HI Market View Commentary 10-21-2019

| Market Recap |

| WEEK OF OCT. 14 THROUGH OCT. 18, 2019 |

| Stocks ended broadly lower as Chinese economic growth fell to the lowest level in 27 years and as Boeing (BA) shares sank on media reports the planemaker may have misled US regulators about a key flight-safety system on the grounded 737 MAX.

Data showed that China’s gross domestic product growth slid to 6% in the third quarter, the weakest pace since 1992. The slowdown came as factory production and demand have slowed in recent months largely due to the country’s continuing trade dispute with the US. Meanwhile, Boeing (BA) dropped 6.8% after Reuters and the New York Times reported that a test pilot for the company said in text messages in 2016 that the MCAS system in the 737 MAX was making the plane difficult to fly in flight simulators. A malfunction of the MCAS system has been cited in two 737 MAX crashes that killed 346 people, one almost a year ago and the other in March. Industrial shares fell nearly 0.9% to lead declining sectors, dragged lower by Boeing’s slide. United Technologies (UTX) retreated 1%, and Textron (TXT) lost 3.6%. Tech shares fell more than 0.9%, dragged lower by Microsoft’s (MSFT) 1.6% fall. Autodesk (ADSK) fell 3.2% while Western Digital (WDC) shed 2.5%. Walt Disney (DIS) fell 1.1% to pull communications services shares nearly 0.9% lower. Netflix (NFLX) dropped 6.2%, and Facebook (FB) fell 2.4% Financials added more than 0.2% as State Street (STT) popped 6.1% after the financial-services company’s quarterly results beat views. ETRADE Financial (ETFC) added 4.6% while People’s United Financial (PBCT) gained 4.3%. Coca-Cola (KO) rose 1.8% on better-than-expected earnings, pushing consumer staples almost 0.2% higher. In corporate news, Johnson & Johnson (JNJ) fell 6.2% after it recalled a single lot of baby powder because of the risk of asbestos. The Dow Jones Industrial Average fell nearly 1% to end the week almost 0.2% lower. The Standard & Poor’s 500 fell almost 0.4% to close out the five-day period up more than 0.5%. The Nasdaq slid more than 0.8% to finish the week 0.4% higher. |

Thoughts for tonight – Earnings moved us higher over bad news

25% of the S&P 500 earnings are happening this week

SO higher but why?= Because the bar has been set at earnings coming in minus 5% for this quarter

Expectations have been set too low,

Financials (banks) are coming off there best quarter seasonally, and Creditors are starting their best quarter for pre-Christmas purchasing

Then we have other seasonal trends for a Christmas Guidance – Some tech, retail, durable goods,

AEP – $600 = 300 Shares

BA – $14,000 = 400 shares

BAC – $1300 = 1000 shares and 10 contracts

BIDU – $2200 = 6 contracts 135 Jun 20 run to $115

DIS – $20,000 = 1000 shares run $150

F – $2000 – 2200 shares run $10

IBB – $500

JPM – $1000 – 500 shares, LP bull put run $125

LLY – $3000 –

TGT – $1600 –

UAA – $8775 – 1300 shares with $20 LP running back to $27.50

V – $7500 – 500 shares running to $191

TOTAL = $62,475

https://seekingalpha.com/article/4296436-locking-apple-gains

Locking In Apple Gains

Oct. 14, 2019 1:23 PM ET

Concentrated, hedged investing, for competitive returns with minimal risk.

This article has been removed from the site.

Except that earnings are the week after your expiration! So doing it with expiration of Oct 25 is pretty much useless. The following weeks 190 puts are way more expensive. Do you homework instead of writing a useless article!

BTO October -25-19 $190 long puts for $0.09 or for 200 shares trading at $234.59 it only costs $18.00

$234.59 – 190 = $44.59 of Risk in AAPL 18.30% of T.I.C.

@Hurley Investments we are willing to pay ATM or slightly OTM long put protection because it is the “best bang for the buck” it protects the most amount of your capital prior to earnings still giving you upside potential

We don’t underpay or overpay for protection

Kevin why would you lose $11 to protect $32 more dollars on AAPL

Well, because it is at an all time high, because it has had a 20% gain, because Japan said they had a 10% increase in parts orders doesn’t mean they will beat ALL areas of their earnings, because we like protecting profits, because we are NOT STUPID and don’t gamble the profits of stock positions away, because we believe there will come another stock market crash that must be worse than 2008

