HI Market View Commentary 08-16-2021

Hell Came: Millennials Lost “Millions” On Bill Ackman’s SPAC Implosion

by Tyler Durden

Saturday, Aug 14, 2021 – 08:11 PM

High profile fund manager Bill Ackman wound up torching retail investors when his special-purpose acquisition company, Pershing Square Tontine Holdings, failed to find a merger partner after months of bluster from Ackman and blind faith from investors.

The failure of PSTH to get off the ground resulted in large losses for retail investors, like one 35-year-old unmarried Chicago psychiatrist who lost nearly $1 million “investing” in call options on the pre-merger entity, a new profile by Institutional Investor points out.

PSTH had been touted by Ackman to be an “investor friendly” SPAC. Ackman even “tweeted a rap video about SPACs minting money” in February 2021. Ackman even joked about “marrying a unicorn” when talking about his SPAC’s launch last July.

I thought the last article was funny and a great warning on SPAC’s !!!!

So today in portfolios we did some work We added Long puts to UAA, BAC, BIDU

Infinite banking concept – https://www.insuranceandestates.com/pros-and-cons-of-the-infinite-banking-concept/

This is concept that is currently bankrupting the USA and is the reason we will lose our reserve currency status

New worries in the world economy – higher covid and the US withdrawal from Afghanistan

