HI Financial Services Commentary 03-21-2017

Cramer’s rules to bail out when the market finally corrects itself (it will happen!)

When Jim Cramer first started trading, he didn’t like rules. He believed they either weren’t helpful or would cut into his upside and prevent him from making more money.

After getting burned too many times, he learned the value of discipline.

“The rules protect you against your own bad judgment about what’s going on at the companies you own or what’s happening in the market overall,” the “Mad Money” host said.

In order to really make money in the market these days, investors need discipline. Mistakes can cost you in trading, but if you do nothing with your money, you will have a whole lot of nothing to show for it.

Cramer constantly worries about the stocks in his charitable trust. He sees danger when the stocks in his portfolio go down as the market goes up. That tells him that someone knows something he doesn’t.

One nightmare scenario is what professionals refer to as being “too long.” This means the price of a stock is falling, and investors can’t buy any more stock because they are out of money. Then they decide to make the terrible decision to borrow money to finance your portfolio, a move that Cramer thinks is a terrible idea.

“Stocks aren’t houses. You can’t fall back and live in them if you have mortgages on them. They just get taken away,” Cramer said.

So, what is the magic trick to bail you out of a bad situation?

“Discipline trumps conviction,” Cramer added.

He recommended that investors find their own form of discipline to watch their stocks and have a game plan for when things go wrong. For instance, Cramer has a system of ranking his stocks when things are good, so this way he can hedge himself when they go awry.

He also thinks it is important to “circle the wagons” on a few high-quality stocks, and be willing to buy them when they fall so you can get a better average price for your earnings.

Cramer’s ranking system will get you through the chaotic times and allow you to remain cool and methodical when everyone is scrambling in chaos.

At the end of the day, Cramer wants investors to recognize that things will go wrong. There will be a stock that you own one day where there is something wrong with the company, and you don’t know about it. Events will come that you cannot foresee.

The trick to reducing the damage to your portfolio is to be ready with a game plan that will bail you out in the short term and keep you in the market long term. This way, your money is ready to work for you when you need it most.

So what do we do to protect our portfolios?

ANSWER = Collar trade, protective put, primary and secondary exits,

What’s happening this week and why?

Lots of fed chairs speak today – One dissenter that said NO RATE HIKE.

Republicans have made changes to the health care plan.

This is the home builders, Fed ex, and home reports

Where will our market end this week?

