HI Market View Commentary 10-11-2021

Today I have three things of interest for today’s market

Trades/NEW Opportunities:

Finance – Related to higher interest rates to make a bogger spread to make the finance companies more money OR if the finance companies are lending their own money they can make a higher interest rate fee from that.

Tech / Commodities in a higher interest rate environment tech usually out preforms

Tech already purchased the materials, is service driven and already borrowed/procured their capital at the lower interest rates

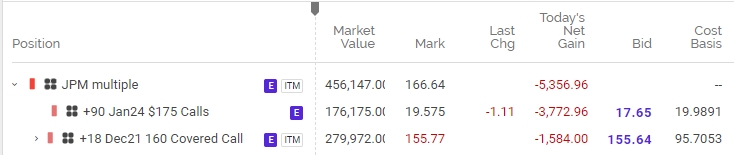

Today some of you will notice a new position:

So We want to get out of positions this year for tax reasons

We are not going to add protective puts because we are 6.64 ITM with an 11.08 credit = 17.72 of downside protection

SQ Jun 23 240/290 Leap Bull Call for $16.50 trying to make $50 I would get out when the stock reaches $288 ish

What do you do when things get tough?

We are going to stick to our process/methodology because it has proven to be the best way to invest in the stock market since the inception of options!!!! It’s what we do and we do it very well !!!

I Love being a Registered Investment Advisor = Because I get to help people the same way my portfolio is structured, using the same methodology and making the same returns they do !!! I am no longer afraid of market crashes because we do something that protects downside market movement. I can be honest in what we charge without hiding commissions, fees and other incentives !!!

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 08-Oct-21 15:10 ET

Wage inflation is a monetary policy problem in the making

The Federal Reserve has a problem on its hands, or what we should say is that it has another problem on its hands.

The first problem is knowing when it should start tapering its asset purchases. That shouldn’t be a problem. The Fed should have started tapering months ago since the conditions that drove the Fed down another quantitative easing path aren’t anywhere close to being as bad as they were when the Fed went down that path.

We made this argument in late July with a piece entitled, Challenging times not as challenging as before.

We digress.

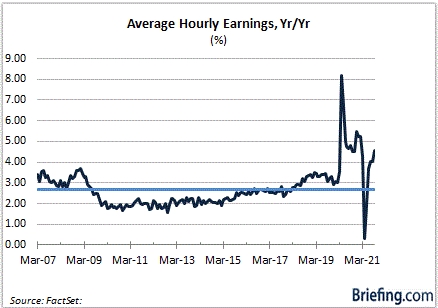

The other problem now on the Fed’s hands is wage inflation. It keeps showing up in the employment reports.

Distortions in the Numbers

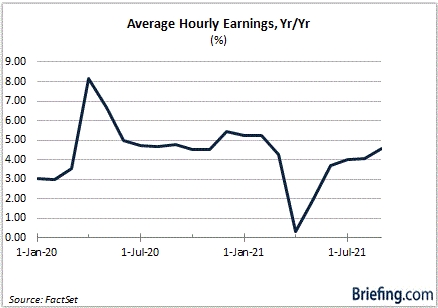

The COVID pandemic has created a lot of distortions. That was plain to see in the average hourly earnings growth in the early stages of the pandemic. It skyrocketed as lower wage earners were disproportionately affected by job cuts when business activity cratered with lockdown/shutdown measures and stay-at-home preferences.

Average hourly earnings growth fell sharply, though, as the economy reopened more fully with the introduction of the COVID vaccines and as lower wage earners went back to work.

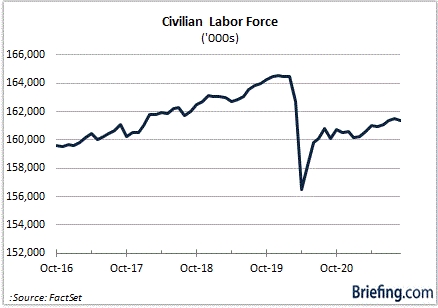

What the September employment report showed is that there are still a lot of people who aren’t back at work. In fact, there are 3.1 million fewer people in the civilian labor force than there were at the start of the pandemic.

It’s a confounding reality given related reports that indicate job openings are at a record high. Meanwhile, one company after the next seems to be calling attention to labor shortages as a factor that is curtailing production/service capabilities and driving up labor costs.

Those costs are going up because the supply chain issues aren’t just a commodity issue. They are also a labor issue and employers are having to pay higher wages to attract and retain workers. Higher minimum hourly pay rates at big-box retailers, like Target (TGT) and Walmart (WMT), at banks, like Bank of America (BAC), and at behemoths like Amazon.com (AMZN) are adding to the wage pressures that are trickling down to small businesses.

These aren’t going to be temporary wage increases either. They will be sticky even when the labor supply improves.

Everybody’s Doing It

Average hourly earnings were up 4.6% year-over-year in September. That wasn’t because lower-wage earners weren’t a big part of the labor mix either.

Retail trade payrolls increased by 56,000 positions in September, and leisure and hospitality payrolls increased by 74,000. Workers in these industries are making more, too. Average hourly earnings on a seasonally adjusted basis increased 3.9% year-over-year to $22.27 for retail trade and 10.8% year-over-year to $18.95 for leisure and hospitality.

In fact, average hourly earnings were up year-over-year for every private industry group, as seen in Table B-3 of the Employment Situation Report.

The 4.6% increase in average hourly earnings was the highest since February 2021, and well above the long-term average of 2.7%.

This wage inflation is going to persist — or so it seems. While supply chain issues are a problem for most companies, most companies are also still extolling the strong demand they are seeing and their ability to pass through price increases to help offset their higher costs.

So far, the price increases have been tolerated in most cases since many consumers are benefiting from excess savings, the wealth effect of rising home and stock values, and, yes, higher wages.

Still, if “everybody’s doing it” (i.e., raising prices), then the more persistent pricing pressures across a broader range of products and services are going to lead to higher wage demands to help offset those inflation pressures.

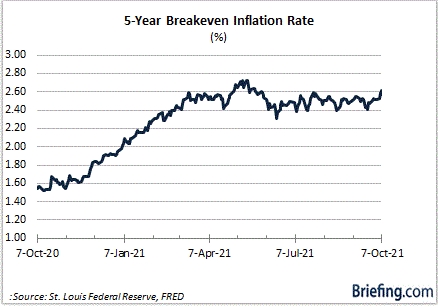

Interestingly, the 5-year breakeven inflation rate, which reflects what market participants think inflation will average in the next five years, is back at its highest level since May.

