HI Market View Commentary 02-04-2019

What I want to talk about today?

What is an inverted yield curve?= Longer term treasury bonds yield less than short term treasury bonds

Why was the inverted yield curve important?

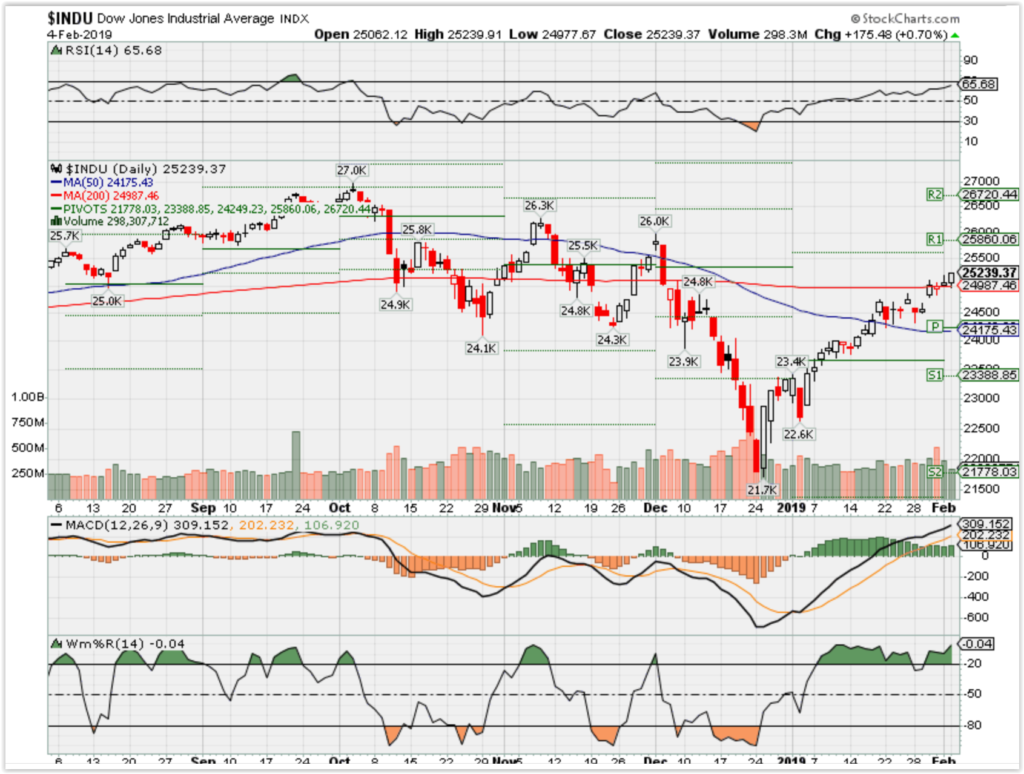

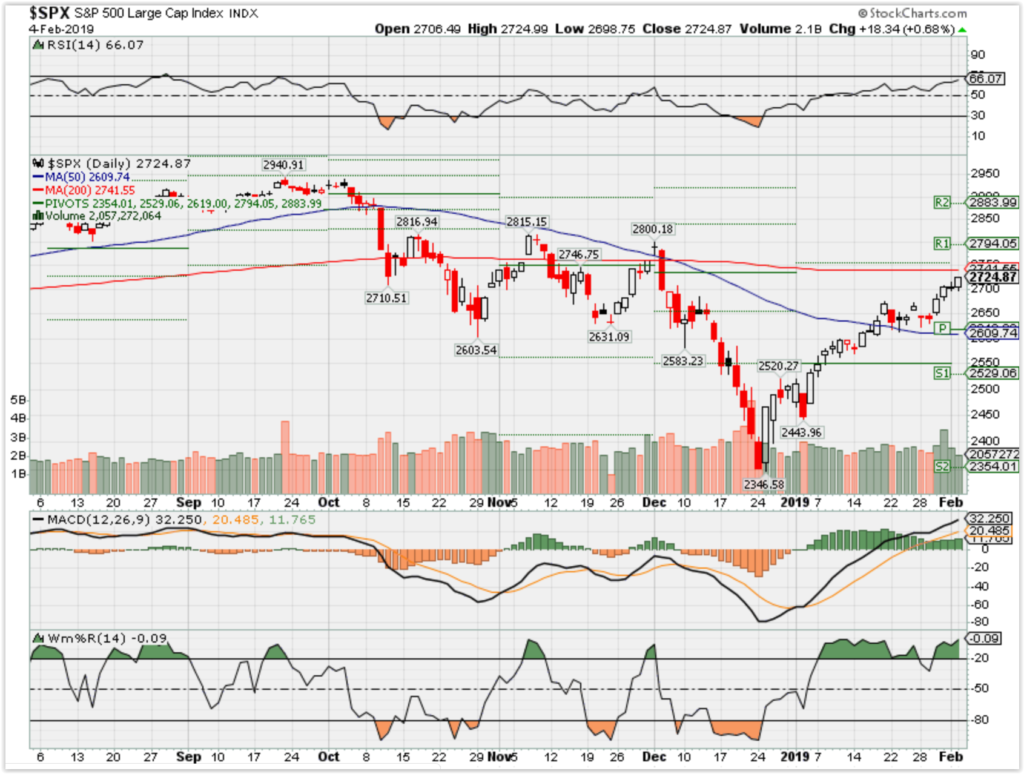

Where will our markets end this week?

