HI Market View Commentary 02-24-2020

| Market Recap |

| WEEK OF FEB. 17 THROUGH FEB. 21, 2020 |

| The Standard & Poor’s 500 index shed 1.3% this week, led by the technology and financial sectors, as investors grew more fearful of the economic impacts of the novel coronavirus.

The market benchmark ended the week at 3,337.75, down from last Friday’s closing level of 3,380.16. This marks the S&P 500’s first negative week since the last week of January. However, the index remains in positive territory for 2020 with a 3.3% increase for the year to date. The technology sector led the weekly drop, down 2.5%, as sector heavyweight Apple (AAPL) said it doesn’t expect to meet its prior revenue guidance for the current quarter. In issuing the warning, the consumer technology company said since it issued the guidance in late January, there had been a slower return to normal conditions than it had anticipated in China amid the coronavirus outbreak and lower customer traffic at its Chinese stores. Apple’s shares fell 3.7% on the week. The warning from Apple weighed heavily on investors’ sentiment not only in the technology sector but also across the market. The financial sector had the next-largest decline of the week, down 1.3%, followed by drops in every sector except real estate, which managed to end the week flat. The financial sector’s decliners this week included Morgan Stanley (MS), whose shares fell 6.1% as the financial services company unveiled an agreement to acquire E-TRADE Financial (ETFC) in an all-stock deal valued at about $13 billion at the time of the announcement. Shares of E-TRADE jumped 21% this week. The flat closing level in real estate came as declines of more than 5% each in shares of companies including Extra Space Storage (EXR) and Vornado Realty Trust (VNO) were balanced out by gains of more than 5% in other sector components such as Ventas (VTR). The declines in Extra Space Storage and Vornado Realty Trust came despite better-than-expected Q4 funds from operations results from both real estate investment trusts this week, while Ventas shares were boosted by better-than-expected Q4 results from the REIT. |

So here’s what I want to talk about today? SUICIDE PREVENTION

There are a couple of things to understand about the market so you DON’T jump off a building

When you have a big down day ore two in a row, you are looking at a big upday following

Would I have done something different ? Answer NO

If I knew we would have a big drop then obviously I would have add or rolled protection out

Why don’t you always be in a full collar trade? Short call and Long Puts

Kevin What about the 4 people who are currently leaving off their money with you?

You have cash available for me to go thru 3 more earnings to make it back before I have to take money and mess up you collar trading –

Collar trading methodology and the way Hurley Investments manages money is NOT a guess – Warrne Buffet way to invest

What would happen if we through protection on right on the start today? With Volatility you would overpay for protection and lose both coming and going

Because we also have taken profits and moved to a stock replacement strategy we lower the risk in big down days like today

We’ve taken some profits and some people have asked why I’m not fully invested with there money? Took profits and something had to look appealing for me to invest – AAPL, BIDU, BA, F, UUA, FB, V, DIS, TGT

Question for this week = Will the markets bounce back

Turnaround Tuesday? Stocks tend to bounce back quickly from market drops like this one

