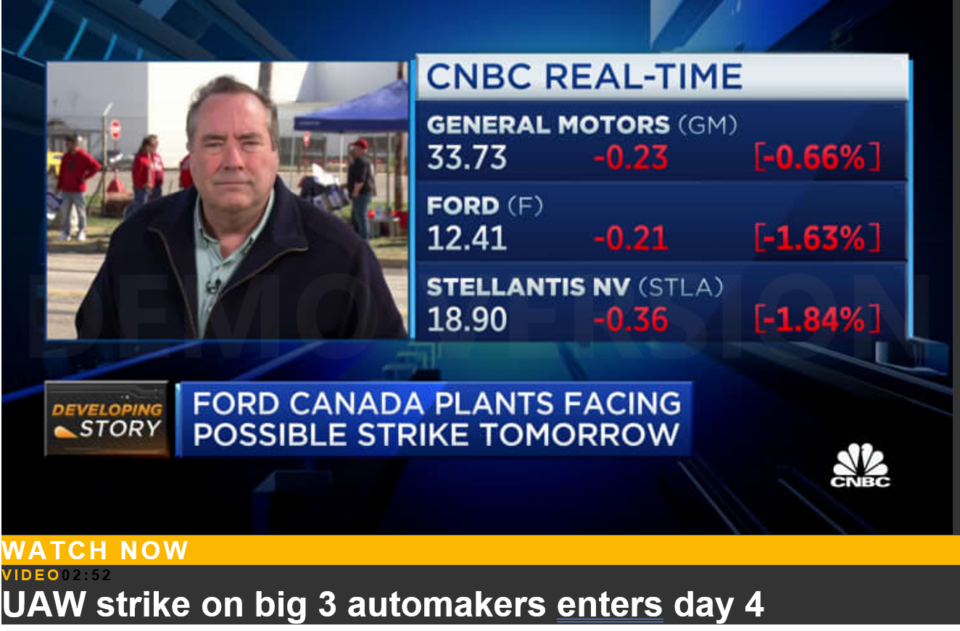

WATCH NOW

VIDEO

02:52

UAW strike on big 3 automakers enters day 4

But Brusuelas said that prospective 9% annual UAW increases shouldn’t have a major impact on macroeconomic conditions, including inflation.

Unions have made up a progressively smaller share of the workforce, declining to a record low 10.1% in 2022, about half where it was 40 years ago, according to the Labor Department. Just 6% of private sector workers are unionized, while 33% of government workers are organized.

“Labor strife is going to have a relatively small effect on the overall macro economy,” Brusuelas said. “This isn’t that big of a deal and it shouldn’t come as a shock following such a steep increase in inflation.”

Biden administration officials also are not sounding any alarms yet about the potential economic impact.

In the immediate term, the stoppage won’t show up in the September jobs numbers, at a time when payroll growth is decelerating.

“I think it’s premature to be making forecasts about what it means for the economy,” Treasury Secretary Janet Yellen told CNBC’s Sara Eisen in an interview aired Monday. “It would depend very much on how long the strike lasts and exactly who’s affected by it. But the important point, I think, is that the two sides need to narrow their disagreements and to work for a win-win.”

McDonald’s franchisee group says new California fast-food bill will cause ‘devastating financial blow’

PUBLISHED FRI, SEP 15 20231:08 PM EDTUPDATED FRI, SEP 15 20233:42 PM EDT

KEY POINTS

- After California lawmakers passed a landmark fast-food bill, an independent advocacy group of McDonald’s owners is pushing back against what it says will be a “devastating financial blow” to its franchisees in the state, according to a memo viewed by CNBC.

- The bill, AB 1228, was passed by the state Senate late Thursday and heads to Gov. Gavin Newsom’s desk for signature. He has pledged to sign it into law.

- It includes a wage floor of $20 for California workers at fast-food chains with at least 60 locations nationwide, starting April 1.

After California lawmakers passed a landmark fast-food bill, an independent advocacy group of McDonald’s owners is pushing back against what it says will be a “devastating financial blow” to its franchisees in the state, according to a memo to its membership viewed by CNBC.

The bill, AB 1228, was passed by the state Senate late Thursday and heads to Gov. Gavin Newsom’s desk for signature. He has already pledged to sign the bill into law. It includes a wage floor of $20 for California workers at fast-food chains with at least 60 locations nationwide, starting April 1.

Labor groups pushed for even higher wages in previous legislation, but the resulting $20 an hour floor prevailed. Even in a state where the minimum wage is $15.50 and the pay floor is even higher in some municipalities, the deal will bring a significant raise for many workers. But despite support from franchisee and restaurant advocacy groups, some owners are concerned about what the bill means for operations in a challenging labor market and during a period of high inflation.

The National Owners Association, an independent advocacy group of more than 1,000 McDonald’s owners, projects in the memo the bill will cost each restaurant in the state $250,000 annually. The group said the costs “simply cannot be absorbed by the business model.” It also warned similar legislation will follow in other states.

