HI Market View Commentary 04-18-2022

Earnings coming up:

AAPL 4/28 AMC

BA 4/27 BMO

BAC 4/18 BMO Earnings: .80/share vs .75 expected $23.33 Billion

BIDU 5/18 est

DIS 5/11 AMC

F 4/27 AMC

FB 4/27 AMC

JPM 4/13 BMO

KO 4/28 BMO

LMT 4/19 BMO

MU 6/30 est

SQ 5/05 AMC

TGT 5/18 BMO

UAA 5/03 BMO

USB 4/14 BMO

V 4/26 AMC

VZ 4/22 BMO

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 14-Apr-22 15:15 ET | Archive

Peak inflation is more bad news than good news right now

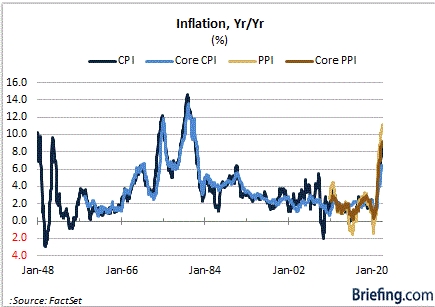

The peak inflation narrative is in full swing following the release of the March Consumer Price Index (CPI) and Producer Price Index (PPI) reports. Each was awful from an inflation reading standpoint, which is part and parcel why there is such an earnest desire to believe that they are as bad as it is going to get.

Briefly, CPI was up 8.5% year-over-year and core CPI was up 6.5% year-over-year. PPI was up 11.2% year-over-year and core PPI was up 9.2% year-over-year.

Those aren’t the Everest-like peaks seen in the 1970s and 1980. Nevertheless, the current inflation readings are at treacherous altitudes that haven’t been visited in the case of CPI since the early 1980s.

We can’t say for certain that we are at peak inflation, not with Russia continuing to wage its war in Ukraine and China continuing to wage its war on COVID with a zero-tolerance approach. What we can say, however, is that the market should be careful about cheering peak inflation, because cheering peak inflation is also unwittingly cheering a peak in the recovery.

The Pivot Is On

Inflation needs to come down. There is no question about it. The way it comes down and the pace at which it comes down are the unanswered questions.

To be fair, supply constraints have played a huge role in driving the outsized inflation prints, yet there are other factors on the demand side that have contributed to the worst inflation readings in 40 years.

That would be roughly $10 trillion combined of fiscal and monetary stimulus that led to huge increases in the money supply, huge upticks in personal savings, and huge increases in asset prices that were catalyzed by the artificial suppression of interest rates driven by quantitative easing.

So, here we are. The stimulus pivot is on.

Fiscal support, outside of the infrastructure bill, is fading fast. Monetary support is being pulled, but arguably not nearly fast enough. A growing number of Fed officials, though, seem to recognize that and have been paying a lot of lip service to the idea that the Fed needs to move rapidly to the neutral rate — and beyond for some hawks — and take a more aggressive approach in reducing the size of the balance sheet (i.e., quantitative tightening) than the Fed did during the previous recovery.

This understanding, combined with base comparison math, a strengthening dollar, predilections that supply chain problems will keep improving, and, ironically, the demand destruction that results from the high inflation, is the basis for thinking inflation readings will start to fade from their March peaks.

It would be a welcome sight if, in fact, they did, but it may just be a short-lived feeling of relief given some emergent activity in the stock market that is more consistent with an outlook for much slower economic growth.

