Trade Findings and Adjustments 08-22-2019

September is five week option expiration which makes it harder to wait (patience) for credit spreads to expire.

It would be foolish for me to ASSume that I have a market trend, a good directional trade and that I have some special knowledge that will guarantee you a profit

NON – Directional – Long Condors, Protective puts, Collar Trade, Strangle/Straddles

PATIENCE and Managing Trades

You have to use common sense and DON’T put bullish trades in the morning on a bearish moving market

USE Common sense and saving a nickel, dime or quarter DOESN’T matter when you could have saved dollars

Limit orders if the trend changes doesn’t protect you, doesn’t necessarily help and might not be important the next day

Hardest = Patience

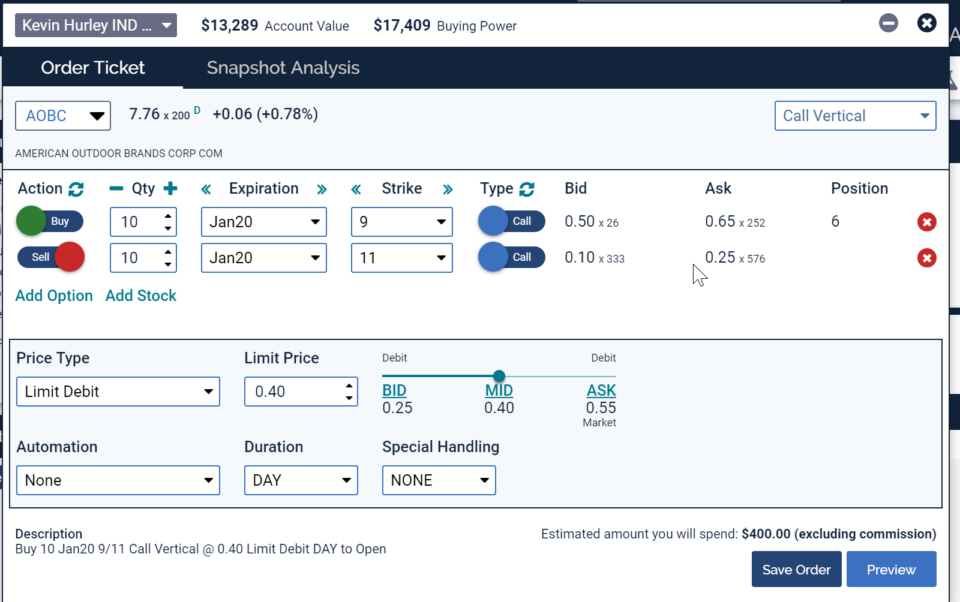

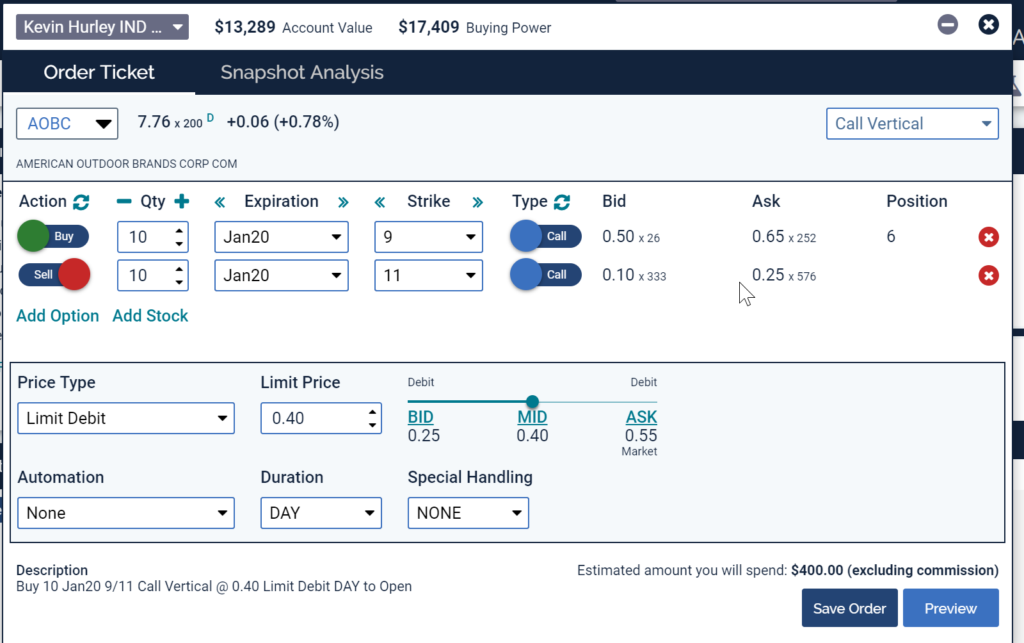

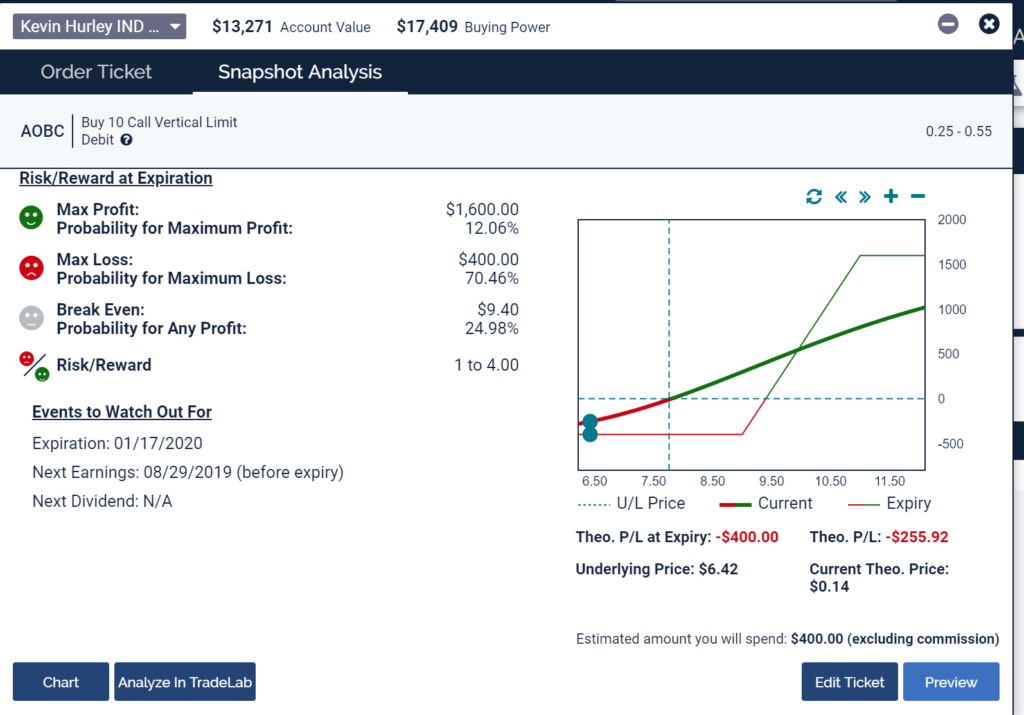

Bearish with earning on 08/29 AMC

Looks like it may be bottoming, Oversold RSI and Williams %R

Flier – Means possible 400% ROI, Need to be ready for an adjustment, riskier than normal ie…probabilities are not in your favor but the question is…. IS it worth the risk

www.hurleyinvestments.com www.myhurleyinvestment.com www.KevinMhurley.com