HI Financial Services Commentary 01-17-2017

What are my choices in the stock market because everything I look at seems to be the same and now it is 2017?

This is the question I’ve gotten since November of last year. What do you think is the correct response?

Of course, I’m going to do the same thing. Because I have experience and know how well it works

There better way to create wealth than by picking up shares as stocks fall in value.

Basis collar trade structure is

BTO Stock @ $100

BTO ATM Long puts 60 days after earnings (45 – 75 days range)

STO 3 -4 strike higher short calls (45-90 days)

Thought less than 3.5% Total invested capital risk for the earnings play

I don’t like to cap the upside

Looking for 4 rewards per 1 risk

If we have really bad earnings = I run out to a leap short call for a huge credit because I want a negative delta effect

Looking to adjust the short call and long put around a support level willing to add long puts again immediately if support doesn’t hold

Trading is a process You get just as excited to see stocks fall as you do to see them go up

What’s happening this week and why?

Holding pattern until China numbers on Thursday and Presidential – Trump in on Friday

Where will our market end this week?

?????

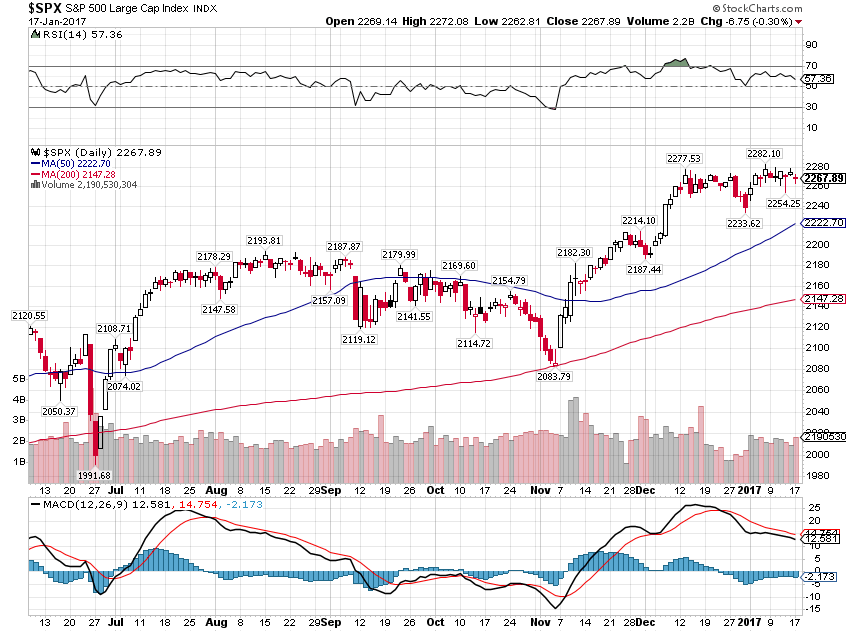

DJIA – Still technically bullish but consolidated

SPX – Technically Bullish still

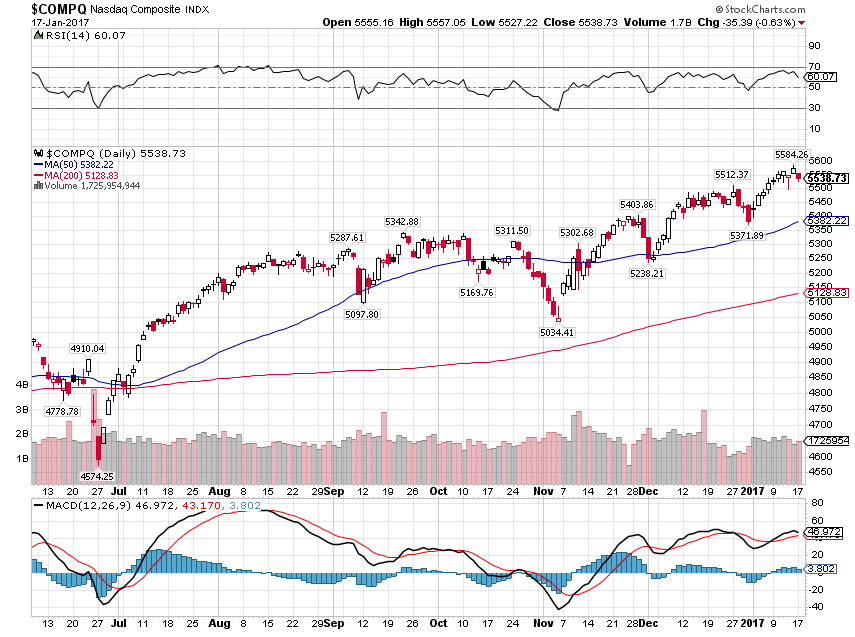

COMP – Bullish with a stair step pattern

Where Will the SPX end Jan 2017?

01-17-2017 -5.0 %

What is on tap for the rest of the week?=

Earnings:

Tues: CSX, IBKR, MS, UNH

Wed: SCHW, C, FAST, GS, KMI, NFLX, USB

Thur: ALK, FUL, IBM, UNP

Fri:

Econ Reports:

Tues: Empire Manu

Wed: MBA, Crude, CPI, Core CPI, NAHB Housing Market Index, Industrial Production, Capacity Utilization, Fed Beige Book

Thur: Initial, Continuing Claims, Housing Starts, Building Permits, Phil Fed

Fri: OPTIONS EXPIRATION

Int’l:

Tues –

Wed –

Thursday – ECB Announcement, CN: GDP, Industrial Production, Retails Sales

Friday – U.S. Presidential Inauguration 2017

Sunday – JP: All Industry Index

How I am looking to trade?

I’m basically collared with – DIS, NFLX, BIDU, F would be my big upside surprise Stocks

Earnings Chart

AAPL 01/31 AMC

BABA 01/24 BMO

BAC 01/13 BMO BEAT EARNINGS

BIDU 02/23 est

C 01/18 BMO

DIS 02/07 est

F 01/26 est

FB 02/01 AMC

NVDA 02/15 est

AOBC 03/02 est

V 02/02 AMC

ZION 01/23 AMC

DHI 01/24 BMO

NFLX 01/18 AMC

Non – Earnings ETF’s

XLF

XLRE

Questions???

Core portfolio components = AAPL, AOBC, BIDU, DIS, V, F, FB, NVDA, BAC, C, CLX, NFLX, MS

750 K or higher = AAPL, BIDU, V, DIS, FB, MS

250K to 750 K = DIS, BIDU, AAPL, V, C, DHI

and looking to move out of AAPL in FB

250K or Less – F, NVDA, SNDK, BAC, ZION, XLF, XLRE,

www.myhurleyinvestment.com = Blogsite

HI Financial Services Mid-Week 06-24-2014