PUBLISHED MON, FEB 24 20205:07 PM ESTUPDATED 31 MIN AGO

KEY POINTS

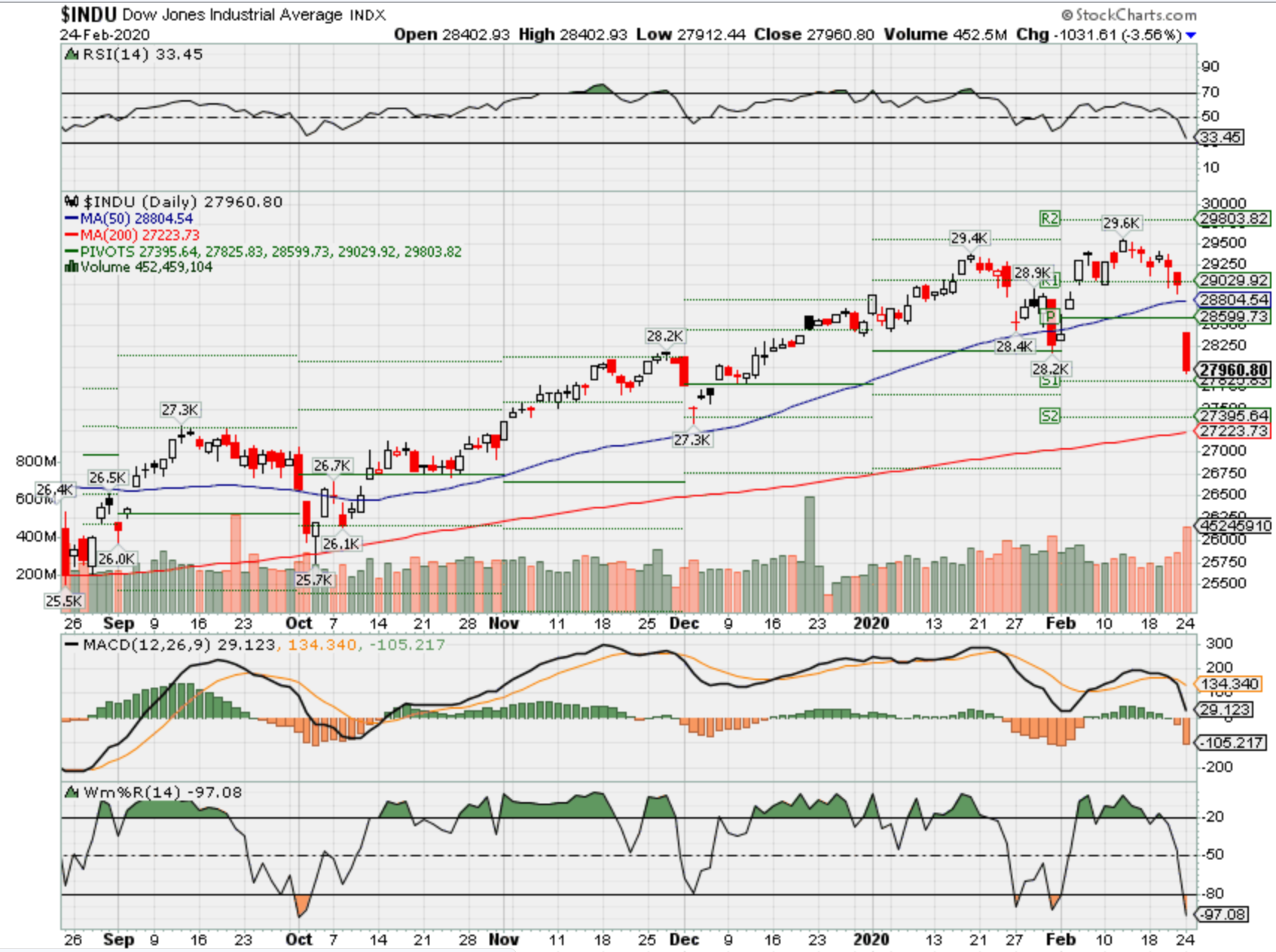

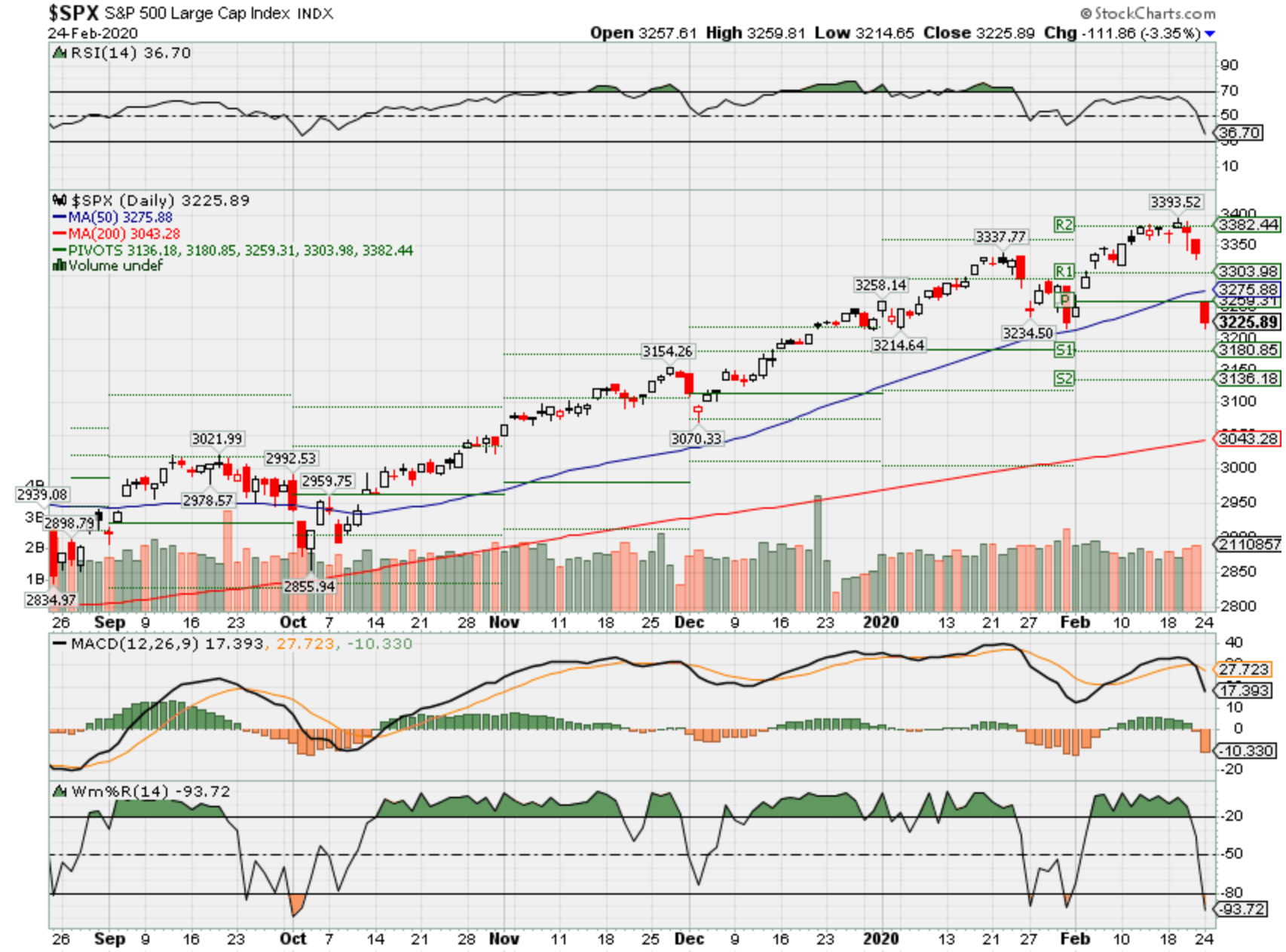

- The major averages all slid more than 3% on Monday as the number of reported coronavirus cases outside of China rose.

- If history is any indication stocks may be set for a relief rally on Tuesday.