What It All Means

The unemployment rate dropped to 4.8% in September from 5.2% in August. That is the lowest unemployment rate since March 2020 as the number of unemployed workers declined by 710,000. Strikingly, there was also a dip in the labor force participation rate to 61.6% from 61.7%.

It was presumed that the labor force participation rate would be increasing since the enhanced unemployment benefits expired in September and schools reopened with an in-person orientation. What is apparent on the surface is that the expiration of the enhanced unemployment benefits didn’t convince former recipients to look for work immediately. What’s apparent beneath the surface is that childcare issues remain a headwind for the labor market recovery.

The latter has been extrapolated from the drop in the female labor participation rate to 55.9% from 56.2% in August and 57.8% in February 2020.

This drop in female participation is an important element in the scarcity of labor supply. More women returning to the labor force would help relieve some of the labor shortage, but it’s unclear if it will really relieve the wage pressures that are turning systemic and risk bleeding over into further price increases as companies try to attract workers to meet a backlog in demand.

That demand is a problem for the Fed because it encourages companies to raise prices as they battle with snarls in the supply chain and transportation bottlenecks that many think will last well into next year, if not further.

Higher prices, and increased demand among workers for higher wages to deal with those increased prices, could become a toxic policy problem for the Fed, whose hand may be forced to move more aggressively with tapering and tightening action to keep elevated inflation pressures in check.

It is a problem the Fed doesn’t want on its hands and it is a problem the stock market doesn’t want on the Fed’s hands. It’s becoming more evident, though, that it’s a problem in the making.

—Patrick J. O’Hare, Briefing.com

| https://go.ycharts.com/weekly-pulse |

| Market Recap WEEK OF OCT. 4 THROUGH OCT. 8, 2021 The S&P 500 posted a 0.8% increase in the first full week of October and Q4 despite falling slightly Friday amid disappointment over weaker-than-expected US September job growth. The benchmark index ended Friday’s session at 4,391.34, up from last Friday’s closing level of 4,357.04. The weekly gain, which follows a September slide that had the S&P 500 fall 4.8% last month, returns the index to the positive territory in which it has spent most of 2021. The S&P 500 is up 17% for the year to date. The US stock market started and ended the week with losses; the S&P 500 fell Monday amid an outage of Facebook’s (FB) social media services and it fell Friday amid the weaker-than-expected September jobs data. The Labor Department’s September employment report showed nonfarm payrolls rose by only 194,000, well below the 500,000 jobs increase expected in a survey compiled by Bloomberg. However, the index still rose on the week as gains posted Tuesday through Thursday, boosted by US lawmakers reaching a deal on a short-term debt-limit extension, outweighed the Monday and Friday declines. All but three of the S&P 500’s sectors rose last week. Energy had the largest percentage gain, up 5%, followed by a 2.3% rise in financials. Other sectors up by more than 1% each included industrials, utilities and consumer staples. The three sectors in the red were real estate, which slid 0.8%, health care, which slipped 0.3%, and communication services, which edged down 0.1%. The energy sector’s climb came as crude oil futures rose. Among the gainers, Phillips 66 (PSX) shares added 13% as Piper Sandler upgraded its investment rating on the stock to overweight from neutral while lifting its price target to $87 per share from $85. Analysts at Cowen as well as Tudor, Pickering, Holt & Co. also raised their price targets on the stock. In the financial sector, shares of Intercontinental Exchange (ICE) climbed 11% as the data, technology and market infrastructure company reported an 11% year-over-year increase in its exchanges’ total average daily volume for the month of September. For Q3, its total average daily volume rose 18% from the prior-year period. In real estate, the decliners included Equinix (EQX), whose shares fell 4.9% on the week. Credit Suisse downgraded its investment rating on the digital infrastructure company’s stock to neutral from outperform, citing supply chain pressures, deployment delays and rising rates. The firm also reduced its price target on the stock to $731 from $942. Next week, the Q3 earnings reporting period will begin. The companies expected to release their latest quarterly results next week include JPMorgan Chase (JPM), Delta Air Lines (DAL), Alcoa (AA), Bank of America (BAC), UnitedHealth Group (UNH) and Goldman Sachs Group (GS). In economic data, next week’s reports are expected to include the September consumer price index on Wednesday, the September producer price index on Thursday, and September retail sales on Friday. October consumer sentiment is also anticipated Friday, among other reports. Provided by MT Newswires |

Earnings Dates

Where will our markets end this week?

Higher

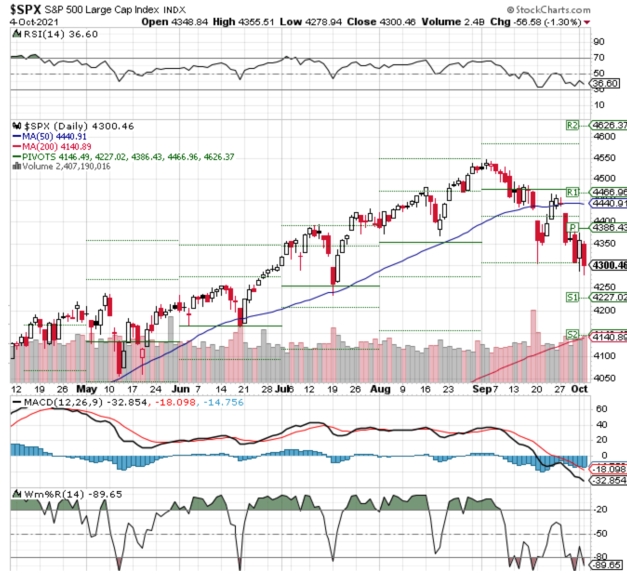

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end October 2021?

