HI Market View Commentary 07-18-2022

I was going come today and put it on record that apparently I was wrong on the market direction

I really thought I had the market wrong until today -0.84

The Cycles are happening so fast – Fed Rate Hike, Supply Chain Constraints, China still is shutting down, Europe still in a recessionary economy, Ukraine and Russia still at war, OIL still above $100, we still have inflation and the consumer dollar is not going as far

I’m Angry = }} Jim Kramer has a new S&P 500 show, acceptance BUT his comments on Mad money today were since 2005 here are his top 10 winners – NFLX, AMZN, AAPL, and he was stating since 2005 they were up 1,000’s of a percent

In 2008 his suggestions were to sell everything on June and again in 2010 sell recommendation the beginning of the year

Local firm here in SLC published last month how they beat the S&P 500 for June = 0.1% Ytd -33.4%

Denver Firm Park Avenue Investments – Sold their services on easy to contact, willing to work with you, always beat the market = In May – 26.5%, won’t sell obvious losers even though requested by portfolio owner, NEVER are available to talk

Denver – We use Artificial Intelligence to buy and sell your securities with 99.9% accuracy for trend recognition = -40%

Las Vegas firm – we are cashing in losers for tax purposes to help your portfolio throughout 2023 = Churning your out of bonds with a 30% loss and we picked bad stocks

Because IF you lie, cheat, don’t know what the hell you are talking about I no longer have the time to hear it

AND I feel punished for be honest and showing a little integrity

I didn’t miss it I’m just realistic in what the markets and our portfolios are doing

Here’s my point today = DO YOUR OWN RESEARCH AND TEST YOU ASSUMPTIONS AGAISNST REAL NUMEBRS

Earnings dates:

AA 7/21

AAPL 7/28 AMC

BAC 7/18 BMO

BA 7/27 BMO

BIDU 8/11 BMO

COST 9/22 AMC

CVS 8/03 BMO

DG 8/25 AMC

DIS 8/10 AMC

F 7/27 AMC

KO 7/26 BMO

SQ 8/04 AMC

UAA 8/03 BMO

V 7/26 AMC

VZ 7/22 BMO

https://www.briefing.com/the-big-picture

| https://go.ycharts.com/weekly-pulse Market Recap WEEK OF JUL. 11 THROUGH JUL. 15, 2022 The S&P 500 index slipped 0.9% last week amid higher-than-expected June inflation figures and a disappointing initial round of Q2 earnings reports, although better-than-expected June retail sales data helped minimize stocks’ overall decline. The market benchmark ended Friday’s session at 3,863.16, down from last Friday’s closing level of 3,899.38. The index is still in positive territory for July with a month-to-date gain of 2.1%, but it is down 19% for the year to date. US stocks fell as inflation data showed US consumer prices as well as producer prices rose faster than expected in June while the first round of earnings reports for Q2 added to investors’ concerns about the economy. The US seasonally adjusted consumer price index, a measure of inflation, rose by 1.3% in June, ahead of expectations for a 1.1% increase and following a gain of 1% in May, according to data released Wednesday by the Bureau of Labor Statistics. The year-over-year rate for overall CPI accelerated to a record 9.1% from 8.6% in May, while the rate for core CPI slowed modestly to 5.9% from 6%. The US producer price index jumped 11.3% in June from a year earlier following May’s revised growth of 10.9%, the Bureau of Labor Statistics reported Thursday. The consensus on Econoday was for a 10.4% gain. Meanwhile, among the first Q2 earnings reports, JPMorgan Chase (JPM) posted a decline in second-quarter earnings that missed analysts’ estimates as the lender set aside more cash to cover for potential loan losses and suspended its share repurchase program. Morgan Stanley (MS) also reported lower second-quarter earnings as the company said its investment banking segment was hurt by “the uncertain macroeconomic environment.” However, the week’s decline was pared on Friday as stocks rose after June retail sales data showed US retail sales increased slightly more than expected in June. The retail sales increase for last month was 1%, a bit better than the Econoday consensus estimate for a 0.9% increase. Excluding autos and gas, retail sales rose 0.7%, compared with a 0.2% fall expected by Wall Street. All but one sector of the S&P 500 fell last week. Communication services had the largest weekly percentage drop, falling 3.3%, followed by a 3.1% slide in energy. Among the others in the red, the materials, industrials and consumer discretionary sectors all logged declines of more than 1% each. The lone gainer was consumer staples, which edged up 0.1%. The decliners in communication services included shares of Facebook parent Meta Platforms (META), which fell 3.6% amid several negative analysts’ actions. Among them, Needham downgraded its investment rating on the stock to underperform from hold, while analysts at Stifel, Citigroup and KGI Securities all lowered their price targets on the shares. The energy sector’s drop came as crude-oil futures fell. Among the decliners, shares of EOG Resources (EOG) shed 7.8% and APA Corp. (APA) lost 8.2%. On the upside, the gainers in consumer staples included shares of Clorox (CLX), which climbed 5.2% as the manufacturer of consumer and professional products increased its quarterly dividend by 2%. Next week, the Q2 earnings reporting season will kick into a higher gear, with results expected from a long list of companies including Bank of America (BAC), Goldman Sachs Group (GS), Hasbro (HAS), Halliburton (HAL), Johnson & Johnson (JNJ), Netflix (NFLX), CSX Corp. (CSX), United Airlines Holdings (UAL), AT&T (T), Verizon Communications (VZ), Twitter (TWTR) and American Express (AXP). Economic reports due next week will feature housing data in the earlier part of the week, including the NAHB/Wells Fargo Housing Market Index for July on Monday, June building permits and housing starts on Tuesday, and June existing home sales on Wednesday. Weekly jobless claims and the July Philadelphia Fed manufacturing index are expected Thursday, followed by S&P Global’s July purchasing managers’ indexes for the US manufacturing and services sectors on Friday. Provided by MT Newswires |