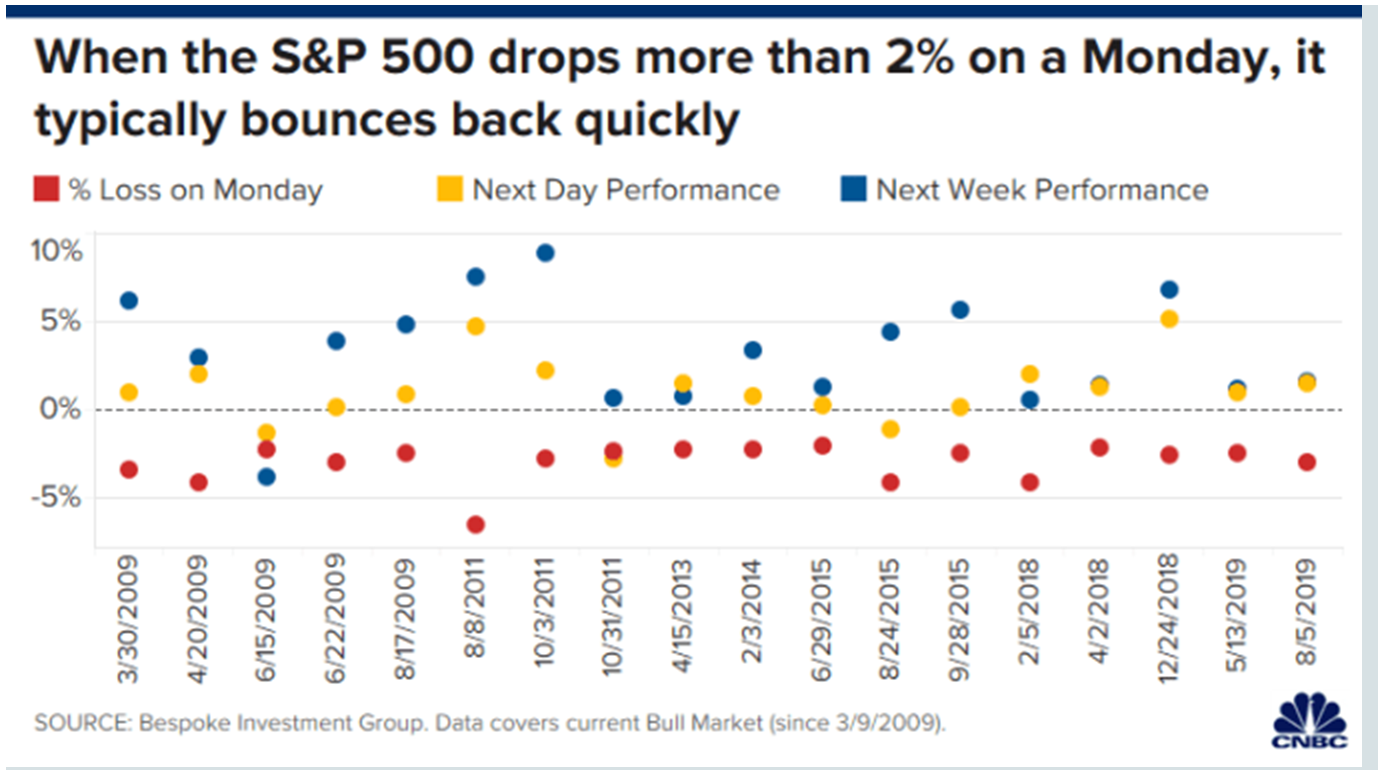

- According to Bespoke Investment Group, since March 2009 the S&P 500 has fallen more than 2% during a Monday session 18 other times, and that in 15 of the prior instances the index rose the following day, for an average gain of 1.02%.

Monday’s trading session was a bloodbath for the market as all major indices slid more than 3%, but if history is any indication, Tuesday might prove to be a different story entirely.

According to Bespoke Investment Group, Monday was the 19th time the S&P 500 has shed more than 2% on a Monday, going back to March 2009. In the prior instances, following a hefty slide the index has, on average, returned 1.02% the next day as these drops have “historically been bought with a vengeance in the near term,” the firm said.

Bespoke found that in 17 out of the 18 prior instances the S&P 500 also had a positive return over the subsequent week, with an average gain of 3.16%. Over the next month, there was an average gain of 6.08%.

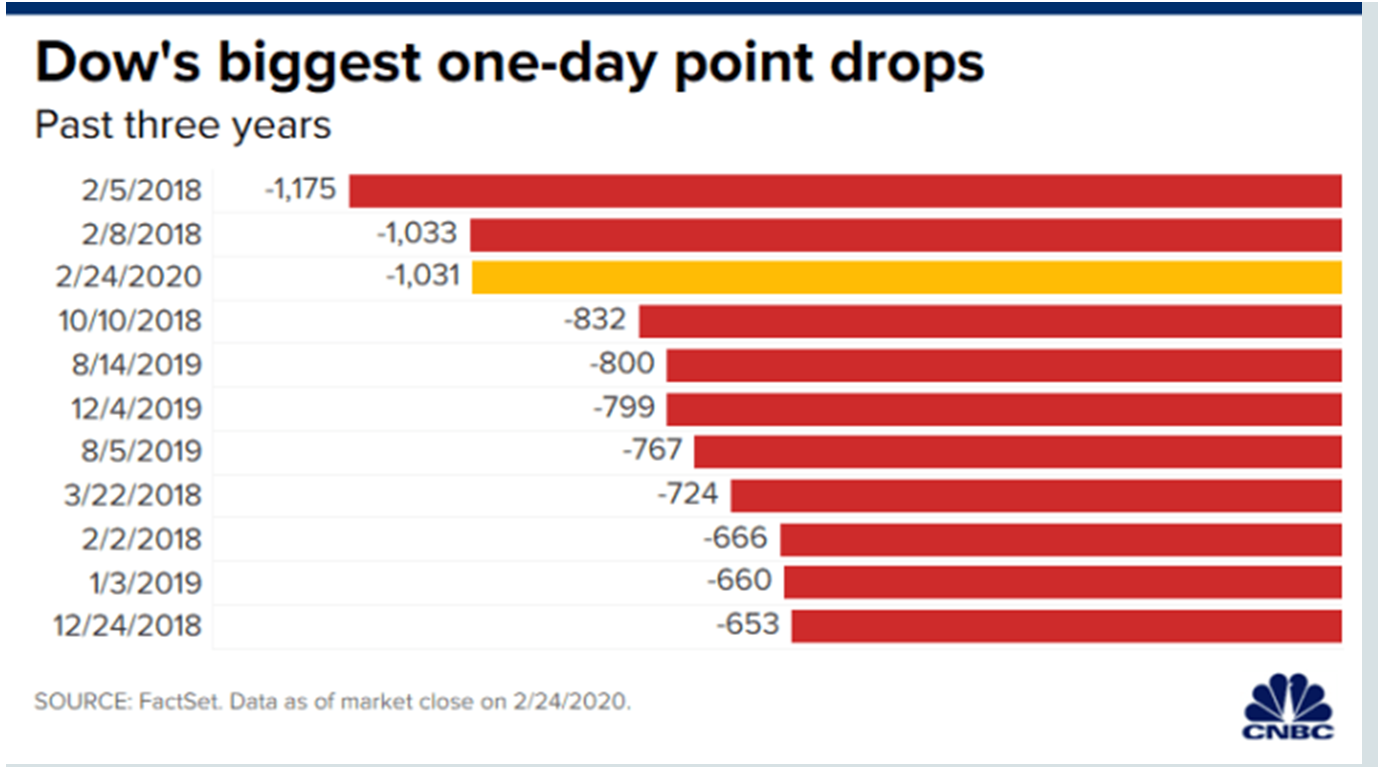

The Dow Jones Industrial Average lost 3.56%, or 1,031 points on Monday, while the S&P 500 and Nasdaq fell 3.35% and 3.71%, respectively.

