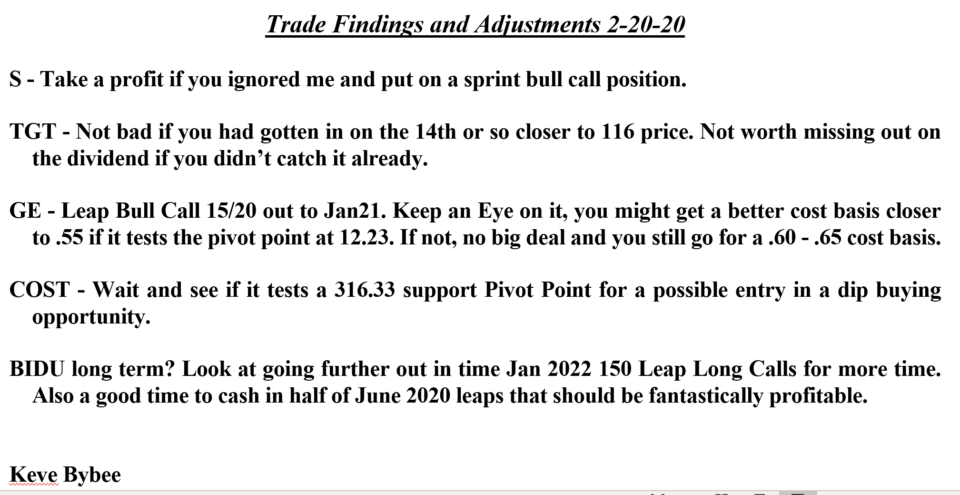

Trade Findings and Adjustments 2-20-20

S – Take a profit if you ignored me and put on a sprint bull call position.

TGT – Not bad if you had gotten in on the 14th or so closer to 116 price. Not worth missing out on the dividend if you didn’t catch it already.

GE – Leap Bull Call 15/20 out to Jan21. Keep an Eye on it, you might get a better cost basis closer to .55 if it tests the pivot point at 12.23. If not, no big deal and you still go for a .60 – .65 cost basis.

COST – Wait and see if it tests a 316.33 support Pivot Point for a possible entry in a dip buying opportunity.

BIDU long term? Look at going further out in time Jan 2022 150 Leap Long Calls for more time. Also a good time to cash in half of June 2020 leaps that should be fantastically profitable.

Keve Bybee