HI Financial Services Commentary 01-31-2017

Let’s talk about timing?!?!?!

What do we know about market timing? – Hard to do, can’t pick tops or bottoms, like weather forecasting and always wrong

We constantly look at charts, info, news about the market to??? – Trying to anticipate

This is what investing comes down to – ALWAYS paying attention to make your best educated guess, while protecting to the downside and letting your winner run. Trading is living with your consequence.

Which means sometimes I don’t get the runs higher that I’m expecting with the stocks I invest in.

When the VIX was at 11ish and markets were at a possible low that would break lower I bought Mar 220 OTM Long Puts on the SPY.

I play the VIX differently by placing OTM Bull Calls 20/26

If you lose your money you can’t play in the game anymore!!!

How did AAPL do at earning today

EPS $3.28 vs est $3.22 beat by $0.06

Rev 17.9 B vs est 18.1B misses by 200 million

Guidance 51.5 to 53.5 B vs est Rueters 53.79 B

Beat top line and missed bottom line and guidance?

78.35 B in revenue was hgher than last years 75.9B

78.3 M iphones sold vs est 77 M = Beat by 1.8 Million

Service revenue 7.17B up from 6.01B and it beat the est 6.9B by 200 Million

Declared a cash dividend of $0.57 BUT

MOST IMPORTANT COMMENT was…. Repatriation is good for the US economy and also good for AAPL!

Not to mention the 10 year anniversary iphone is due out all in glass

What’s happening this week and why?

Fed meeting that should be a non-issue

Ave Workweek reports on Friday – Non-Farm Payrolls, Private Payrolls, ADP Employment

ISM indexes this week

Don’t expect a lot of good news this week because? GDP 1.9 vs est 2.2

Durable goods -0.4 vs est 3.0 Durable ex-trans .6 vs est .5

Yes with AAPL, new month sell of this month we will/might get a bounce tomorrow but still probably will be down week for the third week in a row. AND still for 76 days the S&P has not had a 1% daily pullback which is close to the longest time in history

Where will our market end this week?

Down again

DJIA – Still technically bullish but looks like it is rolling on over

SPX – Still technically bullish but hitting a round number with tons of sell orders stacked up

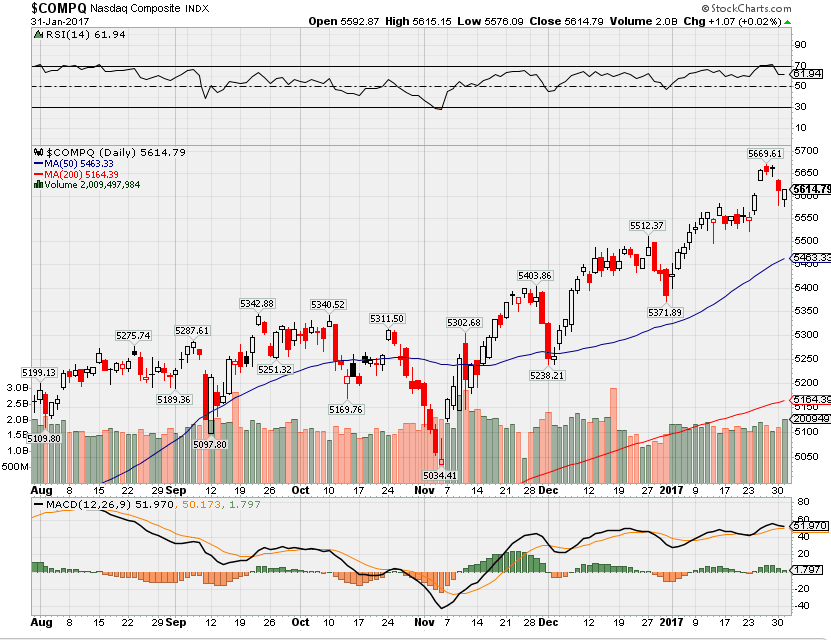

COMP – Bullish stair pattern on the Nasdaq heading to new high spy

Where Will the SPX end Feb 2017?

01-31-2017 -2.5%

What is on tap for the rest of the week?=

Earnings:

Tues: AFL, CHRW, COH, LLY, HOG, MA, NUE, PFE, S, X, VLO, AAPL, XOM, UAA

Wed: ADP, MDC, FB, JCI, D,

Thur: AMZN, AMGN, BSC, CME, COP, EL FEYE, GPRO, IP, RL, V

Fri: HSY, PSX, CLX

Econ Reports:

Tues: Employment Cost Index, Case-Shiller, Chicago PMI, Consumer Confidence

Wed: MBA, Crude, ADP Employment, ISM Index, Consumer Spending, Auto, Truck, FOMC Rate Decision

Thur: Initial, Continuing Claims, Challenger Job Cuts, Productivity, Unit Labor Costs,

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment rate Factory Orders, ISM Services

Int’l:

Tues – CN: CFLP Mani PMI, JP: PMI Manu Index

Wed –

Thursday – JP: BoJ MPB Minutes, CN: PMI Manu Index

Friday –

Sunday –

How I am looking to trade?

I’m basically collared or protective put for earnings

Earnings Chart

AAPL 01/31 AMC

BIDU 02/23 est

DIS 02/07 est

FB 02/01 AMC

NVDA 02/15 est

AOBC 03/02 est

V 02/02 AMC

Non – Earnings ETF’s

XLF

XLRE

Questions???

www.myhurleyinvestment.com = Blogsite

HI Financial Services Mid-Week 06-24-2014