Just Getting Started

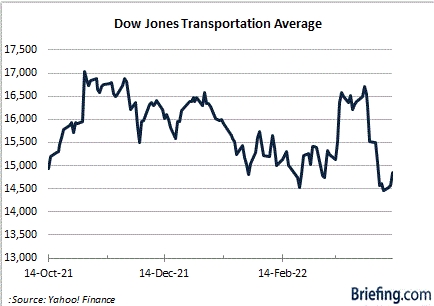

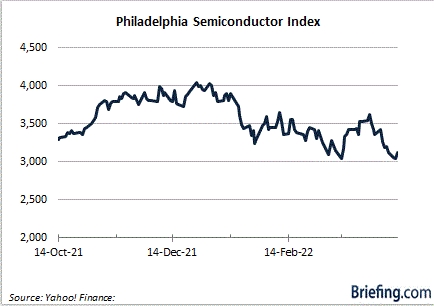

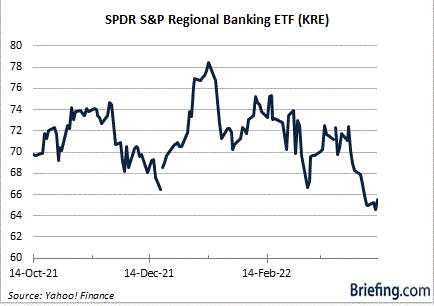

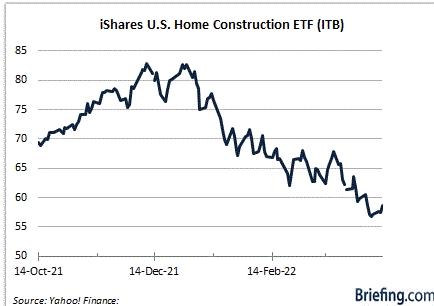

A picture is worth a thousand words, or so it is said. Here we present a few pictures for consideration that are out of sync with a strong economic outlook.

Specifically, we’re looking at the Dow Jones Transportation Average, the Philadelphia Semiconductor Index, the SPDR S&P Regional Banking ETF (KRE), and the iShares U.S. Home Construction ETF (ITB), none of which are trending of late in a manner consistent with feel-good attitudes about the economic outlook.

You want to see the trend lines on these charts moving up. That would be construed as a sign of confidence in the economic outlook that presumably translates into stronger earnings growth. Alas, current trend lines are suggesting the opposite even though the market is presumably embracing the idea that peak inflation has been hit.

This is the case most likely because the connection is also being made that the Fed is intent now on using rate hikes and quantitative tightening to “cure” inflation. That will translate into higher market rates (and has already) that will first curtail borrowing activity and consumption on the margin before having a broader influence.

To a certain extent, things are just getting started there, evidenced in part by the nation’s banks disclosing increased provisions for credit losses in their first quarter earnings reports.

What It All Means

From an objective standpoint, the March CPI and PPI reports were downright bad. There was nothing to cheer there, except maybe if you are thinking of buying a used car. Still, when things are as bad as those inflation reports suggested, the market likes to think things can’t get any worse.

That could be true here, but with the war effort in Ukraine getting bogged down and the reported logistics/supply chain problems in China stemming from lockdowns to stop the spread of Covid, there’s no guarantee things are going to get significantly better soon.

The Fed, however, now sees a target on the back of inflation. That’s the only way it can see it because the Fed has been running behind inflation for too long. It will now be playing catch up with aggressive policy normalization efforts. As it does, the inflation rate is apt to take a step down but so will the economy.

That is the knock-on effect of rising interest rates, which are necessary to get inflation under control.

Cheering peak inflation, then, is tantamount to cheering the arrival of slower economic growth and slower earnings growth that should translate into lower earnings multiples.

To that end, peak inflation is more bad news than good news right now.

