HI Financial Services Commentary 01-24-2017

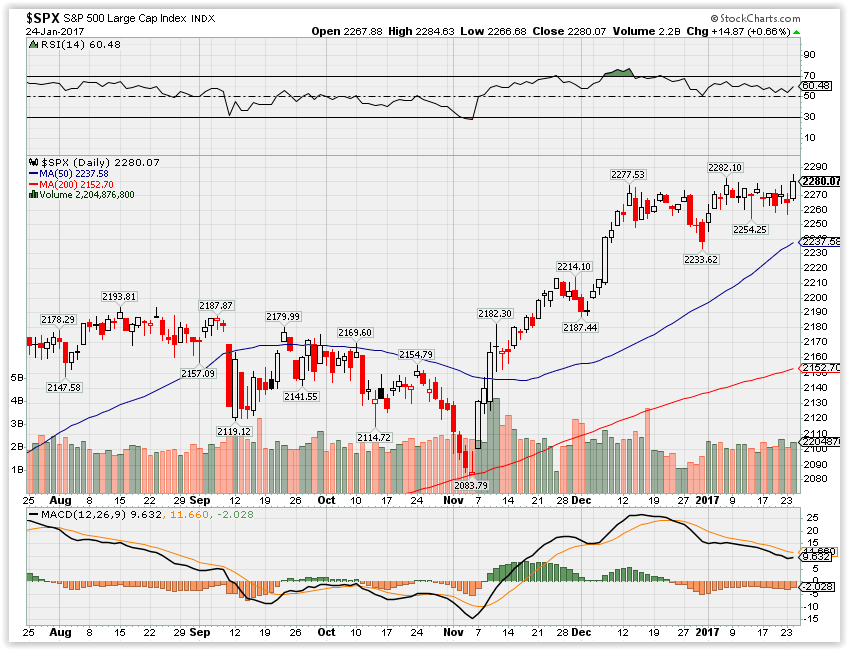

Trump’s executive orders send S&P 500 to an all-time high

Earnings season started today with Alcoa (AA)

Bullish, Very tight range, inflation should come, low volatility so higher volatility should come

Overvalued, Forward thinking overdue for a correction

Many event and tweets to happen this year = very unpredictable

There are NO market experts- Why? Every single model to predict the economy, presidency, etc… isn’t ready or setup for

Trump, deregulation, stimulus, “new normal” ruins the typical or atypical models of investing

Averages ARE NOT YOUR FRIEND

What happened with a stronger dollar = for the day in the market it went down

SO our dollar is back at the 100 level for the index and our markets head up

What’s happening this week and why?

Start of Earnings Season

First week of a Trump Presidency – Executive orders, hype and Hope

Start to worry about the Fed – February 1st FOMC meeting

Existing Home Sale was 5.49 M vs est 5.55 M

Where will our market end this week?

Lower because we haven’t broken the 20,000 down or the 2300 S&P

DJIA – Bullish but 20,000 is a definite resistance level

SPX – Still bullish, Hit all-time high today

COMP – Bullish and also hit an all-time high today

Where Will the SPX end Jan 2017?

01-24-2017 +1.0%

01-17-2017 -5.0 %

What is on tap for the rest of the week?=

Earnings:

Tues: MMM, AKS, DFS, JNJ, KMB, LMT, TXN, AA, DHI, VZ, BABA

Wed: ABT, T, BA, EBAY, FFIV, FCX, HES, LVS, UTX, WDC

Thur: ADS, GOOGL, BMY, CAT, CELG, DOV, DOW, ETFC, INTC, JBLU, RTN, PYPL, NOC, MSFT, LUV, SWK, SBUX, VMW, F,

Fri: AAL, CVX, CL, GD

Econ Reports:

Tues: Existing Home Sales,

Wed: MBA, Crude, FHFA Housing Price Index

Thur: Initial, Continuing Claims, Adv. International Trade, Leading Indicators, New Home Sales,

Fri: GDP, GDP Deflator, Durable Orders, Durable ex-trans, Michigan Sentiment

Int’l:

Tues – FR, DE, EZ: PMI Composite

Wed – FR: Business Climate Indicator

Thursday – JP: CPI

Friday –

Sunday – JP: Retail Sales

How I am looking to trade?

