Trade Findings and Adjustments 2-25-20

S – Take a profit if you ignored me and put on a sprint bull call position.

TGT – Not bad if you had gotten in on the 14th or so closer to 116 price. Not worth missing out on the dividend if you didn’t catch it already. ADJUSTMENT to add 03-April -20 $112 Long Put

GE – Leap Bull Call 15/20 out to Jan21. Keep an Eye on it, you might get a better cost basis closer to .55 if it tests the pivot point at 12.23. If not, no big deal and you still go for a .60 – .65 cost basis.

Future ADJUSTEMNT – Dollar cost average when the price gets to $0.35

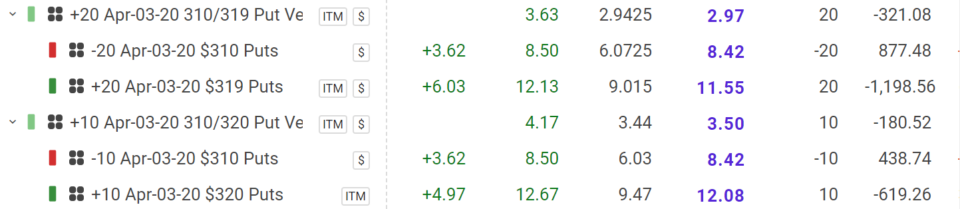

COST – Wait and see if it tests a 316.33 support Pivot Point for a possible entry in a dip buying opportunity.

BIDU long term? Look at going further out in time Jan 2022 150 Leap Long Calls for more time. Also a good time to cash in half of June 2020 leaps that should be fantastically profitable.

CORONA VIRUS and Portfolio Management

No change in the view of the economy, GDP and economists revisions In The USA

CDC – Said “It’s only a matter of time” = Schools shut down, public transportation shuts down and more people work remotely

Ie……. Planes, Trains and gathering centers will be shut down

This morning was frustration, Anger, Fear/controlled panic and the adding of protection

How are you going to make up 75% of the downward movement and how will you be profitable on the down days and make up losses

Before I answer that question let’s do some vocabulary

Dead Cat Bounce = Market is already dead yet it bounces for a day or two to then continue the downward movement

The media to sell air time is making this out to be the 1918 Spanish Flu

This is spreading – Will spread through Europe, Asia, South America

We will have a global slowdown and the worry will affect all market nomatter how strong the

economy

How do we make up losses and/or make money to the downside

1st Thing we do = PRAY for the bottom to fall out!!!!!

We have a 2008 opportunity called the corona virus

IF we add a second set of long puts to stock ownership what does that do?= It creates a negative delta = you make more money than the stock loses

If our current long puts have a delta of 0.66 and we buy new long puts with a delta of 0.58 how much money will we make to the downside? 0.66 + 0.58 = $1.24 as the stock passes through $126

So what happens when it gets down to $120 on the stock price?

SO 0.77 on the newest and 0.89 on the old puts which means as DIS heads to or touches $120 we make 0.77+0.89= $1.66 on every downward $1 DIS moves

How do you know when to add or take them off – Levels of Support and Resistance

What about the LEAPS ?

The position itself has protection

Dollar cost average half the cost or a third of the cost or a quarter of the cost

I can single long puts to create a strangle

OR Keve Likes and I AGREE to QQQ bear puts

219/210 Bear Put 03-April-20 for about $3