Slicing the data even further, Bespoke found that when the S&P 500 drops more than 1% on Friday and more than 2% the following Monday — as the index has currently done — Tuesday’s gain is, on average, slightly higher at 1.5%. The following week’s gain stands at 3.98%, on average, with the subsequent month’s gain coming in at 6.47%.

Since the SPY, which tracks the S&P 500, began trading in 1993, it has only fallen more than 1% on a Friday and more than 2% the following Monday 13 other times. The last instance was in December 2018.

Monday’s sell-off was sparked by a surge in reported coronavirus cases outside of China, fueling fears of a prolonged global economic slowdown.

“The fact that the market is down a lot like this today I don’t think is surprising given that people are rightly concerned that it may be spreading,” Bespoke’s Paul Hickey said Monday on CNBC’s “Power Lunch.” “We don’t know where it will go, and that’s the problem … as data comes in, only time will tell.”

He said that data out of China cannot be 100% trusted, meaning that data coming out of other countries is being closely watched, which is why the increase in cases from Italy and South Korea, for example, “rightfully” freaked out many investors.

“If we go tonight and there’s not another big escalation of cases, I think you could just as easily see the market up strongly tomorrow on some relief,” he said.

– CNBC’s Nate Rattner and Jesse Pound contributed reporting.

Where will our markets end this week?

Higher

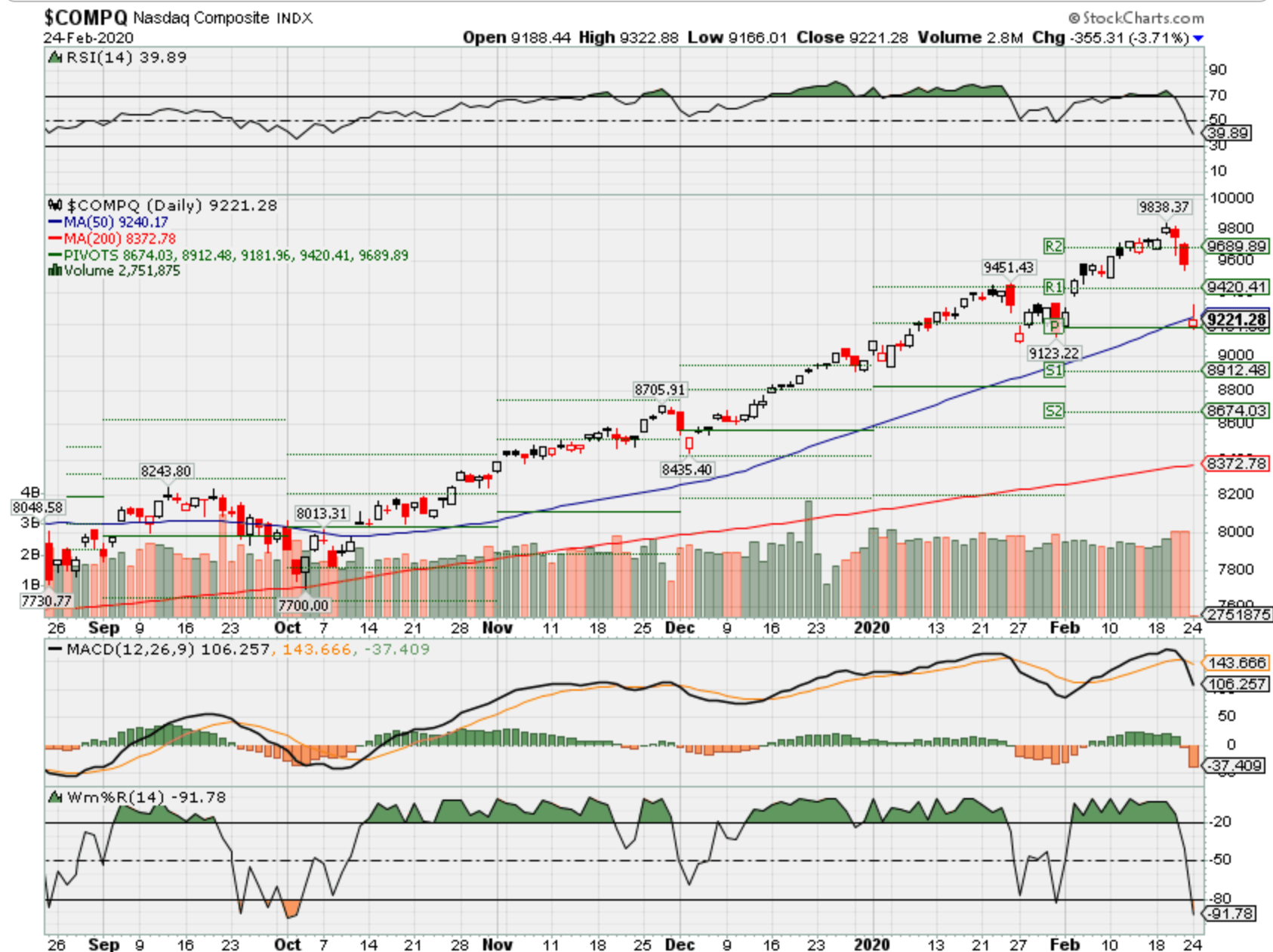

SPX – Bearish

COMP – Bearish

Where Will the SPX end February 2020?