Higher

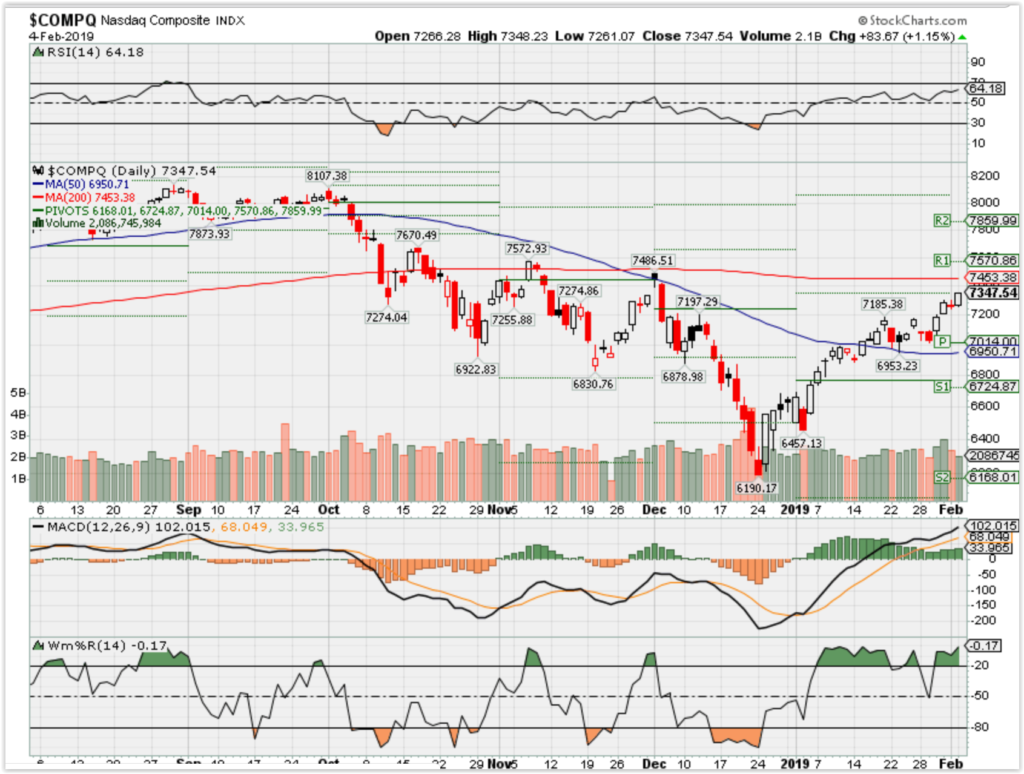

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end February 2019?

02-04-2019 -2.0%

Earnings:

Mon: CLX, BZH, SOHU, GOOGL, GILD

Tues: BP, EMR, EL, RL, EA, SKWS, SNAP, DIS

Wed: BSX, CMI, GM, HUM, SPOT, FEYE, GPRO, NTES, YELP, ZNGA

Thur: CAH, DNKN, GRUB, GT, ICE, K, TWTR, YUM, NVDA, TMUS, WU

Fri: HAS, PSX

Econ Reports:

Mon: Factory Orders, Auto, Truck

Tues: ISM Service Index,

Wed: MBA, Productivity, Unit Labor Costs

Thur: Initial, Continuing, Consumer Credit

Fri:

Int’l:

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Earnings are coming up and protecting through earnings with protective puts and NO short Calls

AOBC – 2/28

BIDU – 2/12 AMC

DIS – 2/05 AMC

GOOGL – 2/4 AMC

IBB

MRO – 2/13 AMC

MRVL – 3/17

OIH

RHT – 3/26

UAA – 2/12 BMO

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

What Performs Best During Inverted Yield Curve?

Dec 5, 2017

Panic About Inverted Yield Curve

There has been a lot of discussion about the inverted yield curve lately. The purpose of this article will be to dispel any rumors that exist about what this symbolizes for the economy. There are a three categories of metrics investors with a keen focus on macro economics need to focus on: company specific metrics researched through reading regulatory filings and researching the competition; the mainstream economic reports such as the ISM reports and the jobless claims; and forecasting metrics which can help you understand where the economy is headed. These forecasting metrics don’t just help you time recessions. They help you figure out where the economy is in the business cycle.

Certain sectors do better in each part of the business cycle. The parts are the following: recovery, mid cycle, late cycle, and recession. As of late-2017 the U.S. economy is probably in the late cycle, but some of the emerging markets economies are acting as though we are in the early part of the cycle, a response that is happening due to the high levels of monetary stimulus. We’ll discuss which sectors do well in the late cycle economy in this article.

Yield Curve Is A Valuable Forecasting Tool

One of the forecasting tools used to pick out where the economy is in the business cycle is the yield curve. The yield curve is a line plot of the treasury yields matched with their maturity dates. In a normal curve, the yields increase with longer dated bonds. With an inverted curve, the yields are lower as the maturity dates are further in the future. A normal yield curve is associated with expansions; an inverted yield curve is associated with warnings about recessions.

