HI Market View Commentary 03-13-2023

Why do we collar trade?

Protection for the downside, to make up money (some money) on the way down, dollar cost average without having to ask for more money

1000 share BTO @ $100 a share and add a $7 long $100 put & short $110 call $3 credit = $104,000 initial investment

Earnings = Awful and they lose 50% which means EVERY share we had at $100 is now worth $50

IF you were every other broker you would invest another 50K to be down 50K but have a cost basis of $75 per share

BUT by Collar trading = How much did you lose?=4K

HI takes the profits form the puts and buys 1000 more shares=2000 shares

2000 shares cost basis= 107=2 = $53.50

NEXT EARNINGS and things still suck = and they take a 25% loss

2000 shares $3 per put =110K Investment that now loses 25%= Stock price is 37.50 per share

2000 shares we can sell @ 50 = 100K still 100,000/37.50 per share = 2666 shares where the other 266 shares or what we would have spent I take back for paying for the protection = 2400 shares

NEXT EARNINGS Flat as a pancake and we have 3500 shares that lose 3500 * $2 we spent for protection=7K

Comparison IF you just invested in the stock (buy and hold) = $37,500 and have lost 62,500 for a 62.5% loss

OR HI = 111K total investment = 2400 * 37.50 = 90K with a 10% loss

BUT we get a good quarter = 2400 *2 for put protection = $4800 BUT the stock pops 30% per Russ Kramer

2400 * (37.50 * 1.30) = 2400 * stock price is now 48.75 = total investment (116) = 117K

We are profitable by 2% while everyone else is down 52.25% or $52,250

LAST earnings Knocked it out of the park for another 30% gain

2400 shares * (48.75 * 1.30)

2400 shares* 63.375 = $152,100 EVERYONE ELSE 63,375 for a 36.725% loss

Two years later it trades at $100 again = total time 3.5 years

4000 * 1000 = 400K in this position while everyone else breaks even

Tuesday of last week VC’s started telling their clientele to pull their money out of SVB

10% held in cash probably closer to 7% for a run on the bank

OH NO there is a 40% run on our deposited funds

Customer has a $1 to $1 obligation from the bank,

They bank FIRST takes every dollar and buys US government securities WHY? To get interest and jhuice the returns,

Second reason = Most important = The BANKS can borrow against the US Treasury bill, note or bond $1 for $1 of what it’s worth

The paper value of bonds changes = IF you hold any treasuries until expiration you get buck $1000 per bond BUT during that time period the paper or tradeable value changes WORTH $120 today

349 Billion in liabilities and our “backstop” is only worth 120 Billion

I heard NO TAXES will pay for this 25B bailout

SVB and the NY bank It is 600 billion in liabilities

WHICH means to replace just that 25B shares amongst banks moving forward what are the fees going to have to be?

Why are regional banks in more trouble than credit unions?= Because regional banks don’t have the big bucks to get the benefits of buying the US treasuries

HOW much is the fed going to raise the interest rates on 3/22 of March? .25-.50

Why is stopping going to help inflation? Employment & Inflation

Something broke, but the Fed is still expected to go through with rate hikes

PUBLISHED MON, MAR 13 20231:58 PM EDTUPDATED 3 HOURS AGO

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

EY POINTS

- Markets still expect the Fed to keep up its inflation-fighting efforts, despite high-profile bank failures that have rattled the financial system.

- Traders on Monday assigned an 85% probability of a 0.25 percentage point interest rate increase when the Federal Open Market Committee meets March 21-22.

- Goldman Sachs was virtually alone when it said it expects the central bank to pass up the chance to hike rates next week.

When the Federal Reserve starts to raise interest rates, it generally keeps doing so until something breaks, or so goes the collective Wall Street wisdom.

So with the second- and third-largest bank failures ever in the books happening just over the past few days, and worries of more to come, that would seem to qualify as significant breakage and reason for the central bank to back off.

Economist Ed Hyman says it might be a good idea for the Fed to pause because of this financial shock

A DAY AGO

Not so fast.

Even with the failure over the past several days of Silicon Valley Bank and Signature Bank that forced regulators to spring into action, markets still expect the Fed to keep up its inflation-fighting efforts. Surging bond yields played into the demise of SVB in particular as the bank faced some $16 billion in unrealized losses from held-to-maturity Treasurys that had lost principal value due to higher rates.

Still, the dramatic events may not even technically qualify as something breaking in the collective Wall Street mind.

“No, it doesn’t,” said Quincy Krosby, chief global strategist at LPL Financial. “Is this enough to qualify as the kind of break that would have the Fed pivot? The market overall doesn’t think so.”

While market pricing was volatile Monday, the bias was toward a Fed that would continue tightening monetary policy. Traders assigned an 85% probability of a 0.25 percentage point interest rate increase when the Federal Open Market Committee meets March 21-22 in Washington, D.C., according to a CME Group estimate. For a brief period last week, markets were expecting a 0.50-point move, following remarks from Fed Chair Jerome Powell indicating the central bank was concerned about recent hot inflation data.

Pondering a pivot

Goldman Sachs on Monday said it does not expect the Fed to hike rates at all this month, though there were few, if any, other Wall Street forecasters who shared that view. Both Bank of America and Citigroup said they expect the Fed to make the quarter-point move, likely followed by a few more.

Moreover, even though Goldman said it figures the Fed will skip a hike in March, it still is looking for quarter-point increases in May, June and July.

“We think Fed officials are likely to prioritize financial stability for now, viewing it as the immediate problem and high inflation as a medium-term problem,” Goldman told clients in a note.

Krosby said the Fed is at least likely to discuss the idea of holding off on an increase.

Next week’s meeting is a big one in that the FOMC not only will make a decision on rates but also will update its projections for the future, including its outlook for GDP, unemployment and inflation.

“Undoubtedly, they’re discussing it. The question is, will they be worried perhaps that that nurtures fear?” she said. “They should telegraph [before the meeting] to the market that they’re going to pause, or that they’re going to continue fighting inflation. This is all up for discussion.”

Managing the message

Citigroup economist Andrew Hollenhorst said pausing — a term Fed officials generally dislike — now would send the wrong message to the market.

The Fed has sought to burnish its credentials as an inflation fighter after it spent months disavowing rising prices as nothing more than a “transitory” effect from the early days of the Covid pandemic. Powell repeatedly has said the Fed will stay the course until it makes significant progress in getting inflation down to its 2% target.

Citi, in fact, sees the Fed continuing to raise its benchmark funds rate to a target range of 5.5%-5.75%, compared to the current 4.5%-4.75% and well above the market pricing of 4.75%-5%.

“Fed officials are unlikely to pivot at next week’s meeting by pausing rate hikes, in our view,” Hollenhorst said in a client note. “Doing so would invite markets and the public to assume that the Fed’s inflation fighting resolve is only in place up to the point when there is any bumpiness in financial markets or the real economy.”

Bank of America said it remains “watchful” for any signs that the current banking crisis is spreading, a condition that could change the forecast.

“If the Fed is successful at corralling the recent market volatility and ringfencing the traditional banking sector, then it should be able to continue its gradual pace of rate hikes until monetary policy is sufficiently restrictive,” Michael Gapen, BofA’s chief U.S. economist, told clients. “Our outlook for monetary policy is always data dependent; at present it is also dependent on stresses in financial markets.”

