HI Financial Services Commentary 05-29-2018

You Tube Link: https://youtu.be/h421hOBCkBc

What I want to talk about today?

How do you do what you do Kevin? – Investor/Trader

Patience = Down 52K or .066% verse a

Nasdaq down -37.26 or -0.50%

DJIA -391.64 or -1.58%

S&P 500 -31.47 or 1.16%

As a Register Investment Adviser I still have Fear, Greed, Emotions, Anger

I can’t catch tops or bottoms of the market but occasionally I do get close.

Buy to Open a Long put – The right to sell at a certain price for a certain period of time.

How do you decide what you can live with BECAUSE you will lose or be losing at times?

If you extend your time horizon you can formulate a plan to “get through” the tough times in the market.

Sometimes when you are close to retirement or in retirement you can’t afford to lose

What happening this week and why?

It was announced that Italy, over the weekend, fought off a consortium or new group that wanted control of the government to exit the Euro and Morgan Stanley/JP Morgan both said that the “wealth management business slowed”

Consumer Confidence is 128.0 vs est 127.5

Case Shiller 6.8 vs est 6.4

Where will our markets end this week?

Higher

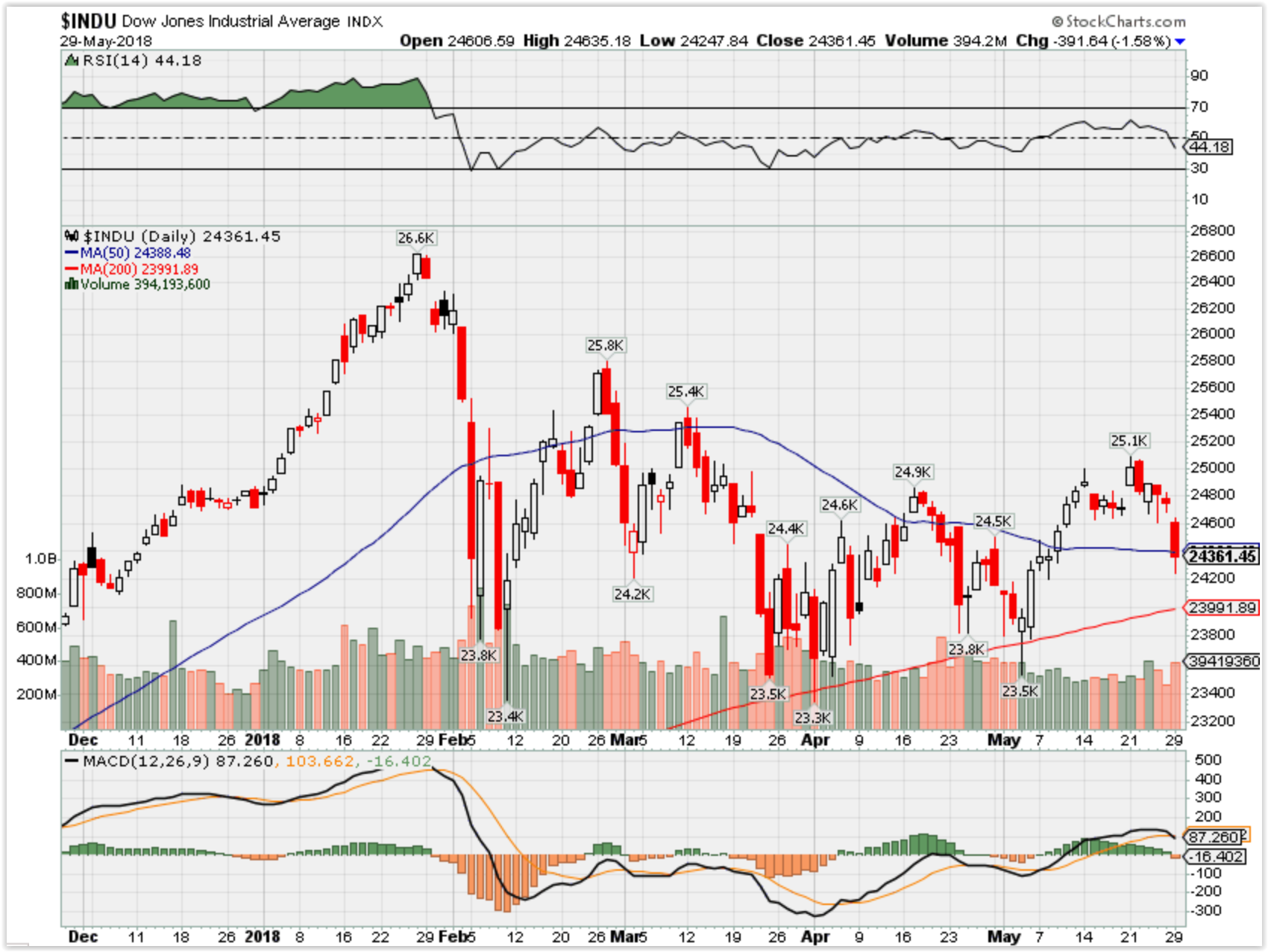

DJIA – Bullish nut turning over and broke the 50 SMA

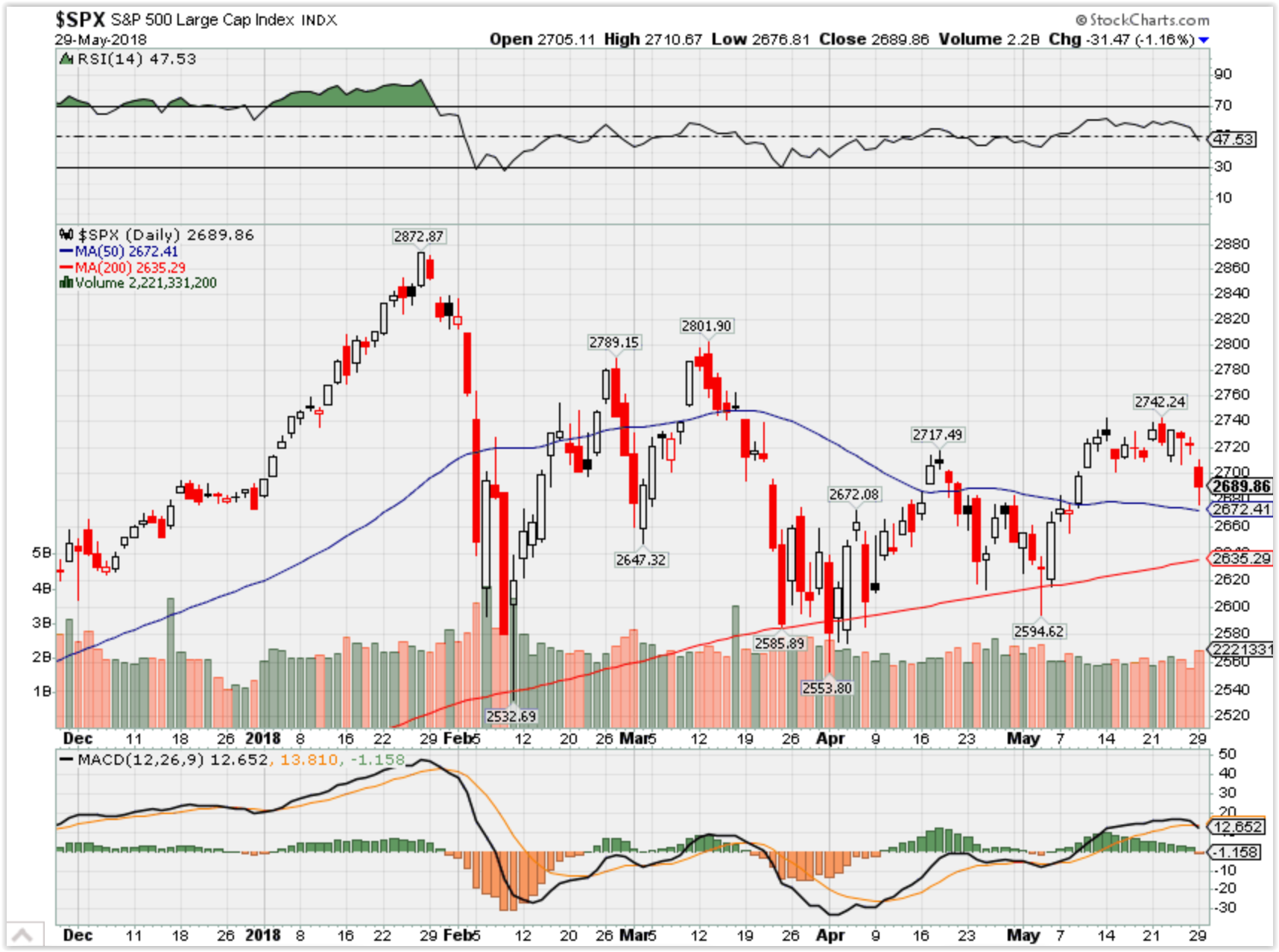

SPX – Bullish but turning over

COMP – Bullish

Where Will the SPX end June 2018?

