HI Market View Commentary 06-15-2020

I do believe you need to stick to your discipline BUT that doesn’t mean you use hard, fast, immovable rules

It’s OK to make as much money as possible in the stock market

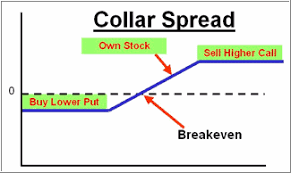

Taxes matter in the stock market = Collar trade

Common Practices on when to set up collar trade, when to add options, why, benefits, what strikes,

I want protection when stock are at their most volatile movements ie… Earnings

ATM puts I like to place 2 weeks to a 1 1/2weeks before earnings

One day ISN’T a market trend !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

When I start a new collar trade I am willing to cap the upside

BUT if the stock trades below the purchase price or the break even I usually do NOT want to cap the upside potential

I am a believer in the Warren Buffett underappreciated/undervalued stock ownership mentality

I like to know I won’t see a stock lose 25% or more of its value at earnings

Benefits of collar trade = dollar cost averaging without having to come up with more money to buy the shares

Thoughts on a leap candidate list emailed to me

Leaps are not for leveraged, funds or mutual funds. They are a cheap stock replacement for a company that might have explosive upside potential

| Market Recap |

| WEEK OF JUN. 8 THROUGH JUN. 12, 2020 |

| The S&P 500 three-week winning streak came to an end last week as worrisome headlines on a possible COVID-19 resurgence from the World Health Organization and Centers for Disease Control and Prevention coupled with Federal Reserve Chair Jerome Powell’s sobering press conference fueled profit-taking across all sectors.

The benchmark index closed at 3,041.31, down 4.8% from last Friday’s 3,193.93 close. Losses were widespread across all sectors, but it was energy stocks that bore the brunt of rekindled COVID-fears along with record US crude inventories. With the risk that governments will reinstate mitigation efforts and travel restrictions, the price of a barrel of brent crude fell 7%, driving down energy stocks by a collective 11.2%. Holly Frontier (HFC) was the worst-performing stock in the sector with a 14.7% loss from last week with Goldman’s downgrade to sell weighing on the stock price. Financials also suffered significant losses this week as falling Treasury yields due to a flight to safety contributed to a 9.2% loss in the sector. Discover Financial (DFS) and Capital One Financial (COF) fell by 12.6% and 10.6%, respectively, making the pair the laggards in the sector largely on the expectation that credit card defaults will escalate. Investors’ recent infatuation with airline stocks fizzled out and the sector was undermined by JP Morgan’s downgrade of United Airlines (UAL) and JetBlue (JBLU). In a note to investors, the firm took a potshot at the sector’s recent meteoric rebound and said the “pace of equity ascent [can’t] be potentially maintained for much longer.” With airline stocks down as much as 11%, the industrial sector shed 8% this week with Delta Airlines (DAL), Alaska Air Group (ALK), and United Airlines (UAL) at the bottom of the pack. The remaining sectors were all in the red as well. Consumer discretionary was down by 4.5%, the healthcare sector fell 5.4%, and materials were lower by 8%. The technology sector was down by just 2% as modest gains in Apple (AAPL) and Microsoft (MSFT) helped offset heavy losses for DXC Tech (DXC) and Alliance Data Systems (ADS). This week’s economic calendar was eclipsed by the Federal Open Market Committee, and specifically, Chairman Powell’s prepared remarks. Powell acknowledged that the unprecedented shock caused by the coronavirus will continue to reverberate through the economy, and, as a result, the Fed will keep interest rates at 0% until at least 2022. Additionally, Powell dismissed the May jobs report as nothing more than a “fluke” as the 13.3% jobless rate is probably understated by at least 3%. Economic data this week was less gloomy but fell short of giving investors something to cheer about. Prices on both the producer and consumer levels remain depressed, while the number of Americans who remain jobless continues to be problematic. Next week’s calendar will give clues on the condition of the consumer as well as the manufacturing sector with the June Empire State and Philadelphia Fed manufacturing indices, industrial production, and April retail sales. Additionally, the June NAHB housing market index on Tuesday and May housing starts/building permits on Wednesday will give investors clues as to how the housing market is absorbing the economic fallout from COVID. |

Where will our markets end this week?

Bullish

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end June 2020?