Where will our markets end this week?

Lower

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end July 2022?

07-18-2022 -2.0%

07-11-2022 -2.0%

07-05-2022 -2.0%

Earnings:

Mon: SCHW, GS, IBM, BAC

Tues: HAL, HAS, JNJ, LMT, NFLX

Wed: ABT, FHN, LAD, AA, TSLA, CSX, DFS, KMI, LVS, UAL, VMI

Thur: ALK, AAL, T, BX, DHI, DPZ, KEY, PM, UNP, SAM, ISRG, MAT

Fri: AXP, SLB, TWTR, VZ

Econ Reports:

Mon: NAHB Housing Market Index

Tues: Housing Starts, Building Permits

Wed: MBA, Existing Home Sales

Thur: Initial Claims, Continuing Claims, Phil Fed

Fri: Monthly Options Expirations

How am I looking to trade?

Currently protection on all core holding and making decisions on earnings,

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Ford unveils new F-150 Raptor R pickup with 700 horsepower

KEY POINTS

- Ford’s newest pickup is the F-150 Raptor R, a new high-performance pickup with a supercharged 5.2-liter V-8 engine that produces 700 horsepower and 640 foot-pounds of torque.

- The new “R” version looks similar to the company’s F-150 Raptor, but it includes some design tweaks and offers a significant boost in performance and off-road parts.

- Automakers have been adding performance variants to their lineups to beef up profit margins before they transition more to electric vehicles.

2023 Ford F-150 Raptor R

Ford

DETROIT — As Ford Motor ramps up production of its electric F-150 pickup, it’s not giving up on offering new, highly profitable performance models with gasoline engines.

The Detroit automaker Monday morning unveiled the F-150 Raptor R, a new version of its high-performance, off-road pickup with a supercharged 5.2-liter V-8 engine that produces 700 horsepower and 640 foot-pounds of torque. The truck will start at $109,145, including destination and delivery charges.

Amid pent-up demand and record high prices, automakers have been adding performance variants to their lineups to beef up profit margins before they transition more to electric vehicles, which can offer high performance but have lower margins than gas-powered vehicles.

The new “R” version looks similar to the company’s F-150 Raptor, but it includes some design tweaks and offers a significant boost in performance and off-road parts. For comparison, the regular 2022 F-150 Raptor is powered by a 3.5-liter EcoBoost V-6 engine that produces 450 horsepower and 510 foot-pounds of torque. Ford said the Raptor R’s top speed is 112 mph, limited by the vehicle’s 37-inch tires.

Ford has largely dominated the high-performance pickup truck market since launching the first Raptor model in 2009. But in recent years, Stellantis’ Ram Trucks brand has been grabbing headlines with its Ram 1500 TRX, a 702-horsepower pickup with supercharged 6.2-liter V-8 engine and 650 foot-pounds of torque.