The Fed plays a role in affecting the short end of the curve with the Fed funds rate. Central bank fed funds rate hikes which go too far can push short-term rates higher than long-term rates, which is an inversion of the yield curve. Usually the Fed hikes rates because inflation is increasing and needs to be tamed. In the last couple of cycles, oil price rallies caused inflation to increase, pushing the Fed to raise rates. While inverting the curve and causing a recession isn’t ideal, sometimes it’s necessary to save the economy from excess inflation. After an inversion of the yield curve occurs, the Federal Reserve cuts rates, generally as this is correlated with an economy that is faltering, which is a result of the initial hiking of rates. As you can see, the Fed creates its own feedback loop that requires it to do and undo its actions. However, at this stage of the cycle something different has been happening – the Fed has been raising rates despite low inflation as measured by the core PCE and CPI.

Looking Into The Late Business Cycle Dynamics & Inverted Yield Curve

As of December 4th, the difference between the 10 year yield and the 2 year yield was 59.9 basis points. As you can see from the grey line below, that implies the economy is at the end of the cycle as it was above 250 basis points in the beginning and middle of the cycle partially because the Fed had rates at 0%. The chart demonstrats that as an inverted yield curve occurs, the final domestic demand growth falls.

An Inverted Yield Curve Implies Demand Weakness

A flattening yield curve doesn’t imply domestic demand growth will falter in 2018 because the signal for a recession occurs only when the curve inverts. Even then, there could be a delay between the the inverted yield curve and an actual recession, as this occurred in the late 1920s.

Are We About To See An Inverted Yield Curve?

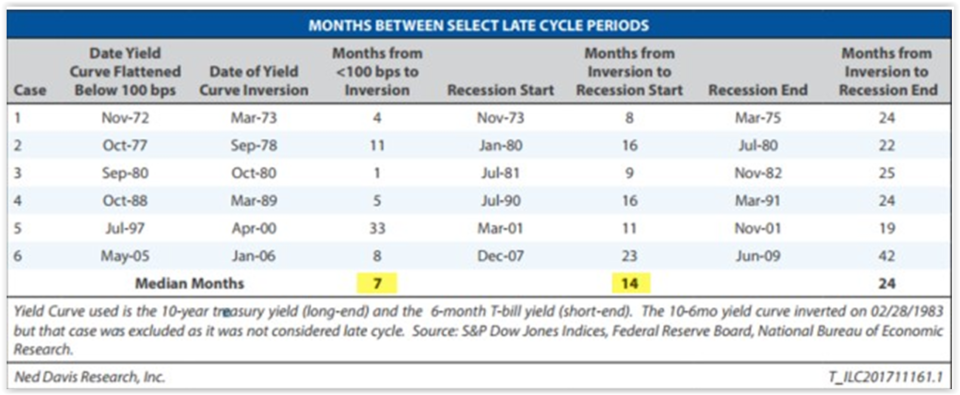

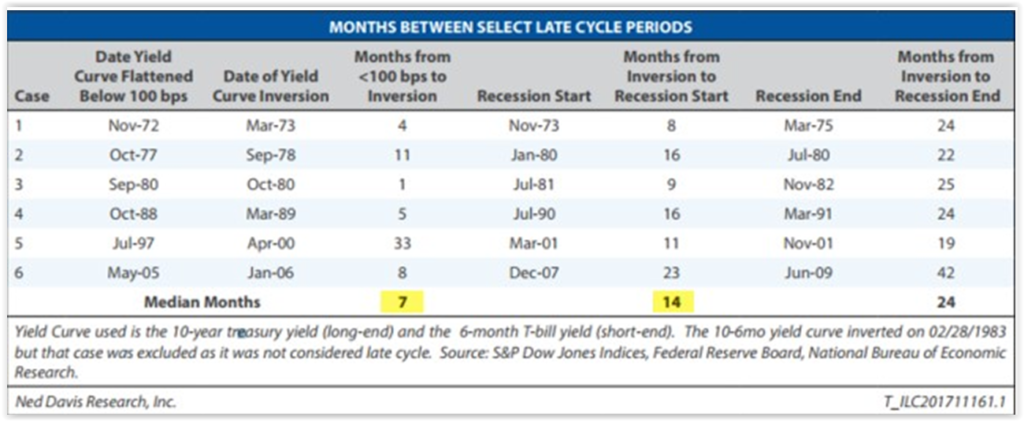

Mathematically, we are nearing an inverted yield curve since it has flattened about 200 basis points and needs to flatten 60 more basis points to be inverted. However, the timing isn’t that simple. The curve doesn’t uniformly flatten like how an hourglass measures time. It might take a few months for an inversion to occur or a few years. The table below details the time it takes for the yield curve to fall from 100 basis points to an inversion.

Length Of The Flattening Period

Keep in mind, this chart uses the 6 month treasury bill as the short end and the 10 year bond as the long end. As of December 4th, the difference between the 6 month and the 10 year yield was 97.5 basis points. As you can see, the inversion time has varied from 1 month to 33 months, with the median being 7 months. The inversion doesn’t signify a recession is coming right away; there’s usually a sizable gap between the inversion and the recession which is why the chances of a 2018 recession are slim according to this indicator. The median time from an inversion to a recession is 14 months, varying from 8 to 23 months.

Flattening Yield Curve: How Stocks React

Stocks generally move up unless there’s economic strife. Therefore, it’s not surprising to hear that stocks go up when the yield curve flattens at the end of the cycle. Sometimes stocks move up a lot because at the end of bubbles there is often a blow off top where incredible returns occur.