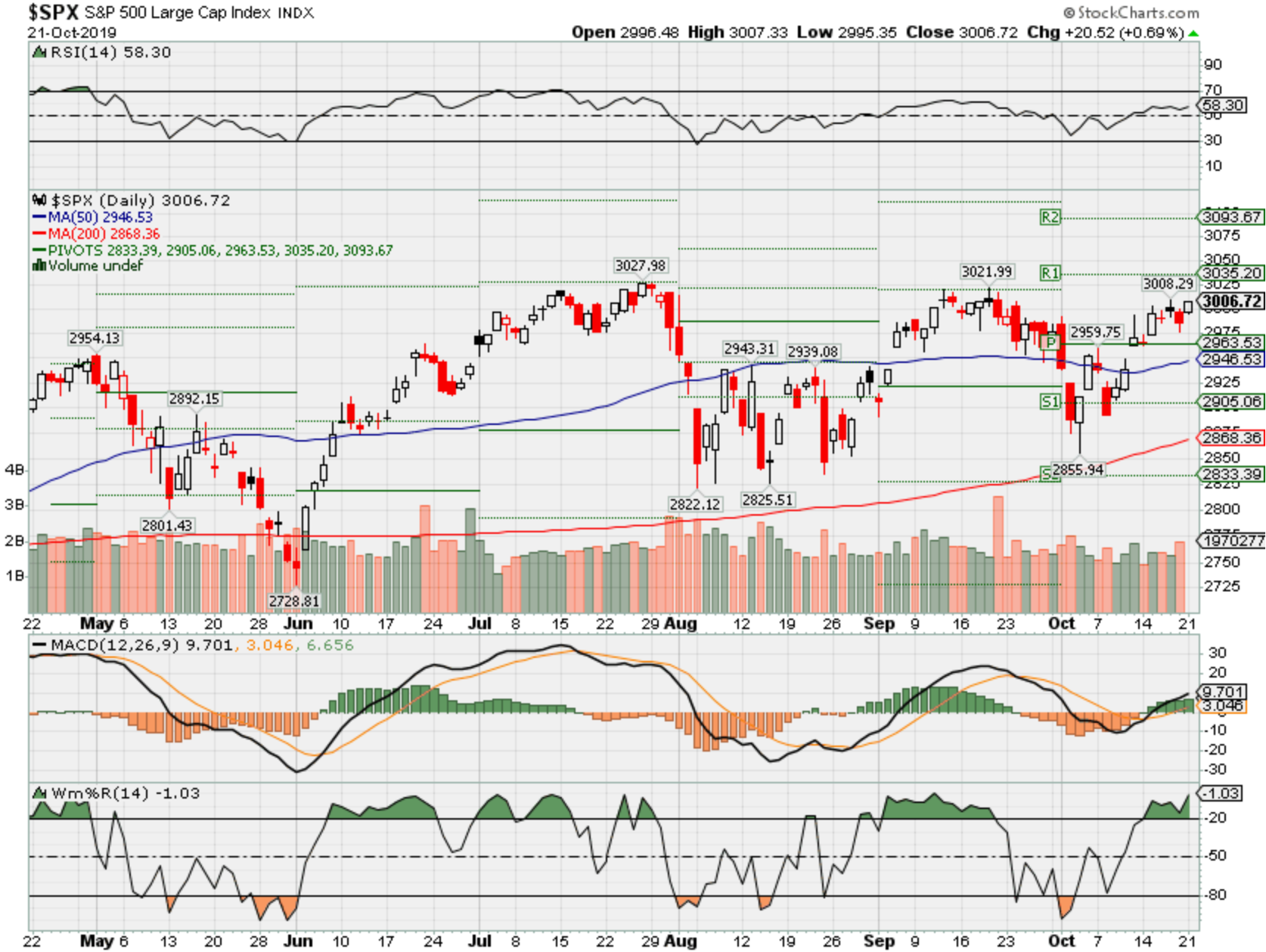

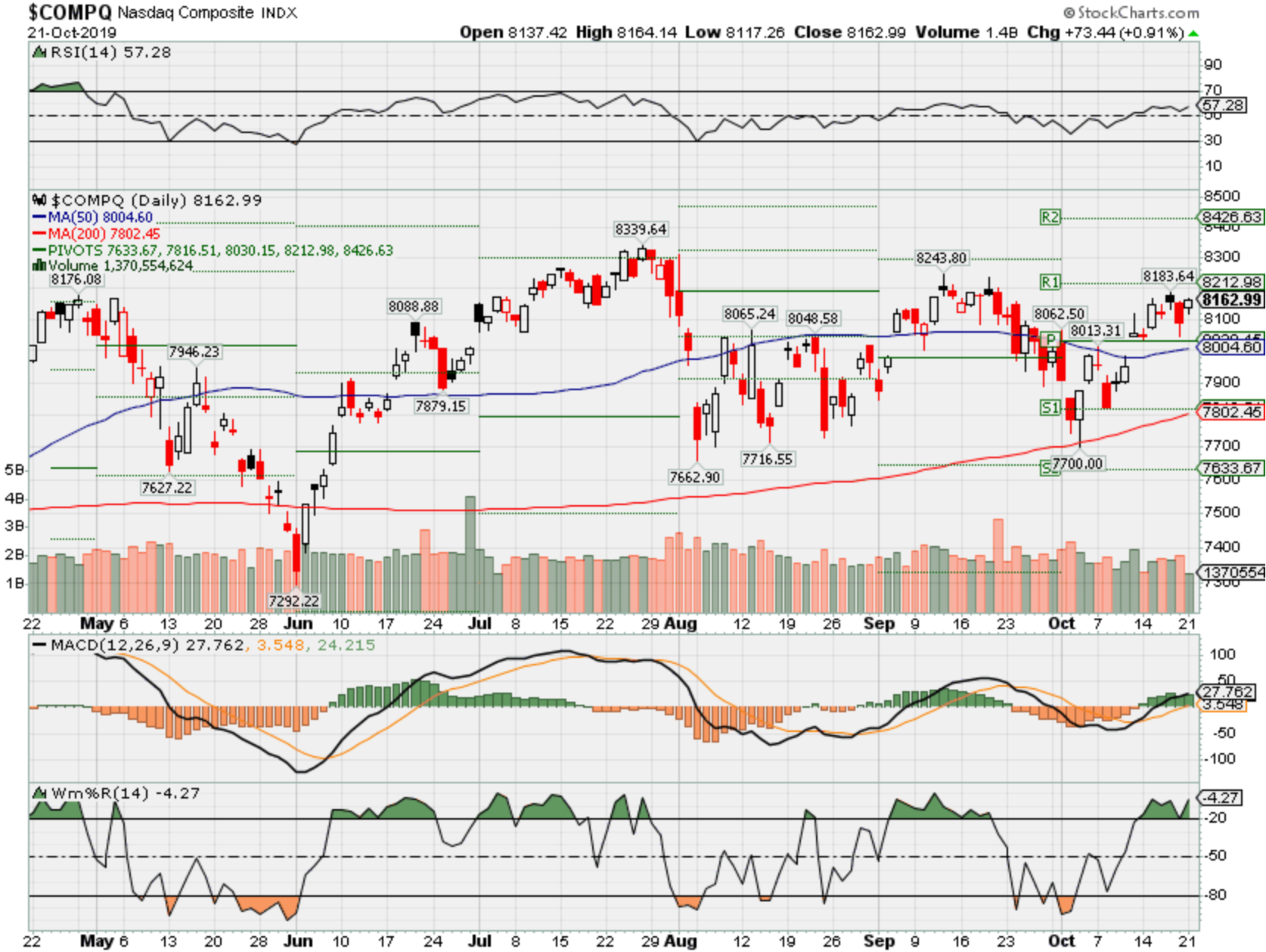

Where will our markets end this week?

Up

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end Oct 2019?

10-21-2019 +1.25%

10-14-2019 +1.25%

10-07-2019 +1.25%

09-30-2019 +1.25%

Earnings:

Mon: HAL, PETS, TACO, ZION

Tues: ARCH, CIT, HOG, HAS, JBLU, KMB, LMT, MCD, NUE, PHM, UPS, CMG, DFS, TXN, WHR

Wed: BSX, CAT, CLF, GD, HLT, OC, EBAY, FFIV, LVS, PYPL, TSLA, VMI, BA, FCX, F, MSFT, LLY

Thur: MMM, AAL, NOK, LUV, TWTR, VLO, ALK, AMZN, COF, GILD, INTC, JNPR, TMUS, V,

Fri: BUD, PSX, VFC, VZ

Econ Reports:

Mon:

Tues: Existing Home Sales

Wed: MBA, FHFA Housing Price Index

Thur: Initial, Continuing, Durable Goods, Durable ex-trans, New Home Sales

Fri: Michigan

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Saturday/Sunday –

How am I looking to trade?