| https://go.ycharts.com/weekly-pulse |

| Market Recap |

| WEEK OF AUG. 9 THROUGH AUG. 13, 2021 |

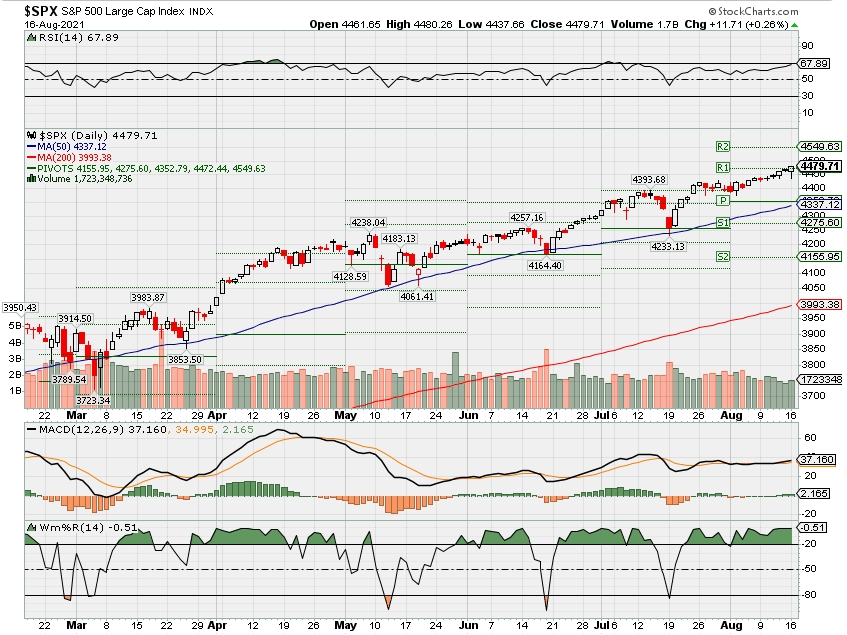

| The S&P 500 index rose 0.7% last week to yet another fresh record closing high as the materials, consumer staples and financial sectors led a broad advance. The market benchmark ended the week at 4,468, up from last Friday’s closing level of 4,436.52, which was a new closing high at the time. The index edged down Monday but resumed setting new record closing highs last week in each of the four sessions that followed. It also reached new intraday highs in the last four sessions, concluding with Friday’s fresh intraday record at 4,468.37. The S&P 500 is now up 19% for the year to date. The gains came as the remaining Q2 earnings reports continued to roll in largely above expectations, while economic data also provided signs that the US economic recovery has persisted despite climbing COVID-19 cases in recent weeks fueled by the delta variant. The materials sector had the largest percentage increase of the week, up 2.7%, followed by a 2.1% increase in consumer staples and a 1.9% rise in financials. Other sectors up by more than 1% each included utilities and industrials. Only one sector was in the red for the week: energy, which slipped 0.8%. Among the gainers in the materials sector, shares of Corteva (CTVA) rose 2.7% last week after the agriculture company reported Q2 results above analysts’ expectations late last week and boosted its 2021 guidance. The stock was the recipient of multiple price target increases last week in response to the Q2 report. In consumer staples, Tyson Foods (TSN) shares jumped 15% as the food producer reported better-than-expected results for its fiscal Q3 and raised its full-year revenue outlook. The financial sector’s gainers included Truist Financial (TFC), which announced its Truist Bank subsidiary agreed to acquire Service Finance, a national provider of point-of-sale financing solutions for the home improvement industry, for $2 billion. Truist shares climbed 1.4% on the week. On the downside, the energy sector’s decliners included Diamondback Energy (FANG), whose Viper Energy Partners (VNOM) subsidiary said it struck a deal to acquire certain mineral and royalty interests from Swallowtail Royalties LLC and Swallowtail Royalties II LLC in exchange for 15.25 million units of common stock and $225 million of cash. Mizuho lowered its price target on Diamondback Energy’s stock to $126 to $131 per share but kept its investment rating on the shares at buy. Shares of Diamondback fell 5.5% for the week. Next week, while the regular earnings season is winding down, a number of retailers on a fiscal calendar are set to release their latest quarterly results. These include Home Depot (HD), Walmart (WMT), Target (TGT) and Macy’s (M). Retail sales for July also will be featured on the economic data calendar next Tuesday, along with July industrial production and capacity utilization. Other economic reports due next week include July building permits and housing starts on Wednesday. Investors will also be focused on the release of Federal Open Market Committee minutes on Wednesday. |

Earnings Dates

COST – 09/23 AMC

TGT – 08/18 BMO

Where will our markets end this week?