The new Raptor falls just shy of the performance of the Ram TRX, but it offers different performance parts. It’s also the highest-powered engine Ford offers. The company previously used the engine for the Ford Mustang Shelby GT500.

Carl Widmann, chief engineer of Ford performance, said the vehicle is the result of customers “demanding the sound and power of a V8 back in Raptor.” Ford hasn’t offered a V-8 engine in a Raptor model since 2014.

Production of the F-150 Raptor R will start in the fall at Ford’s Dearborn Truck Plant in Michigan, the company said. Ordering for the vehicle opens Monday through franchised Ford dealers.

Current Raptor trucks start at about $70,000 — around $40,000 over a base F-150 but less expensive than the top luxury version of the F-150 that starts at roughly $77,000.

Bank of America revenue tops expectations as lender benefits from higher interest rates

KEY POINTS

- Bank of America earnings dropped 32% to $6.25 billion, or 73 cents a share, from a year earlier as the firm took a $523 million provision for credit losses.

- Revenue climbed 5.6% to $22.79 billion, edging out analysts’ expectations, as net interest income surged 22% to $12.4 billion on rising interest rates and loan growth.

- Shares of the lender rose 2.5% premarket trading.

Bank of America on Monday said second-quarter results benefited from rising interest rates, but profit took a hit from about $425 million in expenses tied to regulatory matters.

Here’s what the company reported compared with what Wall Street was expecting, based on a survey of analysts by Refinitiv:

- Earnings per share: 78 cents adjusted vs. 75 cents a share expected

- Revenue: $22.79 billion vs. $22.67 billion expected

Profit dropped 32% to $6.25 billion, or 73 cents a share, from a year earlier as the firm took a $523 million provision for credit losses. A year ago, the bank had a $1.6 billion benefit as borrowers proved more creditworthy than expected.

Excluding the impact of the regulatory expenses, the bank earned 78 cents a share, which was higher than analysts had predicted.

Revenue climbed 5.6% to $22.79 billion, edging out analysts’ expectations, as net interest income surged 22% to $12.4 billion on rising interest rates and loan growth. That figure could climb by $900 million or $1 billion in the third quarter and by at least that much in the fourth quarter, CFO Alastair Borthwick told analysts Monday during a conference call.

Shares of the lender rose about 2.8% in trading Monday.

“Solid client activity across our businesses, coupled with higher interest rates, drove strong net interest income growth and allowed us to perform well in a weakened capital markets environment,” CEO Brian Moynihan said in the release.

“Our U.S. consumer clients remained resilient with continued strong deposit balances and spending levels. Loan growth continued across our franchise and our markets teams helped clients navigate significant volatility reflecting economic uncertainty.”

Bank of America, led by Moynihan since 2010, has enjoyed tailwinds as rising interest rates and a rebound in loan growth have boosted income. But bank stocks have been hammered this year amid concerns that high inflation will spark a recession, which would lead to higher loan defaults.

Noninterest expenses in the quarter rose 2% from a year earlier, as the firm cited about $425 million in costs tied to regulatory matters. Roughly half of that figure was tied to fines announced last week totaling $225 million over how the bank handled unemployment benefits during the pandemic; the rest has to do with an industrywide probe into trading personnel using messaging apps.

Similar to peers at Morgan Stanley and JPMorgan Chase, Bank of America saw investment banking fees plunge 47% to $1.1 billion, just below the $1.24 billion StreetAccount estimate.

Fixed income trading revenue jumped 19% to $2.3 billion and equities revenue rose 2% to $1.7 billion, both essentially matching analysts’ expectations.

Furthermore, broad declines across financial assets have begun to show up in bank results in the quarter, with Wells Fargo saying that “market conditions” forced it to post a $576 million impairment on equity holdings. JPMorgan said last week it had a $257 million writedown on bridge loans for leveraged buyout clients.

On Monday, Bank of America cited “mark-to-market losses related to leveraged finance positions” but didn’t immediately disclose a figure for the losses. Last month, Borthwick said that the bank will likely post a $150 million writedown on its buyout loans.

Bank of America shares have fallen 28% this year through Friday, worse than the 16% decline of the KBW Bank Index.

Last week, JPMorgan and Wells Fargo posted second-quarter profit declines as the banks set aside more funds for expected loan losses, while Morgan Stanley disappointed after a bigger-than-expected slowdown in investment banking. Citigroup topped expectations for revenue as it benefited from rising rates and strong trading results.