06-15-2020 +0.0%

06-08-2020 +2.5%

06-01-2020 +2.5%

05-26-2020 +0.0%

Earnings:

Mon:

Tues: LEN, ORCL

Wed: CCL,

Thur: KR, SWBI

Fri: KMX, JBL

Econ Reports:

Mon: Empire

Tues: Retail Sales, Retail ex-auto, Capacity Utilization, Industrial Production, Business Inventories, NAHB Housing Market Index,

Wed: MBA, Housing Starts, Building Permits,

Thur: Initial Claims, Continuing claims, Phil Fed

Fri: Current Account Balance, OPTIONS EXPIRATION

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Letting some things run, Taking Profits on leaps and adjusting fathur out in time

We are trying to enjoy the run up until July Earnings

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Hertz’s stock may look cheap, but Cramer cautions against buying it

PUBLISHED TUE, JUN 9 20207:41 PM EDT

KEY POINTS

- CNBC’s Jim Cramer warned new investors about the risk of buying the stock of companies that filed for bankruptcy such as Hertz.

- “You may think a stock like Hertz or Chesapeake looks like a steal at these levels, but the only people being robbed here are you the buyers,” the “Mad Money” host said.

- “It doesn’t matter how little you pay for a stock, when it goes to zero, you lose everything,” Cramer added.

CNBC’s Jim Cramer warned new investors Tuesday about the serious risk of buying the stock of companies that filed for bankruptcy such as Hertz.

“You may think a stock like Hertz or Chesapeake looks like a steal at these levels, but the only people being robbed here are you the buyers,” the “Mad Money” host said, referencing Chesapeake Energy amid reports it is preparing its own filing.

Shares of car rental company Hertz ended Tuesday’s session at $4.18 after falling 24%. But the stock had surged Monday and continues to trade higher than when it filed for Chapter 11 reorganization in late May, Cramer noted.

Cramer said it is “highly unlikely” that Hertz, as a business, goes away in its bankruptcy. But the company’s bondholders will be the first in line to get a piece of the post-bankruptcy Hertz. Owners of the common stock, on the other hand, “are at the bottom of the bankruptcy pecking order,” Cramer said.

“If you Hertz here at $4, you’re buying the old Hertz with $19 billion in debt that it can’t repay,” Cramer explained. “Since the creditors can’t collect, they’re going to seize the collateral, which is the business. So this $4 stock will most likely just be cancelled.”

That is a reality well-known by people like legendary activist investor Carl Icahn, Cramer said. Icahn held a nearly 39% stake in Hertz but dumped it last month after the company filed for bankruptcy.

“Believe me, if there was a real chance the common stock would be worth anything, Icahn would’ve stuck around. He didn’t,” Cramer said.

Cramer also said if he were running the bankruptcy court, he would prevent shares of Hertz from being traded, helping “keep inexperienced investors from losing money on it.”

“Instead this darn thing traded 530 million shares yesterday and 295 million today,” Cramer said. “The whole float is only 140 million. That’s insane.”

Cramer, a former hedge fund manager, said he has personal experience about buying stocks that have a risk of being wiped out. He recalled years ago buying stock in a reorganized company, Memorex-Telex, in hopes it had emerged from bankruptcy proceedings stronger than before.

“But it didn’t. It filed for bankruptcy again. We lost the whole investment,” Cramer said. “Taught me a valuable lesson: it doesn’t matter how little you pay for a stock, when it goes to zero, you lose everything. At least it stopped at zero.”

Hertz says it expects stockholders to lose all their money in filing for selling more stock

PUBLISHED MON, JUN 15 202011:13 AM EDTUPDATED 5 HOURS AGO

KEY POINTS

- Hertz said Monday that equity holders won’t see a recovery unless those with higher priority, such as the company’s debtholders, are paid in full.

- And that, the company said, would only happen if there is an astounding change in the progress of Covid-19 and a significant turnaround in travel trends.

- Hertz said it would sell up to $500 million in common stock.

Hertz Global Holdings warned potential buyers in its common stock offering that it’s almost certain that the equity will become worthless.

Hertz said in a government filing Monday that it would sell up to $500 million in common stock. In that very same filing, the company said those shares won’t be worth anything unless those with higher priority in a bankruptcy, such as the company’s debtholders, are paid in full. And that, the company said, would only happen if there is an astounding change in the progress of Covid-19 and a significant turnaround in travel trends.

The company said the following in its filing with the Securities and Exchange Commission:

“Although we cannot predict how our common stock will be treated under a plan, we expect that common stock holders would not receive a recovery through any plan unless the holders of more senior claims and interests, such as secured and unsecured indebtedness (which is currently trading at a significant discount), are paid in full, which would require a significant and rapid and currently unanticipated improvement in business conditions to pre-COVID-19 or close to pre-COVID-19 levels.”

The U.S. Bankruptcy Court for the District of Delaware on Friday approved Hertz to sell up to $1 billion in stock in a last-ditch effort by the company to cash in on its volatile share price and haggles with the New York Stock Exchange to not be delisted.

