Trade Findings and Adjustments 06-09-2020

What does it take to be disciplined enough to wait for the next sale in the stock market?

Probably we will have another 20-35% drop when we end having covid-19 part II in Sept-Nov

Time to be patient when it comes to putting more money to work

What can we do to take advantage of BA move even though its already moved so far ?

For some of you we started off with 6 contracts for $34

We dollar cost averaged 6 more contracts $14

We dollar cost averaged 6-8 at 3.50

I think we even got some at $1.50-2.00

Net Average contract price 350 Jan 2021 Leap Long Calls $7.19-$7.28

So some of you started with 6 contracts and had 24-26

So some of you started with 4 contracts and had 18-20

So some of you started with 10 contracts and had 44-48

We now have 8.90 + 8.10 = $17 to get back into BA

Even though we just booked roughly 14-34K I would start slowly again

I would look to start with 2-3 contracts and two different scenarios

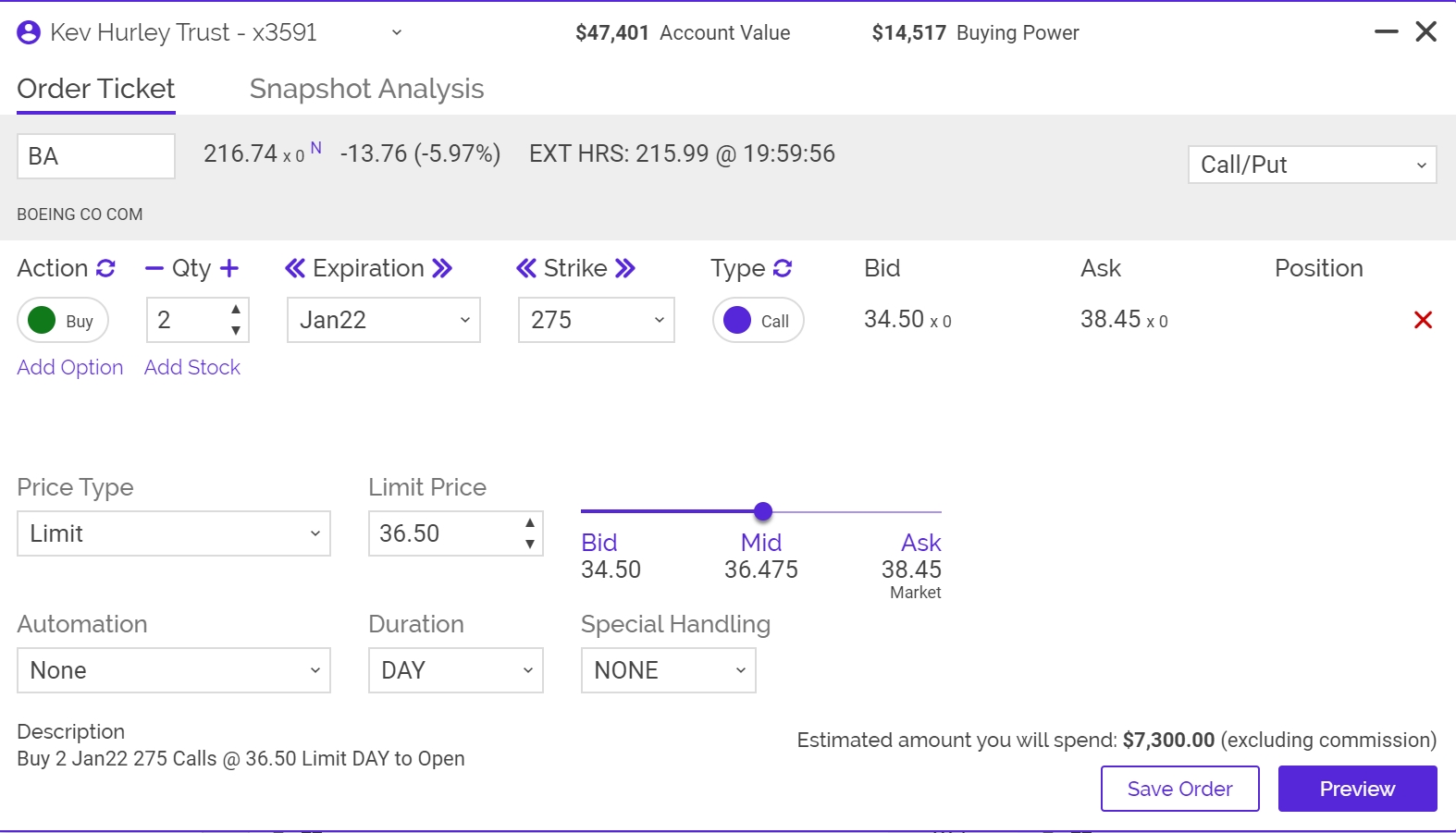

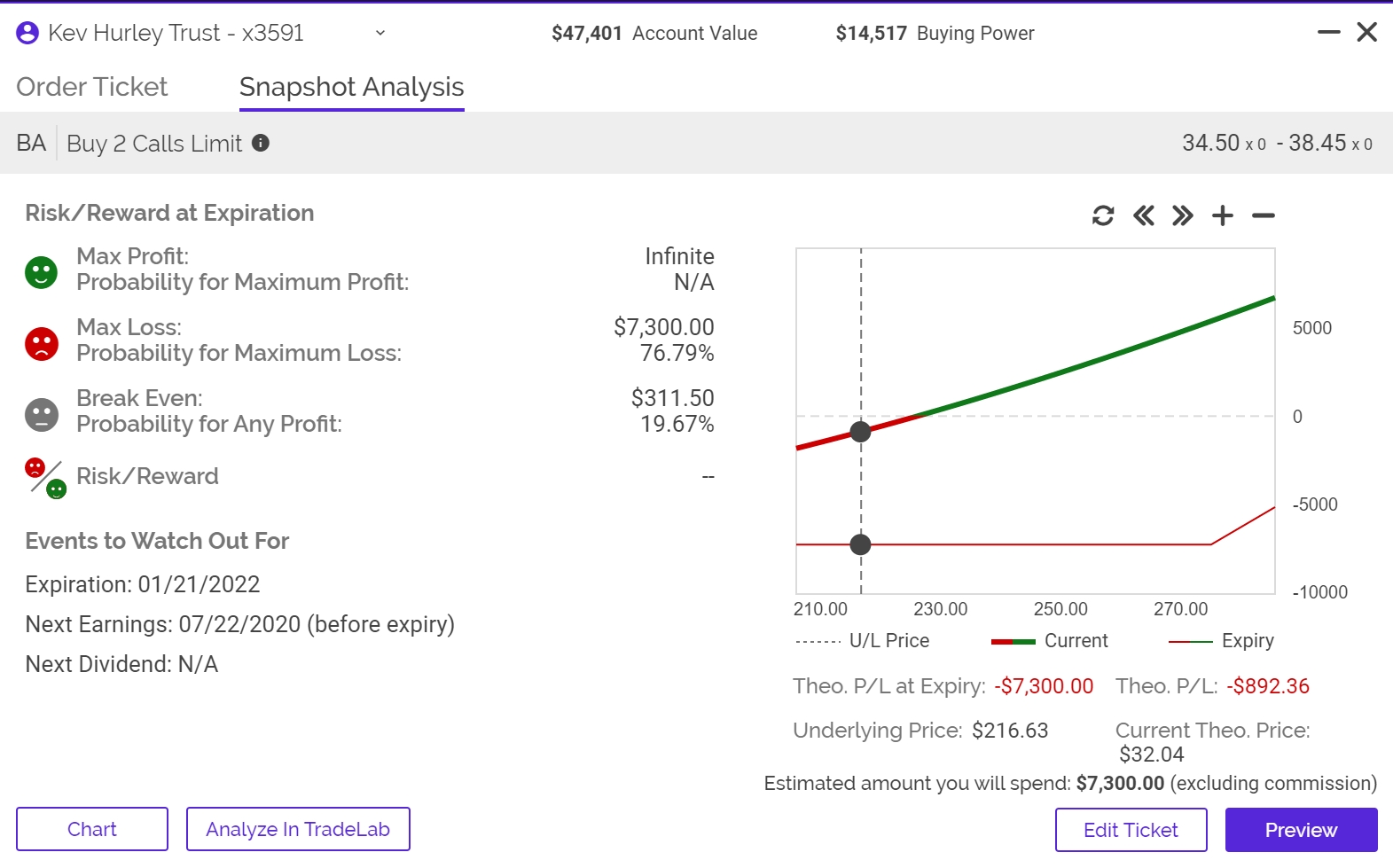

IF I want to play resistance 275 Jan 22 Long Call for $36

Primary exit at $270-$275 I exit my trade for a profit

Secondary exit I will dollar cost average