Powell also has emphasized the importance of using data to determine the direction in which he wants to steer policy.

The Fed will get its final look at inflation metrics this week when the Labor Department releases its February consumer price index on Tuesday and the producer price counterpart on Wednesday. A New York Fed survey released Monday showed that one-year inflation expectations plummeted during the month.

Earnings dates:

MU – 3/29

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 10-Mar-23 16:18 ET | Archive

Stock market temperature goes from hot to cool

The first quarter isn’t complete yet but it has been packed with important developments that have included heightened volatility in the Treasury market, declining earnings estimates, stubbornly high inflation, stronger-than-expected growth, increased geopolitical tension, and an upward shift in rate-hike expectations.

Excluding the part about growth being stronger than expected, it hasn’t been a great backdrop for the stock market. The stock market, however, has held its own.

The S&P 500 is up 0.6% year-to-date, but the Nasdaq Composite is up 6.4% year-to-date. That is not the full story, though. At their highs this year, the S&P 500 was up 9.3% and the Nasdaq Composite was up 17.2%.

The summation is that a stock market that began the year on a hot note has cooled off. We would be surprised if it heated up again soon in a big way.

Topping Things Off

The tremendous start to the year was driven by the following factors:

- Speculative buying interest in stocks that had been hit hard by tax-loss selling activity in 2022

- Short-covering activity

- Offsides positioning (i.e., more accounts were positioned for a difficult market environment, so, as stock prices bucked conventional wisdom and ran higher, those accounts were playing catch up to participate in the gains)

- The thinking that the economy was destined for a hard landing shifted to thinking it would only experience a soft landing and perhaps “no landing” at all

- There was speculation that the Fed was about to be done raising rates and would be cutting rates once, if not twice, before the end of the year

The stock market went on a tear in January, but as we pointed out at the end of the month, it was running into a wall of valuation constraint that led us to think it would be hitting a top soon.

Sure enough, the top was hit on February 2 — the day before the much stronger than expected January employment report and a little less than two weeks before the January Consumer Price Index showed inflation sticking at higher levels and the January Retail Sales Report showed consumers were still spending in a robust manner.

Those reports might have helped quiet the hard landing narrative, but they also did something else that created a bigger stir: they forced the market to recalibrate its interest rate expectations, accounting for the likelihood that policy rates and market rates would have to head higher.

The offshoot of that thinking was that the stock market was overvalued trading at 18.5x forward twelve-month earnings. That thinking was correct given that (a) the 10-yr historical average is 17.2x, according to FactSet and (b) earnings estimates were still being revised lower.

Today, the S&P 500 trades at 17.3x forward twelve-month earnings, more in-line with its historical average. Then again, that 10-yr historical average was established with the 10-yr note yield averaging 2.17% and core-PCE inflation averaging 2.12% over the same period. Today, the 10-yr note yield is at 3.70% and core-PCE inflation is up 4.7% year-over-year, so maybe the S&P 500 isn’t trading as “in-line” with the historical average as meets the eye.

Plenty of Obstacles

We do know that the stock market has traded in a roller-coaster fashion this year — up as much as 9.3% on February 2, but up only 0.2% for the year at its low on March 10.

There was an orderly retracement through much of February, but the retracement turned a bit disorderly this week with Fed Chair Powell telling Congressional committees in his semiannual monetary policy testimony that the ultimate level of interest rates is likely to be higher than previously anticipated given that inflation remains too high and the labor market is still running tight.

Beyond that unsettling revelation for the market, there was a stunning failure of SVB Financial Group (SIVB) that culminated with regulators shutting down Silicon Valley Bank, evoking bad memories of the financial crisis. The speed at which SVB Financial failed triggered a run on other bank stocks and a stark flight-to-safety trade in the Treasury market.

The 2-yr note yield, at 5.06% when word of troubles at SVB Financial first hit, collapsed to 4.61% while the 10-yr note yield went from 4.01% to 3.70% (all in a span of less than two days). Ironically, the drop in yields was not a support factor for stocks. It was more of a scare factor that contributed to broad-based selling and heightened worries that other smaller, regional banks could run into similar deposit flight issues.

Time will tell if that is the case, but the SVB Financial issue has added to what was already a heightened sense of uncertainty in the market.

Fed Chair Powell contributed to that uncertainty, noting that the Fed is data dependent and not on a preset path with its policy decisions. Having said as much, he all but ensured that there will be outsized movement following key data points. That isn’t constructive for the market, however, since excess volatility dampens investor interest/conviction.

The stock market already has enough obstacles in its way:

- Higher interest rates

- Declining earnings estimates

- A hawkish-minded Fed intent on getting inflation back down to 2.0%

- Russia intensifying its efforts in Ukraine

- China and the U.S. experiencing a widening ideological divide

- The latent lag effect of the Fed’s prior rate hikes (and prior rate hikes from other central banks around the world)

- No plan yet in Congress for raising the debt limit

What It All Means

The good news at this point is that the only recession in sight is in the Treasury market. The 2s10s spread recently hit its deepest inversion since 1981. The real economy, however, has yet to buckle under the weight of those expectations.

The Atlanta Fed GDPNow model estimate for real GDP growth in the first quarter is 2.6%; the unemployment rate ticked up to 3.6% in February from a 54-year low of 3.4% in January; the ISM Services PMI sits at 55.1% (a number above 50.0% is indicative of expansion); and the four-week moving average for initial jobless claims is at a lowly 197,000.

It isn’t all rosy, however. Existing home sales have declined for 12 consecutive months, new home sales in January were down 19.4% year-over-year, housing starts were down 21.4% year-over-year in January, and the Conference Board’s Leading Economic Index has declined for 10 consecutive months.

Interestingly, high-yield spreads are trading roughly where they were in late-2018 when there was no talk of a hard landing.

This economy is a tough nut to crack from both a real-time and forecasting standpoint. We do expect the economy, however, to show more cracks in coming months as the lag effect of central bank rate hikes starts having a greater impact on consumer demand. And if it doesn’t… well, then, the market will continue to rue the idea that the Fed is going to keep rates higher for longer.

We said at the start that it hasn’t been the best of backdrops for stocks. That remains the case; in fact, the backdrop has worsened with volatility picking up, geopolitical tension increasing, partisan debt ceiling views becoming more entrenched, and higher Treasury yields creating more competition for stocks.

The stock market has held up reasonably well so far, but that also depends on one’s starting point this year. From the start of the year, the S&P 500 is up 0.6%. That’s not bad. From its high on February 2, it is down 8.0%. That’s not good.

That is a fitting swing that underscores the heightened sense of uncertainty about where the Fed’s tightening cycle ends and what damage it will ultimately do — or not do — along the way.

The stock market’s fickle behavior is a reminder that return expectations for equity investors this year should be lowered because stocks have increased competition from bonds, increased competition from the Fed, and increased competition from reduced earnings expectations. In other words, the competition is heating up, which is why the stock market should be cooling down.

—Patrick J. O’Hare, Briefing.com

https://go.ycharts.com/weekly-pulse

| Market Recap |

| WEEK OF MAR. 6 THROUGH MAR. 10, 2023 |

| The S&P 500 index fell 4.5% last week as a larger-than-expected rise in February jobs added to rate worries while investors also were spooked by the collapse of SVB Financial Group’s (SIVB) Silicon Valley Bank.

