HI Financial Services Commentary 05-22-2018

https://youtu.be/wTmFiA-ZvQY

What I want to talk about today?

What would you plan on doing during this years summer doldrums???

Sell in May and go away?

Are you ready to pay taxes

Blue sky rules – you can’t claim the losses on this years income.

What if you miss the summer run higher 2 out of 3 tears we’ve been higher

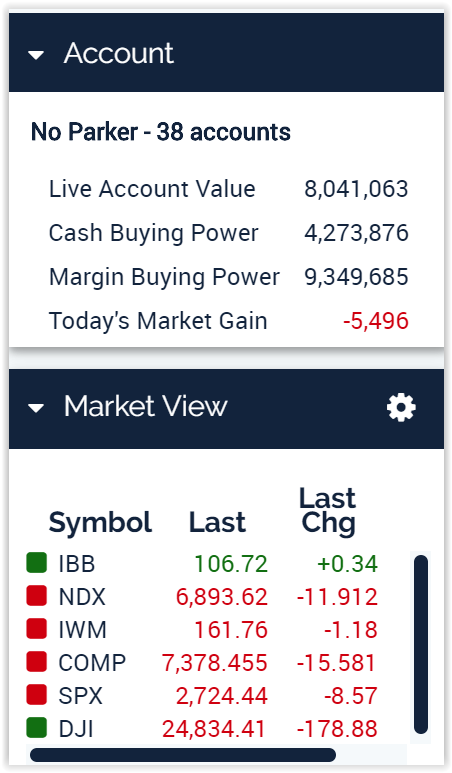

So What am I going to do ? Covered Call Strategy going out to July or August Covered Calls

We are still in “headline RISK” in our market today

What happening this week and why?