I’m preparing for earnings = Adding long puts

AAPL – 10/30 AMC

AOBC – 12/05 est

BA – 10/23 BMO

BIDU – 10/29 est

BAC – 10/16 BMO

CVS – 11/06 BMO

CVX – 11/01 BMO

DIS – 11/07 AMC

F – 10/23 AMC

FB – 10/30 AMC

FCX – 10/23 BMO

MRO – 11/06 est

MRVL 11/26 est

SLB – 10/18 BMO

TGT – 11/12 BMO

V – 10/24 AMC

XOM – 11/01 BMO

VZ – 10/25 BMO

ZION – 10/21 AMC

www.myhurleyinvestment.com = Blogsite

support@hurleyinvestments.com = Email

Questions???

WeWork could run out of cash by mid-November — here’s what would happen next

PUBLISHED THU, OCT 17 20191:59 PM EDTUPDATED THU, OCT 17 20196:56 PM EDT

KEY POINTS

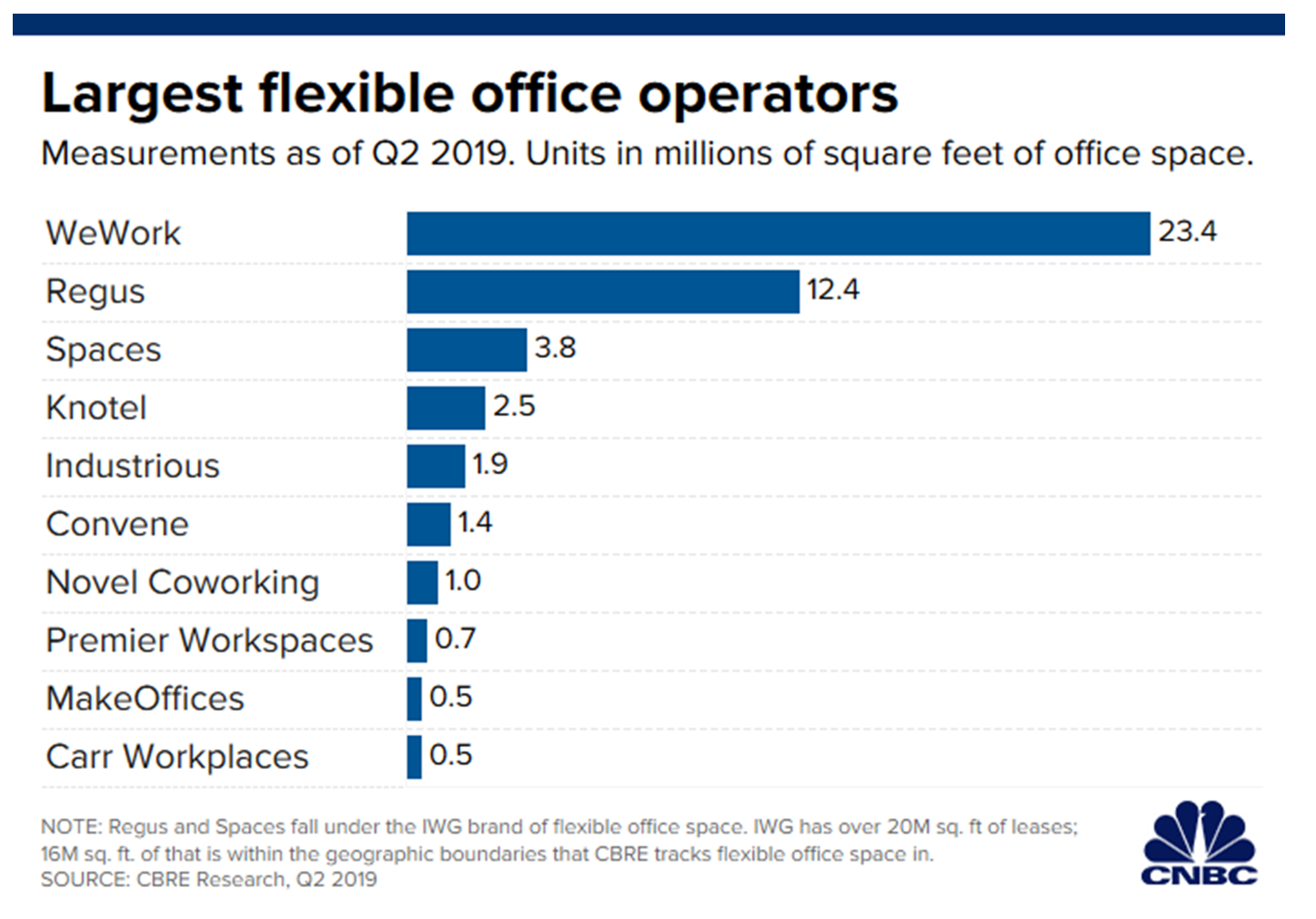

- A year ago, WeWork boasted of becoming the biggest private office tenant in Manhattan, after achieving the same feat in London and Washington earlier in 2018.

- According to CBRE, WeWork controls 33% of the entire flexible space market, making it almost twice the size of closest rival Regus.

- With $22 billion in long-term liabilities as of June 30, including $17.9 billion tied to long-term leases, WeWork is desperate for a major cash infusion.

Last year WeWork boasted about becoming the biggest private tenant in Manhattan, London and Washington, D.C. Those feats have now become an albatross, and WeWork’s biggest investor, SoftBank, is scrambling to keep the coworking space provider from spiraling into bankruptcy.

Just nine months ago, WeWork was valued at $47 billion in a SoftBank-led financing round. Looking at an imminent IPO, the company also rebranded itself to We Company, because “we are always growing and in a constant state of self-discovery, self-growth, and change,” according to a blog post at the time.

CEO Adam Neumann is now gone, and the company has scrapped its IPO along with a $6 billion debt financing that was tied to the offering. That means WeWork, which lost $900 million in the first six months of 2019, is poised to run out of money by mid-November, CNBC reported this week.

WeWork did not respond to CNBC’s request for comment.

SoftBank, WeWork’s biggest outside shareholder, and J.P. Morgan Chase, its third-largest backer and primary lender, have every incentive to keep the company alive and are aggressively trying to pull together financing packages with the aid of outside investors and lenders.

Without a lifeline in the billions of dollars, WeWork will face an ugly fate, with bankruptcy firmly on the table. In turn, the entire commercial real estate market could be upended.

“It’s like you’re trying to sell a property and you’re talking about renovation and some cosmetic work and all of a sudden you have a fire,” said Jake Cantu, global co-leader of the technology, media and telecommunications practice at consulting firm AlixPartners in Chicago. “Then it’s really a completely changed scenario.”

