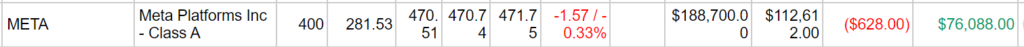

HI Market View Commentary 02-20-2024

We protect as often as possible when earnings, technical crossovers or market trends dictate

This also means that sometimes we have protection when we don’t need it the next day

We initiated a full collar trade= Long Put and Short call

Long Put= We have the right to sell a stock at a certain price for a certain period of time

Short Call = The Obligation to sell a stock at a certain price for a certain period of time

Obligation to sell = Someone pays US or a credit in the account

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 16-Feb-24 15:14 ET | Archive

Mind the earnings estimate gap

Can we just stop for a minute and marvel at how extraordinary the stock market’s performance has been since the lows last October?

Not that the rebound off the low seen in October 2002 wasn’t remarkable, or the rebound off the low seen in March 2009 wasn’t remarkable, but there is something about the move that has been made in the last three-and-a-half months that is truly extraordinary.

Since its low on October 27, the S&P 500 has surged 22.6%! The Nasdaq, which saw an earlier low on October 26, is up 26.5%!

It sure does look good on a chart, as one might expect knowing the market has gone up in 14 of the last 15 weeks.

There have been multiple precipitants for this market move:

- The Treasury Department’s calming quarterly refunding plan announced in October

- Indefatigable buying of the mega-cap stocks

- Lower interest rates

- Improving inflation trends

- Expectations that the Fed is done raising rates and will shift this year to cutting rates

- Assumptions that the U.S. economy will avoid a recession

- Short-covering activity

- Performance chasing/momentum buying

- Increasing equity allocations from underweight (or sidelined) positions

- Rising earnings estimates

We might have missed some, but we trust that our readers get the point. There has been a lot driving this rally effort. The weakest driver of them all, though, is the one that matters most: earnings estimates.

Not Measuring Up

The earnings situation is much improved, but that’s very much a relative barometer.

S&P 500 earnings declined three straight quarters from the fourth quarter of 2022 through the second quarter of 2023. The third quarter of 2023 featured 5.3% year-over-year growth, according to FactSet; meanwhile, the fourth quarter blended growth rate sits at 3.1%.

For good measure, first quarter 2024 earnings are projected to be up 3.7% and calendar 2024 earnings are projected to rise 10.9%.

We noted in last week’s column that the S&P 500 was trading at 20.4x forward twelve-month earnings, which was 16% premium to its 10-year average. Today it still trades at 20.4x forward 12-month earnings — but this is where the earnings estimate picture fails to measure up relative to the stock market’s performance.

As noted above, the S&P 500 has surged 22.6% since its October 27 low. The market, to be fair, has followed the trend in earnings estimates (higher), but to be frank, it has overshot that trend by a mile.

In the same period the S&P 500 has gone up 22.6%, the forward 12-month EPS estimate has gone up just 2.7% to $246.17, according to FactSet.

What It All Means

The gap between the price of the S&P 500 and the forward earnings estimate is the footprint of multiple expansion. That’s a fancy way of saying stock prices are going up faster than earnings estimates.

Multiple expansion isn’t necessarily a bad thing. You see it in bull markets as performance chasing kicks in, or the fear of missing out on further gains compels added buying interest. Naturally, what you also hear amid multiple expansion is a lot of rationalization of the move:

- “The company is going to grow into its valuation.”

- “Analysts aren’t fully understanding the company’s growth prospects.”

- “The stock can sport a premium valuation today, because interest rates will be lower in the future.”

- “Yeah, the stock is overvalued based on 2024 estimates, but if you look at it based on 2026 earnings estimates, then it isn’t overvalued.”

It all sounds reasonable in the moment — until the moment arrives that squashes those growth expectations. It is then that the overvaluation becomes crystal clear in a material decline in the stock price. More than a few companies this earnings reporting season have had this comeuppance. Tesla (TSLA) and Snap (SNAP) are a few that come to mind.

In any case, we are not here to throw stones at any individual company. Our aim is only to highlight for index investors that valuation is a constraint for further price appreciation if forward earnings estimates don’t start picking up.

Could the market move higher if the forward earnings estimate remains static or even falls? Sure, it could if the most heavily-weighted stocks keep moving higher or animal spirits keep speculative interest alive.

Just bear in mind that the further the market, or an individual stock, rises without a concurrent pickup in earnings estimates, the harder the fall could prove to be if prevailing earnings expectations are not met.