As a company exposed to travel demand, Hertz has faced significant headwinds throughout the spring as Covid-19 and efforts to contain its spread have kept Americans at home and prevented the vast majority of everyday travel.

The stock sale is a rare move for a company going through Chapter 11 bankruptcy since common shareholders are last in line when assets are allocated during court proceedings. People and entities that hold Hertz’s bonds will receive payouts first as debtholders receive priority during bankruptcies.

Also unusual is the volatility seen in Hertz stock over the last month, even after the company filed Chapter 11 on May 22. The share price, which bottomed around 40 cents per share on May 26, is up 475% since then at around $2.30.

But the shares dropped 19% on Monday.

The stock has remained popular among retail investors even as others, such as CNBC’s Jim Cramer, thinks “it’s worth zero.” The “Mad Money” host said Monday that retail traders and investors buying stocks like Hertz should first conduct research and due diligence before tying money to the equity.

“It’s not a roulette game. This is a game, if you want to call it that, of skill. And the skill means having an edge, and the edge comes from the debt side,” Cramer said.

The $100 billion conventions industry is starting to reopen after a months-long coronavirus shutdown

PUBLISHED SUN, JUN 14 202011:00 AM EDTUPDATED SUN, JUN 14 20204:06 PM EDT

Contessa Brewer@CONTESSABREWER

KEY POINTS

- The $100 billion dollar conferences and events industry has been essentially shut down since March due to the coronavirus pandemic.

- As some states begin allowing large indoor gatherings, organizers are preparing to host events for up to tens of thousands, beginning as soon as July.

- Sites are using new safety and sanitizing measures once they reopen.

Today it might be hard to imagine a mass, indoor gathering with thousands of attendees. Yet that is the bread and butter of the convention and events industry, which was brought a screeching halt due following the coronavirus outbreak earlier this year.

As states such as Florida and Texas take further steps to reopen, the industry is trying to bounce back, with some centers preparing to host events as soon as next month using safety measures that are becoming commonplace: temperature checks, social distancing, reduced capacity and contactless registration.

“I’m very excited to be getting groups back,” said Mark Tester, executive director of the Orange County Convention Center. Located in Orlando, Florida, it is the second-largest convention site in North America.

Tester said the center is prepping for its first event since the shutdown: a 10,000-person high school volleyball tournament in July. The center plans to host 12 events in July and August and expects a “ramp up” in the fall to its normally busy schedule, he added.

In Texas, the Sunbelt Builders Show is going on as planned for next month at the Gaylord Texan, just outside Dallas. Despite the state’s recent record spike in coronavirus hospitalizations, organizers said in an email to CNBC, they are encouraged by the registration numbers and attendance is trending similar to last year’s 2,300-person event.

It is a critical moment for a massive industry and the economy. The Center for Exhibition Industry Research estimates conferences, which drive business for hotels, airlines and local restaurants contributed more than $101 billion to U.S. gross domestic product last year.

Since March through the end of the year, 64% of conferences tracked by the International Association of Exhibitions and Events have been canceled.

“Shows are watching closely to see what each is doing,” said Cathy Breden, the organization’s executive vice president.

Just this week, McCormick Place in Chicago, the largest center in North America, was notified by organizers of the International Manufacturers Technology Show that its 129,00-person conference scheduled for September would be canceled. The estimated economic impact, which McCormick calculates using a dollar figure per attendee, is nearly $247 million.

On its website, IMTS cited Illinois’ reopening plan, which puts conferences in phase 5, as the main driver for the decision, stating, “The conditions that must be met for the implementation of phase 5 feature either the availability of a vaccine for the COVID 19 virus or a highly effective treatment protocol, neither of which are expected to occur in the coming months.”

Still, event organizers and operators are looking to the fall as a return to normal.

“Based on what we are hearing, it sounds like September is when we’re hoping shows will start being held again,” said Breden.

So far, there have not been any cancellations for 2021, she added. Orange County Convention Center and the Las Vegas Convention Center also say they have no cancellations in 2021.

“While this could suggest meeting planners are still holding out for a potential return to normalcy post-vaccine, we could see cancellations accelerate as the scheduled event date approaches,” Barry Jonas, an analyst at Sun Trust Robinson Humphrey, wrote in a note published Thursday.

Tester said, in Orlando, event organizers are waiting until the last minute to decide whether to go ahead with their plans.

One August event just decided to move into the fall.

“They really held off to see what was happening and received a lot of feedback from exhibitors and attendees that they would prefer it to be moved back in the fall, so we accommodated that,” he said.

With concerns of rising numbers of coronavirus cases in states that are reopening as well as fears of a possible second wave later this year, there’s no telling how many more last-minute cancellations may come or for how long they will last.

