HI Market View Commentary 04-08-2024

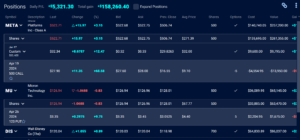

We are going to be talking about taking a profit and adjusting trades today:

IF you are not willing to book your profits then don’t expect to have them “ALL” the profits for you in the future = It cost money to buy protection (puts) and Puts don’t make everything on the way down

IS it a good idea to book 261K or 188K of profit and replace that risk with $9,600

The Big Picture

Last Updated: 05-Apr-24 15:06 ET | Archive

First quarter earnings reporting period will be a breathing exercise

Your ears don’t deceive you and neither will your eyes in due course. Hard as it might be to believe with the fourth quarter earnings reporting season wrapping up not that long ago, the coming week will feature the start of the first quarter earnings reporting period.

It will be a relatively slow start, but the reporting cadence will pick up starting in the third week of April and continuing until mid-May. By then, market participants will have a good line on the results for the March quarter and how companies expect the coming months to unfold for the economy and their earnings prospects.

Here we are reminded that the stock market is not the economy; however, economic activity drives earnings, and earnings (and earnings expectations) drive the stock market. There is no escaping that, which is why every earnings reporting period starts with an inhale and typically (but not always) ends with an exhale.

An Uncommon Development

The fourth quarter reporting period warranted its share of breathing exercises. It didn’t get off to a great start. When we penned our preview of that period in mid-January, the blended fourth quarter earnings growth rate (combines actual results with estimates for companies that have yet to report) was 0.4%. On January 26, it stood at -1.4% (inhale).

When the fourth quarter reporting period ended, the earnings growth rate had settled at 4.3% (exhale).

So, where does the first quarter blended earnings growth rate stand today? It is at 2.9%, according to FactSet. That is down from 5.8% on December 31.

It is not uncommon for the earnings growth rate estimate to be reduced ahead of the reporting period. What is uncommon about this reporting period is that analysts haven’t reduced earnings estimates as much as they normally do.

According to FactSet, the median bottom-up estimate for the first quarter decreased by 2.5% between December 31 and March 27 versus an average decline of 3.7% over the past 20 quarters.

It is understandable why the estimate cuts haven’t followed form with the historical average. The main reason is that the economy hasn’t followed form with the history of a tightening cycle. It has continued to defy expectations that the impact of the so-called lag effect of prior rate hikes would hit more forcefully.

Remarkably, the economy has shown signs of strengthening. Real GDP increased 3.1% in the third quarter, 3.3% in the fourth quarter, and is projected in the Atlanta Fed GDPNow model to grow 2.5% in the first quarter. The overarching point is that there is no contraction evident in those figures, or any substantive slowdown, despite the Fed raising rates 11 times between March 2022 and July 2023.

Estimates Holding Up

We would venture to say, then, that there is optimism in front of the first quarter earnings reporting period. One could stake a claim on that assertion by pointing to the S&P 500 closing at a record high at the end of the first quarter while interest rates were going up.

The interest rate increase was a byproduct of the stronger-than-expected economic data, as well as some sticky inflation data that forced the market to rethink its outlook for Fed rate cuts.

In brief, the year began with an expectation for six cuts by the end of the year. The current expectation is that there will be three rate cuts by the end of the year. Market pricing, however, is entertaining the idea that there might only be two rate cuts, and, alternatively, there have been assertions from some Fed officials that there might be no rate cuts if progress on inflation stalls.

The good news is that there has been no stalling in the economy, which is why earnings estimates have held up as well as they have, not only for the first quarter, but for the calendar year and forward 12-month period as well.

The market has been excited by that and has arguably run ahead of the good earnings news embedded in consensus estimates. Hence, there has been multiple expansion, which is to say stock prices have seen a bigger percentage increase than earnings estimates have. To wit: the S&P 500 has surged 9.4% since the start of the year while the forward 12-month EPS estimate has increased by only 3.2%.

The Trend Has Been the Market’s Friend

The earnings estimate trend, though, has remained the market’s friend. With the market-cap weighted S&P 500 sporting a premium valuation, it is important that relationship stays on good terms.

So, in connection with the first quarter reporting period, the quantitative and qualitative guidance coming out of it will carry a lot of weight with respect to moving the market. Optimism is high, but so is the bar in terms of valuation.

Guidance disappointments will be dealt with prudently by the market, and, in some cases, quite rudely as the benefit of living up to higher growth expectations gets ripped away.

The attention to guidance will be most acute in the higher-growth pockets of the market, namely the information technology and communication services sectors, as well as in the cyclical corners of the market, namely the industrials, materials, and consumer discretionary sectors.

The banks do not tend to provide much in the way of specific earnings guidance, but their qualitative assessment of loan demand and loan quality, coupled with their provisions for loan losses, will offer some meaningful perspective on economic conditions.

Before the guidance, though, comes the actuals for the first quarter.

FactSet informs us that the projected earnings growth in the first quarter will be provided by the information technology (3.68 percentage points), communication services (1.67 percentage points), consumer discretionary (1.05 percentage points), utilities (0.64 percentage points), financials (0.13 percentage points), and real estate (0.13 percentage points) sectors.

The remaining five sectors are all expected to subtract from earnings growth. The energy sector (-2.31 percentage points) is estimated to be the biggest drag followed by health care (-1.16 percentage points).

What It All Means

That, of course, is how things stand today (inhale). These projections will all change in the ensuing weeks. Some will move up and some will move down. Presumably, if history is any guide, the final tabulation will result in first quarter earnings growth for the S&P 500 that is at least two percentage points higher than the 2.9% growth rate projected today (exhale).

If the stock market wants some breathing room, though, as it works its way through the second calendar quarter, then the guidance during the first quarter reporting period can’t be a choking hazard. That would take the market’s breath (and maybe its breadth) away.

—Patrick J. O’Hare, Briefing.com

Earnings dates:

Where will our markets end this week?

Lower

DJIA – Bearish

SPX –Bullish

COMP – Bullish

Where Will the SPX end April 2024?

04-08-2024 +2.0%

04-01-2024 +2.0%

Earnings:

Mon:

Tues: WDFC

Wed: DAL,

Thur: KMX, FAST,

Fri: BLK, WFC, JPM

Econ Reports:

Mon:

Tue

Wed: MBA, CPI, Core, CPI, Wholesale Inventories, FOMC Minutes, Treasury Budget

Thur: Initial Claims, Continuing Claims, PPI, Core PPI

Fri: Import, Export, Michigan Sentiment

How am I looking to trade?

Letting stock runs as the trend is bullish = DIS $120, SQ $80, MU $123, BIDU $104

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Yellen warns China’s surplus of solar panels, EVs could be dumped on global markets

PUBLISHED WED, MAR 27 20243:34 PM EDTUPDATED THU, MAR 28 20245:48 PM EDT

KEY POINTS

- Janet Yellen warned in a Wednesday speech that China’s surplus of clean energy products is depressing prices in global markets and squeezing U.S. green manufacturing.

- After years of clean energy investment, China has an excess of solar power, EVs and lithium-ion batteries, allowing it to export those products at cheaper prices to markets around the world.

- Yellen plans to confront her Chinese counterparts about these trade practices during her upcoming visit to China.

- The U.S. is trying to grow its own clean energy industry domestically with investments from new legislation, but is still playing catch-up with China’s green energy sector.

Treasury Secretary Janet Yellen on Wednesday warned that China is treating the global economy as a dumping ground for its cheaper clean energy products, depressing market prices and squeezing green manufacturing in the U.S.

“I am concerned about global spillovers from the excess capacity that we are seeing in China,” Yellen said during a speech at a Georgia solar company called Suniva. “China’s overcapacity distorts global prices and production patterns and hurts American firms and workers, as well as firms and workers around the world.”

China has a surplus of solar power, electric vehicles and lithium-ion batteries that it can ship out to other countries at cheaper prices. That makes it difficult for the more adolescent green manufacturing industries of the U.S. and elsewhere to compete.

Yellen said she intends to put pressure on Chinese officials about these trade practices during her upcoming visit to China.