02-24-2020 -2.0%

02-17-2020 0.0%

02-10-2020 -2.0%

02-03-2020 -2.0%

Earnings:

Mon: HP, HTZ, PAVW, SHAK

Tues: CBRL, FLR, HD, TREE, M, CRM, TOL,

Wed: FOSL, LOW, ODP, WEN, DDD, LB, MAR, NTES

Thur: BBY, CHS, CROX, JCP, KDP, BYND, AMC, DELL, VMW, MNST, BIDU

Fri: FL, SOHU

Econ Reports:

Mon: President’s Day – Market Closed

Tues: FHFA housing Price Index, S&P Case Shiller, Consumer Confidence

Wed: MBA, New Home Sales

Thur: Initial, Continuing, Durable Orders, Durable Ex-Transportation, GDP, GDP Deflator, Pending Homes Sales,

Fri: Personal Income, Personal Spending, PCE Prices, PCE Core, Michigan Sentiment,

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Earnings are coming up and protecting through earnings with protective puts and NO short Calls

AOBC – 3/05 est

BIDU – 2/27 est

MU – 3/19 est

TGT – 3/03 est

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Will you be adding protection soon? Yes probably

YES We will be adding positions in portfolios that are cash rich, dollar cost averaging the leaps and finding new positions to invest in that are now a bargain. We took profits last year on BIDU, V, FB – Leap Calls on V and Rolling the remained of BIDU is in the plans

SO GOLD is a tell, that has been apricating since last August

Warren Buffett interview highlights: ‘Good’ when stocks fall, likes Apple a lot, coronavirus impact

PUBLISHED MON, FEB 24 20206:06 AM ESTUPDATED 34 MIN AGO

Warren Buffett joined CNBC’s Becky Quick with an exclusive three-hour interview on “Squawk Box” on Monday.

Below are all the highlights:

9:02 am: Long-term outlook ‘not changed’ because of the coronavirus

As the coronavirus outbreak sparks fears of a slowdown in global growth, Buffett closed the CNBC interview saying his long-term outlook remains unchanged.

“We’re buying businesses to own for 20 or 30 years. We buy them in whole, we buy them in parts … and we think the 20- and 30-year outlook is not changed by the coronavirus.”

8:59 am: Buffett says Kraft Heinz should pay down debt, maintain dividend

“I think Kraft Heinz should pay down its debt. Under present circumstances, it appears that it can pay the dividend and pay down debt at a reasonable rate,” Buffett said. “And it has too much debt, but it doesn’t have debt it can’t pay down. The debt holders are going to get the interest and the debt should come down by year-end. I think it will, and I think it can with the present dividend.”

8:57 am: Buffett says he talked to his ‘science advisor’ Bill Gates about the coronavirus

The Berkshire Chairman said he spoke to Microsoft founder Bill Gates about efforts to contain the spread and impact of the coronavirus. “Now what they hope to get is a universal flu vaccine, but that’s a long way off. It isn’t impossible. I mean I asked my own — my own science advisor is Bill Gates … I talked to him in the last few days about it and he’s bullish on the long-term outlook for a universal prevention of it.”

8:45 am: Cryptocurrency has basically ‘no value’

“Cryptocurrencies basically have no value,” Buffett said, noting that they don’t produce anything or mail investors checks. Instead, the value is derived from the belief that someone else will value the more highly in the future. “In terms of value, you know zero,” he said.

8:34 am: ‘Premium’ for buying businesses outright

As a conglomerate, Berkshire Hathaway is known for acquiring entire businesses. But recently, Berkshire has favored buying shares of companies, but not the entire entity. “There’s quite a premium,” Buffett said of buying an entire business. “Part of the premium is because you can borrow so much money so cheaply in buying those businesses.”

8:28 am: These are ‘very unusual conditions’

As the yield on the U.S. 10-year Treasury sank to its lowest level since July 2016, Buffett said there are “very unusual conditions.”

“It makes no sense to lend money at 1.4% to the U.S. government, when it’s government policy to have 2% per year inflation. The government is telling you we’re going to give you 1.4% and tax you on it, and on the other hand we’re going to presumably devalue that money at 2% per year. So these are very unusual conditions.”

8:15 am: Buffett says he got a smartphone

Despite owning a large position in Apple, Buffett famously never had a smartphone — until now. “My flip phone is permanently gone,” he said.

8:11 am: It is ‘harder’ for Berkshire to buy back shares than for other companies

Buffett said it’s difficult for Berkshire Hathaway to buy back large numbers of its shares. “It’s harder to buy back Berkshire Shares than say Bank of America buying back its stock … they can really do it without moving the market.” “Berkshire is held by people that really primarily keep it,” he said.

8:04 am: Apple is ‘probably the best business I know in the world’

Apple is Berkshire Hathaway’s third largest holding behind insurance and railroads, Buffett said. He called the company “probably the best business I know in the world.” Berkshire owns roughly 5.5% of the business, he said.

7:54 am: Would ‘certainly’ vote for Bloomberg

Buffett said he would “certainly” vote for Mike Bloomberg. “I don’t think another billionaire supporting him would be the best thing to announce. But sure, I would have no trouble voting for Mike Bloomberg.”

7:50 am: Buffett says he’s a ‘card-carrying capitalist,’ but not a ‘card-carrying Democrat’

Buffett said that while he’s a Democrat, he’s not a “card-carrying Democrat” and has voted for Republican candidates in the past. As Sen. Bernie Sanders surges in the polls, Buffett said, “we will see what happens” regarding the Democratic nominee. Buffett did say that he’s a “card-carrying capitalist.”

7:41 am: Buffett says Berkshire is worth the same with or without him

In recent years there have been questions about what happens at Berkshire Hathaway in the era after Buffett, who is 89. “Berkshire without me is worth essentially the same as Berkshire with me. My value added is not high, but I don’t think I’m subtracting value,” he said.

7:38 am: Buffett says bank stocks are ‘very attractive compared to most other securities’

“I feel very good about the banks we own. They’re very attractive compared to most other securities I see,” Buffett said. Banks are a big part of Berkshire Hathaway’s portfolio, which is worth more than $248 billion. Goldman Sachs, JPMorgan Chase, Bank of America, BNY Mellon, and U.S. Bancorp were all among Berkshire’s 15 largest stock holdings.