—Patrick J. O’Hare, Briefing.com

| Market Recap |

| WEEK OF APR. 11 THROUGH APR. 15, 2022 |

| The S&P 500 index fell 2.1% last week as investors digested the highest consumer inflation figure in four decades as well as a mixed start to the Q1 earnings season. The market benchmark ended Thursday’s session at 4,392.59, down from last Friday’s closing level of 4,488.28. Thursday marked the last trading day of the week as the US stock market will be closed Friday for the Good Friday holiday. The S&P 500 is now down 3% for the month of April and down 7.8% for the year to date. Despite being short, the week had multiple key updates on the state of the US economy, including inflation data for March and the kickoff of Q1 corporate earnings reports. The US consumer price index rose by a seasonally adjusted 1.2% in March, matching expectations, and the core consumer price index, which excludes food and energy prices, rose by 0.3%, which was better than the consensus estimate for a 0.5% increase. Still, the year-over-year rates for overall and core CPI jumped to 8.5% and 6.5%, respectively, from decades-high levels of 7.9% and 6.4% in the previous month. The US producer price index for March, meanwhile, rose by 1.4%, which was higher than the 1.1% gain expected. The core PPI figure, which excludes food and energy prices, also came in worse than expected at a rate of 0.9%, versus a 0.5% increase expected. Year over year, the PPI climbed 11.2% – marking the largest gain since records began in 2010 – while core PPI rose by 7%. On the earnings front, JPMorgan Chase (JPM) reported lower-than-expected Q1 earnings per share despite revenue coming in slightly above expectations while Delta Air Lines (DAL) posted a Q1 loss but said it anticipates a Q2 profit. Shares of JPMorgan fell 5.6% last week while Delta shares jumped 15%. By sector, technology and communication services had the largest percentage drops of the week, down by 3.8% and 3%, respectively. They were followed by a 2.9% decline in health care and a 2.6% slip in financials. Other sectors in the red included real estate, utilities and consumer discretionary. Four sectors managed to still post gains last week: Materials rose 0.7%, followed by a 0.4% lift in industrials, a 0.3% rise in energy and a 0.2% increase in consumer staples. In the technology sector, shares of PayPal (PYPL) fell 8% last week as the digital payments company said its chief financial officer, John Rainey, is leaving the company to join Walmart (WMT) as its chief financial officer. PayPal named Gabrielle Rabinovitch, its senior vice president of corporate finance and investor relations, as interim CFO while the company’s board has launched a search for a permanent successor. In communication services, Twitter (TWTR) shares ended the week 2.5% lower as the microblogging company confirmed the receipt of an unsolicited, non-binding proposal from Elon Musk – who already has a stake of more than 9% in Twitter – to acquire all of its outstanding common stock for $54.20 per share in cash. Twitter said its board will carefully review the proposal, but a Wall Street Journal report citing a person familiar with the situation said Twitter is also weighing a so-called poison pill, a legal mechanism that would prevent Musk from increasing his stake in the company significantly. On the upside, the materials sector’s gainers included shares of LyondellBasell Industries (LYB), which climbed 6% as the company said it is committing more than $10 million to support a program focused on the recovery of plastics across North America. Wells Fargo raised its price target on the stock to $120 per share from $115 while keeping its investment rating on the shares at overweight. Next week, the companies expected to release quarterly earnings include Bank of America (BAC), Charles Schwab (SCHW), Hasbro (HAS), Johnson & Johnson (JNJ), Netflix (NFLX), Procter & Gamble (PG), Alcoa (AA), AT&T (T) and Verizon Communications (VZ). Economic data will be on the lighter side but with an emphasis on housing data, including March building permits, housing starts and existing home sales. Provided by MT Newswires |

My thoughts?

We have a VERY unpopular president. For Democrats to change that they are probably going to have to take a backpedaling approach, and will need to do something about inflation (read: gas prices) if they want any chance of holding offices in the midterm election. They may have to open up domestic oil drilling to make gas cheaper.

Where will our markets end this week?

Lower

DJIA – Bearish

SPX – Bearish

COMP – Bullish

Where Will the SPX end April 2022?

04-18-2022 +0.0%

04-11-2022 +2.0%

04-04-2022 +2.0%

03-28-2022 +2.0%

Earnings:

Mon: BX, DIDI, BAC

Tues: HAL, HAS, JNJ, FHN, IBM, NFLX, LMT

Wed: ABT, LAD, AA, CSX, KMI, LVS, TSLA, UAL, VMI,

Thur: ALK, AAL, T, BX, KEY, PM, UNP, SAM, ISRG, SNAP

Fri: AXP, KMB, NEM, SLB

Econ Reports:

Mon: NAHB Housing Market Index

Tues: Building Permits, Housing Starts

Wed: MBA, Existing Home Sales

Thur: Initial Claims, Continuing Claims, Phil Fed

Fri:

How am I looking to trade?

Currently protection on all core holding and making decisions on earnings,

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://www.marketwatch.com/articles/russia-ukraine-putin-51645634511?mod=mw_more_headlines

Opinion: Opinion: I’m a Former Moscow Correspondent. Don’t Let Vladimir Putin Fool You—Russia’s War in Ukraine Is Only About One Thing.

Last Updated: Feb. 23, 2022 at 12:03 p.m. ETFirst Published: Feb. 23, 2022 at 11:41 a.m. ET

Lukas I. Alpert, MarketWatch

This commentary piece originally appeared on MarketWatch.

If you walk the streets of Moscow, you will eventually smell the faint odor of gasoline.

It’s as ever-present in the air around Russia’s capital as it is central to the country’s economy, infrastructure and geopolitical posture.

Russian President Vladimir Putin has spelled out a nationalist rationale for his country’s military incursion into two restive provinces in eastern Ukraine largely controlled by Kremlin-backed separatists, but it is primarily about protecting Moscow’s energy interests.

