Trade Findings and Adjustments 3-31-20

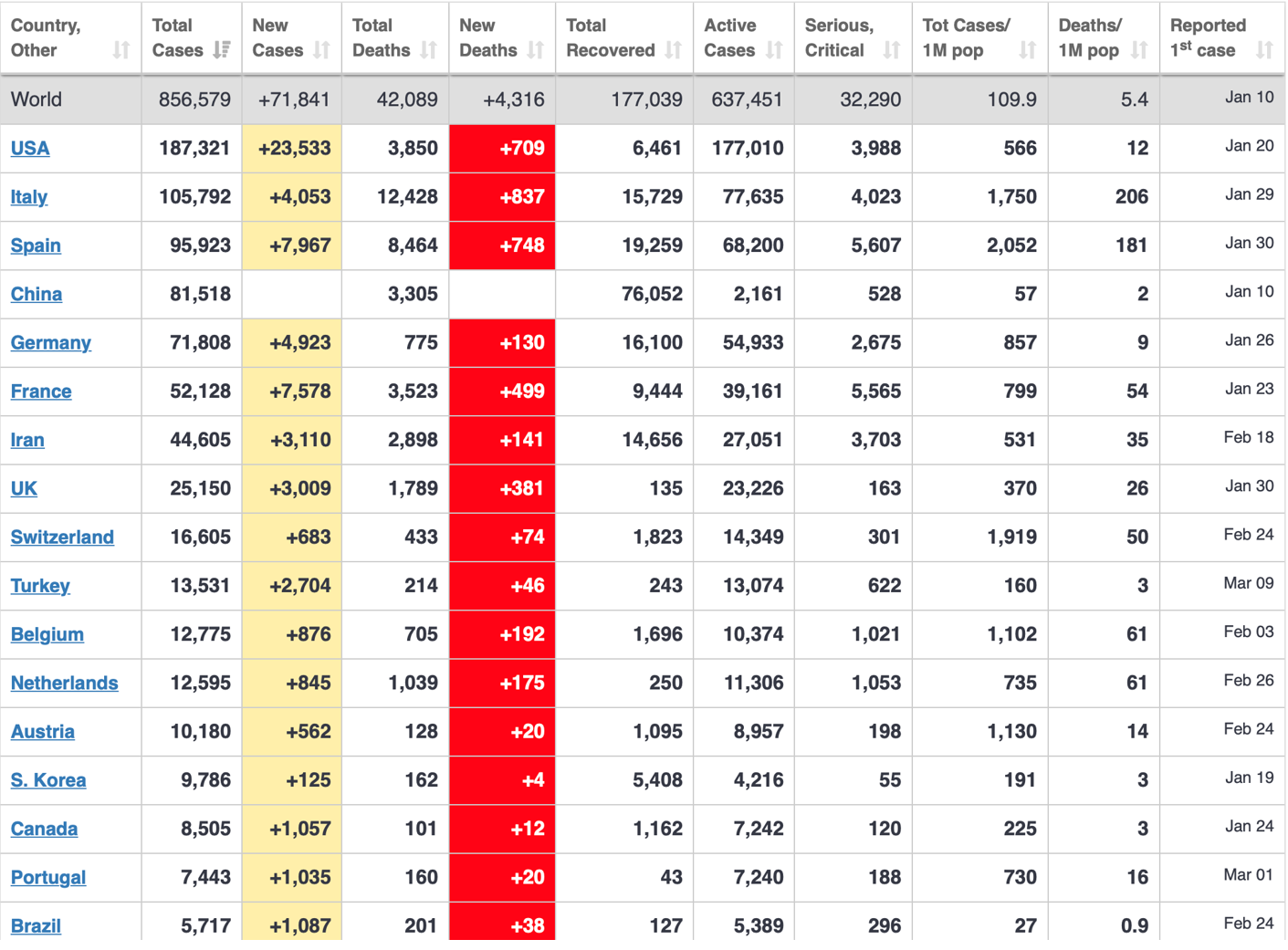