From $25 billion to $167 million: How a major crypto lender collapsed and dragged many investors down with it

MacKenzie Sigalos@KENZIESIGALOS

KEY POINTS

- Celsius is down to $167 million “in cash on hand,” which they say will provide “ample liquidity” to support operations during the restructuring process.

- Celsius owes its users around $4.7 billion, according to its bankruptcy filing — and there’s an approximate $1.2 billion hole in its balance sheet.

Celsius filing for bankruptcy this week surprised virtually no one. Once a platform freezes customer assets, it’s typically all over. But just because the fall of this embattled crypto lender didn’t come as a shock, doesn’t mean it wasn’t a really big deal for the industry.

In October 2021, CEO Alex Mashinsky said the crypto lender had $25 billion in assets under management. Even as recently as May — despite crashing cryptocurrency prices — the lender was managing about $11.8 billion in assets, according to its website. The firm had another $8 billion in client loans, making it one of the world’s biggest names in crypto lending.

Now, Celsius is down to $167 million “in cash on hand,” which it says will provide “ample liquidity” to support operations during the restructuring process.

Meanwhile, Celsius owes its users around $4.7 billion, according to its bankruptcy filing — and there’s an approximate $1.2 billion hole in its balance sheet.

It goes to show that leverage is one hell of a drug, but the moment you suck out all that liquidity, it’s a whole lot harder to keep the party going.

The fall of Celsius marks the third major bankruptcy in the crypto ecosystem in two weeks, and it is being billed as crypto’s Lehman Brothers moment — comparing the contagion effect of a failed crypto lender to the fall of a major Wall Street bank that ultimately foretold the 2008 mortgage debt and financial crisis.

Regardless of whether the Celsius implosion portends a larger collapse of the greater crypto ecosystem, the days of customers collecting double-digit annual returns are over. For Celsius, promising those big yields as a means to onboard new users is a big part of what led to its ultimate downfall.

“They were subsidizing it and taking losses to get clients in the door,” said Castle Island Venture’s Nic Carter. “The yields on the other end were fake and subsidized. Basically, they were pulling through returns from [Ponzi schemes].”

Who will get their money back

Three weeks after Celsius halted all withdrawals due to “extreme market conditions” — and a few days before the crypto lender ultimately filed for bankruptcy protection — the platform was still advertising in big bold text on its website annual returns of nearly 19%, which paid out weekly.

“Transfer your crypto to Celsius and you could be earning up to 18.63% APY in minutes,” read the website on July 3.

Promises such as these helped to rapidly lure in new users. Celsius said it had 1.7 million customers, as of June.

The company’s bankruptcy filing shows that Celsius also has more than 100,000 creditors, some of whom lent the platform cash without any collateral to back up the arrangement. The list of its top 50 unsecured creditors, includes Sam Bankman-Fried’s trading firm Alameda Research, as well as an investment firm based in the Cayman Islands.

Those creditors are likely first in line to get their money back, should there be anything for the taking — with mom and pop investors left holding the bag.

After filing its bankruptcy petition, Celsius clarified that “most account activity will be paused until further notice” and that it was “not requesting authority to allow customer withdrawals at this time.”

The FAQ goes on to say that reward accruals are also halted through the Chapter 11 bankruptcy process, and customers will not be receiving reward distributions at this time.

That means customers trying to access their crypto cash are out of luck for now. It is also unclear whether bankruptcy proceedings will ultimately enable customers to ever recoup their losses. If there is some sort of payout at the end of what could be a multi-year process, there is also the question of who would be first in line to get it.

Unlike the traditional banking system, which typically insures customer deposits, there aren’t formal consumer protections in place to safeguard user funds when things go wrong.

Celsius spells out in its terms and conditions that any digital asset transferred to the platform constitutes a loan from the user to Celsius. Because there was no collateral put up by Celsius, customer funds were essentially just unsecured loans to the platform.

Also in the fine print of Celsius’ terms and conditions is a warning that in the event of bankruptcy, “any Eligible Digital Assets used in the Earn Service or as collateral under the Borrow Service may not be recoverable” and that customers “may not have any legal remedies or rights in connection with Celsius’ obligations.” The disclosure reads like an attempt at blanket immunity from legal wrongdoing, should things ever go south.

Another popular lending platform catering to retail investors with high-yield offerings is Voyager Digital, which has 3.5 million customers and recently filed for bankruptcy, as well.

