Trade Findings and Adjustments 10-22-2019

1. Visa

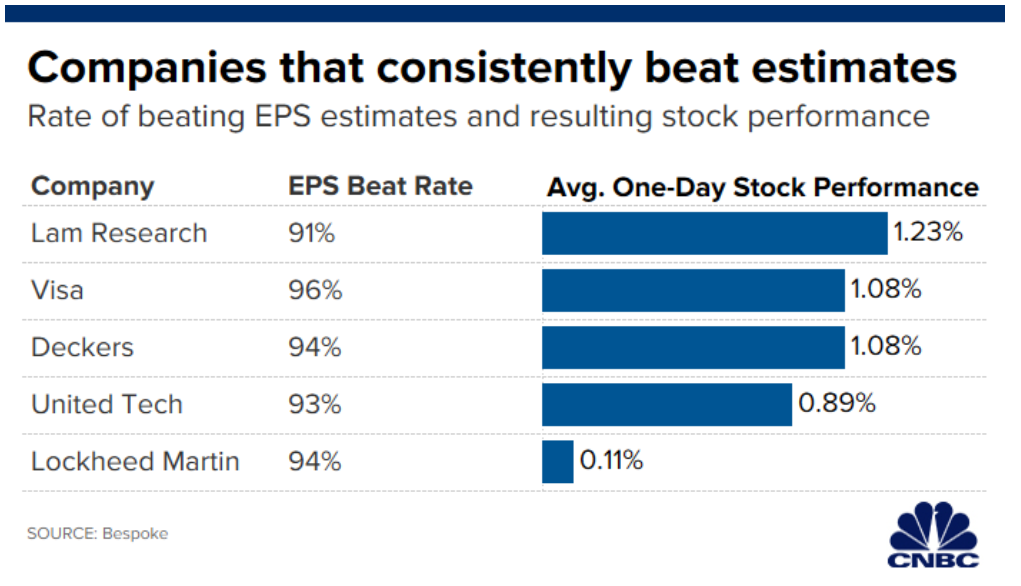

Visa reports fourth quarter earnings on Thursday after the bell, and if history is any indication there’s a good chance the company will beat expectations.

According to Bespoke, the company tops EPS estimates 96% of the time, and sales estimates 89% of the time.