05-29-2018 -2.0%

Earnings:

Tues: HPQ, CRM

Wed: CHS, DKS, MKORS, MGES, TLYS

Thur: AEO, BURL, DG, DLTR, KIRK, COST, GME, LULU, MRVL, VMW

Fri: ANF, BIG

Econ Reports:

Tues: Consumer Confidence, Case Shiller

Wed: MBA, ADP Employment, GDP-2nd, GDP Deflator

Thur: Initial, Continuing, PCE Prices, Personal Income, Personal Spending, Chicago PMI

Fri: Average Workweek, Hourly Earnings, Non-Farm Payroll, Private Payroll, Unemployment Rate, Construction Spending, ISM Index, Auto, Truck

Int’l:

Tues –

Wed – CN: CFLP Manu PMI

Thursday – CN: PMI Manu Index

Friday-

Sunday –

How am I looking to trade?

Still looking for a 20 VIX to add two to three month out in time short calls to stock positions

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://www.cnbc.com/2018/05/21/goldman-sachs-the-fiscal-outlook-for-the-us-is-not-good.html

Goldman Sachs: The fiscal outlook for the US ‘is not good’

- Jan Hatzius, chief economist at Goldman Sachs, sees the deficit ballooning to $2.05 trillion (7 percent of GDP) by 2028.

- “Lawmakers might hesitate to approve fiscal stimulus in the next downturn in light of the already substantial budget deficit,” the economist said.

- The Congressional Budget Office projects that debtcould equal GDP within a decade, a level not seen since World War II.

Published 12:49 PM ET Mon, 21 May 2018 Updated 6:36 PM ET Mon, 21 May 2018

The fiscal outlook for the United States “is not good,” according to Goldman Sachs, and could pose a threat to the country’s economic security during the next recession.

According to forecasts from the bank’s chief economist, the federal deficit will increase from $825 billion (or 4.1 percent of gross domestic product) to $1.25 trillion (5.5 percent of GDP) by 2021. And by 2028, the bank expects the number to balloon to $2.05 trillion (7 percent of GDP).

“An expanding deficit and debt level is likely to put upward pressure on interest rates, expanding the deficit further,” Jan Hatzius — Goldman’s chief economist — wrote Sunday. “While we do not believe that the U.S. faces a risk to its ability to borrow or repay, the rising debt level could nevertheless have three consequences long before debt sustainability becomes a major obstacle.”

Legislators passed a package of corporate and individual tax cuts in December, a two-year budget deal in February and a massive spending bill in March that boosted government expenditures on both domestic and military programs.

In light of the big spending and easier tax burden, the Congressional Budget Office – Capitol Hill’s nonpartisan financial scorekeeper – in April projected that debt could equal GDP within a decade if Congress extends the tax cuts, a level not seen since World War II.

Economic growth should jump above 3 percent in 2018 thanks to the stimuli, the CBO said, but the acceleration will likely prove brief, and debt held by the public will soar to $28.7 trillion by the end of fiscal 2028.

That could create a precarious situation for Congress if the economy faces an economic downturn in the near term, Hatzius wrote, hampering legislators’ ability provide additional fiscal stimulus.

“Lawmakers might hesitate to approve fiscal stimulus in the next downturn in light of the already substantial budget deficit,” the economist said. “While we would expect some additional loosening of fiscal policy during the next downturn, there is a good chance in our view that it would be less aggressive than it was in the last few recessions.”

But even if the debt and deficit levels don’t prevent lawmakers from approving countercyclical fiscal stimulus during the next recession, a political desire to stabilize the debt level would likely arrest growth during the next recovery, the Goldman team explained.

“The current fiscal expansion … must at some point give way not just to a neutral stance, which we expect by 2020, but to a tightening of fiscal policy that could restrict growth,” Hatzius wrote.

Finally, the economist explained that regardless of how much longer the current expansion persists, increasing deficits and debts naturally put upward pressure on interest rates, expanding the deficit further.

According to estimates by Goldman Sachs, a 1 percentage point increase in the budget deficit raises the 10-year Treasury yield by roughly 20 basis points when the economy is at or beyond full employment, as it appears to be currently.