The market benchmark ended Friday’s session at 3,861.59, down from last week’s closing level of 4,045.64. The index is still in positive territory for 2023, but barely — its year-to-date gain has slimmed to just 0.6%. The index began the week’s slide on Tuesday after Federal Reserve Chair Jerome Powell said most-recent economic data are stronger than originally forecast, suggesting interest rates will rise beyond what was anticipated. “If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes,” he said. The comments added to the market’s nerves ahead of Friday’s release of February jobs data. Investors have been worried that a stronger-than-expected labor market could prompt the Federal Open Market Committee to raise interest rates more aggressively to tamp down inflation. The February jobs numbers indeed came in stronger than expected. Nonfarm payrolls rose by 311,000 last month, the US Labor Department said, well above the 225,000 jobs increase expected in a survey compiled by Bloomberg. Private payrolls rose by 265,000 in February, surpassing the increase of 215,000 private jobs expected. The unemployment rate ticked up to 3.6% in February from 3.4% in January, but that came as the participation rate rose and the size of the labor force expanded. The market also was rattled on Friday by the collapse of Silicon Valley Bank, which represents the second-largest bank failure in US history. The California Department of Financial Protection & Innovation said it closed the SVB unit and appointed the Federal Deposit Insurance Corp. as receiver. All of the S&P 500’s sectors fell last week, led by the financial sector that slid 8.5% amid the collapse of Silicon Valley Bank. Materials dropped 7.6%, real estate was down 7%, consumer discretionary lost 5.6% and energy lost 5.3%. Shares of SVB Financial Group plunged 63% last week. The company’s Silicon Valley Bank unit was closed Friday by the Calitornia Department of Financial Protection and Innovation and the US Federal Deposit Insurance Corp. was named receiver. All insured deposits were transferred to a new entity created by the FDIC called the Deposit Insurance National Bank of Santa Clara. Insured depositors will have access to their insured funds no later that Monday, the FDIC said. Also in the financial sector, shares of First Republic Bank (FRC) fell 34% as the company said its underwritten public offering of 2.5 million common shares priced for expected gross proceeds of about $350 million. This implies a per-share price of $140, which represents a discount to the stock’s last reported closing price prior to the pricing. The number of shares also marked an increase from 2 million shares the bank previously said it planned to sell. Among the decliners in the materials sector, shares of International Flavors & Fragrances (IFF) shed 9.7%. Berenberg Bank lowered its price target on the company’s stock to $103 each from $127 while keeping its investment rating on the shares at hold. Next week’s economic data will feature key inflation readings, with the February consumer price index set to be released on Tuesday and the February producer price index expected on Wednesday. Other data anticipated next week include February retail sales on Wednesday, February housing starts and building permits on Thursday, and March consumer sentiment on Friday. Provided by MT Newswires |

Where will our markets end this week?

Lower

DJIA – Bearish

SPX –Bearish

COMP – Bearish

Where Will the SPX end March 2023?

03-13-2023 -2.0%

03-06-2023 -2.0%

02-27-2023 -2.0%

Earnings:

Mon: FL

Tues: TME, GME, NKE

Wed: FUL, KBH

Thur: DRI, GIS

Fri:

Econ Reports:

Mon:

Tue Core CPI, CPI, NFIB Small Business Index

Wed: MBA, Core PPI, PPI, Empire Manu, Retail Sales, Retail ex-auto, Business Inventories, NAHB Housing Market Index

Thur: Initial Claims, Continuing Claims, Import, Export, Building Permits, Housing Starts, Phil Fed

Fri: Capacity Utilization, Industrial Production, Leading Indicators, Michigan Sentiment, MONTHLY OPTIONS EXPIRATION

How am I looking to trade?

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

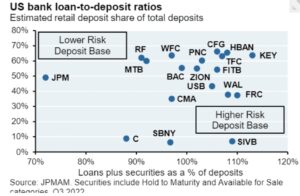

So why is Schwab and BAC going down ? vs

JPM and GS are not using the same dollar with the same risk as the others

Job openings declined in January but still far outnumber available workers

PUBLISHED WED, MAR 8 202310:34 AM ESTUPDATED WED, MAR 8 20232:24 PM EST

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- The Labor Department’s JOLTS report showed there are 10.824 million openings, down some 410,000 from December.

- That equates to 1.9 job openings per every available worker.

- Quits, a signal of worker confidence in mobility, fell to 3.88 million, the lowest level since May 2021.

Job openings declined slightly in January but still far outnumber available workers as the labor picture remains tight, according to data released Wednesday.

The Labor Department’s Job Openings and Labor Turnover Survey, or JOLTS, showed there are 10.824 million openings, down some 410,000 from December, the Labor Department reported. That equates to 1.9 job openings per available worker, or a gap of 5.13 million.

Despite the decline, the total was still higher than the FactSet estimate of 10.58 million. December’s number also was revised up by more than 200,000.

“Jolts data from January highlight that while the labor market could be loosening somewhat on the margin it is still much tighter than previous historical periods and continues to pose upside risk for wages and prices,” Citigroup economist Gisela Hoxha wrote.

Federal Reserve officials watch the JOLTS report closely as they formulate monetary policy. In remarks on Capitol Hill this week, Fed Chairman Jerome Powell called the jobs market “extremely tight” and cautioned that a recent spate of data showing resurgent inflation pressures could push interest rate hikes higher than expected.

Powell told the Senate Banking Committee on Wednesday that the JOLTS report was one critical data point he will be examining before making a decision on rates at the March 21-22 policy meeting.

The JOLTS report showed that hiring was brisk for the month, with employers bringing on 6.37 million workers, the highest total since August.

Total separations were little changed, while quits, a signal of worker confidence in mobility, fell to 3.88 million, the lowest level since May 2021. Layoffs, however, rose sharply, up 241,000 or 16%.

Earlier Wednesday, payroll processing firm ADP reported that companies added 244,000 workers for February, another sign that hiring has been resilient despite Fed rate hikes that are aimed at slowing economic growth and cooling the labor market.

There were some other signs of softness, with construction openings falling 240,000, or 49%. The ADP report indicated the trend followed through to February, with the sector losing 16,000 jobs. Leisure and hospitality, a leader in job gains over the past two years or so, also saw a decline of 194,000 openings in January.

Markets will get a more comprehensive view of the jobs picture when the Labor Department releases its nonfarm payrolls report Friday. Economists surveyed by Dow Jones expect payrolls to increase by 225,000 and the unemployment rate to hold at 3.4%.

Want a risk-free 5% return? How to buy a 3-month Treasury

PUBLISHED WED, MAR 8 20231:32 PM ESTUPDATED WED, MAR 8 20232:16 PM EST

Darla Mercado, CFP®@DARLA_MERCADO

KEY POINTS

- Bond yields surged Tuesday as Federal Reserve Chair Jerome Powell said interest rates may have to remain higher for longer to quell inflation.

- In particular, the 3-month Treasury yield leapt over 5%, touching levels last seen in 2007.

- For investors hoping to put idle cash to work, there’s an opportunity to snap up short-term Treasurys and earn an attractive risk-free return.

The latest spike in bond yields was enough to spook the stock market into a sell-off Tuesday, but there’s a silver lining for fixed income investors: Short-term Treasurys are now touting a risk-free return of 5%.

