HI Market View Commentary 07-05-2022

What happened to the US markets today?

4AM MST a report came out in regards to Europe and Euro being at a 20 tear low against the dollar

US markets opened down 1% and went down as much as 2%

Question that kept coming up was – How does a European recession affect the US markets by 2% in a day

The alternative to not bucking up – Quit = huge losses, letting it ride (Gambling) or never having financial freedom

Difference between the retail investor and big money?= TIME

Earnings coming up: Next week I will create my earnings list as JPM Reports next Thursday

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 01-Jul-22 15:38 ET | Archive

The coming weakness is an eventual bear market cure

The day is June 14. The May Producer Price Index (PPI) was just released. It showed the index for final demand up 10.8% year-over-year and the index for final demand, less foods and energy, up 8.3% year-over-year. That news came hot on the heels of the May Consumer Price Index (CPI), which showed total CPI up 8.6% year-over-year — the highest since 1981 — and core CPI, which excludes food and energy, up 6.0% year-over-year.

The day is June 14. WTI crude futures are at $123.60 per barrel. Natural gas futures are at $8.89/mmbtu. The national average for regular gasoline has hit $5.00 per gallon.

The day is June 14. The S&P 500 closed at 3735.48 and the Nasdaq Composite closed at 10,828.34.

The day is June 14. The 2-yr note yield hit 3.43% and the 10-yr note yield hit 3.50%.

Today is July 1.

We don’t have any new PPI or CPI data yet.

WTI crude futures are at $108.13 per barrel, natural gas futures are at $5.70/mmbtu, and the national average for regular gasoline has dropped to $4.84 per gallon. The S&P 500 is at 3,820 and the Nasdaq Composite is at 11,110.

The real kicker, though, is that the 2-yr note yield is at 2.83% and the 10-yr note yield is at 2.89%. There is a lot wrapped up in those lower yields. A little bit of it is good, but most of it is bad.

Pessimism, Not Optimism

It is fair to say that the stock market has stabilized since Treasury yields and commodity prices have come off the boil. That is good news considering how the stock market fared through most of the first half of 2022.

Lower Treasury yields and commodity prices have been held out as support factors for a struggling stock market for the following reasons:

- A lower discount rate helps ease some of the valuation concerns.

- Lower commodity prices help ease some of the inflation concerns.

- Falling Treasury yields raise the attractiveness of quality dividend-paying stocks with higher dividend yields. Sure enough, the utilities sector, with a 3.16% dividend yield, is up 8.0% since June 14. The real estate sector, with a dividend yield of 3.30%, is up 6.0%, since June 14.

The stock market has needed something to cling to as a reason to pick itself up off the mat.

It may be standing now, but its knees are still shaky and it still feels woozy, because what’s happening in the Treasury market and the commodity market isn’t from a punch of optimism. Rather, it is driven by a punch of pessimism about the economic outlook.

A Weakening View

That punch of pessimism relates in large part to the aggressive rate hikes made by many of the world’s leading central banks and the rate hikes that are yet to come.

It has been driven by a premonition that consumer spending is going to be reined in by rising food and energy costs, increasing debt servicing costs, falling asset prices, a softening labor market, and a weakening housing market.

That view of things is showing up in reduced GDP growth forecasts, falling breakeven inflation rates, widening credit spreads, and a newfound belief that the Federal Reserve won’t be raising the target range for the fed funds rate as much as previously thought.

Specifically:

- The Atlanta Fed’s GDPNow model estimate for real GDP growth in the second quarter is -2.1%.

- The 5-year breakeven inflation rate, which is a measure of what inflation is expected to be in the next five years on average, has dropped to 2.58% from 3.57% in March.

- The ICE BofA U.S. High Yield Option-Adjusted Spread has risen to 5.87% and is at its widest since July 2020.

- According to the CME FedWatch Tool, the target range for the fed funds rate is expected to peak at 3.25-3.50% in March 2023 and then get cut around this time next year. The Fed’s median estimate for the fed funds rate in 2023 is 3.80%.

The Treasury market is seeing a lower glide path for the fed funds rate. Fed officials, though, aren’t playing along — not yet anyway.

Their main point of emphasis remains getting inflation under control, and running the risk of tipping the economy into a recession. Fed Chair Powell acknowledged at an ECB Forum this past week that the importance of fighting inflation is worth the risk of slowing economic activity too much since failing to restore price stability would be the bigger mistake.