10-11-2021 -2.5%

10-04-2021 -2.5%

Earnings:

Mon:

Tues:

Wed: BLK, DAL, JPM

Thur: C, MS, UNH, WBA, WFC, AA, BAC, USB

Fri: SCHW, GS

Econ Reports:

Mon:

Tues: JOLTS, NFIB Small Business Optimism

Wed: MBA, CPI, Core CPI

Thur: Initial Claims, Continuing Claims, PPI, Core PPI

Fri: Empire Manufacturing, Retail Sales, Retail Ex-Auto, Import, Export, Business Inventories, Michigan Sentiment, MONTHLY OPTIONS EXPIRATION

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Long put protection has been added and getting ready for earnings

AAPL – 10/28 AMC

BA – 10/27

BAC – 10/14 BMO

BIDU – 11/16

DIS – 11/11

F – 10/27 AMC

FB – 10/27

JPM – 10/13 BMO

COST – 12/09

SBUX – 10/28 AMC

SQ – 11/04 AMC

TGT – 11/17 BMO

UAA – 11/02 BMO

V – 10/27

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Why aren’t you currently investing in crypto currency = because they are proven to be unsecured currency/investments

China tech stocks rise after Meituan hit with antitrust fine (cnbc.com)

China tech stocks surge despite $534 million antitrust fine slapped on food delivery giant Meituan

PUBLISHED SUN, OCT 10 202111:19 PM EDTUPDATED 31 MIN AGO

KEY POINTS

- China’s State Administration for Market Regulation (SAMR) hit food delivery giant Meituan with a 3.44 billion yuan ($534.3 million) fine for abusing its dominant position.

- Analysts said the fine has removed an “overhang” over Meituan and the company’s shares closed more than 8% higher in Hong Kong.

- Other Hong Kong-listed Chinese giants rose in early trade. Tencent closed 2.9% higher while Alibaba jumped nearly 8%.

GUANGZHOU, China — Meituan shares surged over 8% on Monday despite the food delivery giant being slapped with a $500 million antitrust fine, as the penalty was not as large as expected.

“The Meituan fine was actually lower than expected,” Ken Wong, Asia equity portfolio specialist at Eastspring Investments, told CNBC’s “Street Signs Asia” on Monday.

On Friday, China’s State Administration for Market Regulation (SAMR) said Meituan abused its dominant position in the country’s online food delivery market. The market regulator said Meituan pushed merchants to sign exclusive cooperation agreements with them and carried out punitive measures for those that didn’t.

The SAMR slapped a 3.44 billion yuan ($534.3 million) fine on Meituan and ordered it to carry out rectification measures, concluding a months-long probe.

Meituan closed up more than 8% in Hong Kong trade, while other China technology stocks listed in Hong Kong were also broadly higher. Tencent ended the day higher by 2.9% while Alibaba jumped nearly 8%.

Investment bank Jefferies said the fine has removed an “overhang” on Meituan.

“We believe the SAMR decision addresses market concerns and Meituan (MT) has been communicating with authorities and upgrading its business operations,” the analysts said in a note Sunday.

The fine equated to 3% of Meituan’s 2020 revenue.

Separately, Alibaba was slapped with a $2.8 billion fine in April — about 4% of 2019 revenue the e-commerce giant was forced to pay as part of an anti-monopoly investigation.

“Overall the fact that Chinese equity markets are definitely … trading much more attractive relative to most other countries here in Asia,” Eastspring Investments’ Wong said.

“Chinese markets … are trading at substantially lower valuation levels,” he said. “We are seeing investors bottom fishing a bit.”

Wong said that any positive sentiment coming out of China toward the technology sector should lead to “more buying” of the related stocks.

China has been increasing scrutiny on its domestic technology companies over the past year, wiping billions of dollars of value off tech stocks.

Regulators have focused on tightening rules around unfair competition and data protection but have even gone further than other jurisdictions by turning their attention to regulating algorithms.

Disney’s shift to streaming puts ESPN in awkward position of clinging to the past

PUBLISHED SUN, OCT 10 20218:09 AM EDTUPDATED SUN, OCT 10 202111:10 AM EDT

KEY POINTS

- Disney’s strategic move into streaming conflicts with ESPN’s business, which profits handsomely from linear TV.

- ESPN probably won’t consider a direct-to-consumer service until the pay-TV bundle falls below 50 million U.S. households, according to people familiar with the company’s plans.

- ESPN’s near-term strategy is to incrementally increase the price of ESPN+, its limited streaming service, and add more content.

At last month’s Communacopia conference held by Goldman Sachs, Disney CEO Bob Chapek was asked about the importance of ESPN and sports broadcasting to his company’s streaming strategy. His answer sounded like a throw-away line.

“The number one most-viewed thing every year tends to be sports, something like nine out of 10 of the top viewership events in television are sporting events,” Chapek said in a virtual session on Sept. 21. “Who knows what the future will bring, but it’s certainly an important part of our consumer offerings at the Walt Disney company.”

Chapek’s generic response about the future for one of Disney’s most valuable assets inspired no follow-up questions or headlines. But Chapek was addressing an existential threat facing the media industry, and an issue that may one day rock the foundation of his media empire, which includes some of the most valuable studios and film franchises in the world alongside the dominant network for live sports.

Disney’s big dilemma for ESPN is whether and when to fully embrace a future without cable.

Broadcast and cable networks still make billions of dollars per year from the traditional TV model. ESPN is a huge beneficiary, because media companies earn monthly subscriber fees from pay-TV providers regardless of how many people watch their programming. Niche channels make just a few cents a month per subscriber, while sports networks charge several dollars.

Disney makes more money from cable subscribers than any other company, and that’s solely because of ESPN. ESPN and sister network ESPN2 charge nearly $10 per month combined, according to research firm Kagan, a unit of S&P Global Market Intelligence. That’s at least four times more than almost every other national broadcast or cable network, according to Kagan.

Disney requires pay-TV providers to include ESPN as part of their most popular cable packages. It’s a no-brainer for TV providers, who wouldn’t dare drop ESPN.

Meanwhile, the non-sports world is cutting the cord. More than 6 million people ditched pay TV in 2020, according to research firm eMarketer — the highest annual total ever. About 25 million Americans have dropped linear TV bundles in the past decade.

That creates a struggle within Disney that’s poised to escalate. Disney wants people to sign up for its streaming entertainment products, Disney+ and Hulu. Wall Street wants this too. Streaming video is a growth business. Traditional pay TV is a declining one.

It’s also a wise financial swap for Chapek. While Disney makes more than $10 a month per subscriber for sports, it makes far less for entertainment networks such as Disney Channel and FX, which draw lower audiences and don’t command high advertising rates.

If Disney can get a cord cutter to pay $8 per month for Disney+ and $6 for Hulu, it’s a huge win for the company.