The latest action follows comments from Federal Reserve Chair Jerome Powell, who said Tuesday that interest rates are “likely to be higher” than previously expected. “If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes,” he said.

The yield on the 3-month Treasury touched a high of 5.015% on Tuesday, the highest level since 2007. (Note: that yield is annualized, not what you would get in just three months.)

Rates on the 1-year bill and 2-year Treasury note – the latter of which is most sensitive to the Fed’s policy – also popped more than 5% on Wednesday morning, reaching levels last seen in 2006 and 2007, respectively. Bond yields move inversely to prices.

Short-term Treasurys are a great way to put idle cash to work, and you can also “ladder” them to get a little interest on your money over a certain term. This means you build a portfolio of issues with different maturities and reinvest the proceeds as they mature.

Investors can get in on the action in a couple of ways.

First, they can purchase Treasurys directly from the U.S. government via TreasuryDirect.gov. They will have to set up an account on the site and link their bank to it. For short-term investors, 4-week, 8-week, 13-week and 26-week T-bills are auctioned every week. Two-year notes are auctioned monthly, and 10-year Treasurys are auctioned every quarter.

If you hold the Treasury to maturity, you aren’t subject to market risk. The bonds generally pay interest twice a year, but for T-bills, the interest you get is the difference between what you paid and the face value you receive at maturity.

Another way for investors to buy Treasurys is through a brokerage firm. This makes record-keeping easier for investors, especially if they already have an individual retirement account at a given firm.

The issue is that you may be subject to fees and minimum purchase requirements if you buy Treasurys through a brokerage account. Consider that you can buy Treasurys directly from the government with a minimum purchase amount of $100, but a brokerage firm can charge you for broker-assisted trades. Others require that you buy at least $1,000 in Treasurys.

Though Treasurys are considered risk-free because their payments are backed by the full faith and credit of the United States government, investors should be aware that the real rate of return they’re earning could be eaten away if inflation rises at a pace greater than the yield. A further risk is they may also miss out on investment opportunities in other assets like stocks.

These bonds may be a great way to get some interest on otherwise idle cash, but they shouldn’t make up the entirety of your portfolio.

— CNBC’s Michelle Fox and Gina Francolla contributed to this story.

Biden budget would cut deficit by $3 trillion over next decade with 25% minimum tax on richest Americans

PUBLISHED THU, MAR 9 202312:00 PM ESTUPDATED THU, MAR 9 20234:03 PM EST

KEY POINTS

- Biden’s budget would also raise more revenue by increasing taxes on oil and gas companies, hiking the corporate tax rate to 28% from 21%, and allow Medicare to negotiate drug prices.

- The president’s spending priorities include increasing funding for early childhood education and child care, expanding the $35 cap on insulin prices to all Americans and expanding free community college.

- The budget also boosts military spending to more than $835 billion, making it among the largest peacetime expenditures in U.S. history.

- Biden still faces the unresolved standoff with Republicans over whether to lift the debt ceiling.

President Joe Biden released his budget on Thursday, vowing to cut $3 trillion from the federal deficit over the next decade, in part, by levying a 25% minimum tax on the wealthiest Americans.

Biden’s budget would also raise more revenue by increasing taxes on oil and gas companies, hiking the corporate tax rate to 28% from 21% imposed under former President Donald Trump but below the pre-2017 35% tax, and allow Medicare to negotiate drug prices.

With Biden likely to run for reelection in 2024, his budget is also a preview into his platform as a candidate and campaign pitch in the year ahead. Facing a Republican-controlled House, it’s unlikely many of the proposals will be passed in their current form. The president submits his budget to Congress outlining the administration’s priorities for the upcoming year, but ultimately Congress decides where the funds are allocated.

Fair share

White House Office of Management and Budget director Shalanda Young told reporters the administration is able to cut deficit spending “by asking the wealthy and big corporations to begin to pay their fair share and by cutting wasteful spending on Big Pharma, Big Oil and other special interests.”

“It does this in part by reforming our tax code to reward work, not wealth, including by ensuring that no billionaire pays a lower tax rate than a teacher or firefighter and by quadrupling the tax rate on corporate stock buybacks,” Young said. “That’s a very clear contrast with congressional Republicans.”

The Stock Buybacks Tax builds upon a measure Biden signed into law last year reducing the differential treatment in the code between buybacks and dividends. The goal is to encourage business to invest in growth rather than spending on stock buybacks. Under the budget proposal, the tax would quadruple from 1% to 4%. A Data for Progress poll from February found 58% of Americans support increasing the stock-buyback tax.

Biden’s fiscal year 2024 budget gets some help from the slowing Covid-19 pandemic, which the White House noted needs less emergency aid as the outbreak enters a new phase thanks to widespread vaccinations. The president’s spending priorities include increasing funding for early childhood education and child care, expanding the $35 cap on insulin prices to all Americans and expanding free community college. These proposals are all part of his push to give American families “a little more breathing room.” The 2024 fiscal year begins Oct. 1 and runs through Sept. 30, 2024.

Social programs

Cecilia Rouse, chair of the Council of Economic Advisers, explained how the administration believes the social programs outlined in the White House budget will actually boost the economy.

“Policies such as paid leave and child care will bring more workers into the labor force and improve productivity,” Rouse said. “Investments in early education, mental health and community college not only expand our economy’s productive capacity but pay dividends for generations to come.”

In addition to social spending, the budget includes robust defense funding. At more than $835 billion, the defense budget would be among the largest peacetime expenditures in U.S. history.

For weeks the president has urged House Republicans to present their own budget proposals instead of just criticizing his plan. House Republicans have promised to propose a balanced budget and have scoffed when the White House pointed to GOP proposals to make cuts to programs like Social Security and Medicare. House Budget Committee Chair Jodey Arrington told CNN on Wednesday the Republican budget should be ready by the second week in May.

‘Fight it out’

Speaking in Philadelphia, Pa. on Thursday, Biden said he and House Speaker Kevin McCarthy, who the president noted is “a very conservative guy” with “a very conservative group” of lawmakers, agreed early on to meet after they both introduce their budgets.

“We’ll sit down and we’ll go line by line, and we’ll go through it and see what we can agree on, what we disagree on, and then fight it out in the Congress,” Biden recounted telling McCarthy. “I’m ready to meet with the Speaker anytime, tomorrow if he has his budget. Lay it down, show me what you want to do, I’ll show what I want to do. We can see what we can agree on, see what we don’t agree on and we vote on it.”

The White House, in its budget proposal, includes an entire section dedicated to shoring up Social Security and Medicare, funded by the minimum 25% wealth tax on households with a net worth of $100 million or more. The proposed budget would extend “the solvency of the Medicare Trust Fund by at least 25 years” without removing benefits or raising costs. It also provides a $1.4 billion increase in funding for Social Security to improve services.

Debt ceiling debate

“Benefit cuts are not on the table,” Young said.

Looming over the budget release is the unresolved standoff over whether to lift the debt ceiling. The White House has maintained it will not negotiate over the debt limit, arguing Congress should act to raise it as it has done numerous times over past decades. House Republicans, led by Speaker Kevin McCarthy, have tried to tie the debt ceiling to future spending, saying they will not budge without promises to cut expenses. The debt ceiling, however, pertains to existing spending. To date, House Republicans have been murky on what expenses they would like to see cut.