Ideally, the gap between earnings estimates and the S&P 500 price level will narrow because earnings estimates see a stronger pace of upward revision. The way things stand now is extraordinary in terms of the price level and remarkable in terms of the valuation.

It is indicative of a bull market, but it is also indicative of a market that has little room for challenges to the growth outlook that would diminish earnings prospects.

—Patrick J. O’Hare, Briefing.com

Earnings dates:

BIDU 2/28

COST 3/07

KO 2/13 BMO

MRO 2/21 est

MU 3/30 est

SQ 2/22

TGT 2/26 est

Where will our markets end this week?

Lower

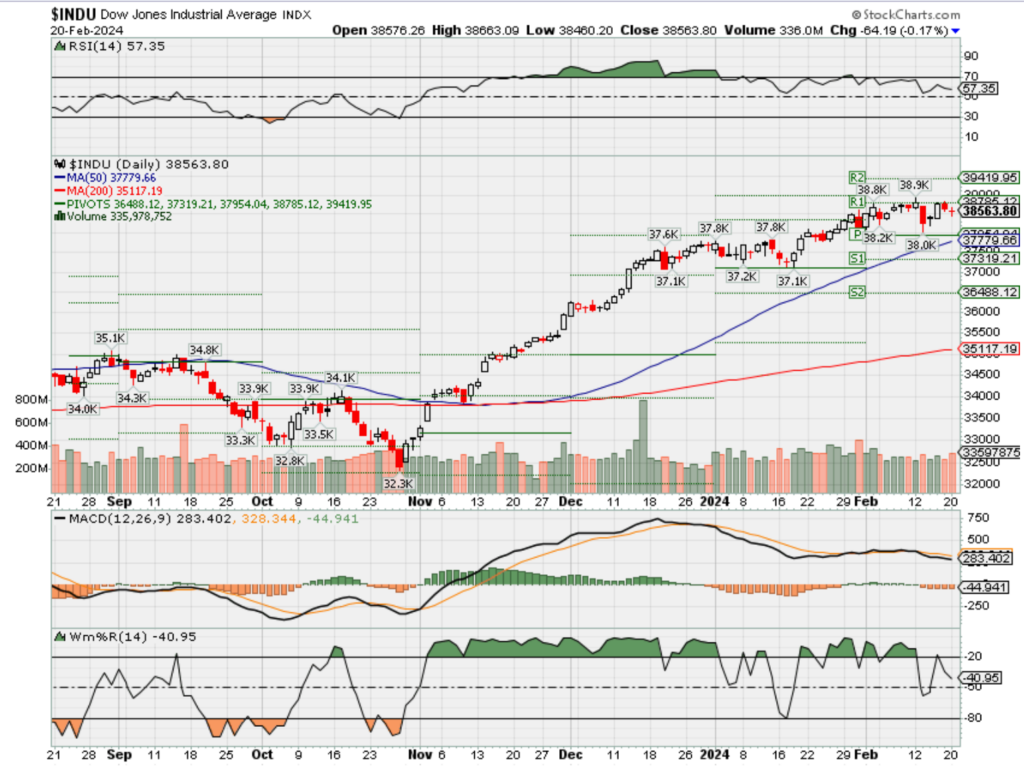

DJIA – Bullish

SPX –Bullish

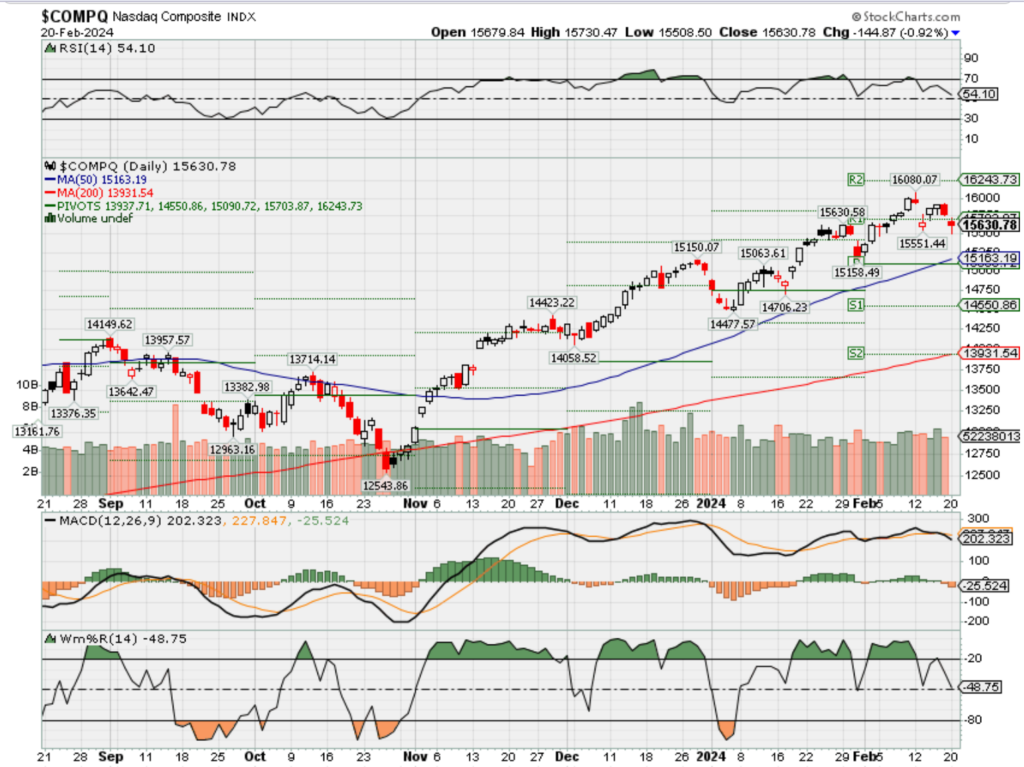

COMP – Bullish

Where Will the SPX end Feb 2024?

01-20-2024 +1.0%

01-12-2024 +1.0%

02-06-2024 +1.0%

Earnings:

Mon:

Tues: FLR, HD, KBR, WMT, CHK, FLS, PANW, TOL, O

Wed: GRMN, WING, CPK, JACK, MOS, NVDA, CPK, MRO

Thur: LNG, D, KDP, INTU, LZ

Fri:

Econ Reports:

Mon: Presidents’ Day

Tue Leading Indicators

Wed: MBA, FOMC Minutes

Thur: Initial Claims, Continuing Claims, Existing Home Sales

Fri:

How am I looking to trade?

current long put protection ITM

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Stock gains to survive a market correction if rate cuts are delayed, one economist says

PUBLISHED TUE, FEB 13 20241:12 AM EST

KEY POINTS

- Despite a “correction” as markets re-price rate expectations, 2024 should see solid equity returns, Allianz’s chief economist told CNBC on Monday.

- Ludovic Subran sees stock gains from late 2023 and early 2024 persisting until the end of the year.

- The S&P 500 on Friday closed above 5,000 for the first time ever, while Europe’s Stoxx 600 has rallied in recent months.

The latest stock gains will hold until the end of the year and survive a mid-year market correction, if central banks implement interest rate cuts later than investors have currently priced in, one economist says.