Higher

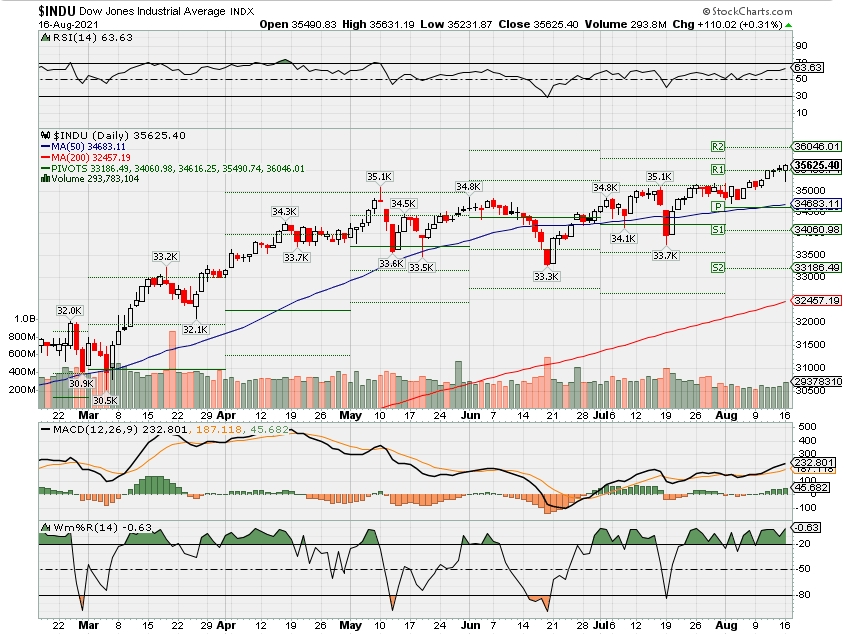

DJIA – Bullish

SPX – Bullish

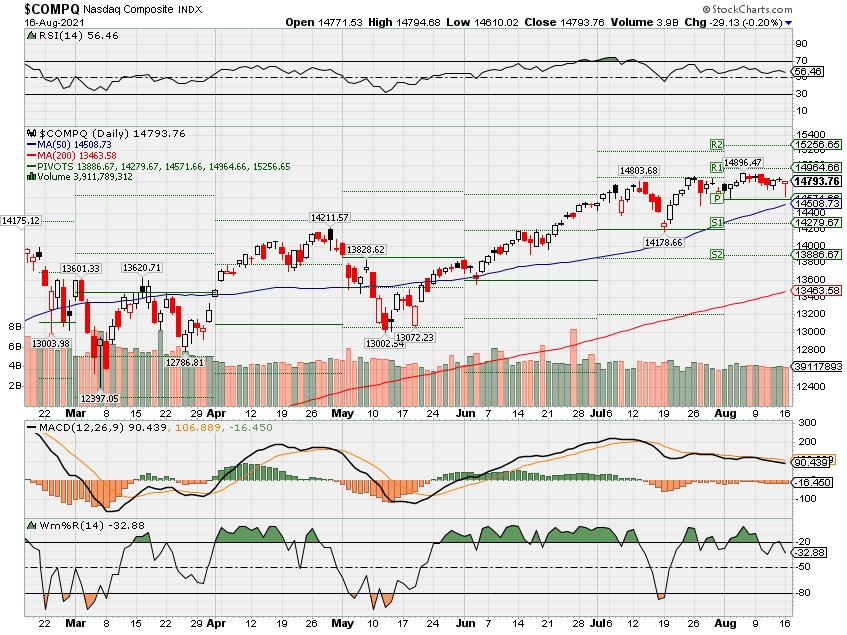

COMP – Bullish

Where Will the SPX end August 2021?

08-16-2021 1.0%

08-09-2021 0.0%

08-02-2021 0.0%

07-26-2021 0.0%

Earnings:

Mon: TME,

Tues: HD, WMT, A, CREE,

Wed: LOW, TJX, CSCO

Thur: BJ, EL, KSS, M, NTES, TPR, AMAT, ROST

Fri: DE. FL

Econ Reports:

Mon: Empire Manufacturing, Net long term TIC Flows,

Tues: Retail Sales, Retail ex-auto, Industrial Production, Capacity Utilization, Business Inventories, NAHB Housing Market Index

Wed: MBA, FOMC Minutes, Housing Starts, Building Permits,

Thur: Initial Claims, Continuing Claims, Phil Fed, Leading Indicators

Fri: Monthly OPTIONS EXPIRATION

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Running stock higher until the seasonal pull back

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Cramer thinks these stocks are bargains with the market at record highs

PUBLISHED WED, AUG 11 20217:06 PM EDTUPDATED WED, AUG 11 20217:26 PM EDT

KEY POINTS

- “Mad Money” host Jim Cramer offered investors a group of stocks he believes are still bargains despite high overall market valuations.

- Ford, PayPal and Boeing are among the companies Cramer highlighted.

CNBC’s Jim Cramer said Wednesday to look for bargain buying opportunities in a stock market sitting at all-time highs.

The S&P 500 and the Dow Jones Industrial Average both notched record closes Wednesday, but the “Mad Money” host said investors can still find “a dozen big-names at any given moment that can roar higher.”

“Sure, when you look at the whole market, it may be overvalued versus where it traded in the past, but when you consider that the bond market’s giving you next to nothing, stocks are still the only game in town,” Cramer said.

Cramer identified seven stocks he thinks are cheap opportunities at the moment.

Ford

Wednesday’s consumer price index showed used car price inflation slowing down in July. Cramer believes that could mean new cars are now available.

Automakers have struggled to keep up with demand due to a semiconductor shortage, but as the chip supply recovers, Cramer thinks Ford is a buy.

“Ford is now too cheap to ignore,” Cramer said.

PayPal

Shares of online payments system PayPal have fallen from their highs since the company reported lower-than-expected second-quarter earnings due to issues involving eBay switching payment processors. That stock price dip has created a buying opportunity for investors, according to Cramer.

“That’s been baked into the stock for ages,” Cramer said, referring to the eBay situation. “Why not pick up some PayPal down that much?”

NortonLifeLock

Cyber safety company NortonLifeLock is on Cramer’s radar.

NortonLifeLock on Tuesday announced a merger with digital security business Avast, sending the stock nearly 9% higher Wednesday. However, Cramer said the stock price is still below where it was when investors first got word about the Avast transaction.