In other words, the Fed Chair was implying that it is going to be hard for the Fed to achieve a soft landing. That is effectively what the Treasury market is saying, too.

What It All Means

Stock and bond prices are looking more closely aligned with their economic views, and those views aren’t favorable.

The counter-cyclical utilities, consumer staples, and health care sectors are relative strength leaders and are handily outperforming the S&P 500 this year. The yield curve has flattened appreciably and there have also been some points of inversion.

Commodity prices are softening, too. Copper futures are down 19% year-to-date and lumber futures are down 40.0%.

It is nice to see some relief on the commodity pricing front, but it isn’t necessarily the most comforting form of relief knowing that some of it is being driven by demand destruction due to the previously higher prices, while some of it is being driven by expectations for weaker demand due to reduced economic activity.

We don’t typically celebrate a weak economy. In an ideal world, you want stronger economic growth joined by stronger earnings growth. This is not an ideal world.

We have weakening economic growth that is going to be joined by weakening earnings growth. That should invite some inflation relief, which is good, because it might lower the market’s temperature with respect to rate-hike fears. It isn’t indisputably good, however, because what the stock market will be left with is weak earnings growth.

The good news is that there have been some signs of improvement in the stock, bond, and commodity markets recently. The sobering point is that it has been driven mainly by an expected bad economic outcome.

Eventually, the economic weakness will be the cure for this bear market, because it will invite more credible earnings estimates that provide a better determination of true value that lends itself to a reduction in volatility and more conviction behind buying efforts.

—Patrick J. O’Hare, Briefing.com

(Editor’s Note: The next installment of The Big Picture will be published the week of July 18)

Where will our markets end this week?

Lower

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end July 2022?

07-05-2022 -2.0%

Earnings:

Mon:

Tues:

Wed:

Thur: LEVI

Fri:

Econ Reports:

Mon:

Tues: Factory orders

Wed: MBA, ISM Non-manufacturing Index, Jolts, FOMC Minutes

Thur: Initial Claims, Continuing Claims, ADP Employment, Trade Balance

Fri: Average Workweek, Non-Farm Payroll, Private Payrolls, Unemployment Rate, Hourly Earnings, Wholesale Inventories, Consumer Credit

How am I looking to trade?

Currently protection on all core holding and making decisions on earnings,

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Is the bear market coming to an end? Here’s one indicator pros say to watch closely

PUBLISHED TUE, JUN 28 20228:16 PM EDTUPDATED WED, JUN 29 20226:39 PM EDT

After the worst first-half for U.S. stocks in decades, a major rebound last week prompted some optimism that the worst of the sell-off may be behind us — but not everyone’s convinced.

It’s perhaps unsurprising that market watchers are reluctant to call the bottom on the brutal selloff, but there’s one indicator that many strategists say is key: earnings revisions.

Trevor Greetham, head of multi-asset at Royal London Asset Management, says an “earnings recession” is coming, which he expects to “drag on for quite a long time.”

“Earnings are the next problem … This rally could persist a bit longer, but don’t think this is the end of the bear market,” told CNBC’s “Squawk Box Europe” on Monday.

Morgan Stanley is also keeping a close watch on earnings revisions.

“Equity markets tend to trough 2-3 weeks before earnings revisions bottom, however the latter have not even turned negative yet,” Morgan Stanley’s European strategists, led by Graham Secker, noted on Monday.

In a separate note on U.S. equities, the bank noted that the bounce in the S&P 500 last week was due to valuations moving higher — an “unusual” phenomenon given the growing concern about earnings.

“Falling yields and lower oil prices have lowered the terminal rate for the Fed. Whether this is bullish or bearish depends on one’s interpretation. Last week, the market took the bullish view which may last a few more weeks before the reality of lower earnings arrives and the bear market resumes,” strategist Michael Wilson said.

Secker noted that while the MSCI Europe may be in the later stages of a valuation de-rating, the peak-to-trough price decline still looks quite modest relative to prior downturns. This is due to earnings estimates which have continued to rise year-to-date despite the sharp fall in equity prices, Secker explained.

“We do not expect this divergence to last much longer however and see a high chance that the economic news flow deteriorates over the next couple of months, which should put downward pressure on [gross domestic product] and [earnings per share] forecasts,” he added.

How low can earnings go?

In a note entitled “Earnings: how low can they go?” UBS also stresses the importance of earnings, although it take a slightly more optimistic tone.

“With the S&P 500 P/E down [around] 6x YTD, how much earnings will fall is a key debate,” the bank’s strategists, led by Keith Parker, wrote last week. It added that its baseline scenario for the U.S. is “slowing growth but no recession.”

