HI Market View Commentary 10-20-2025

So, the question is when is this economic expansion going to end?= Mid-January, Mid-February, Mid-December

After this earnings season / Christmas Rally / Catch-up trade

My expectations = MU, NVDA, AAPL, GOOGL, META, MSTR, PLTR = We will hopefully be called away on all of these positions for a huge profit over End Nov-Beginning of January

Huge Profits doesn’t mean these stocks can’t go higher so we will take 20-30% into a leap bull call position for next year = Stock replacement strategy for dirt cheap with a protection position as we start the trade

Why? Cheaper, less risk and still can capture the next $100 Higher = Cash heavy positions in accounts

Let’s go over last week and the big drops Thursday last week and then the Friday the previous week?

Thursday = Banks (regional) with a higher than expected load default

ZION $1.48 vs $1.46 EPS and Rev 872m vs 843m with no increase in load defaults

Friday before October 10th = China trade war

This Week is earnings and the catch-up trade is in play? GO BIG after the stock reports

But arguably the most important tailwind for equities is optimism regarding the third-quarter corporate earnings season. With 12% of the S&P 500 companies having reported results so far, some 86% delivered a positive earnings per share surprise — which is above the five-year average of 78% — and 84% have reported a positive revenue surprise, according to John Butters, senior earnings analyst at FactSet.

AWS services recover after daylong outage hits major sites

Published Mon, Oct 20 20255:13 AM EDTUpdated 41 Min Ago

Annie Palmer@in/annierpalmer/@annierpalmer

Key Points

- Amazon Web Services, which suffered a major outage, is the leading provider of cloud infrastructure technology, accounting for about a third of the market.

- By Monday evening, the company said “all AWS services returned to normal operations.”

- Downdetector previously showed user reports of problems at sites including Amazon, Snapchat, Disney+, Reddit and Canva.

Amazon Web Services, a leader in the cloud infrastructure market, reported a major outage on Monday that took down numerous major websites.

Many sites came back online within a few hours, although Downdetector showed another spike in user reports around noon ET of outages at Amazon, AWS and Alexa.

The company’s latest update at 6:53 p.m. ET noted that “all AWS services returned to normal operations” shortly after 6 p.m. ET.

Some services continue to have a backlog of messages that will finish processing in the next few hours, AWS said.

“We will share a detailed AWS post-event summary,” the company said in the note.

The update came after outages and delays persisted into Monday afternoon, with the company observing “increased error rates” for customers when trying to launch new instances in EC2, its popular cloud service that provides virtual server capacity.

“We are working to fully restore service as quickly as possible,” the company wrote at the time.

Around 1:30 p.m. ET, AWS said it was starting to see “early signs” of EC2 recovery in some regions and that it was applying fixes to remaining areas “at which point we expect launch errors and network connectivity issues to subside.”

Amazon also confirmed that the outage impacted Amazon.com, some of its subsidiaries and AWS customer support operations.

The outage was first reported at 3:11 a.m. ET in AWS’ main US-East-1 region hosted in northern Virginia. A notice on AWS’ status page said it was experiencing DNS problems with DynamoDB, its database service that underpins many other AWS applications.

DNS, or Domain Name System, translates website names to IP addresses so browsers and other applications can load.

AWS cited an “operational issue” affecting multiple services and said it was “working on multiple parallel paths to accelerate recovery,” in an update at 5:01 a.m. ET. More than 70 of its own services were affected.

AWS said in an update at 6:35 a.m. ET that the DNS issue had been “fully mitigated” and that AWS service operations were “succeeding normally.”

AWS is the leading provider of cloud infrastructure technology, accounting for around a third of the market, ahead of Microsoft and Google, according to Synergy Research Group. Millions of companies and organizations rely on AWS for cloud computing services, such as servers and storage.

Major companies hit

Downdetector showed user reports indicating problems at sites including Disney+, Lyft, the McDonald’s app, The New York Times, Reddit, Ring doorbells, Robinhood, Snapchat, United Airlines, T-Mobile and Venmo.

British government websites Gov.uk and HM Revenue and Customs were also experiencing issues, per Downdetector.

A government spokesperson told CNBC: “We are aware of an incident affecting Amazon Web Services, and several online services which rely on their infrastructure. Through our established incident response arrangements, we are in contact with the company, who are working to restore services as quickly as possible.”

Lloyds Banking Group confirmed that some of its services were affected and asked customers “to bear with us” while it worked to restore them. Some 20 minutes later, it added that services were coming back online.