American Eagle Outfitters

Although Cramer said American Eagle Outfitters consistently sees top same-store sales among mall-based retailers, its stock is still nearly 10% off its record high. Cramer thinks the apparel retail stock looks attractive here.

Boeing

Aircraft maker Boeing has seen several tailwinds recently, including strong orders and deliveries numbers in July. However, the stock is below its 52-week high from March, which Cramer said was “crazy.”

Pioneer Natural Resources and Devon Energy

Oil prices have been under pressure lately and oil companies’ shares follow suit. However, oil prices reversed losses Wednesday and trended higher after the White House called on OPEC to boost oil production.

With oil at lower levels currently, Cramer said it’s an “ideal time to pick up quality exploration and production plays” that care about their shareholders and corporate governance.

To that end, Cramer said Pioneer Natural Resources and Devon Energy are two oil companies with a track record of returning capital to shareholders that are trying to lower their carbon footprints. “Devon and Pioneer both work,” he told viewers.

Disclosure: Cramer’s charitable trust owns shares of PayPal, American Eagle, Boeing, NortonLifeLock and Ford.

Disney+ doubles subscriber base to 116 million in fiscal third quarter after release of Marvel’s ‘Loki’

PUBLISHED THU, AUG 12 20215:02 PM EDTUPDATED THU, AUG 12 20216:53 PM EDT

KEY POINTS

- Disney+ reached 116 million subscribers in the fiscal third quarter, beating analysts’ estimates by nearly 1.5 million.

- That’s up from 57.5 million a year earlier.

- The company also reported 174 million subscriptions across Disney+, ESPN+ and Hulu.

Disney+ reeled in new subscribers in the fiscal third quarter as consumers signed up to watch Marvel’s “Loki” and Pixar’s “Luca.”

Disney said in its earnings report on Thursday that subscribers to Disney+ doubled to 116 million subscribers from 57.5 million a year earlier. The results beat analysts’ average estimates by nearly 1.5 million, according to StreetAccount.

Across Disney+, ESPN+ and Hulu, Disney reported a total of 174 million subscribers. Disney also beat estimates on earnings and revenue, boosting the stock by about 6% in after-hours trading.

Analysts remain optimistic that Disney+ will reach its goal of 230 million to 260 million subscribers by 2024, as the company continues to roll out exclusive content. Consumers, however, are on average paying less. The average monthly revenue per paid subscriber for Disney+ fell to $4.16 from $4.62 a year earlier.

Among the most recent releases from Disney+ are the mini-series “The Falcon and the Winter Soldier,” based on Marvel Comics characters, and “Loki,” another Marvel-based series. The Pixar feature film “Luca” came out in June.

While the service is growing rapidly, it also faces a legal battle with “Black Widow” star Scarlett Johansson, who is suing the company for releasing the film simultaneously on the streaming platforms and in theaters.

Disney beats expectations across the board, with U.S. parks returning to profit

PUBLISHED THU, AUG 12 20213:34 PM EDTUPDATED THU, AUG 12 20218:20 PM EDT

KEY POINTS

- Disney reported blowout fiscal third-quarter earnings after the bell Thursday, beating Wall Street expectations on subscriber growth, revenue and earnings.

- The company topped subscriber estimates for Disney+, coming in at 116 million.

- Disney’s parks, experiences and products segment returned to profitability for the first time since the Covid pandemic began, though the parks alone are not yet profitable.

Disney reported blowout fiscal third-quarter earnings after the bell Thursday, beating Wall Street expectations on subscriber growth, revenue and earnings.

The company’s shares were up more than 5% in after hours trading.

- Earnings per share: 80 cents vs 55 cents expected in a Refinitiv survey of analysts

- Revenue: $17.02 billion vs $16.76 billion expected in the survey

The company beat on subscriber estimates for Disney+, coming in at 116 million. StreetAccount estimated the company to report 114.5 million subscribers for its third quarter. The segment had 103.6 million in its fiscal second quarter.

Average monthly revenue per subscriber for Disney+ dipped 10% year over year to $4.16. The company attributed the drop to a higher mix of Disney+ Hotstar subscribers compared with the prior-year quarter.