The chart below looks at the 10 year- 2 year spread. In the last 4 cycles, the curve inverted 17 months after getting to 60 basis points on average. The average annualized gain is 24.44% during the flattening period. That gain is boosted by the 1990s performance which shows how blow off tops can occur. It can be advantageous to buy stocks before a recession if you know when to get out.

Great Returns In Flattening Periods

Where To Put Your Money During Flattening Yield Curve

The past 4 times the 10 year minus the two year fell below 60 basis points, buying stocks was good. However, the question remains “how do you allocate your portfolio?”

The chart below helps answer that question. As you can see, oil does well and so does the financial and energy sectors.

Best Places To Invest When Flattening

Energy and oil do well because inflation usually increases at the end of the cycle, meaning oil prices are going up along with the other commodities. Financials do well because the Fed fights inflation with higher rates. Higher rates mean higher net interest margins. The telecom sector under performs because rising bond yields mean investors don’t need to buy high yielding telecom stocks, which act as bond-like instruments, to get the returns they crave. Consumer discretionary under performs because input costs go up, squeezing margins. Inflation also hurts the consumer’s purchasing power.

The table below has different returns for the flattening period than the chart in the middle of this article because it uses the 6 month bill as the short end. This chart also has energy doing well and consumer discretionary impacted poorly. Utilities do poorly for the same reason as telecom stocks. They have high dividend yields which face greater competition from fixed income investments when bond yields go up. Tech was involved in the blow off top in the 1990s, but other than that it has had middling performance in the flattening periods. In this cycle, Google and Facebook dominate the sector. They may act in tune with consumer discretionary stocks because they are advertisers.

Buy Energy, Sell Utilities & Consumer Discretionary In Flattening Periods

Conclusion

This is just one factor among the many you should look at when determining the point in the business cycle and which weightings to have in your portfolio. For example, you would want to research how the GOP tax plan will affect each sector before deciding. That being said, this article is a great starting point to see the effects a flattening yield curve have on certain assets. Be sure to check the yield curve weekly to see if the situation changes. Good economic reports or a dovish Fed not intent on raising rates further could cause it the yield curve to steepen.

How Facebook, GE and Apple turned their struggles into stock gains: Cramer

PUBLISHED THU, JAN 31 2019 • 6:19 PM EST | UPDATED THU, JAN 31 2019 • 7:06 PM EST

KEY POINTS

- CNBC’s Jim Cramer says low expectations helped Facebook, General Electric and Apple’s stocks come out on top after earnings.

- Facebook’s results suggest the social media giant has finally managed to move past its scandals, the “Mad Money” host says.

- As for GE, its quarterly report gave investors a sense that “the worst is over,” Cramer says. Facebook, General Electric and Apple have all proved how powerful low expectations can be, CNBC’s Jim Cramer said Thursday after Facebook and GE surprised Wall Street with their quarterly earnings reports.

Despite Facebook’s numerous privacy scandals, the social media giant’s fourth-quarter results handily beat analyst estimates, sending the stock 10.82 percent higher in Thursday’s session. The beleaguered GE saw a similar reaction: shares of the industrial gained the most in 9 years Thursday after a much better-than-anticipated fourth quarter.

Those two stocks helped the broader market along, with the S&P 500 capping off its best January since 1987.

“You know what most of the stocks that have exploded higher this earnings season have in common? They had already gone down hard going into the quarter,” Cramer said on “Mad Money” after markets closed. “We have seen this over and over and over again, including [in] today’s session. […] These stocks are all acting like coiled springs.”

Leading up to Thursday’s report, Facebook’s fate looked especially murky. Negative reports on how the company handled user data grew deafening as revenues slowed, costs soared and people, including celebrities, left the platform.

But when Facebook reported Wednesday night, the weakness seemed to dissipate, with the platform logging user growth, advertising growth, revenue growth and lower costs for its latest quarter.

“I think the stock still has a lot more upside, even after today’s glorious run,” Cramer said, adding that the company’s in a much better place now that its costs are fixed and its revenues are climbing. “When you have operating leverage, you can practically print money, and Facebook is back in the leverage business.”

GE, which has also been a beacon of conflict, managed to give investors “a sense of confidence that the worst is over” in its Thursday report, a feat once thought by many to be nigh-impossible, the “Mad Money” host said.

“The new CEO, Larry Culp, … laid out a road map that could eventually get GE off the do-not-resuscitate list and put it in the ICU,” Cramer said. “Believe me, that’s a major improvement.”

While Culp didn’t offer any particularly awesome projections about GE’s future, he focused on progress, accelerating health-care orders, announced a tentative settlement with the Justice Department and put his own team in place, Cramer said.

“He’s going root and branch, people, and when he downsizes [the] power [division] dramatically, we’re going to think of GE as a nifty industrial again,” he said. “No wonder it rallied.”

As for Apple, the iPhone maker’s savvy first-quarter pre-announcement in early January may have saved its stock ahead of earnings, which turned out better than expected. The news was followed by CEO Tim Cook’s appearance on “Mad Money,” during which he painted an optimistic picture about Apple’s long-term prospects.

“To me, this confirms that you should simply own Apple — don’t try to trade it,” Cramer said. “The service revenue steam keeps growing. […] Most of the weakness in the iPhone is coming from China, which is experiencing a nasty slowdown, as we know, and a rise in [the] trade-war that’s induced a lot of economic nationalism. Plus, the strong dollar makes Apple’s pricey phones even more expensive versus the competition. ”

“But, man, if President [Donald] Trump can work out a trade deal with the Chinese, I bet Apple could become … close to, maybe, a $200 stock again, ” the “Mad Money” host added.

