Today is going to be a bit of an education day in regards to calendars and leap bull calls

Everyone that set shorter term trade = Bull Call, Bull Put, Bull Call Calendar, Call Calendar for JPM is getting their butts handed to them today = Options expiration this Friday, Next week and for the last week of Oct all got killed

Killed = They have taken over an 80% loss with little time to allow the trades to come back

Calendar trades = this trade work with what trend?=stagnant or very slow moving

Primary position = leap long call position = stock replace position – right to buy the stock at a certain price for a certain period of time

Leap = over a year in time

Secondary or protective position is a Short Call – This is the obligation to sell your stock at a certain price for a certain period of time

ONE of the biggest problems I see with calendar trades is that you don’t know the stock is sideways until about 4 weeks have passed

NOW If the trade starts off to the downside then you get to keep that Nov short call credit

The tricky part of calendars is to decide when to let the stock replacement strategy (long call) run for awhile without the short side in the trade

SO I usually use a Leap Bull Call

Longer than a year long call (stock Replacement) – 18-27 months

Longer than a year leap short call ( protective part) – 18-27 months

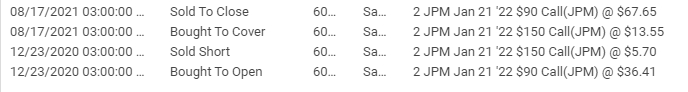

Here is the most recent JPM leap bull call

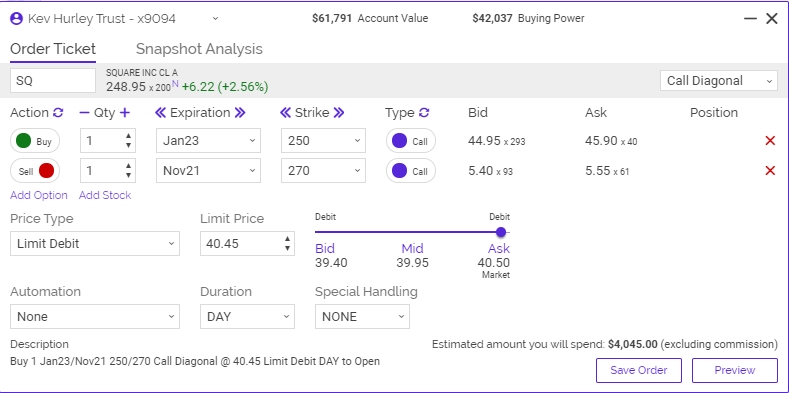

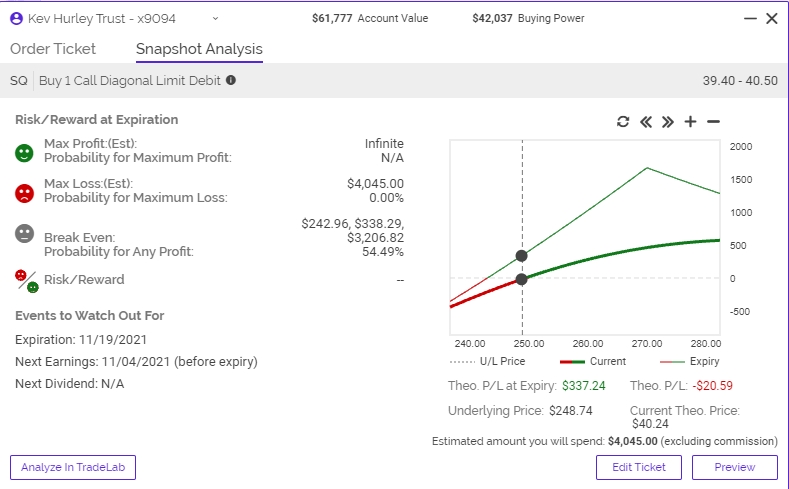

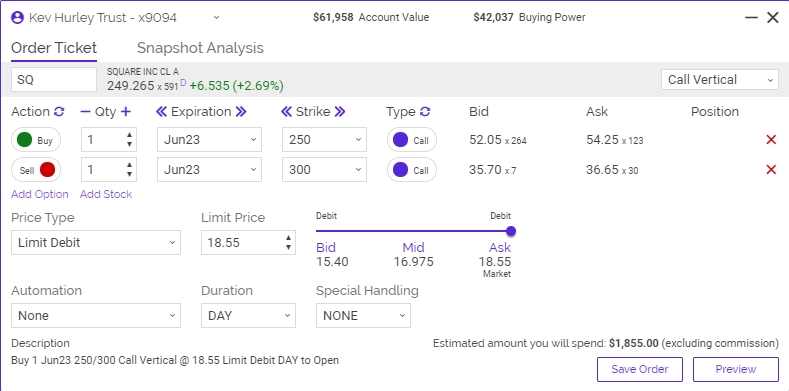

NEW trade is a SQ Leap Bull Call

We are trying to $50 while spending $17

Chip Shortage May Force Apple to Cut iPhone 13 Production Goals

Apple may slash iPhone 13 production goals by as many as 10 million units this year, according to a report by Bloomberg. The company wanted to make 90 million through the end of 2021 but Broadcom, Texas Instruments and other parts suppliers are having trouble delivering components.

- Apple is one of the world’s biggest buyers of chips amid a global chip shortage that has delayed production of everything from personal electronic devices to automobiles.

- Broadcom supplies wireless components to Apple, while Texas Instruments supplies display parts. There is a shortage of TI chips that power OLED displays, the Bloomberg report said. Apple declined to comment to Barron’s on the report, while the chip makers weren’t immediately available.

