HI Market View Commentary 01-29-2024

What I want to talk about today?

S.M.A.R.T. GOALS – A must read

As a Registered Investment Adviser I’ve heard two questions over and over again in the last couple of weeks.

What do you think the market will do in 2024? – What are your goals for 2024?

LET’S TALK ABOUT GOALS !!!

Both questions are intertwined and here is my “two cents”.

1st Goal is a 7.75 % return = last 50 years S&P 500 Average

2nd 15% return

3rd Goal is a 20%+ return and at this point my money management changes to not losing this amount of gains

Let me introduce you to the idea behind being S.M.A.R.T. in your goal setting.

- – Simple, Specific, Schedule – Keep it simple stupid just like old acronym says – KISS. Set a simple return just like you set your primary exits in your trade. Decide on a specific amount (I will talk about this later) and write it down. Schedule it in your planner! Remember your schedule is to make that return over a year’s period not in the month of Jan or in the first half of the year. Make sure you see your goal on a daily basis as you check you schedule on a daily basis.

- M – Measurable – Most people set what is called a “pinpoint” goal. We might decide that we want to make a simple market average return of 7% in a 1 year period. What happens in real life? We hit the goal and then we Quit or Stop trying as hard. Set a range goal. Maybe you always want a minimum return of 7%ish so set your goal to be between 7% to 20%. On the bullish years 7% is easy so I set a goal so If you do make it you still have something to shoot for.

- A – Attainable – Make a plan to how you will attain your goals. Start this step by asking yourself what or who do you want to become? ie… a better trader, a full timetrade, a stay at home dad, a millionaire. Too may people at the start of every year write down a wish list not a goal. I wish at the end of the year I can make this amount of money or lose this amount of weight. How will you do it and what will you do to get there? How much of your portfolio will be safe in collar trades? How much will be pure option strategies? How much will you use for vegas trades? Will you use margin to reach your goals? Figure out the details to how you will get to where you want to be at. Start with the end of the year goal on Dec 31st and walk yourself backwards.

- R – Realistic, Relevant – I always want to make a 50% return or more. Some years like this past year I wasn’t quite close to being at that goal. What happens in real life? We are nowhere close to our goal and we quit. We give up on the whole thing because we will never hit the goal. Step by step progression in trading is fine and make sure your goals remain relevant throughout the whole year. Don’t forget goals can be adjusted like a trade that may go south. S&P Ave 7.74

- T – Time – Set the time period that you want to accomplish your goals. Set short term, intermediate, long term, and life long goals you want to reach and hold your self accountable. Let others know the time period you expect to reach your goals and get the support needed to get there. Whether it is between you and your spouse, your kids, your parents, your education programor maybe the good Lord himself, find support during the tough times. I promise you they will come.

Conservative Trades (Perhaps 70% of your portfolio):

Cash or T-Bills –

Collar Trades –

Protective Puts (also known as Married Puts) –

Covered Calls with Long puts or DITM

Equities –

Medium Risk Trades (Perhaps 20% of your trades):

Bull Put –

Put Calendar –

Call Calendars –

Straddles / Strangles as a volatility play –

Put and / or Call Ratio Backspreads –

Winged Spreads –

Bull Calls (standard application) –

Bear Puts (standard application) –

Straddle / Strangle

Bear Calls –

High Risk Trades (Perhaps 10% or less)

Long Calls or Long Puts (as a non-hedged directional trade) –

Naked Short Put –

Naked Short Call – NEVER DO THIS UNLESS YOU ARE WILLING TO RISK AND LOSE EVERYTHING

Vegas Trades (Outside the box trades) –

Lesson #5 STREAKING

Rule #1 Super Simple – Walk Up my street and back down

Rule #2 Easily Attainable

Rule #3 Daily

Rule #4 Plan for being able to continue your streak on the days that you can’t

Focusing on the good vs feeling the shame or failure of not accomplishing goals

What will the market do in 2024?

