Trade Findings and Adjustments 06-16-2020

I would look to start with 2-3 contracts and two different scenarios

IF I want to play resistance 275 Jan 22 Long Call for $36

Primary exit at $270-$275 I exit my trade for a profit

Secondary exit I will dollar cost average

Protective put

BTO Stock @ 18.60

BTO Jul 18 2020 Long Put for 2.20

Overall CB = 18.60 + 2.20 = 20.80 top 20.85

IF we get filled at 20.85 – Right to sell at 18 = 2.85 risk in trade until puts expire

IF it goes to $25 then you make 4.15 / 20.85 = 19.90% ROI

IF it goes back to 11.84 filling the gap 18.00 – 11.84 = 6.16

ON 500 shares Right to sell @ 18 = $9,000 / 11.84 = 760 shares

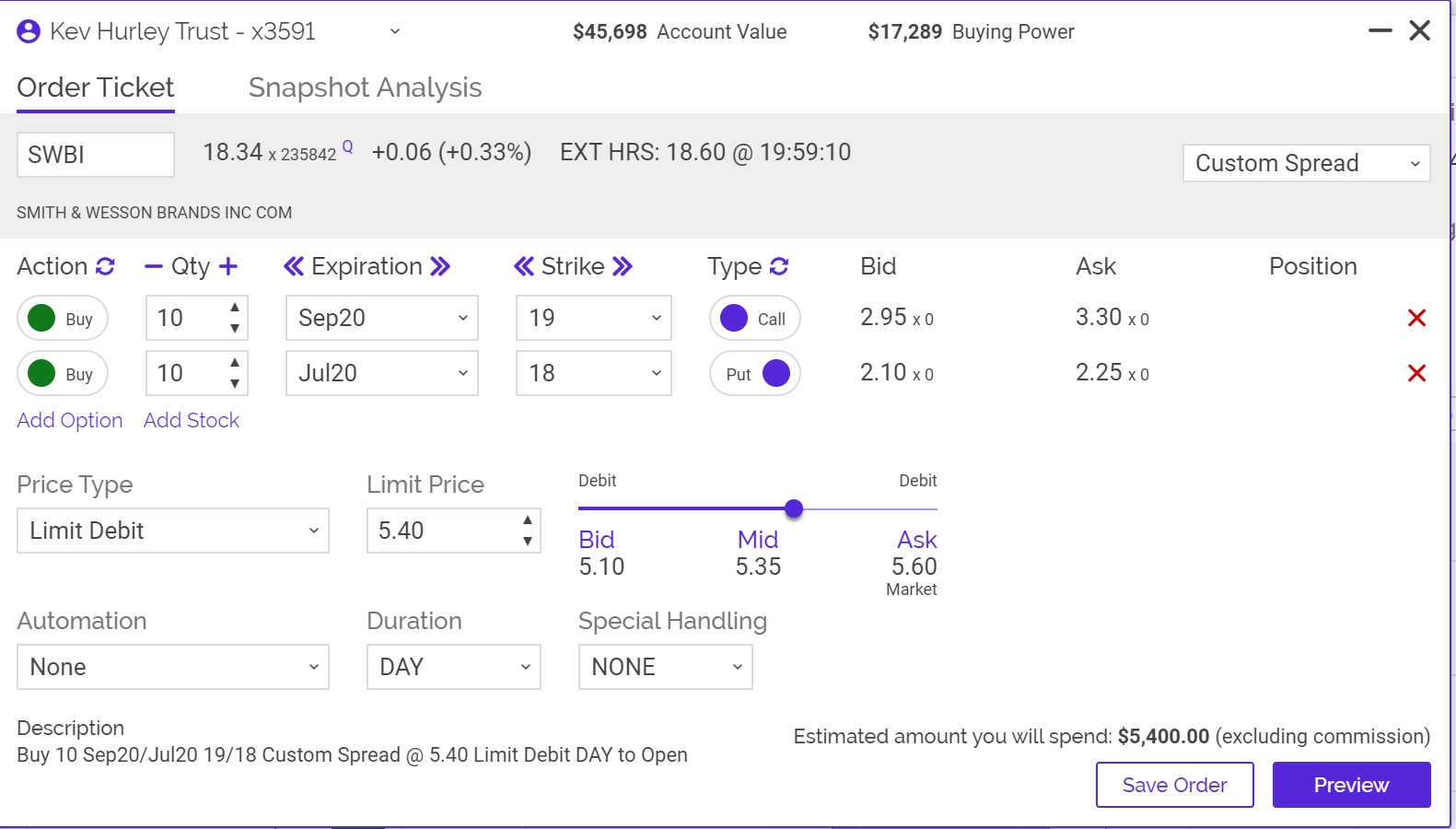

Calendar Strangle

Jul 18 Long Put

Sept 19 Long call

Total cost basis = 5.40

So to the downside I see $6.16 to fill the gap

Which means CB 6.16 – 5.40 = Possible $0.76 of profit 0.76/5.40 = 14.07% ROI

To the upside = 2017 high of $25

From 19 long call to 25= $6 – 5.40 = $0.60 possible guaranteed profit /5.40 = 11.1% ROI