Further, the organization claimed in the letter that “a small coalition of franchisors, including McDonald’s, the National Restaurant Association (NRA) and the International Franchise Association (IFA) independently w/o franchisee involvement, negotiated a deal with the [Service Employees International Union]; causing the legislative outcome to now become certain.”

McDonald’s sent its own letter to its restaurant system on Monday, which was viewed by CNBC. Responding to the bill, the company said it and other franchisee groups “worked tirelessly over the past year to fight these policies and protect Owner/Operators’ ability to make decisions for their businesses locally and protect their restaurants and their crew.”

“This included forming a coalition of brands to refer [an earlier version of the bill] to California voters in November 2024 — while expensive and unexpected we felt we had no other choice. We also significantly increased our political engagement in the state. This included a newly established North America Impact Team to work horizontally, new lobbyists and campaign consultants, and a dramatic step-change in our political activity,” it wrote.

The company declined to comment further on the NOA’s letter or position.

Roger Delph, a McDonald’s franchisee from California who served on the state’s owner/operator task force, said in a statement to CNBC that he worked with McDonald’s, other franchisees and separate companies to “protect” the business model from what he called “an all-out attack.”

“That involved countless conversations and meetings, and a discussion with the Governor’s office directly,” he said. “Anyone who is suggesting this was not a collaborative and successful effort to protect the franchised business model in California, or that franchisee involvement was absent, was either not involved or is contorting the facts.”

In its systemwide letter, the fast-food giant also outlined changes made to the final version of the bill that are considered better for owners than the initial proposed legislation. The new legislation eliminated the threat of joint franchisor-franchisee liability, which McDonald’s said would “destroy the franchise model in California and strip thousands of restaurant owners of the right to run their business.”

In addition, it said the bill unwinds the reconstitution of the Industrial Welfare Commission, which would have “sweeping powers” over decisions on wages and workplace requirements for restaurants. The letter said the commission would have been able to make immediate and unchecked decisions on wages and working conditions in the state.

Other franchise and restaurant groups had a more positive outlook on the compromise.

The International Franchise Association CEO Matt Haller said in a statement that the bill “creates the best possible outcome for workers, local restaurant owners and brands, while protecting the franchise business model in California.” He added in an interview with CNBC, that “franchise brands that were involved in the negotiations had their franchisees first and foremost in front of minds as they were considering deal terms.”

The National Restaurant Association’s EVP of Public Affairs, Sean Kennedy, added in a statement, “This agreement provides a predictable future for California restaurant operators and includes a tremendous investment in the [quick-service restaurant] workforce, while eliminating regulatory and legislative threats endangering their businesses. We recognize the work from all sides that went into getting this legislation written and appreciate the legislature’s support to get it passed.”

Both Kennedy and Haller are co-chairs of the Save Local Restaurants coalition that worked on the negotiations.

Some critics of the deal have said costs will fall solely on small business owners in the state. In its letter, the NOA outlined ways for members, suppliers and McDonald’s corporate office to support owners in the state of California. It said anticipated menu prices hikes will create a “significant revenue windfall” for the company, and said the projected $80 million rent and service fees collected from those sales directly tied to price hikes should be reinvested in California restaurants. It asked that any and all requests for financial support made by owners in the state be considered.

“Everyone has a stake in this and nobody can afford to stand on the sidelines,” the NOA letter said.

Meanwhile, worker advocates — who won wage hikes but not increases as large as they first sought — said their work is just getting started.

“Fast-food workers’ fight in California isn’t close to over — it has only just begun as they prepare to take their seat at the table and help transform their industry for the better,” Service Employees International Union President Mary Kay Henry said in a statement to CNBC.

She added, “California’s Fast Food Council brings together every stakeholder in this industry, including franchisees. At this table, workers and franchisees alike will be heard by global franchisors and will have a direct role in shaping improved standards in the industry. This groundbreaking, sector-wide approach is the path to making fast-food jobs safer and the industry more sustainable for everyone.”

This week 1600 real scientists, including several Nobel winners, sent a letter to the world saying the whole climate crisis is a hoax.

Nobel Prize Winner Who Doesn’t Believe Climate Crisis Has Speech Canceled

BY MATTHEW IMPELLI ON 7/24/23 AT 4:39 PM EDT

Nobel Prize winner Dr. John Clauser, who has disputed issues surrounding climate change, recently was told he would not be speaking to the International Monetary Fund (IMF), according to Co2 Coalition, a non-profit organization that believes carbon dioxide is beneficial to society.

“Nobel Laureate (Physics 2022) Dr. John Clauser was to present a seminar on climate models to the IMF on Thursday and now his talk has been summarily cancelled,” the Co2 Coalition said in a statement. “According to an email he received last evening, the Director of the Independent Evaluation Office of the International Monetary Fund, Pablo Moreno, had read the flyer for John’s July 25 zoom talk and summarily and immediately canceled the talk. Technically, it was ‘postponed,'” the statement added.

The announcement by the Co2 Coalition came shortly after Clauser made comments disputing climate change during a speech in Seoul, South Korea, at Quantum Korea 2023, an international conference centered on the global trends of quantum ecosystem innovations from the academic, government and private sectors.

Newsweek reached out to the IMF via email for more information on why Clauser won’t be speaking.

