HI Financial Services Commentary 06-19-2018

You Tube Video: https://youtu.be/_lb0IcWXsTg

Keve Bybee

What I want to talk about today?

How do I manage news driven reactions in the market?

– Fear News: No number to price into the market, support and resistance

– Fundamental news: what can we price into stocks? Earnings reports – Puts!/insurance

What happening this week and why?

Covered Calls – Cap upside potential for a certain time period to get a few percentage points of protection.

Selling Premium

AAPL – 200 strike Short call for $1.90 of credit in August.

DIS – 109 Strike Short Call for $1.08 of credit July

Where will our markets end this week?

Lower

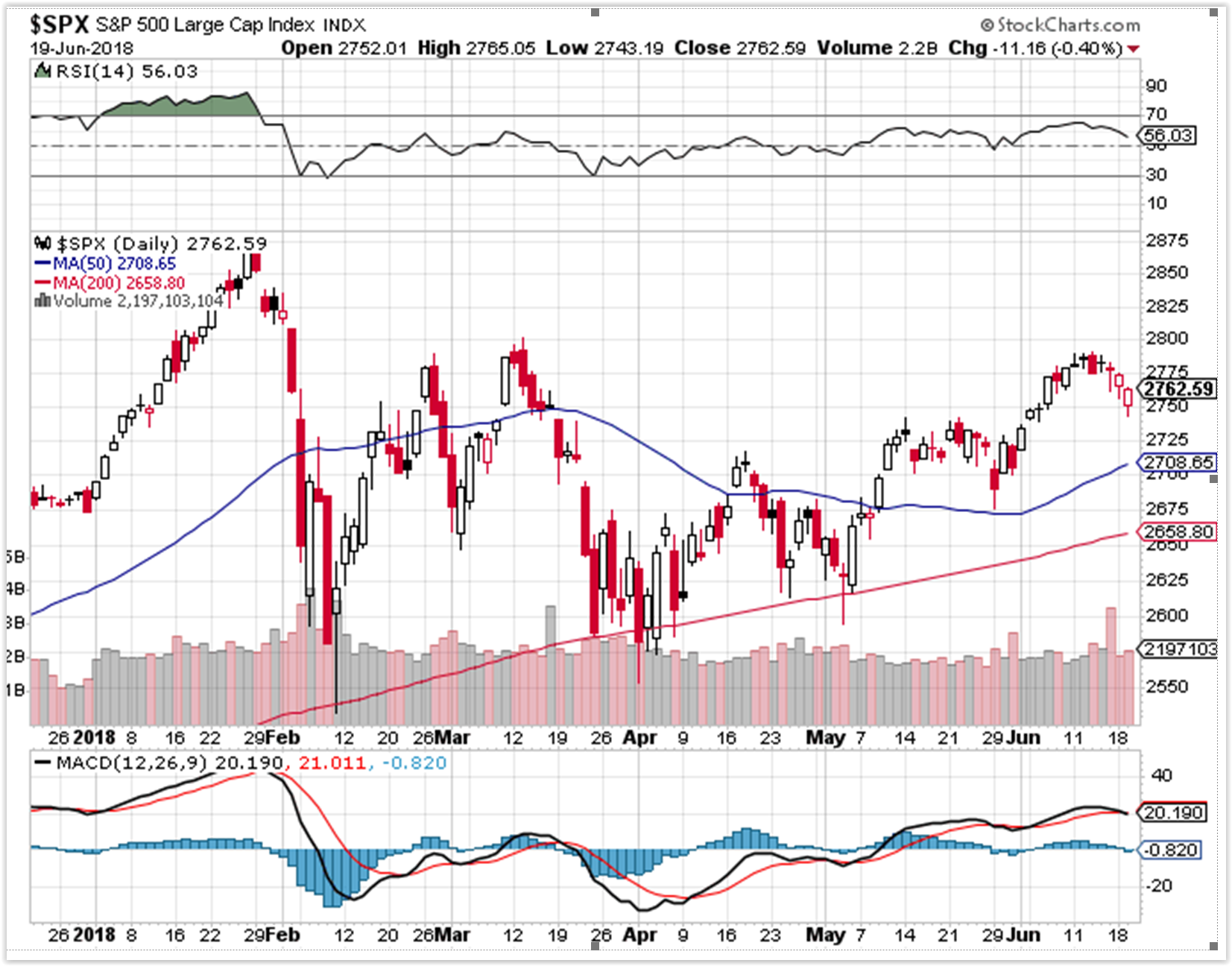

SPX – Down

COMP – test 7600

Where Will the SPX end June 2018?