“I plan to make it a key issue in discussions during my next trip there,” she said. “I will press my Chinese counterparts to take necessary steps to address this issue.”

The secretary’s concerns come as the White House tries to build a burgeoning clean energy industry domestically with investments from the 2022 Inflation Reduction Act, along with other legislation like the CHIPS and Science Act.

Yellen has regularly touted the gains from these investments, including at another recent speech where she doubled down on the electric vehicle “boom” spurred by the IRA.

But those investments are playing catch-up with China’s government.

“The Biden Administration also recognizes that these investments are new,” Yellen said Wednesday.

Meanwhile, China has been pouring billions into clean energy for years, outpacing the rest of the world in the energy transition.

Yellen added that the more China’s clean energy glut interferes with global market prices, the worse off supply chains for these energy sectors will be.

“President Biden is committed to doing what we can to protect our industries from unfair competition,” Yellen said.

The Chinese Embassy in Washington denied the notion that there is an excess of Chinese clean energy products.

Yellen’s comments highlight ongoing U.S.-China trade tension even as the two countries try to steady relations.

President Joe Biden met with Chinese President Xi Jinping in November as an olive-branch effort to break the ice after years of tension, marked in part by a tariff war launched by former President Donald Trump.

Trump has floated reinstating significant tariff levels on Chinese products if he wins a second presidential term.

In the time since the Biden-Xi meeting, strengthening U.S.-China relations has proven a precarious effort due to ongoing cybersecurity and trade concerns.

In February, Biden launched an investigation into Chinese smart cars, which he said pose a national security risk because they connect to U.S. infrastructure when they drive on American roads.

“China is determined to dominate the future of the auto market, including by using unfair practices,” Biden said in a February statement. “China’s policies could flood our market with its vehicles, posing risks to our national security. I’m not going to let that happen on my watch.”

How Dana Walden could defy critics and become Disney’s first female CEO

PUBLISHED MON, APR 1 20245:00 AM EDTUPDATED MON, APR 1 20243:56 PM EDT

KEY POINTS

- Dana Walden is in the running to be Bob Iger’s successor as Disney CEO, according to people familiar with the matter.

- If she is chosen, Walden would be the first female CEO of Disney in its 100-year history.

- She’s proven herself as a TV executive, but some former Disney executives question whether her resume is suitable for the top job.

- More than 20 colleagues and friends spoke with CNBC about her strengths, faults and the perceived likelihood she will take over for Iger.

In 1994, a captain of the media and entertainment industry saw something in Dana Walden that made him think she was capable of a bigger role.

Thirty years later, that may happen again.

That first time, the executive was Peter Chernin, then president of 20th Century Fox Filmed Entertainment and later president and chief operating officer of Rupert Murdoch’s News Corp. Chernin plucked Walden from Fox’s corporate communications division and gave her a job in TV.

In 2024, the executive is Bob Iger, Disney’s CEO, and the position he’s considering Walden for is that of his successor, according to people familiar with the process. The appointment would make Walden the first female CEO of the Walt Disney Co. in its 100-year history.

Just a year into her early career at 20th Century Fox, working in publicity, Walden delivered a presentation at a company retreat in Santa Barbara, California. She was determined to leave a lasting impression on Chernin, now chairman and CEO of investment firm The Chernin Group, after several encounters in which he’d never remembered her.

To get his attention, Walden decided to be bold. She told Fox executives, including Chernin, that they weren’t being aggressive enough to secure top talent. Fox needed to take bigger swings to generate relationships and land shows that could make it to syndication, Walden argued. A spokesperson for Walden confirmed the details of the presentation.

When the retreat ended, Chernin called Peter Roth, then president of 20th Century Fox Television, who later ran Warner Bros.′ TV division.

“The next day she was in my office, and we gave her a job in programming,” Roth said in an interview.

That set Walden on a career course correction that’s led her to the doorstep of becoming Iger’s successor.

Walden, co-chair of Disney Entertainment, is competing internally with Disney Experiences Chairman Josh D’Amaro, ESPN Chairman Jimmy Pitaro, and Alan Bergman, who is Entertainment co-chair with Walden, to be named the next CEO of Disney, said the people familiar, who asked not to be named because the discussions are private.

Iger plans to name a successor and then stick around at Disney to teach that person the job before departing at the end of 2026, CNBC reported in September. He’s fighting to maintain control of Disney’s future against a threat from Trian Partners’ Nelson Peltz.

Peltz has argued he should help spearhead a successor search, considering Iger has pushed back his retirement five times and returned to the job after Bob Chapek, named CEO in 2020, was fired in 2022. Peltz has claimed the Disney board can’t be trusted to handle succession. Disney shareholders will vote on Peltz’s candidacy to the board at its annual meeting Wednesday.

Several executives at Disney privately told CNBC they believe Walden, 59, is the favorite to land the top job, though they have no inside knowledge of the process, and their proximity to Walden may skew their perception. Her relationship with Iger (she lives just blocks from his house in Brentwood, California), her track record of success as a TV executive, her trust among Disney board members, and the symbolism about what it would mean to have a female executive all work in her favor.

“She’s the single best talent exec to come out of TV in the last 20 years,” Chernin said in an interview.

“She would be an outstanding CEO,” Roth added. “Absolutely outstanding.”

Walden declined to comment for this story. More than 20 colleagues and friends spoke with CNBC about her strengths, faults and the perceived likelihood she will take over for Iger.

Allies of Walden’s told CNBC she won’t even discuss succession with them (though many said they tease her about it), choosing to focus on the job of running Disney Entertainment with Bergman that she’s tasked with today.

She faces stiff competition in the other Disney division heads. Walden has spent the last three decades focused on producing TV hits. She hasn’t had the same range of responsibilities as Pitaro, who has run the company’s sports media empire since 2018. And she has no experience running parks and resorts, which Iger and the board may decide is more essential to Disney’s future than a TV business with hazy financial prospects in the streaming era.

Six former colleagues — all of whom worked closely with Walden — privately questioned her business acumen in interviews with CNBC.

“There are people that are in creative positions that rise to a level of management who figure out what a P&L [profit and loss] statement is, what a balance sheet is, what quarterly earnings are,” said one of the people, who asked to remain anonymous to speak candidly. “Dana doesn’t really bother with any of that.”

A second former coworker said Walden’s profile simply doesn’t translate to becoming the Disney CEO — a job that involves close investor interaction, geopolitical deals for parks and resorts, and strategic thinking around acquisition and investment.

“She’ll be eaten up by real investors,” said the person, who likewise requested anonymity. “Does she have the necessary depth of business knowledge? She can learn, but you can’t have someone teach you decades of finance, business and tactics in a year or two.”

Walden supporters dismissed those concerns as either simply incorrect or an example of persistent stereotypes against female executives. Walden has met with many institutional investors through her years at Disney, according to people familiar with the matter.

“There’s something about looking at female execs where questions are asked that would never be asked of men,” said Jennifer Salke, the head of Amazon Studios and a former colleague of Walden’s. “Can they scale? Can a creative person be a business leader? I find that to be a huge bugaboo. She’s in charge of billions of dollars of assets, but she’s not capable of being a business leader?”

Walden defenders brush off criticism from ex-Disney colleagues as the remnants of a grudge against Fox employees who came over as part of Disney’s $71 billion acquisition of Fox’s entertainment assets in 2019, or perhaps as part of an ulterior motive to diminish her CEO prospects in favor of their own preferred candidates.

“At some point, everyone running anything was something before that,” Chernin said. “Anybody they choose will have never been the Disney CEO prior to that.”

Hollywood ties

Chernin and Walden both began their careers in public relations, making them two of a small club of TV executives who started that way — former HBO head Richard Plepler is another exception. Chernin saw Walden’s background as a strength, rather than a weakness.

“She knows nothing is more important to a studio than talent relationships,” said Craig Hunegs, who worked closely with Walden when he was president of Disney TV Studios from 2019 to 2021.

Walden’s entire life has ties to Hollywood. She grew up modestly in Studio City, a neighborhood of Los Angeles, and attended the private Westlake School for Girls (a predecessor of the coed Harvard-Westlake School), where she became friendly with Carol Burnett’s daughter Carrie Hamilton.