The outage also brought down critical tools inside Amazon. Warehouse and delivery employees, along with drivers for Amazon’s Flex service, reported on Reddit that internal systems were offline at many sites. Some warehouse workers were instructed to stand by in break rooms and loading areas during their shift, while they couldn’t load Amazon’s Anytime Pay app, which lets employees access a portion of their paycheck immediately.

Seller Central, the hub used by Amazon’s third-party sellers to manage their businesses, was also knocked offline by the outage.

Reddit, too, is “working on scaling Reddit back to 100 percent as we speak,” a spokesperson told CNBC.

Some United and Delta Air Lines customers reported on social media that they couldn’t find their reservations online, check in or drop bags.

A T-Mobile spokesperson said its customers had issues when trying to use other sites or services due to the AWS disruption, but that there “was no outage or service disruption” at the carrier.

Canvas, an online teaching platform used to host course information and submit assignments, said it was also hit by the “ongoing AWS incident.”

Other social media users cited disruption across cloud-based games, including Roblox and Fortnite, while crypto exchange Coinbase said many users were unable to access the service due to the outage.

Graphic design tool Canva said it was “experiencing significantly increased error rates which are impacting functionality on Canva. There is a major issue with our underlying cloud provider.”

Generative artificial intelligence search tool Perplexity was also affected. “The root cause is an AWS issue. We’re working on resolving it,” CEO Aravind Srinivas said in a post on X.

Centralized software

It’s not the first time in recent history that major companies have been affected by a technical issue. In July 2024, a faulty software upgrade by cybersecurity firm Crowdstrike revealed the fragility of global technology infrastructure when it caused Microsoft Windows systems to go dark, creating millions of dollars worth of chaos and grounding thousands of flights in the process. It also affected hospitals and banks.

AWS has also experienced other outages in recent years. A disruption in 2023 knocked many websites offline for several hours, while a more severe outage in 2021 affected websites and services across the globe, including some of Amazon’s own delivery operations, which were briefly brought to a standstill.

Amazon, Microsoft and Google have long jockeyed to claim enterprise customers. After an outage of Microsoft’s suite of productivity software earlier this month, Google sought to capitalize on the service lapse by pitching its own tools and a business continuity plan that runs its Workspace service in parallel with Microsoft 365.

In a blog post last week, Google wrote, “Just because Microsoft 365 goes down — and it’s a question of when and for how long, not if — doesn’t mean that your teams need to go back to using pen and paper.”

Google’s cloud services went down for an extended period in June, disrupting several major service providers like OpenAI and Shopify. The company said the outage was caused by multiple layers of flawed recent updates.

Monday’s AWS outage doesn’t appear to have been caused by a cyberattack, but is more likely a “technical fault affecting one of Amazon’s main data centres,” Rob Jardin, chief digital officer at cybersecurity company NymVPN, said in a statement.

“These issues can happen when systems become overloaded or a key part of the network goes down, and because so many websites and apps rely on AWS, the impact spreads quickly,” he added.

An Amazon spokesperson pointed to AWS’ service health dashboard when reached for comment.

Indeed, “DynamoDB isn’t a term that most consumers know,” Mike Chapple, IT professor at the University of Notre Dame’s Mendoza College of Business and former computer scientist with the National Security Agency, said in a statement. However, it “is one of the record-keepers of the modern Internet.”

“We’ll learn more in the hours and days ahead but early reports indicate that this wasn’t actually a problem with the database itself. The data appears to be safe. Instead, something went wrong with the records that tell other systems where to find their data,” he added.

“This episode serves as a reminder of how dependent the world is on a handful of major cloud service providers: Amazon, Microsoft, and Google. When a major cloud provider sneezes, the Internet catches a cold.”

— CNBC’s Leslie Josephs and Jennifer Elias contributed to this report.

Clarification: This article has been updated to clarify that there was no service disruption at T-Mobile.

Democratic government shutdown = no fed gov’t employees being paid, EXCEPT for Congress= House/Senate

Ego’s or distain for Trump

Problem this isn’t the way to move legislation forward = Process is an appropriations committee, floor as an act/bill, debates and voting

We are fighting over 1.29 Trillion next year= What part of that is Actual ACA money = 35 Billion

AI Overview

The enhanced premium tax credit (PTC) is a temporary expansion of financial assistance for individuals and families who buy health insurance through the Affordable Care Act (ACA) marketplace

. Created by the American Rescue Plan Act of 2021 and extended by the Inflation Reduction Act of 2022, these enhanced credits are set to expire on December 31, 2025.