The reverse is true for ESPN. Swapping an ESPN subscriber for an ESPN+ customer, who contributes average revenue of less than $5 per month, is a significant loss for Disney. ESPN+ is a streaming service with limited content.

Disney Chairman Bob Iger, who was CEO until last year, told investors when he launched Disney+ that Disney was “all in” on streaming video.

But ESPN isn’t. ESPN’s strategy is to cling to the cable bundle for as long as possible, knowing it can draw potentially billions of dollars from U.S. households that are each paying $120 for the network even if they never watch it.

Some analysts have even questioned whether Disney should spin off ESPN, allowing Chapek to focus more clearly on streaming. An ex-Disney executive, who recently left the company and asked not to be named, said there’s “strategic misalignment” between the parent company and ESPN, and the businesses no longer belong together because Wall Street doesn’t look kindly on declining assets. The executive said having ties to the legacy bundle will weigh down a company’s stock multiple.

ESPN’s fit within Disney

Whether or not the fit still make sense, Disney has a huge financial incentive, at least in the short term, to keep the marriage going.

At $10 per month, or $120 per year, multiplied by about 75 million U.S. homes, Disney earns roughly $9 billion annually in domestic carriage fees from ESPN and its associated networks. Advertising that comes with broadcasting sports brings in billions of additional dollars.

That cash allows ESPN to spend big on sports rights, continuing a virtuous cycle. Disney agreed to spend $2.7 billion for “Monday Night Football” in a deal that runs all the way until 2033. ESPN pays $1.4 billion annually for NBA games and will likely pay more when those rights will need to be renewed after the 2024-25 season. The network owns media rights to every major U.S. sport in some capacity.

It also allows Disney to pay up for original streaming content, bolstering the quality of Disney+ and Hulu as the company competes with Netflix and Amazon.

“We’re successfully navigating the evolution of consumer choice,” said Jimmy Pitaro, chairman of ESPN, which is majority-owned and controlled by Disney, in an interview with CNBC in April. “We believe we can be multiple things at the same time. As consumers continue to gravitate toward direct to consumer, we have the optionality that we need.”

ESPN’s role as cash machine works nicely for the time being. But if 25 million U.S. households ditch cable in the next four or five years, as some predict, the math will no longer add up, said LightShed media analyst Rich Greenfield.

“If we’re going to 40 to 50 million, the question is, ‘Is there any economic model that justifies the level of spending that we’re currently at?’” said Greenfield.

ESPN has to figure out how to make up $3 billion in annual lost pay-TV subscription revenue that’s coming in the next few years as cord-cutting continues, a decline that Disney executives are anticipating, according to people familiar with the matter.

Disney’s plan is to incrementally raise the price of ESPN+ as it adds more valuable content while maintaining contractual obligations for exclusive programming to pay-TV distributors, the people said. An early example is Eli and Peyton Manning’s alternative broadcast of “Monday Night Football,” which will air 10 times this season on ESPN2, with some appearances available on ESPN+.

Should the number of pay-TV bundle subscribers drop to a level well under 50 million U.S. households, Disney would likely take ESPN to consumers in a more complete streaming package, said two people with knowledge of the company’s plans. At that point, the economics would flip, as most of the people paying for linear TV would be sports fans. Disney could likely make more from a full-service sports streaming service than it would make in a wholesale pay-TV distribution model.

In the near term, selling ESPN separate from the linear bundle isn’t feasible. Disney has negotiated digital rights flexibility in almost every major rights renewal in the past few years. But the company is currently restricted by its linear pay-TV obligations, which require certain premium programming to stay exclusive to the cable bundle, according to people familiar with the matter.

What to charge for streaming ESPN

David Levy, the former president of WarnerMedia’s Turner Broadcasting, said that Disney will have plenty of leverage with consumers when the time comes to bypass the bundle.

Levy, who’s now chairman of data firm Genius Sports, said he thinks Disney can get 30 million customers to pay $30 a month for streaming ESPN, or more than double the cost for a standard Netflix subscription. That would bring in $10.8 billion annually — more than Disney makes today from pay-TV affiliate revenue.

“With sports, there’s a guaranteed built-in audience,” Levy said. “It’s much different than entertainment. With entertainment, every show is hit or miss, and you always have to market content. You never know what will succeed and what won’t. That’s why sports is the best content to invest in, and it will be no matter what the distribution model is.”

But Levy’s estimate may be optimistic. A top executive at one of the largest U.S. pay-TV operators told CNBC that about 15% of video subscribers are heavy sports viewers. That would equal just over 11 million U.S. households. Even if ESPN could double that number for a streaming app at $30, the service would make less than the $9 billion ESPN takes in today.

The uncertainty of how many subscribers will pay for sports in an à la carte streaming world isn’t lost on the leagues. The NFL built in early out-clauses to its most recent 11-year deals with the networks, according to people familiar with the matter, allowing the league to bail if the business model stops working. The NFL can end its agreement after seven years with CBS, NBC and Fox and after eight years with ESPN, said the people, who asked not to be named because the negotiations were private.

That’s why Disney and other networks with live sports want to keep the linear bundle around until they have to let it go. It’s difficult to make up the lost revenue in a reliable way.

“We believe strongly that the traditional pay TV bundle will remain intact for a long time,” said

Sean McManus, chairman of ViacomCBS’s CBS Sports. “I don’t think it ever whittles away to zero. And while it’s certainly possible the amount of subscribers will continue to decline, I don’t think the decline ever reaches a point in the coming years that it won’t support the current rights deals that we have, both for NFL football and our other sports.”

Churn baby churn

A streaming-only world would also subject ESPN to a challenge that it’s never had to worry about: Churn.

People who cancel ESPN unsubscribe from the whole linear bundle. In the direct-to-consumer market, it would be easy for football fanatics to only subscribe during the few months when games are played.

ESPN executives have been playing with ways to incentivize annual membership on the existing ESPN+ service to reduce month-to-month volatility. Several times this year, ESPN has sold a pay-per-view UFC fight for $69.99 on ESPN+, and at the same time offered a full-year membership, that would include the match, for $89.99, a 35% discount.

Packaging ESPN+ with Hulu and Disney+ is another churn buster, as the combined offering is 33% cheaper than buying all three individually.

However, a more complete ESPN offering combined with another streaming service would have to cost more, a proposition that would likely scare away the non-sports fans, who are used to paying much less. Disney already packages sports in some of its foreign streaming services, such as India’s Disney+ Hotstar and Latin America’s Star+. But the economics internationally aren’t the same as in the U.S.