“MAGA Republicans in Congress have tried to repeal the Affordable Care Act, Social Security, Medicare, Medicaid — we’re not going to let them folks,” Biden said. “My budget makes robust investments on military defense, let’s see what the MAGA Republicans propose and let’s be clear where I stand: I will not allow cuts to the needs of the intelligence community or military that help keep us safe.”

‘Back to work’

Rouse touted the administration’s economic track record, noting that unemployment has fallen somewhat inexplicably under Biden’s watch — even as the pace of inflation has slowed. She said most economists couldn’t have predicted the jobs market would rebound as strongly as it has since he took office.

“I think if you told most conventional macroeconomists last June that we were about to get seven straight months of declining annual CPI inflation, they would have told us that the unemployment rate would rise over that time, but instead the unemployment rate in January was 3.4%, or 0.2 percentage points lower than it was,” Rouse said, noting that February’s unemployment rate will be released Friday. “The economy looks healthier today than it did in other ways, too.”

Rouse expanded on that, in an attempt to ease recession concerns by pointing to economic gains already seen under the administration’s watch.

“The strength of our recovery has put us on solid ground to weather economic shocks,” Rouse said. “Americans are back to work and the economy is stronger than anyone, including the federal government and private forecasters, imagined it would be when President Biden took office.”

Here’s how the second-biggest bank collapse in U.S. history happened in just 48 hours

PUBLISHED FRI, MAR 10 20233:59 PM ESTUPDATED FRI, MAR 10 20238:38 PM EST

Jonathan Vanian@JONATHANVANIAN

KEY POINTS

- The company’s downward spiral began late Wednesday, when it surprised investors with news that it needed to raise $2.25 billion to shore up its balance sheet.

- “This was a hysteria-induced bank run caused by VCs,” Ryan Falvey, a fintech investor of Restive Ventures, told CNBC.

- All told, customers withdrew a staggering $42 billion of deposits by the end of Thursday, according to a California regulatory filing.

- Now, those who remained with SVB face an uncertain timeline for retrieving their money.

On Wednesday, Silicon Valley Bank was a well-capitalized institution seeking to raise some funds.

Within 48 hours, a panic induced by the very venture capital community that SVB had served and nurtured ended the bank’s 40-year-run.

Regulators shuttered SVB Friday and seized its deposits in the largest U.S. banking failure since the 2008 financial crisis and the second-largest ever. The company’s downward spiral began late Wednesday, when it surprised investors with news that it needed to raise $2.25 billion to shore up its balance sheet. What followed was the rapid collapse of a highly-respected bank that had grown alongside its technology clients.

Even now, as the dust begins to settle on the second bank wind-down announced this week, members of the VC community are lamenting the role that other investors played in SVB’s demise.

“This was a hysteria-induced bank run caused by VCs,” Ryan Falvey, a fintech investor at Restive Ventures, told CNBC. “This is going to go down as one of the ultimate cases of an industry cutting its nose off to spite its face.”

The episode is the latest fallout from the Federal Reserve’s actions to stem inflation with its most aggressive rate hiking campaign in four decades. The ramifications could be far-reaching, with concerns that startups may be unable to pay employees in coming days, venture investors may struggle to raise funds, and an already-battered sector could face a deeper malaise.

The roots of SVB’s collapse stem from dislocations spurred by higher rates. As startup clients withdrew deposits to keep their companies afloat in a chilly environment for IPOs and private fundraising, SVB found itself short on capital. It had been forced to sell all of its available-for-sale bonds at a $1.8 billion loss, the bank said late Wednesday.

The sudden need for fresh capital, coming on the heels of the collapse of crypto-focused Silvergate bank, sparked another wave of deposit withdrawals Thursday as VCs instructed their portfolio companies to move funds, according to people with knowledge of the matter. The concern: a bank run at SVB could pose an existential threat to startups who couldn’t tap their deposits.

SVB customers said CEO Greg Becker didn’t instill confidence when he urged them to “stay calm” during a call that began Thursday afternoon. The stock’s collapse continued unabated, reaching 60% by the end of regular trading. Importantly, Becker couldn’t assure listeners that the capital raise would be the bank’s last, said a person on the call.

Death blow

All told, customers withdrew a staggering $42 billion of deposits by the end of Thursday, according to a California regulatory filing.

By the close of business that day, SVB had a negative cash balance of $958 million, according to the filing, and failed to scrounge enough collateral from other sources, the regulator said.

Falvey, a former SVB employee who launched his own fund in 2018, pointed to the highly interconnected nature of the tech investing community as a key reason for the bank’s sudden demise.

Prominent funds including Union Square Ventures and Coatue Management blasted emails to their entire rosters of startups in recent days, instructing them to pull funds out of SVB on concerns of a bank run. Social media only heightened the panic, he noted.

“When you say, `Hey, get your deposits out, this thing is gonna fail,′ that’s like yelling fire in a crowded theater,” Falvey said. “It’s a self-fulfilling prophecy.”

Another venture investor, TSVC partner Spencer Greene, also criticized investors who “were wrong on the facts” about SVB’s position.

“It appears to me that there was no liquidity issue until a couple of VCs called it,” Greene said. “They were irresponsible, and then it became self-fulfilling.”

‘Business as usual’

Thursday evening, some SVB customers received emails assuring them that it was “business as usual” at the bank.

“I’m sure you’ve been hearing some buzz about SVB in the markets today so wanted to reach out to provide some context,” one SVB banker wrote to a client, according to a copy of the message obtained by CNBC.

“It is business as usual at SVB,” the banker wrote. “Understandably there may be questions and I want to make myself available if you have any concerns.”

By Friday, as shares of SVB continued to sink, the bank ditched efforts to sell shares, CNBC’s David Faber reported. Instead, it was looking for a buyer, he reported. But the flight of deposits made the sale process harder, and that effort failed too, Faber said.

Falvey, who started his career at Wells Fargo and consulted for a bank that was seized during the financial crisis, said that his analysis of SVB’s mid-quarter update from Wednesday gave him confidence. The bank was well capitalized and could make all depositors whole, he said. He even counseled his portfolio companies to keep their funds at SVB as rumors swirled.

Now, thanks to the bank run that ended in SVB’s seizure, those who remained with SVB face an uncertain timeline for retrieving their money. While insured deposits are expected to be available as early as Monday, the lion’s share of deposits held by SVB were uninsured, and it’s unclear when they will be freed up.

“The precipitous deposit withdrawal has caused the Bank to be incapable of paying its obligations as they come due,” the California financial regulator stated. “The bank is now insolvent.”

Rep. Blake Moore questions Secretary Yellen about Biden’s proposed corporate tax increase

By Joshua Lee, Deseret News | Posted – March 11, 2023 at 7:04 p.m.

Utah Rep. Blake Moore speaks with John Boyer, of North Ogden, at a Republican watch party in Ogden on Nov. 8, 2022. The corporate tax increase in President Joe Biden’s proposed 2024 budget would hurt Utah businesses, according to Moore. (Ben B. Braun, Deseret News)

SALT LAKE CITY — The large corporate tax increase in President Joe Biden’s proposed 2024 budget would hurt Utah businesses, according to Utah Republican Rep. Blake Moore.

Moore had a chance to question Treasury Secretary Janet Yellen on Biden’s proposal at a House Ways and Means committee hearing Friday. Later on Friday, he spoke to the Deseret News about his thoughts on the budget and on the debt ceiling debate.