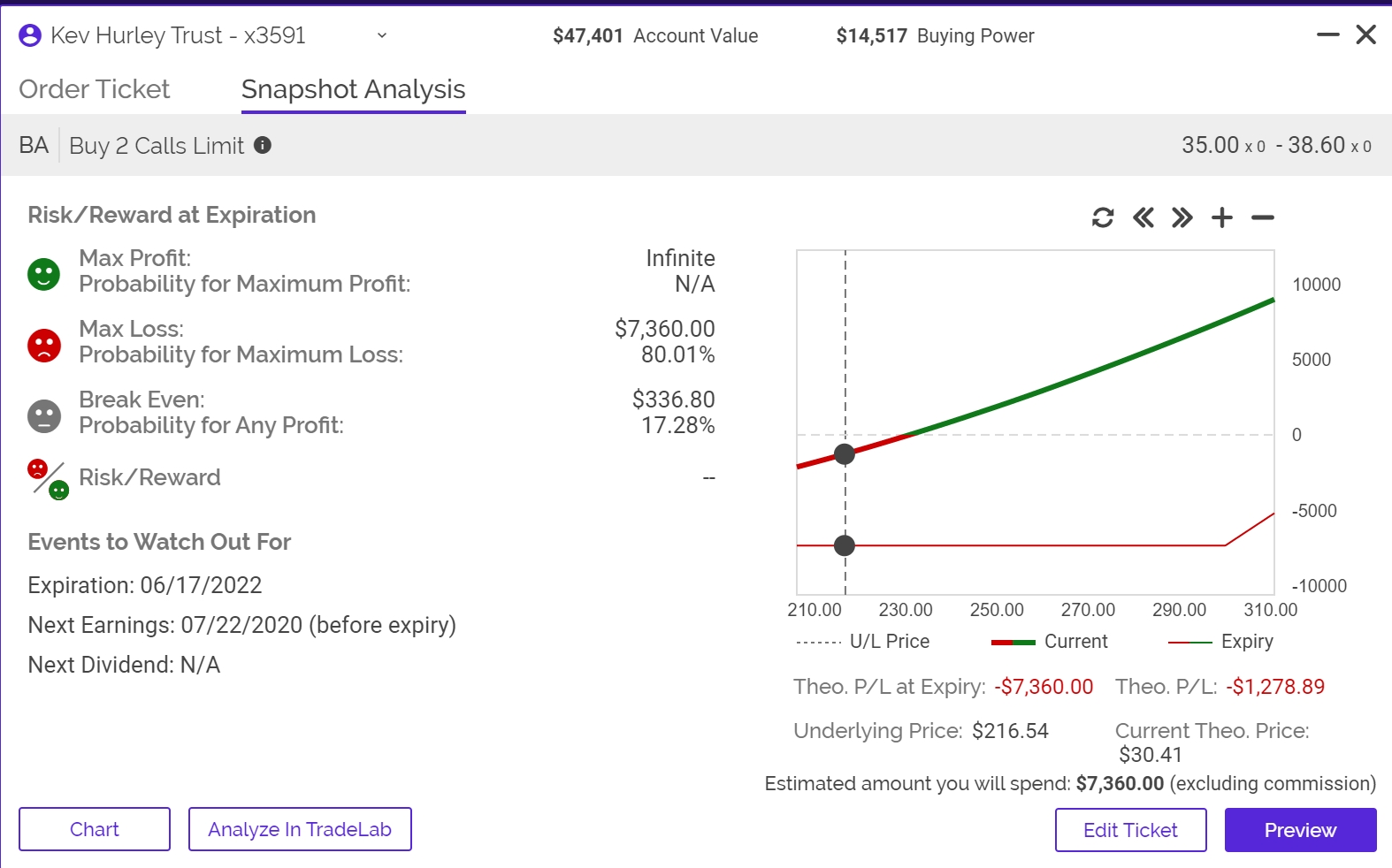

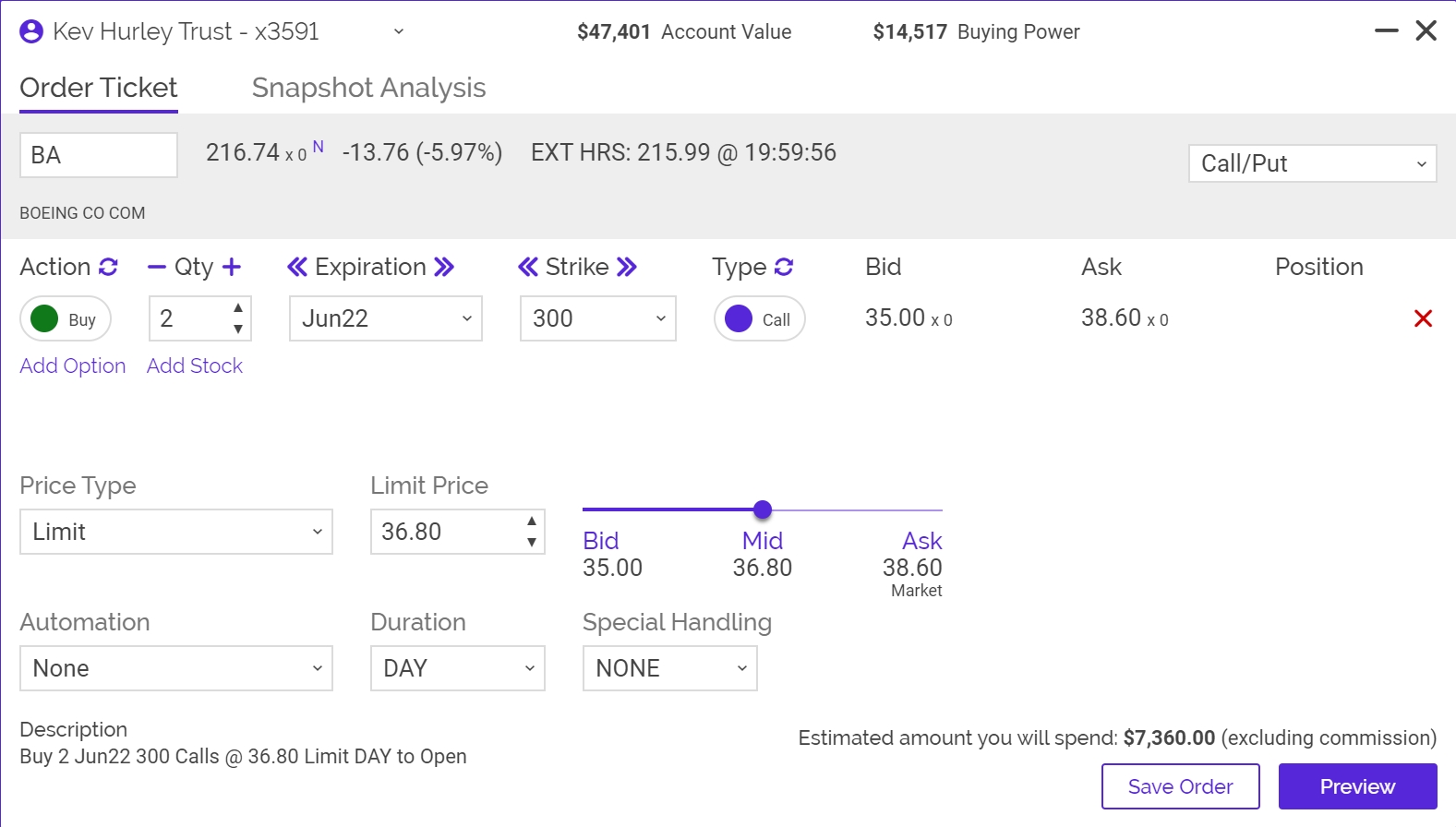

IF I want play the long term rebound to $380-$400

I would use a 300 Jun 22 Long Call for $36

Primary exit when it hits $380-400 exit the trade

Secondary exit dollar cost average

Resistance adjustment add one month short calls when it struggles getting over the 200 SMA

www.hurleyinvestments.com www.myhurleyinvestment.com www.KevinMhurley.com