Trade Findings and Adjustments 09-21-2023

FIRST 7 MINUTES THE SCREEN WAS FROZEN

PROTECTION !!!

How important is it –

Market down 1.12 Portfolio down 0.0018

Long Put = Right to sell a stock at a certain price for a certain period of time, Debit, BTO

Placed ATM or slightly OTM or ITM

At the start it will make up 0.40 to 0.50 roughly half the downward movement

Which means at the start yes you lose more money on stock than the put can make up

Goal to have the put make up 70% to 90% of the daily downward movement

Nov 3, 2023 334 SPY Long puts

For a review we currently have open:

Meta Jan 17 2024 240/300 Bull Call

Meta Jan 17 2024 300/350 Bull Call

Oct 20, 2023 444 Long put = 102.02% ROI

https://www.investopedia.com/terms/l/long_put.asp

Long Put: Definition, Example, Vs. Shorting Stock

By TIM SMITH

Updated January 23, 2021Reviewed by

What Is a Long Put?

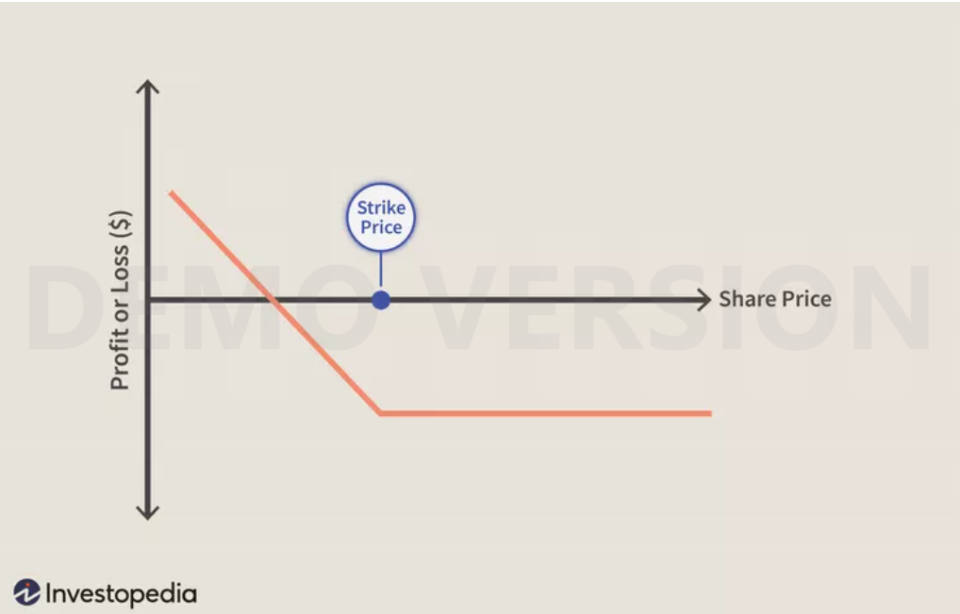

A long put refers to buying a put option, typically in anticipation of a decline in the underlying asset. The term “long” here has nothing to do with the length of time before expiration but rather refers to the trader’s action of having bought the option with the hope of selling it at a higher price at a later point in time.

A trader could buy a put for speculative reasons, betting that the underlying asset will fall which increases the value of the long put option. A long put could also be used to hedge a long position in the underlying asset. If the underlying asset falls, the put option increases in value helping to offset the loss in the underlying.

Image by Julie Bang © Investopedia 2019

KEY TAKEAWAYS

- A long put is a position when somebody buys a put option. It is in and of itself, however, a bearish position in the market.

- Investors go long put options if they think a security’s price will fall.

- Investors may go long put options to speculate on price drops or to hedge a portfolio against downside losses.

- Downside risk is thus limited using a long put options strategy.