Homes Sales report, Durable Goods,

China trade talks with North Korea Summit attendance in the balance

Memorial Day so big money will probably be out by tomorrow or Thursday

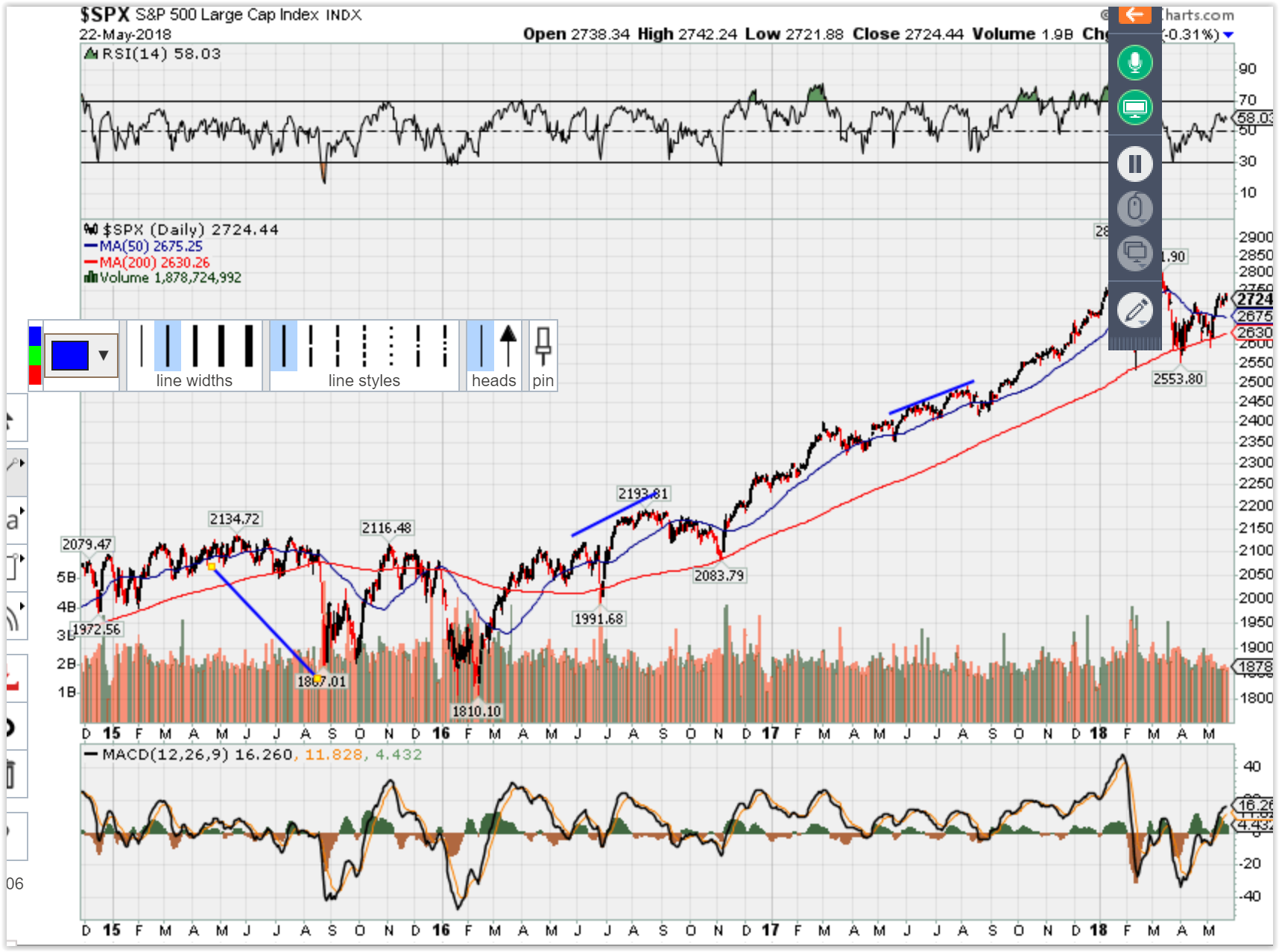

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end May 2018?

05-22-2018 2.0%

05-14-2018 0.0%

05-08-2018 -2.0%

05-01-2018 -2.0%

Earnings:

Tues: AZO, CBRL, HPE, KSS, RRGB, TJX, TOL, URBN

Wed: LB, LOW, NTAP, TGT, TIF, TOYS

Thur: BBY, BURL, DICK, GPS, HRL, ROST, SHLD, SPWH

Fri: Z, BIG, BKE, FL

Econ Reports:

Tues:

Wed: MBA, New Home Sales, FOMC Minutes

Thur: Initial, Continuing, FHFA Housing Price Index, Existing Home Sales,

Fri: Durable Goods, Durable ex-trans, Michigan sentiment

Int’l:

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

I’m looking at longer term July/August Covered calls

Add puts as needed

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

A volatility spike to add covered calls

Two of the supposedly safest stock market strategies are losing badly this year

- Two popular trades, bettingon stocks with low volatility and ones with high dividend yields, have been two of the market’s worst performers this year.

- Combined, the trade is down more than 5 percent, according to Bank of America Merrill Lynch.

- So-called low-vol strategies helped trigger the February market correction, while high dividend yield has gotten hurt by rising interest rates.

Published 11:45 AM ET Tue, 15 May 2018 Updated 4:19 PM ET Tue, 15 May 2018

In a year where the market has been trying to find a direction, investors have been largely looking the wrong way.

Two of the most crowded trades, betting on stocks with low volatility and ones with high dividend yield, have been major losers, according to Bank of America Merrill Lynch. The high-yield strategy has netted a 3.6 percent loss heading into this week, while so-called low beta, which seeks stocks that have less volatility and lower correlation to broad market indexes, has lost 4.4 percent.

Put them together, and the combined trade is down more than 5 percent, BofAML said in a note to clients. An ETF that combines the two strategies, the $2.6 billion PowerShares S&P 500 High Dividend Low Volatility Portfolio, is down more than 6 percent year to date.

Both strategies were considered safety plays after years of low interestrates and little volatility, but have suddenly turned dangerous. The S&P 500 for the year is up about 1.5 percent.

“Market participants have been mispricing risk since the financial crisis, in our view, conflating safety with low price volatility, and capital preservation with high dividend yields,” Savita Subramanian, equity and quant strategist at BofAML, said in a note to clients. “In our factor work, these risks are just now being revealed.”