That was true in 2014, when Russia seized Crimea and I was a Moscow correspondent for the Wall Street Journal, for which I wrote dozens of stories about the insurgency in Donetsk and Luhansk that Russia helped foment. And it remains true now.

To understand the Kremlin’s motivations in regard to its smaller, and relatively impoverished, neighbor, the key fact to know is that Russia supplies 40% of Europe’s heating-fuel supplies—namely, natural gas.

To get it there, Russia relies mostly on two aging pipeline networks, one of which runs through Belarus and the other through Ukraine. For this, Russia pays Ukraine around $2 billion a year in transit fees.

Russia is a petrostate and relies on oil and natural-gas sales for about 60% of its export revenue and 40% of its total budget expenditures. Any crimp on Russia’s ability to access the European market is a threat to its economic security.

In the Kremlin’s view, a switch of allegiance by Kiev, or Kyiv by Ukrainian preference, to the West—be it an economic association agreement with the European Union like Ukraine was on the verge of signing in 2014, or even the hint of joining NATO—is close to an act of war.

In my three years covering Russia, I watched as the country slowly withdrew into itself after Putin returned to office for what was then his third term as president.

Gone were prior efforts to intertwine Russia’s economy and the global system and encourage foreign investment. As towering skyscrapers rose in Moscow atop a pile of oil cash, Putin’s government became more backward-looking and more isolated.

In Ukraine, meanwhile, many were growing increasingly ill at ease with the impoverished state of their country and highly corrupt political system as it languished, locked in a kind of Soviet-era limbo under Russian domination.

As Ukrainians looked to rising living standards in places like Poland and Latvia that had joined NATO and the European Union, many wondered why they couldn’t have the same for themselves.

This is where Putin’s nationalistic impulses kick in. He views the fall of the Soviet Union as the “greatest geopolitical tragedy” of the past century and the rush of former Eastern bloc countries into the embrace of the European Union, and even NATO, as a great humiliation.

He has drawn a line in the sand with countries that border Russia, invading Georgia in 2008 when it hinted at joining NATO, and moving to destabilize Ukraine when it moved to establish closer economic ties with Europe.

Domestically, Putin has sold the incursions into Ukraine on purely nationalistic grounds—even going so far this weekend as to dismiss Ukraine’s history as an independent country as a falsehood.

While Ukrainians and Russians share religions and ethnicities, they speak different, albeit similar, languages, even as there are pockets of native Russian speakers in some Ukrainian regions, as there are in other former Soviet republics. And while Russians have seen their quality of life improve awash in petro-rubles in the decades under Putin’s rule, Ukrainians have been mired in poverty and bogged down by misrule.

While it is no wonder many Ukrainians yearn to be unmoored from their bigger, imperialist neighbor, for Putin and his cohort of oligarchs Ukrainian self-determination is not really on the table.

Not when it puts at risk the flow of money that has kept them in power.

This value fund manager is sticking with Netflix and Facebook’s parent — and has a new position in another megacap tech stock

Last Updated: April 12, 2022 at 8:33 a.m. ETFirst Published: April 12, 2022 at 6:59 a.m. ET

Investment letters are starting to be released a week or so after the first quarter has ended, and if there’s one constant, it’s that many portfolio managers are having to explain the hammering that Netflix NFLX and Facebook parent Meta Platforms FB took between January and March.

Bill Nygren, portfolio manager for the $5 billion Oakmark Select Fund OAKLX, was particularly stung by the Netflix and Meta slumps due to that fund’s style of concentrated investments. “While the portfolio is well positioned for rising interest rates and higher oil prices — both of which were front and center to start the year — two company-specific earnings reports put a damper on what otherwise would have been a solid relative performance quarter,” he said in explaining its 6% drop in the first quarter, even with two energy holdings, APA Corp. APA and EOG Resources EOG.

Netflix, he said, is experiencing a COVID-19 induced hangover, but he said the firm used the price weakness to add to its exposure. “Looking at Netflix’s business performance with a longer term lens, one hardly sees any disruption in the franchise,” he said.

Meta Platforms, after being hurt by Apple’s privacy policies, is now valued as if it isn’t growing at all, he said. To boost exposure to Meta Platforms, the firm sold put options. “When other investors believe our companies are substantially riskier than we do, options prices will be higher than our estimate of their intrinsic value. When opportunities like this surface, we’ll sell puts or calls as an alternative to purchasing or selling shares, respectively,” said Nygren.

