Trade Findings and Adjustments 11-07-2019

Today is the day you talk about all of your great returns

Meaning you should be out of every AAPL, BAC, FCX, FB, BA, MU QQQ, SPY

SO most of your spread trades are done, over and very profitable

Some we’ve dollar cost averaged over the year

We AT Hurley Investments want you to truly understand your money vs just BLINDLY following someone who really doesn’t know and can’t out guess the good old stock market !!!!!

So if you were looking to put on a trade today and expect some profit taking what would you do?

Longer term to the end of the year you are expecting a Christmas Rally, Bullish run

Take some profit and you can reenter if or once it comes back down

Protect or add some protection with the profit to make a little on a small dip

Enter ITM positions giving you a buffer or cushion for a little downside drop

Ladder into the position – put a third on giving yourself two more opportunities to place positions at a lower cost basis or lower price

Questions??? 11/04/2019

Trade Findings and Adjustments

Leap Long Calls on FB starting at $200 strike or above

AAPL longer term Bull calls 260/280 April or Jun

MSFT Leap long calls

Close 25% of the BIDU long calls to take some risk off the table

Pre earnings Leaps on BIDU and

DIS Leap $150 Long calls

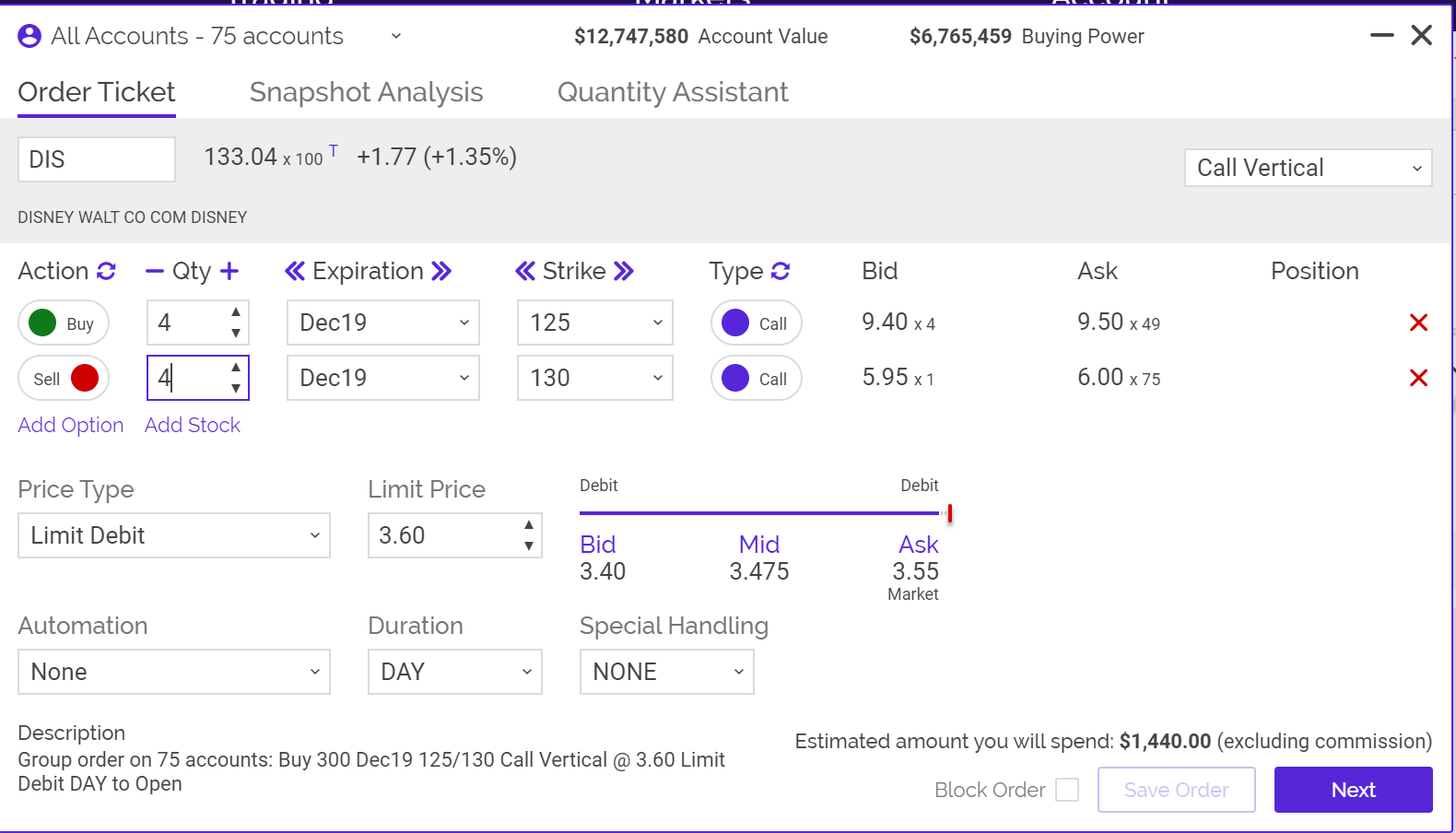

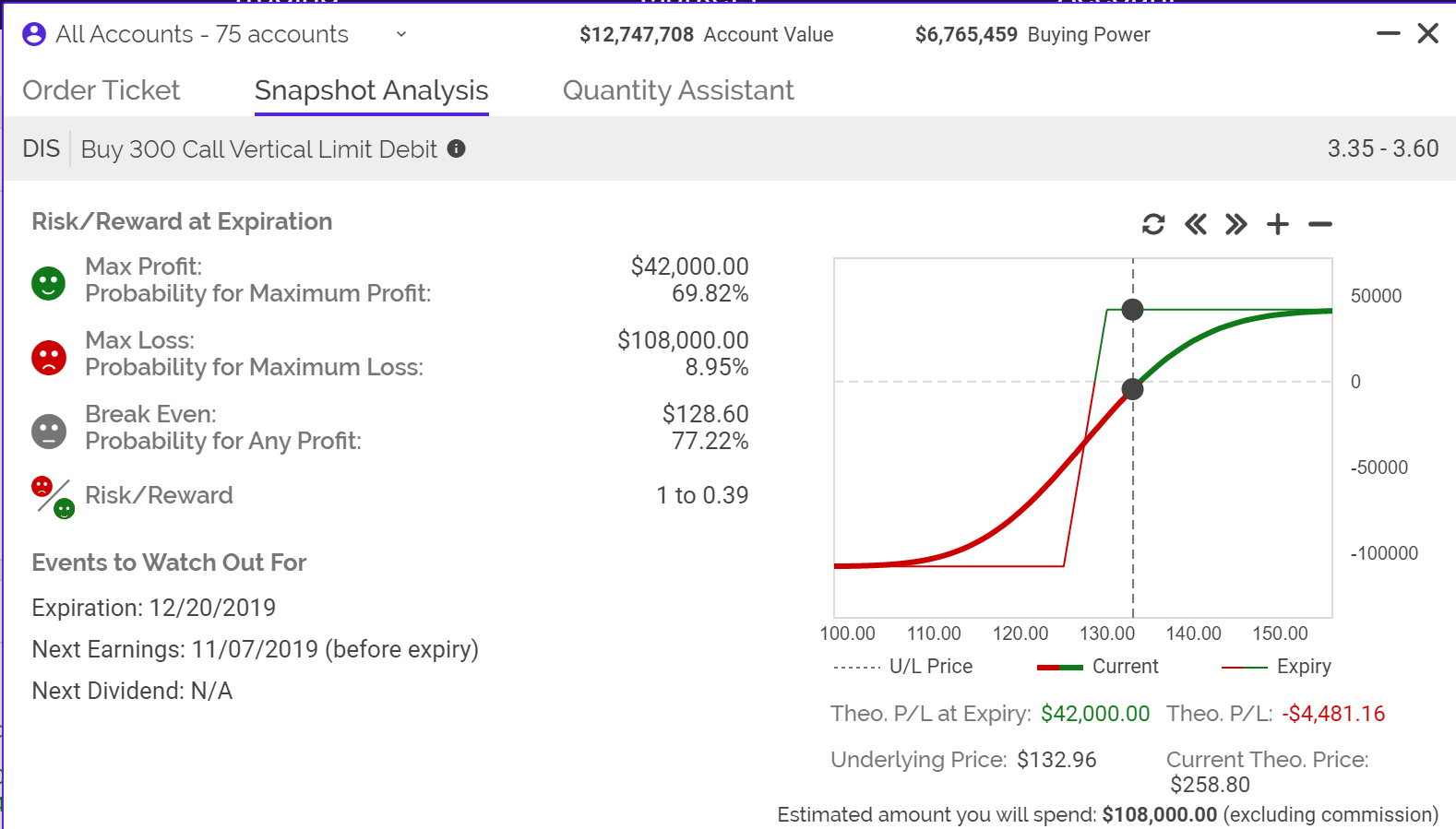

OR Dec 125/130 Bull call playing the earnings

www.hurleyinvestments.com www.myhurleyinvestment.com www.KevinMhurley.com