“If you put sports into Hulu or Disney+, instead of charging $5 or $7, now you’re charging $30?” Greenfield said. “And then you’re trying to compete against Netflix at $15. There is no model I see that works. There’s no easy answer.”

Threats and saviors

Then there are the technology risks.

ESPN executives are hesitant about moving their prized programming to directly to consumers because of rampant password sharing among young users, according to people familiar with the matter.

“Watching a pirated stream or sharing a streaming service password seems like a victimless crime,” said John Kosner, who led digital media at ESPN from 2003 to 2017 and is now president of media consulting firm Kosner Media. “But it really impacts the business model of sports on streaming services.”

Whether younger audiences even want live sports is another issue for Disney. Other entertainment options, such as social media, mobile games and on-demand entertainment services may be eroding the cultural grip of televised sports. Americans age 13 to 23 are half as likely as millennials to watch live sports regularly and twice as likely to never watch, according to a 2020 Morning Consult survey.

“The overall relevance of sports is an open question for the younger generation,” said Kosner.

One potential model that could save Disney a lot of future heartburn is a new streaming bundle that effectively replicates pay TV but with more options. If that becomes the winning form of distribution, media companies may be in a familiar position, making money from their most-popular services even if not everyone is watching them.

Dexter Goei, CEO of cable TV provider Altice USA, said in May that such a product offering could work well for the sustainability of the media industry.

It “would allow us to focus primarily on our broadband product” and “be a partner for content on a direct-to-consumer basis as opposed to a partner on a linear basis,” Goei said at JPMorgan’s Technology, Media & Communications conference. It “will dramatically improve the economic trends of our business from a cash-flow standpoint,” he said.

The growing popularity of sports betting could also help. Betting by mobile app, which is slowly being legalized around the country, boosts viewership, because “if you place a bet on a game, you’re much more likely to watch that game,” Levy said.

Kosner added that augmented reality devices that create new viewing experiences and innovative products like non-fungible tokens (NFTs), which are digital collectibles, also have the potential to lure younger fans to watch games.

Add it all up, and media executives can find plenty of reasons to be optimistic despite the uncertainty that lies ahead for live sports.

“The value of sports continues to be more and more important every single year,” CBS’s McManus said. “Advertisers are going to continue to want to reach the largest possible audiences. The way to do that is with sports. I don’t see a cliff coming. Our roadways are clear.”

(Disclosure: Comcast’s NBCUniversal is the parent company of CNBC.)

Tech whistleblowers are having a moment, and one woman who’s been there has found a new way to help

PUBLISHED SUN, OCT 10 20218:13 AM EDTUPDATED SUN, OCT 10 20213:11 PM EDT

KEY POINTS

- Ifeoma Ozoma, a former employee at Pinterest and Google, just published a resource guide for tech workers who are considering going public with complaints about their employer.

- Also this week, the bill she helped write that limits nondisclosure agreements, was signed into law in California.

- Ozoma told CNBC that she’s using skills she learned at various tech companies to equip employees facing misconduct.

Whistleblowers are getting louder in Silicon Valley. Most notable is ex-Facebook employee Frances Haugen, who testified in front of Congress this week after revealing documents that showed the company is aware of the harm its products cause.

Also this week, California Gov. Gavin Newsom signed the Silenced No More Act, which prohibits employers from using nondisclosure agreement to muzzle complaints about discrimination.

The timing was fortuitous for Ifeoma Ozoma, a former Pinterest employee, who’s recently been spending much of her energy trying to create a safe space for tech whistleblowers. In 2020, Ozoma and another Black ex-Pinterest employee went public with claims of discrimination and retaliation during their time at the social media company.

On Wednesday, Ozoma launched a free online resource guide for tech workers who are considering making workplace complaints. It’s called “The Tech Worker Handbook,” and Ozoma says it’s meant to help those who need basic information with how to share their stories of misconduct and how to prepare for what comes next.

“It’s really depressing stuff when you get into it,” Ozoma, 29, said in an interview. “When you look at all the expenses you need to be planning for when you decide you’re going to potentially leave a company, it is such a huge decision to make for yourself and your family. I think we’re doing individuals a disservice if we’re not providing any kind of support or resources. It’s basically saying ‘throw yourself into the lion’s den and good luck.’”

Ozoma’s guide reached over 30,000 website views its first day and received praise from many across the industry. Ozoma owns the domain and is overseeing the site. She’s tapped dozens of tech workers and organizations to help contribute to the guide.

She told CNBC that since launching the guide, she’s received hundreds of inquiries from workers, asking how to get involved and whether they should speak out about their company. Ellen Pao, a tech investor and former Reddit CEO, who sued venture firm Kleiner Perkins for gender discrimination in 2012, praised Ozoma’s work.

“I think it’s incredibly important to set people’s expectations,” Pao said. “Your company is going to come after you like we saw with the PR smear against Frances,” she said, referring to Facebook’s efforts to discredit Haugen during and after her testimony.

Ozoma said her goal isn’t to convince people to blow the whistle but to show them their options. The guide offers pages of resources for advice on media, legal actions and security precautions.

An assessment gives workers several questions to consider before speaking out. Ozoma warns about the potential loss of income and health care that could come as a result of being fired or leaving a position. She said she had to pay $900 a month for health insurance when she left Pinterest.

DMs aren’t going to cut it

Ozoma said employees approach her each week for advice, often by text, but having worked in the tech industry, she knows software is a necessary part of the equation.

“I am happy to respond to people’s DMs for the rest of my life, but that is really not a scalable way for tech workers to find out what they need in order to protect themselves,” she said.

Erika Cheung is another one of the better-known whistleblowers in Silicon Valley. She’s among the former Theranos employees who came forward, alleging the blood-testing company was producing faulty results.

Ozoma and Cheung spoke months ago about the various costs to workers who speak out about their workplace conditions and the need for more resources. Ozoma included Cheung’s voice in the guide.

“You will face retaliation and lots of difficulties navigating the legal system, but the thing that kept me going was knowing that the company was wrong and causing harm to people by hiding a certain defect in their product,” Cheung said in the handbook. “That anchor is what I turned to when I was facing especially difficult circumstances.”

Both the Silenced No More Act and her handbook came after more than a year of lobbying and organizing, Ozoma said. Ozoma co-sponsored the bill and helped gather support from thousands of people in the tech industry.