Correction: An earlier version misstated Buffett’s title. He is chairman and CEO of Berkshire Hathaway.

7:32 am: Wells Fargo shareholders would be ‘a lot better off’ had company addressed problems sooner

Berkshire has been selling its stake in Wells Fargo, and Buffett said the bank is a “classic in terms of one lesson,” which is that the company should have attacked its phony accounts scandal “immediately.” “They had an obviously very dumb incentive system,” Buffett said. “The big thing is they ignored it when they found out about it.” Buffett said shareholders would be “a lot better off” if the bad practices weren’t ignored, which was a “total disaster.”

7:20 am: ‘Would not be a profit’ if Berkshire were to be split up

While some have said that Berkshire Hathaway’s businesses could be more profitable if the conglomerate were to split, Buffett said that would actually be bad for business. “You can have spinoffs … you cannot dispose of the entire business without having very substantial tax liabilities,” he said. “It would not produce a gain. Having them together, however, produces very valuable synergies.”

“There would not be a profit if we were simply to announce that over the next 24 months you could come in and buy any business we had and we would sell to the highest bidder,” he added.

7:13 am: Coronavirus outbreak shouldn’t affect what investors do with stocks

Buffett said that while the coronavirus outbreak is daunting for the human race, it shouldn’t impact investors’ portfolio decisions. “It is scary stuff. I don’t think it should affect what you do with stocks, but in terms of the human race it’s scary stuff when you have a pandemic,” he said. Berkshire Hathaway’s annual meeting is May 2, which Buffett said the coronavirus could “very well” impact.

7:05 am: Buffett warns that ‘reaching for yield is really stupid’

The Berkshire Hathaway chief said that investors should not reach for yield beyond their risk-tolerance, even with interest rates so low and stocks seemingly like the only place to get a return. “Reaching for yield is really stupid. But it is very human,” he said, delivering sobering advice to folks near or in retirement. “People say, ’Well, I saved all my life and I can only get 1%, what to do I do? You learn to live on 1%, unfortunately.”

7:00 am: Berkshire’s cash pile stands at $128 billion, we’d ‘like to buy more’

Berkshire Hathaway’s cash balance now stands at $128 billion, leading some investors to question why the Oracle of Omaha hasn’t put the firm’s war chest to work. “We’d like to buy more,” he said, after being asked about his cash on hand.

6:55 am: Buffett says American public going ‘wild’ with enthusiasm for index funds

As passive investing becomes more and more popular, Buffett likened index funds to conglomerates, saying the American public is going “wild” with enthusiasm for passive investing. “You buy 500 businesses all put together, and I mean that’s the ultimate conglomerate.”

6:46 am: Buffett says economy is ‘strong,’ but a ‘little softer’ than 6 months ago

Buffett said that while the U.S. economy still looks healthy, it isn’t as robust as it was even half a year ago thanks to a combination of global headwinds. “It’s strong, but a little softer than it was six months ago, but that’s over a broad range,” he said. “Business is down but it’s down from a very good level,” he added.

6:39 am: Buffett won’t reveal why he sold Wells Fargo

Berkshire Hathaway sold some of its Wells Fargo position in the fourth quarter, filings revealed, but when Buffett was pressed for why the firm decreased its position he wouldn’t reveal why. “We’ve bought Bank of America and sold Wells Fargo,” he said.

6:25 am: ‘Very significant percentage of business’ impacted by coronavirus

As the coronavirus outbreak hits stocks, Buffett said, “a very significant percentage of our businesses one way are affected.” He added, however, that the businesses are being affected by a lot of other things, too, and he said the real question is where those businesses are going to be in five to 10 years. “They’ll have ups and downs,” he said.

Specifically, he pointed to Apple and Dairy Queen being hit, as well as carpet maker Shaw Industries.

6:19 am: Buffett says he’s bought stocks every year since he was 11

Buffett said that no matter what’s going on in the market, he’s always been an overall net buyer of stocks. “I’ve been a personal net buyer of stocks ever since I was 11, every year.”

“I haven’t bought stocks every day. There have been a few times where I thought stocks have been quite high, but that’s very seldom” he added.

6:11 am: Don’t buy or sell ‘based on today’s headlines’

As volatility in the market increases because of the coronavirus, Buffett said not to make investing decisions based on day-to-day moves. “You don’t buy or sell your business based on today’s headlines. If it gives you a chance to buy something you like and you can buy it even cheaper, you’re in good luck,” he said, adding that “you can’t predict the market by reading the daily newspaper.”

6:06 am: ‘That’s good for us,’ Buffett says of dropping stocks

As stock futures dropped before Monday’s opening bell, Buffett said “that’s good for us.” “We’re a net buyer of stocks over time,” he said. “Most people are savers, they should want the market to go down. They should want to buy at a lower price.”

– CNBC’s Tom Franck, Michael Sheetz and Matthew Belvedere contributed reporting.

Coronavirus could spark a 20% tech pullback, investor Paul Meeks warns

PUBLISHED SUN, FEB 23 20205:01 PM EST

Stephanie Landsman@STEPHLANDSMAN

Investor Paul Meeks is bracing for a bear market in technology.

Meeks, who’s known for running the world’s largest tech fund during the dot-com boom, sees 20% pullback risks growing as the coronavirus outbreak spreads.

“There is some comeuppance due, and unfortunately I think the coronavirus is that exogenous variable that is a catalyst to take some of these stocks down,” the portfolio manager at Independent Solutions Wealth Management told CNBC’s “Trading Nation” on Friday.

The major indexes ended the week meaningfully lower after a series of new coronavirus cases sparked fresh concerns over a global economic slowdown. Tech stocks led Friday’s sell-off. The Nasdaq had its worst daily performance since last month.

Meeks, who has been avoiding the space, suggests Friday’s activity may be the tip of the iceberg.

If the outbreak isn’t contained soon, Meeks believes the next serious tech sell-off could be longer and deeper than his original prediction almost a year ago.

Last April, he warned on “Trading Nation” the tech rally had gone too far, too fast and he has been singling out Apple. He still owns the iPhone maker’s stock, but as an underweight.

“Apple is grossly overvalued,” said Meeks, who has $700 million in assets under management.