Handcuffed by leases

WeWork is shuttering noncore businesses and divesting assets like Neumann’s private jet in an urgent effort to control costs. Last week, WeWork announced it would close its Manhattan private school, WeGrow, in 2020, and the Guardian reported Tuesday that the company may lay off at least 2,000 of its 15,000 employees as soon as this week.

But cuts alone aren’t enough.

WeWork’s core concept as a business is to turn its massive leases into tech-friendly spaces for businesses of all sizes, including early stage start-ups with uncertain prospects. WeWork calls tenants “members” and counted 527,000 of them across the globe at the end of June, up 97% from a year earlier.

WeWork had $22 billion in long-term liabilities as of June 30, with $17.9 billion of that tied to long-term leases, according to its prospectus. The company warned that the length of the leases “extend for periods that significantly exceed the length of our membership agreements with our members, which may be terminated by our members upon as little notice as one calendar month.”

Now, as one part of its liability management, the company is focusing on renegotiating or getting out of its most expensive leases and concentrating on its best properties, according to a person familiar with the matter who asked not to be named because the negotiations are private.

But unlike a retailer short on cash, which can simply halt payments for goods, a service company like WeWork can’t just stop paying leases.

Landlords who have WeWork as a major tenant may not want to see it go bankrupt, and therefore might give it a short-term reprieve by renegotiating rent or other alternatives, say experts. The trouble is, figuring out which deals WeWork can renegotiate or exit will be complex.

Doing so in a month would be a Herculean feat.

“The IPO only filed in the middle of September, now it’s the middle of November that they may be out of cash,” said Stephen Selbst, chair of the restructuring and bankruptcy group at New York law firm Herrick, Feinstein. “They don’t have the luxury of time to do an in-depth analysis.”

In bankruptcy, WeWork could more immediately break and renegotiate its leases. But that move would rattle multiple commercial real estate markets that WeWork now dominates.

In May, real estate firm CBRE published a report on the flexible office market, showing that WeWork had added almost 11 million square feet to its portfolio since the second quarter of 2018. CBRE said WeWork now accounts for 33% of the entire flex space market, making it almost twice the size of closest rival Regus (IWG), a company founded two decades earlier.

In the past year, WeWork was responsible for the five largest flexible operator transactions in Manhattan, amounting to over 1 million square feet, bringing its market share of flexible working space there to 48%, according to CBRE. It also accounted for the five biggest flex space deals in Los Angeles and Denver, and four of the top five in Washington, Boston, San Francisco, Seattle and Atlanta.

Most vulnerable may be the commercial firms that have leased out entire buildings to the company, and would now have WeWork-branded buildings without a principal lessee and, in many cases, an unreliable tenant base.

Many of WeWork’s landlords, which include TH Real Estate (now Nuveen Real Estate), have also subsidized WeWork’s growth by offering funds for renovation.

“Market landlords will place flex operators under klieg lights with a level of skepticism approaching the Salem witch trials,” said Eric Schiffer, CEO of the Patriarch Organization, a technology and media private equity firm.

A complicated structure

Billions of dollars of equity value has already been wiped out and employees are staring at worthless options. If the company were to declare bankruptcy and continue as a going concern, it would need some sort of incentive structure to keep everyone from walking out the door, especially the talent that it wants to keep or recruit.

“You’ve got this perfect storm where you can just see things feeding off each other and making the storm worse,” said Charley Moore, CEO of Rocket Lawyer, a provider of online legal support and documents. “The only way most businesses break free of that is with a significant restructuring of both costs and capitalization.”

Beyond restructuring and getting out of leases, a bankrupt WeWork would likely try to reorganize by striking a deal with its lenders and coming up with a plan to emerge. But WeWork’s assets are sprawling and complex, particularly outside the U.S., complicating matters further.

For example, In China, WeWork owns 59% of ChinaCo, the exclusive operator of the company’s business on the mainland as well as in Hong Kong, Taiwan and Macao. It also has partial ownership over JapanCo and PacificCo, which covers Singapore, Korea, the Philippines, Malaysia, Thailand, Vietnam and Indonesia.

Among the leading partners in the joint ventures is SoftBank, which has contributed $1.65 billion of its total $10.65 billion WeWork investment to the Asian entities.

“A WeWork bankruptcy would turn into a devastating financial debacle to SoftBank and the commercial property owners who invested hundreds of millions in improvements,” said Schiffer.

— CNBC’s Alex Sherman contributed to this report.

https://seekingalpha.com/news/3505710-facebook-bull-expects-modest-earnings-beat

Facebook bull expects modest earnings beat

Oct. 15, 2019 8:04 AM ET|About: Facebook, Inc. (FB)|By: Brandy Betz, SA News Editor

Rosenblatt Securities says investors should buy Facebook (NASDAQ:FB) shares ahead of the earnings report on October 30.

The firm cites “strong underlying demand” and says the News Feed and Instagram services, on ad spend, are “hard to match on either absolute or relative ROAS from other ad platforms.”

Rosenblatt expects a rather modest beat this quarter due to the regulatory scrutiny, but thinks even a small beat will satisfy the Street.

Rating maintained at Buy with a $242 price target. Facebook has an Outperform average Sell Side rating.

FB shares are up 0.3% pre-market to $183.82.

UPDATE 2-Advisory fees, lending power Bank of America beat

PUBLISHED WED, OCT 16 20198:13 AM EDT

Anirban Sen and Imani Moise

The lender’s shares rose 1.6% in premarket trading as consumer banking – its biggest business – showed strength in the face of uncertainties in global financial markets and reinforced optimism about the financial health of individuals.Oct 16 (Reuters) – Bank of America Corp beat Wall Street estimates for quarterly profit as it earned more in advisory fees and grew its loan book, easing concerns that lower interest rates would crimp growth at the second-largest U.S. bank.

“In a moderately growing economy, we focused on driving those things that are controllable,” Chief Executive Brian Moynihan said in a statement.

Since 2015, Wall Street’s marquee banks have benefited from higher interest rates, as they could afford to charge more interest on loans, without having to significantly raise payouts on deposits. However, this year, markets have been buffeted by lower interest rates as macroeconomic conditions have worsened.

Bank of America is the most vulnerable among the big U.S. banks to fluctuations in interest rates because of its large deposit stock and rate-sensitive mortgage securities. The Federal Reserve has already cut rates twice this quarter.

BofA took a small hit on its spread and reported a 4 basis-point decrease in its interest margin to 2.41% for the third quarter. But a 5% growth in overall loans helped it overcome the impact of lower rates.