It all depends on how many rate hikes we get from the FOMC

Let’s now travel to the future. The fed funds futures market thinks the Fed will cut rates five times before the end of 2024 (although it is a close call for as many as six rate cuts), according to the CME FedWatch Tool.

- Probability of 25 basis points rate cut to 5.00-5.25% at March FOMC meeting is 47.4% versus 83.3% a month ago

- Probability of 25 basis points rate cut to 5.00-5.25% at May FOMC meeting is 87.6% versus 99.7% a month ago

- Probability of 25 basis points rate cut to 4.75-5.00% at June FOMC meeting is 87.0% versus 97.8% a month ago

- Probability of 25 basis points rate cut to 4.50-4.75% at July FOMC meeting is 80.2% versus 98.0% a month ago

- Probability of 25 basis points rate cut to 4.25-4.50% at September FOMC meeting is 75.9% versus 95.7% a month ago

- Probability of 25 basis points rate cut to 4.00-4.25% at November FOMC meeting is 55.5% versus 85.4% a month ago

- Probability of 25 basis points rate cut to 3.75-4.00% at December FOMC meeting is 47.6% versus 77.9% a month ago

We would concur that the Fed is likely to cut rates in 2024, but five to six rate cuts is ambitious for a Fed that is fearful of making the same mistake the Fed did in the 1970s when it started to cut rates only to see inflation flare up again.

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 26-Jan-24 15:27 ET | Archive

Rate-cut patience to be frustrating virtue for market

It is time to take a walk down Memory Lane. It won’t be a long walk. We are only going back to April 2023. That was when the fed funds futures market was pricing in three rate cuts before the end of 2023.

For the record, the Fed didn’t cut rates three times before the end of 2023. In fact, the Fed didn’t cut rates at all.

Let’s now travel to the future. The fed funds futures market thinks the Fed will cut rates five times before the end of 2024 (although it is a close call for as many as six rate cuts), according to the CME FedWatch Tool.

- Probability of 25 basis points rate cut to 5.00-5.25% at March FOMC meeting is 47.4% versus 83.3% a month ago

- Probability of 25 basis points rate cut to 5.00-5.25% at May FOMC meeting is 87.6% versus 99.7% a month ago

- Probability of 25 basis points rate cut to 4.75-5.00% at June FOMC meeting is 87.0% versus 97.8% a month ago

- Probability of 25 basis points rate cut to 4.50-4.75% at July FOMC meeting is 80.2% versus 98.0% a month ago

- Probability of 25 basis points rate cut to 4.25-4.50% at September FOMC meeting is 75.9% versus 95.7% a month ago

- Probability of 25 basis points rate cut to 4.00-4.25% at November FOMC meeting is 55.5% versus 85.4% a month ago

- Probability of 25 basis points rate cut to 3.75-4.00% at December FOMC meeting is 47.6% versus 77.9% a month ago

We would concur that the Fed is likely to cut rates in 2024, but five to six rate cuts is ambitious for a Fed that is fearful of making the same mistake the Fed did in the 1970s when it started to cut rates only to see inflation flare up again.

Under Control

The Fed was speedy with its rate hikes starting in March 2022. It had to be, because it waited far too long to raise rates and let inflation get out of control.

To the Fed’s credit, it has gotten inflation under control (but not total control) with some help from easing supply chain pressures. You can see that in the inflation numbers.

We just don’t think — and we don’t think the Fed will think — it has inflation in a strong enough chokehold to allow for five to six rate cuts by the end of 2024. The Fed’s own projections call for three rate cuts, but to be fair, the December core PCE Price Index could move the needle on the Fed’s thinking.

The problem is that we won’t have anything codified in that respect until the next Summary of Economic Projections (SEP) is released in March. However, if the last SEP is any indication, the Fed should be sticking with an outlook for at least three rate cuts by the end of 2024.

Why do we think that?