Disney’s average revenue per user has shrunk in recent quarters because of the lower price points for its Disney+ and Hotstar bundle in Indonesia and India. The service has lower average monthly revenue per paid subscriber than traditional Disney+ in other markets, pulling down the overall average for the quarter.

Disney is also continuing to experiment with viewership habits and how it releases films following the coronavirus pandemic. The company will release “Shang-Chi” in theaters exclusively for 45 days before adding it to its streaming service.

“The prospect of being able to take a Marvel title to the service after going theatrical with 45 days will be yet another data point to inform our actions going forward on our titles,” CEO Bob Chapek said during Thursday’s earnings call.

Overall, the company said it had nearly 174 million subscriptions across Disney+, ESPN+ and Hulu at the end of its third quarter. Revenue for its direct-to-consumer segments increased 57% to $4.3 billion. Average monthly revenue per paid subscriber grew slightly for ESPN+ and Hulu.

Disney said the company’s total addressable market is 1.1 billion households across the globe.

“We’ve only just begun our journey and as I think you see what’s really going to make the difference for Disney is our spectacular content, told by the best storytellers, against our powerhouse franchises,” Chapek said.

In an interview with CNBC’s Jim Cramer later Thursday on “Mad Money,” Chapek reaffirmed the company’s expectations of between 230 million to 260 million subscribers to Disney+ by 2024.

“We’re very confident in our sub trajectory,” he said. The company had ramped up its spending in content over the past year. Now, Chapek said those films and shows are starting to trickle in.

“Our confidence only continues to grow as that content permeates our services,” he added.

Parks segment returns to profitability

Disney’s Parks, Experiences and Products segment returned to profitability for the first time since the pandemic began, though the parks alone are not yet profitable.

Revenue in the segment jumped 308% to $4.3 billion, as all of its parks were reopened during the fiscal third quarter and attendance and consumer spending rose. Operating income reached $356 million, compared with a loss of $1.87 billion during the same quarter last year.

Much of this profitability is attributable to the segment’s consumer products business, which saw operating income reach $564 million. During the quarter, Disney garnered higher revenue from merchandise based on Mickey and Minnie, Star Wars, Disney princesses and Spider-Man.

Disney’s domestic parks eased restrictions in April, which led to a boost in attendance. Domestic parks reported operating income of $2 million. International parks posted a loss of $210 million.

Disney had reported a loss in operating income in the segment over each of the previous five quarters because of the Covid-19 pandemic.

“We see strong demand for our parks continuing,” Chapek said on the call.

In late July, rival Comcast, which owns and operates several Universal Studios theme parks in the U.S. and aboard, reported its parks turned a profit, marking the division’s first profitable period since the first quarter of 2020.

The resurrection of the theme park industry is critical to Disney’s bottom line. In 2019, the segment, which includes cruises and hotels, accounted for 37% of the company’s $69.6 billion in total revenue.

Content sales and licensing revenues decreased 23% to $1.7 billion in the quarter. At the same time, operating income decreased 58% to $132 million.

Correction: This story has been updated to reflect that Disney’s U.S. parks returned to profit, while international parks did not.

Disclosure: Comcast is the parent company of NBCUniversal and CNBC. NBCUniversal operates Universal Studios theme parks. Comcast owns a stake in Hulu.

Another 3.9 million people quit their jobs in June—and many are getting higher-paying roles

Published Tue, Aug 10 20211:37 PM EDT

The U.S. quitting spree is still going strong.

After dipping slightly in May, the share of people leaving their employer rose again in June, when another 3.9 million people quit their jobs, according to the latest Job Openings and Labor Turnover Survey. The numbers come in slightly lower than April figures that showed a record 4 million people quit during that month, sparked by confidence they could find a better job elsewhere.

The number of people who quit their jobs in June make up 69% of total separations, which also includes layoffs, firings and retirement.

Worker confidence ticked up through the spring and summer as vaccination efforts climbed, Covid-19 infection rates leveled off and businesses ramped up hiring in order to meet rising consumer demand in the recovering economy.

In June, industries that saw an uptick in quitters include professional and business services; durable goods manufacturing; and state and local government, excluding education.