How the enhanced PTC works

The enhanced PTC temporarily made two major improvements to the standard premium tax credits available under the ACA:

- Eliminated the “subsidy cliff”: Before the enhanced PTC, individuals with incomes above 400% of the federal poverty level (FPL) were ineligible for any financial help with premiums. The enhanced credits removed this income cap, allowing middle-income households to qualify.

- Increased financial assistance: For those already eligible, the enhanced credits reduced the maximum percentage of household income that individuals and families must contribute toward their health insurance premiums. This change provided more generous subsidies and, for many low-income enrollees, made benchmark plans available for $0 per month.

What happens when the enhanced PTC expires?

Without action from Congress, the enhanced PTC will expire at the end of 2025, leading to significant changes for millions of Americans who buy health insurance on the marketplace.

If the enhanced credits expire, some analyses predict:

- Increased premiums: Average monthly payments for subsidized enrollees are projected to more than double.

- Loss of coverage: An estimated 4 million to 4.8 million people could become uninsured in 2026.

- Reinstated subsidy cliff: Households with incomes above 400% of the FPL will lose all financial assistance.

- Disproportionate impact: Older adults, rural residents, and low- to middle-income families could be especially affected by the higher costs.

Current status and outlook

The impending expiration of the enhanced PTC has become a major point of debate in Washington, DC.

- Record enrollment: The credits have spurred record marketplace enrollment, with 24.3 million people enrolled in 2025.

- Political debate: Congress is actively debating whether to extend the credits permanently, extend them temporarily, or allow them to expire.

- Budgetary impact: The Congressional Budget Office (CBO) estimates that making the enhanced PTC permanent would increase the federal deficit by nearly $350 billion over a decade.

- Public support: Despite budget concerns, a KFF poll from October 2025 found that most of the public, including majorities of Republicans, supports extending the credits.

Earnings

AAPL 10/30 AMC

BA 10/29 BMO

BIDU 11/20 est

CB 10/21 AMC

DIS 11/13 BMO

F 10/23 AMC

GE 10/21 BMO

GOOGL 10/28 est

KEY 10/16 BMO

LMT 10/21 BMO

MA 10/30 est

META 10/20 AMC

MSTR 10/30 est

MU 12/17 est

NVDA 11/29 AMC

O 11/03 AMC

PLTR 11/03 est

TGT 11/19 BMO

TXN 10/21 AMC

UAA 11/06 est

V 10/28 est

VZ 10/21 BMO

WMT 11/20 BMO

https://www.briefing.com/the-big-picture

The Big Picture

The Big Picture

Last Updated: 10-Oct-25 09:27 ET | Archive

Disappointing earnings guidance need not apply for bull market job

Briefing.com Summary:

*A premium P/E multiple implies the stock market is expecting strong Q3 earnings and upbeat guidance.

*In a rare move, analysts raised their earnings estimates in aggregate during the third quarter.

*Earnings results need to be on point, or many points will be taken off stock prices.

Over the next four weeks or so, there is some very good news coming—or at least the stock market is of the belief that very good news is coming. We are referring not only to earnings results for the third quarter but also to the earnings guidance that will be accompanying the reports.

Our assessment of the stock market’s mindset is rooted in a forward 12-month P/E multiple of 23.0x that is a 24% premium to the 10-year average and a 36% premium to the 25-year average.

You don’t get an earnings multiple like that if you think bad news is coming.

A Cumulus Earnings Cloud

Estimates compiled by FactSet show a blended third-quarter earnings growth rate of 8.1% for the S&P 500. That is up from 7.1% at the end of the second quarter. That may not sound like a big change, but it is a big deal because analysts typically lower their earnings estimates during the quarter.

The last time analysts raised their estimates in aggregate during a quarter was the fourth quarter of 2021, according to FactSet. The takeaway is that expectations are high going into this reporting period.

We can understand why. The dollar is weaker; the AI buildout is stronger; capital markets activity is hotter; the tax outlook is brighter; consumer spending in aggregate has been solid; tariff concerns have moderated; and expectations for multiple rate cuts before year-end are prevalent.

The silver lining on this cumulus earnings cloud is that earnings growth is typically two to three percentage points higher than what is expected going into the reporting period. Of course, that is typically off a lower starting base, but that is not the case going into this reporting period.

If S&P 500 companies live up to the historical precedent, good earnings news will indeed be stronger than expected as opposed to stronger than lowered estimates.

Must Be on Point

The investment banks seem destined to lead off the reporting period on a high note. Much is going their way, including a revival of the IPO market and a stock market at record highs, which are mutually inclusive. The element that will matter most to the market, though, is the commentary on credit quality.