“Surprises are clearly possible in both directions, but we believe the risks are tilted in the direction of larger deficits than projected,” Hatzius concluded. “While we expect Congress will eventually address the widening budget gap, it also seems quite likely to take longer than most market participants might expect.”

https://www.cnbc.com/2018/05/22/trumps-demand-that-china-cut-its-us-trade-deficit-is-impossible.html

Trump’s demand that China cut its US trade deficit by $200 billion defies the laws of economics

- President Donald Trump’s demand that China cut its trade deficit with the U.S. by $200 billion in two years is tall order politically.

- It also defies the laws of economics.

- Even if China decided to buy that much more from U.S. farmers and manufacturers, it would be all but impossible for U.S. companies to fill those orders.

Published 3:33 PM ET Tue, 22 May 2018 Updated 10:56 AM ET Wed, 23 May 2018

President Donald Trump‘s demand that China cut its trade deficit with the U.S. by $200 billion in two years is tall order politically.

It also defies the laws of economics.

On Tuesday, the president walked back comments over the weekend from Treasury Secretary Steven Mnuchin essentially calling a “truce” in the emerging trade war with China. The administration has threatened to impose steep tariffs on Chinese goods entering the U.S. unless Beijing engineers a $200 billion reduction in its trade surplus with the U.S. by 2020.

“Last year, we lost $500 billion on trade with China,” Trump said, erroneously, at a March 23 news conference. “We can’t let that happen.”

To begin with, Trump’s math is off – by more than $100 billion.

Last year, the U.S. imported roughly $505 billion in Chinese goods (including cellphones, computers, shoes and kitchen appliances) and shipped about $130 billion back (with big orders for airplanes and soybeans), a difference of about $375 billion.

A country’s trade balance is nothing more or less than the difference between the value of everything it imports from a trade partner and everything it exports back to that country. A trade deficit occurs when the value of imports is greater than the value of exports, in terms of both goods and services.

It’s not at all clear that the trade deficit has harmed the U.S. economy, which is enjoying one of its longest expansions in history.

Trump also conveniently ignores a widening trade advantage the U.S. enjoys with China in services, which includes everything from travel to banking.

When a Chinese family travels to Disneyland on an American airline, or a Chinese student pays tuition to an American university, that adds to the trade surplus for the U.S. Last year, the U.S. services trade balance with China widened to $36.8 billion.

But the Trump administration insists that China must take steps to slash its trade surplus in goods by 2020. Even in the unlikely event that Chinese officials agreed to such a massive shift in trade policy, it would be all but impossible to shrink their trade surplus by $200 billion in just two years.

The only way to make that happen would be to reduce U.S. imports from China by that amount, or increase U.S. exports to China – or a combination of the two.

China has little control over U.S. demand for its products and services, which included more than $70 billion in cell phone shipments alone. If the U.S. imposed tariffs on Chinese products, it’s not clear whether consumers would buy fewer cellphones. But they would certainly pay more.

Shifting the other side of the equation – which means boosting U.S. exports by $200 million a year – would be even more problematic.

“Even if we sell them every last soybean we own or produce, its only going to make up a small portion of that $200 billion,” Stefan Selig, an investment banker at Bridgepark Advisors, told CNBC.

The same holds true for U.S. made Boeing airplanes or Ford trucks. Even if China decided to buy $200 million worth of goods from U.S. manufacturers, with the U.S. unemployment rate now below 4 percent, it would be all but impossible to find enough skilled workers to fill those orders.

And despite Trump’s insistence, the U.S. didn’t “lose” $375 billion to China. In return for that money, American consumers and businesses received products that were worth that much more, collectively, than all the goods China received from the U.S.

That’s why most economists look at a wider measure of the economic ties between countries, known as the current account, which includes income from abroad and other capital transfers. When an American company earns profits on a overseas operation, for example, that money is included in the current account balance.

“What really matters is that China’s current-account surplus has been falling since 2008, and now stands at a relatively small 1 percent of GDP,” according Jeffrey Frankel, an economist at Harvard University’s Kennedy School of Government.

https://www.cnbc.com/2018/05/29/santoli-choppy-sideways-trading-likely-ahead-this-summer.html

Historical patterns, valuations and investor positioning suggest choppy, sideways trading this summer

- Up slightly year to date and exactly four months since its peak, the market is clinging to its long-term uptrend as seasonal headwinds build up

- The S&P 500 is now well-anchored near the middle of its 2018 range heading into the summer.

- This year could be similar to 2014, where the market made very little net headway through October before a strong finish to the year.

Michael Santoli | @michaelsantoli

How is the stock market set up heading into summer?

It’s hard to make a confident case the summer of 2018 will either be “hot fun” or particularly cruel.