To reassure their millions of users, Voyager CEO Stephen Ehrlich tweeted that after the company goes through bankruptcy proceedings, users with crypto in their account would potentially be eligible for a sort of grab bag of stuff, including a combination of the crypto in their account, common shares in the reorganized Voyager, Voyager tokens, and then whatever proceeds they are able to get from the company’s now-defunct loan to the once prominent crypto hedge fund Three Arrows Capital.

It is unclear what the Voyager token would actually be worth, or whether any of this will come together in the end.

Three Arrows Capital is the third major crypto player seeking bankruptcy protection in a U.S. federal courtroom, in a trend that can’t help beg the question: Will bankruptcy court ultimately be the place where new precedent in the crypto sector is set, in a sort of regulate-by-ruling model?

Lawmakers on Capitol Hill are already looking to establish more ground rules.

Sens. Cynthia Lummis, R-Wyo., and Kirsten Gillibrand, D-N.Y., are aiming to provide clarity with a bill that lays out a comprehensive framework for regulating the crypto industry and divvies up oversight among regulators like the Securities and Exchange Commission and the Commodity Futures Trading Commission.

What went wrong

Celsius’ overarching problem is that the nearly 20% APY it was offering to customers wasn’t real.

In one lawsuit, Celsius is being accused of operating a Ponzi scheme, in which it paid early depositors with the money it got from new users.

Celsius also invested its funds in other platforms offering similarly sky-high returns, in order to keep its business model afloat.

A report from The Block found that Celsius had at least half a billion dollars invested in Anchor, which was the flagship lending platform of the now failed U.S. dollar-pegged stablecoin project terraUSD (UST). Anchor promised investors a 20% annual percentage yield on their UST holdings — a rate many analysts said was unsustainable.

Celsius was one of multiple platforms to park its cash with Anchor, which is a big part of why the cascade of major failures was so significant and swift after the UST project imploded in May.

“They always have to source yield, so they move the assets around into risky instruments that are impossible to hedge,” said Nik Bhatia, founder of The Bitcoin Layer and adjunct professor of finance at the University of Southern California.

As for the $1.2 billion gap in its balance sheet, Bhatia chalks it up to poor risk models and the fact that collateral was sold out from under it by institutional lenders.

“They probably lost customer deposits in UST,” Bhatia added. “When the assets go down in price, that’s how you get a ‘hole.’ The liability remains, so again, poor risk models.”

Celsius isn’t alone. Cracks keep forming in the lending corner of the crypto market. Castle Island Venture’s Carter says the net effect of all this is that credit is being destroyed and withdrawn, underwriting standards are being tightened, and solvency is being tested, so everyone is withdrawing liquidity from crypto lenders.

“This has the effect of driving up yields, as credit gets more scarce,” said Carter, who noted that we’re already seeing this happen.

Carter expects to see a general inflationary deleveraging in the U.S. and elsewhere, which he says only further makes the case for stablecoins, as relatively hard money, and bitcoin, as truly hard money.

“But the portion of the industry that relies on the issuance of frivolous tokens will be forced to change,” he said. “So I expect the result to be heterogeneous across the crypto space, depending on the specific sector.”

Jim Cramer says investors should eye these 5 downtrodden stocks

KEY POINTS

- CNBC’s Jim Cramer on Thursday said that investors should search for buying opportunities among stocks being hammered by the turbulent stock market.

- “For many groups, this bear market’s simply about working off the excesses of the past two years. … However, for some stocks, the sell-off has even been worse than that,” the “Mad Money” host said.

CNBC’s Jim Cramer on Thursday said that investors should search for buying opportunities among stocks being hammered by the turbulent stock market.

“You could argue that for many groups, this bear market’s simply about working off the excesses of the past two years. … However, for some stocks, the sell-off has even been worse than that,” the “Mad Money” host said.

“The hardest-hit names are now trading below where they were at the start of the pandemic — in some cases, well below. These are what I call total giveback stories, and while some of them are dangerous, I admit, others represent amazing buying opportunities down here,” he added.

The market has see-sawed for months as Russia’s invasion of Ukraine, skyrocketing inflation, the Federal Reserve’s interest rate hikes and Covid shutdowns in China shook Wall Street and led the market to downturn.

Cramer told investors that rather than bottom-fishing for the worst-performing stocks, they should stick to stocks that are down but still have consistent stories that prove they are capable of making a rebound.

To come up with his list, Cramer focused on the 10 total giveback stocks with the largest market capitalizations as of Wednesday’s market close. Then, he narrowed the list down to five names that he believes could be great additions to investors’ portfolios.