“I am concerned … that they’re just going to raise (corporate taxes) just to cover more spending that we’re seeing from the president’s budget,” Moore said to Yellen. “What am I to tell these companies and individuals?” He said that the proposed increase from 21% to 28% would be an enormous burden on companies in his district.

Yellen agreed with Moore that before Republicans lowered the rate in 2017, the previous corporate tax rate was too high compared to others around the globe. But she said she believes lowering the rate to 21% caused a “race to the bottom,” that could reduce future federal revenue collection when additional funds are necessary “for essential investments like those proposed in the president’s budget.”

During his questions, Moore referenced business leaders in Box Elder County who told him they were able to give raises to employees because Congress lowered the corporate tax rate. But Yellen said the Treasury hasn’t seen the “economic payoff in the form of great increases in investment spending” to make the tax decrease worth it.

Due to time constraints at the hearing, Moore wasn’t able to ask a follow-up question. But the Deseret News caught up with him shortly after the hearing to ask about why he views the low corporate tax rate differently than the Biden administration.

“Democrats aren’t looking at those second and third order benefits to lower taxes,” the congressman said. “Middle class wages significantly increased since the 2017 Tax Cut and Jobs Act.”

He further claimed the federal government’s record tax revenue collection in recent years is partly due to Republicans lowering the tax rate. Moore is concerned Americans could lose jobs if the federal government “starts creeping (the tax rate) back up to where it’s an easier decision for companies to offshore some of their work.”

What’s in Biden’s 2024 budget proposal

Democrats have criticized the Republican 2017 tax reform bill for cutting taxes that benefited the rich, a line used again Thursday by Biden when he gave a speech about his budget proposal.

“For too long, working people (have) been breaking their necks, the economy’s left them behind — working people like you — while those at the top get away with everything,” Biden said to a crowd gathered at a Pennsylvania union hall.

The president’s budget requests a tax increase in order to increase funding for defense, immigration, health care and clean energy programs. Biden’s 2024 budget would cost $6.8 trillion, significantly increasing federal spending from his $5.8 trillion 2023 budget proposal.

Biden proposed tax increases on the wealthy as a means to fund his plan. The president says his budget will cut the deficit by $3 trillion over the next decade.

Besides raising the corporate tax rate, Biden proposed raising the individual tax rate to 39.6% from 37% and hiking the take rate for top income earners on Medicare to 5% from 3.8%.

He also pledged to raise taxes on the wealthy to shore up support of Social Security.

Republican response to the budget proposal

Biden’s budget request is largely considered dead on arrival in Congress. With the House controlled by the Republican majority and a Democratic Senate majority, the White House will have to negotiate with lawmakers in both chambers — and parties — to find a compromise deal.

Related to that, House Speaker Kevin McCarthy and fellow Republicans have threatened to block an additional debt ceiling limit increase unless Biden agrees to rein in federal spending, but Biden’s budget disregards those demands.

At the hearing, Yellen likewise urged Republicans to raise the debt limit “without conditions and without waiting until the last minute.”

Moore told the Deseret News that Biden will “not get Republicans to support a irresponsible debt ceiling increase.”

“We have to make some significant changes in reduction of costs and reduction of spending,” Moore said before mentioning that the GOP goal is to incentivize a cultural shift by reinstating “Clinton-era work requirements” for those on government welfare programs.

Moore also said Republicans have proposed terms for budget negotiations they want Senate Democrats to agree to before they come to the table. They no longer want to fund government through continuing resolutions, but instead want Congress pass regular appropriation bills.

His comments mirrored some of what his colleagues in the House Freedom Caucus said Friday that they would like to see from the White House before agreeing to a debt ceiling increase.

On Friday, Utah GOP Sen. Mike Lee tweeted his support of the House Freedom Caucus’ budget demands, which include: restoring Clinton-era work requirements for welfare programs, and top lining discretionary spending at 2022 levels for 10 years with only a 1% annual growth rate, which they say will save money “by cutting the wasteful, woke and weaponized federal bureaucracy.”

Moore said he is optimistic that the two sides can work it out if they are willing to negotiate. Time to approve a debt ceiling limit increase is quickly running out as the Treasury has indicated it is already utilizing “extraordinary measures” after the country hit the current debt ceiling in January.

“We are ready to negotiate,” Moore said. “The Speaker’s office has reached out again and now that the (president’s) budget request is out, hopefully he’s willing to engage and do a thoughtful, good faith negotiation.”

Mortgage rates tumble in the wake of bank failures

PUBLISHED MON, MAR 13 202312:43 PM EDTUPDATED 3 HOURS AGO

Diana Olick@IN/DIANAOLICK@DIANAOLICKCNBC@DIANAOLICK

KEY POINTS

- The average rate on the popular 30-year fixed mortgage dropped to 6.57% on Monday, according to Mortgage News Daily.

- If rates continue to drop now, buyers could return to the housing market once again.

- “This mini banking crisis has to drive a change in consumer behavior in order to have a lasting positive impact on rates. It’s still all about inflation,” said Matthew Graham, chief operating officer at Mortgage News Daily.

The average rate on the popular 30-year fixed mortgage dropped to 6.57% on Monday, according to Mortgage News Daily. That’s down from a rate of 6.76% on Friday and a recent high of 7.05% last Wednesday.

Mortgage rates loosely follow the yield on the 10-year Treasury, which fell to a one-month low in response to the failures of Silicon Valley Bank and Signature Bank and the ensuing ripple through the nation’s banking sector.

In real terms, for a buyer looking at a $500,000 home with a 20% down payment on a 30-year fixed mortgage, the monthly payment this week is $128 less than it was just last week. It is still, however, higher than it was in January.

So what does this mean for the spring housing market?

In October, rates surged over 7%, and that started the real slowdown in home sales. But rates then started falling in December and were near 6% by the end of January. That caused a surprising 8% monthly jump in pending home sales, which is the National Association of Realtors’ measure of signed contracts on existing homes. Sales of newly built homes, which the Census Bureau measures by signed contracts, also surged far higher than expected.

While the numbers for February are not in yet, anecdotally, agents and builders have said sales took a big step back in February as rates shot higher. So if rates continue to drop now, buyers could return once again — but that’s a big “if.”

“This mini banking crisis has to drive a change in consumer behavior in order to have a lasting positive impact on rates. It’s still all about inflation,” said Matthew Graham, chief operating officer at Mortgage News Daily.

Markets now have to contend with the “inflationary impact of consumer fear,” he added, noting that Tuesday brings a fresh consumer price index report, a monthly measure of inflation in the economy.

As recently as last week, Federal Reserve Chairman Jerome Powell told members of Congress that the latest economic data has come in stronger than expected.

“If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes,” Powell said.

While mortgage rates don’t follow the federal funds rate exactly, they are heavily influenced by both the Fed’s monetary policy and its thinking on the future of inflation.

SVB Exec Joseph Gentile Served as CFO to Lehman Brothers Before 2008 Collapse

Before joining the Silicon Valley Bank (SVB) as the Chief Administrative Officer (CAO) in 2007, Joseph Gentile served as the Chief Financial Officer (CFO) at Lehman Brothers’ Global Investment Bank before the public collapse in 2008.

Gentile worked at Lehman as the CFO, directing the accounting and financial needs in the Fixed Income division before he left in 2007 — just one year before it became one of the biggest banks to declare bankruptcy during the 2008 financial crisis.

