Trade Findings and Adjustments 05-18-23

Keve Bybee – keve@hurleyinvestments.com

DIS – Took a profit on out 102 puts. Booked about $92,000 in profit.

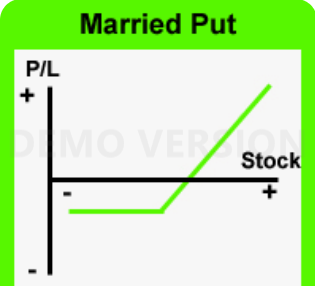

– Rolled protection down to 92 strike puts to continue to have a level

of protection

– We will lose less money on 92 strike puts than the 102 puts because

the 102’s would be way “In The Money”

– Gives us a level of protect still and also the opportunity to book a

nice profit on 102 puts.

UAA – Booked profit on 9 Strike puts and rolled down to 7.50 puts.

– Booked about $110,000 in profit across all accounts

– Same as DIS. Wanted to book good profit but still need a level of

protection.

META – looking at buying Leap Bull Call

– 240 long call with 300 short call out to 1/17/25 expiration

– This way if we get a pull back from being overbought we have

something protecting us a bit

How do we choose stocks?

– We go in depth on it here:

– https://myhurleyinvestment.com/trade-findings-and-adjustments-

01-06-2022/