The Fed’s median estimate for core-PCE inflation for 2023 was 3.2%. We learned in the December Personal Income and Spending Report that the core-PCE Price Index ended 2023 up 2.9% year-over-year — the lowest since March 2021. However, the six-month annualized rate was just 1.9%.

New Voters

Fed officials haven’t avoided the topic of rate cuts. Some have volunteered that they think the Fed can cut rates, but most have conceded that they can proceed carefully with that effort.

Importantly, none of the new voting Fed presidents on the 2024 FOMC have signaled that a rate cut is imminent. Those presidents are Raphael Bostic (Atlanta), Loretta Mester (Cleveland), Thomas Barkin (Richmond), and Mary Daly (San Francisco).

Ms. Daly, viewed by many to be more dovish minded, said last week that it is premature to think a rate cut is around the corner. There won’t be a rate cut at the January 30-31 FOMC meeting, but from our vantage point, March 19-20, which is the date of the next FOMC meeting, is right around the corner.

The fed funds futures market has been walking back its March rate-cut expectations. A month ago, it priced in an 83.3% probability of a rate cut at the March meeting, according to the CME FedWatch Tool. Today, that probability is 47.4%, so it is close to a coin toss in the market’s mind.

It’s one thing for core PCE to be moving back toward 2.0%, but it’s still another thing to think that it is going to get there and stay there on a sustained basis. The latter condition is key to the Fed’s policy view, which is why its patience may prove to be a frustrating virtue for the market.

What It All Means

The Fed made the mistake of waiting too long to raise rates, and it knows it. That understanding should factor heavily in its thinking that it should take a more deliberate approach to cutting rates.

We would argue, too, that the Fed is taking notice of the easing in financial conditions, manifested clearly in lower rates and a stock market trading at record highs, and will be concerned that it risks compounding an easing in financial conditions that could delay efforts to get inflation down to the 2.0% target on a sustainable basis.

That doesn’t mean the Fed wants the stock market to sell off, only that it is going to be pre-occupied with wanting to see more inflation data in coming months before it commits to the first rate cut, confident inflation can stay down even if the stock market keeps going up.

That deliberate approach is apt to undermine the market’s more generous rate-cut expectations. Nonetheless, the prospect of a rate cut, or several rate cuts, before the end of 2024 looks more practical than it did in April 2023 when core-PCE inflation was running at 4.8% year-over-year, assuming of course inflation continues on its current glide path.

—Patrick J. O’Hare, Briefing.com

Earnings dates:

AAPL 2/01 AMC

AMZN 2/01 AMC

BA 1/31 BMO

BABA 2/21 est

BIDU 2/20 est

COST 3/07

CVS 2/07 AMC

CVX 2/02 BMO

DIS 2/07 AMC

F 2/06 AMC

GM 1/30 BMO

GOOGL 1/30 AMC

KO 2/13 BMO

MA 1/31 BMO

META 2/01 AMC

MRO 2/18 est

MSFT 1/30 AMC

MU 3/30 est

NVDA 2/21 AMC

PYPL 2/07 AMC

SBUX 1/30 AMC

SIRI 2/01 BMO

SQ 2/21 est

TGT 2/26 est

TSLA 1/24 AMC

UAA 2/06 est

XOM 2/02 BMO

Where will our markets end this week?