The bank forecasts earnings per share (EPS) of $235.50 and $250 for the S&P 500 for 2022 and 2023, respectively, which they believe are “achievable.” This compares to $186.60 in 2021, according to FactSet data.

However, the strategists stressed that “risks are to the downside.”

The bank has an “implied EPS change indicator” which it says remains positive, pointing to further upgrades.

“S&P 500 implied revisions over the next 8wk remains positive. Energy, Utilities and REITs have the highest sector level implied EPS revisions. Transportation and Banks lead IGs [investment grade],” the analysts wrote.

The bank said its indicator had been a “helpful signal” during periods of market weakness and earnings downgrades, including the stock market crash of 2008 to 2009.

Asset manager says the S&P 500 is primed for a rally — and reveals his top stock picks

PUBLISHED THU, JUN 30 20228:04 PM EDT

The S&P 500 — down about 20% so far this year — is on pace for its worst first half of the year since 1970. But fund manager Robert Luna believes it could be primed for a rally.

“It’s definitely time for a rally talk because there’s a lot of pessimism out there right now, similar to what we saw back then [in 1970 when it was] down 21%. We’re very close to that,” Luna told CNBC “Squawk Box Asia” on Thursday.

Luna, CEO and chief investment strategist at Surevest Wealth Management, noted that around 90% of stocks on the S&P 500 are trading below their 200-day average — a key indicator used by traders and analysts to determine long-term market trends.

But he believes the worst could soon be over, due to the “record amounts of money” on the sidelines, adding that it’s “all a recipe … for a market rally at some point.”

“I can’t tell you whether or not we’re going to be up 25% or 26%, but I can tell you this: if you are one of those people who have money sitting on the sidelines, if you look at where valuations are today and if you look at some of the statistics in terms of where we’ve been at prior to market bottoms, we do think now is time to start putting some money into this market,” he said.

Not everyone is convinced, however. Trevor Greetham, head of multi-asset at Royal London Asset Management, told CNBC this week: “This rally could persist a bit longer, but don’t think this is the end of the bear market – I think there’s quite a bit more time to run through, and you’ve got to be tactical and you’ve got to be diversified.”

No ‘bell at the bottom’

While it’s rewarding to catch the bottom of a sell-off, it is notoriously difficult to do so.

“There’s nobody who’s going to ring a bell at the bottom and say: it’s time to get in now, we have finally hit a bottom,” Luna said.

He noted that the S&P 500 has historically traded about 30%-50% from its high in prior recessions. The index is down about 20% this year, which could mean more downside to come.

Luna warned that there could be more selloffs if the Fed turns more hawkish than expected, inflation worsens or if corporates begin to turn bearish on earnings. If that happens, the S&P 500 could test the 3,250 to 3,300 level, he added. That’s below its close of 3,818.83 Wednesday.

But investors could utilize dollar cost averaging — a strategy that involves investing the same amount at regular intervals, regardless of what markets are doing. “I think that’s really the prudent strategy right now,” Luna said.

Stock picks

Luna believes that the technology and consumer discretionary sectors — which have been hit the hardest this year — could be “the first” to lead the economy out of the recession.

One of his top picks is Disney. He says the company will be “around for a very long time,” with the company’s “great management” providing it with a competitive advantage.

He also likes Meta — a company he thinks will continue to grow its topline by about 25%. “When you can find a company that’s growing double-digits during this recession — which I believe we’re either in or headed into — those are companies that you want to own,” Luna said.

He noted that the stock is trading at just 12x forward earnings — lower than some other tech companies — implying that “a lot of the bad news has been priced in.” Forward earnings are an estimate of a company’s expected earnings. When compared to its share price, the resulting ratio provides an indication of the company’s valuation relative to its peers.

Another stock that Luna likes is Texas-based cybersecurity firm CrowdStrike. He says the company will continue to “grow 50% to 55%” even in today’s volatile environment — with cybersecurity becoming a bigger issue for companies.

Starbucks also made Luna’s list of top stocks. He believes China’s reopening from its Covid-related lockdowns will be a “tailwind” for the company.

Raising interest rates is the wrong solution to the inflation problem, analyst says

PUBLISHED MON, JUL 4 20229:38 PM EDT

KEY POINTS

- Raising interest rates to tame demand and therefore inflation is not the right solution as high prices have been mainly driven mainly by supply chain shocks, MBMG Group managing partner Paul Gambles told CNBC.

