Trade Findings and Adjustments 11-09-2023

Keve Bybee – keve@hurleyinvestments.com

AAPL – Earnings proved a lot of naysayers wrong and phone sales

were excellent.

DIS – Everybody said “their parks are bleeding cash!”

– One their biggest earners was parks!

– “They’re losing subscribers!” beat their subs expectations.

– 150.2Million Subs. 148 expected.

Which one would you choose for a trade?

– AAPL maybe looks safer near term for a trade

– DIS Looks much more impressive earnings report wise

– Maybe we keep an eye out for a pull back to launch higher for both

stocks?

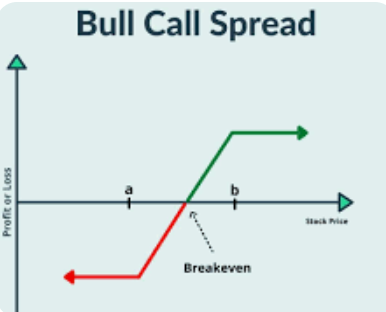

– Maybe we look at a bull call spread now, where if we get a pull

back we can take the short call off and let the long call run.

– AAPL 185/195 Bull Call out to January monthly.

– DIS 90/95 Bull Call same expiration OR 90/100

– AND/OR wait a few days and get in on a pullback