Along with that, strong performance in investment banking and equities trading boosted total revenue past Wall Street expectations.

Revenue from investment banking fees jumped 40%, while revenue from consumer banking – its biggest business – rose 3% to $9.7 billion.

The bank’s equity trading business outperformed its peers with a 13% jump.

The bank’s net interest income also came in higher at $12.34 billion, accounting for more than half of its total revenue.

Net income applicable to common shareholders fell 21% to $5.27 billion, or 56 cents per share, hit by a $2 billion impairment charge. Excluding the charge, the bank earned 75 cents per share.

Revenue, net of interest expense, rose slightly to $22.96 billion.

Analysts were expecting a profit of 51 cents per share and revenue of $22.79 billion, according to IBES data from Refinitiv. (Reporting by Anirban Sen in Bangalore and Imani Moise in New York; Editing by Saumyadeb Chakrabarty)

https://seekingalpha.com/article/4296669-4-reasons-like-ford-2020

4 Reasons To Like Ford For 2020

Oct. 15, 2019 5:28 PM ET

Summary

Ford shares struggle to gain positive momentum.

Dividend growth investors ignore Ford despite its dividend of close to 7%.

Company’s product overhaul a positive catalyst.

Looking for more stock ideas like this one? Get them exclusively at DIY Value Investing. Get started today »

Stuck in a wide trading range of between $8 and $10 this year, Ford Motor (NYSE:F) is struggling to reward its loyal shareholders for believing in its tremendous upside potential. The company is, for the most part, exiting the automotive segment and doubling down its efforts on trucks and SUVs. Beyond that, Ford is investing in the future of EVs. So, why should dividend-income growth investors consider Ford stock? Shares pay a dividend yielding 6.8%, but the erratic stock price movement undermines the capital risks of a paper loss against the safety of income.

Investors have four reasons that would support a strong turnaround in demand for its new product line-up for 2020.

1 – Lincoln Navigator

Lincoln reported an overall 4.9% increase, or 29,000 units, in Ford and Lincoln sales. Lincoln sales grew 12% on continued new product momentum while Lincoln SUV sales grew 19% to 21,000 units. With SUV sales at performance not seen since 2003, Ford has strong positive traction with the brand and the model. The company achieved this strength for two reasons. First, its strong advertising campaign is resonating with consumers. Its all-new advertising campaign with Matthew McConaughey led to a nearly three-fold increase in web traffic on the Lincoln website. The YouTube video ad has a massive 23.7 million views so far. Even a compilation of MKZ commercials from 2015 had a total of ~500,000 views.

Positive reviews for Aviator are a second reason for strong sales in the last quarter. Car and Driver wrote that the Aviator delivers a genuine luxury experience. Ford also priced the product at a competitive range at between $56,190 – $77.695. By comparison, an Audi Q8 with most of the major options and packages will cost nearly $100,000. A BMW X7 xDrive40i starts at $73,900 while the flagship xDrive50i starts at $92,600.

2 – Escape SUV

Ford completely redesigned the Escape, a product update that should drive stronger sales in 2020. The base models are bland and devoid of features, while the top-end Titanium is better in every way. This difference may encourage SUV shoppers to pick a higher-trimmed version of the Escape. The company faces heavy competition from an already crowded segment with other brands vying for more market share.

At the operational level, the company has much of its manufacturing ready and is already shipping the new model to dealers. If most of the 2019 models are already drawn down, Ford should not face a big margin compression that would hurt results. In the next quarter.

3 – F-Series and Ranger Market Share Growth

Ford currently enjoys strong momentum for the F-Series and Ranger, as pickup sales rose 6%. Although it increased incentive spending slightly, this is at a rate that is below its major competitors. After selling 27,211 Rangers, up from 20,880 last year, Ford will solidify a leadership position in this segment in 2020. On YouTube, the Ford truck lineup is getting strong buzz that will help build brand awareness. And just as Lincoln sales rose on better quality and features, the same will happen with the F-Series and Ranger.

4 – Confident Consumer, Low Unemployment

At a 52-year low, September’s unemployment rate of 3.5% will lead to sustained demand for automobiles. Real wage growth puts more disposable income in the consumer’s hand. And as the average age of vehicles in the USA reaches 11.8 years old, consumers may decide it is time to buy a new one.

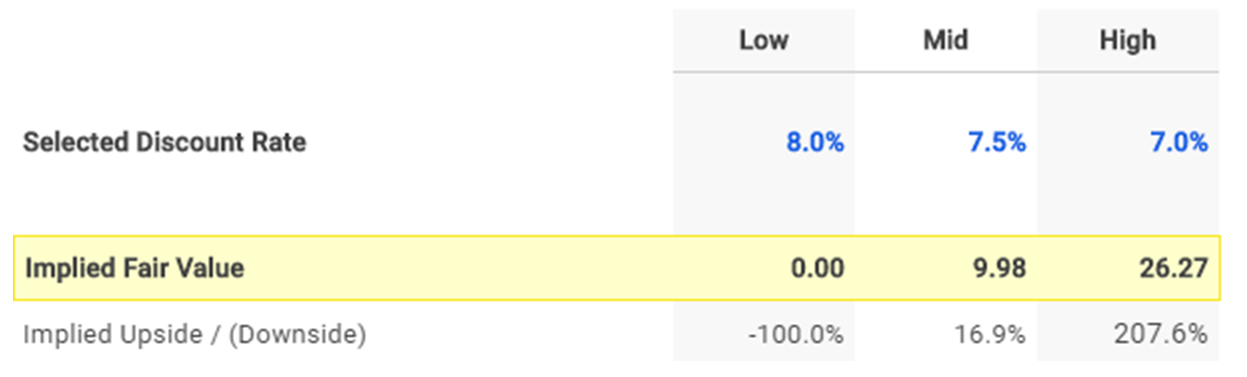

Investors might argue that, based on the cash the company is expected to make, F stock trades close to its fair value already (per simplywall.st).

Conversely, investors may assume flat revenue 5-year CAGR. But at a 0% 5-year average EBITDA margin, the stock’s fair value is above $10 a share:

| (USD in millions) | Input Projections | |||||

| Fiscal Years Ending | 18-Dec | 19-Dec | 20-Dec | 21-Dec | 22-Dec | 23-Dec |

| Revenue | 160,338 | 152,321 | 149,275 | 149,275 | 156,738 | 164,575 |

| % Growth | 2.30% | -5.00% | -2.00% | 0.00% | 5.00% | 5.00% |

| EBITDA | 12,727 | 12,435 | 12,807 | 15,418 | 16,699 | 17,534 |

| % of Revenue | 7.90% | 8.20% | 8.60% | 10.30% | 10.70% | 10.70% |

In this baseline scenario, I assume that the product refresh will not offset the drop in car sales. This is bearish and unlikely but still sets a case that shareholders are holding the stock at a discount.