- “Supply is very difficult to manage, we are finding across a whole bunch of industries, a whole bunch of businesses, they’re having very different challenges just turning the taps back on,” he said.

- “And the Fed are the first ones to put up their hands and say monetary policy can’t do anything about supply shock. And then they go and raise interest rates,” he added.

Raising interest rates to tame demand — and therefore inflation — is not the right solution, as high prices have been driven mainly by supply chain shocks, one analyst said.

Global manufacturers and suppliers have been unable to produce and deliver goods to consumers efficiently during Covid lockdowns. And more recently, sanctions imposed on Russia have also curtailed supply, mainly of commodities.

“Supply is very difficult to manage, we are finding across a whole bunch of industries, a whole bunch of businesses, they’re having very different challenges just turning the taps back on,” Paul Gambles, managing partner at advisory firm MBMG Group, told CNBC’s “Street Signs” on Monday.

Referring to the energy crisis that Europe faces as Russia threatens to cut off gas supplies, he said that “on American independence day, this is sort of a co-dependence day where Europe is absolutely shooting itself in the foot, because so much of this has come about as a result of sanctions.”

“And the Fed are the first ones to put up their hands and say monetary policy can’t do anything about supply shock. And then they go and raise interest rates.”

Governments around the world have, however, focused on cooling demand as a means of reining in inflation. The lifting of interest rates is intended to put demand more on an even keel with constricted supply.

The U.S. Federal Reserve, for example, increased its benchmark interest rate by 75 basis points to a range of 1.5%-1.75% in June — the biggest increase since 1994 — with Chair Jerome Powell flagging there could be another rate hike in July.

The Reserve Bank of Australia is set to raise rates again on Tuesday, and other Asia-Pacific economies like the Philippines, Singapore and Malaysia have all jumped on the same rate hike bandwagon.

The Fed said in a statement it opted to raise rates as “overall economic activity” appeared to have picked up in the first quarter of the year, with rising inflation reflecting “supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.”

Monetary policy the ‘wrong solution’

Gambles said demand is still below the level it was at before the pandemic started, but would’ve fallen short even without the roadblocks of Covid.

“If we look at where employment would have been in the States, if we hadn’t had Covid, and we hadn’t had the lockdowns, we’re still about 10 million jobs short of where we would be. So there’s, there’s actually quite a lot of potential slack in the labor market. Somehow that’s not translating to the actual slack,” he said.

“And, again, I don’t think that’s a monetary policy issue. I don’t think monetary policy would make a great deal of difference to that.”

With supply shocks rearing their ugly heads from time to time, it would be hard for central banks to maintain a sustained grip over inflation, Gambles added.

Gambles argued that the United States should instead look at a fiscal boost to fix inflation.

“The U.S. federal budget for the financial year 2022 is $3 trillion on a gross basis lighter than it was in 2021. So we’ve got, you know, we’ve got a huge shortfall going into the U.S. economy. And, you know, there’s probably very little that monetary policy can do about that,” he said.

Gambles says adjusting monetary policies is “the wrong solution to the problem.”

Other “unconventional economists” — cited by Gambles in the interview — such as HSBC senior economic advisor Stephen King, have also put forward analyses saying that it’s not simply either demand or supply shock that is to blame for inflation, but the workings of both sides of the equation.

Both pandemic lockdowns, supply chain upheavals and the Russia-Ukraine war, as well as the stimuli governments pumped into their economies and loose monetary policies, have contributed to rising inflation, economists like King have said.

“Economically, the COVID-19 crisis was regarded by many primarily as a demand challenge. Central banks responded by offering very low interest rates and continued quantitative easing, even as governments offered huge fiscal stimulus,” King said in a note earlier this year, referring mainly to the pandemic.

“In truth, COVID-19 had only limited lockdown-related, demand-side effects in the advanced economies.”

“Supply-side effects have proved to be both large and far more persistent: markets now work less well, countries are economically disconnected, and workers are less able to cross borders and, in some cases, less readily available within borders. Loosening policy conditions when supply performance has deteriorated so much is only likely to lead to inflation.”

Since supply is unable to respond fully to increased money coursing through economies like the United States, prices have to rise, he added.

Still a popular antidote

Nevertheless, interest rate hikes remain the popular antidote to fix inflation.

But economists are now concerned that the use of interest rate hikes as a tool to solve the inflation problem could trigger a recession.

