Trade Findings and Adjustments 2-27-20

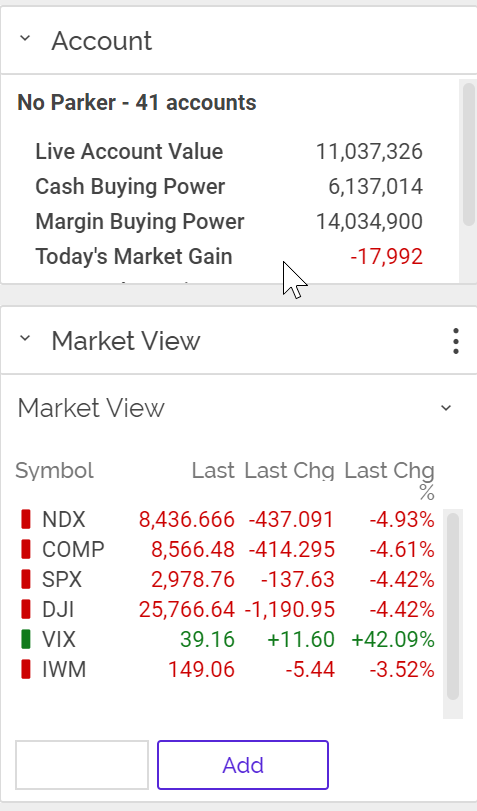

Right now TODAY markets across the globe are down between 10-13.4%

Corona Virus

Who is going to stay in the market over this coming weekend? NOBODY want to

What is our expectation for Friday ? Probably another 1000 point drop

Why ? Rebalancing of portfolios, end of month, tax selling, people don’t want to stay in

Today we are down a 15th of one percent and yesterday we were down 18th of one percetnt

My expectation/wants at Hurley Investments = BURN BABY BURN

Light at the end of the tunnel for 2020 = Trump as president

Road bumps – Tax Selling, Corona Virus running through Europe, US, Cananda, South America, Russia, Middle East, US Earnings next TWO quarters, Summer doldrums, Election cycle

This is why when you don’t see a flashing opportunity to put your money to work GO AHEAD And keep cash available

That cash is your protection to add long puts, to use for bills, to dollar cost average at prices we’ve seen back in 2017

ONE DAY should never make or break your portfolio.

What about the LEAPS ?

The position itself has protection

Dollar cost average half the cost or a third of the cost or a quarter of the cost

I can single long puts to create a strangle BUT right now we are in QQQ, SPY Long puts and/or Bear Puts

OR Keve Likes and I AGREE to QQQ bear puts

219/210 Bear Put 03-April-20 for about $3

Questions ? =