I’m basically collared for earnings

Earnings Chart

AAPL 01/31 AMC

BIDU 02/23 est

DIS 02/07 est

F 01/26 est

FB 02/01 AMC

NVDA 02/15 est

AOBC 03/02 est

V 02/02 AMC

ZION 01/23 AMC

DHI 01/24 BMO

Non – Earnings ETF’s

XLF

XLRE

Questions???

Core portfolio components = AAPL, AOBC, BIDU, DIS, V, F, FB, NVDA, BAC, C, CLX, NFLX, MS

750 K or higher = AAPL, BIDU, V, DIS, FB, MS

250K to 750 K = DIS, BIDU, AAPL, V, C, DHI

and looking to move out of AAPL in FB

250K or Less – F, NVDA, SNDK, BAC, ZION, XLF, XLRE,

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

The S&P 500 is on course to do something it hasn’t in 52 years

Alex Rosenberg | @AcesRose 7 Hours AgoCNBC.com›

The S&P 500 has traded in a mere 1.6 percent range in the month of January through Monday’s open. If the month were to end now, that would make January the month with the narrowest range since 1965, according to Oppenheimer.

In November 1965, the S&P traded in just a 1.1 percent range from its high to its low. Actually, the market enjoyed several months around then — March 1965, October 1964, May 1964, and February 1964 — when the then-relatively new index traded in a band of up to 1.6 percent.

In more recent times, the S&P traded in a 2.1 percent range in August 2016, which was the tightest range seen since December 1993.

This time, the top end of the range marks the market’s all-time high, hit on Jan. 6. Its January nadir was hit on the first day of the year

The stock stasis didn’t start when the calendar turned, to be sure. It has also been noted that the S&P hasn’t closed lower by at least 1 percent since Oct. 11.

Some see the muted nature of the S&P’s moves as a cause for concern.

Dennis Davitt, an options-focused portfolio manager with Harvest Volatility Management, said the market’s range can be compared to “a spring that just keeps getting compressed and getting compressed more and more, and then once you realize the movement out from that tight range, it seems that much more dramatic.”

To protect against a big move, Davitt advises the purchase of protective options, which are now unusually cheap.

Yet Ari Wald, head of technical analysis at Oppenheimer, counters that “just because fire insurance is cheap, that doesn’t necessarily increase the risk of an actual fire occurring.”

To the contrary, following a huge postelection market move, the recent flatness has “allowed previously overbought conditions to recede.”

Wald says a pullback of 3 to 4 percent may be due, but that such “weakness should be bought.”

5 Tragic Reasons why Marissa Mayer Failed.

https://www.linkedin.com/pulse/why-marissa-mayer-failed-yahoos-rescue-oleg-vishnepolsky

- Published on January 12, 2017

- Featured in: Business Strategies, Leadership & Management

Like5 Tragic Reasons why Marissa Mayer Failed.

Learning from mistakes is the best education – if you can afford the tuition.

Much cheaper and safer is to learn from mistakes of others.

So what can we learn from a multi-billion mistake of putting Marissa Mayer in charge of Yahoo ?

1.Experience

I would not trust a brilliant rocket scientist to do a heart transplant on me. Why anyone thought that a highly intelligent person with no turnaround experience, no experience in running large enterprises, and no real management experience is the right person to run Yahoo ?

- Compatibility

Marissa’s Google experience was not applicable. If you do a heart transplant, you need to make sure that the new healthy heart is compatible with the body.

What works in one company does not work in another. I have seen all too often new leaders come in and try to instill a foreign culture, strategy and methods – and fail.

- Humility

And then there is thing called arrogance. A brilliant book “Why smart executives fail” by Sydney Finkelstein names arrogance as one of the most common reasons for executive failure.

We need to stay humble, no matter what achievements we had and what successful companies we have worked for previously, and what fancy university we graduated from.

- Leadership

Leaders do not ask people to do what they would not do themselves. She abolished WFH for everyone else. Creating a WFH substitute for herself by installing a nursery next to her office was considered by many as a slap in the face – to women and men alike.

Much was made in the beginning of Mayer’s data-driven approach. As leaders, before we become data-driven, we need to become people-driven.

People first, data second !

“I have to walk fast to follow my people because I am their leader”. I wish they would teach this quote at Stanford University.

If Marissa Mayer read this excellent article by Dr. Marla Gottschalk — Managing Others? 8 Research-Backed Strategies to Help You Excel things may have been different.

- Strategy

Marissa’s strategy was Video, Mobile, Native and Social. On the surface it sounds common sense. It is so common sense, that a college graduate can come up with this. And that is precisely the problem – the strategy is too broad.

