Trade Findings and Adjustments 06-29-2021

I want to take advantage of the Democratic wave of money coming into the economy via stimulus

What companies can take advantage of this money?= DE, CAT, MU

In general Material companies,

Green Companies = FSLR

I want to do something bullish but need time to make sure I can make some money

Leap long calls that act like or are a stock replacement strategy

Longer term Bull call or calendar bull call

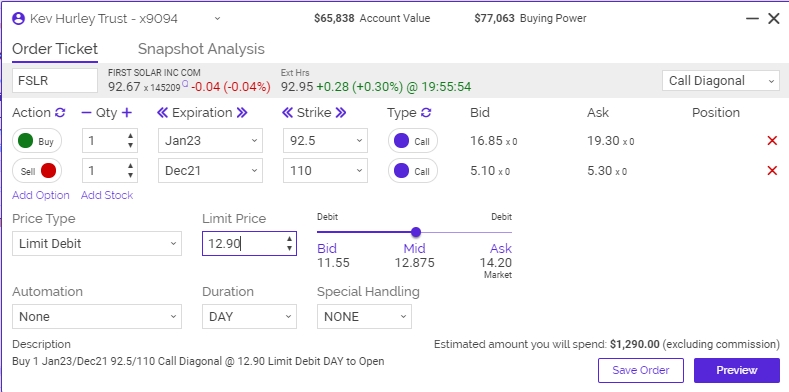

FSLR Long Call Jan 23 $92.50 strike price $18.10 (Stock replacement strategy)

Lower my risk Sell to Open Dec 22 $110 Short call credit of $5.20

Overall investment = 18.10 – 5.20 = 12.90

Max Reward = 110 – 92.50= 17.50 – 12.90 net debit = 4.60 IF I get called out at $110

4.60 / 12.90 =35.65% Return on Investment

IF FSLR moves quickly my Adjustment is to roll the short call out to a Jun 2022 $125 strike price

92.50 obligated to sell at 125= 32.50 – maybe $15 of cost 17.50 or 120% ROI