- The iPhone 13 Pro and iPhone 13 Pro Max went on sale in September on Apple’s website but orders won’t be delivered until mid-November, just in time for the holiday season. This quarter Apple is projected to make $120 billion in revenue.

- Apple warned earlier this year supply constraints, especially chip shortages, could dent iPhone and iPad in the third quarter, which ended in September. The iPhone 13 was introduced Sept. 14.

What’s Next: President Joe Biden will meet today with leaders of the Ports of Los Angeles and Long Beach and the union representing workers there, and later host a roundtable with executives from Walmart, UPS and The Home Depot after the administration unveiled a series of public and private commitments to tackle supply-chain problems this morning.

—Liz Moyer

JPMorgan (JPM) earnings Q3 2021 (cnbc.com)

JPMorgan exceeds profit expectations on $1.5 billion boost from better-than-expected loan losses

PUBLISHED WED, OCT 13 20215:55 AM EDTUPDATED WED, OCT 13 202110:49 AM EDT

KEY POINTS

- Here are the numbers: earnings of $3.74 per share vs. $3 per share estimate of analysts surveyed by Refinitiv.

- Revenue: $30.44 billion vs, $29.8 billion estimate.

JPMorgan Chase on Wednesday posted third-quarter results that exceeded expectations on a $1.5 billion boost from better-than-expected loan losses.

The gain came after the bank released $2.1 billion in reserves and had $524 million of charge-offs in the quarter, New York-based JPMorgan said in a release.

The bank produced $3.74 per share in earnings, which includes a 52 cent per share boost from reserve releases and a 19 cent per share benefit tied to a tax filing. JPMorgan shares dipped 2.7%, giving up gains in premarket trading.

Here are the numbers:

- Earnings: $3.74 per share vs. $3 per share estimate of analysts surveyed by Refinitiv.

- Revenue: $30.44 billion vs $29.8 billion estimate.

The bank “delivered strong results as the economy continues to show good growth – despite the dampening effect of the Delta variant and supply chain disruptions,” CEO Jamie Dimon said in the statement. “We released credit reserves of $2.1 billion as the economic outlook continues to improve and our scenarios have improved accordingly.”

Dimon reiterated a message from previous quarters, which also benefited from reserve releases, that managers didn’t consider the gain to be fundamental to their business. The firm set aside billions of dollars for losses last year after the onset of the coronavirus pandemic, and this year has been releasing those funds after the losses didn’t arrive.