Higher

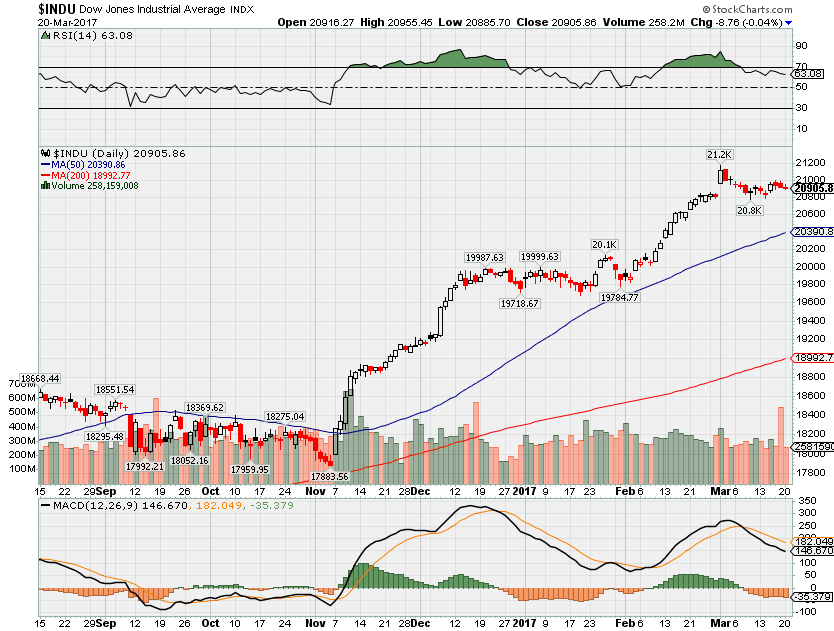

DJIA – Still bullish

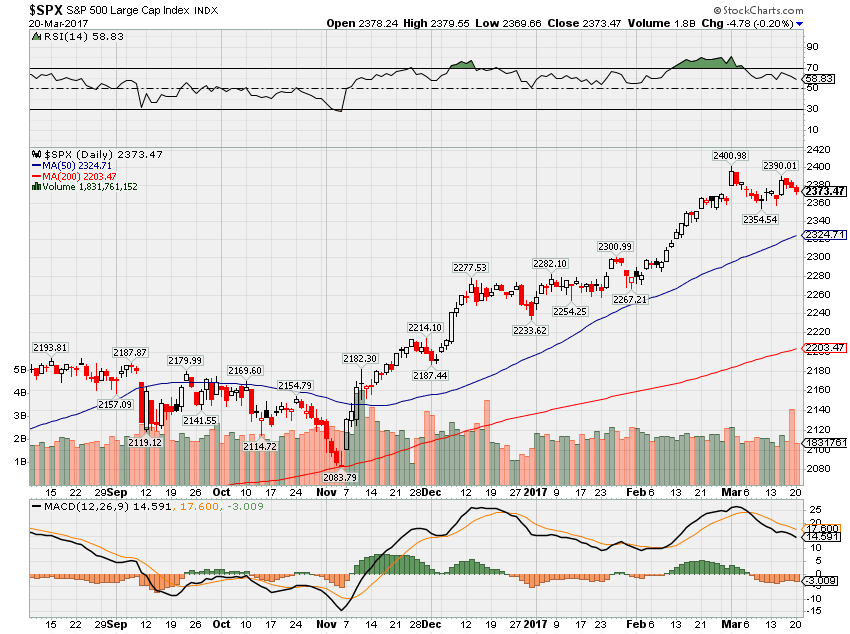

SPX – Bullish

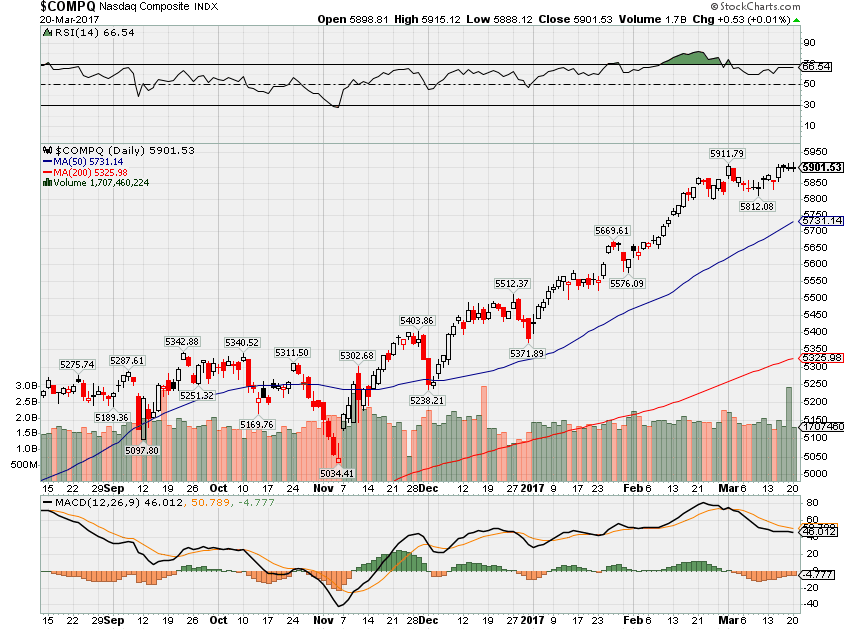

COMP – Bullish

Where Will the SPX end March 2017?

03-21-2017 +2.0%

03-14-2017 +2.0%

03-07-2017 +2.0%

02-28-2017 +2.0%

What is on tap for the rest of the week?=

Earnings:

Tues: FDX, GIS, FUL, NKE

Wed: CTAS, FIVE, PVH, WGO

Thur: GME, KBH

Fri:

Econ Reports:

Tues: Current Account balance

Wed: MBA, Crude, FHFA Housing Price Index, Existing Home sales,

Thur: Initial, Continuing Claims, New Home Starts

Fri: Durable Goods, Durable ex-trans

Int’l:

Tues – JP: BOJ Minutes

Wed –

Thursday –

Friday – JP: PMI manufacturing index, Yellen Speaks

Sunday –

How I am looking to trade?

I have a lot of stocks just running

Questions???

Most of what I’m trying to find are stocks that didn’t run last year

AND most of those happen to be what I was in last year= AAPL, BA, F, BIDU, BABA, DIS, V,

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Op-Ed: The Fed’s stealthy QE — $267 billion of fresh liquidity injected since mid-January

Dr. Michael Ivanovitch | @msiglobal9

While solicitously “guiding” the markets to its “earth-shaking” 0.25 percent interest rate increase last Wednesday, the Fed has been expanding its balance sheet – big time — by buying a huge amount of assets in exchange for cash to reassure equity and bond traders.

Only during the two weeks preceding the push of the federal funds rate (interest rate banks charge each other for overnight loans) to the 0.75-1.0 percent range, a total of $115.5 billion of new liquidity has been created.

If that was meant to confuse the gallery it is mission accomplished. Just look at weird headlines wondering how the markets could rally in reaction to “credit tightening,” and muddled up commentaries about preferred maturities and asset classes as the Fed continues to wind down the long celebration of abundant and cheap credit.

But the gallery has changed. It seems that the famed “Fed-watchers,” drawing six- and seven-figure annual compensations, have all been fired, because now, the ingénues think, the Fed is telling it all in its “forward market guidance.”

So, here is the centerpiece of that “guidance:” The Fed is determined to “normalize” its extraordinarily bloated balance sheet, and negative real interest rates along the yield curve reaching almost all the way to the Treasuries ten-year maturities.