What the banks say there will influence perceptions about the economy and how that translates into earnings growth prospects. Again, everything said during this reporting period, and not just by the banks, will be viewed through the lens of what it means for the earnings growth outlook.

That is the fate of a market trading with a premium valuation. The guidance must be on point, or many points will be taken off stock prices.

It goes without saying, but we will say it anyway: that is especially true for the mega-cap stocks specifically and growth stocks in general. They have been the thoroughbreds pacing the market to record highs.

In fact, the S&P 500 information technology sector is expected to deliver a command earnings performance for the third quarter. Its blended growth rate is 20.8%, according to FactSet. That translates to a 4.58 percentage point contribution—or more than half—to the overall growth rate.

The bulk of the residual is expected to be delivered by the financial sector (2.21 percentage points). The energy, consumer staples, consumer discretionary, and health care sectors are currently expected to detract ever so slightly (i.e., 0.2 percentage points or less) from earnings growth.

Briefing.com Analyst Insight

The earnings results and guidance shared over the next several weeks will be an influential factor in determining if the stock market has a so-called “melt-up” into year-end or a meltdown. Investors have been treated to one good earnings reporting period after another, in aggregate, for some time.

There is a palpable feeling today that this third-quarter reporting period will be no different. However, if this time is different, it won’t be a good outcome for a stock market that is priced somewhere between needing to be reassured by what it hears and hoping to be positively surprised.

That is what trading at 23x forward 12-month earnings implies. Disappointing earnings guidance need not apply for the job of keeping this bull market going.

—Patrick J. O’Hare, Briefing.com

(Editor’s Note: The next installment of The Big Picture will be published the week of October 20.)