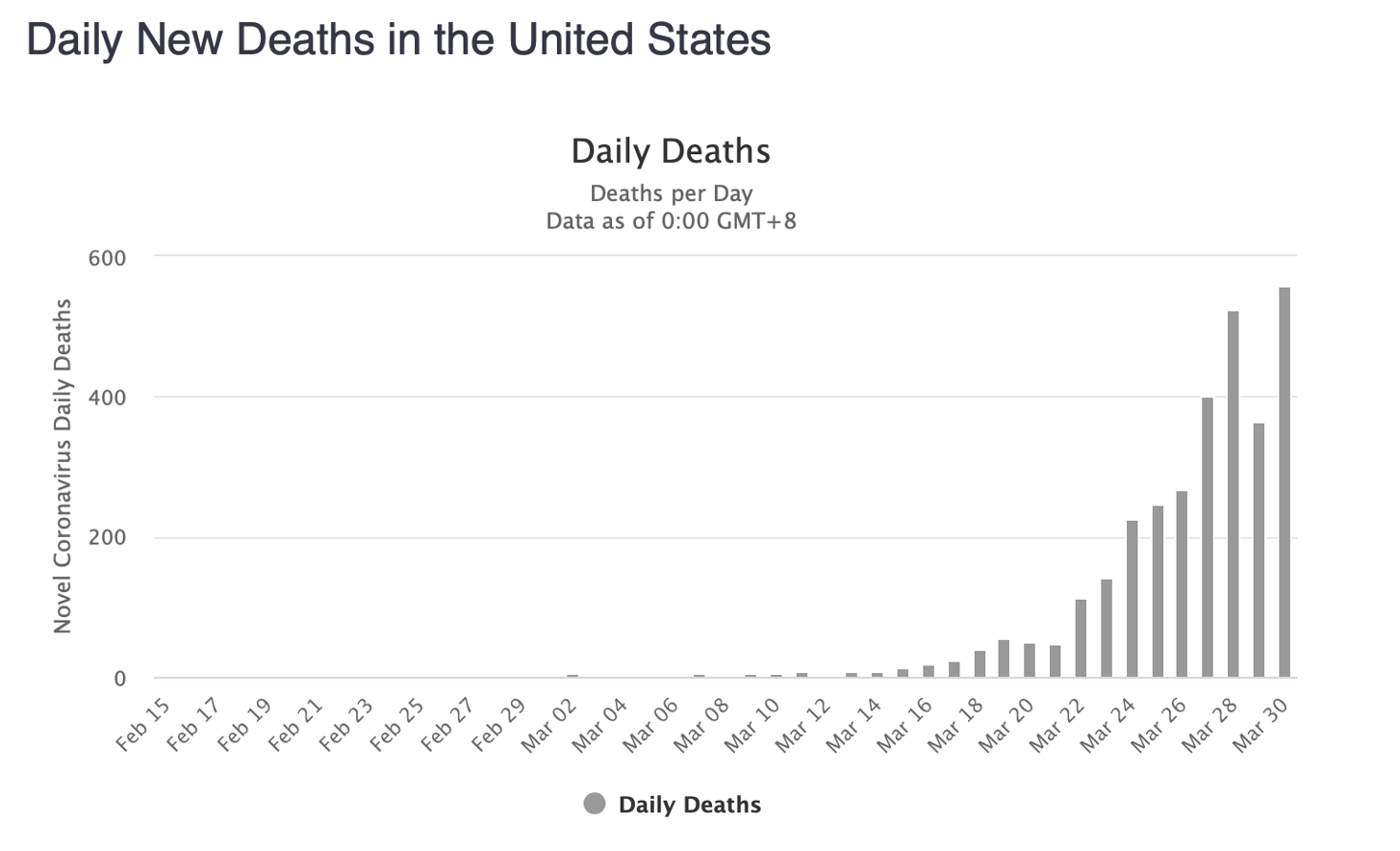

Have we peaked in the US???

- The numbers have not confirmed that.