In the meantime, some companies are using convention space to drive profits in other areas.

The MGM Grand in Las Vegas is hosting boxing matches — without spectators — twice a week.

Legendary boxing promotor Bob Arum said MGM has allowed them to use the empty convention space to accommodate the fights, the training, dining facilities and the production crews and equipment required to air the matches. Arum said it creates a bubble of protection from coronavirus.

“The people once they get tested and go into the bubble, can’t go out of the bubble. They have to eat the meals in this dining area and the convention center,” he said.

For the convention industry itself, the real fight will be reassuring clients, vendors, exhibitors and attendees that it’s safe to return.

https://www.cnbc.com/2020/06/15/coronavirus-us-doctor-says-the-second-wave-has-begun.html

U.S. doctor warns on recent uptick in virus cases, says medical system may be stressed if people aren’t careful

PUBLISHED MON, JUN 15 20201:56 AM EDTUPDATED 41 MIN AGO

KEY POINTS

- “The second wave has begun,” said William Schaffner of the Vanderbilt University School of Medicine.

- Even so, he said he “cannot imagine” a second shutdown following the economic, social and cultural impact of the first one.

- Other countries, however, have not shied away from reimposing measures. Last week, Beijing reportedly banned tourism and locked down 11 neighborhoods in response to infections related to a wholesale market.

A second wave of coronavirus has started in the U.S. — and people need to remain careful or risk stressing out the health-care system again, said William Schaffner, a professor at the Vanderbilt University School of Medicine.

“The second wave has begun,” said the professor of medicine told CNBC’s “Street Signs Asia” on Monday. “We’re opening up across the country, but many, many people are not social distancing, many are not wearing their masks.”

Even so, he said he “cannot imagine” a second shutdown due to the impact of the first one.

Several states in America have reported recent spikes in Covid-19 cases as measures are eased throughout the country. The U.S. has the highest number of cases in the world. Nearly 2.1 million people have been infected by the disease and more than 115,000 people have died, according to data from Johns Hopkins University.

Schaffner added that mass gatherings and religious services are also being held. “Many people are simply not being careful, they’re being carefree,” he said. “That, of course, will lead to more spread of the Covid virus.”

Although Schaffner warned that the second wave may be underway, disease specialists said last week that the rise in Covid-19 cases across the U.S. was actually just a continuation of the first wave of the outbreak.

Ian Lipkin, a professor of epidemiology and director of the Center for Infection and Immunity at Columbia University, said that for the fresh outbreak to be defined as a second wave, the coronavirus would have needed to retreat and reappear, or a new strain of the virus would have had to emerge. He noted that the recent increase in U.S. cases “does not reflect either” scenario.

Despite claiming there were signs of a second wave, Schaffner said the option of another lockdown is “off the table.”

Instead, governments, businesses and religious leaders have to work together to promote mask wearing and social distancing in order to flatten the curve.

He said wearing masks is “very, very important” and authorities should “persuade and educate” their residents to make this a “social norm.”

“If we all do that in respect of each other, then I think we can make some progress,” said Schaffner.

“If we do all the opposite — if we open up, do not have social distancing, don’t wear masks and congregate in large numbers again, we are going to be very stressed in the medical care system,” he warned.

“The complete shutdown was such a financial disaster, and had so many social and cultural implications that I cannot imagine we’ll have a shutdown again,” he said.

Other countries, however, have not shied away from reimposing measures when new clusters are detected in the community. In May, South Korea shut all night clubs and bars in Seoul after a new cluster surfaced there.

Last week, Beijing reportedly banned tourism and locked down 11 neighborhoods in response to infections related to a wholesale market.

India shut down its economy to contain the coronavirus. It’s now one of the most affected countries

PUBLISHED SUN, JUN 14 20208:56 PM EDTUPDATED SUN, JUN 14 20209:26 PM EDT

KEY POINTS

- India reported more than 11,000 new cases of infection as of 8 a.m. local time on June 14, government data showed.

- Delhi is said to have become a recent hotspot, with accounts of people struggling to get a hospital bed there, Reuters reported.

- Infection cases have risen despite India being in a strict lockdown that began in late March and was lifted at the end of May, after a few rounds of extensions.

India’s coronavirus cases have spiked in recent days, fueling concerns the situation could spiral out of control even as the country starts to reopen after weeks of stringent lockdown.

India is the fourth worst-hit nation in the world, with cumulative infection numbers over 320,000 — behind only the United States, Brazil and Russia, according to Johns Hopkins University data.

Daily reported cases in South Asia’s most populous nation hovered near, and sometimes exceeded, 10,000 per day over the last several days. As of 8 a.m. local time Sunday, there were 11,929 new cases of infection, according to government data.