Investors have been pouring cash into low-volatility exchange-traded funds, and the blowup of the trade played a big role in the early February market correction. Low-vol funds have seen sharp asset growth over the past five years or so.

The biggest of the group, the $14.6 billion iShares Edge MSCI Min Vol USA ETF, has fallen nearly 1 percent in 2018.

For high dividend, the biggest fund in the group, the $21 billion Vanguard High Dividend Yield Index Fund ETF Shares, is off nearly 2 percent year to date.

On the upside, strategic investors should be seeking out secular growth companies, which Subramanian called a “coiled spring.” They’ve outperformed the S&P 500 index by 1.6 percentage points in May.

For April, the best-performing screen was companies that had high “estimate dispersion,” or companies where analysts disagreed most. That group returned 5 percent against the S&P 500’s flat returns for the month. The worst screen was high foreign exposure, which fell 2.2 percent as emerging markets began to fall out of favor.

For the year, companies with the highest earnings estimate revisions have seen strong performance, with a 7.2 percent return.

When earnings look this great, it’s actually a really bad time to invest in stocks

- Corporate earnings are up nearly 25 percent in the first quarter, but the S&P 500 has risen less than 2 percent this year.

- History suggests this is the way it goes: When profits rise by more than 20 percent, market returns have been notoriously low.

- Few on the Street expect this to signal an end to the bull market, but gains could be significantly harder to come by as earnings peak.

Published 10:49 AM ET Thu, 17 May 2018 Updated 11:29 AM ET Sat, 19 May 2018

To the naked eye, corporate profits are in a state of bliss. To history, the perspective is quite a bit different.

Investors have been puzzling over the strange earnings-stocks disconnect this year. With profit growth at a 7½-year high in the first quarter, it would be logical to assume that Wall Street would be roaring and the bull market would be entering a new, even more prosperous phase.

But as impressive bottom-line (and top-line for that matter) numbers continue to roll through, equities are stuck in a funk. The S&P 500 has gained about 1.5 percent in price for the year, a far cry from the nearly 25 percent jump in year-over-year profits for the index.

While that seems odd on the surface, a look back in time says that’s pretty much how it works this late in the economic cycle.

“There’s a contrarian story to tell when earnings growth joins the > 20% club,” Liz Ann Sonders, chief investment strategist at Charles Schwab, said in a recent market note. Investors, she said, should remember that “the stock market has a keen ability to sniff out inflection points in advance.”

“Yes, 20%-plus earnings growth is good news in an absolute sense, but it also likely represents a rate fairly close to the ultimate peak growth rate — beyond which the growth rate will inevitably slow,” Sonders added.

Indeed, the market has been here before, and the results have been about the same.

In fact, earnings growth of more than 20 percent has been the worsttime for stock market performance, other than the rare instances when profits have declined by more than 25 percent, according to data going back to 1927:

Earnings to stocks comparison from 3/31/1927-3/31/2018

| Earnings growth (YoY) | Annualized S&P 500 gain |

| >20% | 2.60% |

| 10%-20% | 7.40% |

| -10% to 10% | 9.20% |

| -25% to -10% | 25% |

| <-25% | -23.70% |

Source: Charles Schwab, Ned Davis Research

The sheer numbers for earnings so far are remarkable.

With 93 percent of companies reporting, 78 percent of S&P 500 companies have beaten Wall Street estimates, which would be the highest level since FactSet started tracking the measure in 2008.

Earnings growth following this week’s report was 24.5 percent, the best since the third quarter of 2010. Ten of the 11 sectors in the index have seen higher growth rates than what was projected.

Finally, the rest of the year looks strong as well. FactSet projects quarterly growth of 18.8 percent, 20.9 percent and 16.7 percent for the respective three quarters ahead, with full-year profit gains coming in at 19.4 percent on 7.3 percent revenue growth.

The reasons for the lackluster market reaction have been well-documented: Fears that this may well be the peak, along with concerns that rising inflation will prompt a strong interest rate response from the Fed which could slow what is expected to be above-trend economic growth ahead.