Lithia Motors LAD is a new holding for the Select Fund. Nygren said the auto dealer not only has best-in-class operations but can grow by acquiring smaller dealers. Its online retailing platform, Driveway, could become a major contributor over the next five to seven years. “With the stock priced at less than 7x management’s 2025 EPS target and with substantial future growth potential from Driveway, we believe Lithia shares are a bargain today,” he said.

At the $17 billion Oakmark Fund OAKMX, the fund sold put options in Amazon AMZN to get exposure to the retailing and cloud computing giant. “More recently, concerns about rising investment spending have weighed on the stock — as they have in times past — providing us another opportunity to purchase shares at an attractive multiple of normalized earnings and a discount to its peer-weighted enterprise value-to-sales multiple,” he said.

Pinterest PINS is a company the fund was able to again invest in. “Though Pinterest had more than 430 million global users as of year-end, the company is still in the early days of monetizing its platform. We believe that its shares trade well below fair value on conventional metrics, such as enterprise value to revenue, as well as when we benchmark its ultimate revenue and margin potential against more mature internet companies,” he said.

Equifax EFX, Global Payments GPN, Pulte PHM and Salesforce CRM also were new positions, while it sold ADP ADP, Mastercard MA and S&P Global SPGI.

The buzz

U.S. consumer price growth accelerated to 1.2% in March, the Labor Department reported on Tuesday. Over the last 12 months, prices have gained 8.5%. Core price growth, however slowed to 0.3%.

U.S. stock futures ES00 NQ00 advanced after the report was released, and the yield on the 10-year Treasury BX:TMUBMUSD10Y slipped to 2.72%.

Make Sense of Your Investments

Earlier, the NFIB small business index fell for the third straight time to reach the lowest level since April 2020. The percentage of owners raising average selling prices increased four points to 72%, the highest reading in the history of the survey.

The White House said it will allow more ethanol in gasoline over the summer, which it said could save 10 cents a gallon on average.

Data Journal DJCO, the newspaper publisher whose investment portfolio is run by Berkshire Hathaway vice chair Charlie Munger, cut its stake in Alibaba Group BABA in half, according to the latest Securities and Exchange Commission filing.

CarMax KMX shares fell in premarket trade after missing earnings expectations.

Top tickers

Here were the most active stock-market ticker symbols on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA | Tesla |

| GME | GameStop |

| AMC | AMC Entertainment |

| NIO | Nio |

| DWAC | Digital World Acquisition Corp. |

| MULN | Mullen Automotive |

| NVDA | Nvidia |

| AAPL | Apple |

| VERU | Veru |

| BABA | Alibaba |

Goldman says recession risks are growing, but it’s too early to worry. Here’s why

PUBLISHED SUN, APR 17 20228:16 PM EDT

Goldman Sachs says the risks of a recession are growing, but it’s too early for “recession obsession.”

“With elevated inflation, slowing growth from the Covid rebound and a historically tight labour market, stagflation concerns remain high among investors. And, with the Fed embarking on one of the steepest hiking cycles since the 1990s, there are also growing concerns over recession risk,” Goldman analysts, led by Christian Mueller-Glissmann, stated in an April 14 research note.

In the note, entitled “Growing Risks But Too Early For Recession Obsession,” the analysts considered a number of market indicators, including the closely-watched 2-year and 10-year Treasury yields, to assess the probability of a recession.

Usually, investors would expect a longer-term bond to yield more than a shorter-term one, but at the end of March the rate of the 2-year note was higher than the 10-year’s. This inversion is seen by some as a sign of a forthcoming recession.

“Since the late 1980s the time lag between US yield curve inversion and US recessions has been on average 20 months,” Goldman’s analysts stated.

The other indicators Goldman looked at include the volatility index, or VIX, and the excess bond premium (EBP), a measure of investors’ appetite for risk. While these indicators spiked in the first quarter because of the Russian invasion of Ukraine, as well as concerns over the Fed tightening monetary policy, they have now declined “materially,” according to Goldman’s analysts.

Currently, there is a market-implied recession probability of 20% to 30%, the bank said, and historically that has resulted in a recession 28% of the time within 12 months. This is “broadly in line with our economists’ assessment of the risk of the US entering a recession over the next year,” Goldman said.

“While the recession probability embedded in leading market variables has increased YTD, it still points to a relatively low level of risk,” the bank added.

Market implications

Mueller-Glissmann and colleagues noted that predicting the timing of recessions is notably difficult.