The weight of the evidence tilts toward some more aimless knocking around, punctuated by a few bursts of excitement, and probably a couple of attempts by the bears to raid investors’ picnic.

Memorial Day weekend marked four months since the major indexes peaked in a crescendo of heedless optimism and maximum momentum, and the past two have seen them settle into a tight band.

Call it rediscovered stability or stalemate or indecision, but whatever the characterization, the S&P 500 has been well-anchored near the middle of its 2018 range. At Friday’s close of 2721, the index was up 5.4 percent from its Feb. 8 closing low, and it would take a 5.5 percent gain from here to match the Jan. 26 all-time high.

The tape showed impressive resilience in April, refusing to buckle despite several trips toward the lower end of the 2018 range. But the thrust behind rallies has been unimpressive and the strength has been selective and shifting within the market.

The forces holding the market in this zone are well-known to the point of being taken for granted now: supported by fast-rising corporate profits, solid consumer trends and favorable credit conditions, while hampered by somewhat higher bond yields, suspense about rising inflation and persistent questions about how much profitable life is left in this cycle.

It’s tough to see how any of these factors resolve themselves decisively in one direction or the other in the next couple of months. The long-term trend still favors the bulls and will continue to so long as the S&P holds within a few percent of the current level. Yet on a tactical basis in the short term, the aggressive equity optimists have a bit more to prove. Recent rallies have failed to surmount the threshold on the S&P 500 — around the 2750 mark — from which stocks fell hard two months ago on a swirl of China trade salvos, Facebook privacy scandal and the latest Federal Reserve rate hike.

The valuation of stocks relative to bond yields — to cite one big-picture relationship — has been steady at levels that seem neutral based on the past decade or so.

The 10-year Treasury hit 2.94 percent in a rush higher on Feb. 21; the yield finished Friday at 2.93 percent on a pullback. On both dates, the S&P sat a bit above 2700. There’s nothing necessarily rigid about that relationship over time, but these asset classes seem engaged in a sort of uneasy equilibrium for the moment.

Back to lows?

Global strategist Michael Hartnett at Bank of America Merrill Lynch has set out what would likely need to happen for the market to break one way or the other out of its sticky range.

For a drop to fresh lows, a slide in U.S. GDP and earnings forecasts and some sort of credit “contagion.” (It would be a decidedly odd, though not unprecedented, year if earnings were up 15 percent or more, as now anticipated, and stocks stayed flat or fell.)

To regain the January highs, he thinks the Fed and President Trump must “blink” and cut back on rate hikes and trade aggression, respectively, while stock buybacks and perhaps a reanimated tech-stock lovefest emerges. It’s quite unclear much of this would have time to develop, say, by July 4, though of course markets attempt to front-run the next economic plot point.

Researchers who study the aggregate bets of the big-money index-options traders for clues about which way the index might be pulled say the pricing of bets expiring in late August suggest a flattish summer that chops around but shouldn’t be too far from 2700. (These traders’ positions collectively don’t always bunch together near the current index price, for those wondering.) The good news is, options dealers don’t see deep and lasting damage to come in summer, but they also aren’t betting on a summer surge.

The familiar seasonal patterns have not been all that helpful to traders and investors in recent years, proving that they are merely broad tendencies and not cues for action. Still, for what they’re worth, this year they seem a headwind.

The hackneyed “sell in May” idea that May-October returns have been weak over the decades has failed in recent years as stocks made good headway in that half a year. But it’s in years when the market was down year to date through April — as it was this year — when the historical weakness mostly shows up. In such years, the May-October S&P 500 return has averaged a 2.9 percent loss.

And Stock Trader’s Almanac chimes in that June in midterm election years since 1950 ranks dead last for average returns.

2014 a guide?

I’ve been keeping an eye on the comparison of this year’s market path with that of 2014. Why? Both years were preceded by unusually strong years (2013 and 2017) with extraordinarily low volatility. Early in each 2014 and this year, there was a nasty shakeout lower amid complacent investor sentiment. In each year, too, the Fed was entering a new phase of removing “easy money” policy — ending QE in 2014 and reducing its balance sheet this year while lifting short-term rates.

As the charts show, the paths are not dissimilar, though the January run-up and February drop this year were more dramatic.

As of Memorial Day weekend in 2014, the S&P was up 2.8 percent, and now is up 1.8 percent. In 2014, credit markets stayed firm and the economy and earnings held up well, but as the highlighted box shows, the market made very little net headway through October before a strong finish to the year.