Fool me once …

That’s very much at odds with what the Fed is doing. For example, these $267 billion the Fed added to its balance sheet since mid-January represent one-third of its last “normal” average monthly balance sheet of $820 billion before the onset of the financial crisis in 2008. That huge liquidity creation over the last two months has now brought the Fed’s monetary base to $3.9 trillion – very close to record-high levels observed in August 2014.

What kind of normalization process is that? These numbers look more like a colossal new round of quantitative easing (QE) totally “missed” – but greatly enjoyed – by financial markets.

The Fed is also slipping by another feat of extraordinary economic management: It is increasing the supply of money while raising its price. It looks like the price of money is no longer determined by its demand and supply. But the Fed is doing it: It pushed up last week the effective rate banks charge each other for overnight loans from 0.66 percent to 0.90 percent, even though excess reserves of the banking sector (i.e., the pool of funds for overnight loans) increased since the beginning of this month by $115 billion to an incredibly high level of $2.2 trillion.

It’s like the Groucho’s number: Who ya gonna believe, me or your own eyes?

And the Fed’s magic goes on. The latest rate hike is motivated by an “economy doing well,” and an inflation rate that is still “within the policy targets.”

A good “Fed-watcher” of yore would ask: Economy doing well? You mean an economy that slowed down to an annual growth rate of 1.6 percent last year from 2.6 percent in 2015? Or is the Fed enthusing over the fourth quarter 1.9 percent growth rate — a sharp slowdown from 3.5 percent in the third quarter — because it exceeded the dismal 1.5 percent noninflationary growth potential of the U.S. economy?

Maybe the Fed sees a lot of firepower in the slowing growth of inflation-adjusted after-tax household income?

This income variable drives three quarters of the U.S. economy (private consumption and residential investment), but its growth last year declined to 2.8 percent, well below its 3.5 percent increase in 2015.

Inflation’s structural causes

How about jobs? Yes, we’ve made big strides there, but we are still struggling to connect 14.9 million people (9.4 percent of the labor force) with stable employment. And nearly 40 percent of the civilian labor force is out of the labor market. President Trump apparently counts on German-style vocational training to make these people employable again, but that’s a long-term project still on the drawing boards.

Are we forgetting the promised “massive middle class tax cuts,” the “largest since the Reagan era?”

Well, maybe we are, but it remains to be seen to what extent revenues from taxing the rich, and from an expected faster economic growth, can finance middle class tax cuts. The White House apparently wants a deficit-neutral budget and is rearranging public spending accordingly. That’s the way it should be because the U.S. can’t afford a widening budget gap. Remember, we need to push the primary budget surplus (budget before interest charges on public debt) to 3-4 percent of GDP (from a current deficit of 1 percent of GDP) — and to keep it there for many years — to stop and reverse the progression of America’s $20 trillion in national debt.

Price stability is another problem. The headline consumer price inflation (CPI) shot up to 2.7 percent last month from only 0.8 percent in July 2016; its core component (CPI minus food and energy costs) has been firmly in the 2.0-2.3 percent range for more than a year, and the key service sector prices have also been rising between 3 and 4 percent for a long time.

But the real inflation story is told by the structural nature of unit labor costs – labor compensation minus labor productivity – because they put the floor below any medium-term inflation outlook. Last year’s steadily increasing labor demand drove compensations to an annual growth rate of 2.9 percent. That brought unit labor costs up to 2.7 percent as the result of a pitiful 0.2 percent labor productivity growth.

Two things are readily apparent here. One, we have to increase the supply and skills (i.e., productivity) of employable labor in order to keep down the costs per unit of output. Two, there is nothing the Fed can do here; this is the domain of labor, education, healthcare and trade policies.

Investment thoughts

I believe that the Fed’s strange and unsustainable operations should be seen as a laudable effort to help the new administration come up with appropriate fiscal, structural and trade policies in an environment of orderly financial markets, confident households and optimistic business community.

But the Fed must make clear to legislative and executive authorities that – at this point in the business cycle – it is absolutely essential to focus on price stability. The White House and the Congress must deliver – fast – on their part of the bargain, because any major inflation slippages would totally compromise the growth outlook.

The extraordinary activism of the Trump administration’s economic policy is a good thing. But it has to keep delivering to put steady foundations below the market rally.

One of these things was done last week. Washington deftly used the visit of the German delegation to clarify its trade policy – free but fair – where the fair part has to be defined as a refusal to accept excessive and systematic trade surpluses resulting from inappropriate (aka, beggar-thy-neighbor) economic policies. That is what John Maynard Keynes wrote in the IMF’s Articles of Agreement at Bretton Woods in July 1944. Washington may wish to “codify” that as a binding rule in the G20 platform of international economic policy coordination during the summit in Hamburg next July.

Meanwhile, we need policy coordination at home. The U.S. economy, financial markets and the dollar need a close coordination of monetary, fiscal, structural and trade policies.

That would allow the Fed to review its “forward market guidance” in order to protect its credibility. If that were done, funny things like boosting the supply of money while raising its price would no longer be necessary.

HI Financial Services Commentary 04-13-2016