All in all, muted expectations can do wonders for a stock, so investors trying to profit during earnings season might want to consider picking up plays that look especially down-and-out ahead of their reports, Cramer said.

“Here’s the bottom line: expectations are everything during earnings season, and when they’ve come down into the gutter, well, all it takes are some decent numbers and your stock can explode higher,” he concluded. “So scour the losers here; they may be ready for the comeback of a lifetime.”

Brexit is a revolt against a German-run European super-state

PUBLISHED MON, FEB 4 2019 • 1:28 AM EST | UPDATED MON, FEB 4 2019 • 9:27 AM EST

Dr. Michael Ivanovitch@MSIGLOBAL9

KEY POINTS

- Led by an appallingly incompetent German management, the European Union will most probably come out terminally fractured after next May’s parliamentary elections.

- The political forces already at work in a number of countries will go back to nation states and a free-trading area, abandoning the pipe dream of a European statehood and sovereignty.

- That may not scuttle the euro because such a free-trading area needs a common currency to be a genuine customs union and a homogeneous single market.

- Britain’s idea of a united Europe has never been more than a free-trading area.

In spite of that, the Germans and the Dutch liked the prospect of sharing the European Union membership with British free-traders, apparently as a counterweight to overbearing Frenchstate interventionists.

Having twice vetoed in the 1960s the British entry into what was then called the European Common Market, France eventually relented and agreed to Britain’s accession in 1973.

Soon, however, France and other EU members had to deal with British “opt-outs” from legislative and regulatory provisions London was finding contrary to its government traditions and requiring sovereignty transfers to unelected officials running the European Commission in Brussels.

Nearly three years after the successful referendum to leave the EU, Britain is now in the final stages of negotiating its exit.

Germany planted the seeds of destruction

Although the form of the British exit from the EU is often presented as a reductionist binary choice — “a no-deal exit” or “a deal the U.K. and the EU can live with” — London has in effect restated the fundamental question of what is a European project: A Europe of sovereign nation states, or a federal European super-state.

The disastrous fiscal austerity policies imposed by German Chancellor Angela Merkel on sinking euro area economies at the beginning of this decade, and her subsequent disorderly open-door immigration waves in 2015 have been a catalyst and a detonator of strong centrifugal forces throughout the European Union.

In response to cataclysmic shocks of the Great Recession, Merkel set out to teach a lesson to euro area “fiscal miscreants” and those unable to control their banks (Spain). In the process, she rebuffed American President Barack Obama’s request to ease up on her devastating fiscal austerity, because Washington was rightly concerned that a deep and intractable European recession would hit hard one-fifth of American exports.

To those calling for some European solidarity, Merkel retorted that it’s everybody for themselves, with Germany continuing to live off its trade surpluses with the euro area partners while pursuing a “black zero” budget balance.

Presidential candidate and later President Donald Trumpunderstood all that. He told Merkel that trade free-riding on the U.S. was over, and so was Washington’s total underwriting of German security. Apparently shocked by the lack of American solidarity (stupidity), Merkel’s response was that“Europeans truly have to take our fate into our own hands.” In other words, never mind, Germany will continue to bilk Europe.

That, however, was too late for Merkel and Germany. Her policies have led to the extreme-right xenophobic Alternative for Germany (AfD) shooting up from zero votes in 2013 to the country’s third-largest political party now.

And that was also an eye opener for some smarter Europeans. When the Hungarians saw that Merkel was going to direct refugees their way, Budapest said it didn’t want Berlin to decide who was going to live in Hungary.

Berlin and a Berlin-run European Commission were outraged at that lack of Hungary’s European solidarity. Worse, an arrogant German EU budget commissioner publicly threatened that he would cut off regional development funds to which Hungary was entitled.

France’s ‘civil war’

Germany got its next comeuppance in Italy. Rome finally summoned the courage to say “basta!” (enough!), after being left alone for years to handle thousands of African and Middle-Eastern migrants and refugees landing on its shores. Berlin’s only response to Italian appeals for European solidarity was to criticize Rome for refusing to honor the maritime traffic laws and to secure people in danger.

To get back at Italy for refusing to follow Germany’s diktat on immigration policies, Berlin led the assault, with its French sidekicks, on Italy’s attempts to rescue its sinking economy with fiscal policies that were well within the euro-area budget rules.

Germany and its EU Commission now got exactly what they wanted: The Italian economy sank into recession late last year, and will probably remain there for most of 2019.

The story is not over, though. Italy is now teaming up with Hungary and Poland to create an anti-German and anti-French block, with unpredictable consequences for the EU’s future.

All that is happening at a time when France is split by a violent and deepening social unrest — some conservative French thinkers call a “civil war,” in a country prone to “violence” and “revolutions.” The government has no answer to three months of demonstrations and rioting of a social movement dubbed “yellow vests.” Watching an increasingly violent police warfare, the French governing elites are organizing town hall discussions, apparently believing that they can wear down, and wait out, their opponents.

But, as things now stand, there seems no end to the French political crisis. Last Saturday, for example, about 60,000 people demonstrated and rioted in all major French cities, confronted by 80,000 police in lethal combat gear.