Here is his list:

“I like Meta Platforms, some of the banks, Cisco and Disney. … The others? Not yet my cup of tea,” he said.

Disclosure: Cramer’s Charitable Trust owns shares of Cisco, Disney, Meta Platforms and Wells Fargo.

Bill Ackman to wind up SPAC, return $4 billion to investors

KEY POINTS

- Billionaire investor William Ackman, who had raised $4 billion in the biggest-ever special purpose acquisition company (SPAC), told investors he would be returning the sum after failing to find a suitable target company to take public through a merger.

- The development is a major setback for the prominent hedge fund manager who had initially planned for the SPAC to take a stake in Universal Music Group last year when these investment vehicles were all the rage on Wall Street.

Billionaire investor William Ackman, who had raised $4 billion in the biggest-ever special purpose acquisition company (SPAC), told investors he would be returning the sum after failing to find a suitable target company to take public through a merger.

The development is a major setback for the prominent hedge fund manager who had initially planned for the SPAC to take a stake in Universal Music Group last year when these investment vehicles were all the rage on Wall Street.

In a letter sent to shareholders on Monday, Ackman highlighted numerous factors, including adverse market conditions and strong competition from traditional initial public offerings (IPOs), that thwarted his efforts to find a suitable company to merge his SPAC with.

“High quality and profitable durable growth companies can generally postpone their timing to go public until market conditions are more favorable, which limited the universe of high-quality possible deals for PSTH, particularly during the last 12 months,” said Ackman, referring to the ticker symbol for his SPAC.

In July 2020, Pershing Square Tontine raised $4 billion in its initial public offering and wooed prominent investors ranging from hedge fund Baupost Group, Canadian pension fund Ontario Teachers and mutual fund company T. Rowe Price Group.

SPACs, also known as blank-check companies, are publicly-listed shells of cash that are created by large investors — known as sponsors — for the sole purpose of merging with a private company. The process, which is similar to a reverse merger, takes the target company public.

SPACs peaked during 2020 and the early part of 2021, helping rake in paper gains worth hundreds of millions of dollars for a number of prominent SPAC creators like Michael Klein and Chamath Palihapitiya.

However, over the past year, companies that merged with SPACs have performed poorly, forcing investors to shun blank-check deals. That coupled with tighter regulatory scrutiny and a downturn in equity markets have practically shut down the SPAC economy, with several billions of dollars at stake.

Moreover, the record-breaking performance of regular IPOs in the United States in 2021 posed competitive challenges for SPAC sponsors like Ackman, as several richly valued startups chose to list their shares on exchanges through traditional routes instead.

“The rapid recovery of the capital markets and our economy were good for America but unfortunate for PSTH, as it made the conventional IPO market a strong competitor and a preferred alternative for high-quality businesses seeking to go public,” Ackman said.

In July last year, Ackman’s efforts to take a 10% stake in Universal Music, which was being spun off by French media conglomerate Vivendi, through his SPAC were derailed due to regulatory hurdles. The U.S. Securities and Exchange Commission objected to the deal and Ackman put the investment into his hedge fund instead.

“While there were transactions that were potentially actionable for PSTH during the past year, none of them met our investment criteria,” Ackman said.

From $10 billion to zero: How a crypto hedge fund collapsed and dragged many investors down with it

MacKenzie Sigalos@KENZIESIGALOS

KEY POINTS

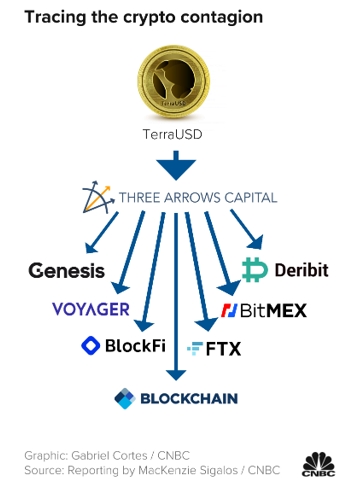

- The bankruptcy filing from Three Arrows Capital (3AC) triggered a downward spiral that wrapped in many crypto investors.

- The hedge fund failed to meet margin calls from its lenders.

- “3AC was supposed to be the adult in the room,” said Nik Bhatia, professor of finance and business economics at the University of Southern California.

As recently as March, Three Arrows Capital managed about $10 billion in assets, making it one of the most prominent crypto hedge funds in the world.