Gains will stay in line with recent rallies despite seasonal volatility, as markets potentially re-price to acclimate to a different rate cut trajectory from central banks, Ludovic Subran, chief economist at German financial services firm Allianz, told CNBC’s “Squawk Box Europe” on Monday.

Investors currently “expect a huge pivot and they expect a very early pivot,” Subran said, despite signs now suggesting a mid-year rate pivot from central banks that may come in smaller than previously thought.

“That means substantial volatility ahead, when people are going to re-rate, but I also think that what we’ve seen as gains from the last part of ’23, and early ’24, are going to be there by the end of the year,” he continued.

European stocks went on a tear through the final two months of 2023, taking the regional Stoxx 600 index to an annual gain of 12.7%, according to LSEG data. The U.S. S&P 500 has meanwhile been on the ascent since late October and on Friday closed above 5,000 for the first time on record.

Companies have reported a solid earnings season in recent weeks, with markets experiencing only a slight rattling of sentiment as some central bankers push back on rate cut expectations — particularly in Europe.

“I think it’s going to be very seasonal. So we’re going to have maybe a correction… investors are going to see that pivoting is not going to be so huge because of growth resilience in the U.S., or maybe because of inflation stickiness in Europe,” Subran told CNBC.

“But then I think by the end of the year, we’re going to have quite some good 5-10% equity returns. And that’s quite good, you know, for a year of normalization in everything else in the economy.”

$6 trillion in cash on the sidelines will come into play this year: Payne Capital’s Courtney Garcia

NewEdge’s Cameron Dawson and Payne Capital’s Courtney Garcia, join ‘Closing Bell’ to discuss the market momentum, inflation and this weeks economic data.