Walden’s parents made connections in the entertainment industry from their time living in Las Vegas, where her mother was a background dancer who performed with George Burns, among other artists. Her father became a member of The Friars Club, famous for its Dean Martin celebrity roasts, and established friendships with entertainers including Martin and Buddy Hackett. Walden spent her childhood years with celebrities as family friends, attending dinner parties and occasionally celebrating holidays at their homes. She went on to marry a member of the entertainment industry, producer Matt Walden, in 1995; they have two daughters, now in their 20s.

After graduating from the University of Southern California, Walden took a job working for public relations firm Bender, Goldman & Helper, starting out as a receptionist and an assistant. Within four years, she’d become a vice president.

At Bender, she represented “The Arsenio Hall Show” on behalf of her client Paramount. The show poached Walden to come work as head of marketing for Hall’s production company. Less than a year later, Lucie Sulhany, president of Paramount Domestic Television, took a job as a high-ranking Fox TV executive. She asked Walden to come along and work in publicity, and Walden joined her with an eye toward eventually making TV shows.

Mastering the TV business

At Fox, Walden and fellow TV executive Gary Newman jointly began running the studio business — the engine of the company that makes series both for itself and other networks. Starting in 1999, they kept that position for the next 15 years until they were promoted to run all of Fox Broadcasting in 2014.

A former attorney, Newman began his partnership with Walden handling many of the business issues, while Walden developed a reputation for winning over creative talent and having impeccable taste for both dramas and comedies.

“People used to joke we were work spouses,” Newman said in an interview. “She was very good at the job very quickly. It’s just a combination of being smart, being really fast, being curious, being fearless.”

Over time, Walden mastered the business side of TV, according to Newman and others who have worked with her.

“The difference between Dana in the beginning of our partnership, when she leaned on her creative background, and where she was a few years later was night and day,” Newman said. “She picked up what she needed to pick up about business. I had a surgery at one point — the responsibility fell on Dana to be in there for me. That included being in charge of the business side of things.”

Newman recounted one difficult negotiation over a Fox-produced show with CBS. It was the day before CBS would announce its fall schedule, and it wasn’t clear if the broadcast network would pick up the series. CBS gave Newman and Walden a midnight deadline to revise a deal on its terms or it would cancel the show. Walden told Newman that CBS was bluffing, realizing the show was the linchpin for other programming that day. She persuaded Fox to simply ignore the deadline. The next day, CBS included the series, proving Walden right.

“I don’t know if she plays poker, but she’d be a great poker player,” Newman said.

Fox’s studio began churning out hits, including “24,” “Homeland,” “How I Met Your Mother,” “Sons of Anarchy,” “Modern Family,” “This is Us,” “New Girl,” “Bob’s Burgers,” and mini-empires created by Seth MacFarlane (“Family Guy,” “American Dad,” “The Cleveland Show”) and Ryan Murphy (“Nip/Tuck,” “Glee,” “American Horror Story,” “9-1-1”).

Walden began making lasting relationships with TV showrunners and producers who have repeatedly worked with her, including MacFarlane, Murphy, “Modern Family” co-creator Steve Levitan and “This is Us” creator Dan Fogelman. She earned a reputation for her creative notes on scripts, particularly on shaping “24,” an unusually constructed drama that ran from 2001 to 2014 and earned critical praise for its storytelling techniques, according to Rick Rosen, a partner and head of TV of the talent agency WME .

“People felt her notes and constructive criticisms helped move that show forward,” recounted Rosen, who represented Howard Gordon, at one time the “24″ showrunner. “She helped get it unstuck.”

Walden’s taste, her discipline around getting talent to deliver on budget, and her honesty about what’s working and what isn’t have set her apart from other executives, according to Levitan.

“Hollywood is a business of relationships,” Levitan said. “What you can’t teach somebody is how to inspire people. She is whip smart. If there is a subject that she needs to take a deep dive on, she’s going to be an expert in that subject before you know it.”

Joining Disney

Disney’s acquisition of Fox moved Walden to a new company with a new culture. Iger called Walden on the day of the deal’s announcement in December 2017 to let her know he wanted her to come to Disney, according to people familiar with the matter. Newman planned to stay at Fox; he ultimately exited the company in 2018.

Walden hoped she’d run Disney’s TV unit as a direct report to Iger, according to people familiar with her thinking at the time. But Iger wanted Peter Rice, Walden’s boss at Fox, for the top job. Passed over, Walden considered walking away from both Disney and the studio she helped build for other opportunities, the people said.

Still, she had a strong relationship with Rice, who ultimately persuaded her to stay despite her disappointment. Walden eventually took Rice’s job when Disney fired him in 2022 after Chapek and some members of the Disney board concluded he wasn’t a team player, specifically noting that he’d privately criticized the company’s messaging around Florida’s controversial “Don’t Say Gay” legislation, according to people familiar with the matter. Chapek told Rice he wasn’t a culture fit despite years of Rice receiving positive feedback, the people said. A Disney spokesman and Rice declined to comment.

“The conversations around selling a series — licensing fees, profit participation, residuals — or discussions about budgets, and how many guest stars we can sign, or which platform a series should air on … all of that I’ve done directly with Dana,” said Rich Appel, the executive producer and co-showrunner of “Family Guy.” “No disrespect to Gary [Newman], but for the past few years, it’s only been Dana.”

At Disney, Walden has hit several home runs, including FX’s “The Bear,” Hulu’s “The Dropout” and “Only Murders in the Building,” and ABC’s “Abbott Elementary.” She has heavily invested in marketing children’s show “Bluey,” which in 2024 has spent time as the most-watched show on all streaming services. She has also focused on building up Disney+’s family programming with originals including “Percy Jackson and the Olympians,” “Spidey and His Amazing Friends” and “Goosebumps.”

Still, critics say it’s easy to cherry-pick the successes and ignore the failures. One Disney insider said that grading Walden’s performance honestly would require a robust analysis of all the shows she’s greenlit.

The anti-Chapek

The last time Iger chose a successor, it didn’t go well. As outlined by CNBC in 2023, the relationship between Chapek and Iger, who remained Disney’s executive chairman until the end of 2021, fell apart, and the Disney board ultimately fired Chapek and brought Iger back less than three years later.

Iger returned as CEO in part to right the wrong he believed he made by selecting Chapek as his successor, according to people familiar with his thinking. If he’s looking for the anti-Chapek candidate, Walden fits the description.

Chapek climbed the corporate ladder at Disney for 30 years by showcasing his business and finance chops. He studied microbiology at Indiana University and got his MBA from Michigan State University. He developed expertise in the minute details of Disney’s parks and resorts, such as how specific hotel discounts could affect park attendance and the price elasticity of seasonal ticket rate adjustments.

But he had almost no Hollywood relationships. Without a foundation of trust, “The Town,” as Hollywood is known, turned on Chapek. Agents, producers and showrunners blamed him for Disney’s forceful public rebuke of A-list star Scarlett Johansson in a Covid pandemic-related contract dispute and for bungling the company’s response to “Don’t Say Gay,” as CNBC reported in 2023.

Walden’s resume sets her up as Chapek’s inverse: a Disney outsider whose Hollywood ties are among the best in the industry. In the latter months of Chapek’s tenure as CEO, as CNBC reported, Disney communications head Kristina Schake began setting up meetings for Chapek with Hollywood’s power players — at Walden’s house.

A potential handover from Iger to Walden would also look very different from the Iger-Chapek transition, predicted United Talent Agency Vice Chairman Jay Sures, a close friend of Walden’s. Chapek saw Iger as a threat to his power, according to people familiar with his thinking at the time. Walden would stay close to Iger for as long as possible, Sures said.

“When Bob Chapek got the job, he couldn’t wait for Bob Iger to leave. If Dana ever got the job, she’s gonna dread the day Bob Iger leaves,” Sures said. “She values the skill and leadership he brings. She knows a good thing when she sees it.”