“Market-implied recession probabilities can help but investors need to balance the ‘time in the market’ with ‘timing the market’ as divesting too early can mean giving up positive equity returns,” they wrote.

The bank remains overweight equities in its asset allocation, but said it is focussed on “managing risks with tail risk hedges.” It is also overweight commodities and cash, and underweight bonds and credit.

“While we acknowledge the combination of geopolitical uncertainty and hawkish policy increases the risk of a correction even without a recession, we still think equities stand a better chance of beating inflation in the long run,” Goldman stated.

– CNBC’s Patti Domm contributed to this report.

Fund manager names 3 ‘must own’ tech stocks — and explains why he is keeping an eye on Meta

PUBLISHED SUN, APR 17 202210:40 PM EDT

Tech stocks have endured a difficult start to the year amid a troubling macro backdrop, but fund manager Sid Choraria thinks there are some “must own” stocks in the sector.

Investors have been shunning growth stocks, including once high-flying tech names, as the Federal Reserve hiked rates for the first time since 2018 amid 40-year high inflation and signaled that more could be on the horizon.

The outlook has deteriorated considerably since, as the Russia-Ukraine war and a surge in energy prices rattled an already jittery market and sent investors into a tailspin. Some market watchers have also argued that recent movements in U.S. Treasury yields suggest a recession is around the corner.

Against this backdrop, tech stocks ended the first quarter as the worst performing sector on the S&P 500, highlighting a continued lack of appetite among investors in the beleaguered sector.

Still, Choraria, senior portfolio manager at Gordian Capital, believes Apple, Microsoft and Google parent Alphabet are “fantastic businesses” that investors must own.

The investment veteran is best known for uncovering an under-followed 135-year-old Japanese company called Kobayashi Pharmaceutical and attracting the attention of legendary investor Warren Buffett in the process.

Speaking to CNBC Pro Talks, he described Microsoft as “one of the greats of the greats,” with significant free cash flow and a strong history of acquisitions.

″[Microsoft’s CEO] Satya Nadella has been a phenomenal capital allocator,” Choraria said, citing Microsoft’s acquisition of LinkedIn for about $26 billion in 2016 — a figure which Choraria initially thought was “over the top.”

But LinkedIn’s strong revenue growth, which culminated in the company posting revenue of more than $10 billion for the first time in financial year 2021, changed his mind. “That [acquisition] was a steal,” he concluded.

Microsoft has continued to expand into other adjacent businesses. It completed the acquisition of Massachusetts-based cloud and artificial intelligence software provider Nuance Communications in a $19.7 billion deal last month, paving the way for its potential expansion into the fast-growing metaverse space.

Meta’s potential

Another company making inroads into the metaverse space is Facebook parent Meta — a stock which Choraria is keeping a close eye on.

“One of the topics talked about in Silicon Valley, but perhaps your viewers might not necessarily appreciate, is that Facebook has been a phenomenal capital allocator in the past,” he said.

“The acquisition of Instagram in April 2012 for about $1 billion screamed expensive at that time but has been an unbelievable steal,” he added.

Meta CEO Mark Zuckerberg highlighted Instagram Reels as one of the company’s “major investment priorities” this year during the company’s fourth-quarter earnings call on Feb. 2.

The feature, which allows Instagram users to create and share short-form TikTok-like videos, is now Meta’s “fastest growing content format by far,” according to Zuckerberg.

The feature is already the “biggest contributor” to engagement growth on Instagram and is growing very quickly on Facebook too, he added.

The other thing to watch out for is Zuckerberg’s “next big bet,” Choraria said, advising investors to focus on Reality Labs — Meta’s metaverse arm and new growth area.

While Choraria does not currently have a stake in the company, he is actively watching the stock. Shares in Meta closed at around $215 on April 13, representing a 43% premium to Choraria’s “no brainer” entry price of $150 on the stock.

“This is a great company which generates a lot of cash. That means they are going to have options. [It also has] a CEO whose reputation is on the line but who was delivered great acquisitions. I wouldn’t rule him out,” Choraria said.

JPMorgan Chase reports $524 million hit from market dislocations caused by Russia sanctions

PUBLISHED WED, APR 13 20226:03 AM EDTUPDATED WED, APR 13 20226:32 PM EDT

KEY POINTS

- Here are the numbers: adjusted earnings of $2.76 a share vs $2.69 estimate.

