Trade Findings or Adjustments 02-07-2019

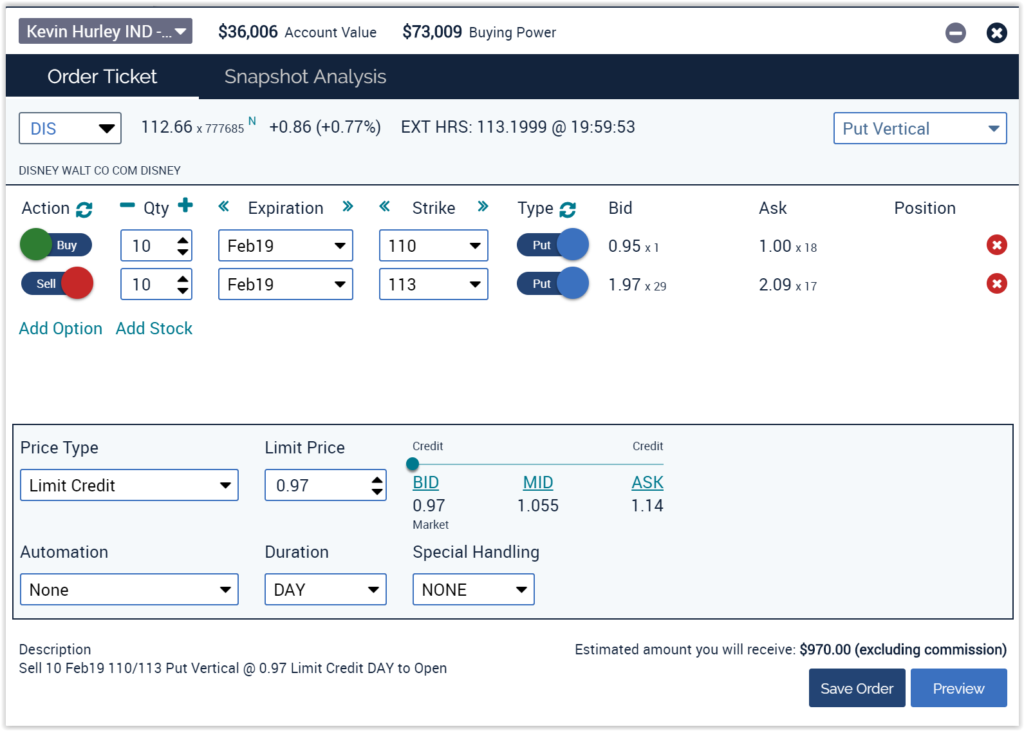

MY trade is post earnings trade on DIS

DIS had great earnings, currently bullish and lost $2.00 in after market gains due to the guidance Q&A session after their earnings