She said she used skills acquired while working in various public policy roles for Google, Facebook and Pinterest.

“I learned how to work with policymakers, I learned how to lobby and engage with press, which have been huge parts of this,” she said. “It’s been an interesting way to apply these learnings but now for workers and not just my employers.”

Ozoma said she worked with former colleagues from each of her past employers. At times, that meant educating people who didn’t have the same experience.

“Most folks in the tech industry have no idea how legislations work,” Ozoma said. “It’s been a painstaking process conducting meetings with offices of senators over Zoom and asking supporters to sit in on hour-long calls for the chance to say audibly they support the bill.”

‘Too much for a person to bare’

One person in Ozoma’s corner is Ariella Steinhorn, founder and CEO of Lioness, an organization that helps workers tell their stories of misconduct allegations. Lioness published an essay in September by 21 former and current employees of Blue Origin who described a toxic work culture at the Jeff Bezos-led space company.

“We are in support and in awe of Ifeoma’s much-needed work in this space,” said Steinhorn.

Steinhorn added that she’s seen an influx of workers from the tech industry inquiring about how to share their stories externally after failed internal attempts.

“There’s definitely a need for something like this,” she said of Ozoma’s guidebook. “There’s usually such a mismatch between the reality and the image of a company and it’s too much for a person to bare themselves.”

Ozoma is now living in Santa Fe, New Mexico, where she moved in 2020. While she won’t get to experience the immediate results of her work on the California bill, she’s pushing for company executives and shareholders to include language from the law in their NDAs.

David Barrett, CEO of expense management software start-up Expensify, told Protocol that he agreed to include a sentence in NDAs, saying “Nothing in this agreement prevents you from discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct you have reason to believe is unlawful.”

Ozoma said she hopes the California bill will spark similar action in other states, especially as distributed workforces become the norm.

Chelsey Glasson, who worked at Google for five years, told CNBC that Ozoma’s effort on the bill inspired her to approach lawmakers in Washington state. She said they seem receptive to potentially matching the bill.

Glasson filed a lawsuit against Google in July 2020, after the Equal Employment Opportunity Commission opened an investigation into the complaint of pregnancy discrimination. Her trial is set for January.

Glasson’s complaint led to a bill that passed the Washington state Senate, extending the statute of limitations for filing a pregnancy discrimination complaint from six months to a year.

She said that Ozoma’s guide gives potential whistleblowers “a sense of community.”

“I continue to hear from so many workers who are experiencing misconduct and terrified because they don’t know what do,” Glasson said.

Start your holiday shopping now. Here are some goods that may be running out of stock

PUBLISHED SUN, OCT 10 20217:38 PM EDTUPDATED SUN, OCT 10 20218:45 PM EDT

KEY POINTS

- The energy crises in mainland China and Europe are the latest to roil shipping. Capital Economics noted that the number of ships waiting outside Chinese ports has jumped again in recent weeks.

- Factory shutdowns in Vietnam, where many firms moved manufacturing to amid the U.S.-China trade dispute, have also affected the production of many goods.

- Here’s a list of goods that have been affected in the leadup to the year-end holiday shopping season.

Supply chains everywhere have been hit by massive disruptions this year, from container shortages to floods and Covid infections setting off port closures.

The energy crises in mainland China and Europe are the latest to roil shipping.

Capital Economics noted that the number of ships waiting outside Chinese ports have jumped again in recent weeks, calling it “concerning.” According to the research firm, the 7-day average for the number of ships as of Sept. 30 was 206, compared with an average of 82 ships for 2019, before the pandemic.

Julian Evans-Pritchard, senior China economist at the research firm, said that power rationing along the supply chain could be interfering with ports’ ability to ship orders.

Factory shutdowns in Vietnam, where many firms moved manufacturing to amid the U.S.-China trade dispute, have also affected the production of many goods.

Here’s a look at how recent developments have once again snarled shipping and what types of goods are affected in the leadup to the year-end holiday shopping season.

Energy crises in China and Europe

The power crunch in China has caused widespread disruptions as local authorities ordered power cuts at many factories. Europe is also grappling with a massive gas shortage.

What’s happening in both regions is a perfect storm that’s disrupting supply chains globally, industry watchers and analysts say.

Factories in China and Europe have temporarily shuttered or at least reduced output because of the energy crisis. More than 60 companies in China have suffered power-related disruptions so far, and the list is likely to grow, says Jena Santoro of Everstream Analytics.

The biggest impact will be felt by consumers in the form of higher prices as inflated energy prices will cascade into increased manufacturing costs, said Dawn Tiura, president of the Sourcing Industry Group.

What goods are being hit:

1. Food

Rising energy prices in Europe will have a “serious cascading effect” on the region’s food supply chains, says Tiura.

“Major fertilizer plants were forced to curtail output because of the rising costs, and now farmers can’t produce enough food as a result,” she explained.

2. Carbonated beverages, dry ice, packaged foods

The pressure on fertilizer will also lead to a shortage of one “very interesting by-product” – carbon dioxide – which is used in a wide range of consumer products, says Per Hong, senior partner at consulting firm Kearney.

“With curtailed fertilizer production, we almost certainly will be faced with a global shortage of CO2 that is used widely. CO2 is used extensively in the food value chain from inside packaged food to keep it fresher longer, for dry ice to keep frozen food cold during delivery, to giving carbonated beverages (like soda and beer) their bubbles,” he said.

That points to the vulnerability of global food supply chains, Hong said.

3. Apple iPhones, electronics, toys

Several major Apple suppliers have suspended operations at their factories in China, according to Hong. In fact, the entire electronics industry — already reeling from the big chip shortage — is likely to suffer, he said.

“While likely to normalize in the longer term, in the immediate near term these power restrictions and production cuts in China we are observing are likely to lead to export price hikes, worsening inflation into the holiday season,” Hong said, adding that goods such as toys and textiles are also likely to be affected.

4. Christmas decorations

Companies are warning there will be huge demand for Christmas decorations.

“People hoping to buy a holiday tree and other decorations this holiday season better do so before Thanksgiving or risk paying through the nose or not having anything at all,” said Chris Butler, CEO of the National Tree Company, who said this was due to supply chain disruptions in China.

Other sectors that would feel the biggest and most immediate impact from the crises include metals, chemicals and cement – all of which are energy intensive, said Pawan Joshi, executive vice president of supply chain software firm E2open.