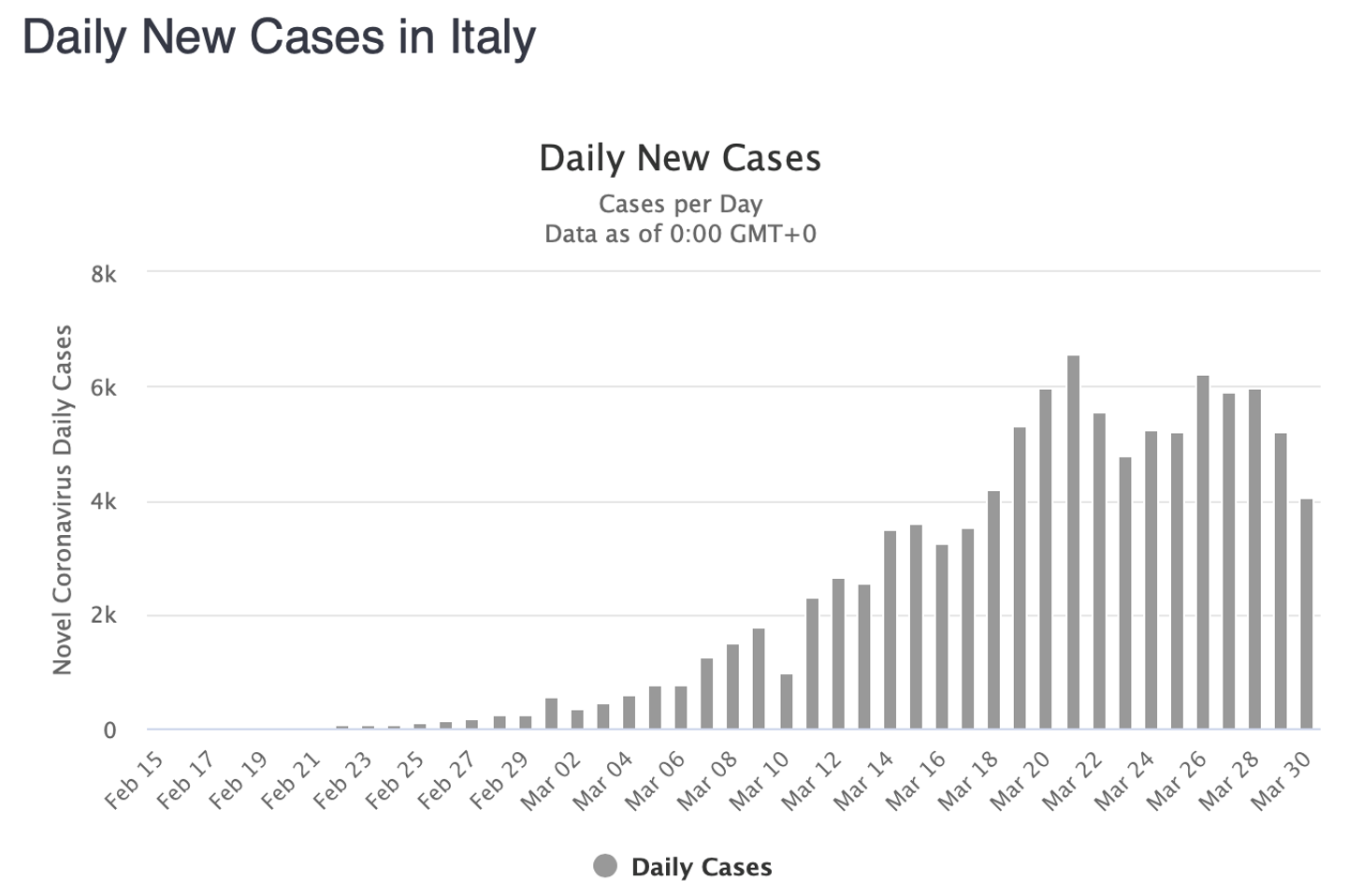

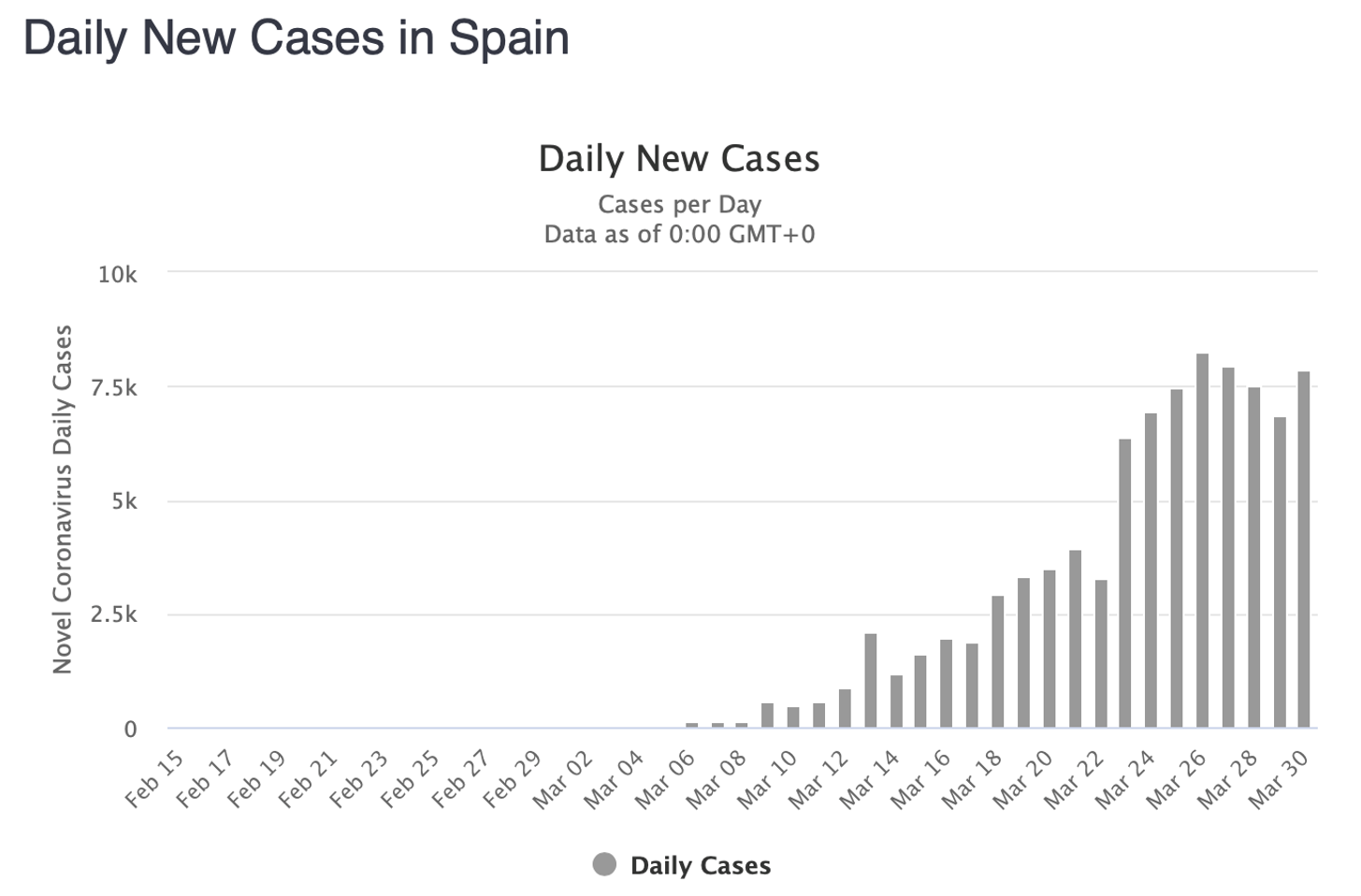

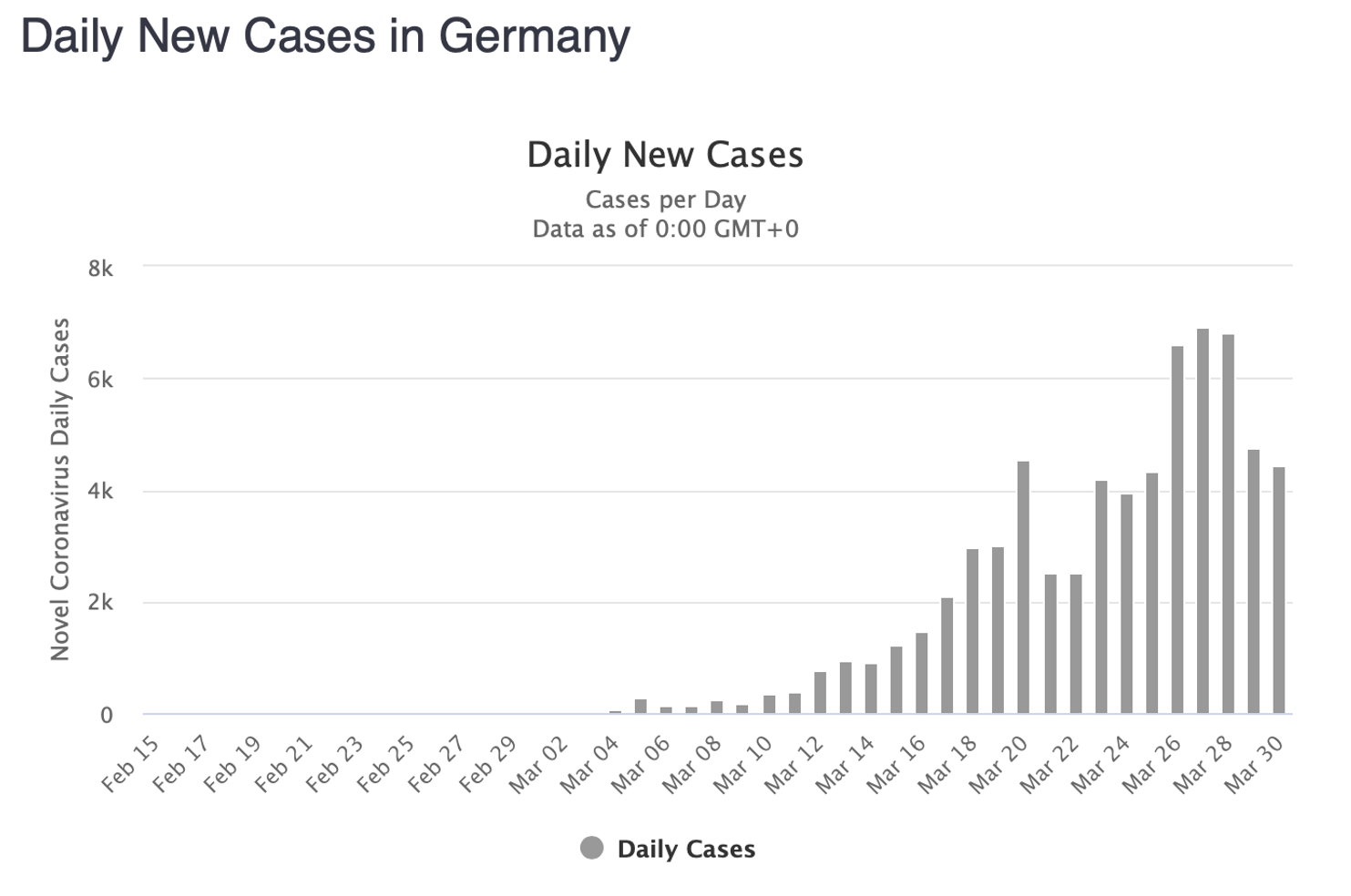

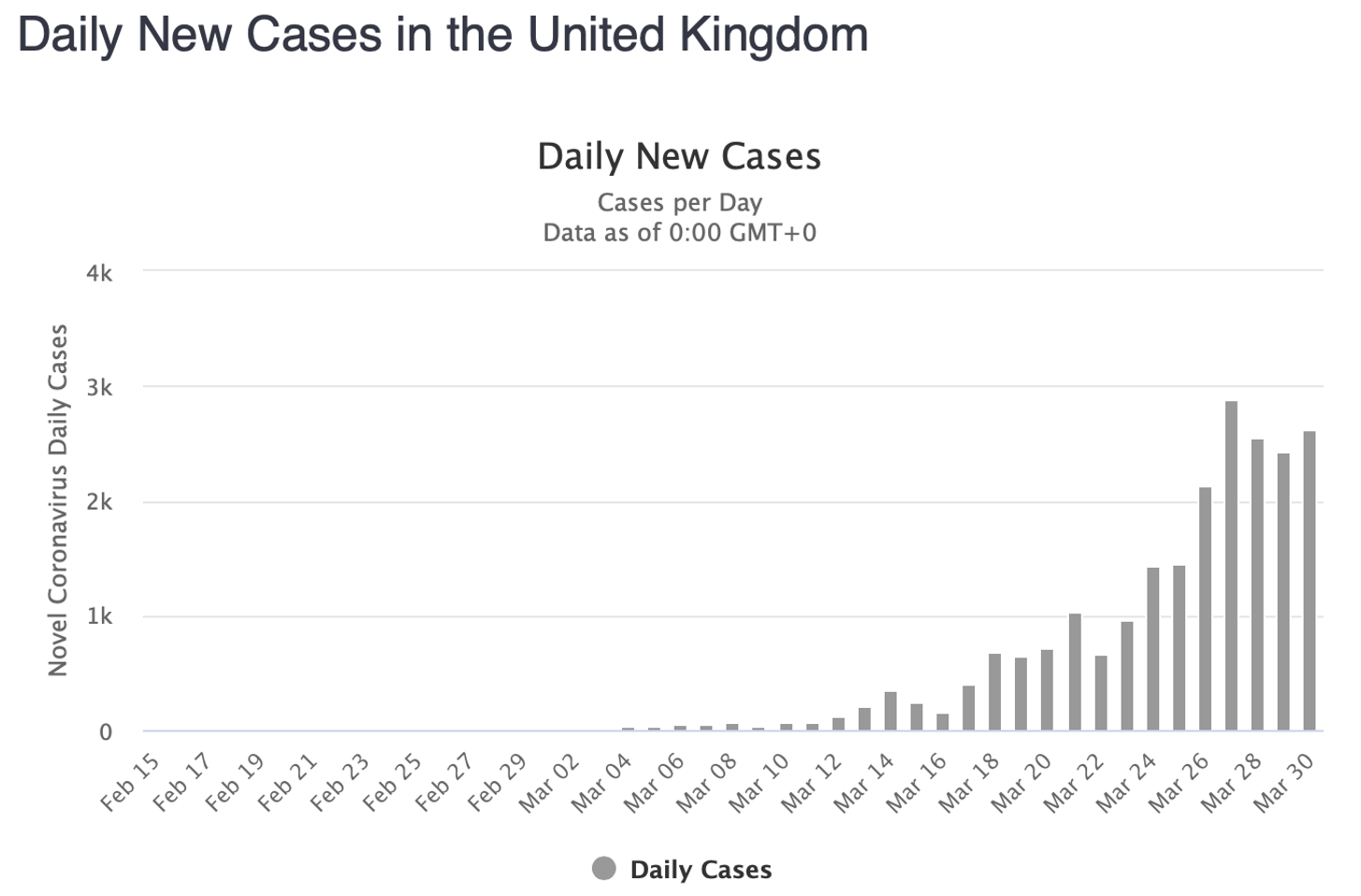

- Europe is also not on the downtrend yet.

How do we invest in this market?

Lets say you have $10k:

25% in SPY now at $255

Dollar Cost Average with 25% if it tests the bottom $220

Leaves you room to DCA with 25% more on a 10% drop from $220

Leaves more room for the rest of the year where you can add the last 25%

Vs.

Collar Trade

DIS

- We just added hundreds of shares without asking for more money

- 131 puts

- Added 125 puts

- We made up roughly $33 or so dollars of the downward movement

- Added roughly 20% more shares without having to come up with more money to Dollar Cost Average.

- All paid for by put profit.

The best way to manage long term investing in stocks is to?

- Dollar Cost Average

- All forms of DCA are good

- Collar trading to DCA is superior

Keve Bybee

www.hurleyinvestments.com www.myhurleyinvestment.com www.KevinMhurley.com