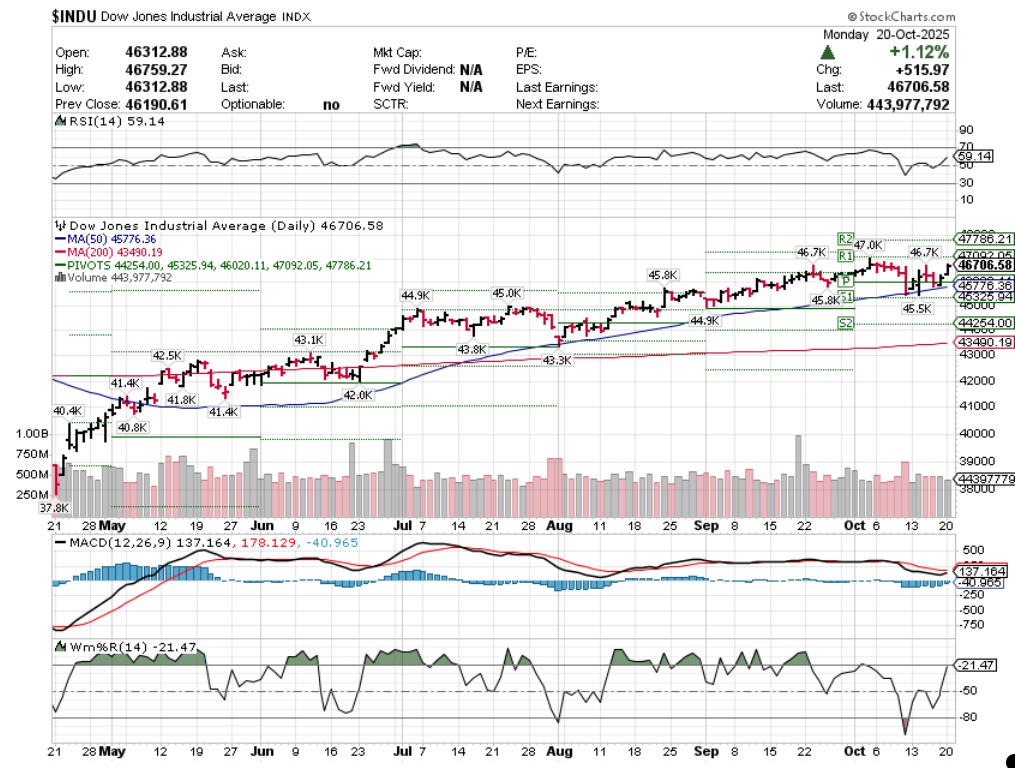

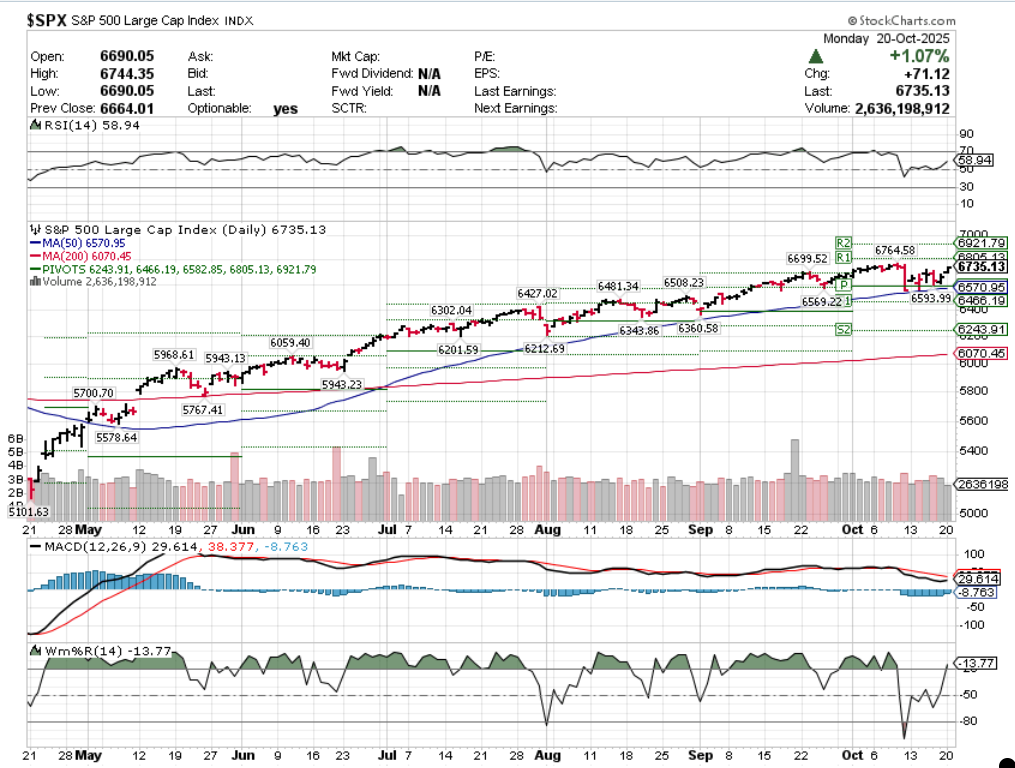

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end October 2025?

10-20-2025 +2.0%

10-13-2025 +2.0%

10-06-2025 +2.0%

09-29-2025 -2.0%

Earnings:

Mon: CLF, ZION,

Tues: MMM, KO, GE, GM, PHM, VMI, COF, MAT, NFLX, TXN, LMT, CB

Wed: T, BSX, CME, AA, IBM, KMI, LVS, TSLA, GEV

Thur: AAL, BX, HAS, HON, TMUS, UNP, VLO, ALK, INTC, FDX, F

Fri: PG

Econ Reports:

Mon: Leading Indicators,

Tue

Wed: MBA,

Thur: Initial Claims, Continuing Claims, Existing Home Sales

Fri: New Homes Sales, Michigan Sentiment, CPI, Core CPI ????

How am I looking to trade?

Time to start protecting for earnings

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Will AAPL continue = Yes probably but it will also sit around $300 for period of time

AAPL, BA, GOOGL, META, NFLX, MU, NVDA, PLTR (?), V, MSTR, AXP

Nvidia, Microsoft, xAI and BlackRock part of $40 billion deal for Aligned Data Centers

Published Wed, Oct 15 20259:43 AM EDTUpdated

Ashley Capoot@/in/ashley-capoot/

Key Points

- A consortium of investors has agreed to purchase Aligned Data Centers for $40 billion.

- MGX, BlackRock’s Global Infrastructure Partners and members of the Artificial Intelligence Infrastructure Partnership will buy the company from Macquarie Asset Management.

- AIP was created by BlackRock, MGX, Microsoft and Nvidia in September 2024 to accelerate investment in AI infrastructure.

Nvidia, Microsoft, BlackRock and Elon Musk’s xAI are part of a consortium of investors that has agreed to purchase Aligned Data Centers for $40 billion, the companies announced Wednesday.

Aligned designs and operates data centers and data campuses across North and South America, and is owned by Macquarie Asset Management.

MGX of Abu Dhabi, United Arab Emirates, BlackRock’s Global Infrastructure Partners and members of Artificial Intelligence Infrastructure Partnership, or AIP, will acquire 100% of the company’s equity, in what will be the largest global data center deal to date, according to a release.