- Revenue: $31.59 billion vs. $30.86 billion estimate

- In remarks, CEO Jamie Dimon said he saw “significant geopolitical and economic challenges ahead due to high inflation, supply chain issues and the war in Ukraine.”

JPMorgan Chase said Wednesday that first-quarter profit fell sharply from a year earlier, driven by increased costs for bad loans and market upheaval caused by the Ukraine war.

Here are the numbers:

- Adjusted earnings: $2.76 a share vs $2.69 estimate.

- Revenue: $31.59 billion vs. $30.86 billion estimate, according to Refinitiv.

Profit fell 42% from a year earlier to $8.28 billion, or $2.63 a share, the New York-based bank said. Adjusted earnings of $2.76, which excludes the 13-cent impact tied to Russia, exceeded the $2.69 estimate of analysts surveyed by Refinitiv.

Revenue dropped a more modest 5% to $31.59 billion, exceeding analysts’ estimate for the quarter, helped by better-than-expected trading results.

Shares of the bank dipped 3.2%, reaching a new 52-week low.

The quarter illustrated how quickly events have changed the industry’s outlook. A year ago, JPMorgan CEO Jamie Dimon predicted a long-running economic expansion and banks were reaping benefits as billions of dollars in loan loss reserves were released. Now, amid rampant inflation and the worst European conflict since World War II, Dimon called attention to the possibility of a recession ahead.

JPMorgan said it took a $902 million charge for building credit reserves for anticipated loan losses, compared with a $5.2 billion release a year earlier. The bank also booked $524 million in losses driven by markdowns and widening spreads after Russian’s invasion of its neighbor.

Combined, the two factors sapped 36 cents from the quarter’s earnings, the bank said.

Dimon said he built up credit reserves because of “higher probabilities of downside risk” in the U.S. economy, specifically from the impact of high inflation and the Ukraine conflict.

“We remain optimistic on the economy, at least for the short term – consumer and business balance sheets as well as consumer spending remain at healthy levels – but see significant geopolitical and economic challenges ahead due to high inflation, supply chain issues and the war in Ukraine,” Dimon said.

The bank’s provision for credit losses, which includes the $902 million reserve build, was $1.46 billion, more than double the $617.5 million expected by analysts.

JPMorgan, the biggest U.S. bank by assets, is closely watched for clues to how Wall Street fared during a tumultuous first quarter. On the one hand, investment banking fees were expected to plunge because of a slowdown in mergers, IPOs and debt issuance in the period. On the other hand, spikes in volatility and market dislocations caused by the Ukraine war may have benefited some fixed income desks.

That means there may be more winners and losers on Wall Street than usual this quarter: Firms that navigated the choppy markets well could exceed expectations after analysts slashed estimates in recent weeks, while others could disclose trading blowups.

Indeed, fixed income trading revenue of $5.7 billion in the quarter exceeded analysts’ estimates by roughly $800 million, and equities trading revenue of $3.1 billion topped estimates by nearly $500 million. At the same time, investment banking revenue of $2.1 billion came in below the $2.37 billion estimate.

JPMorgan said last month that its trading revenue dropped 10% through early March, but that turbulence tied to the Ukraine war and sanctions on Russia made further forecasts impossible.

“The markets are extremely treacherous at the moment; there’s a lot of uncertainty,” Troy Rohrbaugh, JPMorgan’s global markets chief, said during the March 8 conference.

Another area of focus for investors is how the industry is taking advantage of rising interest rates, which tend to fatten banks’ lending margins. Analysts also anticipate improving loan growth as Federal Reserve data show banks’ loans increased 8% in the first quarter, driven by commercial borrowers.

Net interest income at JPMorgan climbed 7% to $13.97 billion, topping the $13.7 billion estimate.

Still, while longer-term rates rose during the quarter, short-term rates rose more, and that flat, or in some cases inverted, yield curve spurred concerns about a recession ahead. Banks sell off when investors worry about a recession as that could create a surge in loan losses as borrowers fall behind.

JPMorgan said last month that it was unwinding its Russia operations. Dimon said in his annual shareholder letter that while management isn’t worried about its Russia exposure, it could “still lose about $1 billion over time.”

During a call Wednesday with reporters, CFO Jeremy Barnum said there was roughly $600 million in Russia exposure remaining after taking the quarter’s hit.

Shares of JPMorgan have dropped 16.9% this year before Wednesday, worse than the 10.6% decline of the KBW Bank Index.