Meeks may have a discouraging forecast, but he’s not predicting a recession.

“The fundamentals are strong in tech,” he added. “They are stronger relative to the rest of the sectors within the economy.”

‘I’d be buying with both hands’

If big tech has a dramatic drop similar to the fourth quarter of 2018, Meeks indicated he’d head back to the group that made him famous.

“I’d be buying with both hands,” he said.

Meeks would target semiconductors, particularly Lam Research, Nvidia, Advanced Micro Devices, Micron and Applied Materials.

“I’m most bullish on the semiconductor and semiconductor capital equipment companies,” Meeks said. “You’ve had some companies that have already reported their results. So, we have some clean and fresh data.”

Disclosures: Paul Meeks owns shares of Apple, Lam Research, Nvidia, Advanced Micro Devices, Micron and Applied Materials.

Op-Ed: Bernie Sanders is the front-runner because of how we raised our kids

PUBLISHED SUN, FEB 23 20209:38 AM EST

KEY POINTS

- How did an avowed socialist get to the top of the Democratic Party? He is supported by millions of younger voters who have been raised to support Bernie Sanders, even if their parents don’t realize it, writes Jake Novak.

With his convincing victory in Saturday’s Nevada caucuses, Sen. Bernie Sanders is solidifying his status as the front-runner for the Democratic presidential nomination more than ever before.

So how did a life-long avowed socialist and someone who’s never actually won an election as a Democrat get to the top of the party’s mountain?

The simple answer is that he’s being supported by millions of younger Democratic voters, and those voters have been raised to be Sanders voters, even if their parents don’t realize it.

Here’s how it happened:

We convinced everyone college was 100% necessary, and then we made college unaffordable. Since the end of World War II, the chorus of educators, politicians, and journalists making it sound like college was essential for career success only became louder and drowned out any counterargument.

At the same time, college tuition costs have exploded thanks greatly to government programs that produced unintended, but predictable consequences. It mostly started in 1978 when more loans and subsidies became available to a greatly expanded number of students. The cost of college tuition has risen by six times more than the rate of inflation since the 1970s.

Now, millions of American young people are straddled with college loans that look impossible to repay. The total student loan debt in the U.S. now stands at more than $1.6 trillion.

Is it any wonder so many of them are attracted to a candidate who not only promises to forgive their student debts, but presents their predicament as the result of corporate greed and misplaced government priorities?

Luckily for Sanders, young voters supporting him for his college tuition forgiveness promises don’t seem to be too interested in his own family history. His wife Jane Sanders was president of the now defunct Burlington College and she and other administrators were reportedly the subjects of a long-running FBI probe that they misled bank loan officers about the real number of donations pledged to the college.

The FBI probe of the matter ended in 2018, and Jane Sanders was not charged. But the policies she oversaw, which included pushing for major campus expansions, were indicative of some of the root causes of increased college costs in America.

The establishment in both parties ignored young voters. As sacred as our politicians make college education sound, it’s nothing compared to the way leaders from both parties talk about programs for older Americans like Social Security and Medicare.

None of that is a mystery, as older Americans have always been more likely to vote. Even though voters aged 18-29 have been showing increased turnout numbers in recent elections, senior citizens still stand atop the heap. In 2016, 71% of Americans 65 and older voted compared to just 46% of 18-29-year-olds. In the 2018 midterms, that gap narrowed to 66% to 36%, but it’s still a wide gap.

All of this focus on older voters and their retirement funds is a nice sentiment but it’s misplaced. Older Americans aren’t just doing okay. A 2017 study of age-based wealth in the U.S. shows that a typical household headed by an adult 65 and older has 47 times the net worth of a household headed by younger Americans. Yep, Papa and Granny are loaded.

Now, helping older people who happen to be poor or on the margins of poverty is something different. But the cultural assumption many of us have about elderly folks needing more financial help in America is pretty much the opposite of the truth.

Throw in the Affordable Care Act, which literally and foolishly leaned on younger and healthier Americans to foot the bill for covering older and sicker people, and you see a pattern here.

Sanders talks plenty about Social Security, and he’s obviously a senior citizen himself. But he usually expands his campaign promises to include younger people, as he did when he took the lead on the Medicare for All promise in 2017.

We told them America’s house was on fire. For all the policy differences and political minutiae Democrats delve into when criticizing President Trump, the most enduring attacks on Trump from the Democratic establishment remain accusations that Trump is supporting white supremacy and is controlled by Russian President Vladimir Putin.

These are over-the-top accusations, and it’s hard to accept that even most elected Democrats actually believe them. But pushing that message on America for the last three-plus years comes at a price for both sides.

For the Democrats, the price is becoming clear: it’s made moderate presidential candidates look less viable than ever.

Think about it: if you really believe the president is a traitor and supporting violent plots against non-white Americans, is this really the time to support mainstream Democrat or Republican candidates?

Sanders may be a career politician, but he’s never been a mainstream politician. His persona and political brand fits much better into the current Democratic narrative that we’re living in desperate times.

Establishment Democrats are reaping what they sowed.

As a result, it’s looking more and more like Sanders has unstoppable momentum going into the Super Tuesday primaries and beyond. The big question now is whether that Democratic establishment will try to derail Sanders before or during the Democratic National Convention.

But either way, the party would be playing with fire and risking alienating those younger voters forever.

Jake Novak is a political and economic analyst at Jake Novak News and former CNBC TV producer. You can follow him on Twitter @jakejakeny.

GE Might Want to Sell More Jet Engines to Airbus. That’s Part of Aerospace Competition.

By

Al Root

Updated Feb. 20, 2020 5:23 pm ET / Original Feb. 20, 2020 12:39 pm ET

The scrutiny of Boeing and its grounded 737 MAX jet hasn’t changed industry fundamentals.

Photograph by Amir Makar/AFP via Getty Images

The commercial aerospace industry is a very long-lead-time duopoly. There are only two makers of large jets, the kind that fly travelers around the globe. What’s more, the industry is characterized by just a handful of capable suppliers at the top of the supply chain selling very complex machines to Boeing and Airbus.