Higher

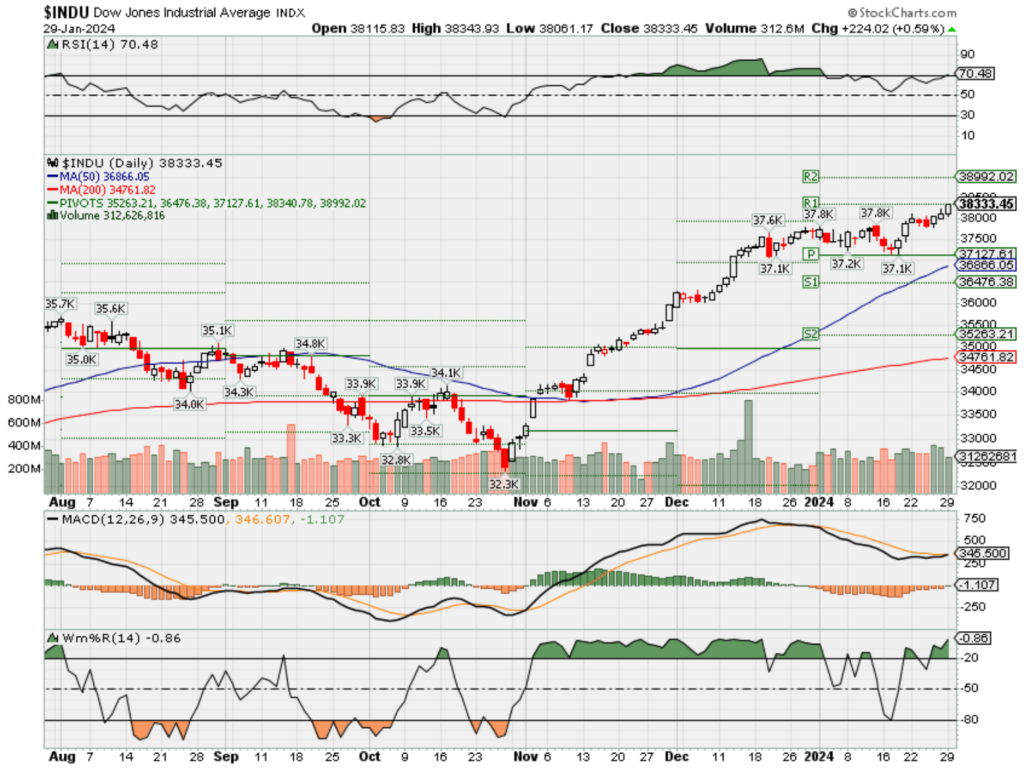

DJIA – Bullish just touching overbought

SPX –Bullish but just touching over-bought

COMP – Bullish just touching overbought

Where Will the SPX end Jan 2024?

01-29-2024 +3.0%

01-22-2024 +3.0%

01-16-2024 +2.5%

01-08-2024 +3.0%

Earnings:

Mon: SOFI, CLF, FFIV, NUE,

Tues: GLW, JBLU, JCI, MDC, PFE, UPS, AMD, EA, JNPR, SWKS, GM, GOOGL, MSFT, SBUX

Wed: BSX, HES, QCOM, BA, MA

Thur: GOLD, CAH, HON, MRK, BZH, CLX, SKYW, SIRI, AMZN, HUBS, META, AAPL

Fri: BMY, GWW, CVX, XOM

Econ Reports:

Mon:

Tue FHFA Housing Market Index, Consumer Confidence, Case-Shiller

Wed: MBA, ADP Employment, FOMC Meeting

Thur: Initial Claims, Continuing Claims, ISM Manufacturing Index, Productivity, Unit Labor Costs, Construction Spending

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate, Factory Orders, Michigan Sentiment

How am I looking to trade?

Preparing for earning and may run current long put protection OTM

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

But EVERY Broker sent out a margin update = Prime plus Prime = IF you are borrowing money from the broker to “TRY” to make more money the interest rate is a daily 10.5-11% APR 20-21.5%

We had APEX for a few days last week have 1099’s available

The correlation between bonds and stocks has ruptured. It’s not a problem for equities, says this analyst.

Last Updated: Jan. 26, 2024 at 8:38 a.m. ETFirst Published: Jan. 26, 2024 at 6:32 a.m. ET

By

Jamie Chisholm

Early Friday skirmishing in the stock-index futures market suggests the S&P 500 will struggle to reach a sixth successive record high.

Technology stocks are on course to lead the retreat, as a 10% plunge in Intel shares INTC, after the chipmaker delivered weak guidance late Thursday, highlights the danger of disappointment in a sector some consider priced for AI perfection.