Meanwhile, opportunities continue to abound for job-seekers. The number of job openings in the U.S. economy jumped to 10.1 million in June — the highest on record, according to the Labor Department — led by openings in professional and business services; retail trade; and accommodation and food services.

“Labor demand keeps getting stronger. This is the third straight month of record-breaking job openings,” writes Nick Bunker, an economist with the jobs site Indeed. “The quits rate is also close to its all-time high, which was set just two months ago in April. This wave of demand will eventually recede, but job-seekers should ride it until then.”

Job-switchers are seeing higher pay

Data suggests workers leveraging today’s tight labor market are coming out ahead with higher wages. While average wage growth for all workers increased just 1.5% in June compared to a year ago, it’s up by 5.8% for job-switchers, according to the latest Workforce Vitality Report from ADP, the payroll company.

Many employers are having to compete for workers by offering attractive signing bonuses, higher pay, better benefits and more accommodating work schedules.

Job-switchers joining employers with at least 500 workers are making even bigger gains: “switchers into large firms are reaping the largest rewards, with pay jumping by nearly 7% for job changers,” the ADP report reads.

Additionally, “larger firms are also enjoying lower rates of turnover as they are better able to retain their current workforce. This will take on an increasingly important role as the number of job openings have soared to record highs and firms continue to struggle to find qualified applicants.”

Job gains aren’t benefiting everyone

The latest jobs report says there are 8.7 million Americans looking for work, meaning there are currently more than 1 million more job openings than people who can fill them.

But unemployment numbers don’t capture the millions of people who are misclassified, experienced a pay cut or drop in hours, or had to stop looking for work altogether. For example, limited child-care access during the pandemic has disproportionately caused women to be forced out of work. Workers excluded from official unemployment numbers are disproportionately Black, Hispanic, Asian, low-income, women and those without a college degree.

If all these workers were taken into account, July’s unemployment rate would be 8.1% instead of the reported 5.4%, according to Heidi Shierholz, the director of policy at the Economic Policy Institute.

Meanwhile, women who recently quit for a new job are seeing above-average wage growth, ADP data shows — 6.4% wage growth for women versus 5.5% for men. But because of the wage gap, women are starting from a lower average wage level of $27.79, compared to $32.61 for men. Furthermore, women make up a disproportionate share of workers in leisure and hospitality, which is the only industry where wages were lower this year than last year.

Delta variant could impact job gains

While the number of people leaving their current jobs to look for new ones exceeds pre-pandemic levels, lingering pandemic concerns and limited caregiving options remain major barriers to a fuller economic recovery, writes ADP chief economist Nela Richardson.

A resurgence of Covid-19 cases across the country, due to the contagious delta variant, could upend economic recovery from the spring and early summer. Already, employers are having to navigate the CDC’s updated indoor masking guidance, a growing body of organizations requiring vaccines and delayed return-to-office plans.

“The jobs market’s swings have been head-spinning since the pandemic began, with strong job gains and disappointing losses,” Richardson says. “But new concerns about rising infections tied to the delta variant may continue to cause an ebb and flow in the recovery.”

Pandemic unemployment benefits end in September—here’s who loses aid

Published Tue, Aug 10 20219:52 AM EDTUpdated Tue, Aug 10 202112:05 PM EDT

Three key pandemic-era unemployment benefits programs established by the March 2020 CARES Act are set to expire on Sept. 6.

The March 2020 CARES Act established three new federal unemployment aid programs: Pandemic Unemployment Assistance, or PUA, which covers those not traditionally eligible for aid; Pandemic Emergency Unemployment Compensation, or PEUC, which extends aid to those who’ve exhausted their state’s benefits period; and Federal Pandemic Unemployment Compensation, or FPUC, a weekly boost intended to help people recover more of their lost wages.

Nearly 13 million people were still collecting jobless aid as of mid-July, including 9.4 million drawing from PUA or PEUC specifically.

Governors in 26 states already announced plans to withdraw from federal benefits early in June and July, though some have faced legal challenges.

Here’s what will happen when the aid programs expire in the rest of the U.S. after Sept. 6.

People collecting PUA lose all jobless aid

People on PUA don’t qualify for any other type of unemployment insurance. During the pandemic, this program supported people who couldn’t work due to child- or dependent-care needs, as well as the self-employed, freelancers, gig workers and part-time workers.