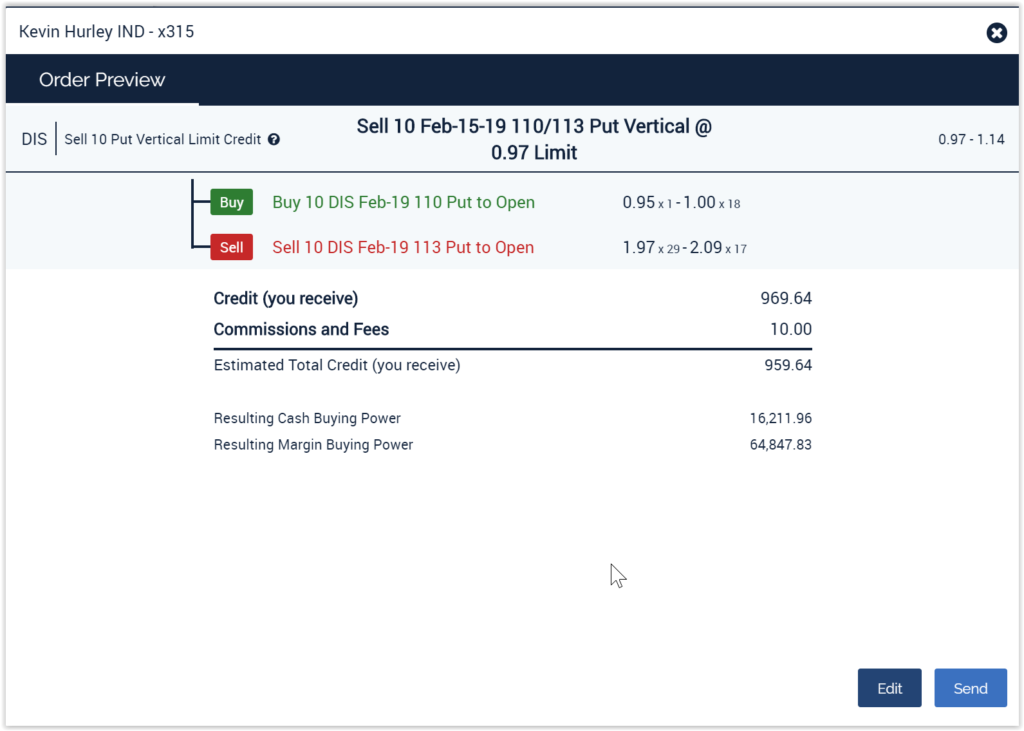

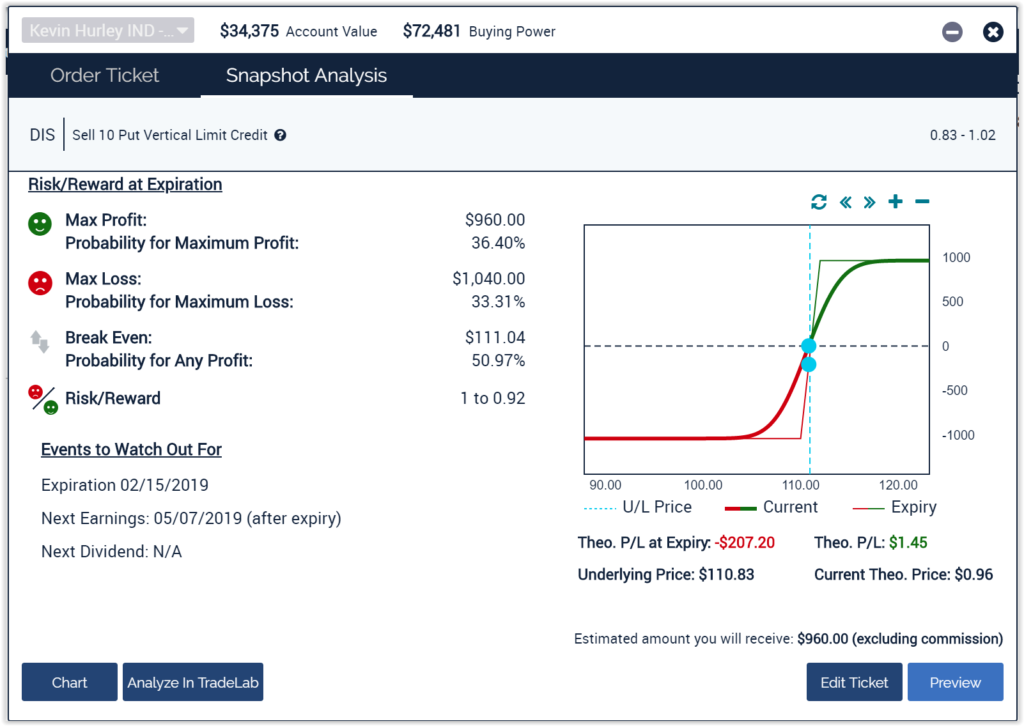

Really Like the $1.00 Credit for $2000 of risk

One reward = $1000 for $2000 of risk or 2 risks

So it is a 8 trading day 10 day total days in the trade

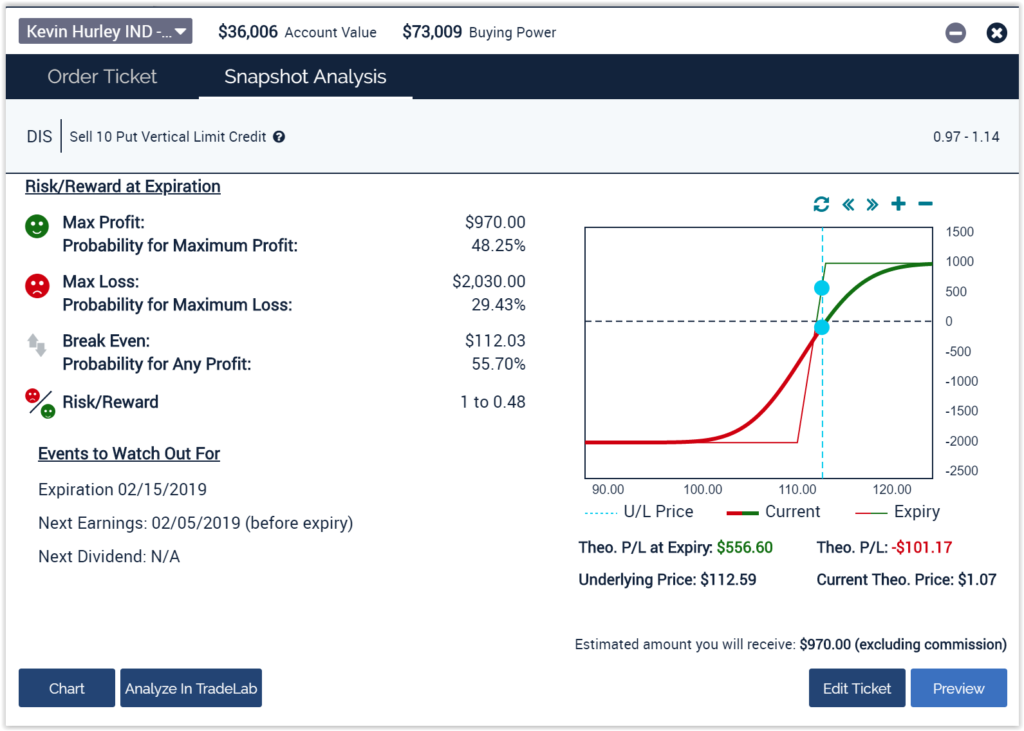

I would be fine exiting with a $500 to $700 profit on Friday or Monday morning

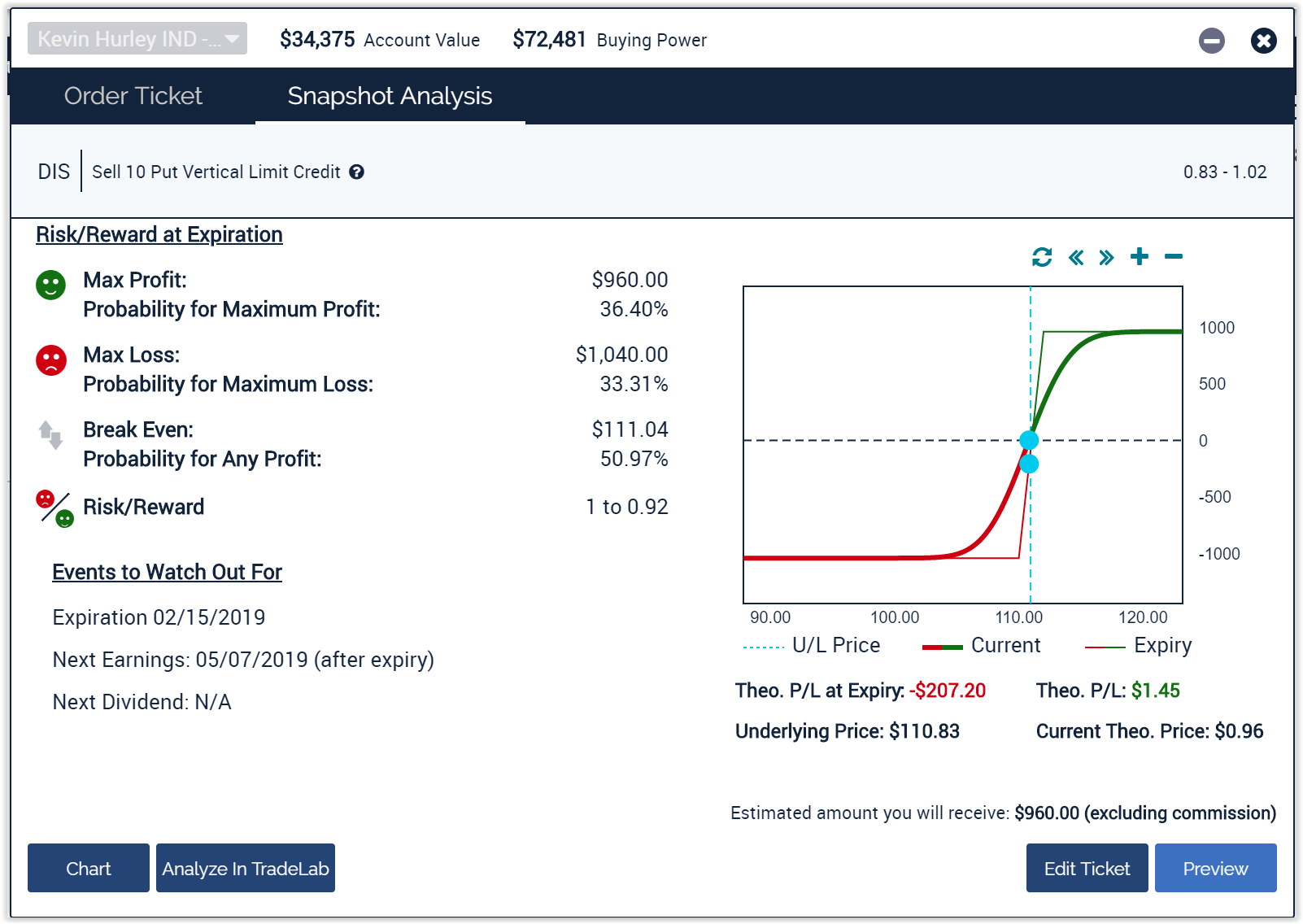

$112.03 is my break even point where at Expiration I would be flat minus commissions

To be safe I will probably place this trade after the first hour

Why? To allow the e-minis to clear out and to allow the market to accept a direction on both DIS and the indexes

Adjustment Expectation – After filled set a stop loss at $500 or $0.50 a contract

I also could take assignment as an adjustment strategy

Assignment of the short put would mean a 112K to fulfill the short put obligation

IF you are willing to take assignment you close the long put on Friday monthly expiration for any premium left in the position!!!!

A third adjustment would be to add an additional longer term long put

02-07-2019

Today DIS looks like this

www.hurleyinvestments.com www.myhurleyinvestment.com www.KevinMhurley.com