Source: finbox.io

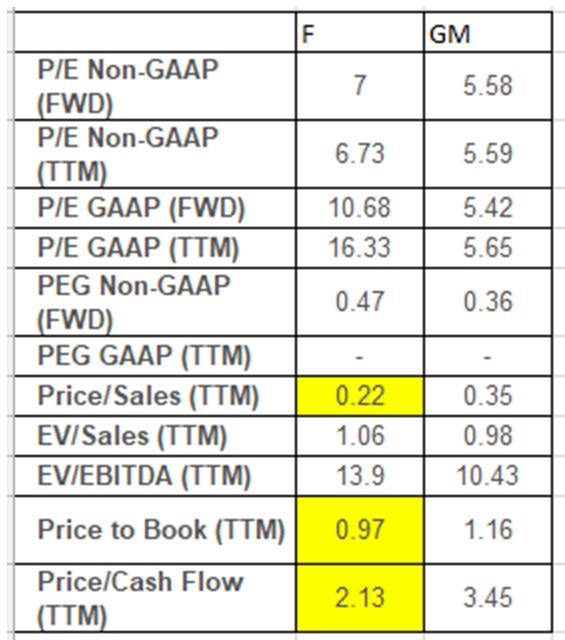

From a valuation standpoint, General Motors (NYSE:GM) is even more discounted than Ford on many metrics. But Ford has a lower price/sale, price/book, and price/cash flow:

Source: SA Essentials

Ford still has a better dividend yield, at 6.8% compared to 4.28% with GM. Ford’s willingness to pay out more from cash flow suggests that it will issue a special dividend if things get better next year and beyond.

Please [+]Follow me for coverage on deeply-discounted stocks. Click on the “follow” button beside my name.

Also, for a limited time, I am inviting you to join DIY investing.

Disclosure: I am/we are long F. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Ken Fisher’s sexist comments have cost his company nearly $1 billion in assets

PUBLISHED WED, OCT 16 20194:13 PM EDTUPDATED THU, OCT 17 20199:51 AM EDT

KEY POINTS

- The Boston Retirement System is the latest pension plan to pull its money from Ken Fisher’s investment firm after the billionaire made off-color comments at conference last week.

- Philadelphia’s board of pensions and Michigan’s retirement system have also ended their association.

- Fidelity has also said that it’s reviewing a $500 million relationship it has with the firm.

The City of Boston is ending its relationship with Fisher Investments, pulling $248 million in pension assets from the firm.

Mayor Martin Walsh announced on Wednesday that the city would stop working with the company in light of sexist comments Ken Fisher had made at an investment conference last week.

“The statements made by Ken Fisher implicate not only his own judgment, but potentially that of the company as a whole,” Walsh wrote in a letter to the Boston Retirement Board. The board today voted 5-0 to end its relationship with Fisher Investments

“While there are no doubt employees of the firm that are just as disturbed by these comments as I, there remains a risk that such thinking runs deeper than this specific commentary, and this is not a risk to which I believe the Retirement System should expose itself,” wrote Walsh.

The Boston Retirement System has a $5 billion portfolio in total. The pension plan’s board will determine how to reinvest the $248 million that were divested, said Emme Handy, chief finance officer for the City of Boston. It’s not uncommon for pension managers to spread investments across multiple firms.

Boston is the latest pension plan to pull its assets from Camas, Washington-based Fisher.

The state of Michigan is withdrawing $600 million of its pension fund from the firm, as well as Philadelphia’s board of pensions, which yanked $54 million.

Fidelity Investments said on Tuesday that it was reviewing a $500 million relationship with the firm.

“We are very concerned about the highly inappropriate comments by Kenneth Fisher,” said Fidelity spokesman Vincent Loporchio. “The views he expressed do not align in any way with our company’s values.”

Ken Fisher has since apologized for the comments.

“Some of the words and phrases I used during a recent conference to make certain points were clearly wrong and I shouldn’t have made them,” he said in a statement. “I realize this kind of language has no place in our company or industry. I sincerely apologize.”

Tiburon comments

CNBC obtained an audio recording last week of Fisher’s comments at the Tiburon CEO Summit, as well as audio of him speaking at a previous conference.

Clips from both were featured on CNBC Power Lunch last Friday. Combined, they show that the money manager made flippant remarks about sex.

In the audio obtained by CNBC, Fisher says at the Tiburon conference: “Money, sex, those are the two most private things for most people,” so when trying to win new clients you need to be careful.

He says: “It’s like going up to a girl in a bar … [inaudible] …going up to a woman in a bar and saying, hey, I want to talk about what’s in your pants.”

Further, when Fisher was a speaker at the Evidence-Based Investing conference in 2018 he compared marketing mutual funds to propositioning a woman for sex at a bar.

“I mean the, the most stupid thing you can do, which is what every mutual fund firm in the world always did, was to brag about performance, uh, in, in a direct mail piece, which is a little bit like walking into a bar if you’re a single guy and you want to get laid and walking up to some girl and saying, ‘Hey, you want to have sex?’” Fisher said, according to audio obtained by CNBC.

Organizers of both conferences subsequently banned him from speaking again in the future.

CNBC’s Leslie Picker, Scott Zamost, Caroline Skinner and Jennifer Schlesinger contributed to this report.

Forget the trade war: The market just wants to see good earnings

PUBLISHED FRI, OCT 18 20194:13 PM EDTUPDATED MON, OCT 21 20198:09 AM EDT

KEY POINTS

- Here’s what investors need to focus on this week.

- The S&P 500 is around 1% below its all-time high.

- The record high could be tested as about 120 S&P 500 companies, or around 24%, are scheduled to release their quarterly results.

- “You’ve got the potential for a combination of things that drive us to new highs,” says one strategist.

Stocks will try this week to break the all-time highs set earlier in the year as a slew of S&P 500 companies get set to report earnings.

The S&P 500 is around 1% below its all-time high. The index got a lift last week after a big chunk of companies posted better-than-expected earnings. It was also boosted by improving sentiment around Brexit and U.S.-China trade negotiations.

The all-time high could be tested as about 120 S&P 500 companies, or around 24%, are scheduled to release their quarterly results this week. Those companies include Caterpillar and Boeing, both of which are expected to report Wednesday morning. Amazon, Intel, McDonald’s and Chipotle Mexican Grill are also on deck for the week.

“You’ve got the potential for a combination of things that drive us to new highs,” said Art Hogan, chief market strategist at National Securities. “At the same time you’re getting better micro data in the earnings, you’re getting better news on the macro hurdles facing us.”