A rise in interest rates make it more expensive for firms to expand. That, in turn, could lead to cuts in investments, ultimately hurting employment and jobs.

Child psychologist: The No. 1 skill that sets mentally strong kids apart from ‘those who give up’—and how parents can teach it

Published Mon, Jul 4 202210:31 AM EDTUpdated Mon, Jul 4 20221:07 PM EDT

Michele Borba, Contributor@MICHELEBORBA

A raging pandemic, gun violence, climate change — as an educational psychologist, I’ve seen firsthand how the troubling events of today are taking a toll on our children.

“It’s hard to stop thinking about bad stuff,” an 11-year-old told me recently. “Sometimes I worry about waking up.”

Without the right tools to handle adversity, hopelessness can set in and kids’ overall well-being can decline. Hope is what energizes them to stay mentally strong during tough times, and it’s what sets them apart from those who give up easily.

Mentally strong kids understand the value of hope

Research shows that hopefulness can dramatically reduce childhood anxiety and depression. Hopeful kids have an inner sense of control. They view challenges and obstacles as temporary and able to be overcome, so they are more likely to thrive and help others.

Yet despite its immense power, hope is largely excluded from our parenting agendas. The good news? Hope is teachable. One of the best ways to increase this strength is by equipping children with skills to handle life’s inevitable bumps.

Here are nine science-backed ways to help kids maintain hope — especially during tough times:

1. Stop negativity in the moment.

Ungrounded pessimism eats away at hope, which is why it’s important to help kids catch negativity before it becomes a habit. Develop a private code to signal “that’s a negative comment,” like pulling on your ear. Then encourage them to interrupt negative thoughts.

Creating a nickname for their pessimistic voice (“Mr. Negative Nelly”) can help kids control it. When your kid utters even an ounce of optimism (“I’m getting better at this.”), salute it (“Yes, I can tell you’ve been practicing!”).

2. Use hopeful mantras.

Words have great power. Help your child develop an upbeat mantra (“I got this!,” “There’s always tomorrow,” or “I’ll be okay”) to use during tough times. Then teach them to use the phrase to reduce pessimism.

You can also have your kid set their positive mantra as a phone screensaver by using quote creation platforms like Canva. Don’t forget to adopt one for yourself. Say it until your voice becomes your child’s inner voice.

I always said, “I have what it takes!” to my kids, and now they still say it as adults.

3. Teach brainstorming.

Hopeful kids don’t avoid problems. They take it head on because they’ve learned problems can be solved.

Explain to your child: “The trick to getting unstuck is to ‘spark your brain’ for solutions.” Then teach brainstorming. One trick is to use the S.T.A.N.D. acronym to help kids recall the steps:

- Slow down so you can think.

- Tell your problem.

- Ask: “What else can I do?”

- Name everything you could do to solve it without judgements.

- Decide the best choice and do it.

4. Share hopeful news.

Hopeful kids hear hopeful stories. Violent media can create a view of the world as completely mean, scary dangerous. Uplifting news keeps children’s hope alive.

Look for inspiring news stories to share with your kids from time to time. Institute a bedtime review of the good parts about each person’s day to help your kids find the bright side of life.

And remind them of their own triumphs over struggles: “Remember when you had trouble making friends? Now you have great buddies!”

5. Ask ‘what if?’

Pessimistic kids often think of “gloomy probabilities,” which dims hope. But hopeful kids learn to assess accurately. When your child shares a doubt, pose “what-if” type of questions to think through possible outcomes more realistically.

You might ask: “What might happen if you tried — or didn’t try — that? What is the worst thing that could happen? How likely is that to happen? What’s the most likely outcome?”

These questions help kids weigh if potential outcomes really are as bad as they imagined. That knowledge can be the path forward.

6. Celebrate small gains.

Repeated failure increases hopelessness, but recognizing even a small success boosts hope. Redefine “success” as a gain: a small improvement over past performance due to effort. Then help your child identify personal gains.

For example, “Last time, you got nine words correct. Today you got 10! That’s a gain!” Or, “Yesterday you hit one run; today you got two. That’s a gain!”

7. Boost assertiveness.

Kids who feel hopeless find it difficult to self-advocate. Learning assertiveness, which is the mid-point between passivity and aggression, increases hopefulness and agency.

Body language matters, too. Teach the basics of confident body language: “Holding your head high helps you appear confident. Always look the person in the eye.”

Brainstorm comebacks your child can use to stand up for herself: “Not cool.” “That’s not right.” “I don’t want to do that.” Practice these skills until your child can defend themselves.