Noting Thursday’s somewhat meager gains, given U.S. data showing a strong economy but benign inflation, Mark Newton, head of technical strategy at Fundstrat, reckons: “The U.S. equity rally appears to be getting a bit tired.”

Perhaps any cooling of the bulls’ ardor reflects a market starting to pay more attention to shifting prospects for Federal Reserve interest-rate cuts in the near future. The chart below from BTIG’s chief market technician, Jonathan Krinsky, shows how stocks in recent months have closely tracked the odds of borrowing costs being trimmed in March.

But in the last few weeks the link has fractured, with stocks trundling higher as the chances of a 25-basis-point cut in the federal-funds rate have fallen from around 90% to less than 50%. “[T]his divergence is likely to resolve with [the S&P 500 ] moving lower over the near term,” Krinsky warned in a recent note.

SOURCE: BTIG

This just goes to show that market correlations can matter — until they don’t, suddenly. The trick for investors is to understand whether the dislocation is a brief aberration or evidence of a fundamental shift.Take the the 2-year Treasury, which Nicholas Colas, co-founder of DataTrek Research, thinks “is the most important security in the world, at least when it comes to the direction of the S&P 500.”

Colas provides the following chart to show how 2-year yields moved since the start of 2022, and how the S&P 500 performed over those periods of rising, stable or declining rates.

Source: DataTrek Research.

The relationship is clear, says Colas: “When 2-year yields are rising, stocks drop (all of 2022, August–October 2023). When they are relatively stable (January–July 2023, even with the sudden drop due to the U.S. bank mini-crisis) or declining (November 2023–present), stocks go up.”

Importantly, Colas stresses, this is not mere correlation but causation, and explains what is going on. Those 2-year yields reflect the market’s best guess about the fed-funds rate over the next 24 months, he says, and, in the context of the last few years of monetary policy, show how investors have been trying to predict where short-term rates need to go to bring inflation back down to the Fed’s target of 2%.

This impacts stocks because when yields move higher the market frets that terminal policy rates will be far higher still than current levels. “This raises the specter of recession, since the U.S. economy can only withstand a certain level of interest rates before it buckles under the strain. No one knows where that level is, so any marked increase in yields is unwelcome,” he says.

Crucially, the 5% level on 2-year yields is what Colas calls a “break point for equity investor psychology.” Last year’s market pullback between August and October occurred as yields rose above 5% and looked liked going higher still, while the latest fall in yields eased those concerns.

But there’s a quirk. This year short-term rates have gone up, but so has the equity market. The 2-year Treasury note’s yield began 2024 at 4.25% and hit 4.4% at midweek, while the S&P 500 is up 2.6% to date in 2024.

Colas has three explanations for the correlation’s rupture. First, stocks have tended to advance when yields are relatively stable, and frankly the latest move higher in rates is not that great relative to recent bond-market volatility.

Second, “The FOMC’s December Summary of Economic Projections called for three rate cuts this year. Markets have assumed, rightly or wrongly, that the committee is being conservative. Either way, projected rate cuts put a ceiling on 2-year yields,” says Colas.

Finally, investors are relaxed about the Fed’s policy trajectory. A recent survey by DataTrek showed only 6% of respondents saying they expected no rate cuts or higher rates this cycle.

That’s not to say 2-year yields will stop exerting influence on equities, says Colas. After all, there is still some uncertainty about about when the Fed will ease monetary policy, and it likely will be better for stocks if bonds indicate the pivot is coming sooner rather than later and that a multiyear easing cycle is on the cards.

The takeaway from all this is that Colas thinks 2-year Treasury yields will likely determine whether the S&P 500 has a good year, with a gain of between 5% and 10% — or an even better one well into double digits. “We think the latter is more likely, but lower 2-year rates would increase our confidence in that prediction.”