More than 14% of S&P 500 companies have reported through Friday, FactSet data shows. Of those companies, 81% posted earnings that beat analyst expectations.

J.P. Morgan Chase’s report on Tuesday sent the stock to an all-time high while Citigroup and Bank of America also got boosts from their earnings releases. Netflix briefly rallied around 7% Thursday before ending the session up 2.5%. Morgan Stanley advanced 1.5% on earnings. Coca-Cola climbed more than 1% on Friday after releasing its quarterly numbers.

To be sure, the companies are being rated on a very low bar this earnings season. Analysts polled by FactSet expected third-quarter earnings to have fallen by 4.6%.

“Earnings can be a positive catalyst to the extent that expectations are pretty low,” said Dan Russo, chief market strategist at Chaikin Analytics. “The bar has been lowered to the point where companies can jump over it.”

But investors might have a harder time digesting the week’s reports.

Companies such as Caterpillar are heavily affected by the U.S.-China trade war given their exposure to overseas markets. Boeing and Intel also have overseas exposure. Meanwhile, reports from companies such as Amazon, McDonald’s and Chipotle will be heavily scrutinized as investors look for clues on how the consumer is doing.

“Trade frictions and the global economic slowdown have clearly affected 2019 earnings growth thus far,” Scott Wren, senior global equity strategist at Wells Fargo Investment Institute, said in a note. “The third-quarter earnings reporting season will likely confirm that those negatives continued to pour over into last quarter’s results.”

The good news for investors is recent trade talks appear to have yielded some progress. President Donald Trump announced Oct. 11 the U.S. and China had reached a “very substantial phase one” deal. Multiple reports last week said China wants additional talks before signing off on the first phase, but National Economic Council Director Larry Kudlow said Thursday there is “a lot of momentum” to finalize the deal.

John Augustine, chief investment officer at Huntington Private Bank, said the “narrative” around trade had gotten “so one-sided to the negative side, there may be a better chance than not that a phase-one deal is signed.”

Preliminary figures on consumer sentiment showed a slight increase in October from September. The final consumer sentiment numbers for the month are scheduled for release on Friday.

“If corporate earnings show signs of resilience, especially by the U.S. consumer, then a run to new highs is by no means out of the question,” Tom Essaye, founder of The Sevens Report, said in a note.

Week ahead calendar (times in ET)

Monday

Earnings before the bell: Halliburton, SAP, Lenox Intl., PetMed Express

Earnings after the bell: Cadence Designs, Celanese, TD Ameritrade, Zions Bancorp (530p cc)

Tuesday

8:30 a.m. Philadelphia Fed nonmanufacturing (Oct)

10 a.m. Existing Home sales (Sept)

Earnings before the bell: Biogen, Lockheed Martin, McDonald’s, NextEra Energy, Novartis, Procter & Gamble, Travelers, UBS, United Tech, UPS

Earnings after the bell: Texas Instruments, Canadian Natl. Railway, Chipotle Mexican Grill, CoStar, Discover Fincl., Equity Residential, Snap, Whirlpool

Wednesday

7 a.m. Weekly mortgage applications

10:30 a.m. EIA weekly inventories report

Earnings before the bell: Boeing, Boston Scientific, Caterpillar, Daimler, Eli Lilly, Alexion Pharmaceuticals, Blackstone, Freeport-McMoRan, General Dynamics, Hilton, Invesco, LG Display, Nasdaq OMX, Norfolk Southern

Earnings after the bell: eBay, Ford Motor, Microsoft, PayPal, Tesla

Thursday

8:30 a.m. Weekly jobless claims

8:30 a.m. Durable goods orders (Sept)

9:45 a.m. Manufacturing PMI (Oct flash)

9:45 a.m. Services PMI (Oct flash)

10 a.m. New Home sales (Sept)

Earnings before the bell: 3M, AstraZeneca, Comcast, Danaher, Dow, Equinor, Raytheon

Earnings after the bell: Amazon.com, Gilead Sciences, Intel, Vale, Visa

Friday

10 a.m. Consumer sentiment (Oct final)

Earnings before the bell: A-B InBev, Ambev, Barclays, Charter Comm., Eni, Verizon

This chart ranks everyone (even you) by their wealth, and it’s a snapshot of inequality

Published Mon, Oct 7 20194:21 PM EDTUpdated Mon, Oct 14 20199:27 AM EDT

Catherine Clifford@CATCLIFFORD

There is massive income inequality in the in the U.S. and in the world, and everyone from political candidates to billionaires is talking about it.