Combating female stereotypes

If Walden were appointed CEO, she would be the first woman to run the century-old company. Some close to Iger say he would look fondly on being the person to help break the glass ceiling.

Amazon’s Salke saidshe’s had several discussions over the years with Walden about how to survive in the male-dominated entertainment world. It requires a deftness of character and ability to avoid enemies, said Salke.

“I watched ‘Barbie,’” said Salke, referencing the Greta Gerwig-created hit 2023 movie that skewers elements of modern patriarchy. “That speech from America Ferrera’s character [Gloria], it’s true. You have to be likable but not too likable. If you’re too likable, that’s seen as threatening to men.”

While Walden has crossed a bridge to become close friends with a number of her professional colleagues (she’s the godmother of Murphy’s children), she is attuned to her image in ways male executives don’t have to worry about, according to people familiar with her personality.

Even when the attention is nonthreatening, Walden is aware that her appearance may be judged as readily as her business performance, the people said.

“When I first met her, the writers would see Dana walk by from time to time, and we used to call her ‘Why Miss Jones,’” Levitan said. “Because she’d wear these glasses. So it was like in old Hollywood movies, when an actress would take off her glasses and one of the characters would say, ‘Why, Miss Jones! You’re beautiful!’”

Levitan later became close friends with Walden and praised her professionalism. Of note, he cited last year’s cancellation of “Reboot,” a show he created for Hulu.

“I don’t agree with the decision that was made there, and I don’t agree that it got a fair shake,” Levitan said. “But Dana and I talked about it. She took me through her reasons. And it’s a genuine conversation. There’s a reason people are pretty effusive about the way Dana handles herself. It’s because she genuinely goes out of her way to treat people with decency.”

Walden and her team have a reputation for sending birthday gifts to Hollywood’s movers and shakers and bottles of champagne to them when their shows premiere. Supporters view it as relationship-building. Critics said her actions sometimes border on corporate largesse.

Walden herself has joked that she was “raised by wolves” at Fox, and that she’s had to consciously adjust to the more toned-down Disney culture over the last five years, according to people familiar with her thinking.

She’s also had to toe a line between stereotype and successful executive. Of the 20 people interviewed for this story, nearly every one of them called Walden “direct” and “demanding.”

“Sharp elbows, right?” Salke said, anticipating the hackneyed criticism of female leaders. “So many times Dana and I have been the only women in the room. Can she be demanding and hold people to a high bar? Yes. But men come on in, and the first thing they do is fire people, and no one bats an eye.”

Walden’s champions noted that every successful executive is demanding of excellence, and said her directness is a major strength that separates her from many other TV executives.

“She can be ‘business’ tough,” said WME’s Rosen. “Nobody likes to deliver bad news. A show is canceled, or it’s over budget, or this project didn’t work. But she’s not harsh. You feel like she’s coming from a place of optimism — let’s figure out where we go from here.”

The final pick

While the Disney board will have the ultimate say on the company’s next CEO, Iger will likely be the real decision-maker, given his history at the company, status among board members, and knowledge of the job.

“The importance of the succession process cannot be overstated, and as the Board continues to evaluate a highly qualified slate of internal and external candidates, I remain intensely focused on a successful transition,” Iger said in a statement in 2023 when he renewed his contract as CEO to the end of 2026.

Even if Iger agrees with some of Walden’s critics about whether her strengths will specifically fit the top job at Disney, it’s possible his recollection of his own experience being selected as CEO in 2005 could influence his decision.

“Go back and look at the articles that were written about Bob Iger,” Sures said. “I was friends with Bob then. It was a lot of ‘empty suit’ — a good-looking, tall guy who never had any experience in the movie business and never did anything in M&A [mergers and acquisitions] before in his life. Nineteen years later, he’s one of the greatest, if not the greatest CEO the entertainment business has ever seen.”

“The same things are being said about Dana now,” Sures said.

Iger and the board’s selection for a successor may ultimately come down to the direction they envision for Disney.

D’Amaro could be the choice if they decide the parks are the most important part of the company’s future. Pitaro seems logical if ESPN and its upcoming digital transformation are seen as an essential part of Disney’s future, as opposed to its past. Either Walden or Bergman could be the choice if creative taste and relationships trump all, though Bergman’s recent troubles with Disney’s film division may be a knock against them.

Still, Chernin said it’s a mistake to view Disney so simply. The magic of the company is how all the parts interact with each other, rather than emphasizing one unit over all others, he said.

“The business is changing so rapidly. That company is going to change so much,” Chernin said. “Someone is going to have to imagine what a media company of the future looks like. Bob [Iger] is going through that right now. He’s actively spending every day thinking that through. The most important part of that company is ongoing relationships with customers.”

Jim Cramer says the AI buzz is far from a bubble — the game has yet to start

PUBLISHED WED, APR 3 20247:50 PM EDTUPDATED WED, APR 3 20249:56 PM EDT

KEY POINTS

- CNBC’s Jim Cramer on Wednesday pushed back on suggestions that AI is just buzzy tech losing its luster.

- Cramer cautioned that it isn’t prudent to so quickly dismiss AI bellwethers like chipmaker Nvidia in favor of high-performing refinery and dollar store stocks.

CNBC’s Jim Cramer on Wednesday contended the impact of artificial intelligence on business and the stock market isn’t yet fully realized, pushing back on suggestions it’s just buzzy tech losing its luster.

“It’s clear that lots of investors have no idea what AI is,” Cramer said on “Mad Money.” “In fairness, the reason they have no idea is because we really haven’t even seen anything transformative from the AI camp just yet.”

Cramer cautioned that it isn’t prudent to so quickly dismiss AI bellwethers like chipmaker Nvidia in favor of high-performing refinery and dollar store stocks. He said that kind of outlook amounts to investors saying, “Move over, Nvidia CEO Jensen Huang, it’s all about the oils and the gold.”

“In terms of innings, I don’t think the AI game has even started yet,” Cramer said.

Expanding his baseball metaphor, Cramer said AI is in its batting practice stage but may eventually replace many “undesirable” jobs involving physical labor. In potentially doing so, AI could become a tool for kickstarting businesses that wouldn’t otherwise have enough funds to open their doors, he said.

“The most difficult aspects of generative AI and large language models have to do with our inability to grasp what can actually be changed here,” Cramer said. “Most of us have a hard time seeing things out 10 minutes.”

So CNBC once again is misleading the public about Donald Trump. I remind my readers that CNBC is the home to Jim Cramer who picks stocks on his Mad Money show. There is evidence that by taking his advice, you can become a millionaire using this one little trick: start with a billion dollars to invest.

Seeking Alpha came up with the Inverse Jim Cramer Strategy.

SA said, “We have built a trading strategy that is by design inversing most of Cramer’s top-mentioned stock recommendations, which so far has proved successful in generating alpha on the market.”

When E.F. Cramer speaks, people listen.

And suppress their laughter as they do the exact opposite of what he recommends.

The story posted the performances of his top picks in a one-year period ending in August 2022 (when the article ran), starting with Procter & Gamble (down 10%), Disney (down 29%), Qualcomm (down 29%), Constellation Brands (down 4%), Morgan Stanley (down 17%) and so on down the line. And I really mean down.

In reporting that 21% drop in the share price of Trump’s company, CNBC failed to report something CNN did: “Shares of Trump Media tumbled 21% Monday following the new filings, though they are still up nearly 200% so far this year.”

Fed’s Kashkari raises prospect of zero rate cuts — but Goldman says that would be ‘very surprising’

PUBLISHED FRI, APR 5 20246:31 AM EDTUPDATED FRI, APR 5 20248:27 AM EDT

Sam Meredith@IN/SAMUELMEREDITH@SMEREDITH19

KEY POINTS

- Goldman Sachs Chief Economist Jan Hatzius said he still expects three interest rate cuts from the Federal Reserve this year.

- His comments came shortly after Minneapolis Fed President Neel Kashkari became the latest high-profile official to float the possibility of zero rate reductions in 2024 if inflation remained sticky.

- “I would be quite surprised if we didn’t get rate cuts this year. Quite surprised,” Hatzius told CNBC on Friday.