FRI, FEB 16 20244:58 PM EST

Universe 25: The Mouse “Utopia” Experiment That Turned Into An Apocalypse

Over the last few hundred years, the human population of Earth has seen an increase, taking us from an estimated one billion in 1804 to seven billion in 2017. Throughout this time, concerns have been raised that our numbers may outgrow our ability to produce food, leading to widespread famine.

Some – the Malthusians – even took the view that as resources ran out, the population would “control” itself through mass deaths until a sustainable population was reached. As it happens, advances in farming, changes in farming practices, and new farming technology have given us enough food to feed 10 billion people, and it’s how the food is distributed which has caused mass famines and starvation. As we use our resources and the climate crisis worsens, this could all change – but for now, we have always been able to produce more food than we need, even if we have lacked the will or ability to distribute it to those that need it.

But while everyone was worried about a lack of resources, one behavioral researcher in the 1970s sought to answer a different question: what happens to society if all our appetites are catered for, and all our needs are met? The answer – according to his study – was an awful lot of cannibalism shortly followed by an apocalypse.

John B Calhoun set about creating a series of experiments that would essentially cater to every need of rodents, and then track the effect on the population over time. The most infamous of the experiments was named, quite dramatically, Universe 25.

In this study, he took four breeding pairs of mice and placed them inside a “utopia”. The environment was designed to eliminate problems that would lead to mortality in the wild. They could access limitless food via 16 food hoppers, accessed via tunnels, which would feed up to 25 mice at a time, as well as water bottles just above. Nesting material was provided. The weather was kept at 68°F (20°C), which for those of you who aren’t mice is the perfect mouse temperature. The mice were chosen for their health, obtained from the National Institutes of Health breeding colony. Extreme precautions were taken to stop any disease from entering the universe.

As well as this, no predators were present in the utopia, which sort of stands to reason. It’s not often something is described as a “utopia, but also there were lions there picking us all off one by one”.

The experiment began, and as you’d expect, the mice used the time that would usually be wasted in foraging for food and shelter for having excessive amounts of sexual intercourse. About every 55 days, the population doubled as the mice filled the most desirable space within the pen, where access to the food tunnels was of ease.

When the population hit 620, that slowed to doubling around every 145 days, as the mouse society began to hit problems. The mice split off into groups, and those that could not find a role in these groups found themselves with nowhere to go.

“In the normal course of events in a natural ecological setting somewhat more young survive to maturity than are necessary to replace their dying or senescent established associates,” Calhoun wrote in 1972. “The excess that find no social niches emigrate.”

Here, the “excess” could not emigrate, for there was nowhere else to go. The mice that found themself with no social role to fill – there are only so many head mouse roles, and the utopia was in no need of a Ratatouille-esque chef – became isolated.

“Males who failed withdrew physically and psychologically; they became very inactive and aggregated in large pools near the center of the floor of the universe. From this point on they no longer initiated interaction with their established associates, nor did their behavior elicit attack by territorial males,” read the paper. “Even so, they became characterized by many wounds and much scar tissue as a result of attacks by other withdrawn males.”

The withdrawn males would not respond during attacks, lying there immobile. Later on, they would attack others in the same pattern. The female counterparts of these isolated males withdrew as well. Some mice spent their days preening themselves, shunning mating, and never engaging in fighting. Due to this they had excellent fur coats, and were dubbed, somewhat disconcertingly, the “beautiful ones”.

The breakdown of usual mouse behavior wasn’t just limited to the outsiders. The “alpha male” mice became extremely aggressive, attacking others with no motivation or gain for themselves, and regularly raped both males and females. Violent encounters sometimes ended in mouse-on-mouse cannibalism.

Despite – or perhaps because – their every need was being catered for, mothers would abandon their young or merely just forget about them entirely, leaving them to fend for themselves. The mother mice also became aggressive towards trespassers to their nests, with males that would normally fill this role banished to other parts of the utopia. This aggression spilled over, and the mothers would regularly kill their young. Infant mortality in some territories of the utopia reached 90 percent.

This was all during the first phase of the downfall of the “utopia”. In the phase Calhoun termed the “second death”, whatever young mice survived the attacks from their mothers and others would grow up around these unusual mouse behaviors. As a result, they never learned usual mice behaviors and many showed little or no interest in mating, preferring to eat and preen themselves, alone.

The population peaked at 2,200 – short of the actual 3,000-mouse capacity of the “universe” – and from there came the decline. Many of the mice weren’t interested in breeding and retired to the upper decks of the enclosure, while the others formed into violent gangs below, which would regularly attack and cannibalize other groups as well as their own. The low birth rate and high infant mortality combined with the violence, and soon the entire colony was extinct. During the mousepocalypse, food remained ample, and their every need completely met.