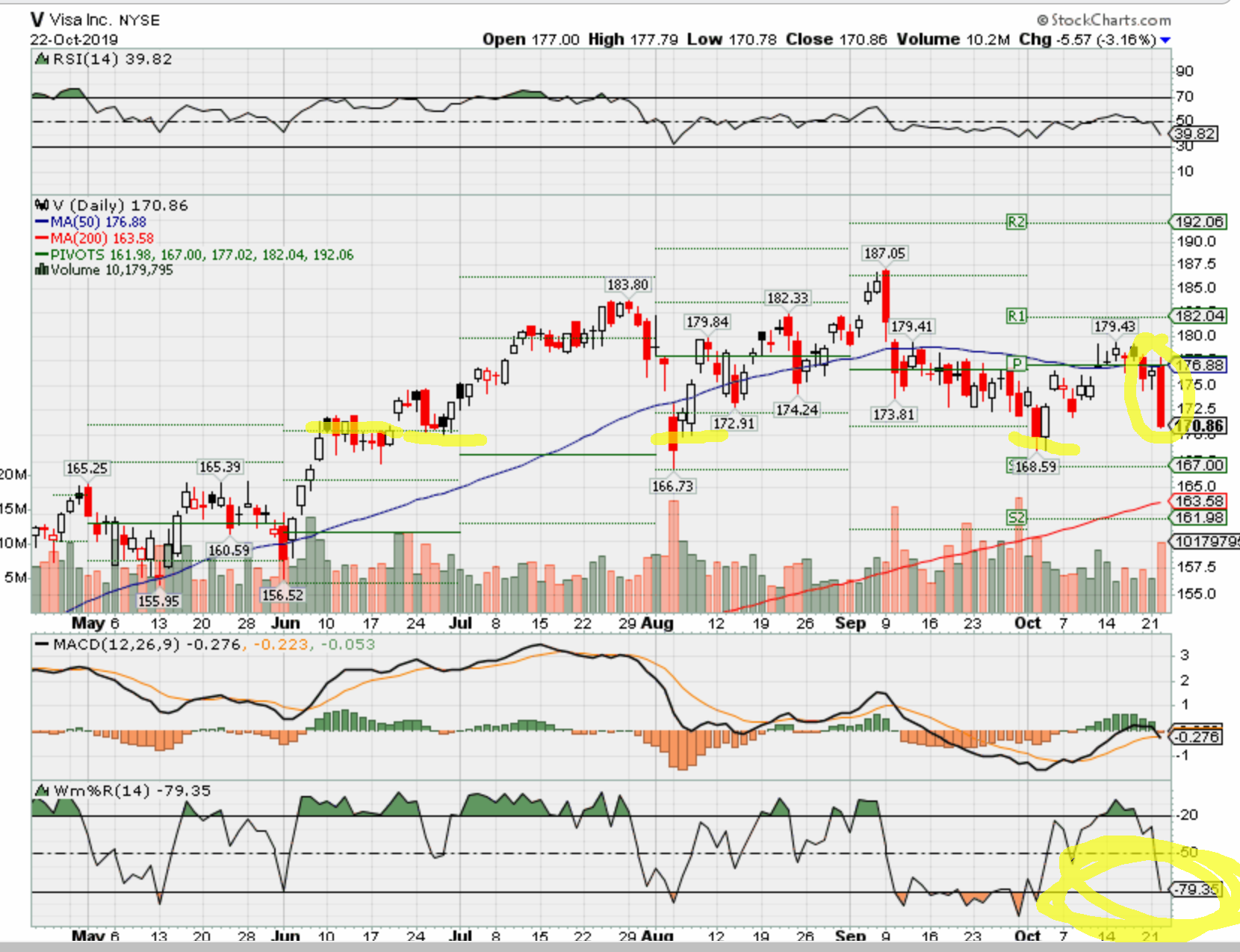

Shares of the credit card company have gained 35% this year, outperforming the S&P’s 20% gain, but recent weakness is leading some analysts to lower their estimates ahead of earnings.

Bank of America said not to expect “fireworks,” and cut its EPS estimate for the quarter to $1.42. The firm also lowered its revenue expectations to $6.05 billion, down from $6.08 billion previously.

The firm maintained its buy rating on the stock and said that it still views “fundamental sentiment as positive.” But the recent market rotation could hit the credit card company’s bottom line.

On the flip side, on Thursday Bernstein raised its expectations for the company’s results. Analyst Harshita Rawat lifted her EPS estimate to $1.45, citing credit card “purchase volume growth” as a catalyst.

According to estimates from FactSet, the consensus for Visa is EPS of $1.43 on $6.08 billion in revenue.

Since this is Visa’s fourth quarter, both analysts noted that even more important than the quarterly results will be what the company says about full-year guidance for 2020.

Visa’s 35% gain for 2019 is behind competitor Mastercard’s 47% rise.