Further, Sonders pointed out that while falling price-earnings multiples may make the market look cheaper, that’s really just a natural reaction to inflation expectations.

“In simple terms, this is a function of earnings being less valuable when inflation is higher,” she said.

To be sure, neither Sonders nor many other market veterans are predicting that the weak reaction to earnings necessarily foreshadows a recession and an end to the bull market. Instead, the sluggish first-quarter market gains simply could become the norm.

John Lynch, chief investment strategist at LPL Financial, points out that this is the 36th consecutive quarter that earnings have beaten Wall Street estimates, and he expects the momentum to continue. Absent a recession, Lynch sees the bull market continuing.

“We expect strong earnings growth to drive a double-digit return for the S&P 500 in 2018, though as we have seen recently, those gains may come with higher volatility,” he said.

That’s a familiar sentiment on the Street.

“Earnings growth has been exceptionally strong; but much of the latest acceleration is already in the books and partly a function of one-time factors,” Sonders said. “This does not necessarily signal the end of the bull market, but it does suggest the bar has been set quite high, which could lead to both disappointments and bouts of volatility as markets look out toward a slower growth rate and deteriorating profit margins.”

Hundreds of companies are now paying off their employees’ student loans

- Around 70 percent of college graduates are in debt today. The average person leaves school $30,000 in arrears, and many owe more than $100,000.

- Hundreds of companies are now offering student loanassistance to their workers.

- “It’s as meaningful to recent graduates as 401(k)s,” said Meera Oliva, chief marketing officer at Gradifi, a Boston-based firm that designs student loanrepayment programs for companies.

Published 2:00 PM ET Sat, 19 May 2018

Jessica Crowley used to dwell on an unpleasant thought. When her children began college, she’d still be repaying her own student loans.

But a few months ago, the company where she works announced a new benefit: student loan assistance.

Now, New York Air Brake, which makes train control systems, pays Crowley $166 a month toward her student loan balance, which means she’ll be debt-free sooner than she thought.

“It’s going to shorten my loan life by a couple of years,” Crowley, 30, said. “It’s going to be a big difference.”

Student loan assistance, which started as a niche offering by a handful of companies, is finding its way into the mainstream menu of workplace benefits.

“This is certainly emerging as a new and very important benefit,” said David Pratt, a professor at Albany Law School who studies employee benefits.

This year, Fidelity began to offer businesses a way to contribute to their workers’ education debt. Since then, more than two dozen companies have signed up and it expects that number to double by the year’s finish.

“This is going to grow rapidly over time,” said Asha Srikantiah, vice president of workplace emerging products at Fidelity. “We’re seeing so many more people who have debt and who are overwhelmed by that.”

Indeed, 7 in 10 college graduates have student loan debt. The average person leaves school $30,000 in arrears, while nearly 20 percent owe more than $100,000. Americans are now more burdened by education loans than they are by credit card or auto debt.

Companies offering assistance grows

Helping employees with their education debt is a great way to attract new talent, said John Samaan, senior vice president and head of human resources at Millennium Trust Company.

The financial services firm began offering its employees student loan assistance a few months ago. Now, 20 percent of the company’s 300 employees are already enrolled, Samaan said.

“We got a lot more inquiries from potential candidates,” Samaan said. “People want to join us to be able to participate in this program.”

Options Clearing Corporation, a large clearinghouse for equity derivatives, also started providing its employees student loan contributions this year. More than 70 employees signed up within the first month, said Erin Smith, first vice president of total rewards at the company.

She said student loan assistance is the number one benefit being talked about at job and recruiting fairs.

“Most companies provide a pretty standard benefit menu, like medicine, dental and vision, so when you introduce a program that differentiates you, that really matters,” Smith said.

More than 350 companies are administering education debt benefits to their employees through Gradifi, a Boston-based firm that designs student loan repayment programs for companies.

“It’s as meaningful to recent graduates as 401(k)s,” said Meera Oliva, chief marketing officer at Gradifi.