The hard part about a strategy is deciding what not to do. Steve Jobs did not turn around Apple with broad platitude strategies, but with brilliant new products.

IBM CEO Louis Gerstner decided to pivot the company into Services.

Saying we will do social, video, mobile and native is saying we will do everything everyone else is doing.

Yahoo should have been on this diagram –This is what Death of Ad Tech in 2017/2018 means.

—–

I feel bad for all those people who worked so hard at Yahoo all these years, nights and weekends. What a monumental waste of efforts by so many smart and dedicated employees. What was the number one Internet company becomes a division of a telephone giant.

That said, Verizon is a very smart company. They have an incredibly experienced and strategic leadership.

Do not ditch your Yahoo email accounts !

8 Research-Backed Strategies Every Manager Should Discover

https://www.linkedin.com/pulse/20140723140925-128811924-managing-others-8-research-backed-strategies-to-help-you-excel

- Published on July 23, 2014

- Featured in: Leadership & Management

“People leave their managers, not organizations.”

Managers have tremendous potential to impact our workplaces for the better. They have the potential to motivate and inspire, to provide guidance and offer understanding. However, with all of the change occurring in workplaces, serving as a manager continues to present as a uniquely challenging (and often thankless) role.

Often mired between the concepts of “leading” vs. “directing” — I feel the role has been greatly misunderstood.

To be completely frank, managers have shouldered the blame for a host of organizational woes, including lowered employee engagement, job satisfaction and of course, turnover.

As much as we harp about managers, helping them help us, is the best path to explore. We seem to have ample modes of measuring our criticism; yet not nearly enough constructive, usable advice. There are fantastic managers out there — and we can develop more of them. We simply need to pause and look back at what we have learned.

Have we nothing to offer managers to help them meet their challenges?

The answer is “yes”, we do.

Here are a few researched backed suggestions that managers can apply:

- As a manger continue to engage with the work. As a manager, you may no longer complete all of the tasks that your team completes. However, continuing to express keen interest in all aspects of the work can impact performance. The seminal Hawthorne studies, let us know that we respond not only to actual changes in our work environment — we are motivated by the interest that is displayed. (Whether the lights were dimmer or brighter, productivity increased.) Remain connected — it matters.

- Provide specific feedback. Managers often find themselves in a difficult place when dealing with performance deficits. Many work under the unrealistic premise, that they should treat every team member in exactly the same manner. However, in application this is rarely effective. Strive to be fair, but offer targeted, specific feedback (even if negative) to help team members affect their performance issues.

- Be the example. According to recent HBR research, how leaders behave has far greater impact than what they might say. (Surprise, surprise.) When leaders/managers model key aspects of sustainable work environments (healthy working hours, “refueling breaks”, utilizing vacation time) employees experience less stress and greater job satisfaction. It’s very simple: practice what you preach.

- Be a “Scrum Master “. In the agile management method of Scrum, there is a specific role aimed at tackling impediments that prevent great work from being executed/implemented. It’s often the case, that great ideas and products never take flight because they become bogged down by “red tape”. So — use your skills (and influence) to make great things happen.

- Be a coach. Google’s Project Oxygen went to great lengths to pin-point what separates competent managers from those that are truly exceptional. The takeaway? Becoming a better manager is much simpler than you might have expected (See more here). High on their 8 point list? Be a career advocate and clear away pesky obstacles. What is less important? Deep technical expertise.

- Talk about personal goals. Newcomers enter organizations with their own career goals. Research tells us that helping employees make progress and possibly attain these goals — can impact both job satisfaction and organizational commitment. Be sure to converse with each team member about what they would like to learn or achieve, as these help maintain a viable psychological contract.

- Do a great job of defining team roles. For all of the training we invest in to help teams excel, one of the best actions is to clarify roles and take a step back. (No one wants to be micro-managed.) In fact, to increase collaboration, make role boundaries clear; there will be less time negotiating “who does what” and fewer turf wars.

- Practice positivity. We all have a tendency to emphasize negative information (our brains are wired to pay greater attention). However, emphasizing what is actually going well within your team, can be a motivating force. Remaining positive, even in the face of challenge, is shown to correlate with meaningful business outcomes. You can begin by building Psychological Capital (PsyCap) (The HERO skills of Hope, self-efficacy, resiliency and optimism), by recognizing small successes and building flexible thinking.