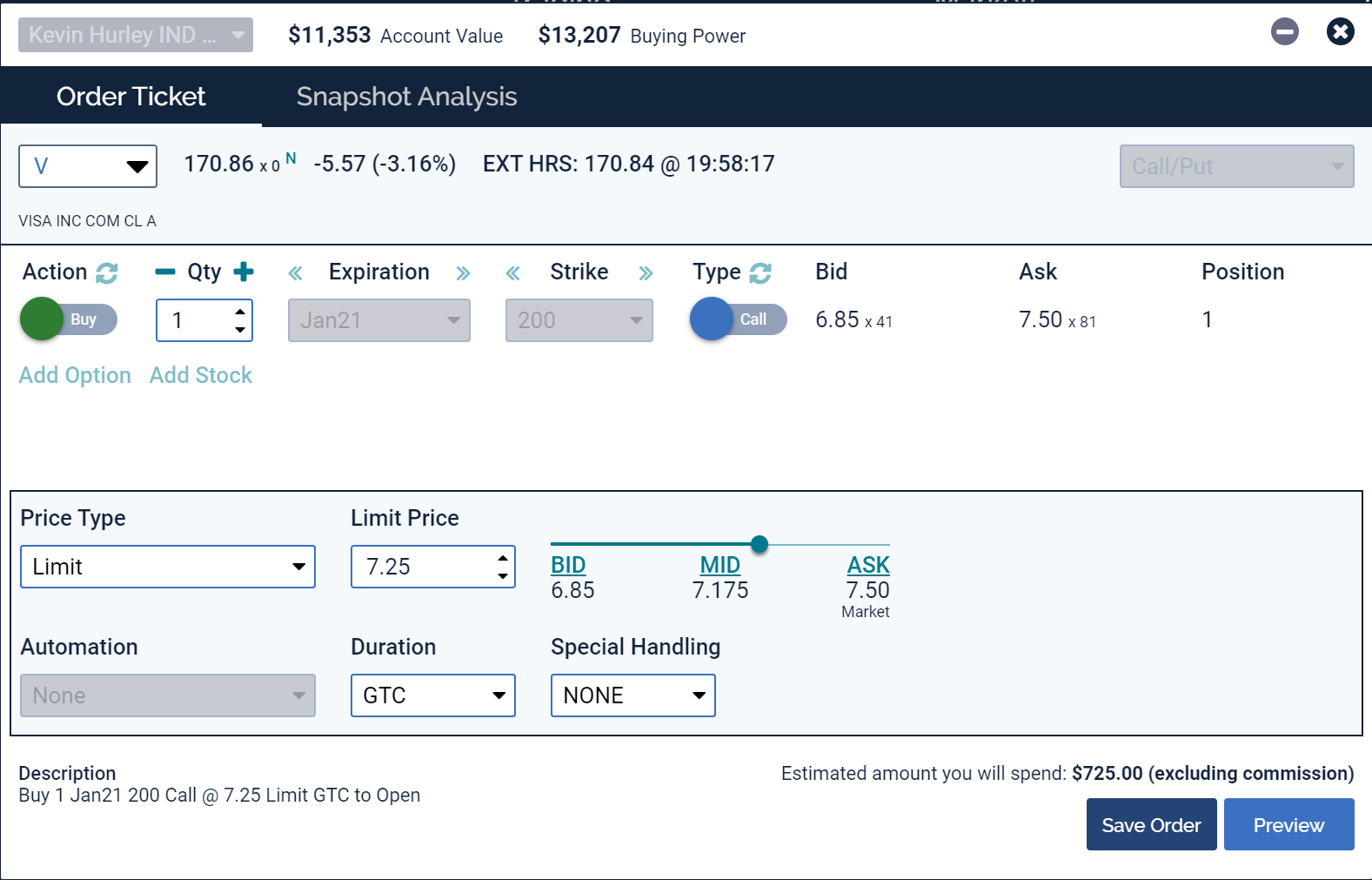

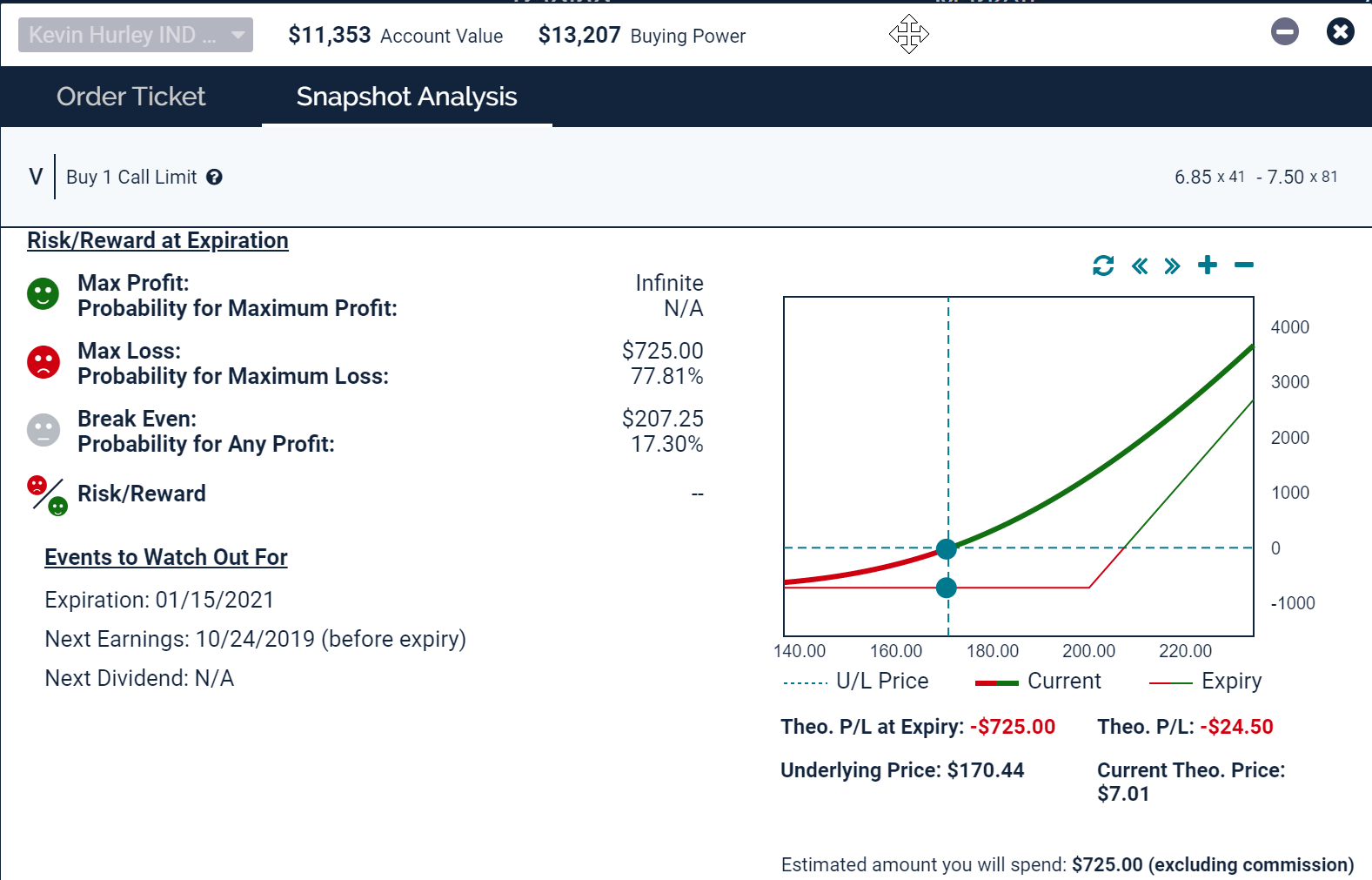

LEAP Long Call Jan -21 