Indeed, analysts have said that banks have exhausted most of the benefit from releases and must now rely on core activities like growing loans and rising interest rates to boost profits.

Companywide revenue rose 2% to $30.4 billion, mostly driven by booming fees in the firm’s investment banking and asset and wealth management divisions. Net interest income of $13.2 billion edged out the $12.98 billion StreetAccount estimate on higher rates and balance sheet growth.

Fixed income revenue dropped 20% to $3.67 billion, below the $3.73 billion StreetAccount estimate. But equities trading revenue more than made up the shortfall, producing $2.6 billion, beating the $2.16 billion estimate.

Robust levels of mergers and IPO issuance in the quarter helped the firm’s investment bank. The company posted a 50% increase in investment banking fees to a record $3.28 billion, exceeding the estimate by half a billion dollars.

For most of the pandemic, booming trading revenue across Wall Street has benefited JPMorgan’s investment bank. But that was expected to moderate in the third quarter. Last month, JPMorgan executive Marianne Lake said that trading revenue will be 10% lower than a year ago, which was an unusually strong quarter.

The firm’s asset and wealth management division posted a 21% increase in revenue to $4.3 billion on higher management fees and growth in balances. Assets under management rose 17% to $3 trillion on rising equity markets.

Companywide loan growth has stabilized and should pick up next year, driven by higher spending and increased revolving of debts by credit-card users, CFO Jeremy Barnum told analysts during a conference call.

Executives were asked about the bank’s acquisition strategy after a string of recent deals. Last month, it acquired restaurant review service the Infatuation and college planning platform Frank. That followed three acquisitions of fintech start-ups in the past year.

Barnum hinted that the bank’s deals will likely continue, saying that “acquisitions are still potentially on the horizon” next year.

Shares of JPMorgan have climbed 30% this year before Wednesday, trailing the 37% increase of the KBW Bank Index.

Trade Findings and Adjustments 10-14-2021

Today is going to be a bit of an education day in regards to calendars and leap bull calls

Everyone that set shorter term trade = Bull Call, Bull Put, Bull Call Calendar, Call Calendar for JPM is getting their butts handed to them today = Options expiration this Friday, Next week and for the last week of Oct all got killed

Killed = They have taken over an 80% loss with little time to allow the trades to come back

Calendar trades = this trade work with what trend?=stagnant or very slow moving

Primary position = leap long call position = stock replace position – right to buy the stock at a certain price for a certain period of time

Leap = over a year in time

Secondary or protective position is a Short Call – This is the obligation to sell your stock at a certain price for a certain period of time

ONE of the biggest problems I see with calendar trades is that you don’t know the stock is sideways until about 4 weeks have passed

NOW If the trade starts off to the downside then you get to keep that Nov short call credit

The tricky part of calendars is to decide when to let the stock replacement strategy (long call) run for awhile without the short side in the trade

SO I usually use a Leap Bull Call

Longer than a year long call (stock Replacement) – 18-27 months

Longer than a year leap short call ( protective part) – 18-27 months

Here is the most recent JPM leap bull call

NEW trade is a SQ Leap Bull Call

We are trying to $50 while spending $17

Chip Shortage May Force Apple to Cut iPhone 13 Production Goals

Apple may slash iPhone 13 production goals by as many as 10 million units this year, according to a report by Bloomberg. The company wanted to make 90 million through the end of 2021 but Broadcom, Texas Instruments and other parts suppliers are having trouble delivering components.

- Apple is one of the world’s biggest buyers of chips amid a global chip shortage that has delayed production of everything from personal electronic devices to automobiles.

- Broadcom supplies wireless components to Apple, while Texas Instruments supplies display parts. There is a shortage of TI chips that power OLED displays, the Bloomberg report said. Apple declined to comment to Barron’s on the report, while the chip makers weren’t immediately available.

- The iPhone 13 Pro and iPhone 13 Pro Max went on sale in September on Apple’s website but orders won’t be delivered until mid-November, just in time for the holiday season. This quarter Apple is projected to make $120 billion in revenue.