For the time being, the French government is hanging on thanks to massive police operations and the fact that the rioting social groups have neither the leadership nor the programs that would offer viable alternatives for the transition of power in the quasi-imperial presidential system of the Fifth Republic.

By comparison, a weak and disoriented German government looks like a paragon of stability. The governing coalition forces can’t wait to see Merkel’s back, the right-of-center CDU/CSU sister parties are still settling their differences, and their hapless Socialist (SPD) partners are looking for a major leadership change.

And everybody is waiting to see what political forces will emerge from the European parliamentary elections in late May. The event is billed as a decisive showdown between established and highly contested governing circles, and what are derisively called “populist” demagogues and illiberal democracies.

Investment thoughts

That huge European mess is exactly what Trump and the U.K. need to settle their trade scores with a disintegrating European Union.

Will the euro survive all that?

The probability is very high that it will. The euro is in the hands of the European Central Bank, and no member country now has an overwhelming anti-euro constituency.

Upon reflection, the Europeans will also realize that a demise of the euro would herald Germany’s total political, economic and financial domination of a system of fragmented European states. The long pre-euro experience shows that no country could be protected from that by managed or free-floating exchange rates. The German central bank would then be on par with the U.S. Federal Reserve, and the Bundesbank’s president would reclaim its old role as a lecturer-in-chief on world economy and finance.

But many in Europe would find such a German domination unacceptable. Europe’s old demons would soon take over, and Washington would have to step in to keep the erstwhile European “brothers” off each other’s throats.

And here is how Henry Kissinger talks in his memoirs about a most humiliating history lesson he received on that topic from the towering French President Charles de Gaulle. Egged on by President Richard Nixon, during his visit to France in the 1960s, to challenge de Gaulle’s ideas about Germany, Kissinger piqued the haughty general with the question how he would prevent Germany from dominating Europe. De Gaulle’s answer was simple: “Through war.”

Commentary by Michael Ivanovitch, an independent analyst focusing on world economy, geopolitics and investment strategy. He served as a senior economist at the OECD in Paris, international economist at the Federal Reserve Bank of New York, and taught economics at Columbia Business School.

Here’s how much Jeff Bezos, Bill Gates, Warren Buffett could pay under Bernie Sanders’ tax plan

Published Thu, Jan 31 2019 • 3:47 PM EST • Updated Fri, Feb 1 2019 • 11:37 AM EST

As the adage goes, there are only two certainties in life: death and taxes. And if Vermont Senator Bernie Sanders’ new tax plan were to go into effect, death would trigger much higher taxes for the billionaire set.

Under Sanders’ new tax plan announced Thursday, billionaires would be subject to a 77 percent estate tax, which is the tax levied on the cash, property, real estate and other assets ( “everything you own or have certain interests in, ” according to the Internal Revenue Service) of a deceased person when it is transferred to another person. In 2018, the Tax Cuts and Jobs Act put the estate tax at 40 percent after the first $11.18 million, according to the Internal Revenue Service.

“Our bill only applies to the richest 0.2% of Americans,” Sanders tweeted earlier on Thursday.

According to estimates made by Sanders’ office, here’s what the new bill would establish for the wealthiest five billionaires in the United States:

(For the calculations, Sanders’ office used the net worth list from Forbes, as of Monday, “and then applied our proposed rates” to determine what each billionaire would pay if the new tax plan were implemented, Sanders’ spokesperson Josh Miller-Lewis tells CNBC Make It. To determine a baseline of what each billionaire would have to pay in estate tax under current law, Sanders’ office applied the 40 percent estate tax rate on the Forbes net worth of the given person as of Monday.)

- Amazon co-founder Jeff Bezos, 55, is currently set to pay $53 billion in estate taxes, and would have to pay $101 billion under Sanders’ plan.

- Microsoft co-founder Bill Gates, 63, is currently set to pay $38 billion in estate taxes, and would have to pay $74 billion under Sanders’ plan.

- Berkshire Hathaway CEO Warren Buffett, 88, is currently set to pay $33 billion in estate taxes, and would have to pay $64 billion under Sanders’ plan.

- Oracle co-founder Larry Ellison, 74, is currently set to pay $24 billion in estate taxes, and would have to pay $46 billion under Sanders’ plan.

- Facebook founder Mark Zuckerberg, 34, is currently set to pay $22 billion in estate taxes, and would have to pay $41 billion under Sanders’ new plan.

The fairest way to reduce wealth inequality, invest in the disappearing

middle class and preserve our democracy is to enact a progressive estate tax on

the inherited wealth of multi-millionaires and billionaires.

Today I’m introducing a bill to do that:https://www.washingtonpost.com/us-policy/2019/01/31/bernie-sanders-propose-dramatic-expansion-estate-tax-richest-americans-including-percent-rate-billionaires/ …

The proposed estate tax rates under Sanders’ new plan are tiered and impact the top 0.2 percent of Americans: from $3.5 million up to $10 million in assets owned upon time of death, the tax rate would be 45 percent; from $10 million to $50 million, the tax rate would be 50 percent; and from greater than $50 million to $1 billion, the tax rate would be 55 percent tax.

Changing the estate tax is not unheard of: Indeed, the estate tax has fluctuated from year to year for most of the last 20 years “creating uncertainty for taxpayers and their advisors,” the Joint Committee on Taxation says in a primer on the U.S. Federal Wealth Transfer Tax System published in 2015.