06-19-2018 -2.0%

06-05-2018 -2.0%

05-29-2018 -2.0%

Earnings:

Tues: ORCL

Wed: AOBC, MU

Thur: RHT

Fri: KMX

Econ Reports:

Tues: NAHB Housing Market Index

Wed: Housing Starts/ Business Permits, Existing Home Sales

Thur:

Fri:

Int’l:

Tues –

Wed – DE: PPI

Thursday – JPN: CPI

Friday- FRA: GDP

Sunday –

How am I looking to trade?

Still looking for a 20 VIX to add two to three month out in time short calls to stock positions

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://www.cnbc.com/2018/06/19/trump-is-wrong-on-tariffs-and-trade-just-look-at-his-iphone.html

President Donald Trump’s threat to impose steep tariffs on Chinese exports to the U.S. would probably inflict a lot more harm on American consumers than it would on China.

To see why, you have to understand how Trump’s policy apparently misreads the reasons the U.S. runs a trade deficit in the first place.

“Last year, we lost $500 billion on trade with China,” Trump said, erroneously, at a March 23 news conference. “We can’t let that happen.”

To begin with, Trump’s math is off — by more than $100 billion.

A trade deficit occurs when the value of imports is greater than the value of exports, in terms of both goods and services.

Last year, the U.S. imported roughly $505 billion of Chinese goods and shipped about $130 billion back, a difference of around $375 billion.

And Chinese-made products like his Apple iPhone, for example, represent a big part of that deficit, even though many of its most valuable parts come from other trading partners.

Some $70 billion of the U.S. trade deficit with China is from shipments of cellphones. But that $70 billion is not an accurate measure of the value China added to the cellphones it shipped to the U.S.

That’s because the accounting used in the “official” trade statistics hasn’t kept up with the growth of global supply chains, which source parts and raw materials from multiple countries to make a single product.

“About two-thirds of world trade now is involved in value chains that cross borders during the production process,” said David Dollar, a senior fellow at the John L. Thornton China Center, in a blog post.

Each country that adds a link in the chain also adds a little value to the final product. But those intermediate contributions are rolled up into the final export value that tallied when the product reaches its final destination. As a result, much of that $70 billion U.S.-China cellphone trade deficit really comes from other U.S. trade partners, such as South Korea, Japan and Singapore.

To better understand why that happens, all Trump has to do is take a closer look at his iPhone the next time he tweets.

Of the $1,000 retail price, about $370 represents the cost of making each phone, including parts and assembly costs, according to an analysis by IHS Markit. The most expensive part, the display, comes from Samsung Electronics in South Korea and represents about $110 of the final price of the phone.

Another $44.45, for memory chips, goes to Japan’s Toshiba and South Korea’s SK Hynix. Other suppliers, from Singapore to Switzerland, provide parts and components that are assembled by a contract manufacturer in China. But the value Chinese workers add by putting those parts together represents only between 3 and 6 percent of the retail price of the phone, according to the IHS Markit analysis.

When the assembled phone is shipped to Apple and its distributors in the U.S., though, the entire $370 cost of making it — including parts — is rolled into the “export value” and becomes part of China’s total trade deficit with the U.S., even though much of the value was added by suppliers in other countries.

That also means any tariff on Chinese shipments of iPhones to the U.S. would also hurt the countries caught in the middle of that supply chain, as well as the American consumers who would pay more for the phone.

Discounts could evaporate

Companies that produce products globally aren’t the only ones who benefit from these multinational value chains. So do the consumers of the much cheaper products that result.

Slapping large tariffs on the movement of goods and materials across borders would quickly drive up the prices of goods whose producers rely most heavily on global supply chains.

American consumers have enjoyed substantial discounts on these goods over the last two decades as the pace of globalization has picked up. With steep tariffs, those discounts would evaporate.

Trump’s obsession with the trade deficit in goods made in China also conveniently ignores a widening U.S.-China trade surplus in services.