AIP was created by BlackRock, MGX, Microsoft and Nvidia in September 2024 to accelerate investment in AI infrastructure. The Kuwait Investment Authority, xAI and Temasek have joined as additional participants.

The Aligned deal marks AIP’s first investment and is a step toward the group’s goal of deploying $30 billion of equity capital.

“With this investment in Aligned Data Centers, we further our goal of delivering the infrastructure necessary to power the future of AI, while offering our clients attractive opportunities to participate in its growth,” Larry Fink, CEO of BlackRock and Chairman of AIP, said in a statement.

AI companies have been racing to build out the infrastructure they believe they will need to meet growing demand for the technology.

Companies including OpenAI, Nvidia, CoreWeave and Oracle are striking ambitious data center and computing deals that will require unprecedented amounts of funding and power.

Data centers are the large facilities that house the hardware and equipment needed to run big AI workloads and train models. Aligned currently operates 50 campuses and has more than 5 gigawatts of operational and planned capacity.

The Aligned transaction is expected to close late next year, and it is still subject to regulatory approvals and other standard closing conditions.

Who will lose out when ACA health insurance subsidies expire?

Alyssa Fowers, (c) 2025 , The Washington Post

Tue, October 14, 2025 at 8:36 AM MDT

Almost everyone who got their health insurance through an ACA marketplace in 2025 received the enhanced premium tax credit, so describing the people who have ACA plans is a good way to get a sense of the people who get the credit.

Some 22 million Americans are set to lose health insurance subsidies by the end of the year. Who are they, and what will happen if the subsidies are allowed to expire?

These subsidies, known as enhanced premium tax credits, lower costs for people who buy their health insurance through Affordable Care Act (ACA) marketplaces (sometimes called Obamacare). They are at the heart of a weeks-long standoff that has shuttered the federal government since Oct. 1. About 80 percent of the people who benefit from them live in states that Donald Trump won in the 2024 presidential election. Many have no idea that their health insurance costs are on track to go up.

– – –

Who benefits from the tax credit?

Almost everyone who got their health insurance through an ACA marketplace in 2025 received the enhanced premium tax credit, so describing the people who have ACA plans is a good way to get a sense of the people who get the credit.

The typical person with an ACA plan is an adult in their mid-40s with an income between 100 and 200 percent of the federal poverty line, or about $21,000 to $42,000 for a family of two.

Lower-income people with ACA plans will return to the lower subsidy levels from the early years of the ACA if the enhanced credits expire. A smaller group with higher incomes will become responsible for the full cost of their premiums.

Advertisement

Nearly half of the adults on ACA marketplace plans are self-employed, small-business owners or small-business employees, according to an analysis from KFF, an independent health policy research organization. While most Americans get their health insurance through their employer, those who work for small businesses (or themselves) often have to rely on the exchange.

“The Affordable Care Act is specifically designed to fill that gap,” said Jessica Banthin, a senior fellow in the health policy division of the Urban Institute, a think tank.

Marketplace coverage is especially common among some occupations: At least a quarter of chiropractors, musicians, real estate brokers, farmers, dentists and manicurists currently benefit from the tax credit.

Not everyone who gets their health insurance through a marketplace is employed. A Washington Post analysis found that about 9 percent are retired people who may not yet be eligible for Medicare and that 6 percent are students. However, only people with an income are eligible for the enhanced premium tax credit.

– – –

Where do people use the credit?

Democrats have made extending the enhanced credits their main demand to reopen the government. That extension will mostly benefit people living in states where Trump won the 2024 presidential election.

While about 8 percent of the country has their health insurance discounted through an enhanced premium tax credit, that share is much higher in some states. Twenty-four percent of Floridians under 65 benefit from the tax credit, as do 14 percent of Georgians.

The credits are most widely used in the 10 states that did not expand Medicaid eligibility after the ACA was enacted. Without the Medicaid expansion, many lower-income people without employer-sponsored health insurance could get health insurance only through ACA marketplaces.

Advertisement

Marketplace plans became even more popular in those states once the enhanced premium tax credits became available in 2021, bringing costs for some plans down to $0 for people making less than 200 percent of the federal poverty level. Overall enrollment in marketplace health insurance plans nearly doubled, with the greatest gains in states without Medicaid expansions.

– – –

How much will costs go up?

