Trade Findings and Adjustments 04-11-2024

https://youtu.be/tYLiKL_-4Lw

We are looking for trading opportunities in a very volatile market

What trend do we currently see in our markets? = Bearish with a possible bounce

What is causing our market to go down= inflation = no rate cuts = no coolaid, harder for customers and small business owners to make ends meet

There might be 6 trillion on the sidelines according to CNBC Fast Money Show on 4/10/2024

March CPI

Updated: 10-Apr-24 09:08 ET

Highlights

- Total CPI was up 0.4% month-over-month in March (Briefing.com consensus 0.3%) while core CPI, which excludes food and energy, was also up 0.4% (Briefing.com consensus 0.3%).

- On a year-over-year basis, total CPI increased 3.5%, accelerating from 3.2% in February, and core CPI was up 3.8% for the second consecutive month.

- The index for shelter (+0.4%) remained a significant contributor to the overall increase while the index for gasoline (+1.7%) was also a notable source of inflation in March.

Key Factors

- The food index was up 0.1% month-over-month and up 2.2% year-over-year.

- The energy index was up 1.1% month-over-month and up 2.1% year-over-year.

- The used cars and trucks index was down 1.1% month-over-month and down 2.2% year-over-year.

- The apparel index was up 0.7% month-over-month and up 0.4% year-over-year.

- The all items index less food, shelter, and energy was up 0.5% month-over-month and up 2.4% year-over-year.

Big Picture

- The key takeaway from the report is that the yr/yr reading of headline CPI accelerated for the second consecutive month, which will boost expectations for ongoing hawkishness from FOMC officials, in turn pressuring expectations for a rate cut in June.

| Category | MAR | FEB | JAN | DEC | NOV |

| All Items | 0.4% | 0.4% | 0.3% | 0.2% | 0.2% |

| Food and Beverages | 0.1% | 0.0% | 0.4% | 0.2% | 0.2% |

| Housing | 0.4% | 0.4% | 0.6% | 0.3% | 0.4% |

| Equivalent Rent | 0.4% | 0.4% | 0.6% | 0.4% | 0.5% |

| Apparel | 0.7% | 0.6% | -0.7% | 0.0% | -0.6% |

| Transportation | 0.8% | 1.4% | -0.6% | 0.1% | -0.2% |

| Vehicles | -0.2% | 0.6% | -1.4% | -0.3% | 0.9% |

| Motor Fuel | 1.7% | 3.8% | -3.3% | -0.6% | -4.0% |

| Medical Care | 0.5% | 0.0% | 0.5% | 0.4% | 0.5% |

| Educ and Commun | 0.0% | 0.4% | 0.4% | 0.1% | -0.3% |

| Special Indices | |||||

| Core | 0.4% | 0.4% | 0.4% | 0.3% | 0.3% |

| Energy | 1.1% | 2.3% | -0.9% | -0.2% | -1.6% |

| Services | 0.5% | 0.5% | 0.7% | 0.4% | 0.5% |

Commons sense says not a great time for a trade unless it is longer term and energy related

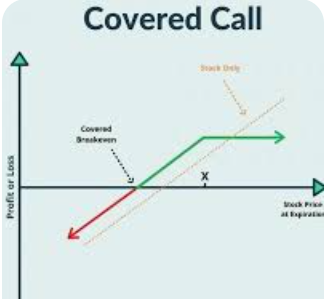

D or EIX Covered Call strategy looks good