U.S. stock-index futures ES00 YM00 NQ00 were lower early Friday as benchmark Treasury yields dipped fractionally. The dollar was little changed, while oil prices CL fell and gold GC00 traded around $2,022 an ounce.

| Key asset performance | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 4,894.16 | 2.37% | 2.32% | 2.61% | 20.53% |

| Nasdaq Composite | 15,510.50 | 3.02% | 2.75% | 3.33% | 34.73% |

| 10 year Treasury | 4.111 | -1.98 | 23.05 | 23.05 | 59.96 |

| Gold | 2,023.30 | -0.42% | -2.34% | -2.34% | 4.96% |

| Oil | 76.61 | 4.33% | 7.40% | 7.40% | -3.49% |

| Data: MarketWatch. Treasury yields change expressed in basis points | |||||

The chart

Equity markets trading at new highs may suggest investors are relaxed, goes the thinking. That’s why, even though it might make sense to pay up for option protection when one’s portfolio surges, fewer do, and the CBOE VIX index tends to move lower when stocks rally.

Indeed, extrapolating this reasoning, Société Générale asks: “Don’t equity markets always make new highs when volatility is low?” It points to the chart below of the VIX when the S&P 500 hits a new record and answers: “Well, clearly not.”

Source: Societe Generale

China is ‘risky’ for supply chains and India a favored destination for U.S. firms, survey shows

PUBLISHED WED, JAN 24 20245:00 PM ESTUPDATED THU, JAN 25 20244:14 AM EST

Charmaine Jacob@CHARMAINEMJACOB

KEY POINTS

- Of the 500 executive-level U.S. managers surveyed by market research OnePoll, 61% said they would pick India over China if both could manufacture the same materials.

- The survey showed that 59% of the respondents found it “somewhat risky” or “very risky” to source materials from China, compared with 39% for India.

- “Companies are seeing India as a long-term investment strategy as opposed to a short-term pivot to avoid tariffs,” said Samir Kapadia, CEO of India Index and managing principal at Vogel Group.

U.S. firms are increasingly viewing China as a risky bet for their supply chains — neighbor India is set to benefit as companies look elsewhere to set shop.

As many as 61% of the 500 executive-level U.S. managers surveyed by UK market research firm OnePoll said they would pick India over China if both countries could manufacture the same materials, while 56% preferred India to serve their supply chain needs within the next five years over China.

The survey showed that 59% of the respondents found it “somewhat risky” or “very risky” to source materials from China, compared with 39% for India.

At least a quarter of the executives who participated in the independent, third-party survey, commissioned by marketplace India Index in December, do not currently import from either China or India.

“Companies are seeing India as a long-term investment strategy as opposed to a short-term pivot to avoid tariffs,” said Samir Kapadia, CEO of India Index and managing principal at Vogel Group, in an exclusive interview with CNBC.

Warming ties between the U.S. and India, spearheaded by President Joe Biden and Prime Minister Narendra Modi, with the former’s “friendshoring” policy aimed at encouraging U.S. companies to diversify away from China have also made India an attractive alternative.

The relationship between the two countries entered a new chapter with Modi’s state visit to the White House in June where a slew of deals on large collaborations in defense, technology and supply chain diversification were signed.

“The U.S. and China continue to sit in rather chilling air. Whereas there is a constant stream of iterations, conversations, dialogues and agreements between U.S. and India,” Kapadia said.

India has seen a flurry of announcements about investments into the country in the recent past.

Earlier this month, Maruti Suzuki, announced that it would invest $4.2 billion to build a second factory in the country. Vietnamese electric auto maker VinFast also said in January that it aims to spend around $2 billion to set up a factory in India.

Risks still remain

Despite the optimism, U.S. firms are still cautious of India’s supply chain capabilities.

The survey showed that 55% of the respondents found quality assurance was a “medium risk” they might face if they have factories in India.

In September, Apple supplier Pegatron had to temporarily cease operations at its factory in the Chengalpattu area near Chennai after a fire broke out.