The high infection numbers also makes India the worst-affected Asian country. Russia, which has the third highest number of cases in the world, is technically part of both Europe and Asia, but most of its major cities are in the European part.

The city of Delhi is said to have become a recent hotspot, with accounts of people struggling to get a hospital bed there and some saying their loved ones died on the doorsteps of medical centers that refused to take them in, Reuters reported.

The deputy chief minister for Delhi told reporters that cases in the national capital region is expected to grow to 550,000 by the end of July, according to the news wire. Delhi reported more than 38,900 total cases as of Sunday morning.

“Last two, three weeks have seen a very significant increase in the number of cases every day,” Arvind Kumar, chairman of the Center for Chest Surgery at Sir Ganga Ram Hospital in Delhi, told CNBC’s “Street Signs” on Friday.

Stop community transmission

The number of infections have risen despite India being in a strict lockdown that began in late March. After a few rounds of extensions, the country finally lifted those measures at the end of May. Still, some states and regions have restrictions in place and many districts are now demarcated into low-risk and high-risk zones. In low-risk areas, economic activity is resuming slowly, while the high-risk zones activities remain restricted.

As a medical doctor, Kumar said he has been appealing to people not to think “everything has returned to normal” — just because the lockdown has officially ended. He cautioned against “moving out and mingling in large numbers.”

Even as confirmed cases would likely rise further, continued improvement in recovery rate and a low mortality rate would be key factors for the economy to open up as India ‘learns’ to live with the virus.

Samiran Chakraborty and Baqar M Zaidi

CITI

He also implored people to wear face masks if they have to step outside and maintain social distancing. “Presume every other person to be infected and maintain at least a meter distance from them,” he said, adding that people should keep washing their hands as frequently as possible.

“If the people-to-people interactions become less in numbers, the transmission will become less and we’ll be able to control the numbers,” he added.

Nationwide restrictions grounded economic activities around the country, and India’s growth outlook was badly hit.

Gross domestic product grew 3.1% in the three months between January to March — reportedly the slowest pace in at least eight years. The situation is expected to deteriorate further in this quarter.

Still, there are some encouraging signs emerging. Citi economists, Samiran Chakraborty and Baqar M Zaidi, said in a note there was a “sharp” improvement in economic activities in May, compared to the lows seen in April.

“Our weekly activity indicators continue to suggest further improvement in the first week of June as the economy has entered ‘Unlock 1.0’ from 8 Jun,” they said in a note early last week, referring to the early stage of restrictions being lifted.

The geographic concentration of the virus has weakened further, with India’s top 5 states accounting for 68% of daily new cases compared to around 80% in mid-May, according to the Citi economists in their June 8 note.

Maharashtra remains the worst affected Indian state, with its latest cumulative cases at 104,568.

Government data showed on a national level, more than 162,000 people have been discharged, while active cases are over 149,000. The death toll is comparatively low at 9,195.

“Recovery rate and incidence of death both improved a little more this week,” the Citi economists said. “Even as confirmed cases would likely rise further, continued improvement in recovery rate and a low mortality rate would be key factors for the economy to open up as India ‘learns’ to live with the virus.”

Still, reports have suggested that India’s level of testing for the virus remains low and many people are dying without being tested positive for Covid-19. As such, the official death toll may potentially be lower than it really is.

A burst of market volatility is just starting, National Securities’ Art Hogan warns

PUBLISHED SUN, JUN 14 20205:00 PM EDT

Stephanie Landsman@STEPHLANDSMAN

Investors may want to hold on tight.

National Securities’ Art Hogan warns the volatility burst will affect the market for weeks.

He cites a laundry list of risks including the uptick of coronavirus cases paired with overbought conditions.

“The fear of the unknown catches more volatility than anything,” the firm’s chief market strategist told CNBC’s “Trading Nation” on Friday. “Volatility is going to tick up a bit into summertime.”

Thursday’s downdraft contributed to the market’s biggest weekly loss since March. The Dow, S&P 500 and tech-heavy Nasdaq closed solidly higher on Friday, but it didn’t come close to making up the losses.

But Hogan, who has spent almost four decades on Wall Street, and oversees $15 billion in assets, believes it’s no reason for investors with longer-term time horizons to cash out of stocks.

“Have a plan, stick to it, and have balance in the equity portion of your portfolio,” he said. “Sticking to your plan is one of the best things you can do right now.”

His best advice is to strictly rebalance the classic 60% stock and 40% fixed income portfolios on a quarterly basis. Hogan also advocates a barbell approach to investing right now.

On one side, he recommends growth or technology names.

“You’ve got those that seem to have worked so far that have free cash flow during the work from home environment,” he said.