Since leaving Lehman, before the major collapse, he has been serving as CAO at SVB.

After being founded in 1983, SVB, the tech sector-focused bank, collapsed last week when panicked customers suddenly withdrew tens of billions of dollars after the bank announced a loss of approximately $1.8 billion from a sale of its investments in U.S. treasuries and mortgage-backed securities.

Ultimately, regulators shut Silicon Valley Bank down, and the Federal Deposit Insurance Corporation (FDIC) took control of the bank and said they would protect insured deposits.

On Sunday, the U.S. Treasury, the Federal Reserve, and the FDIC announced they would be taking “decisive actions to protect the U.S. economy by strengthening public confidence in [the U.S.] banking system” by effectively making deposits above the FDIC’s $250,000 limit available on Monday.

At the time of the collapse in 2008, Lehman was the fourth-largest U.S. investment bank, with $639 billion in assets and $619 billion in debt, according to case studies. At the end of 2022, SVB was the sixteenth largest bank by assets according to U.S. Federal Reserve data.

Gentile’s connection to Lehman and SVB has sparked numerous takes over social media.

“Like I said, Lehman 2.0 – when you’re levered over 10x++ and you sell assets for a loss, it’s a catastrophe,” stated one Twitter account going by “Stratton Oak.” “Joseph Gentile was the Chief Administrative Officer at [SVB]. Prior to joining in 2007, he served as the CFO for Lehman Brothers’ Global Investment Bank.”

“This is truly unusual,” another Twitter account called “unusual_whales” tweeted.

“Meet Joseph Gentile. He was the Chief Administrative Officer at Silicon Valley Bank,” the account stated, before noting, “Prior to joining the firm in 2007, he served as the CFO for Lehman Brothers’ Global Investment Bank.”

“What a co-incidence,” the Twitter account “Wealth Saga” emphasized.

“Meet Joseph Gentile. He was the Chief Administrative Officer at Silicon Valley Bank. Prior to joining the firm in 2007, he served as the CFO for Lehman Brothers’ Global Investment Bank,” the account added.

Jacob Bliss is a reporter for Breitbart News. Write to him at jbliss@breitbart.com or follow him on Twitter @JacobMBliss.

Pinkerton: Green, Woke, and Now Broke — How SVB Became the 2nd Biggest Bank Failure in U.S. History

11 Mar 2023

Go Woke, Go Bust

Oh so woke, oh so green, oh so diverse Silicon Valley Bank (SVB) just went bust.

One can go to its website—still up for who knows how much longer—and see that it claims assets of $212 billion. But as they say, the bigger they are, the harder they fall; and SVB makes for the second largest bank failure in U.S. history.

Remarkably, 93 percent of the bank’s $161 billion in deposits are uninsured by the Federal Deposit Insurance Corporation (FDIC), which only covers accounts up to $250,000. And Roku, to name just one whale, had $487 million in Silicon Valley Bank. So, just for starters, a lot of CFOs—the folks in charge of handling a company’s money—are gonna have some ‘splaining to do.

Speaking of ‘splaining, SVB officials will need to answer a lot of questions, including, What role did wokeness play in SVB’s failure?

Another term for wokeness, of course, is ESG, which stands for environmental, social, and governance. ESG is a pertinent question, as there’s a considerable body of economic literature showing that woke investments aren’t good investments. For instance, one study by professors at the London School of Economics and Columbia University finds that:

ESG funds appear to underperform financially relative to other funds within the same asset manager and year, and to charge higher fees. Our findings suggest that socially responsible funds do not appear to follow through on proclamations of concerns for stakeholders.

Shorter version: ESG makes less, costs more, and is a fraud.

Of course, if ESG investing only soothed the conscience of gullible trust-funders, it might be okay. But now, as a big ESG bank goes belly up, we see the danger of systemic risk to the whole economy. That’s what happened when bank failures domino-ed back in 1929.

So, it’s funny, in a not-funny way, that as recently as March 7, Treasury Secretary Janet Yellen was urging faster please on ESG. “A delayed and disorderly transition to a net-zero economy can lead to shocks to the financial system,” she said.

Well, we haven’t gotten to net-zero yet—and we never will, especially with China still building coal plants—but we’ve already had a shock to the financial system.

Then there’s the question of bailing out SVB beyond FDIC requirements. As The Washington Post reported on Saturday, a “ferocious political debate” has erupted in D.C. over some political fix that could, of course, cost taxpayers many, many billions. On the other hand, a larger and graver banking crisis could damage the economy and cost Biden many, many votes. So, what D.C. will do is an unknown unknown.

Yet in the meantime, if the evidence continues to pile up that woke/ESG is bad business, then it will be hard for financial officers across the spectrum—in banks, investment houses, pension funds, insurance companies, and university endowments—to argue that they can be woke while still upholding their fiduciary duty. That duty is a heavy legal concept, containing significant civil and even criminal penalties if it is violated.

To be sure, plenty have been warning about the dangers of ESG, including House Majority Leader Steve Scalise (R-LA) and also some of those directly tasked with growing and safeguarding pension funds, such as West Virginia State Treasurer Riley Moore. There’s even a new network of right-leaning investment overseers, the State Financial Officers Foundation.

So, now expect a scramble, as all the Emperors of ESG—including Al Gore, Larry Fink of BlackRock, and maybe even Bono—rush to tell us that this is fine. (As for Janet Yellen, we’ll take her gauge later on.)

Okay, back to SVB and its fiduciary duty, which is especially extensive when it comes to federally regulated banks. (Once again, nobody wants another Depression.) Let’s consider SVB’s fiduciary duty as we go through the bank’s own statements. (We can leave for another time speculation about any other legal violations that might have been committed—it is, after all, quite something to blow $212 billion.)

For instance, here’s an SVB headline from January 10, 2022: “Silicon Valley Bank Commits to $5 Billion in Sustainable Finance and Carbon Neutral Operations to Support a Healthier Planet.” Sounds green! But was that the best use of funds? All we know for sure is that CEO Greg Becker chose not to address the fiduciary matter when he said, “Our ability to make a meaningful difference for people and the planet, and to address the systemic risk that climate change presents, is magnified by the outsized impact our innovative clients make.”

All that money might have seemed great for some people (not counting, say, the slave laborers in Africa mining green minerals) and maybe the planet (not counting the bald eagles being killed by windmills), but it doesn’t seem to have been great for SVB investors and depositors.

SVB has more to proclaim about ESG:

Our corporate philosophy of transparency and accountability guides our reporting on environmental, social and governance performance with the goal of building trust and evolving our policies and disclosures.

Yes, that’s what SVB is all about, right? Building trust. Although some have a funny way of building it. For instance, it seems that SVB CEO Becker sold $3.6 million in stock on February 27. Did he know something? Did he act on insider information? (There’s a whole ‘nother passel of laws concerning that, and they’re doozies.)

And it gets better. Here’s more green blather from SVB:

We support entrepreneurs and high-growth businesses at the forefront of innovation, helping to advance solutions that create a more just and sustainable world. Our longstanding commitment to innovation, combined with our deep experience supporting evolving technologies, enables us to contribute to a healthier planet via our own efforts and those of our clients.

A good paragraph for Woke Bingo: “just,” “sustainable,” “healthier planet”—so many words to win!