Strike price $200 for $7.25 Limit order

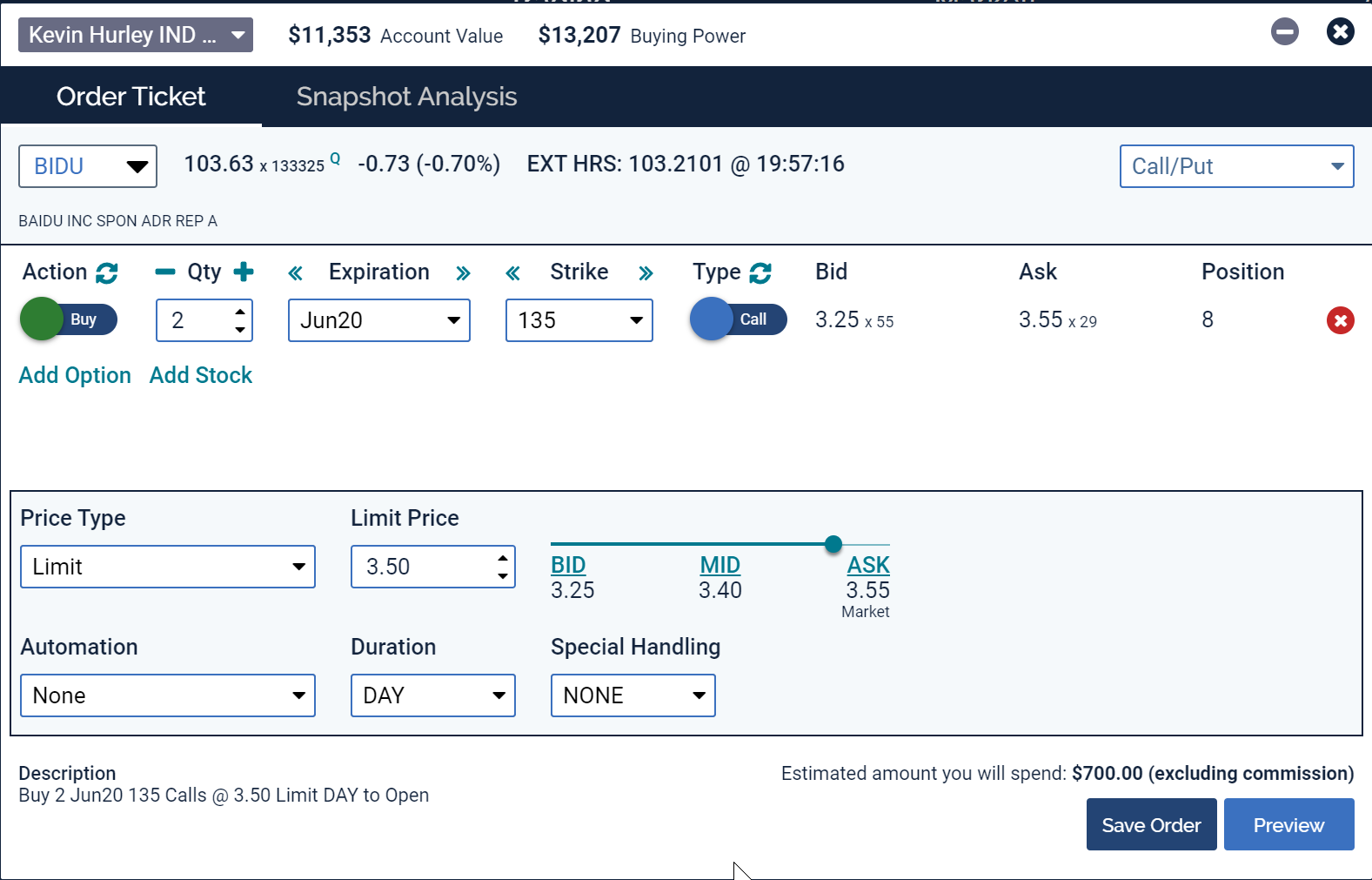

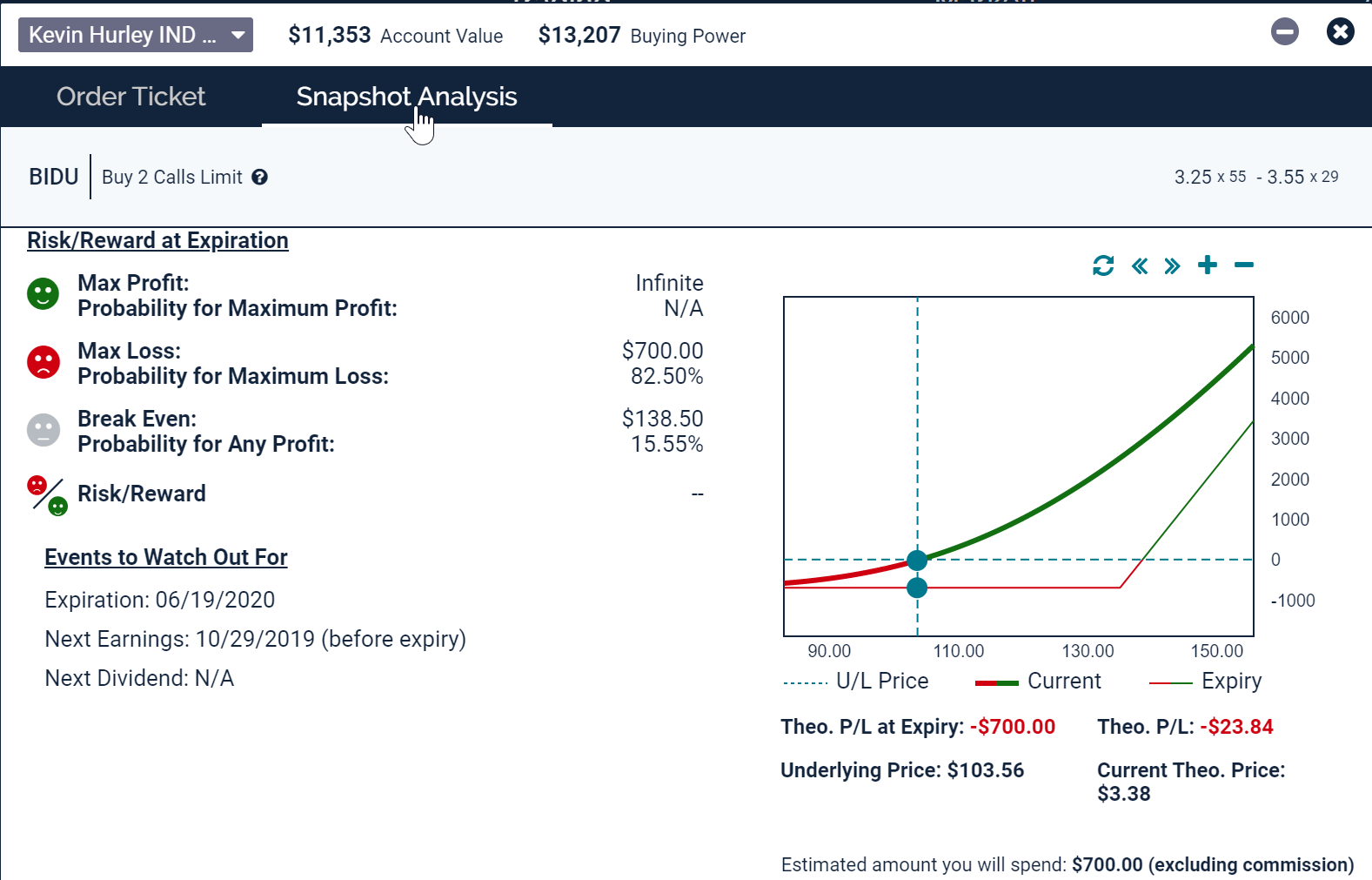

BIDU Leap Long Call

www.hurleyinvestments.com www.myhurleyinvestment.com www.KevinMhurley.com