As of Sept. 6, these recipients will not have another safety net to recover lost wages.

People collecting PEUC may qualify for extended benefits

PEUC offered additional weeks of jobless benefits to the long-term unemployed who exhausted their state’s benefits window, which averages 26 weeks but can vary.

After Labor Day, workers in some states may be eligible for continued aid by moving over to Extended Benefits, a federally funded aid program that kicks in depending on their state’s unemployment rate. EB generally offers an additional 13 to 20 weeks of jobless aid.

These benefits are currently on in nine states and Washington, D.C. However, as Andrew Stettner of The Century Foundation wrote, five states and D.C. are paying EB on the condition of it being 100% federally funded.

“As of September 6, we predict that only Alaska, Connecticut, New Jersey, and New Mexico will be able to transition exhausting PEUC recipients onto EB, but with 50% state funding,” he wrote.

If a worker already depleted their EB weeks earlier in the pandemic, they will not have any additional weeks after PEUC runs out on Labor Day.

Everyone loses the $300 weekly supplement

Under the CARES Act, everyone receiving jobless benefits was entitled to a weekly supplement, which started at $600 per week and was later reduced to $300 per week.

By Sept. 6, The Century Foundation estimates, 3 million people will remain eligible for unemployment insurance and will no longer have this weekly booster.

Without the supplement, state benefits replace about 38% of a worker’s previous wages on average, according to the Labor Department.

Could pandemic unemployment benefits be extended?

While the ongoing public health crisis could “make people think twice about this cutoff of benefits,” Stettner told CNBC Make It, “people are holding out hope for that extension, but to be honest, there’s not a lot of political momentum behind it right now.”

Stettner said it’s not clear that enough lawmakers would support the continuation of jobless benefits because critics are primarily focused on whether the $300 weekly boost disincentivizes people from finding new work. While he sees little political support for continuing the $300 weekly benefit, “that doesn’t mean we have to cut off everything.”

Worker advocacy groups have called to make temporary programs such as PUA and PEUC permanent in order to address the vulnerable and marginalized workers left out of traditional unemployment insurance systems. Americans most likely to be supported through PUA and PEUC — the long-term unemployed, self-employed, freelancers, gig workers, part-time workers and caregivers — are also disproportionately Black, Hispanic, Asian, women and low-income earners.

Stettner added that unemployment programs have been extended before during previous recessions, including the 2008 financial crisis, when Congress ended enhanced jobless aid in December 2013.

“They’re usually kept in place several years into a recovery period,” Stettner said, “with the understanding unemployment happens fast, but reemployment takes time.”

The Walt Disney Company’s Stellar Developments

Aug. 14, 2021 11:28 AM ETThe Walt Disney Company (DIS)32 Comments10 Likes

Summary

- The management team at The Walt Disney Company announced financial results for the third quarter of its 2021 fiscal year.

- Performance across most parts of the enterprise was encouraging and indicative of a broad recovery for the firm.

- Shareholders should take this opportunity to consider loading up on the company because of its long-term potential.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

On August 12th, after the stock market closed, the management team at The Walt Disney Company (DIS) announced financial results for the third quarter of the company’s 2021 fiscal year. In pretty much every respect, the business excelled for the quarter, showing signs that the worst of the crisis is likely behind it. Moving forward, the path to a healthier enterprise would not be a quick one, but the trajectory is clear. With some of its core operations recovering and its streaming business continuing to grow at a rapid pace, shareholders have a lot to look forward to.

Streaming had a big win

According to the management team at Disney, the third quarter of the 2021 fiscal year saw some really awesome results for the company. This included on the streaming side of the business. Take, as an example, the overwhelming success seen by Disney+. During the quarter, this streaming service saw its subscriber count increase to 116 million. This represents a nearly 12% increase over what the company had in the second quarter of this year when it posted 103.6 million subscribers, and it represents a more than doubling compared to the 57.5 million that’s subscribed to the service at the end of the third quarter of 2020.