The Sanders’ tax plan could make $2.2 trillion from 588 billionaires in the United States, according to a written statement from Sanders’ office published Thursday. (The precise date as to when this $2.2 trillion could be reaped is “hard to say,” Miller-Lewis tells CNBC Make It, because it’s impossible to know when an estate tax will be levied since a person’s time of death is unknown.)

The goal, which is a common theme for the progressive Senator from Vermont, is to stem the tide of wealth inequality.

“At a time of massive wealth and income inequality, when the three richest Americans own more wealth than 160 million Americans, it is literally beyond belief that the Republican leadership wants to provide hundreds of billions of dollars in tax breaks to the top 0.2 percent,” Sanders says in the written statement. “Our bill does what the American people want by substantially increasing the estate tax on the wealthiest families in this country and dramatically reducing wealth inequality. From a moral, economic, and political perspective our nation will not thrive when so few have so much and so many have so little.”

Indeed, Gates, Bezos and Buffett own more wealth than the bottom half of the American population combined, or 160 million people, according to November 2017 report published by the Institute for Policy Studies, a left-leaning think tank based in Washington, D.C.

Representatives for Buffett, Ellison, Zuckerberg, Gates and Bezos did not immediately respond to a request for comment.

However, Buffett addressed Republicans’ idea to eliminate the estate tax in an interview with Becky Quick on CNBC’s Squawk Box in October 2017.

“I don’t think I need a tax cut,” Buffett said. ”[I]f they passed the bill that they’re talking about, I could leave $75 billion to a bunch of children and grandchildren and great grandchildren, and if I left it to 35 of them, they would each have a couple of billion dollars. They could put it out at 5 percent and have $100 million.

“Is that a great way to allocate resources in the United States?” Buffett continued. “That’s what you are doing through the tax code is you are affecting the allocation of resources.”

Still, some are fierce critics of the estate tax, even at current levels. “You work your whole life to build up a nest egg or a family-owned business or family farm. Then you pass away… Uncle Sam can swoop in and take over 40% of everything you’ve earned over a certain amount. It’s just wrong,” House Ways and Means Committee Chairman Kevin Brady said in August 2017, when the estate tax was being considered then, according to CNN.

Elizabeth Warren says she wants billionaires to ‘stop being freeloaders’

PUBLISHED THU, JAN 31 2019 • 6:43 PM EST | UPDATED THU, JAN 31 2019 • 7:09 PM EST

KEY POINTS

- CNBC’s Jim Cramer checks in with Democratic Sen. Elizabeth Warren, who calls on billionaires like Howard Schultz and Michael Bloomberg to pay “their fair share” in taxes.

- “I want these billionaires to stop being freeloaders,” Warren says.

- The Massachusetts senator is considering a run for president in 2020.

Sen. Elizabeth Warren wants billionaires like Howard Schultz and Michael Bloomberg to subscribe to the United States’ “social contract” and pay “their fair share” in taxes, she told CNBC on Thursday in an interview with Jim Cramer.

“I want these billionaires to stop being freeloaders,” the Democratic senator said on “Mad Money.” “I want them to pick up their fair share. That’s how we make a system that works not just for the rich and the powerful, but works for all of us.”

Warren, who is considering a 2020 run for president, proposed a “wealth tax” on Americans with over $50 million in assets earlier this month. She has also criticized former Starbucks CEO Howard Schultz — who is also weighing a 2020 presidential bid — for thinking he can “buy the presidency.”

On Thursday, the Massachusetts senator broke down her problem with billionaires, even those who contribute to charities and do good social works.

“We have watched billionaires stand up and say, ‘Look, I want to run for president. And one of the first planks in my plan is going to be no new taxes for billionaires,’” she told Cramer.

“The thing about taxes is everybody who is an ultra-millionaire has to pay a portion, not just those who sign up, not just those who wave their hands and say, ‘I’ll do it as long as it goes to the particular charity I like,’” Warren continued. “That is your obligation. That’s part of the social contract. That’s part of being a citizen of the United States of America.”

A 2 percent tax, for example, was “not unreasonable” to impose on the “thinnest one-tenth of 1 percent” who earn multimillions, Warren said, adding that that portion of the U.S. population pays roughly 3.2 percent of their total worth in taxes, compared with the 7.2 percent the 99 percent pays.

That additional money could go to child care, lowering student loan debt, or a Green New Deal, she added.

“All I’m asking for is a little slice from the tippy, tippy top. A slice that would raise — and this is the shocking part, Jim — about $2.75 trillion over the next 10 years,” the senator said. “That’s money we need so that every kid in this country has a decent childcare opportunity, has an opportunity for pre-K, has an opportunity for a decent school.”

The only way for stocks is down as earnings rally hits its peak: Stifel

PUBLISHED FRI, FEB 1 2019 • 8:37 AM EST | UPDATED FRI, FEB 1 2019 • 9:13 AM EST

| Keris Lahiff@KERISALISON |

Earnings season just crossed the halfway mark and stocks are surging.

Better-than-expected quarters from names such as Boeing, Apple, AMD and Facebook pushed the S&P 500 to close its best January in 32 years.

This could be as good as it gets for the market before things turn south, says Barry Bannister, head of U.S. equity strategy at Stifel.