Now the firm, also known as 3AC, is headed to bankruptcy court after the plunge in cryptocurrency prices and a particularly risky trading strategy combined to wipe out its assets and leave it unable to repay lenders.

The chain of pain may just be beginning. 3AC had a lengthy list of counterparties, or companies that had their money wrapped up in the firm’s ability to at least stay afloat. With the crypto market down by more than $1 trillion since April, led by the slide in bitcoin and ethereum, investors with concentrated bets on firms like 3AC are suffering the consequences.

Crypto exchange Blockchain.com reportedly faces a $270 million hit on loans to 3AC. Meanwhile, digital asset brokerage Voyager Digital filed for Chapter 11 bankruptcy protection after 3AC couldn’t pay back the roughly $670 million it had borrowed from the company. U.S.-based crypto lenders Genesis and BlockFi, crypto derivatives platform BitMEX and crypto exchange FTX are also being hit with losses.

“Credit is being destroyed and withdrawn, underwriting standards are being tightened, solvency is being tested, so everyone is withdrawing liquidity from crypto lenders,” said Nic Carter, a partner at Castle Island Ventures, which focuses on blockchain investments.

Three Arrows’ strategy involved borrowing money from across the industry and then turning around and investing that capital in other, often nascent, crypto projects. The firm had been around for a decade, which helped give founders Zhu Su and Kyle Davies a measure of credibility in an industry populated by newbies. Zhu also co-hosted a popular podcast on crypto.

“3AC was supposed to be the adult in the room,” said Nik Bhatia, a professor of finance and business economics at the University of Southern California.

Court documents reviewed by CNBC show that lawyers representing 3AC’s creditors claim that Zhu and Davies have not yet begun to cooperate with them “in any meaningful manner.” The filing also alleges that the liquidation process hasn’t started, meaning there’s no cash to pay back the company’s lenders.

Zhu and Davies didn’t immediately respond to requests for comment.

Tracing the falling dominoes

The fall of Three Arrows Capital can be traced to the collapse in May of terraUSD (UST), which had been one of the most popular U.S. dollar-pegged stablecoin projects.

The stability of UST relied on a complex set of code, with very little hard cash to back up the arrangement, despite the promise that it would keep its value regardless of the volatility in the broader crypto market. Investors were incentivized — on an accompanying lending platform called Anchor — with 20% annual yield on their UST holdings, a rate many analysts said was unsustainable.

“The risk asset correction coupled with less liquidity have exposed projects that promised high unsustainable APRs, resulting in their collapse, such as UST,” said Alkesh Shah, global crypto and digital asset strategist at Bank of America.

Panic selling associated with the fall of UST, and its sister token luna, cost investors $60 billion.

“The terraUSD and luna collapse is ground zero,” said USC’s Bhatia, who published a book last year on digital currencies titled “Layered Money.” He described the meltdown as the first domino to fall in a “long, nightmarish chain of leverage and fraud.”

3AC told the Wall Street Journal it had invested $200 million in luna. Other industry reports said the fund’s exposure was around $560 million. Whatever the loss, that investment was rendered virtually worthless when the stablecoin project failed.

UST’s implosion rocked confidence in the sector and accelerated the slide in cryptocurrencies already underway as part of a broader pullback from risk.

3AC’s lenders asked for some of their cash back in a flood of margin calls, but the money wasn’t there. Many of the firm’s counterparties were, in turn, unable to meet demands from their investors, including retail holders who had been promised annual returns of 20%.

“Not only were they not hedging anything, but they also evaporated billions in creditors’ funds,” said Bhatia.

Peter Smith, the CEO of Blockchain.com said last week, in a letter to shareholders viewed by CoinDesk, that his company’s exchange “remains liquid, solvent and our customers will not be impacted.” But investors have heard that kind of sentiment before — Voyager said the same thing days before it filed for bankruptcy.

Bhatia said the cascade hits any player in the market with significant exposure to a deteriorating asset and liquidity crunch. And crypto comes with so few consumer protections that retail investors have no idea what, if anything, they’ll end up owning.

Customers of Voyager Digital recently received an email indicating that it would be a while before they could access the crypto held in their accounts. CEO Stephen Ehrlich said on Twitter that after the company goes through bankruptcy proceedings, customers with crypto in their account would potentially receive a sort of grab bag of stuff.