Hogan likes cyclical groups including financials, industrials and energy on the other side.

“That cyclical part will actually do well as the economy picks up,” Hogan said. “That balanced approach, I think, is going to be a great portfolio to have for the next 12 to 18 months.”

Brace for a ‘gut check’ summer sell-off, investor Peter Boockvar suggests

PUBLISHED WED, JUN 10 20207:37 PM EDT

Stephanie Landsman@STEPHLANDSMAN

Investors may want to curb their enthusiasm for the market rally.

The Bleakley Advisory Group’s Peter Boockvar warns stocks are vulnerable to a 10% or more summer sell-off.

“That’s when the gut check is going to take place,” the chief investment officer told CNBC’s “Trading Nation” on Wednesday. “Right now, the market is ignoring all the bad news in the hopes that things obviously get better as we reopen.”

Over the next couple of months, Boockvar suspects the market will trade sideways. Once most of the economy reopens, that’s when he warns a wave of profit-taking will likely strike stocks.

“The market is extraordinarily expensive. Now, we have to bifurcate that because a lot of that overvaluation is concentrated in technology,” he said. “Because technology is huge chunk of the S&P [500], it makes the overall valuation metrics pretty high.”

The Technology Select Sector SPDR Fund, the ETF tracking S&P 500 tech stocks, has soared 46% since the March 23 low. It has outperformed the index by 7% in that time frame.

Plus, the tech-heavy Nasdaq closed above 10,000 for the first time ever on Wednesday.

Boockvar acknowledges unprecedented Federal Reserve stimulus policies are a major driver of the rally. But he adds the upside has also been driven by a premature assumption that the coronavirus pandemic has turned a corner.

“When you shut down, you cause yourself your own pain. When you reopen, obviously things get better,” he said. “Come August [or] September, when most things are reopened… that’s when we’ll be able to sort of fairly measure the state of the economy.”

According to Boockvar, it’ll be difficult to determine the scope of the recovery until local barber shops, clothing stores and other businesses reopen — as well as how many employees actually return to their jobs and consumers’ intentions to spend.

Despite his pullback position, Boockvar still sees pockets of opportunities.

Boockvar’s main strategy, which focuses on unloved areas of the market, is to find groups that may benefit from an inflation comeback later this year or next year. He expects prices to rise due to the increased cost of doing business in a post-coronavirus world.

His picks include oil, gold, silver, copper and fertilizer stocks.

After big sell-off, stock market will be wary of virus and Fed testimony in week ahead

PUBLISHED FRI, JUN 12 202012:01 PM EDTUPDATED 3 HOURS AGO

Patti Domm@IN/PATTI-DOMM-9224884/@PATTIDOMM

KEY POINTS

- Fed Chairman Jerome Powell’s two days of Congressional testimony is a highlight in the week ahead, and markets will watch him with a wary eye after the Fed’s sober assessment of the economy spooked investors.

- Retail sales is the most important data point, in addition to jobless claims, that economists will be watching and it may show very slight improvement over April, as states reopened.

- The bottom line for markets is the status of the virus and whether there are continued outbreaks that threaten economic progress.

Stocks could be caught in a tug-of-war in the week ahead, as investors weigh the potential positives of a reopening economy against worry that the coronavirus continues to spread.

In the past week, the S&P 500′s sharp gains briefly drove the index into positive territory for the year, before a bruising sell-off at the end of the week. Stocks were more than 47% above the March 23 low before investors got spooked by signs the coronavirus is picking up in some areas.

The Fed also dampened sentiment when it released economic forecasts Wednesday that showed a slow recovery and interest rates at zero through the end of 2022. Investors will hear more of the same when Fed Chairman Jerome Powell speaks before Congress this Tuesday and Wednesday in his semi-annual economic testimony. He may provide more clarity on the Fed’s bond buying and other policy moves.

Retail sales for May are released Tuesday, and that will be an important look at consumer spending activity. It is the most important data in the coming week, other than the weekly jobless claims report on Thursday.

Stocks rose on Friday with the S&P 500 up more than 1% after Thursday’s sharp sell-off that sent the index down nearly 6%. Treasury yields, which move opposite price, also moved sharply lower as investors moved to the safety of bonds. The 10-year yield was back to 0.70%, well off the high of 0.95% in the week earlier.

“We’ve been overbought for awhile and digesting gains would be natural,” said Sam Stovall, chief investment strategist at CFRA.

Stovall said the fact that 97% of the S&P 500 companies’ stocks were above their 50-day moving average this past week was a warning. The 50-day moving average is a momentum indicator, and if a stock or index rises above it, it is usually a positive, but if they all do, it’s a contrarian warning.