8. Create gratitude rituals.

Hopeful kids are grateful. One study found that people who keep gratitude journals feel more hopeful about their lives in just 10 weeks.

Hold a meal-time tradition in which each family member reveals one thing they grateful for that happened that day. Institute a bedtime ritual where everyone names someone they’re grateful for and why. Or log your children’s appreciations in a family journal to recall the good parts of their lives.

9. Embrace service.

As misfortunes increase, hopelessness can set in. Showing children that they have power to make differences in other’s lives inspires hope and builds self-efficacy.

Hopeful kids have caring adults who model hopefulness. Start a family charity box where kids add gently-used toys, clothes and games. Deliver it to a needy family so they see the impact of kindness.

Find causes tailored to your children’s passion and support their efforts. Projects should be driven by their own concerns, not designed to look good on resumes. Follow their lead!

With recession fears surging, UBS dips into the history books to predict what could happen to stock markets

PUBLISHED WED, JUN 22 20229:14 PM EDT

Is a recession in the cards? Market watchers are split on if, and when, a recession will strike the U.S.

The major U.S. averages clocked their 10th losing week in 11 last week on fears that an aggressive rate hike cycle by the Fed to rein in soaring inflation will risk causing an economic downturn.

The S&P 500 slipped 5.8% last week for its biggest weekly loss since March 2020, while the blue-chip Dow Jones Industrial Average dipped below 30,000 for the first time since January 2021, losing 4.8% for the period. The tech-heavy Nasdaq Composite slipped 4.8%.

Warnings of a looming recession are growing louder. A slew of investment banks — including the likes of Goldman Sachs, Morgan Stanley and Deutsche Bank — now believe a recession is becoming a more likely scenario as the Fed hikes rates and economic growth slows.

But UBS is standing by its base case forecast of “no recession.”

“We don’t see a U.S. or global recession in 2022 or 2023 in our base case, but it’s clear that the risks of a hard landing are rising. Even if the economy does slip into a recession, however, it should be a shallow one given the strength of consumer and bank balance sheets,” UBS’ strategists, led by Bhanu Baweja, said in a research note on Jun. 21.

The bank looked at market and sector return patterns around 17 U.S. recessions in the last 100 years for clues to what may happen should a recession strike.

To be sure, history is not necessarily a reliable predictor of future performance, but it could provide investors with an idea of what’s in store next as recession risks grow.

What happens in a ‘shallow recession’

Of the 17 recessions studied by UBS, 10 were deemed to be “deep recessions,” when gross domestic product in the U.S. fell more than 3% from peak to trough. The remaining seven were classed as “shallow recessions” — defined as GDP decline of less than 3%.

UBS noted that shallow recessions are associated with central banks hiking rates, typically in response to high inflation.

The bank’s data showed that a shallow recession typically lasts 12 months, with returns declining by an average of 11% over the period.

It noted that sell-offs typically begin eight months prior to the start of a recession, reaching a bottom within four months of the start.

This implies that the market sell-off is concentrated in roughly the first one-third, with a recovery through the latter two-thirds of the recession, Baweja noted.

On a sectoral basis, share price returns of financials, industrials, and consumer discretionary stocks are notable for being the “most sensitive” to the depth of recession — whose prospects are most improved if one can be confident that a deep recession would be avoided, according to UBS.

“In fact, around previous shallow recessions, financials and consumer discretionary stocks have modestly outperformed the market,” Baweja added.

UBS’ data also showed that on average, the U.S. inflation rate and the Fed funds rate were 6.6% and 8.1%, respectively, prior to a shallow recession.

Following the Fed’s 75 basis point hike last week, the Fed’s benchmark funds rate now stands in the range of 1.5%-1.75%. The U.S. consumer price index rose 8.6% in May from a year ago, the highest increase since December 1981. Core inflation excluding food and energy rose 6%.

Ford reports slight uptick in quarterly sales that misses analysts’ expectations

PUBLISHED TUE, JUL 5 20229:17 AM EDTUPDATED TUE, JUL 5 202212:57 PM EDT

KEY POINTS

- Ford on Tuesday reported a 1.8% uptick in second-quarter sales compared with a year earlier, including a 31.5% increase in June.

- Analysts expected the Detroit automaker’s second-quarter sales to increase between 3.3% and 5.1%.

DETROIT – Ford Motor on Tuesday reported a slight increase in new vehicle sales for the second quarter that missed automotive analysts’ expectations.