That could include a combination of the crypto they held, common shares in the reorganized Voyager, Voyager tokens and whatever proceeds they’re able to get from 3AC. Voyager investors told CNBC they don’t see much reason for optimism.

Boeing CEO says supply chain issues are hindering 737 Max production increase

KEY POINTS

- CEO Dave Calhoun said he expects supply chain issues could persist for the next 18 months.

- Boeing is producing an average of 31 737 Max planes a month.

- Calhoun said the company wants to ensure production is stabilized before ramping up.

Boeing CEO Dave Calhoun on Monday said the manufacturer won’t ramp up production of its best-selling 737 Max yet because of supply chain constraints.

The manufacturer is producing 31 of the Max planes each month on average, and Boeing will focus on stabilizing that rate before increasing output, according to Calhoun.

“Averages don’t work very well for customers; predictability does. We have to be at 31 every month, consistently and predictability,” he told CNBC’s “Squawk Box,” speaking from the Farnborough Airshow outside of London. “We’ll get into rate increases when we get into rate increases, but the supply chain isn’t ready for it yet.”

Calhoun spoke shortly after Boeing announced a Delta Air Lines order for at least 100 737 Max-10 planes, the airline’s first major purchase from the company in more than a decade. Deliveries are slated to begin in 2025.

Calhoun said longer-term constraints on aircraft production are from engine makers, like General Electric and Raytheon Technologies unit Pratt & Whitney. He said that will likely persist over the next 18 months.

“It is really difficult,” Raytheon CEO Greg Hayes said in interview with CNBC’s “Worldwide Exchange” earlier Monday.

Skilled labor is the hardest thing to come by, he added: “There are a lot of things we can’t get done because we don’t have the people.”

Hayes said he also expects the supply chain and labor shortage challenges to last into late 2023 or early 2024.

Boeing is scheduled to report second-quarter results on July 27.

93% of employers want to see soft skills on your resume—here are 8 of the most in-demand ones

When applying for a job, there are many ways to optimize your resume. You can check the listing to see where the employer’s priorities lie in terms of experience, and make sure to highlight what’s most important to them, for example. You can include any major achievements like exceeding sales goals. And you can include a link to your LinkedIn profile.

One group of skills career experts say is crucial to include is your soft skills. An overwhelming majority ― 93% of employers ― say “soft skills play a critical role in their decision about whom they want to hire,” Ian Siegel, co-founder and CEO of ZipRecruiter, said in the company’s recent report The Job Market Outlook for Grads.

Soft skills include a wide array of abilities. “I would say, in general, communication is very high on that list right now considering how people are working in very different situations, hybrid situations,” says Kristin Kelley, chief marketing officer at CareerBuilder, as an example.

ZipRecruiter compiled some of the most in-demand soft skills on its platform. Here are the top skills on that list, including the number of jobs on the site listing the skill as a requirement.

Communication skills

Number of jobs listing the skill: 6.1 million

Customer service

Number of jobs listing the skill: 5.5 million

Scheduling

Number of jobs listing the skill: 5 million

Time management skills

Number of jobs listing the skill: 3.6 million

Project management

Number of jobs listing the skill: 2.8 million

Analytical thinking

Number of jobs listing the skill: 2.7 million

Ability to work independently

Number of jobs listing the skill: 2 million

Flexibility

Number of jobs listing the skill: 1.3 million

When it comes to the importance of communication, in part, as Kelley says, that’s a result of the new remote and hybrid work arrangements that rely heavily on tech. “How you respond to someone who sent you an email” matters, she says as an example. “Formally respond to them in 24 hours.”

The importance of communication is also a result of various companies’ recent diversity, equity and inclusion initiatives.

“To be a diverse and inclusive employer,” says Georgene Huang, co-founder and CEO of Fairygodboss, “you have to work with all different kinds of people, which means you have to be able to communicate effectively with all different kinds of people.”

When it comes to scheduling and time management, “no matter what kind of role you have, if you can’t organize your time,” you can’t be effective, she says.

Finally, when it comes to flexibility, “people really have to be able to turn left, turn right on a dime, join the Zoom, be able to manage their own instant messages coming in,” says Kelley. There’s an element of ease with multitasking and being able to switch what you’re doing at a moment’s notice that has heightened since the pandemic and as so many people continue to work from home.

Include your soft skills by giving concrete examples of how you’ve used them either in your resume intro or the bullets under your job descriptions.

HI Financial Services Mid-Week 06-24-2014