“The problem is the price-to-earnings multiple is about right,” Bannister said on CNBC’s “Trading Nation ” on Thursday. “The earnings growth is not that much this year, so the market is fairly valued and that’s the trouble for upside here.”

The S&P 500 should pull in $165 in earnings per share this year, says Bannister, lower than the nearly $170 estimate compiled by FactSet. Bannister’s estimate implies 3 percent earnings growth, half the growth the Street expects.

“The difficult dollar comparisons [and] weak global growth have really weighed on the growth this year, and if earnings growth this year were only 5 percent, the price-to-earnings multiple should be around 16, 17 times. There’s not a lot of upside at this point,” said Bannister.

Based on his earnings estimate and expected valuation, Bannister says an end-of-year target of 2,725 for the S&P 500 sounds realistic. The index is less than 1 percent from that level.

Bannister says one of the biggest risks to this stock market rally is the Federal Reserve and the possibility it pushes the yield curve to invert through its tightening policy. In that event, so-called bond proxy stocks that offer high dividend yields could offer shelter.

“Some of the staples, most of the utilities, do look like a good defensive trade if the Fed has indeed over-tightened,” said Bannister.

However, in some cases, it’s what you keep out of your portfolio that matters.

“If the yield curve does invert … then the industrials and the cyclicals and the materials that I mentioned are going to be under pressure,” he added. “It’s kind of what you avoid not so much as what you own if there is going to be a slowdown that really blows back on the U.S.”

The yield curve inverts when a shorter-term bond yields higher than a longer-term bond. The Fed’s tightening actions typically effect the shorter-end of the curve. The Fed left rates unchanged at its January meeting on Wednesday and said it would be “patient” with future hikes. The central bank next meets in March.

Baidu: Earnings To Remain Strong

Feb. 3, 2019 7:01 PM ET

Summary

Even accounting for slower earnings growth, Baidu’s earnings multiple of 13 looks dirt cheap.

Gross margins, although dropping, remain over 50%.

Rising costs and R&D still come in under 70% of gross profit.

Remaining long the stock.

This idea was discussed in more depth with members of my private investing community, Elevation Code. Get started today »

Although Baidu, Inc. (BIDU) has rallied back over $170, we still remain underwater on our position by just over $20 a share. We wrote recently how regulation in the company’s search segment has slowed growth. Baidu’s customers are not spending as much as they once did due to this regulation and also a slowing Chinese economy.

When growth stocks hit a speed bump, Wall Street takes notice. Nobody knows whether Baidu’s peer-leading growth will return, irrespective of its fundamentals. We all know how management has been talking up its prospect in the AI space. For example, the fundamentals of the firm’s software (Apollo) in the autonomous driving space look to be really strong. Will progress here though significantly impact the company’s income statement over the next year or so? Probably not.

Instead of solely focusing on slowing growth rates, we believe investors should be focusing in on other areas of the income statement. As mentioned in previous commentary, Baidu’s present earnings multiple of just under 13, for example, is light years behind the industry average of 35. A long investment here is getting plenty of earnings irrespective of growth rates. Apart from that, though, let’s look at Baidu’s income statement and explain what continues to attract us. All numbers below are in Chinese yuan.

- Over the past 10 quarters, Baidu’s cost of revenues has easily outpaced the growth of its top line. Gross margins, as a result, have dropped to around 50%, which is quite a distance from the 70%+ margins the firm enjoyed back in 2010 and 2011. However, I do not feel Baidu’s 50% gross margin number is a cause for concern here just yet. For example, Tencent Holdings Limited (OTCPK:TCEHY) and Alibaba Group Holding Limited (BABA) both are operating with gross margins under 50%, and Alphabet’s (GOOG) is at the 57% mark. Gross margin is a critical metric on the income statement because it demonstrates whether the company in question has a clear competitive advantage or not. Roughly half of what Baidu still sells is gross profit. No cause for concern here.

- When we move onto operations, we have the “Research & Development” tab and “Selling, general and administrative expense”. As we all know, there are many companies that have excellent gross profits, but their operating costs can drive the company into the ground over time. Again, we are focusing in on the important trends here. In the firm’s latest quarter, Research & Development came in at 3.9 billion and Selling, general and administrative expense came in at 5.64 billion. Despite recent content and traffic costs, operating costs have increased by 43% over the past 10 quarters, whereas gross profit has increased by 46%. This is a good starting point. Furthermore, operating expense at present makes up about 68% of the firm’s gross profit. This is important, as it shows Baidu has sustained competitive advantages which are still evident in times of elevated spend.

- Even if operating income growth continues to slow, Baidu may need to continue to pivot in what has become a fiercely competitive tech sector. The company already holds 41.2 billion of debt on its balance sheet. To see how this debt is affecting the income statement, we look at the interest expense line item. Over the past four quarters, Baidu has paid out 1.7 billion in interest payments on its debt. Operating income over the same time frame came in at just over 19 billion. Again, we do not see any adverse trend here in terms of how profits could be affected by debt. Baidu is not financially distressed. This brings stability to the company concerning future growth.

To sum up, analysts who follow this company are projecting 20%+ bottom line growth rates per year on average over the next 5 years. We expect this should move the needle with respect to the share price. If that projected growth does not happen, however, Baidu’s income statement doesn’t look like it will come under pressure anytime soon. Gross margins of 50% continue to drive earnings forward. We maintain this stock remains a Strong Buy at this moment in time.

Disclosure: I am/we are long BIDU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.