Shutdowns in Vietnam, Southeast Asia

Factory shutdowns and worker shortages across Southeast Asia due to Covid are causing “significant short-term disruption, with production in Vietnam, Thailand and Malaysia dropping “sharply,” says Gareth Leather, senior Asia economist at Capital Economics.

The situation in Vietnam appears to be especially significant, as many companies moved their manufacturing there from China, amid the U.S.-China trade war.

Companies with significant exposure to Vietnam include Nike (43%), Lululemon (33%) and Under Armour (40%), financial services firm BTIG said in a September note.

What goods are being hit:

1. Sports shoes and sportswear

Shutdowns in Vietnam have led to a production loss of around 100 million to 150 million pairs of sports shoes, according to Bank of America estimates published in a note last week.

BTIG noted footwear is being hit harder by the Vietnam shutdowns than sports apparel.

Meanwhile, Lululemon CEO Calvin McDonald said in an earnings call last month that the Vietnam closures and port-related issues are contributing to disruptions within supply chains, and increased costs.

2. Autos

Factory shutdowns in Malaysia are hitting auto production, analysts say.

Bank of America said in a recent note that supply bottlenecks will persist for some time, even as Malaysia starts to reopen.

Disruptions to chip supply from Malaysia are also holding back car production in China, according to Capital Economics.

Apart from sportswear, other industries which rely heavily on manufacturing in Vietnam include toys, clothes and even coffee, say analysts.

Winter is coming

Shortages of goods and price hikes are likely to get worse as winter approaches, says Santoro of Everstream Analytics.

“As demand for gas naturally increases during the winter season, shortages are likely to intensify,” Santoro said. “Entering the season with low inventory levels and heightened demand also enables surging prices to continue an upward trajectory.”

Cotton prices just hit a 10-year high. Here’s what that means for retailers and consumers

PUBLISHED SUN, OCT 10 20219:00 AM EDT

KEY POINTS

- Cotton prices surged to a 10-year high on Friday, reaching $1.16 per pound and touching levels not seen since July 7, 2011.

- “In 2011, we needed a prayer meeting,” Levi CEO Chip Bergh said about the cotton crisis roughly a decade ago.

- But today, analysts and experts say many apparel companies are in a much different position than they were in 2011. So far, higher costs are being passed along to consumers.HBI-0.01 (-0.06%)Scott Olson | Getty Images

The last time cotton prices were this high, it was July 2011.

“In 2011, we needed a prayer meeting,” Levi Strauss Chief Executive Chip Bergh told investors on an earnings call Wednesday.

Bergh recalled how he had just joined the denim retailer and was learning his way around Levi’s business. But he was also staring down a historic surge in cotton prices. Cotton had skyrocketed above $2 a pound, as demand for textiles rebounded from a global financial crisis, while India — a major cotton exporter — was restricting shipments to help its domestic partners.

The price of a cotton T-shirt rose about $1.50 to $2, on average, National Retail Federation Chief Economist Jack Kleinhenz said. Consumers felt the impact. And it also ate into companies’ profits.

Bergh sits in the camp with analysts and experts who say the current cotton price inflation will be less damaging to the industry. Manufacturers and retailers have pricing power. Companies will be able to pass along the higher costs without destroying consumer demand.

“It’s a very different situation today,” Bergh explained. “We’ve been able to take pricing over the last 12 months and it’s sticking. … We priced ahead of some of these inflationary pressures hitting us.”

Cotton prices surged to a 10-year high on Friday, reaching $1.16 per pound and touching levels not seen since July 7, 2011. The price of the commodity rose roughly 6% this week, and is up 47% year to date. Analysts note that gains are being intensified further from traders rushing to cover their short positions.

The runup stems from a number of factors. Last December, the Trump administration blocked companies in the United States from importing cotton and other cotton products that originated in China’s Western Xinjiang region over concerns it was being produced using forced labor by the Uyghur ethnic group. The ruling, which has remained in place during the Biden administration, has now forced Chinese companies to buy cotton from the U.S., manufacture goods with that cotton in China, and then sell it back to the U.S.

Extreme weather, including droughts and heat waves, have also wiped out cotton crops across the U.S., which is the biggest exporter of the commodity in the world. In India, deficient monsoon rains threaten to hurt the country’s cotton output.

The dynamic has already pressured shares of HanesBrands, an apparel manufacturer known for its undergarments and cotton T-shirts. Historically, HanesBrands shares fall as cotton prices rise. The stock tumbled 7% over the past week. On Friday alone, shares shed 5% to close at $16.23.

‘Real pricing power’

Credit Suisse analyst Michael Binetti said he views any worries or pullbacks on retail stocks because of the rising cotton prices as overblown.

He said only 2% of HanesBrands’ cost of goods sold comes from direct cotton purchases. Back in 2012, that figure was higher, at 6%.

Following the runup of cotton prices in 2011, HanesBrands hiked the prices of various cotton goods by a double-digit percentage three times, through 2012, to offset the inflation, Binetti said. HanesBrands’ profits still shrunk from all the costs it was facing. But ultimately, the company maintained some of those price increases. Today, it is in a healthier position with stronger profit margins, the Credit Suisse analyst said.

“We think the stocks are under-appreciating the most powerful dynamic that this sector has not had in over a decade. Real pricing power,” Binetti said.

Retailers have achieved that pricing power by proactively veering away from discount channels and culling excess inventory. The Covid pandemic has acted as a “cover” for companies to accelerate this shift. Ongoing supply chain bottlenecks have also played a role in tightening up inventories. This dynamic has driven costs up so much, businesses are raising prices and consumers are still buying.

“We think inventory will remain rational, margins will remain strong, and retailers will be able to push bigger and more consistent price increases than they’ve been able to for over a decade,” Binetti said. He expects the cotton inflation will be transitory.

UBS analyst Robert Samuels said the retailers he expects to be hardest-hit by the rising commodity prices are those that specialize in denim. Cotton accounts for more than 90% of the raw materials used to make jeans and other denim goods.

“As if retailers don’t have enough things to worry about with supply chain constraints and labor shortages,” Samuels said in a note to clients.

A more severe spike

But Levi has already attempted to assuage any fears about its denim business.