Goldman Sachs Chief Economist Jan Hatzius on Friday said that he still expects the Federal Reserve to implement three interest rate cuts this year, adding that he would be “very surprised” if the U.S. central bank ultimately decided no trims at all were necessary.

His comments come shortly after Minneapolis Fed President Neel Kashkari became the latest high-profile official to float the possibility of zero rate cuts before the year’s end, if inflation remained sticky.

“If we continue to see inflation moving sideways, then that would make me question whether we need to do those rate cuts at all,” Kashkari said Thursday during an interview with Pensions & Investments.

Separately, Fed Chair Jerome Powell said earlier in the week that it would take a while for policymakers to evaluate the current state of inflation, leaving the timing of potential interest rate cuts uncertain.

Market participants have been closely monitoring comments from Fed officials about the expected number of rate reductions due to take place this year, and many will be scouring Friday’s U.S. jobs data for further clues on the labor market and inflation.

Speaking to CNBC’s Steve Sedgwick on the sidelines of the Ambrosetti Spring Forum on Friday, Goldman Sachs’ Hatzius said he was bullish on the outlook for the U.S. economy.

“I’m certainly optimistic on this year. On the growth side, we’re well above consensus, close to 3% growth this year,” Hatzius said.

“We’re well below consensus in terms of the risk of a recession. We think 15% over the next 12 months, which is sort of average recession probability, since we’ve had a recession about once every seven years in the post-war period.”

Hatzius said he was also optimistic that robust economic growth this year can coincide with cooling inflation, projecting that the personal consumption expenditures price index will come in at 2.4% by the end of 2024 and at 2% next year.

The core PCE price index, which excludes food and energy components, is the Fed’s preferred measure of inflation.

“In that sort of environment, I would expect some rate cuts based on what Chair Powell and other Fed officials have said,” Hatzius said.

“That’s more uncertain. The timing of that of course is going to depend on near-term data, on the reaction function from the Fed but under our forecast I would be quite surprised if we didn’t get rate cuts this year. Quite surprised.”

In line with expectations, the U.S. central bank last month held interest rates steady for a fifth consecutive meeting, keeping its benchmark overnight borrowing rate at 5.25%-5.5%. The Fed also signaled that it still expects three quarter-percentage point cuts by the end of 2024.

Traders pegged a nearly 94% likelihood that rates remain unchanged at the Fed’s May policy meeting, according to the CME Fed WatchTool as of Friday morning. They’re anticipating a roughly 60% probability of a cut at the June gathering, marking a significant decline from a week ago.

ECONOMYNEWS

Where US Job Growth Occurred in March Reveals the Ugly Truth About ‘Bidenomics’

Will Kessler / April 05, 2024

Huge job gains reported by the Bureau of Labor Statistics in March were fueled largely by increases in government positions and employment of foreign-born workers.

The government added 71,000 jobs in March, a new all-time record and above the average of 52,000 over the last 12 months, bringing the total number of employees to 23,270,000, according to data from the BLS released Friday. The number of employed foreign-born workers increased by 112,000 in March, rising to 31,114,000 from 31,002,000 in February.

The U.S. added 303,000 nonfarm payroll jobs in March, far above economists’ expectations of 200,000, while the unemployment rate ticked down to 3.8% from 3.9%.

In total, the employment level for foreign-born workers has increased by 1,266,000 in the last year, while the number of native-born Americans has fallen by 651,000, according to the BLS. The unemployment rate for foreign-born workers is just 3.6%, while it is 4.0% for native-born workers.

The BLS does not record whether foreign-born workers are in the country legally and acknowledges that the survey likely includes illegal immigrants working in the U.S. The U.S. has experienced a surge in illegal immigration under President Joe Biden, with Border Patrol recording around 2 million migrant encounters at the southern border in just fiscal year 2023, up from 1.7 million in fiscal year 2021.

The growth of government jobs in March was followed by an 81,000 gain for health care jobs and a 49,000 increase in jobs in the leisure and hospitality sector, according to the BLS.

March is the fifth month in a row that the number of people employed by the government has hit a new record, beating out the old record that was achieved in May 2010 of 22,996,000 due to a surge in temporary hiring for census collection. Government debt has continued to pile up under Biden, totaling over $34.6 trillion as of Wednesday, according to the Treasury Department.

The White House did not respond to a request for comment from the Daily Caller News Foundation.

Originally published by the Daily Caller News Foundation

Disney’s parks are its top money maker — and it plans to spend $60 billion to keep it that way

PUBLISHED SUN, APR 7 20248:00 AM EDT

KEY POINTS

- Disney’s experiences division, which includes its theme parks, is the best-performing part of Disney’s business as the company tries to adapt to changes in movie and TV viewing habits.

- Josh D’Amaro, who leads the division, is overseeing additions and changes to the parks as Disney pledges $60 billion in investments in the segment over the next decade.

- From innovations in robotics and animatronics to more immersive storytelling, Disney is looking for new ways to keep people coming to its parks.

Three years ago, Josh D’Amaro stood in a nearly empty Disneyland.

The California theme park’s Main Street was quiet: no cheery tunes from famed barbershop quartet the Dapper Dans, no clanging railroad bell, and no wafting scent of waffle cones from the Gibson Girl Ice Cream Parlor.

It had been more than a year since the Covid pandemic had forced Disney’s domestic parks to shutter, but D’Amaro, chair of Disney’s experiences division, was confident guests would flood back in when the gates reopened.

His confidence was well founded. D’Amaro’s division is now Disney’s best-performing segment, rebounding and offering stability in recent quarters as Disney shuffles to adapt its entertainment business to match consumer habits that changed after the pandemic.

On that quiet day in 2021, D’Amaro had been in charge of the parks, experiences and consumer products division, now just called experiences, for only a little more than a year. He took the helm when Bob Chapek was tapped as CEO in early 2020. D’Amaro spent much of those 12 months dealing with substantial operating losses from global park closures, a docked fleet of cruise ships and a plunge in hotel visits.

Revenues fell 35% in 2020, a nearly $10 billion decrease from the $26.2 billion the experiences division had tallied in the year before the pandemic. Then revenue dropped an additional 3% in 2021.

But a lot has changed in three years. D’Amaro — sitting in a conference room in Burbank, an hour north of Disneyland and just a few miles from the heart of Disney’s theme park creative engine, Walt Disney Imagineering — has much to brag about.

The experiences division posted record revenue of $32.5 billion in fiscal 2023, a 16% increase from the prior year. Operating income jumped 23% to $8.95 billion.

D’Amaro described the pandemic as “an opportunity to take a breath” and a time for his division to “think about what we wanted the future to look like.”

“So, as difficult as that situation was, we saw it as a platform, a new vantage point for us to look at the operation,” he said.

While its parks were shuttered, Disney continued construction of its Avengers Campus themed land in Disneyland and touched up old favorites such as the King Arthur Carousel. And it built new rides, and refurbished others, in the years that followed.

World of Frozen opened in Hong Kong Disneyland in November, and a Zootopia land opened in Shanghai Disneyland in December. The company also launched two new rides at Walt Disney World in Florida: a “Guardians of the Galaxy”-themed ride in its Epcot park in 2022, and a “Tron”-themed roller coaster in the Magic Kingdom in April 2023.

Additionally, the company has revamped attractions and themed park areas, turning the Pacific Wharf area of Disneyland’s California Adventure into San Fransokyo Square, based on the animated hit “Big Hero 6,” updating Mickey’s Toon Town at Disneyland and making major transformations at Epcot.

Those investments, coupled with new technology in mobile ordering and the ability for guests to pay to skip to the front of the line for certain rides, have kept guests coming and boosted Disney’s earnings at a time when the entertainment division is struggling to recapture its late-2010s boom.

“Sitting here now, today, you’ve seen our results; our results have been record-setting as recently as the last first-quarter earnings,” D’Amaro said. “Record revenue, record margins, record operating income. So, the recovery has been swift, it’s been strong. But more importantly, I think the future looks incredibly bright for our segment — and the company, quite frankly.”