The scrutiny of Boeing (ticker: BA) and its grounded 737 MAX jet hasn’t changed industry fundamentals. But it leaves investors to put new, rapidly delivered data points into context. It can be hard. Are stories about new-engine competition a sign of something big afoot in the industry, or are they just the normal course of business, amplified by Boeing’s woes? The answer can be yes to both scenarios. For the most part, however, investors are learning amid the Boeing MAX crisis that commercial aerospace is a pretty good business.

The Wall Street Journal reported that General Electric ( GE ) wanted to sell GEnx engines to Airbus (AIR.France). In most business environments, investors would weigh the likelihood of that engine being added as an option to the A330 NEO program and adjust stock-market valuations accordingly. The news impacts Boeing—the maker of the competing 787 jet—Airbus, and Rolls-Royce (RR.London), which provides the current engines for the A330 NEO.

This isn’t an ordinary environment, though. The MAX has been grounded worldwide for almost a year, following two deadly crashes within five months. What’s more, Boeing halted production of the MAX in January, sending a small shock wave up and down the aerospace value chain. The 737 MAX drama magnifies all business decisions about engines and planes these days.

The Journal’s report doesn’t much change any one business outlook. Instead, it shows that the aerospace industry, despite its small competitor pool, is quite competitive.

For starters, the A330 NEO is a wide-body jet with two aisles. It competes, for the most part, with Boeing’s popular 787 jet. The 737 MAX is a single-aisle jet. It competes with the A320 NEO. Wide-body and narrow-body planes have different capacities, ranges, prices, and technologies. The 737 MAX, essentially, never enters into the mind of an airline or leasing executive wishing to purchase a wide-body jet.

Up till now, the 787 has been more successful than the A330. Boeing has taken in about 1,500 orders for its plane, which it started delivering in 2011. Airbus has taken in about 340 orders for the A330 NEO, a newer jet that it began delivering in 2018.

The A330 NEO is powered by Rolls-Royce Trent 7000 engines. The 787 is powered by either GE engines or Rolls-Royce engines, based on the choice of the airline customers. The GEnx engines have about 63% of the market for 787 engines.

The scenarios of engine choice or no engine choice vary by plane in the industry. The 737 MAX and A330, for instance, aren’t offered with a choice of engines. But the A320 NEO has two options—either a CFM built Leap-1A engine or a Pratt & Whitney geared turbo fan.

CFM is a joint venture between GE and Safran (SAF.France). Pratt is a division of United Technologies (UTX).

Rolls, GE, and Pratt are competitive, trying to sell engines with the best mix of reliability, fuel efficiency, power, and price. GE might persuade Airbus to add its GEnx engine as an option on the A330 NEO. That would be a small bit of good news for GE investors and a small bit of bad news for Rolls-Royce investors. If it were to happen, however, that version of the plane would have to be certified by global aviation authorities. It would take a while.

All engine makers will continue to pitch their best technology to Boeing and Airbus—no matter who is the incumbent.

Pratt, for instance, doesn’t supply the 737 family of jets, including both the older NG model and newer MAX, but that doesn’t mean the company doesn’t want to. It’s likely Pratt wants to sell more engines to Boeing, just like GE wants to sell more to Airbus. But if Boeing wanted to try out the GTF, it would have to certify that version with regulators. That would take time, too—very likely measured in years.

The Pratt GTF is only an example. United Technologies, Pratt’s parent, and Boeing didn’t respond to questions about Barron’s scenario. That isn’t a surprise. Companies rarely comment on customer negotiations. Investors shouldn’t read anything into that.

Airbus didn’t return a request for comment about the A330, either. GE referred Barron’s to the comment given to the Journal, in which it indicated it is always trying to win new business.

The next battleground for aircraft engine makers might be Boeing’s new medium-size-aircraft. It was intended to be a smaller-than-787 twin-aisle aircraft. This is where the MAX situation might affect the larger-jet market. Boeing might decide to do a new single-aisle jet instead of a 767-size replacement. That is just Barron’s speculation, but it is based on some comments by Wall Street analysts who weigh in on the prudence of the NMA.

Whether Boeing’s next jet is a single- or twin-aisle plane doesn’t matter all that much. Jet engine makers will all want to win that business. And those that don’t win on the first go-round won’t automatically stop trying.

Boeing thinks it can return the MAX to the skies by mid-2020. If the date keeps shifting further into the year, the negative effects on suppliers such as GE will grow. But, surprising as it may seem, if the MAX flies again on Boeing’s timeline, the MAX situation will be only a blip on the radar screen for the majority of suppliers.

Boeing stock has fluctuated but remains down about 20% since the second deadly MAX crash, trailing far behind comparable gains of the S&P 500 and Dow Jones Industrial Average over the same span.

Write to Al Root at allen.root@dowjones.com

If 98% of funds don’t beat the market, why do people still give their money to financial advisors and money managers? Why doesn’t everyone just invest in a low cost index fund that follows the S&P 500?

Manish Joshi, Director, Program Mgmt @ Wealthfront

Originally Answered: If 98% of funds don’t beat the market, why do people still give their money to financial advisors and money managers?

I believe there are four reasons:

- Failure in logical reasoning. No single money manager has been able to beat the market consistently (20+ years), but if you look at any given year, you can find a set of funds who did manage to do it. People generally look at point in time, they focus on winners, and they make inferences easily. If money manger (M) beats an index fund (I) during a specific time period (T), then M > I for all T. Basically, a failure in logical reasoning.

- Belief that they’re the exception. Taking your 98% figure to be true, people truly believe that they can find those 2% of funds who canbeat the market. These are the folks who understand the data, but think that they are the exception and have found that secret “edge”.

- Being unaware.It’s unfortunate, but the masses still believe that a man wearing a designer suit sitting in a nice office can bring them great returns and is justified to charge high fees to do so. They are simply unaware of the data that shows passive investing in low cost index funds is far superior than active management in the long run.

- Being totally clueless. See #3 except add to the fact that they don’t know where their money is being invested, what fees they are paying, nor what constitutes a good return. These are the pour souls who hear from a ‘friend of a friend’ about this great financial advisor and end up getting taken advantage of.

HI Financial Services Mid-Week 06-24-2014