- Apple warned earlier this year supply constraints, especially chip shortages, could dent iPhone and iPad in the third quarter, which ended in September. The iPhone 13 was introduced Sept. 14.

What’s Next: President Joe Biden will meet today with leaders of the Ports of Los Angeles and Long Beach and the union representing workers there, and later host a roundtable with executives from Walmart, UPS and The Home Depot after the administration unveiled a series of public and private commitments to tackle supply-chain problems this morning.

—Liz Moyer

JPMorgan (JPM) earnings Q3 2021 (cnbc.com)

JPMorgan exceeds profit expectations on $1.5 billion boost from better-than-expected loan losses

PUBLISHED WED, OCT 13 20215:55 AM EDTUPDATED WED, OCT 13 202110:49 AM EDT

KEY POINTS

- Here are the numbers: earnings of $3.74 per share vs. $3 per share estimate of analysts surveyed by Refinitiv.

- Revenue: $30.44 billion vs, $29.8 billion estimate.

JPMorgan Chase on Wednesday posted third-quarter results that exceeded expectations on a $1.5 billion boost from better-than-expected loan losses.

The gain came after the bank released $2.1 billion in reserves and had $524 million of charge-offs in the quarter, New York-based JPMorgan said in a release.

The bank produced $3.74 per share in earnings, which includes a 52 cent per share boost from reserve releases and a 19 cent per share benefit tied to a tax filing. JPMorgan shares dipped 2.7%, giving up gains in premarket trading.

Here are the numbers:

- Earnings: $3.74 per share vs. $3 per share estimate of analysts surveyed by Refinitiv.

- Revenue: $30.44 billion vs $29.8 billion estimate.

The bank “delivered strong results as the economy continues to show good growth – despite the dampening effect of the Delta variant and supply chain disruptions,” CEO Jamie Dimon said in the statement. “We released credit reserves of $2.1 billion as the economic outlook continues to improve and our scenarios have improved accordingly.”

Dimon reiterated a message from previous quarters, which also benefited from reserve releases, that managers didn’t consider the gain to be fundamental to their business. The firm set aside billions of dollars for losses last year after the onset of the coronavirus pandemic, and this year has been releasing those funds after the losses didn’t arrive.

Indeed, analysts have said that banks have exhausted most of the benefit from releases and must now rely on core activities like growing loans and rising interest rates to boost profits.

Companywide revenue rose 2% to $30.4 billion, mostly driven by booming fees in the firm’s investment banking and asset and wealth management divisions. Net interest income of $13.2 billion edged out the $12.98 billion StreetAccount estimate on higher rates and balance sheet growth.

Fixed income revenue dropped 20% to $3.67 billion, below the $3.73 billion StreetAccount estimate. But equities trading revenue more than made up the shortfall, producing $2.6 billion, beating the $2.16 billion estimate.

Robust levels of mergers and IPO issuance in the quarter helped the firm’s investment bank. The company posted a 50% increase in investment banking fees to a record $3.28 billion, exceeding the estimate by half a billion dollars.

For most of the pandemic, booming trading revenue across Wall Street has benefited JPMorgan’s investment bank. But that was expected to moderate in the third quarter. Last month, JPMorgan executive Marianne Lake said that trading revenue will be 10% lower than a year ago, which was an unusually strong quarter.

The firm’s asset and wealth management division posted a 21% increase in revenue to $4.3 billion on higher management fees and growth in balances. Assets under management rose 17% to $3 trillion on rising equity markets.

Companywide loan growth has stabilized and should pick up next year, driven by higher spending and increased revolving of debts by credit-card users, CFO Jeremy Barnum told analysts during a conference call.

Executives were asked about the bank’s acquisition strategy after a string of recent deals. Last month, it acquired restaurant review service the Infatuation and college planning platform Frank. That followed three acquisitions of fintech start-ups in the past year.

Barnum hinted that the bank’s deals will likely continue, saying that “acquisitions are still potentially on the horizon” next year.

Shares of JPMorgan have climbed 30% this year before Wednesday, trailing the 37% increase of the KBW Bank Index.