Trade Findings and Adjustments 09-30-2021

Let’s talk about protection one more time and free protection as needed

FREE Protection means you can make nothing or next to nothing on the way

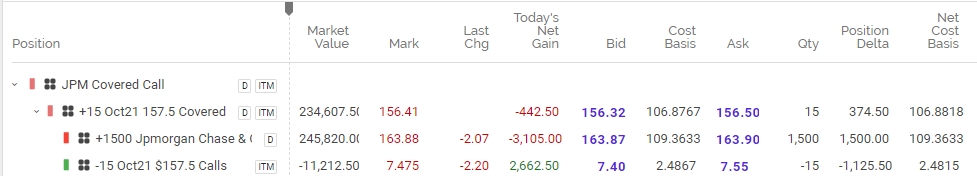

Deep In the Money (DITM) covered call protection

SO you BTO stock and then you have a profit in the stock = CB 109.36

STO DITM Covered call = The obligation to sell your stock at a certain price for a certain period of time

This example OCT 21 $157.50 credit of $2.4867 which is like selling the stock at $160

THIS is a GET PAID protection strategy

This is protection down to $155

Adjustment IF we don’t want to take a profit = rolling up in strike out in in time for more credit

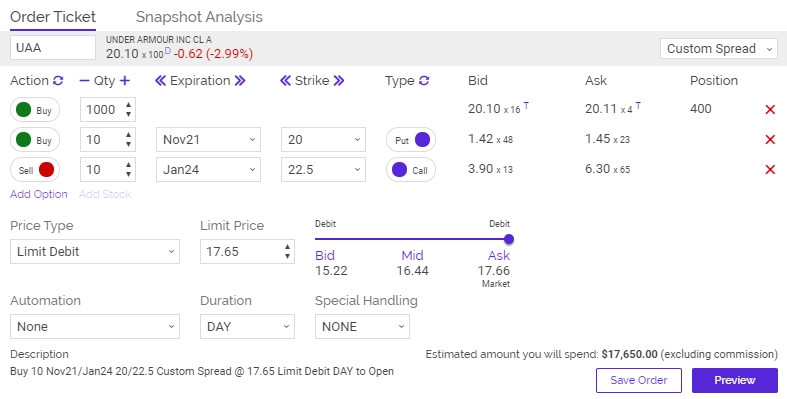

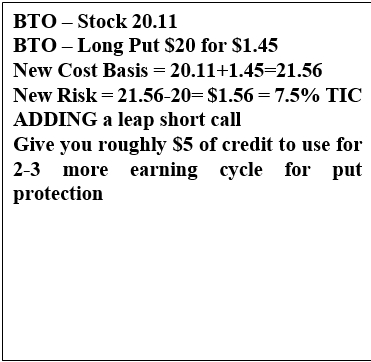

The long term 100% protection for a period of time collar trade

Stock ownership, long put (30-90 days) out in time and then Leap covered call

Thought process is the Leap Covered Call pays for protection for maybe 2-3 earnings cycles

The Options delta make 100% of downward movement

PROBLEM – You are not 100% protected up to leap covered call expiration as the short call caps upside movement and the credit gets used up as you continue to buy long put protection

The Leap is out to Jan 24 BUT we have 9 more earnings until the short call expires

The 4th Earnings we only have maybe $0.50 of credit to use to pay for the long put protection

IF we want to continue with long puts we have to come up with cash = profits of the stock ownership

Don’t forget the LADDEING or adding more than a one to one ration of Long puts

Two long puts and can make more to the downside than the stock loses

We asked 3 major investors what happens next in the market — none of them see big returns

KEY POINTS

- Stock returns are likely to be much more muted going forward, while volatility will remain the same, according to Jason Klein, chief investment officer at Memorial Sloan Kettering Cancer Center.

- The CIO said expectations for 10% average annualized returns should be more like 5%.

- In response to bonds that offer negative real returns, big investors are seeking alternative investments that provide a yield and that aren’t correlated to stocks, according to Ashbel Williams, executive director and CIO of the Florida State Board of Administration.

The strong stock performance of the past year is unlikely to last, according to some of the biggest U.S. institutional investors.

The response by central banks around the world to the coronavirus pandemic has boosted equity returns, Mary Erdoes, JPMorgan Chase head of asset and wealth management, said Wednesday at CNBC’s Delivering Alpha conference.

“Since last year’s Delivering Alpha, markets are up 30% to 50%, clearly not normal,” Erdoes said. “We’re enjoying it, but this is not a normal time period.”

Stock returns are likely to be “much more muted” going forward, while volatility will remain the same, according to Jason Klein, chief investment officer at Memorial Sloan Kettering Cancer Center.

The CIO said expectations for 10% average annualized returns should be closer to 5%.

“What had been tail winds are now headwinds,” said Klein. To his eye, stock valuations are “stretched market wide” and could be vulnerable as the Federal Reserve pulls back the extraordinary support it has provided markets since 2020.

In response to bonds that offer negative real returns, big investors are seeking alternative investments that provide a yield and that aren’t correlated to stocks, according to Ashbel Williams, executive director and CIO of the Florida State Board of Administration. He manages more than $195 billion in assets for one of the largest U.S. pension funds.

He invests in assets including planes, trains, timber, and music and TV rights, he said. Bonds now make up a smaller percentage of his holdings, down to 18% or 19% from about 25% a decade ago, Williams said.

Another area that might warrant more investor attention is China, where equities have tumbled after regulatory crackdowns. Specific Chinese companies can be very attractive investments, Erdoes said.

“China has gone on sale,” she said. “Clients are underweight emerging markets and very underweight China in particular.”

There are also a “ton of opportunities” in Europe and mentioned their banks, which are still trading below tangible book value, she said.

“You want to look for the other areas of the world that might be able to play catch-up,” Erdoes said.

Both Williams and Klein emphasized that now is a good time for teaming up with world-class active managers.

“If you own entire markets with the view that asset selection doesn’t matter, that’s great when the markets are going up,” Williams said. “But when things become really tough, and circumstances hit different industries and different companies in different ways … this is a time active management makes sense.”

The S&P 500 is up 31% over the last 12 months.

“The froth has continued,” Erdoes said. “Only time will tell how long that will go.”

Missed this year’s CNBC’s Delivering Alpha investor summit? Access the full sessions on demand for a limited time only. Don’t miss the biggest investment ideas in the business. Register for on-demand access at https://bit.ly/390rL5A