Rival banks Goldman Sachs, Citigroup, Morgan Stanley and Wells Fargo are scheduled to report results Thursday.

China’s lockdowns are a greater threat to inflation today than in 2020, Bernstein says

PUBLISHED THU, APR 14 20229:13 PM EDT

KEY POINTS

- China’s latest Covid lockdowns are a greater risk for global inflation today than they were in 2020, Bernstein analysts said.

- The world has become more reliant on Chinese goods since the pandemic started in 2020, which means the latest round of lockdowns have a greater impact on global growth and inflation, they said.

- Over the last several weeks, mainland China has tackled its worst Covid wave in two years with lockdowns and travel restrictions that foreign business leaders have described as tougher than in early 2020.

BEIJING — China’s latest Covid lockdowns are a greater risk for global inflation today than they were in 2020, Bernstein analysts said.

That’s because the world has become more reliant on Chinese goods since the pandemic began, the analysts said in an April 8 note.

China’s share of exports globally rose to 15.4% in 2021, the highest since at least 2012.

China’s exports have surged in the last two years as the country was able to control the initial Covid outbreak within weeks and resume production, while the rest of the world struggled to contain the virus. China has maintained its zero-Covid policy, while other countries have relaxed controls in the last year.

Over the last several weeks, mainland China has tackled its worst Covid wave in two years with lockdowns and travel restrictions that foreign business leaders have described as tougher than in early 2020. The stay-home orders and virus testing requirements have particularly affected coastal economic centers like Shanghai.

“We believe, the macro impact of China lockdowns could be quite high and something which the market is not yet pricing in,” Bernstein’s Jay Huang and a team said in a report.

Compared to pre-pandemic levels, Shanghai export container costs are five times higher and air freight rates are two times higher, the report said, noting similar strains on supplier delivery time. “Hence, there would be higher export of inflation, especially to China’s large trading partners but at the same time delay China’s own demand recovery.”

Reflecting supply chain disruptions, Chinese electric car company Nio announced production halts over the weekend, with some production resuming Thursday. German automaker Volkswagen said its factories on the outskirts of Shanghai and in the northern province of Jilin remained closed through at least Thursday.

Given that these recent lockdowns are coming at a point when global supply chains are already strained … we believe the impact of this lockdown could be much higher on global inflation and growth outlook compared to what we saw back in 2020.

BERNSTEIN

Bernstein’s analysis found that China manufactures the majority of overseas demand for containers, ships, rare earths and solar modules — along with the bulk of mobile phones and PCs.

Chinese factories no longer only complete the final assembly for those electronic products but also manufacture components like LCD panels and integrated circuits, the report said, pointing to faster growth in 2021 in exports of those parts.

China’s first quarter trade data showed steady growth in exports. The country’s producer price index and consumer price index rose faster-than-expected in March, according to data out Monday.

China, a rising car exporter

Since the pandemic began, China has become a significant manufacturer in the auto industry, especially in the electric vehicle supply chain, the Bernstein report said.

The analysts noted how automobile and component exports grew an average 119% in 2021 from the previous year, exceeding the 30% growth in China’s exports overall. The country accounts for roughly 74% of global battery cell production, the report said.

China is the world’s largest auto market and began to promote electric vehicle development and purchases in the last several years, primarily through subsidies. Foreign automakers attracted to the market have accordingly begun to launch electric vehicles for China in the last few years.

Now, Tesla, BMW and other automakers are increasingly making electric vehicles in China to export to other countries, the Bernstein report said. Including fuel-powered cars, Chinese state-owned automakers SAIC and Chery are the top exporters from China of passenger vehicles by volume, the report said, noting growing sales of China-made cars to Chile, Egypt and Saudi Arabia.

While the report did not discuss the specific impact of Covid lockdowns on auto-related supply chains, the analysts pointed out a number of Korean and Japanese automakers faced production disruptions in 2020 when Covid forced Wuhan to lockdown.

In March, passenger car exports rose by 14% from a year ago to 107,000 units, with new energy vehicles accounting for 10.7%, according to the China Passenger Car Association. The report noted the impact of external uncertainties and declines in exports to Europe.

China vehicle exports accounted for around 3.7% of vehicle sales outside the country in 2021, albeit up from less than 2% in the two previous years, the Bernstein report said.

— CNBC’s Michael Bloom contributed to this report.

HI Financial Services Mid-Week 06-24-2014