It’s not enough, critics say

To be sure, there’s some skepticism about how much the private sector can remedy a $1.5 trillion — and growing, outstanding student loan debt balance.

“The problem is we’re treating the symptom of a disease — and the disease is that education is more expensive in this country than anywhere else in the world,” said Pratt, the professor at Albany Law School who studies employee benefits.

The country needs a more universal solution, like bringing down the cost of tuition, said Kate Bronfenbrenner, director of labor education research at Cornell University.

“It doesn’t work if it’s provided via employers, because it’s always going to be a small amount that offer it,” Bronfenbrenner said. “And they’re going to provide this, but then take away that.”

Indeed, the number of companies supplying the benefit remains relatively small — around 4 percent, according to the Society for Human Resource Management.

And one of the factors likely contributing to the nation’s swelling student loan debt is that the number of employers helping their workers with their original education costs is shrinking.

Company contributions to undergraduate education expenses dropped to 53 percent in 2017, from 61 percent in 2013, according to the Society for Human Resource Management.

During that same time period, graduate school assistance at work also fell, to 50 percent from about 60 percent.

Still, the benefit can make a big difference for the employees who do recieve it.

For example, if someone has a student loan balance of $26,500 on a 10-year repayment term with a 4 percent interest rate, a $100 a month contribution from his or her employer would free them from their debt three years earlier.

It can also help employees better take advantage of other workplace benefits.

Ed Farrington, head of retirement strategies at Natixis Investment Managers, said the company realized after annual surveys of 401(k) plan participants that student loan debt was hindering millennials’ ability to save for retirement.

“We thought, what can we do to try eliminate one of those barriers?” Farrington said. “And we said we want to start helping people who are carrying student loan debt.”

It seems to be working for Maggie McCuen, 26, public relations manager at Natixis, who’s been receiving the assistance at work for around two years now.

“The money that I would have been spending on the student loan I’ve been reallocating to my 401(k),” McCuen said. “I think I’ve put away at least four times as much.”

Will loan assistance become as big as 401(k)s?

There’s still an unfortunate tax hurdle that will likely stall the growth of a student loan assistance benefit, experts say.

Companies recieve no particular tax incentive for such contributions while employees must report their payments as income to the IRS.

However, recent bills seek to address this. Rep. Rodney Davis, R-Illinois, introduced the Employer Participation in Student Loan Assistance Act, which would make assistance employees receive from their bosses tax free up to $5,250 a year. Employers, for their part, could deduct “the subsidy.”

Companies including Starbucks and Verizon have expressed support for the measure.

“Congress needs to take the next step and make this benefit tax free,” said Mark Kantrowitz, president of Cerebly, Inc. and a student loan expert. “Most people don’t remember that 401(k) plans started in exactly the same way about 35 to 40 years ago.”

https://www.financial-planning.com/index/client-risk-aversion-deepens-amid-trade-war-fears

Index Client risk aversion deepens amid trade war fears

- April 12 2018, 5:51pm EDT

Escalating trade tensions, chaos in the White House and seesawing stock markets are deeply unsettling investors, advisors say.

Clients’ appetite for risk has deteriorated further, according to the latest Retirement Advisor Confidence Index – Financial Planning’s monthly barometer of business conditions for wealth managers.

CurrentQ1: Amount of Client Assets Used to Purchase Equity-Based SecuritiesQ4: Amount of Client Assets used to Purchase Bonds or Debt-Based SecuritiesQ5: Dollar Amount of Client Assets Allocated to Cash12-Jun12-Jul12-Aug12-Sep12-Oct12-Nov12-Dec13-Jan13-Feb13-Mar13-Apr13-May13-Jun13-Jul13-Aug13-Sep13-Oct13-Nov13-Dec14-Jan14-Feb14-Mar14-Apr14-May14-Jun14-Jul14-Aug14-Sep14-Oct14-Nov14-Dec15-Jan15-Feb15-Mar15-Apr15-May15-Jun15-Jul15-Aug15-Sep15-Oct15-Nov15-Dec16-Jan16-Feb16-Mar16-Apr16-May16-Jun16-Jul16-Aug16-Sep16-Oct16-Nov16-Dec17-Jan17-Feb17-Mar17-Apr17-May17-Jun17-Jul17-Oct17-Nov17-Dec18-Jan18-Feb18-Mar18-Apr18-May4050607080RACI, is a monthly barometer of business conditions for wealth managers, based on a Financial Planning survey of planning professionals. Readings below 50 indicate a decline relative to the prior month, while readings above 50 indicate expansion.Retirement Adviser Confidence IndexInteractive: Use the dropdown menu and date slider, or mouse over the image, to filter or drill down.RACI composite18-May50.7Change fromPrevious Month-0.2%70 MonthAverage53.3