Of course, SVB is also big into DEI (Diversity, Equity, and Inclusion), declaring, “We’re building a culture of belonging with a global workforce that celebrates greater dimensions of diversity.” More Bingo hits. And to get an even better sense of SVB’s DEI footprint, we might consider this (now deleted) tweet from one Christina Qi, who identifies herself as a former hedge fund CEO:

The SVB collapse has been devastating in more ways than one: They supported women, minorities, & the LGBTQ community more than any other big bank. This includes not just diverse events, but actual funding. SVB helped us move one step forward; without them, we move two steps back.

One sharp tweeter responded, “Maybe other banks will take a look at this failure and realize they need to do actual banking instead of virtue signaling.”

Hmm. Was all that virtue-signaling in keeping with fiduciary duty? Is this what the Biden administration might possibly choose to bail out?

Sunlight Is the Best Disinfectant

It’s a challenge to to cut through this spiel; as the song goes, “the information’s unavailable to the mortal man.” Fortunately, to help, we have subpoenas and other investigative tools. So, while the Biden administration might not be interested in digging too deep on SVB, others will be.

Yes, the fate of SVB is a topic for Congressional investigative committees, at least on their Republican side.

One Republican with a good sense of how this could work is entrepreneur-turned-Republican presidential candidate Vivek Ramaswamy, an early woke-watchman. As he tweeted in the wake of the SVB’s fall:

A key cause of the 2008 financial crisis was the use of social factors to make loans (back then, fostering home ownership). When we don’t learn lessons, history repeats itself: did Silicon Valley Bank use ESG factors to price its loans? Roll that log over & see what crawls out.

For people wondering where their funds went—and for others merely curious about how the rich play with other people’s money—Congressional hearings can indeed be instructive. Those curious about how they’ve worked in the past might Google “Pujo,” “Pecora,” and “Enron,” as well as “Lehman Brothers.”

In each of those past cases, we found that financial players were either not as strong as touted or they were outright frauds. We got through each meltdown, but lots of people lost money—and not enough people went to jail.

So, does SVB prove that the green economy is a house of cards? Here in Breitbart World, we might share common suspicions about that, but we might be interested to know that others seem to have the sneaking feeling that we’re right. For instance, the Biden administration(!).

Biden Not Walking the Green Mile Anymore

After two years of relentlessly anti-real energy policies, starting on day one (happily, some of Biden’s worst moves were thwarted by bipartisan opposition in Congress), the Biden administration is reportedly poised to make a sudden shift: to approving a new carbon-fuel development in Alaska. That’s 600 million barrels of oil, which is great news for American energy consumers (which is all of us, whether we admit it or not). But that’s also 9.2 million tons of CO2 into the atmosphere, which is a downer for greens. Why the shift toward Big Oil?

Politico Playbook punned its answer as “Biden’s crude move to the center”—as in, the center is where you get re-elected. Politico added that it was “another policy development from the Biden administration that is causing agita on the left, this time from environmentalists.” (The most notable other left-agitating development being Biden’s acquiescence to the Republican crime bill.)

The moral of this story is that Joe Biden really, really, really wants to get re-elected. And he’s good at that. It happened five times in Delaware. So, if that means leaving ideological greens in the lurch, he’ll do that faster than you can say “flip-flop.”

The question of bailing out financial greens (SVB’s large depositors and investors) is trickier. After all, many of them are donors to Biden’s campaign. If the Biden administration thinks it can help them and hide the financials somehow from the public, he’ll do that faster than you can say “flim-flam.” The whole Biden clan has proven able at that.

So, can Joe Biden follow his re-election formula nationwide in 2024? We can’t yet know. But if you see Janet Yellen saying, “Drill, baby, drill,” you’ll know that he’s giving it his best.

An 85-year Harvard study on happiness found the No. 1 retirement challenge that ‘no one talks about’

Published Fri, Mar 10 202310:09 AM EST

Robert Waldinger, Contributor@ROBERTWALDINGER

People who fare the best in retirement find ways to cultivate connections with others, according to Harvard’s 85-year happiness study.

Marloes De Vries for CNBC Make It

In 1938, Harvard researchers embarked on a study that continues to this day to find out: What makes us happy in life?

The researchers gathered health records from 724 people from all over the world, asking detailed questions about their lives at two-year intervals.

As participants entered mid- and late-life, the Harvard Study often asked about retirement. Based on their responses, the No. 1 challenge people faced in retirement was not being able to replace the social connections that had sustained them for so long at work.

Retirees don’t miss working, they miss the people

When it comes to retirement, we often stress about things like financial concerns, health problems and caregiving.

But people who fare the best in retirement find ways to cultivate connections. And yet, almost no one talks about the importance of developing new sources of meaning and purpose.

One participant, when asked what he missed about being a doctor for nearly 50 years, answered: “Absolutely nothing about the work itself. I miss the people and the friendships.”

Leo DeMarco, another participant, had a similar feeling: After he retired as a high school teacher, he found it hard to stay in touch with his colleagues.

“I get spiritual sustenance from talking shop. It’s wonderful to help someone acquire skills,” he said. “Teaching young people was what started my whole process of exploring.”

Taking on hobbies might not be enough

For many of us, work is where we feel that we matter most — to our workmates, customers, communities, and even to our families — because we are providing for them.

Henry Keane was abruptly forced into retirement by changes at his factory. Suddenly he had an abundance of time and energy.

He started volunteering at the American Legion and Veterans of Foreign Wars. He put time into his hobbies — refinishing furniture and cross-country skiing. But something was still missing.

“I need to work!” Keane told the researchers at age 65. “Nothing too substantial, but I’m learning that I just love being around people.”

To retire happy, invest in your relationships now

Keane’s realization teaches us an important lesson not only about retirement, but about work itself: We are often shrouded in financial concerns and the pressure of deadlines, so we don’t notice how significant our work relationships are until they’re gone.

To create more meaningful connections, ask yourself:

- Who are the people I most enjoy working with, and what makes them valuable to me? Am I appreciating them?

- What kinds of connections am I missing that I want more of? How can I make them happen?

- Is there someone I’d like to know better? How can I reach out to them?

- If I’m having conflict with a coworker, what can I do to alleviate it?

- Who is different from me in some way (thinks differently, comes from a different background, has a different expertise)? What can I learn from them?

At the end of the day, notice how your experiences might affect your sense of meaning and purpose. It could be that this influence is, on balance, a good one. But if not, are there any small changes you can make?

“When I look back,” Ellen Freund, a former university administrator, told the study in 2006, “I wish I paid more attention to the people and less to the problems. I loved my job. But I think I was a difficult and impatient boss. I guess, now that you mention it, I wish I got to know everyone a little better.”

Every workday is an important part of our personal experience, and the more we enrich it with relationships, the more we benefit. Work, too, is life.

Robert Waldinger, MD, is a professor of psychiatry at Harvard Medical School, director of the Harvard Study of Adult Development, and director of Psychodynamic Therapy at Massachusetts General Hospital. He is a practicing psychiatrist and also a Zen master and author of “The Good Life.” Follow Robert on Twitter @robertwaldinger.

Marc Shulz, PhD, is the associate director of the Harvard Study of Adult Development, and a practicing therapist with postdoctoral training in health and clinical psychology at Harvard Medical School. He is also the author of “The Good Life.”

HI Financial Services Mid-Week 06-24-2014