The company said sales rose 1.8% to 483,688 new vehicles in the second quarter compared with a year earlier, but noted that results improved in June and were up 31.5% for the month. Analysts expected the Detroit automaker’s sales to rise between 3.3% and 5.1%.

Ford’s results easily outperformed the industry during the quarter, as overall sales were forecast to be down between 19% and 21% from the year-ago period. Automakers have been scrambling to rebuild dealer inventories that have been hit hard by production cuts amid a global shortage of semiconductor chips and other key automotive components.

Shares of Ford hit a 52-week low of $10.61 on Tuesday. The stock was at around $10.90 in afternoon trading, down more than 3%. Shares of the automaker have declined 47% in 2022.

Ford was significantly impacted a year ago by the chip shortage, which was largely the result of a fire at one of its suppliers in Japan that forced production cuts during the first half of 2021.

“Amid industry-wide supply constraints, Ford outperformed the industry driven by strong F-Series, Explorer and new Expedition and Navigator SUV sales,” Andrew Frick, Ford’s vice president of sales, distribution and trucks, said in a release.

The company said demand remains strong, with a record 50% of retail sales coming from customer orders in June, rather than from purchases out of dealer inventories. Automakers have pushed customers to order vehicles, which helps companies better measure demand and plan accordingly. Ford said its retail sales were up 30.3% last month compared with a year earlier.

Notably, Ford’s sales of F-Series pickups improved to 57,673 units in June – their highest monthly total of 2022. The sales include the F-150, including an all-electric version, and larger iterations of the pickup.

Sales of the company’s electric F-150 Lightning continue to ramp up. Ford said it sold 2,296 of the trucks since it went on sale in late May, including 1,837 in June.

Ford said sales of its electric vehicle – F-150 Lightning , Mustang Mach-E and E-Transit – jumped 76.6% to 4,353 in June from a year ago. For the first half of the year, it said EV sales totaled 22,979 units, up 77% from the same period in 2021.

Examining the stock market’s pain points as it tries to hold onto this bounce from the lows

PUBLISHED SAT, JUN 4 20228:03 AM EDT

Michael Santoli@MICHAELSANTOLI

“Some discomfort is normal but call me if the pain gets bad,” the doctor will say, leaving it up to the patient to determine the line between the tolerable and the worrisome.

Investors in the five months since stocks peaked have mostly been feeling a typical degree of discomfort for the procedure the economy and markets are undergoing: Pricing in an inflationary squeeze, the start of a financial-tightening cycle, decelerating growth and a resulting valuation reset.

It’s not yet clear whether all this will break through to acute suffering and more lasting impairment of asset values, with several key macroeconomic factors — nominal and real bond yields, earnings downgrades and oil prices — still short of Wall Street’s apparent pain threshold.

Last week’s market action — the S&P 500 slipping 1.2% in choppy, indecisive trading, retaining most of the 9% ramp from the May 20 low while declining plenty of decent excuses to break down further — fits well into this category of routine discomfort.

It’s fair to observe that skepticism prevails as to whether the index low two weeks ago just above 3800 was a reliable trough, and with good reason: Previous rallies this year have been brief interludes before further new lows. The longer-term downtrend remains in place.

And it’s difficult to see anything like an “all clear” signal for risk-taking soon given the Federal Reserve’s singular focus on hustling rates higher to fight an inflationary trend which, even if it has peaked, can’t prove that notion for another few months.

Still, the market’s slippage last week does nothing to hurt the case that the recent rebound is fairly well-supported and could continue higher to test the nerve of the now-confident camp insisting that all rallies should be sold.

Bottom or bear bounce?

The lopsided positive-market-breadth statistics from the initial three-day ramp off the lows triggered some signals that tend to have pretty good long-term implications for returns several months to a year out (with the huge exceptions being the multi-year recessionary bear markets starting in 2000 and 2007).

Stocks remain pretty well in tune with other asset classes, too. The S&P 500 is within half a percent of where it stood four weeks ago, and the 2- and 10-year Treasury yields, junk-bond spreads and full-year 2022 S&P 500 earnings forecasts are likewise all in pretty much the same place now as they were then.

A model used by Fidelity macro strategist Jurrien Timmer to gauge fair value for stocks based on the 2-year Treasury yield (as a proxy for the Fed’s likely policy path) explains most of equities’ valuation compression this year. The slope tracks well, though stocks remain a bit above the implied proper values.