“Historically that’s just too high … and also the P/E on the S&P was 25.1 of forward 12-months earnings, which is a 52% premium to the P/E average since 2000,” he said. The P/E, or the price-to-earnings ratio, is an important tool to value stocks, and it averages around 16.5 times.

In the sell-off, stocks that would benefit from the economy’s reopening were the hardest hit. Investors had been jumping into those names, driving them higher at a dizzying pace. They were also the sectors that were last to join the rally, like banks, casinos, airlines and hotels.

“Once the pullback runs its course I think investors will move back again into the sectors and subsectors that were most beaten up in the bear market,” said Stovall.

Scott Redler, partner with T3Live.com, said he lightened up his holdings earlier in the week. “There were some clues early in the week that the market was vulnerable, like when the S&P closed below 3,191 on Tuesday. You had some feverish trading in some of the very speculative names,” he said.

Stovall said other headwinds hang over the market, and one big one is the upcoming presidential election, which could become a bigger influence on the market. RealClearPolitics has President Donald Trump trailing former Vice President Joseph Biden by 8.1 points in the latest average of polls.

“Trump’s numbers are just looking so bad, and if the Fed needs to keep interest rates at zero and we have the potential for a resurgence in Covid cases, then Trump is not going to benefit from an economic recovery, and as a result, that gives Biden a better chance of being elected,” said Stovall. “It’s not necessarily that the market dislikes Biden, but they dislike uncertainty. And a decline in equity prices would be representative of that uncertainty.”

Consumer barometer

Retail sales are typically a barometer for consumer spending, and when Americans were shut in their homes they did much less shopping than usual. April data showed a 16.7% drop in sales, but consumers did spend online.

Economists are watching Tuesday’s report on May sales closely, particularly after the May jobs report had a large upside surprise. There were 2.5 million jobs added in May, instead of an expected loss of 8.3 million.

Mark Zandi, chief economist at Moody’s Analytics, said business-to-business spending data for May implies that retail sales were flat compared with April’s depressed level and could be down 22% from a year ago.