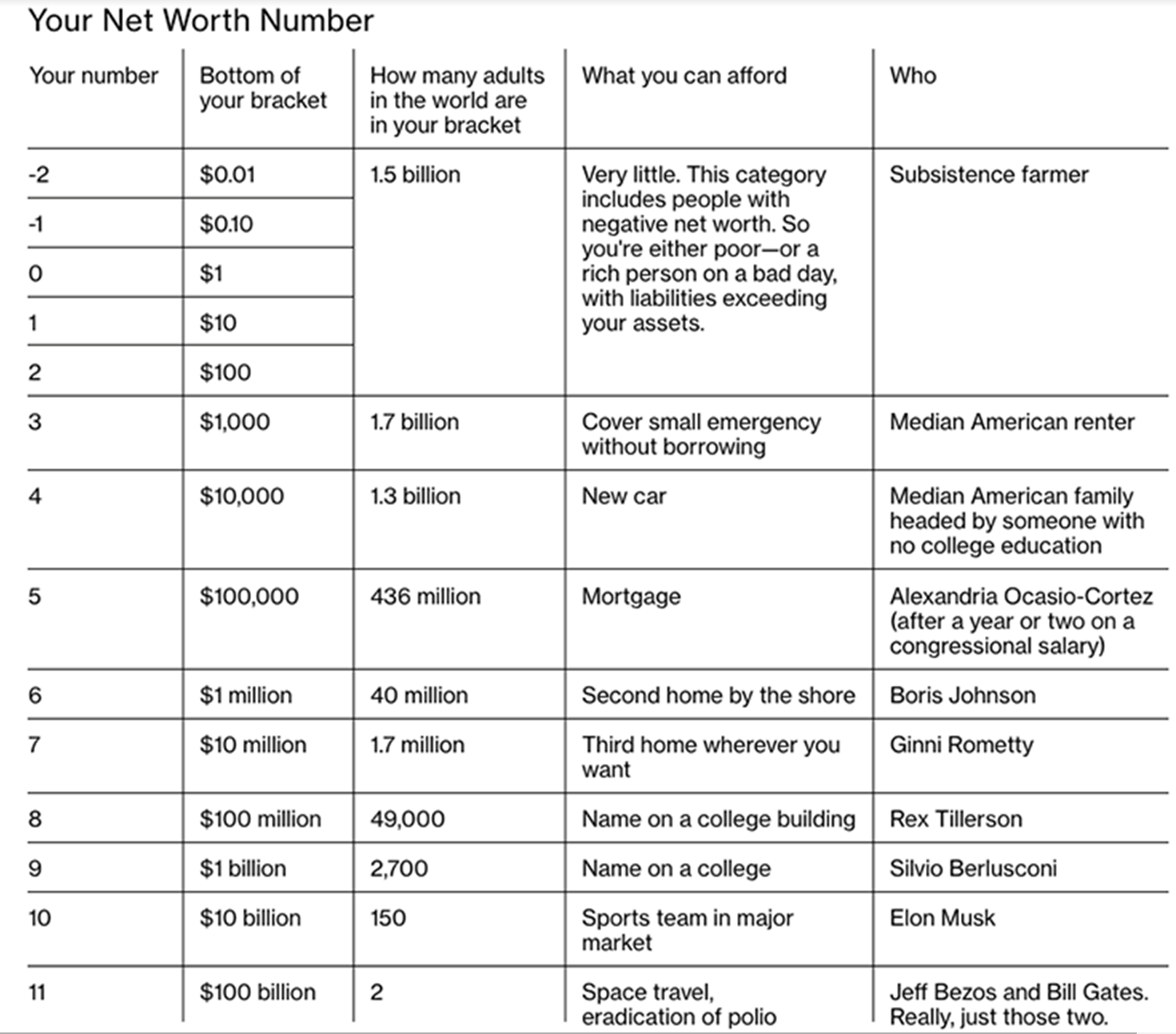

A recent global wealth ranking by Bloomberg Businessweek put a fine point on it. The ranking gives everyone in the world a “wealth number,” from -2 (the world’s poorest) to 11 (the world’s wealthiest).

Only two people get an 11: Jeff Bezos and Bill Gates. Scoring 11 on the Businessweek ranking means you have $100 billion or more.

There are just 150 people who have a wealth number of 10, a bracket that’s entry level net worth is $10 billion (up to just under $100 billion). Elon Musk scores a 10, for example. Individuals with a wealth number 10 can afford to buy a sports team in a major market, the chart says, for context.

Compared to those very small numbers of very rich people, there are 1.3 billion people who have a wealth number of 4, a bracket that’s entry level net worth is $10,000 (up to just under $100,000). These individuals are generally, in a “median American family headed by someone who has no college education,” the chart says, and can afford a new car, the chart estimates.

At the other end of the scale, 1.5 billion adults reside in the brackets -2 through 2, meaning they have a net worth of less than $1,000, including people with a negative net worth. This population would generally be subsistence farmers and can afford “very little,” the chart says. “So you’re either poor—or a rich person on a bad day, with liabilities exceeding your assets,” according to Businessweek.

You can find your own net worth number on the chart.

Image credit: Bloomberg. Data sources: Credit Suisse Global Wealth Report 2018 for worth numbers -2 through 8. Bloomberg Billionaires Index for 9-11. Federal Reserve, Financial Samurai, Bloomberg Reporting, Bloomberg Billionaires Index.

One caveat: The numbers of people who are grouped in each net worth number are estimates, because the data used, from both the Bloomberg Billionaires Index and the Credit Suisse Global Wealth Report, are not exact, Businessweek says. (For example, Bloomberg data says there are 2,800 billionaires while Credit Suisse says there are 1,600.)

“The purchasing power figures are likewise intended to be illustrative, not hard data. For example, we say a 4 can afford a new car. The point isn’t that new cars cost $10,000 to $99,999 (although that’s the right order of magnitude). It’s that you probably need to be a 4 to afford a new car,” Bloomberg Businessweek says in the accompanying story. “Although, of course, there are 1s, 2s, and 3s who will stretch to buy one.”

What is clear from the chart is how extreme wealth inequality is.

Indeed, in 2018, the world’s wealthiest 26 individuals had the same amount of wealth as the poorest half of the population, according to an Oxfam report published in January. That’s down from the 43 wealthiest people the year before.

During the same period, the wealth of the world’s billionaires increased by $900 billion ($2.5 billion per day), while the wealth of the poorest half of the population (3.8 billion people) fell by 11%, the Oxfam report found.

Even some of the billionaires at the top of Businessweek’s ranking see a problem with such extreme wealth concentration.

Facebook CEO and founder Mark Zuckerberg — who, with a net worth of $69.8 billion, according to Bloomberg, would be a No. 10 — was asked Thursday about his thoughts on Sen. Bernie Sanders comment that billionaires should not exist. Zuckerberg said, “I don’t know if I have an exact threshold on what amount of money someone should have but at some level no one deserves to have that much money.”

“I think if you do something that is good, you get rewarded, but I do think some of the wealth that can be accumulated is unreasonable,” Zuckerberg said. (Zuckerberg and his wife, priscilla Chan, have pledged to give away 99% of their Facebook shares through their non-profit, the Chan Zuckerberg Initiative.)

Bill and Melinda Gates have also said their own wealth is an undue privilege. “No, it’s not fair that we have so much wealth when billions of others have so little,” said Melinda, in the Bill and Melinda Gates Foundation’s 2018 annual letter. “And it’s not fair that our wealth opens doors that are closed to most people.”

Ray Dalio, the founder of the most successful hedge fund in the world, says capitalism needs to be reformed and that the American dream is lost https://cbsn.ws/2K0CZeI

Octogenarian and multi-billionaire Warren Buffett says the economy has overwhelmingly financially rewarded people, like him, who are at the top. Buffett is worth $82.2 billion, and would also be a wealth No. 10 on the chart.

“The real problem, in my view, is — this has been — the prosperity has been unbelievable for the extremely rich people,” he said on PBS Newshour in 2017. It “has been disproportionately rewarding to the people on top.”

The Gates and Buffett have pledged to give away more than half of their wealth through The Giving Pledge, a public commitment Buffet and Bill Gates founded and launched in August 2010.

And according to billionaire hedge fund guru Ray Dalio, the wealth inequality that exists in the U.S. may have dire consequences. Dalio has a net worth of $16.6 billion according to Bloomberg, and would therefore be a No. 10.

Current wealth inequality is unsustainable and capitalism needs to be reformed, Dalio says. “We’re at a juncture. We can do it together, or we will do it in conflict, that there will be a conflict between the rich and the poor,”

HI Financial Services Mid-Week 06-24-2014