In 2023, experiences was the best-performing part of Disney’s business, accounting for 36% of the company’s total revenue but 70% of its operating income. Meanwhile, Disney’s entertainment division, which includes its theatrical and streaming businesses, represented 45% of revenue but just 11% of operating income.

The ability to get more out of the parks in recent years was crucial for CEO Bob Iger and Disney’s board as they tried to make the company more profitable and improve share performance. On Wednesday, Disney beat back activist investor Nelson Peltz’s proxy fight, reelecting its full board.

Always innovating

The division’s strength is why Disney has pledged to invest $60 billion in experiences over the next 10 years — a key part of its strategy to keep the parks fresh and relevant in a competitive segment.

D’Amaro said about 70% of that money will go toward “new experiences” in domestic and international parks, along with cruise lines. The other 30% will go toward technology and infrastructure, including maintenance of existing attractions.

Innovation at theme parks has been a central goal since Walt Disney ran the company. Disney’s founder used to say that its theme parks would “never be finished” and would evolve to meet consumer demand and changing tastes, along with developments in technology.

Walt Disney Imagineering has long been on the cutting edge of development. Its innovations, from ride mechanics and animatronics to creature design and immersive architecture, have made Disney’s parks a standout in the industry.

Last year, guests caught a glimpse of one of these innovations — a trio of tottering bipedal robots from Star Wars called BDX droids. First spotted at California Disneyland’s Star Wars: Galaxy’s Edge, they are just one iteration of a new technology Disney Imagineering is developing to bring walking robotic characters to life.

Engineers create the mechanics for the remote-controlled droids to move and balance, and work with animators to give those movements personality. The robots were designed to have childlike curiosity, reflected through cheeky head tilts and chirping beeps, along with a special emote dubbed “tantrum,” where their eyes glow red and they emit a high-pitched squeal.

Guests who visit Galaxy’s Edge in the next three months may stumble across this trio as part of Disney’s “Season of the Force.” They add to the regular roaming character meet-and-greets with the likes of Rey, Chewbacca, Kylo Ren and stormtroopers.

Disney hopes hands-on innovations such as the robots will keep guests coming.

“Those moments where there’s a spark, there’s an emotion that’s on full display, where a guest is interacting with an attraction or a cast member or a character, it’s very real and genuine,” said D’Amaro.

That emotion was on display at the South by Southwest conference in March 2023, when Disney debuted a new iteration of its “stuntronics” robot, this time in the form of Judy Hopps from “Zootopia.” This technology had previously been used to create the Spider-Man leap stunt at Avengers Campus. During the 2023 presentation, Imagineers showed the audience how the Judy Hopps robot could balance on roller blades and perform somersaults.

The biggest audience reaction came at the end of the presentation, when an Imagineer lifted the bot to sit on his shoulders and it realistically moved its legs to fit around his neck, as a child would. The simple motion — programmed just for the presentation, Imagineers told CNBC — captured something intrinsic to the human experience.

D’Amaro said those moments show why it’s important for Disney animators to be part of the development process: As the Imagineers craft new technologies, the artists can help bring them to life.

It shows in Disney’s rebrand of Splash Mountain. In both the California and Florida parks, the company is refurbishing the ride into Tiana’s Bayou Adventure, which will feature dozens of animatronic characters from “The Princess and the Frog.”

Imagineers have developed all-electronic audio-animatronics for the ride for characters such as Lewis, the trumpet-playing alligator from the film. Disney revolutionized animatronics decades ago with its hydraulic, or liquid-fueled, and pneumatic, or air-fueled, systems, but the electronic animatronics for Tiana’s Bayou allow for more refined and precise movement, making them appear more realistic. Similar animatronics can be seen in the rides Smuggler’s Run and Rise of the Resistance, in Galaxy’s Edge.

Interior pieces of some of the animatronics were crafted using 3-D printing, resulting in a lighter-weight material.

Telling stories in the parks

Disney’s ambitions to grow its experiences unit hinge in part on making its attractions feel more real.

“They continue to push the envelope of storytelling and creativity,” D’Amaro said of the Imagineering team.

He cited the recently shuttered Star Wars Galactic Starcruiser, a hotel and immersive experience that took guests on a two-day “voyage” in space. It was a 48-hour interactive story that allowed fans to physically play in the Star Wars universe.

“This is something that had never been done before,” D’Amaro said. “It was difficult to even explain to the public, and I think it was incredibly brave for us to move into this space. … And this, to me, says Imagineering is still at its best today.”

High ticket prices deterred the average parkgoer, and the Galactic Starcruiser shuttered in September. Still, D’Amaro said the experiment was a learning opportunity for the company.

“Those learnings are being employed on the next experiences, which we haven’t even announced yet,” he said.

Storytelling is at the heart of everything across Disney’s experiences division.

This extends to Disney’s cruise line and hotels, as well as its video game business. The company has a fleet of five cruise ships, and plans to add three more by fiscal 2026.

The Disney Wish, which made its maiden voyage in 2022, was the first addition to the fleet in a decade and bet big on its powerhouse franchises to entice travelers to the high seas.

There’s a “Frozen” sing-along dinner and a Marvel dining experience, as well as a Star Wars-inspired Hyperspace Lounge. The ship also has the first ever Disney water ride attraction on board, the AquaMouse.

“This is something I think that’s really important, the idea of the Disney difference,” D’Amaro said. “That this company works together as one is more powerful now than I think it ever has been — whether it’s [entertainment co-chair] Alan Bergman in the studios creating a new property that we can then take to Disney experiences and bring it to life and extend that story in brand new ways, or franchises that are birthed out of the theme parks.”

Disney’s ‘blue sky’

Disney’s experiences division has immediate expansion plans — even before the bulk of the planned $60 billion investment kicks in.

Next to open for Disney is Fantasy Springs, an eighth port at the Tokyo DisneySea park. The land will be home to three new areas — inspired by the films “Frozen,” “Tangled” and “Peter Pan” — as well as the new Tokyo DisneySea Fantasy Springs Hotel.

Concept and design work is also underway for the Tropical Americas area at Disney’s Animal Kingdom in Florida. There have been no official updates on the previously announced third ride at Avengers Campus in the California Adventure area at Disneyland.

The company is developing what it’s dubbed “blue sky” ideas for its parks — projects that are still in early development and may ultimately not see the light of day.

Disney has teased that an area based on “Coco” or “Encanto” or both could be underway in the Magic Kingdom. There were also talks about opening an area of the Magic Kingdom that would be overrun by Disney villains.

During the company’s investor meeting this week, Iger even teased the possibility of an “Avatar” land at Disneyland in California.

“We have thousands of acres of land still to develop,” Iger said during the Morgan Stanley Conference in March. “We could actually build seven new full lands if we wanted to around the world, including the ability to increase the size of Disneyland in California, which everybody thinks is kind of landlocked, by 50%.”

Price points for these projects will vary, if they do come to fruition. The recent additions of the two Star Wars: Galaxy’s Edge lands in Disneyland and Disney World are estimated to have cost $1 billion each.

That’s where the $60 billion investment comes in.

Disney likely won’t spend it all soon.

“We actually have a fairly good idea in the near term of what’s being built, but we’re purposefully not going to allocate it all,” Iger said at a media event Tuesday, according to the Los Angeles Times. “Because who knows? In five years we can end up with a giant hit movie — think ‘Frozen’ — that we may want to mine essentially as an attraction, or a hotel or restaurant in our parks. So you want to maintain some flexibility.”

But Iger won’t be head of the company in five years, if all goes according to plan. The CEO, who returned to the post in 2022, is set to step down at the end of 2026. Disney’s board is in the process of succession planning.

D’Amaro is on the short list.

His track record helming Disney experiences is part of a 26-year career with the Walt Disney Company, in which D’Amaro has held posts as chief financial officer for consumer products and global licensing and chief commercial officer for Walt Disney World Resort.

For now, however, D’Amaro said he is concentrating on his current post. He called it a “blessing” to have Iger back as CEO.

“I’m focused on Disney experiences,” he said when asked about potential succession plans. “And I’m focused on driving innovation and storytelling forward and paying tribute to our fans and continuing to grow this business.”