*Taken from The Walt Disney Company

It wasn’t just the subscriber side of the business that fared well. The company also benefited from slightly better pricing. Ever since launching, the revenue generated per customer by Disney+ had been on the decline. In the second quarter of 2020, as an example, the service was bringing in revenue of $5.63 per month. By the second quarter of 2021, this figure had declined to $3.99 per month for each of its users. As the company expanded, particularly in India, it could only achieve success by coming in at a low price point. However, a reduction in the mix of customers who are wholesale customers during the quarter facilitated an increase in the third quarter this year to $4.16 per month. Though this may not seem like a significant improvement, if the company can achieve the midpoint user base of 245 million people by the end of 2024 that it is aiming for, that $0.17 per month pricing improvement would be responsible for nearly $500 million in additional revenue for the business.

*Taken from The Walt Disney Company

The star of the streaming side of the company for the month was undoubtedly Disney+. However, other streaming services owned by Disney fared well too. ESPN+, as an example, saw its user base increase to 14.9 million. This represents an increase of 8% over the 13.8 million seen just one quarter earlier. Not only that, pricing improved year over year. Though it did decrease from $4.55 per month in the second quarter of this year to $4.47 per month in the third quarter, the third quarter results for 2020 amounted to $4.18. This firming of its pricing position is undoubtedly encouraging. Also, Hulu posted an improvement as well, seeing its user base increase by 2.9% from 41.6 million to 42.8 million. Pricing also got better, heading $19.28 per month compared to the $18.45 per month seen in the second quarter of this year.

Other parts of the business are alive and well

Other aspects of Disney were also encouraging for shareholders. In particular, investors should pay attention to the theme parks admissions operations of the enterprise. In the third quarter, this sub segment of the company generated revenue of $1.15 billion. This compares to the paltry $34 million generated in the third quarter of the company’s 2020 fiscal year. Although this performance was outstanding, the strong first quarter of 2020 has resulted in performance for this year as a whole still coming in lower. That figure is just under $2.30 billion compared to the $3.66 billion generated in the first nine months of 2020. The resorts and vacations part of the business also did well, with revenue of $776 million dwarfing the $80 million generated the same time a year earlier. And for the year sa whole, this subsegment follows the same theme as the theme parks admissions operations, with revenue of $1.72 billion coming in lower than the $3.09 billion generated last year.

There were other encouraging developments for shareholders. For starters, net debt continues to decline of the business. Based on my calculations, this figure came in at $39.77 billion. This compares to the $40.26 billion reported for the second quarter of 2021. This implies a decrease of $488 million in just three months. This was only made possible by overall robust performance at the enterprise. As an example, consider revenue for the business. In the third quarter, this came in at $17.02 billion. This is 44.5% higher than the $11.78 billion generated the same quarter last year.

As revenue increased, so too did profitability. Net income for the company came in at $918 million during the third quarter. This is a huge improvement over the $4.72 billion loss the company generated a year earlier. Even more impressive, at least to me, was operating cash flow. This totaled $1.47 billion, bringing total operating cash flow for the current fiscal year to $2.93 billion. To put this in perspective, operating cash flow in the third quarter of 2020 was a more modest $1.16 billion, with total operating cash flow in the first three quarters of 2020 totaling $5.95 billion.

One area that does still need some progress but is showing initial signs of recovery is the theatrical distribution and licensing part of the business. This part of the enterprise was hit particularly hard by the pandemic. However, during the third quarter, the company generated $140 million of revenue from it. This is significantly higher than the $51 million generated in the third quarter of 2020. However, the year-to-date figure of $280 million is still significantly lower than the $2.06 billion generated the same time of 2020. More likely than not, this would be the piece of Disney that will recover at the slowest pace. Investors should not expect a full recovery probably until at least next year.

Takeaway

Based on the data provided, it is clear to me that the management team at Disney is making a lot of the right choices. The company continues to see its streaming business grow at a nice clip, essentially putting concerns of a slowdown in this piece of the enterprise on the back burner. Most other aspects of Disney seem to be quite healthy, and even the hardest hit portions of the business are demonstrating some sort of recovery. In all, shareholders should be incredibly happy about these results. And those who do believe in the long term potential of the business should take this as an opportunity to consider adding it to their portfolio.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

HI Financial Services Mid-Week 06-24-2014