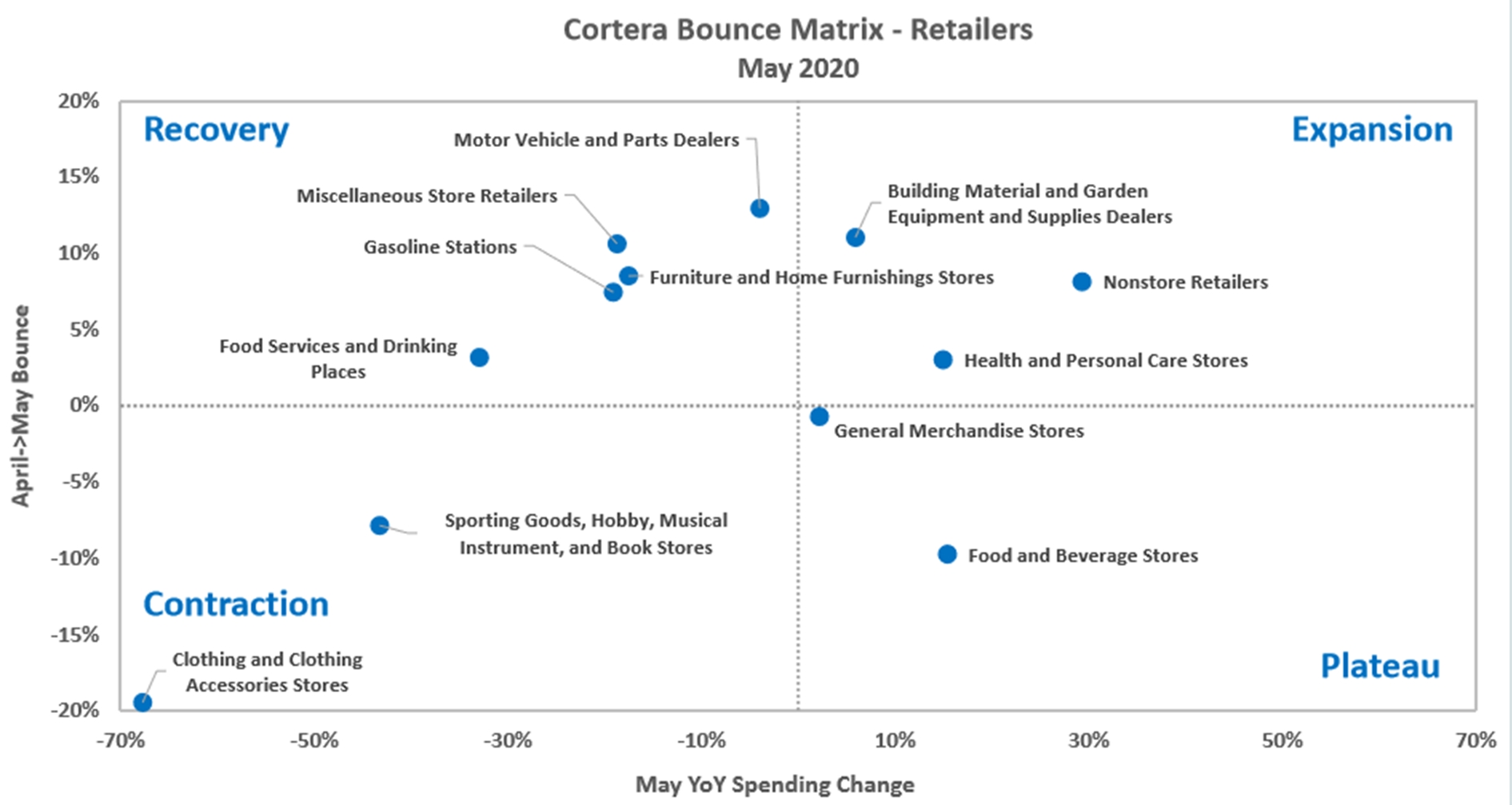

Zandi used data from Cortera, which collects information on about $1.5 trillion in business-to-business spending. In an analysis of spending by retailers in May, it found there were gains from April in some categories, including furniture, gasoline stations and restaurants.

“Clothing and sporting goods store sales have been crushed, and that continued in May. Restaurants, gasoline stations and furniture stores have been hit hard, but showed strong improvement in May. Food and health and personal care stores have done well through the crisis, but gave some of that back in May,” notes Zandi. “Online retailers, general merchandise stores (which includes WalMart and Target), and building material and garden supply stores (Home Depot and Lowes) have navigated the crisis well, and May was another solid month.”

Zandi said weakness in apparel and sporting goods washed out the gains in other areas.

Source: Cortera

Fed ahead

Strategists said Powell did not surprise the market with his comments this past week, but his sober approach reminded investors that the Fed policy will have to be in place for a very long time to pull the economy out of its deep rut. That will keep markets on high alert during his two days of testimony.

“I think the cat’s out of the bag. I don’t think he can sugarcoat it. The thing he’s got to worry about is he needs help. He needs Congress and the administration to come up with another fiscal rescue package. He can’t do it on his own,” said Zandi. “He has to keep the pressure on them and get a piece of legislation before they go on August recess. … He’s speaking as much to the American people as he is to the policy makers.”

Zandi said the Fed has acted aggressively and swiftly to unfreeze credit markets when they locked up in March, but the economy needs more stimulus ahead of a wave of potential business defaults and with a high level of unemployment. The Fed’s balance sheet has ballooned to $7.2 trillion, and on Wednesday the central bank committed to monthly purchases of $80 billion in Treasury securities and $40 billion in mortgage securities.

“I think he continues to lay the foundation for policy changes to come,” said Zandi. “He’s strongly suggesting there’s going to be more monetary support, and that would come in the form of a few things – it would be performance dependent forward guidance. … He’s going to make it clear until the economy is at full employment and inflation is at least at target, if not above.”

Zandi said Powell may discuss yield curve controls, which would mean the Fed would set targets for interest rate levels in the Treasury market, and make purchases to influence rates. Some economists believe the Fed will adopt that tool before the end of the year.

“I think he’s going to more clearly define the amount of QE they’re doing going forward. He’ll try to preserve some optionality, but he’ll try to make it known, they’re buying a lot of bonds for a long time to come,” Zandi said.

But the hearings could be more politicized, and Powell may be criticized by Congress for helping financial markets more than Main Street, said John Briggs, head of strategy at NatWest Markets. “I’d be surprised if there’s a lot new, given it comes on the heels of the FOMC meeting,” Briggs said.

Week ahead calendar

Monday

8:30 a.m. Empire State survey

4:00 p.m. Treasury TIC data

Tuesday

Fed Chairman Jerome Powell before Senate banking

8:30 a.m. Retail sales

8:30 a.m. Business leaders survey

9:15 a.m. Industrial production

10:00 a.m. Business inventories

10:00 a.m. NAHB survey

Wednesday

Fed Chairman before House Financial Services Committee

8:30 a.m. Housing starts

Thursday

8:30 a.m. Initial jobless claims

8:30 a.m. Philadelphia Fed

Friday

8:30 a.m. Q1 current account

10:15 a.m. Boston Fed President Eric Rosengren

HI Financial Services Mid-Week 06-24-2014