A Registered Investment Adviser

HI Market View Commentary 04-08-2024

We are going to be talking about taking a profit and adjusting trades today:

IF you are not willing to book your profits then don’t expect to have them “ALL” the profits for you in the future = It cost money to buy protection (puts) and Puts don’t make everything on the way down

IS it a good idea to book 261K or 188K of profit and replace that risk with $9,600

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 05-Apr-24 15:06 ET | Archive

First quarter earnings reporting period will be a breathing exercise

Your ears don’t deceive you and neither will your eyes in due course. Hard as it might be to believe with the fourth quarter earnings reporting season wrapping up not that long ago, the coming week will feature the start of the first quarter earnings reporting period.

It will be a relatively slow start, but the reporting cadence will pick up starting in the third week of April and continuing until mid-May. By then, market participants will have a good line on the results for the March quarter and how companies expect the coming months to unfold for the economy and their earnings prospects.

Here we are reminded that the stock market is not the economy; however, economic activity drives earnings, and earnings (and earnings expectations) drive the stock market. There is no escaping that, which is why every earnings reporting period starts with an inhale and typically (but not always) ends with an exhale.

An Uncommon Development

The fourth quarter reporting period warranted its share of breathing exercises. It didn’t get off to a great start. When we penned our preview of that period in mid-January, the blended fourth quarter earnings growth rate (combines actual results with estimates for companies that have yet to report) was 0.4%. On January 26, it stood at -1.4% (inhale).

When the fourth quarter reporting period ended, the earnings growth rate had settled at 4.3% (exhale).

So, where does the first quarter blended earnings growth rate stand today? It is at 2.9%, according to FactSet. That is down from 5.8% on December 31.

It is not uncommon for the earnings growth rate estimate to be reduced ahead of the reporting period. What is uncommon about this reporting period is that analysts haven’t reduced earnings estimates as much as they normally do.

According to FactSet, the median bottom-up estimate for the first quarter decreased by 2.5% between December 31 and March 27 versus an average decline of 3.7% over the past 20 quarters.

It is understandable why the estimate cuts haven’t followed form with the historical average. The main reason is that the economy hasn’t followed form with the history of a tightening cycle. It has continued to defy expectations that the impact of the so-called lag effect of prior rate hikes would hit more forcefully.

Remarkably, the economy has shown signs of strengthening. Real GDP increased 3.1% in the third quarter, 3.3% in the fourth quarter, and is projected in the Atlanta Fed GDPNow model to grow 2.5% in the first quarter. The overarching point is that there is no contraction evident in those figures, or any substantive slowdown, despite the Fed raising rates 11 times between March 2022 and July 2023.

Estimates Holding Up

We would venture to say, then, that there is optimism in front of the first quarter earnings reporting period. One could stake a claim on that assertion by pointing to the S&P 500 closing at a record high at the end of the first quarter while interest rates were going up.

The interest rate increase was a byproduct of the stronger-than-expected economic data, as well as some sticky inflation data that forced the market to rethink its outlook for Fed rate cuts.

In brief, the year began with an expectation for six cuts by the end of the year. The current expectation is that there will be three rate cuts by the end of the year. Market pricing, however, is entertaining the idea that there might only be two rate cuts, and, alternatively, there have been assertions from some Fed officials that there might be no rate cuts if progress on inflation stalls.

The good news is that there has been no stalling in the economy, which is why earnings estimates have held up as well as they have, not only for the first quarter, but for the calendar year and forward 12-month period as well.

The market has been excited by that and has arguably run ahead of the good earnings news embedded in consensus estimates. Hence, there has been multiple expansion, which is to say stock prices have seen a bigger percentage increase than earnings estimates have. To wit: the S&P 500 has surged 9.4% since the start of the year while the forward 12-month EPS estimate has increased by only 3.2%.

The Trend Has Been the Market’s Friend

The earnings estimate trend, though, has remained the market’s friend. With the market-cap weighted S&P 500 sporting a premium valuation, it is important that relationship stays on good terms.

So, in connection with the first quarter reporting period, the quantitative and qualitative guidance coming out of it will carry a lot of weight with respect to moving the market. Optimism is high, but so is the bar in terms of valuation.

Guidance disappointments will be dealt with prudently by the market, and, in some cases, quite rudely as the benefit of living up to higher growth expectations gets ripped away.

The attention to guidance will be most acute in the higher-growth pockets of the market, namely the information technology and communication services sectors, as well as in the cyclical corners of the market, namely the industrials, materials, and consumer discretionary sectors.

The banks do not tend to provide much in the way of specific earnings guidance, but their qualitative assessment of loan demand and loan quality, coupled with their provisions for loan losses, will offer some meaningful perspective on economic conditions.

Before the guidance, though, comes the actuals for the first quarter.

FactSet informs us that the projected earnings growth in the first quarter will be provided by the information technology (3.68 percentage points), communication services (1.67 percentage points), consumer discretionary (1.05 percentage points), utilities (0.64 percentage points), financials (0.13 percentage points), and real estate (0.13 percentage points) sectors.

The remaining five sectors are all expected to subtract from earnings growth. The energy sector (-2.31 percentage points) is estimated to be the biggest drag followed by health care (-1.16 percentage points).

What It All Means

That, of course, is how things stand today (inhale). These projections will all change in the ensuing weeks. Some will move up and some will move down. Presumably, if history is any guide, the final tabulation will result in first quarter earnings growth for the S&P 500 that is at least two percentage points higher than the 2.9% growth rate projected today (exhale).

If the stock market wants some breathing room, though, as it works its way through the second calendar quarter, then the guidance during the first quarter reporting period can’t be a choking hazard. That would take the market’s breath (and maybe its breadth) away.

—Patrick J. O’Hare, Briefing.com

Earnings dates:

Where will our markets end this week?

Lower

DJIA – Bearish

SPX –Bullish

COMP – Bullish

Where Will the SPX end April 2024?

04-08-2024 +2.0%

04-01-2024 +2.0%

Earnings:

Mon:

Tues: WDFC

Wed: DAL,

Thur: KMX, FAST,

Fri: BLK, WFC, JPM

Econ Reports:

Mon:

Tue

Wed: MBA, CPI, Core, CPI, Wholesale Inventories, FOMC Minutes, Treasury Budget

Thur: Initial Claims, Continuing Claims, PPI, Core PPI

Fri: Import, Export, Michigan Sentiment

How am I looking to trade?

Letting stock runs as the trend is bullish = DIS $120, SQ $80, MU $123, BIDU $104

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Yellen warns China’s surplus of solar panels, EVs could be dumped on global markets

PUBLISHED WED, MAR 27 20243:34 PM EDTUPDATED THU, MAR 28 20245:48 PM EDT

KEY POINTS

- Janet Yellen warned in a Wednesday speech that China’s surplus of clean energy products is depressing prices in global markets and squeezing U.S. green manufacturing.

- After years of clean energy investment, China has an excess of solar power, EVs and lithium-ion batteries, allowing it to export those products at cheaper prices to markets around the world.

- Yellen plans to confront her Chinese counterparts about these trade practices during her upcoming visit to China.

- The U.S. is trying to grow its own clean energy industry domestically with investments from new legislation, but is still playing catch-up with China’s green energy sector.

Treasury Secretary Janet Yellen on Wednesday warned that China is treating the global economy as a dumping ground for its cheaper clean energy products, depressing market prices and squeezing green manufacturing in the U.S.

“I am concerned about global spillovers from the excess capacity that we are seeing in China,” Yellen said during a speech at a Georgia solar company called Suniva. “China’s overcapacity distorts global prices and production patterns and hurts American firms and workers, as well as firms and workers around the world.”

China has a surplus of solar power, electric vehicles and lithium-ion batteries that it can ship out to other countries at cheaper prices. That makes it difficult for the more adolescent green manufacturing industries of the U.S. and elsewhere to compete.

Yellen said she intends to put pressure on Chinese officials about these trade practices during her upcoming visit to China.

“I plan to make it a key issue in discussions during my next trip there,” she said. “I will press my Chinese counterparts to take necessary steps to address this issue.”