Calhoun termed what he saw as the cause of the collapse “behavioral sink”.

“For an animal so simple as a mouse, the most complex behaviors involve the interrelated set of courtship, maternal care, territorial defence and hierarchical intragroup and intergroup social organization,” he concluded in his study.

“When behaviors related to these functions fail to mature, there is no development of social organization and no reproduction. As in the case of my study reported above, all members of the population will age and eventually die. The species will die out.”

He believed that the mouse experiment may also apply to humans, and warned of a day where – god forbid – all our needs are met.

“For an animal so complex as man, there is no logical reason why a comparable sequence of events should not also lead to species extinction. If opportunities for role fulfilment fall far short of the demand by those capable of filling roles, and having expectancies to do so, only violence and disruption of social organization can follow.”

At the time, the experiment and conclusion became quite popular, resonating with people’s feelings about overcrowding in urban areas leading to “moral decay” (though of course, this ignores so many factors such as poverty and prejudice).

However, in recent times, people have questioned whether the experiment could really be applied so simply to humans – and whether it really showed what we believed it did in the first place.

The end of the mouse utopia could have arisen “not from density, but from excessive social interaction,” medical historian Edmund Ramsden said in 2008. “Not all of Calhoun’s rats had gone berserk. Those who managed to control space led relatively normal lives.”

As well as this, the experiment design has been criticized for creating not an overpopulation problem, but rather a scenario where the more aggressive mice were able to control the territory and isolate everyone else. Much like with food production in the real world, it’s possible that the problem wasn’t of adequate resources, but how those resources are controlled.

https://www.cnbc.com/2024/02/19/capital-one-acquiring-discover-financial-services-report-says.html

Capital One to acquire Discover Financial Services in $35.3 billion all-stock deal

PUBLISHED MON, FEB 19 202412:32 PM ESTUPDATED 13 MIN AGO

Christine Wang@IN/CHRISTINEJWANG@CHRISTIIINEEEE

KEY POINTS

- Capital One Financial is set to acquire Discover Financial Services in a $35.3 billion all-stock deal.

- The Wall Street Journal reported that Capital One, which already uses Visa and Mastercard networks, plans to keep the Discover brand.

- The merger of the two companies, which are among the largest credit card issuers in the U.S., would expand Capital One’s credit card offerings Capital One Financialis set to acquire Discover Financial Services in a $35.3 billion all-stock deal.

Under the agreement, Discover shareholders would receive 1.0192 Capital One shares for each Discover share or about a 26% premium from Discover’s Friday closing price of $110.49. The companies said they expect the deal to close in late 2024 or early 2025, after which Capital One shareholders would hold 60% and Discover shareholders would own 40% of the combined company.

The merger of the two companies, which are among the largest credit card issuers in the U.S., would expand Capital One’s credit card offerings and its deposit base. The company bought digital concierge service Velocity Black, a premium credit card and luxury market platform, in June of last year.

The Wall Street Journal reported that Capital One, which already uses Visa and Mastercard networks, plans to keep the Discover brand.

“Discover has done a better job of bringing in a lot of deposits and [has] access to a lot of institutions to run the debit card network and provide service. So it gives them a lot of deposit gathering ability, which particularly in the current market is enormously important,” said David Schiff, West Monroe’s head of consumer retail and banking.

CNBC has reached out for comment from both Capital One and Discover.

There aren’t many parallels for similar acquisitions in the financial industry, meaning that the Capital One-Discover deal will likely have broad implications for merger activity within the sector, said Schiff.

“It’s a good example of the risk we’re seeing in the market, where the competing interests from regulators for increased control and rigor balance against the competitive demands that are being made quite clearly, in terms of the overall market,” Schiff said.

The deal comes amid a period of increasing pressure for Discover, including regulatory scrutiny and new leadership. The current CEO Michael Rhodes was announced in December 2023.

Shares of Discover are down 1.7% lower for the year, putting the company at a $27.63 billion market cap. Capital One has a market cap of $52.2 billion and shares of the company are up 4.6% in 2024.

Bloomberg News reported on Monday that Capital One was considering the Discover acquisition.

The Capital One-Discover merger would be one of the largest deals announced so far this year. Synopsys announced a deal to buy Ansys for $35 billion in January and Diamondback Energy’s $26 billion deal to buy privately held oil and gas producer Endeavor Energy was announced on Feb. 12.

HI Financial Services Mid-Week 06-24-2014