Almost everyone with ACA insurance has their health care subsidized by a tax credit. That’s been true since 2014. But those subsidies became more generous in 2021 when the “enhanced” credit was introduced in the American Rescue Plan Act. That expanded the income range for people who could get the credit and lowered the share of income spent on health insurance – down to $0 for many people.

Advertisement

When those tax credits expire, subsidies will become less generous for most recipients and will go away entirely for some. KFF estimated that the average premium would more than double when the enhanced version of the tax credits expire. However, those changes look very different across income levels.

If the credit expires, ACA marketplace customers at or near the poverty line would see their premiums jump from $0 to 4 percent of their income for a silver-level plan. A 50-year-old couple in Dallas who made 150 percent of the federal poverty level ($32,000 in 2025) would see their premiums increase to about $1,300 in 2026.

“The cost of health insurance is never going to be low enough for a person who makes just above poverty to be able to afford it,” said Cynthia Cox, vice president of the Program on the ACA at KFF. “If you want that person to have health insurance, then there needs to be financial assistance.”

Even if a family can afford the increased premiums, the administrative hurdle of submitting payments as low as $1 could cause as many as 430,000 people to lose their health insurance, according to an analysis from the Brookings Institution.

Advertisement

Those with slightly higher incomes pay for part of their premiums already, but the amount would increase dramatically if the enhanced credits expire. For people who make 250 percent of the federal poverty level ($53,000 for a couple in 2025), costs would go from about 4 percent to 8 percent of their income.

The increases would be most extreme for the more than 1 million marketplace customers making more than 400 percent of the poverty level (about $84,000 for a family of two).

About a million people would go from paying 8 percent of their income on health insurance premiums to becoming responsible for the entire cost themselves. That would be especially painful because health insurance premiums are expected to increase by 18 percent in 2026. For lower- and middle-income people whose costs are capped at a particular share of their income, that doesn’t make a difference. But those who are no longer covered by the credit are responsible for the full cost of their premiums – including those increases.

What happens if the credits expire?

If the tax credits do expire, the Urban Institute estimates that about a third of the people who benefit from the enhanced premium tax credit will lose those subsidies entirely. Of those, 4.8 million will become uninsured, and the rest will achieve health coverage some other way: perhaps switching to a spouse’s insurance, or leaving their job at a small business to find an employer that will offer health insurance.

“The marketplaces themselves are going to become smaller,” said Banthin. “In some states, they’ll be half the size. And so the people who stay enrolled are going to have fewer choices.”

Those who remain will have to either shoulder higher costs or switch to a lower level of coverage. These increasing costs will probably come as a surprise to many people who benefit from the enhanced tax credit. A poll conducted a week before the government shutdown found that more than half of people who purchased insurance through the marketplaces said they had heard little or nothing about the expiring tax credits.

Advertisement

According to Cox, that’s because the tax credits usually operate as a discount at the time of purchase – and the marketplaces don’t advertise why the prices are lower or what they would be without the enhanced premium tax credits. Anyone who purchased a plan for the first time after the enhanced credits went into effect might not even be aware that prices used to be higher.

“People are really just focused on how much do they have to pay each month,” said Cox. “They’re really not looking at how much they would have had to pay without the enhanced rate.”

– – –

About this story

To determine the employment status and primary activities of adults with individually purchased health insurance, The Post used the 2024 Annual Social and Economic Supplement to the Current Population Survey. Our analysis excludes anyone who had multiple sources of health insurance. Small businesses were defined as any firm with fewer than 25 employees.

PayPal’s crypto partner mints a whopping $300 trillion worth of stablecoins in ‘technical error’

Published Thu, Oct 16 20255:34 AM EDTUpdated Fri, Oct 17 20255:41 AM EDT

Dylan Butts@in/dylan-b-7a451a107

Key Points

- Paxos mistakenly minted the stablecoins as part of an internal transfer, before it “immediately identified the error and burned the excess PYUSD,” the company said in a social media statement.

- There aren’t enough dollars in global circulation to back $300 trillion PYUSD, which would theoretically require more Paxos, the blockchain partner of PayPal, mistakenly minted $300 trillion worth of the online payment giant’s stablecoin on Wednesday in what the company called a “technical error.”

Market watchers had spotted the enormous injection of the PayPal PYUSD stablecoin on Etherscan — a block explorer and analytics platform for the Ethereum blockchain.

Paxos had mistakenly minted the stablecoins as part of an internal transfer, before it “immediately identified the error and burned the excess PYUSD,” the company said in a social media statement.

“This was an internal technical error. There is no security breach. Customer funds are safe. We have addressed the root cause,” it added. PayPal didn’t respond to an inquiry from CNBC outside of regular business hours.