The secretary’s concerns come as the White House tries to build a burgeoning clean energy industry domestically with investments from the 2022 Inflation Reduction Act, along with other legislation like the CHIPS and Science Act.

Yellen has regularly touted the gains from these investments, including at another recent speech where she doubled down on the electric vehicle “boom” spurred by the IRA.

But those investments are playing catch-up with China’s government.

“The Biden Administration also recognizes that these investments are new,” Yellen said Wednesday.

Meanwhile, China has been pouring billions into clean energy for years, outpacing the rest of the world in the energy transition.

Yellen added that the more China’s clean energy glut interferes with global market prices, the worse off supply chains for these energy sectors will be.

“President Biden is committed to doing what we can to protect our industries from unfair competition,” Yellen said.

The Chinese Embassy in Washington denied the notion that there is an excess of Chinese clean energy products.

Yellen’s comments highlight ongoing U.S.-China trade tension even as the two countries try to steady relations.

President Joe Biden met with Chinese President Xi Jinping in November as an olive-branch effort to break the ice after years of tension, marked in part by a tariff war launched by former President Donald Trump.

Trump has floated reinstating significant tariff levels on Chinese products if he wins a second presidential term.

In the time since the Biden-Xi meeting, strengthening U.S.-China relations has proven a precarious effort due to ongoing cybersecurity and trade concerns.

In February, Biden launched an investigation into Chinese smart cars, which he said pose a national security risk because they connect to U.S. infrastructure when they drive on American roads.

“China is determined to dominate the future of the auto market, including by using unfair practices,” Biden said in a February statement. “China’s policies could flood our market with its vehicles, posing risks to our national security. I’m not going to let that happen on my watch.”

How Dana Walden could defy critics and become Disney’s first female CEO

PUBLISHED MON, APR 1 20245:00 AM EDTUPDATED MON, APR 1 20243:56 PM EDT

KEY POINTS

- Dana Walden is in the running to be Bob Iger’s successor as Disney CEO, according to people familiar with the matter.

- If she is chosen, Walden would be the first female CEO of Disney in its 100-year history.

- She’s proven herself as a TV executive, but some former Disney executives question whether her resume is suitable for the top job.

- More than 20 colleagues and friends spoke with CNBC about her strengths, faults and the perceived likelihood she will take over for Iger.

In 1994, a captain of the media and entertainment industry saw something in Dana Walden that made him think she was capable of a bigger role.

Thirty years later, that may happen again.

That first time, the executive was Peter Chernin, then president of 20th Century Fox Filmed Entertainment and later president and chief operating officer of Rupert Murdoch’s News Corp. Chernin plucked Walden from Fox’s corporate communications division and gave her a job in TV.

In 2024, the executive is Bob Iger, Disney’s CEO, and the position he’s considering Walden for is that of his successor, according to people familiar with the process. The appointment would make Walden the first female CEO of the Walt Disney Co. in its 100-year history.

Just a year into her early career at 20th Century Fox, working in publicity, Walden delivered a presentation at a company retreat in Santa Barbara, California. She was determined to leave a lasting impression on Chernin, now chairman and CEO of investment firm The Chernin Group, after several encounters in which he’d never remembered her.

To get his attention, Walden decided to be bold. She told Fox executives, including Chernin, that they weren’t being aggressive enough to secure top talent. Fox needed to take bigger swings to generate relationships and land shows that could make it to syndication, Walden argued. A spokesperson for Walden confirmed the details of the presentation.

When the retreat ended, Chernin called Peter Roth, then president of 20th Century Fox Television, who later ran Warner Bros.′ TV division.

“The next day she was in my office, and we gave her a job in programming,” Roth said in an interview.

That set Walden on a career course correction that’s led her to the doorstep of becoming Iger’s successor.

Walden, co-chair of Disney Entertainment, is competing internally with Disney Experiences Chairman Josh D’Amaro, ESPN Chairman Jimmy Pitaro, and Alan Bergman, who is Entertainment co-chair with Walden, to be named the next CEO of Disney, said the people familiar, who asked not to be named because the discussions are private.

Iger plans to name a successor and then stick around at Disney to teach that person the job before departing at the end of 2026, CNBC reported in September. He’s fighting to maintain control of Disney’s future against a threat from Trian Partners’ Nelson Peltz.

Peltz has argued he should help spearhead a successor search, considering Iger has pushed back his retirement five times and returned to the job after Bob Chapek, named CEO in 2020, was fired in 2022. Peltz has claimed the Disney board can’t be trusted to handle succession. Disney shareholders will vote on Peltz’s candidacy to the board at its annual meeting Wednesday.

Several executives at Disney privately told CNBC they believe Walden, 59, is the favorite to land the top job, though they have no inside knowledge of the process, and their proximity to Walden may skew their perception. Her relationship with Iger (she lives just blocks from his house in Brentwood, California), her track record of success as a TV executive, her trust among Disney board members, and the symbolism about what it would mean to have a female executive all work in her favor.

“She’s the single best talent exec to come out of TV in the last 20 years,” Chernin said in an interview.

“She would be an outstanding CEO,” Roth added. “Absolutely outstanding.”

Walden declined to comment for this story. More than 20 colleagues and friends spoke with CNBC about her strengths, faults and the perceived likelihood she will take over for Iger.

Allies of Walden’s told CNBC she won’t even discuss succession with them (though many said they tease her about it), choosing to focus on the job of running Disney Entertainment with Bergman that she’s tasked with today.

She faces stiff competition in the other Disney division heads. Walden has spent the last three decades focused on producing TV hits. She hasn’t had the same range of responsibilities as Pitaro, who has run the company’s sports media empire since 2018. And she has no experience running parks and resorts, which Iger and the board may decide is more essential to Disney’s future than a TV business with hazy financial prospects in the streaming era.

Six former colleagues — all of whom worked closely with Walden — privately questioned her business acumen in interviews with CNBC.

“There are people that are in creative positions that rise to a level of management who figure out what a P&L [profit and loss] statement is, what a balance sheet is, what quarterly earnings are,” said one of the people, who asked to remain anonymous to speak candidly. “Dana doesn’t really bother with any of that.”

A second former coworker said Walden’s profile simply doesn’t translate to becoming the Disney CEO — a job that involves close investor interaction, geopolitical deals for parks and resorts, and strategic thinking around acquisition and investment.

“She’ll be eaten up by real investors,” said the person, who likewise requested anonymity. “Does she have the necessary depth of business knowledge? She can learn, but you can’t have someone teach you decades of finance, business and tactics in a year or two.”

Walden supporters dismissed those concerns as either simply incorrect or an example of persistent stereotypes against female executives. Walden has met with many institutional investors through her years at Disney, according to people familiar with the matter.

“There’s something about looking at female execs where questions are asked that would never be asked of men,” said Jennifer Salke, the head of Amazon Studios and a former colleague of Walden’s. “Can they scale? Can a creative person be a business leader? I find that to be a huge bugaboo. She’s in charge of billions of dollars of assets, but she’s not capable of being a business leader?”

Walden defenders brush off criticism from ex-Disney colleagues as the remnants of a grudge against Fox employees who came over as part of Disney’s $71 billion acquisition of Fox’s entertainment assets in 2019, or perhaps as part of an ulterior motive to diminish her CEO prospects in favor of their own preferred candidates.

“At some point, everyone running anything was something before that,” Chernin said. “Anybody they choose will have never been the Disney CEO prior to that.”

Hollywood ties

Chernin and Walden both began their careers in public relations, making them two of a small club of TV executives who started that way — former HBO head Richard Plepler is another exception. Chernin saw Walden’s background as a strength, rather than a weakness.

“She knows nothing is more important to a studio than talent relationships,” said Craig Hunegs, who worked closely with Walden when he was president of Disney TV Studios from 2019 to 2021.

Walden’s entire life has ties to Hollywood. She grew up modestly in Studio City, a neighborhood of Los Angeles, and attended the private Westlake School for Girls (a predecessor of the coed Harvard-Westlake School), where she became friendly with Carol Burnett’s daughter Carrie Hamilton.