Source: Yahoo Finance

Source: Yahoo Finance

Not a prediction, just something to ponder over the long days of summer.

These two men paid over $650,000 for lunch with Warren Buffett—here are 3 things they learned

9:00 AM ET Mon, 28 May 2018

The average American spends just over $1,000 a year getting lunch at restaurants. But investors Guy Spier, 52, and Mohnish Pabrai, 53, spent $650,100 on just one lunch for a very special reason: They got to dine with billionaire Warren Buffett.

The businessmen purchased their big ticket lunch in 2007 as part of an annual charity auction for Glide Foundation, which helps the homeless and impoverished get back on their feet.

This year’s auction started on May 27 and concludes June 1. The winning bidder can bring up to seven guests to dine with the Berkshire Hathaway chairman at the Smith & Wollensky steakhouse in New York City.

Last year, the bidding price topped $2.5 million — a steep climb from the $25,000 winning bid when the annual auction began in 2000. While some may scoff at paying such an exorbitant fee for a two-and-a-half-hour lunch (even if it is with the Oracle himself), Spier and Pabrai told CNBC’s Squawk Box in 2010 that it was “worth every penny.”

“I think we would have been willing to pay a lot more than that,” said Pabrai. “Well worth it.”

Not only was the experience “fantastic,” according to the two investors, but they also walked away with three key business lessons:

1. Approach everything with integrity

During their lunch, Buffett explained how he and his longtime business partner Charlie Munger approach the truth, honesty and integrity. “He and Mr. Munger use an internal yardstick,” Pabrai told CNBC.

Buffett gave the men an unconventional method to determine their integrity, asking them, “Would you rather be the greatest lover in the world yet be known as the worst, or would you rather be the worst lover and be known as the greatest?”

“And he said, ‘If you know how to answer that correctly, then you have the right internal yardstick,'” recalled Pabrai.

Spier continued, “It’s a very interesting person who can walk around, imagine that the world, the feedback that they’re getting is that they’re awful at what they do, but deep down they know that what they’re doing is right.”

Buffett has long been a big believer in cultivating integrity, especially at young age, and has previously noted that he looks for this key characteristic in all employees.

“A student [of college age] can pretty much decide what kind a person they are going to be at 60,” the billionaire said in an interview with Nebraska Business magazine. “If they don’t have integrity [now], they never will.”

2. Get comfortable saying ‘no’

Buffett reportedly once said, “The difference between successful people and really successful people is that really successful people say ‘no’ to almost everything.” And he clearly lives by this sentiment, Spier wrote in a 2014 article for MarketWatch.

During their “power lunch,” Spier said that Buffet showed them his diary, which was almost bare. “He likes to leave his time unstructured, and to leave plenty of room for spontaneity,” said Spier.

This isn’t a new habit of his, according to Buffett’s close friend and fellow billionaire Bill Gates. In an interview, Gates said that when he first met Buffett in 1991, he showed him his calendar, and it was largely empty.

This taught the Microsoft co-founder a valuable lesson. “You control your time,” explained Gates, who used to have a penchant for packing his agenda. “It’s not a proxy of your seriousness that you’ve filled every minute in your schedule.”

Years later, nothing has changed for Buffett and the billionaire still credits his “consistently amazing growth” with this ability to say “no.”

Spier pledged to do the same after his lunch with Buffett. He wrote for MarketWatch, “Observing Buffett, I could tell that even though he is a kind man at heart he also has absolutely no trouble enduring the momentary unpleasantness that comes from saying no. As I realized this, I resolved to get a lot better at my own ability to say no.”

3. Do what you love

Buffet also discussed the importance of doing what you love, Spier told CNBC at the time. The billionaire first pointed out that Cecil Williams, founder of the Glide Foundation, does what he loves by taking care of the less fortunate. Buffett then added that he also he loves what he’s doing as the CEO of Berkshire Hathaway.

In fact, Buffett, who is worth $86.3 billion, loves his job so much that he’d be happy doing it for much less. “Certainly with $100,000 a year, I could be very happy,” the billionaire told PBS Newshour.

He urges young people to find jobs that they love in much the same way. “When you go out in the world, look for the job you would take if you didn’t need the money,” Buffett told 40,000 attendees at Berkshire Hathaway’s 2017 shareholder meeting.

“You really want to think about, what will make you feel good, when you get older, about your life, and you at least generally want to keep going in that direction.”

Spier noted that the billionaire’s genuine love for his job was evident at their lunch, adding that it “came across in spades.”