At 38.6, the component tracking risk tolerance registered one of its lowest readings since the index was launched in 2012, and remained deep in contraction territory, extending a retrenchment that began in February. Readings above 50 indicate an increase, while readings below 50 indicate a decline.

Many advisors say clients have grown increasingly sensitive to ongoing volatility in equity prices. They also say clients are particularly unnerved by President Trump’s tariffs and the White House’s threats to take even more aggressive actions in that realm.

“Trade has been the single most important indicator of both portfolio and client concerns,” one advisor says.

Fears about the impact of a trade war are accompanied by broader concerns about President Trump’s impulsive approach to governing, according to some advisors, one of whom describes it as a “chaos management style.”

“The president is unstable, and causing further instability,” another advisor says.

Weighed down by the risk component, the composite RACI barely kept above water at 50.7, a drop of 0.2 points. The composite tracks asset allocation, investment product selection and sales, client risk tolerance and tax liability, new retirement plan enrollees and planning fees.

Some advisors say rattled investors are reallocating to cash and fixed-income investments. One advisor highlights the impact on retirement planning, saying clients are “rolling over 401(k) plans to annuities or traditional IRAs with bonds because of the market volatility.”

Many adjustments are taking place within stock portfolios, as clients seek to harvest losses for tax purposes and build positions in more conservative equities.

“While clients expressed concerns about the national and international political scenes, they increased exposure to equities in defensive sectors including food and healthcare,” one advisor says.

Other advisers say many clients are taking renewed stock market volatility in stride, however, by buying on the dips, eschewing macro wagers and sticking to long-term strategies. “We are not a tactical shop, so when stocks go down, we will rebalance into them,” one advisor says.

Overall, the RACI component tracking the amount of client assets used to buy equities fell 1.4 points to 52.6, and the component measuring flows into cash slipped 1 point to 45.8. The component measuring allocations to bonds dipped 3.4 points to 49.9.

Notwithstanding market and policy turmoil, advisors say flows into equities have been sustained in part by clients’ abiding focus on saving for retirement. “Elective deferrals from paychecks into 401(k) plans remained unchanged,” one advisor says.

In fact, the RACI component tracking the dollar amount of contributions to retirement plans jumped 5.2 points to 62.7 as clients boosted tax-protected accounts prior to April deadlines.

“Increased volatility in equity markets made investors less willing to buy equities and more likely to buy fixed income,” says one advisor. “However, with March being tax season, there was an increase in contributions.”

The latest RACI, which is based on advisors’ assessment of conditions in March relative to February, is accompanied by the quarterly Retirement Readiness Index. RRI tracks advisors’ evaluations of their clients’ income replacement ability, likely dependence on Social Security and exposure to big economic shifts.

The number of advisors who say mass-affluent clients would be extremely vulnerable to a significant decline in equity prices improved slightly to about 18%.

Roughly 35% of advisors say a significant increase in health care costs would be extremely damaging to mass-affluent clients’ retirement security, also a small improvement.

In another assessment of clients’ retirement preparations, advisors say they believe that about 62% of mass-affluent clients will be able to replace their income for 30 years by the time they retire, compared with 77% of high-net-worth clients and 80% of ultrahigh-net-worth clients.

Harry Terris

Harry Terris is a Financial Planning contributing writer in New York. He is also a contributing writer and former data editor for American Banker.

HI Financial Services Mid-Week 06-24-2014