In its earnings call, Levi said it has already negotiated most of its product costs through the first half of next year, at very low-single-digit inflation. For the second half of the year, it expects to see a mid-single-digit increase. And Levi said it plans to offset that hike with the pricing actions it’s already been taking.

Levi has been shifting its business from predominantly wholesale to a mixed base that has a growing share of direct-to-consumer sales. And with strong consumer demand and tightened inventories, it’s been able to sell more products at full price.

Cotton accounts for about 20% of the cost to make a pair of Levi’s jeans, Chief Financial Officer Harmit Singh said, with every pair of jeans containing about two pounds of cotton.

Due to the timing of its earnings call, Levi was one of the first apparel retailers to comment publicly on the surging cotton prices. Others will report fiscal third-quarter results in the coming weeks.

According to analysts at Goldman Sachs, it will take a while before the rising cotton costs even begin to show up on retailers’ income statements, given the timing of contracted cotton purchases. And it’s worth noting that in 2011, cotton prices spiked to more than $2 per pound, which is well above where the commodity is trading today.

Still, apparel stocks may face some pressure as the higher prices persist. As examples, analysts flagged companies such as Ralph Lauren, Gap Inc., Kontoor Brands, and Calvin Klein-owner PVH. Shares of Kontoor Brands, which owns Wrangler and Lee jeans, fell nearly 6% this past week, while PVH, Gap and Ralph Lauren each ended the week down less than 2%.

—CNBC’s Michael Bloom contributed to this reporting.

Flat Fee Models Can Keep Clients Around Longer: RIA Execs

By Sam Del RoweOctober 11, 2021

Charging flat fees helps advisors explain their value to clients, many of whom don’t understand what they are paying for in the first place, according to industry executives.

It’s “critical” for advisors to have simple fee structures and be able to explain them well to clients, said Jenn Anderson, head of advisor engagement at Hightower Advisors.

“The more succinct and clear a firm can be on the services to be expected and the fee for those services, the higher degree of success they will have in converting the prospect into a client,” she said.

Most clients working with an advisor don’t know what they’re being charged, according to a study released earlier this year by State Street Global Advisors. For example, 60% of investors who work with advisors that State Street surveyed incorrectly believe that fund fees are included in the fees they pay an advisor or an investment platform. And just 24% of advised investors say they “completely” understand the concept of an expense ratio.

Hightower’s Anderson said advisors “must feel confident” in the value of the services they provide as well as the value the clients assign to those services so they can explain them better.

“The trend towards flat fees is indicative of this need to be clear,” she said.

Around 26% of the 1,000 registered investment advisor firms that use the platforms of technology provider Advyzon charge a flat fee for their services in some capacity, according to the firm.

Fee transparency only get more important as advisory firms tailor their service offerings to meet the demands of the next generation of clients, according to Hightower’s Anderson.

Hightower predominantly furnishes investment advice through discretionary advisory services, which are offered through an unbundled or bundled fee program, according to the firm’s March 31 regulatory filing with the Securities and Exchange Commission. Hightower also has a wrap fee program through which it offers portfolio management services, according to the filing.

Clients generally have a choice of how fees will be calculated for services, and these options include a percentage of client assets, hourly charges, flat fees and other retainer or service fees, or some combination of those options, the filing notes.

Advantageous for FAs

Jacksonville, Florida-based registered investment advisor firm Sterling Newton started charging clients a flat fee around six years ago. Before that, the firm was charging clients a percentage of the assets in their accounts.

“As we started to explore level fees, it started making sense because our level of service has to maintain the same regardless of the type of economy,” according to Bill Newton, the firm’s president.

Before making the transition to flat fees, Newton was “having difficulty justifying why clients’ fees were going up” under the percentage of assets model.

Charging flat fees is also advantageous for the advisory firm because the percentage of assets model tends to be impacted by market performance, Newton notes.

The percentage of assets fee model is “a bunch of hogwash.”Bill NewtonSterling Newton

“If your portfolio goes up, our fees go up. If your portfolio goes down, our fees go down. And if you really examine that theory, it’s a bunch of hogwash,” he said.

While strong market performance drives fees higher in that model, poor performance reduces them.

“The advisor can’t control the market, and he still has expenses that he has to pay for,” Newton said.

When an advisor’s fees are going down, “there’s a good chance” that “their service level would have to go down as well,” according to Newton. That’s what happened during the 2008 global financial crisis when advisory firms had to cut back on staff, for example, he said.

Meanwhile, advisors are also increasingly charging separate fees for their financial planning work, driven by a range of factors from improved payment processing to a desire for more stable revenue streams. A September 2020 survey of more than 1,600 advisors by Envestnet MoneyGuide found 38% of the respondents charge a separate fee for financial planning. Of those, 65% charge a flat planning fee, while 18% bill by the hour, and 8% charge by subscription.

Do you have a news tip you’d like to share with FA-IQ? Email us at editorial@financialadvisoriq.com.

SEC Considers Jailed Ex-Broker’s $6.5M Disgorgement Settled

By Alex PadalkaOctober 11, 2021

The Securities and Exchange Commission says it has obtained a final judgement against a jailed former broker but considers the disgorgement it ordered him to pay satisfied by a parallel criminal action from 2020.

Steven Pagartanis pleaded guilty in January 2020 to one count of conspiracy to commit mail and wire fraud connected to a scheme he ran between January 2000 and March 2018 that defrauded 17 individuals out of more than $13 million. He was sentenced to 14 years in prison around a week after pleading guilty. Pagartanis was also ordered to pay roughly $6.5 million in restitution.

Even before his arrests, the Financial Industry Regulatory Authority had barred Pagartanis. The industry self regulator took action in April 2018, after he didn’t show up for testimony into an “investigation of allegations that he made fraudulent misrepresentation to customers and misappropriated customers’ funds,” according to his BrokerCheck profile.

It took the SEC until February 2021 to bar Pagartanis from the financial services industry in connection to the criminal charges to which he had pleaded guilty the previous year, as reported.

Last week, the SEC announced that the U.S. District Court for the Eastern District of New York entered a final judgment against Pagartanis, permanently enjoining him from future violations and ordering him to pay $6,519,594 in disgorgement — which the regulator deemed satisfied by the restitution order in the parallel January 2020 criminal action, according to a litigation release the regulator published on Thursday.

Do you have a news tip you’d like to share with FA-IQ? Email us at editorial@financialadvisoriq.com.

HI Financial Services Mid-Week 06-24-2014