Delivery risk (48%) and IP theft (48%) were also a worry for U.S. firms looking at India.

Other firms looking to fully or partially move their supply chains to India may not be able to duplicate Apple’s fast presence in the country, warned Amitendu Palit, senior research fellow and research lead of trade and economics at the Institute of South Asian Studies.

“What Apple has done will not be able to be done immediately and as quickly by many other companies. Apple has the capacity to create an ecosystem much faster than other companies, so time must be factored in,” Palit told CNBC in a Zoom interview.

Both Palit and Kapadia agreed that completely shifting supply chains away from China will not be possible.

“I don’t think China will ever be taken out of the equation,” Kapadia said. “The reality is that China will always be a cornerstone of U.S. supply chain strategy.”

Investments into China still remain robust and it is still the “second choice” for investments after the U.S., said Raymund Chao, Asia-Pacific and China chairman at PwC.

Vietnam the next best bet?

Similar to India, Vietnam has been also been option on investors’ minds when adopting a “China plus one” strategy.

The optimism in the Vietnamese market led to a more than 14% surge in foreign direct investments last year compared with 2022.

According to LSEG data, $29 billion in foreign direct investments were pledged to Vietnam from January to November last year.

But Vietnam will not be able to achieve what India can, Kapadia pointed out, explaining that the world’s most populous country has access to “a very large customer base that Vietnam doesn’t offer.”

“Companies are not making these decisions for cost arbitrage. They’re making these decisions for cost savings and access to markets. You’re not going to see that same sort of benefit in just shifting to Vietnam,” he added.

China is ramping up stimulus to boost market confidence — but is it enough?

PUBLISHED THU, JAN 25 202412:44 AM ESTUPDATED THU, JAN 25 20241:09 AM EST

KEY POINTS

- Starting Feb. 5, the People’s Bank of China will allow banks to hold smaller cash reserves, central bank governor Pan Gongsheng said at a press conference, his first in the role.

- “The latest [PBOC] announcements may be interpreted as the beginning of a policy pivot from previous reactive and piecemeal measures by investors, and they will continue to look for further signs and acts of policy support,” Tao Wang, head of Asia economics and chief China economist at UBS Investment Bank, said in a note.

- Pan also told reporters the central bank and the National Financial Regulatory Administration would soon publish measures to encourage banks to lend to qualified developers. The document was released later that day.

BEIJING — Expectations for more support from China to boost its economy and stock markets are rising— especially after the central bank’s easing announcements on Wednesday.

Starting Feb. 5, the People’s Bank of China will allow banks to hold smaller cash reserves, central bank governor Pan Gongsheng said at a press conference, his first in the role.

Cutting the reserve requirement ratio (RRR) by 50 basis points is set to release 1 trillion yuan ($139.8 billion) in long-term capital, the central bank said.

“The latest [PBOC] announcements may be interpreted as the beginning of a policy pivot from previous reactive and piecemeal measures by investors, and they will continue to look for further signs and acts of policy support,” Tao Wang, head of Asia economics and chief China economist at UBS Investment Bank, said in a note Thursday.

Beijing has been reluctant to embark on massive stimulus, which would also widen the yield gap between China and the U.S. given the Federal Reserve’s tighter stance on monetary policy. The PBOC kept a benchmark lending rate unchanged again on Monday, holding pat on loan prime rates.

The magnitude of the central bank’s announcement Wednesday on the RRR cut exceeded Nomura’s forecast for a 25 basis point reduction, said the firm’s chief China economist, Ting Lu.

“We think this larger-than-expected RRR cut is a further sign that the PBoC and top policymakers have become increasingly concerned about the ongoing economic dip, which we have been flagging since mid-October last year, and the latest equity market performance,” he said in a note Thursday.

“More interestingly, the policy decision was revealed in a less-usual fashion, as the PBoC Governor made the announcement personally during a Q&A session at the press conference,” Lu said.

