Trade Findings and Adjustments 08-29-2019

Quick “rebound” trade following the market

An education is to help you learn how to do it on your own. It is NOT to blindly follow a unlisenced, unbonded, uninsured market guru that hasn’t even done the minimum requirements to become a true judiciary

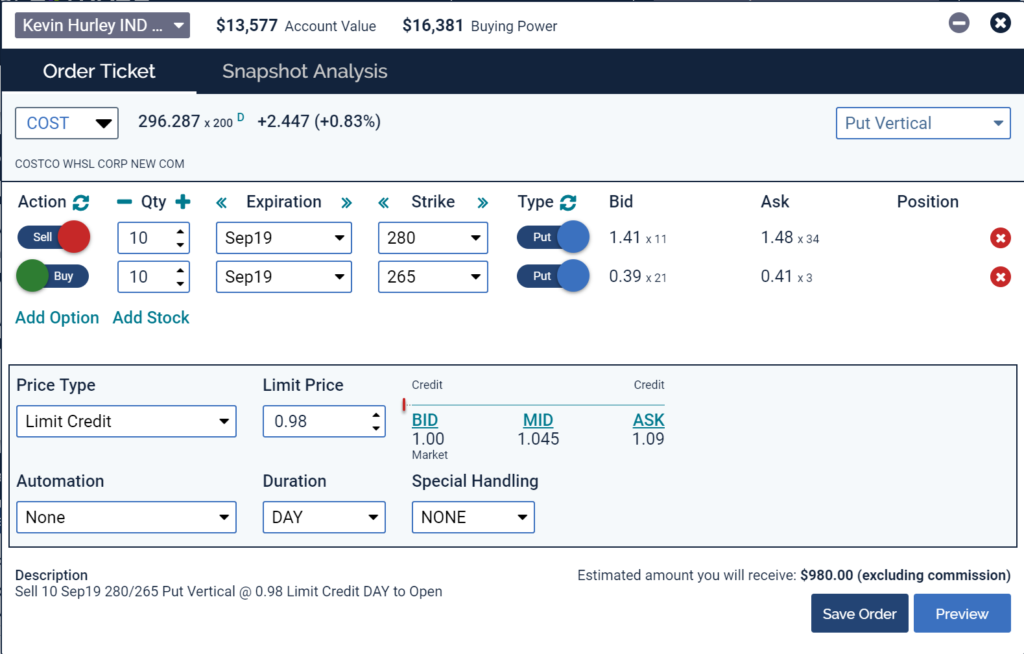

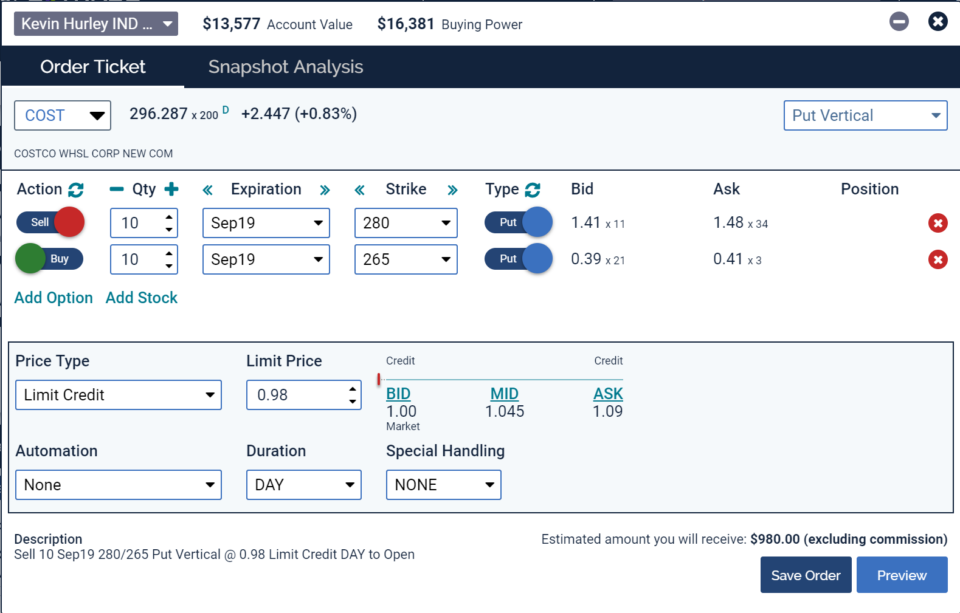

COST

Option 1

Cash Covered Short Put.

Sept. 275 Strike for $2.26 of credit

Make sure you have the cash to cover the purchase of stock

Option 2

275/265 Bull Put

275 Short Put for $2.26ish and 265 Long Put guessing about $1 for about 1.26 of net credit

The strategy is to lose credit on short options of around .30-.50 on a higher volatility week and 3 day weekend to bleed off credit.

I get asked all the time why we keep doing the same trades, on the same stocks, over and over again?

Follow the trend, on stocks you know to CONTINUE to keep making money!!!