Transactions on Etherscan showed that the mistake had been fixed after about 20 minutes.

PYUSD is advertised as a dollar-pegged stablecoin that is fully backed by U.S. dollar deposits, U.S. treasuries and similar cash equivalents. Therefore, PayPal says the tokens are always redeemable for U.S. dollars on a 1:1 basis.

However, the technical error highlights that while the dollar peg is guaranteed by Paxos and its independent third-party attestation reports, it isn’t intrinsically tied to the minting of a stablecoin.

There aren’t enough dollars in global circulation to back $300 trillion PYUSD, which would theoretically require more than double the world’s estimated total GDP.

Paxos’ error comes at a time when stablecoins are becoming more mainstream as its adopted by an increasing number of banks and payment platforms.

PYUSD is currently the sixth-largest stablecoin in the world with a market capitalization of over $2.6 billion, according to data from CoinMarketCap.

Clarification: This story has been updated to clarify that while PayPal agrees to redeem PYUSD, Paxos is the partner obligated to redeem 1:1.

FAA lets Boeing increase 737 Max production almost two years after near-catastrophic accident

Published Fri, Oct 17 20255:01 PM EDT

Key Points

- The FAA said Boeing can produce 737 Max planes at 42 a month, above the 38 a month limit Boeing had been producing at.

- Boeing CEO Kelly Ortberg had said the company expects to ramp up more in the future.

- It’s a milestone for the manufacturer, which hasn’t turned an annual profit since 2018.

Boeing has won regulator approval to ramp up production of its best-selling 737 Max jetliners to 42 a month, a milestone for the manufacturer nearly two years after the Federal Aviation Administration capped its output after a midair near-catastrophe.

In January 2024, the FAA restricted Boeing to building the planes at a rate of no more than 38 a month — though it had been below that level at the time — after a door plug from a nearly new 737 Max 9 blew off from an Alaska Airlines flight as it climbed out of Portland, Oregon.

Boeing failed to reinstall key bolts on the door plug before it left the factory, a National Transportation Safety Board report found. The 737 Max returned and landed safely, but it put the company back into crisis mode just as leaders were expecting a turnaround year.

The FAA said Friday that it would still oversee Boeing’s production. “FAA safety inspectors conducted extensive reviews of Boeing’s production lines to ensure that this small production rate increase will be done safely,” the agency said in a statement.

Boeing said it would work with its suppliers to increase production.

“We appreciate the work by our team, our suppliers and the FAA to ensure we are prepared to increase production with safety and quality at the forefront,” Boeing said Friday in a statement.

An increase in output is key to the company’s turnaround after years of problems, since airlines and other customers pay for the bulk of an aircraft when they receive it. CEO Kelly Ortberg, named last year to stabilize the top U.S. manufacturer, said last month he expected to soon win FAA approval to raise output to 42, with other increases planned for down the line.

“We’ll go from 42 and then we’ll go up another five, and we’ll go up another five,” Ortberg told a Morgan Stanley investor conference in September. “We’ll get to where that inventory is more balanced with the supply chain, probably around the 47 a month production rate.”

The change shows the FAA’s softening tone and increased confidence in Boeing after years of restrictions. Last month, the agency said it would allow Boeing to again sign off on some of its aircraft itself before they’re handed over to customers, instead of that responsibility falling solely with the FAA.

The Max program was crippled following two crashes of the planes in 2018 and 2019, which killed all 346 people on the two flights. The aircraft was grounded for nearly two years. Covid also hurt production, followed by supply chain problems and, last year, a labor strike at Boeing’s main factories in the Seattle area.

Boeing hasn’t posted an annual profit since 2018. But it has increased output, and its deliveries of new planes are on track to hit the highest rate since that year.

Boeing is scheduled to release quarterly results on Oct. 29.

— CNBC’s Phil LeBeau and Meghan Reeder contributed to this report.

4 comments

Your blog is a true gem in the world of online content. I’m continually impressed by the depth of your research and the clarity of your writing. Thank you for sharing your wisdom with us.

I simply could not go away your web site prior to suggesting that I really enjoyed the standard info a person supply on your guests Is going to be back incessantly to investigate crosscheck new posts

Your writing is like a breath of fresh air in the often stale world of online content. Your unique perspective and engaging style set you apart from the crowd. Thank you for sharing your talents with us.

Your blog is a true gem in the world of online content. I’m continually impressed by the depth of your research and the clarity of your writing. Thank you for sharing your wisdom with us.