Physicist Dr. John Clauser poses after having been awarded the Nobel Prize in Physics 2022 during the Nobel Prize award ceremony at the Concert Hall in Stockholm, Sweden, on December 10, 2022. The Co2 Coalition said this week that the International Monetary Fund canceled Clauser’s speech scheduled for July 25, 2023.CHRISTINE OLSSON/TT NEWS AGENCY/AFP/GETTY

“I don’t believe there is a climate crisis,” Clauser said during at Quantum Korea. “The world we live in today is filled with misinformation. It is up to each of you to serve as judges, distinguishing truth from falsehood based on accurate observations of phenomena.”

According to the Co2 Coalition, Clauser made similar comments in the past, including: “In my opinion, there is no real climate crisis. There is, however, a very real problem with providing a decent standard of living to the world’s large population and an associated energy crisis. The latter is being unnecessarily exacerbated by what, in my opinion, is incorrect climate science.”

According to the Nobel Prize website, Clauser won a Nobel Prize in physics in 2022 for quantum mechanics research. The Co2 Coalition said that he was awarded the Nobel Prize “for experimentally elucidating the phenomenon of quantum entanglement, which forms the theoretical basis for quantum cryptography.”

Newsweek reached out to Clauser via email for comment.

A spokesperson for the Co2 Coalition provided Newsweek with a portion of the email Clauser sent to the organization after learning that he wouldn’t be speaking. In the email, Clauser wrote that he was informed that Moreno canceled his speech because he “feared that I might say technical things that were over his head and that he couldn’t understand.”

Dr. William Harper, a founder of the Co2 Coalition, told Newsweek in a statement that it is a disgrace that Clauser has been silenced.

Second Nobel Prize Winner Signs Letter With 1,600 Scientists Declaring Climate ‘Emergency’ A Myth

BY: TRISTAN JUSTICE

SEPTEMBER 01, 2023

3 MIN READ

IMAGE CREDITPEDRO SZEKELY / FLICKR/CC BY-SA 2.0

A coalition of more than 1,600 scientists critical of their peers’ hyperbolic claims about climate change drew a prominent recruit to sign their 2019 declaration that the climate “emergency” is a myth.

John Clauser, who won last year’s Nobel Prize in physics, became the second Nobel laureate last month to sign the document with 1,607 other scientists rebuking the idea of a climate crisis.

“Climate science should be less political, while climate policies should be more scientific,” the declaration organized by the Climate Intelligence Foundation (CLINTEL) reads. “Scientists should openly address uncertainties and exaggerations in their predictions of global warming, while politicians should dispassionately count the real costs as well as the imagined benefits of their policy measures.”

Last year, the International Energy Agency (IEA) debuted a roadmap to net-zero emissions that became the model for corporate bishops of environmental, social, and governance (ESG) standards. A June report from the Energy Policy Research Foundation criticized the initiatives outlined as a “green mirage.” The IEA roadmap, researchers wrote, “will dramatically increase energy costs, devastate Western economies, and increase human suffering.”

“The aim of global policy should be ‘prosperity for all’ by providing reliable and affordable energy at all times,” reads CLINTEL’s World Climate Declaration. “There is no climate emergency. Therefore, there is no cause for panic and alarm.”

Norwegian-American engineer Ivan Giaever, who won the Nobel Prize in physics in 1973, is also a signatory to the declaration.

“The popular narrative about climate change reflects a dangerous corruption of science that threatens the world’s economy and the well-being of billions of people. Misguided climate science has metastasized into massive shock-journalistic pseudoscience,” Clauser said. “In turn, the pseudoscience has become a scapegoat for a wide variety of other unrelated ills. It has been promoted and extended by similarly misguided business marketing agents, politicians, journalists, government agencies, and environmentalists.”

The document makes several claims that contradict popular narratives peddled by climate hysterics. For example, the planet is warming slower than predicted and has not driven a spike in natural disasters.

Mega-disasters are actually on the decline, while the destruction from natural events such as hurricanes and wildfires is on the rise. The increase in billion-dollar disasters, however, is a result of there being more to destroy. But that hasn’t stopped legacy outlets from blaming every natural event on the “climate crisis.” Two years ago, The New York Times published “Postcards From A World On Fire” despite natural disaster deaths declining by 90 percent.

The World Climate Declaration also notes that carbon dioxide is plant food, “not a pollutant.”

“It is essential to all life on Earth,” the document reads.

In fact, reforestation is on the rise, promoted by a global “greening” effect proliferating plant growth.

<hr size=2 width=100 style=’width:75.0pt’ align=center>

Tristan Justice is the western correspondent for The Federalist and the author of Social Justice Redux, a conservative newsletter on culture, health, and wellness. He has also written for The Washington Examiner and The Daily Signal. His work has also been featured in Real Clear Politics and Fox News. Tristan graduated from George Washington University where he majored in political science and minored in journalism. Follow him on Twitter at @JusticeTristan or contact him at Tristan@thefederalist.com. Sign up for Tristan’s email newsletter here.

HI Financial Services Mid-Week 06-24-2014