Trade Findings and Adjustments 09-29-2020

Jim Cramer’s week ahead: ‘Good riddance’ to September

Tyler Clifford@_TYLERTHETYLER_

KEY POINTS

- “We’re finally kissing the month of September goodbye next week, and I say good riddance,” CNBC’s Jim Cramer said.

- “I don’t know if October will be much better, but I doubt it could be much worse,” the “Mad Money” host said.

- Cramer delivered his game plan for the week to come.

The stock market turned in a positive day of trading on Friday, but CNBC’s Jim Cramer lamented the string of negative weeks that Wall Street has endured this month.

“We’re finally kissing the month of September goodbye next week, and I say good riddance,” Cramer said after the market close on “Mad Money.”

The Dow Jones Industrial Average added about 358 points, to finish the session up 1.3% at 27,173.96. The S&P 500 advanced 1.6% to 3,298.46 and the Nasdaq Composite rallied 2.26% to a 10,913.56 close.

While the Nasdaq was the only of the major stock averages to finish the week higher, climbing 1.1% in the last five sessions, the tech-heavy index has suffered the biggest losses since the beginning of the month. The index is down 7.32% month-to-date, compared to the 4.42% decline in the Dow and the 5.77% decrease in the S&P 500.

The market in September, which is historically a tough month for the stock market, faced further downward pressure from ongoing uncertainty about the trajectory of the U.S. coronavirus response and the nearing General Election, among other things.

Many investors took action in the last string of weeks to protect big gains, especially in tech stocks, that were made dating back to the market’s low point in March.

It remains to be seen if the market will quickly rebound from a correction earlier this month or to continue on a downward spiral as market players gauge whether lawmakers in Washington will come to an agreement on more stimulus spending to bolster the economy.

“I don’t know if October will be much better, but I doubt it could be much worse,” Cramer said.

Cramer presented his game plan for the week ahead and delivered his thoughts on companies as earnings season is set to kick-off.

All projections are based on consensus estimates in Factset:

- Q4 fiscal 2020 earnings release: before market

- Projected EPS: $1.36

- Projected revenue: $2.29 billion

“I’m betting RVs remain a vacation staple for a lot longer than you might expect,” Cramer said.

Tuesday: McCormick, Micron Technology earnings; presidential debate

- Q3 fiscal 2020 earnings release: before market; conference call: 8 a.m.

- Projected EPS: $1.52

- Projected revenue: $1.39 billion

Many people “discovered they like to cook. Meanwhile, the foodservice business that hurt McCormick last [quarter] has improved,” Cramer said. “To me, that smells like another upside surprise, though at this point the analysts they might not care, and they might not get behind it.”

- Q4 fiscal 2020 earnings release: unspecified; conference call: 4:30 p.m.

- Projected EPS: 98 cents

- Projected revenue: $5.89 billion

“Micron’s core DRAM business could be saved by their disk drive business, but I don’t see the stock roaring unless management says they see tightness coming in DRAMs,” he said. “At these levels, I’d be willing to bet they do just that.”

Thursday: PepsiCo, Conagra Brands, Constellation Brands, Bed Bath & Beyond earnings

- Q3 fiscal 2020 earnings release: 6 a.m.; conference call: 6:30 a.m.

- Projected EPS: $1.48

- Projected revenue: $17.20 billion

“I’m betting PepsiCo’s having a terrific quarter because their Frito Lay business is the snack king. I like this one ahead of the quarter,” Cramer said. “I would buy it.”

- Q1 fiscal 2021 earnings release: 7:30 a.m.; conference call: 9:30 a.m.

- Projected EPS: 57 cents

- Projected revenue: $2.61 billion

“I’m betting their frozen foods businesses is incredibly strong right now. Millennials love it,” he said. “I have less conviction though in Conagra, in part because it only yields 2.4%, even as the stock is much cheaper on an earnings basis.”

- Q2 fiscal 2021 earnings release: before market; conference call: 11:30 a.m.

- Projected EPS: $2.50

- Projected revenue: $2.19 billion

“Constellation’s beer business is killing it with consumers, even as bars are closing at a frightening pace,” the host said. “I suspect they’ll have a good quarter, though lately it feels like nothing these guys do is good enough for the stock.”

- Q2 fiscal 2020 earnings release: before market; conference call: 8 a.m.

- Projected losses per share: 30 cents

- Projected revenue: $2.63 billion

“Bed Bath is very heavily shorted … and those shorts will try to foment panic by slamming the stock down after the quarter,” he said. “Watch carefully, because if the [short sellers] do push Bed Bath to a [lower level] after a solid quarter, then I’m going to come out here and say you’ve got to buy.”

Disclosure: Cramer’s charitable trust owns shares of PepsiCo and Marvell Technology.

What if you had money to invest?

You have to take market conditions into consideration !!

Possible stimulus, worst month historically in the S&P, Volatile due to pre-election, Earnings start middle of October, second week of October is the financials, short options month for expiration

What could you do? I mentioned non-directional or protective puts or nothing

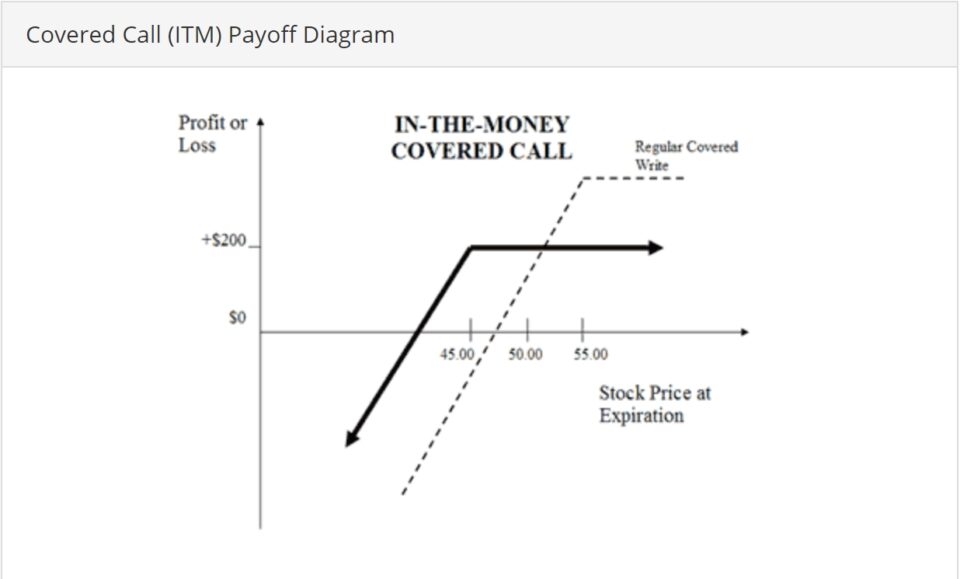

OR Deep In The Money Covered Calls