When a Chinese family travels to Disneyland on a U.S. airline or a Chinese student pays tuition to an American university, that adds to the trade surplus for the U.S. Last year, the U.S. services trade balance with China widened to $36.8 billion.

The growth in that trade surplus reflects a broader shift in the U.S economy away from manufacturing toward service industries.

And because fewer of those service providers rely on supply chains that cross borders, a greater share of the value they created stays within U.S. borders and benefits American workers.

https://www.cnbc.com/2018/06/19/china-has-a-limited-number-of-weapons-to-use-in-a-trade-war-with-the-us.html

China has a limited number of weapons to use in a trade war with the US

- The U.S. and China moved closer to the brink of a trade war after President Donald Trump threatened another $200 billion in tariffs, responding to a lack of progress made in negotiations.

- Because it imports far less than it exports, China would face limitations in how it could respond to U.S. duties.

- Options include action against U.S. companies in China, currency devaluation, selling Treasurys and easing sanctions against North Korea.

As China and the U.S. near a trade war, both nations bring different weapons to the table. For the U.S., it’s direct tariffs on the plethora of goods it imports, while for China the calculus is a little different.

China is limited somewhat in the amount of retaliatory tariffs it can apply, simply because it doesn’t import nearly as much in American goods compared with what the U.S. takes of Chinese products. China imported just $129.9 billion from the U.S. in 2017, compared with $505.5 billion in exports, according to the Census Bureau.

“China is going to run out of direct reprisals quickly should it look to match the U.S. in tariffs,” LPL Research said in a note. “There is also broad agreement globally that China engages in a range of unfair trade practices, which provides some moral high ground for the U.S. to demand concessions.”

What China does have at its disposal is a handful of other measures that, while not as likely to be implemented as simple tariffs, remain potentially harmful.

Markets are clearly nervous about the possibility of an escalation. The Dow industrials took a big tumble in market action Tuesday while government bond yields and commodity prices also mostly moved sharply lower.

Describing the environment, Craig Erlam, senior market analyst at forex brokerage Oanda, noted that while China “doesn’t want a trade war, it’s not afraid to engage in one” and thus “it’s difficult to see how and when this ends.”

In figuring out how it ends, markets will be watching where it’s going.

Denis Balibouse | Reuters

Chinese President Xi Jinping

While the White House has been clear about where it could go — $50 billion of tariffs already announced plus another $200 billion that President Donald Trump threatened this week — China has been a little less direct. Chinese officials have threatened tit-for-tat tariffs, but eventually could run out of items to target.

“In our view, the most likely outcome is that China responds in kind by introducing tariffs or other import restrictions on US goods or services. This could be calibrated to be proportional in response to the US action,” Goldman Sachs economists Alec Phillips and Andrew Tilton said in a research note earlier this year on the potential implications of a U.S.-China trade war.

The Goldman analysis set out an additional menu of options outside simple tariffs that China could employ.

They include action against U.S. companies operating in China such as boycotts against Apple or Google parent Alphabet, currency devaluation, selling U.S. assets, Treasurys in particular, and changes on geopolitical issues, such as easing sanctions on North Korea.

Each poses certain obstacles — action against U.S. companies could run afoul of World Trade Organization rules, currency devaluation would counteract ambitious measures the government has taken to stabilize the yuan, and selling U.S. bonds or easing North Korean sanctions might not have much impact dollar-wise.

Indeed, on the latter points China has cut its Treasurys holdings 10.2 percent since the peak in late 2013 but still is the global leader with $1.18 trillion on the books. Should China or others around the world continue to reduce their purchases of government debt, the U.S. is hoping that pension funds, insurance companies and private investors step into the void.

One potential strategy, then, for the administration is to simply wear China down in a “trade war of attrition,” as Peter Boockvar, chief investment officer at Bleakley Advisory Group, put it.

The U.S. faces its own risks in such a scenario. Should the administration implement the full $250 billion it threatened, that would be a tax on nearly half the $505 billion in goods the U.S. imported from China in 2017, according to Beacon Policy Advisors.

“We continue to have strong conviction that Trump’s second round of tariffs is all bark and no bite,” Beacon said in its daily report.

Finance Editor

HI Financial Services Mid-Week 06-24-2014