Fidelity

Timmer believes that because the year’s P/E decline has merely taken it to the range of fair rather than cheap, upside is likely limited even if fundamentals should offer good support at the recent lows.

A market experiencing unease and bracing against the known headwinds yet not yet forced to price in truly painful potential outcomes – this is the theme of the moment. Deutsche Bank strategists who track the investment stance of all categories of investors on Friday reported that “while a slowdown in growth looks priced in across the board, very few [positioning indicators] are down to recession levels.”

This makes sense, incidentally, given that last week’s jobs report and ISM manufacturing survey showed nothing approaching recessionary conditions.

Hedge funds have radically cut back on equity risk and rampant call-option buying of the past few years has largely receded, yet short interest is low and households continue to carry elevated stock allocations relative to history.

Watch the profit outlook

The real pain point for stocks would obviously be the profit outlook giving way just as valuations have begun to look pretty palatable based on current earnings forecasts. KKR & Co. chief investment officer Henry McVey says he believes the market is now transitioning from a mode where inflation is the main preoccupation to earnings expectations getting cut significantly over the second half and into 2024.

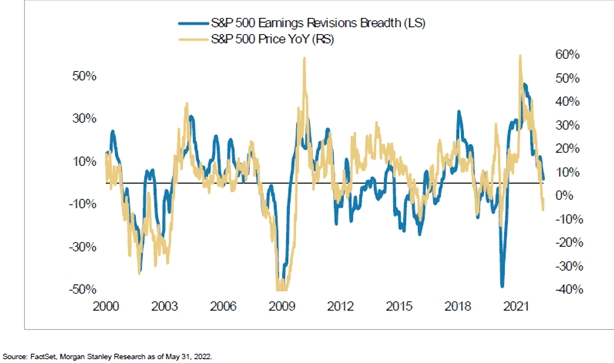

Morgan Stanley notes the breadth of earnings revisions — the net percentage being raised versus cut — looks about to flip negative. Not great, but the S&P 500 annual-return path shows this isn’t exactly news to the market and there have been times when this gauge cracked below zero in a mid-cycle slowdown rather than recession.

Morgan Stanley

With Fed officials last week consistently waving investors away from the hope that they will be looking for an opportunity to pause their rate-hiking campaign in coming months, yields would seem to be one of the more obvious things that could test stocks’ pain threshold.

Watch rates, oil

The 10-year yield has climbed back to the doorstep of 3%, not far below the peak above 3.1% it hit briefly in early May, which itself was just short of the 3.25% level reached in late 2018, which helped trigger a rapid stock-market tumble into late December that year. A break above this zone also represents a breach of the multi-decade downtrend in yields, so such a move would not go unnoticed.

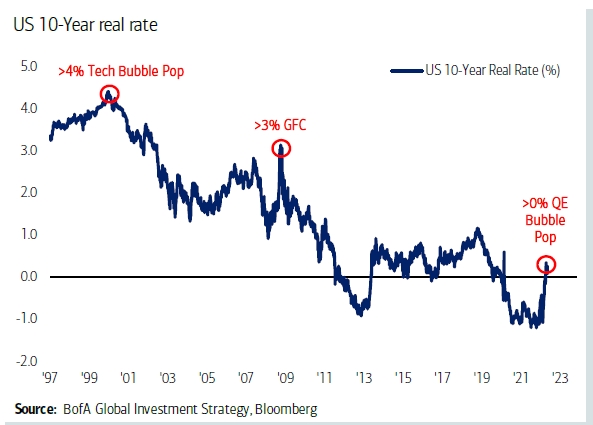

Real rates — yields adjusted for market-implied inflation expectations — are another thing to watch on the hunt for sources of possible pain. The real yield has recently turned positive again. When it got to 1% in 2013 it coincided with the attention-getting but ultimately benign “taper tantrum.” The same level in late 2018, later in the cycle and with stocks more expensive, proved tougher to digest for stocks, which had a near-20% setback that ended as the Fed signaled a pause to its tightening efforts.

Bank of America

For sure, oil ramping above the March war-panic peak of $130 a barrel for WTI crude (from $120 now) would be an obvious additional challenge too, though it remains a less-onerous burden now than it was from 2011-2014 adjusted for the larger size and lower energy-intensity of today’s economy. It’s fair to sum up by saying there is no shortage of potential sources of pain. Yet markets have absorbed plenty of unpleasantness already and have not decisively broken down, in large part because investors collectively have been fearful and flinching for months now, anticipating pain rather than

HI Financial Services Mid-Week 06-24-2014