Pan on Wednesday told reporters the central bank and the National Financial Regulatory Administration would soon publish measures to encourage banks to lend to qualified developers. The document was released later that day.

“It is a significant step from the regulators to enhance credit support for developers,” UBS’ Wang said. “For developer financing to fundamentally and sustainably improve, property sales need to stop falling and start to recover, which could require more policy efforts to stabilize the property market.”

Real estate troubles are just one of several factors that have weighed on Chinese investor sentiment. The massive property industry has dragged down growth, and along with a slump in exports and lackluster consumption, kept the economy from rebounding from the pandemic as quickly as expected.

The mainland Chinese and Hong Kong stocks have steadily dropped to multi-year lows.

Stocks turned higher this week after a series of government announcements and media reports indicating forthcoming state support for growth and capital markets.

Such efforts to stabilize the stock market helps put a floor to stop the market from capitulating and falling further, Winnie Wu, Bank of America’s chief China equity strategist, said Thursday on CNBC’s “Street Signs Asia.”

But she pointed out a fundamental turnaround in the economy is needed for investors to return to Chinese stocks, which will take time.

A 2 trillion yuan boost?

The world’s second-largest economy grew by 5.2% in 2023, according to official numbers released last week. That’s a marked slowdown from double-digit growth in decades past.

Chinese Premier Li Qiang on Monday called for much stronger measures to boost market stability and confidence, according to an official readout.

On Tuesday, Bloomberg News, citing people familiar with the matter, said Chinese authorities are looking to use state-owned companies’ funds to stabilize the market — in a package of about 2 trillion yuan ($278 billion).

PBOC Governor Pan on Wednesday did not mention such a fund, although he took the initiative to speak about the capital markets, Citi’s Philip Yin and a team pointed out in a report. They said the 2 trillion yuan in capital would need to be deployed over weeks or months given current regulations, and would only amount to a fraction of current trading volume.

“Most importantly, it seems not sufficient to create a real impact on the underlying challenges in the economy,” the Citi analysts said.

For many consumers and businesses in China, uncertainty about the future remains high in the wake of recent Chinese government crackdowns on internet technology companies, the gaming sector, after-school education businesses and real estate developers.

Tensions between the U.S. and China, centered on tech competition, have also weighed on sentiment.

Chinese authorities since last summer have made it a point to talk up support for the non-state, private sector.

“Ultimately what is going to get fundamentals back on track is meaningful improvement in confidence and sentiment – which is why recent measures have been designed to give confidence a boost,” said David Chao, global market strategist for Asia Pacific (ex-Japan) at Invesco.

“The road forward to economic normalization lies in the wallets of Chinese households and businesses and less so in China’s stimulus toolkit,” he told CNBC.

Looking for fiscal support

But markets have generally been waiting for more action. Chinese authorities in October already announced the issuance of 1 trillion yuan in government bonds, alongside a rare increase in the deficit.

“To address the macro challenges, it still calls for opening the monetary box even wider — and arguably with broader fiscal policy and easing deleveraging policy,” Citi’s analysts said.

Governor Pan’s comments about the narrowing difference between the U.S. and Chinese monetary policy are “clues for more monetary accommodation down the road especially with the Fed expected to ease later in the year,” the report said.

China is set to hold its annual parliamentary meeting in March, at which it could reveal a wider fiscal deficit and other policies for the year ahead.

The Economist Intelligence Unit on Thursday said in its China 2024 outlook that China’s leaders could aim for 5% growth in the year ahead, with the help of greater fiscal support.

The report pointed out that Chinese leaders called for a fresh round of fiscal reform during their annual Central Economic Working Conference in December. Those details could be released at the third plenary session of the Chinese Communist Party’s central committee, which is “likely to take place in early 2024,” EIU added.

— CNBC’s Clement Tan contributed to this report.

HI Financial Services Mid-Week 06-24-2014